- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Digital Assets: The Future of Finance, Investment, and Blockchain

What is a digital asset?

To define digital asset in simple terms is any asset that exists in a digital format. This expansive category includes everything from familiar digital files like images and documents to the innovative realm of blockchain-based assets such as cryptocurrencies and non-fungible tokens (NFTs). These digital assets are primarily stored and traded on blockchain networks, a decentralized and secure infrastructure that employs cryptographic techniques to ensure transparent ownership and transaction records across a distributed ledger. The global cryptocurrency market capitalization reached approximately $3.52 trillion as of late May 2025 (Coin Gecko, 2025), highlighting the immense value now held in these digital currencies.

The broader digital asset management market reflects this growth, valued at around $3.96 billion in 2023 with projections to reach $16.18 billion by 2032 (Fortune Business Insights), indicating a substantial compound annual growth rate (CAGR) of about 17.0%. This surge is further fueled by increasing institutional interest, with a recent survey revealing that 83% of institutional investors plan to increase their allocations to digital assets in 2025 (EY, 2025).

Blockchain technology, the fundamental infrastructure supporting many digital assets, is also experiencing rapid adoption. Global spending on blockchain solutions is forecasted to reach $19 billion in 2024, a significant leap from $6.6 billion in 2021 (Business Wire, 2021). This adoption translates to a growing user base, with over 560 million people estimated to be using blockchain technology globally, and the number of blockchain wallet users exceeding 85 million (Demand Sage, 2025). Furthermore, nearly 90% of surveyed businesses report deploying blockchain technology in some capacity, recognizing its potential to enhance security and efficiency. These facts collectively underscore the increasing integration of digital assets into modern financial systems and various industries, signaling a profound shift towards leveraging blockchain technology for a more digital and potentially decentralized future.

Examples of digital assets

Talking about digital asset examples, the following are some of the common ones that you can decide to invest in.

- Cryptocurrencies: These are decentralized digital or virtual currencies secured by cryptography. Operating independently of a central bank, cryptocurrencies like Bitcoin (BTC), the first and most well-known cryptocurrency, and Ethereum (ETH), which also serves as a platform for decentralized applications, are used for peer-to-peer transactions, as a store of value, and for various financial services within their respective ecosystems.

- Non-Fungible Tokens (NFTs): NFTs represent unique digital items, meaning each token is distinct and cannot be replaced by another identical item. This uniqueness makes them ideal for representing ownership of digital collectibles such as digital art, music, virtual real estate in metaverses, and even in-game items. The ownership of an NFT is recorded on a blockchain, providing verifiable proof of authenticity and provenance.

- Digital files: While seemingly basic, digital files such as documents, images, and videos can also be considered digital assets, especially when they possess intrinsic value or are subject to licensing and ownership. For instance, a professional photograph, a proprietary document containing valuable information, or a popular video can be bought, sold, and their usage rights managed digitally.

- Tokenized assets: This category involves converting real-world assets into digital tokens on a blockchain. This process, known as tokenization, allows for fractional ownership and increased liquidity for traditionally illiquid assets. Examples include tokenized real estate, where ownership of a property can be divided into multiple tokens, allowing more investors to participate with smaller capital outlays. Similarly, commodities like gold or oil can be tokenized, making them more accessible for trading and investment.

Digital asset management: how to organize and protect your digital assets

Digital Asset Management (DAM) refers to the systematic processes and technologies used to store, organize, and secure a wide range of digital assets throughout their lifecycle. Think of it as creating a well-organized and heavily guarded digital library for all your valuable digital content.

In the business world, especially those dealing with large volumes of digital content like marketing materials, product images, videos, and design files, DAM systems play a crucial role (IBM). These systems provide a centralized repository that makes it easy for teams to efficiently find, share, and manage their digital assets. By streamlining workflows, DAM systems prevent duplication of effort, ensure brand consistency through controlled asset usage, accelerate content creation and distribution, and ultimately contribute to improved productivity and reduced operational costs.

For example, imagine a marketing team being able to instantly access the latest approved logos, product shots, and campaign creatives without sifting through countless emails and shared drives – that’s the power of a well-implemented DAM system.

A variety of tools and platforms are available to optimize digital asset management workflows and ensure security. These can range from cloud-based SaaS (Software as a Service) solutions to on-premise software, and the key features often include the following.

- Centralized storage: Providing a single, accessible location for all digital assets.

- Metadata management: Allowing for detailed tagging and categorization of assets with relevant information (e.g., keywords, usage rights, dates, versions) to improve searchability and organization.

- Access control and permissions: Defining who can view, download, edit, and share specific assets, ensuring sensitive information is protected.

- Version control: Tracking changes made to assets over time, allowing users to revert to previous versions if needed.

- Workflow automation: Automating tasks such as asset approvals, distribution, and expiration.

- Search and discovery: Offering powerful search functionalities, often including advanced filtering and AI-powered visual search, to quickly locate the required assets.

- Integration capabilities: Connecting with other business systems like content management systems (CMS), product information management (PIM) systems, and marketing automation platforms.

- Security features: Implementing encryption, watermarking, and audit trails to protect assets from unauthorized access and misuse.

How to make money from digital assets

When it comes to digital assets trading, the world of digital assets offers diverse avenues for generating income. The following is a breakdown of how investors, traders, and creators can potentially profit.

- Investing in digital Assets: The global cryptocurrency market capitalization currently stands at approximately $3.56 trillion (as of late May 2025) (Mitrade, 2025), showcasing the substantial capital invested in this asset class. The NFT market, while more volatile, reached a global market capitalization of around $79.96 billion (Forbes) in the same period, demonstrating the significant value attributed to unique digital items.

- Digital asset trading: The 24-hour trading volume in the cryptocurrency market is substantial, often exceeding $100 billion (Pepperstone), indicating the high level of activity and potential for profit (and loss) for traders capitalizing on short-term price movements. Similarly, while NFT trading volumes fluctuate, significant transactions in high-value digital art and collectibles continue to occur, with individual NFTs sometimes selling for millions of dollars. For instance, the Bored Ape Yacht Club collection has seen individual NFTs trade for prices ranging from tens to hundreds of thousands of dollars.

- Creating digital assets: Through digital assets marketing, the NFT market has provided a tangible avenue for creators to monetize their work. In 2024, the global NFT market size was estimated to be around $36.23 billion, with projections indicating a significant growth to approximately $703.47 billion by 2034 (Precedence Research, 2025), highlighting the increasing financial opportunities for artists and creators in this space. Platforms like OpenSea and Rarible facilitate millions of dollars in creator earnings through primary sales and resale royalties. For example, digital artists like Beeple have sold NFTs for tens of millions of dollars, demonstrating the transformative potential for creators.

Blockchain digital assets: intersection of technology and finance

Blockchain technology serves as the very foundation that enables the creation, secure storage, and transparent trading of digital assets. At its core, a blockchain is a decentralized and distributed ledger that records transactions across numerous computers. This distributed nature eliminates the need for central authority, making the system more resilient and less susceptible to single points of failure or manipulation.

Here’s how blockchain powers digital assets:

- Creation (Minting): For assets like cryptocurrencies and NFTs, the blockchain provides the infrastructure for their creation, often referred to as “minting.” When an NFT is minted, for example, its unique information and the creator’s identity are permanently recorded on the blockchain, establishing its authenticity and ownership history. Similarly, new units of cryptocurrencies are often generated through processes like mining or staking, which are also recorded and verified on the blockchain.

- Storage: While the actual digital file of an NFT (like an image) might be stored elsewhere, crucial information about its ownership and transaction history is immutably stored on the blockchain. For cryptocurrencies, blockchain acts as the public record of all transactions and the current balance of each digital wallet address. This distributed storage ensures that the asset’s record is not held in one vulnerable location.

- Trading: Blockchain facilitates peer-to-peer trading of digital assets without the need for traditional intermediaries like banks. When a digital asset is traded, the transaction is recorded as a new block on the blockchain, which is then verified by the network participants.

In addition to that, the advantages of using blockchain for digital asset transactions are significant:

- Transparency: All transactions recorded on a public blockchain are generally visible to everyone on the network.

- Security: The cryptographic nature of blockchain technology makes it extremely difficult to tamper with transaction records.

- Decentralization: By distributing the ledger across numerous participants, blockchain eliminates the control of a single entity.

This is the reason why several blockchain networks have become prominent in the realm of digital assets such as:

- Ethereum: When talking about digital assets investment, this is one of the most widely used blockchain platforms for digital assets, particularly NFTs and decentralized applications (dApps). Its robust smart contract functionality enables complex transactions and the creation of diverse digital assets.

- Binance Smart Chain (now BNB Chain): Known for its lower transaction fees and faster processing times compared to Ethereum, BNB Chain has also become a popular platform for various digital assets and DeFi (Decentralized Finance) applications.

- Solana: This blockchain is designed for high speed and low transaction costs, making it attractive for applications requiring high throughput, including NFT marketplaces and decentralized exchanges.

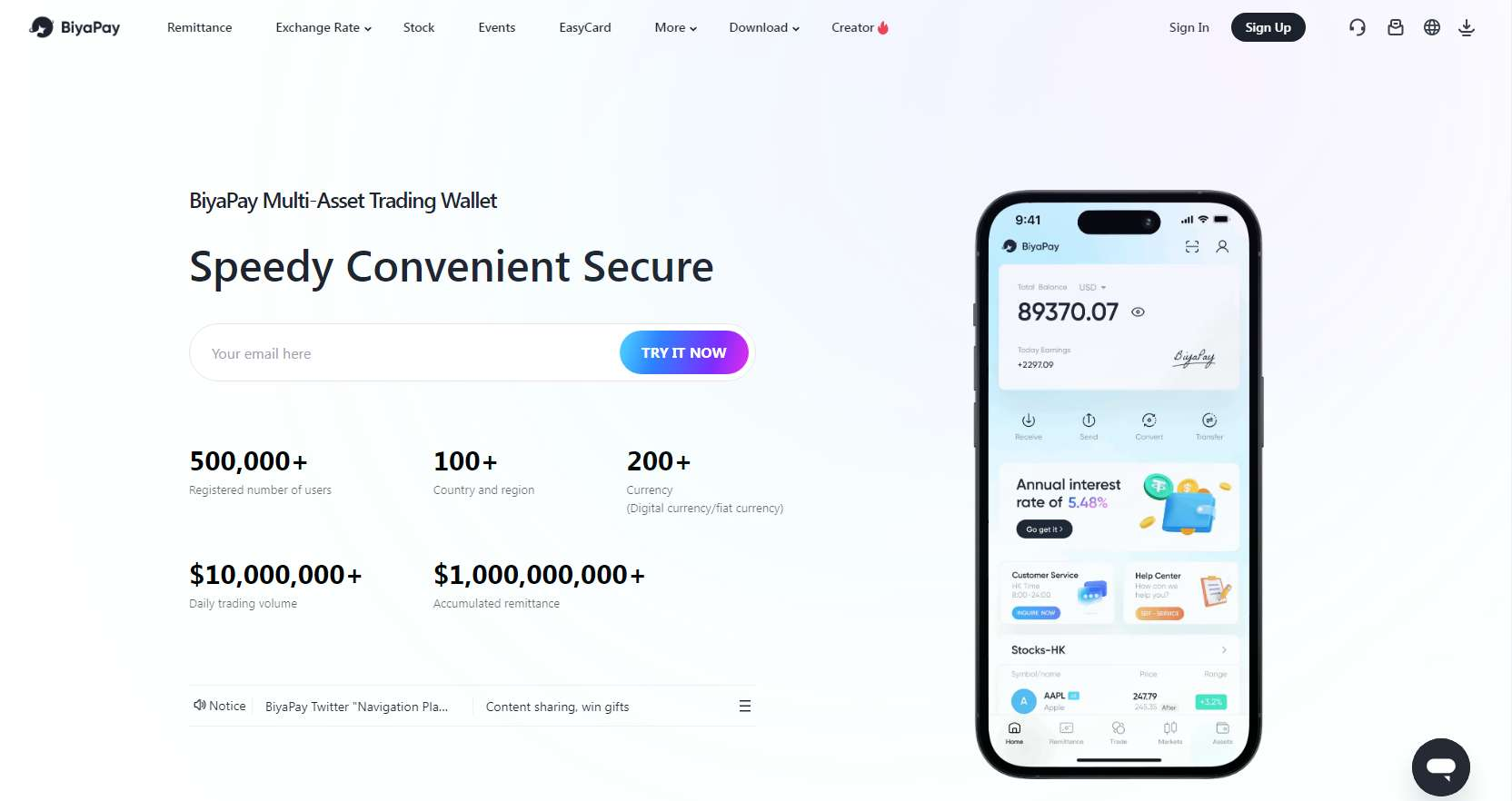

BiyaPay: simplifying digital asset transactions and investment

BiyaPay stands out as a comprehensive platform simplifying the often-complex world of digital asset transactions and investments. Its intuitive interface enables seamless buying, selling, and exchanging of various digital currencies, catering to both beginners and seasoned traders. Businesses and individuals benefit from a centralized platform to efficiently manage diverse digital portfolios, including cryptocurrencies and tokenized assets, providing a holistic view and enhanced control over their holdings.

Key features of BiyaPay are designed for user empowerment and security. The platform offers competitive low transaction fees, robust security measures to safeguard user funds and data, and real-time price tracking for informed decision-making. Notably, BiyaPay integrates digital asset management with secure payment processing, positioning itself as a potential all-in-one solution for digital asset enthusiasts seeking efficient investment management and seamless transactional capabilities.

Key Features

- Simplified digital asset transactions: Facilitates easy buying, selling, and exchanging of various digital currencies through a user-friendly interface.

- Comprehensive portfolio management: Offers a centralized platform to manage diverse digital asset holdings, including cryptocurrencies and tokenized assets.

- Low transaction fees: Provides cost-effective trading and exchange of digital assets.

- Secure transactions: Implements robust security measures to protect user funds and data during all transactions.

- Integrated payment processing: Seamlessly combines digital asset management with efficient payment capabilities, potentially allowing users to utilize their digital assets for everyday transactions.

Steps to use BiyaPay for digital asset transactions

Step 1: Download the BiyaPay app

Kickstart the process by first downloading the BiyaPay app on your smartphone. The app is available for both Android and iOS devices presently.

Step 2: Register and verify your identity

After successfully downloading and installing the app, launch it and sign-up using your email address. After that, complete the identity verification process and fill out your user profile to activate all features securely. Remember that this process can take some time to be completed.

Step 3: Fund your BiyaPay account

Once your account is verified, head over to the “Wallet” or “Deposit” section of the app and select the digital asset or fiat currency you want to deposit. For cryptocurrency deposits, you need to copy your BiyaPay wallet address for the selected cryptocurrency and send funds from an external wallet. Ensure you are sending the correct cryptocurrency to the correct address. Alternatively, for fiat (normal) currency deposits, you can use bank account transfer, credit/debit cards, or other regional/local payment methods.

Step 4: Initiate a digital asset transaction

As soon as your added funds are reflected in your BiyaPay Wallet, proceed to purchase a digital asset of your choice. Simply head over to the “Trade” section of the app and select the asset that you want to invest in. After that, proceed to pay for the transaction using your BiyaPay Wallet.

Step 5: Manage your purchased digital asset

Finally, use the “Assets” section of your BiyaPay app or account to access and manage your purchased digital assets.

User Reviews

“BiyaPay has truly simplified my crypto journey! The interface is incredibly intuitive, making buying and selling digital assets a breeze, even for a beginner like me. The low fees are a huge bonus, and I feel confident with their security measures.”

“As a small business owner, managing various digital assets was a headache until I found BiyaPay. Their comprehensive portfolio management is a game-changer, and integrated payment processing means I can handle everything in one secure place. Highly recommended!”

“I’m impressed with BiyaPay’s real-time tracking and efficient transaction speeds. Whether I’m trading or just checking my portfolio, the platform is responsive and reliable. It’s definitely my go-to for all things digital assets now.”

The future of digital assets: trends and predictions

The future of digital assets is dynamic and poised for significant evolution, driven by emerging trends and the ever-increasing integration of blockchain technology across various sectors.

Emerging trends

- Continued rise of NFTs: Non-fungible tokens are expected to move beyond digital art and collectibles, finding increasing utility in areas like ticketing, loyalty programs, digital identity, and even fractional ownership of physical assets. The focus may shift towards NFTs with tangible benefits and real-world applications.

- Central Bank Digital Currencies (CBDCs): Many central banks worldwide are exploring or piloting their own digital currencies (Bank for International Settlements, 2023). The introduction of CBDCs could significantly impact existing payment systems and the broader financial landscape, potentially interacting with other digital assets.

- Increased institutional adoption: As regulatory clarity improves and the digital asset infrastructure matures, more institutional investors are expected to enter space, bringing significant capital and driving further market development.

- Tokenization of Real-World Assets (RWAs): Converting physical assets like real estate, commodities, and even company shares into digital tokens on a blockchain is gaining traction (Chainlink). This can enhance liquidity, transparency, and accessibility for these traditionally less liquid assets.

Impact of regulation

Regulation will also play a pivotal role in shaping the future trajectory of digital assets.

- Increased regulatory scrutiny: Governments and regulatory bodies globally are increasingly focused on establishing frameworks for cryptocurrencies and NFTs to address concerns related to investor protection, market integrity, and illicit activities like money laundering (Thomas Reuters).

- Balancing innovation and protection: The challenge for regulators lies in creating rules that provide consumer protection and market stability without stifling innovation in this nascent space. Clear and consistent regulations are crucial for fostering trust and encouraging wider adoption.

- Impact on market dynamics: Regulatory announcements and actions can significantly impact the price and volatility of digital assets, creating both opportunities and risks for investors and traders. Positive regulatory developments can boost market confidence and attract institutional investors, while restrictive measures could hinder growth.

Evolution and potential reshaping of industries

Digital assets have the potential to revolutionize various industries in the coming years:

- Finance: Beyond cryptocurrencies and DeFi, tokenization could transform traditional financial markets by enabling fractional ownership, faster settlements, and new investment opportunities (PwC).

- Real estate: Tokenization could democratize real estate investment, allowing more people to own fractions of properties and potentially increasing market liquidity.

- Supply chain: Blockchain-based digital assets can enhance transparency and traceability in supply chains, improving efficiency and reducing fraud (Deloitte)

- Identity management: NFTs or other blockchain-based tokens could provide secure and portable digital identities, streamlining verification processes and empowering individuals with greater control over their data.

Conclusion

In conclusion, grasping the fundamentals of digital assets and their burgeoning role in modern finance, investment, and technology is no longer optional but essential in today’s evolving landscape. From cryptocurrencies reshaping transactions to NFTs revolutionizing ownership and blockchain underpinning secure and transparent systems, these innovations are rapidly transforming industries.

To confidently navigate this exciting and often complex world, consider exploring BiyaPay, a trusted platform designed to streamline your digital asset management, trading, and investment journey, empowering you to engage with digital currencies and NFTs with ease and security. So, start using BiyaPay today and enhance the prowess of your digital assets!

FAQs:

- What is the difference between digital assets and cryptocurrencies?

Digital assets are any asset in digital form, while cryptocurrencies are a specific type of digital asset using cryptography for security and often operating on decentralized blockchains. Think of cryptocurrencies as a subset within the broader category of digital assets. BiyaPay simplifies managing both, offering a unified platform for all your digital holdings.

- How do I start investing in digital assets?

Begin by researching different digital assets and choosing a reputable exchange or platform. Open an account, complete any required verification, and then you can fund your account to start buying and trading digital assets. With BiyaPay’s user-friendly interface, getting started with digital asset investment is seamless.

- What are the risks associated with investing in digital assets?

Digital assets are highly volatile, meaning their prices can fluctuate significantly and rapidly, leading to potential losses. Regulatory uncertainty and security risks like hacking also pose considerable threats to your investments. BiyaPay prioritizes the security of your investments with advanced encryption and multi-factor authentication.

- Can I use digital assets as collateral for loans?

Yes, some platforms offer crypto-backed loans where you can use your digital assets as collateral to borrow fiat currency or other digital assets. Terms and conditions vary significantly depending on the lender. BiyaPay may offer integrated options for leveraging your digital assets for financial opportunities.

- How does BiyaPay help manage digital asset transactions and investments?

BiyaPay provides a platform for users to securely store, manage, and transact with various digital assets. It might offer features for tracking investments, facilitating payments, and potentially accessing other digital asset-related services. BiyaPay offers a comprehensive suite of tools for efficient digital asset transaction and investment management, all in one place.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.