- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Stock Trading: Know Everything to Start Investing in the Stock Market

What is stock trading?

Stock trading meaning is defined essentially as the the buying and selling of shares of publicly listed companies on stock exchanges, like the New York Stock Exchange (NYSE) or the Nasdaq Stock Market. When you buy stock, you purchase a small piece of ownership in that company. The fundamental principle behind successful stock trading is to buy low and sell high, with the difference in price generating profit. It’s fascinating to note that over 58,000 companies are publicly traded worldwide (Investopedia).

There are various approaches to stock trading online, each with its own timeframe and risk profile:

- Day trading involves intra-day transactions, capitalizing on minor price movements.

- Long-term investing focuses on holding stocks for extended periods, aiming for growth based on the company’s fundamentals. Historically, the average annual return of the S&P 500 has been around 10% since its inception in 1928 (Investopedia), although this can vary significantly year to year. For instance, between 2015 and 2024, the annual returns of the S&P 500 ranged from -20.3% to 29.8% (Wells Fargo Advisers).

- Swing trading aims to profit from short-term price swings over a few days or weeks.

Understanding these distinctions is crucial for beginners. Interestingly, the Bombay Stock Exchange (BSE) is the oldest in Asia and has over 5,000 listed companies (Wikipedia), making it the largest in the world by the number of listed entities. However, only a small fraction of the Indian population, around 2.6%, actively invests in the stock market (Precize, 2024). The price of a stock is dynamic, influenced by the forces of supply and demand, reflecting the collective sentiment and expectations of investors.

How to start stock trading: a step-by-step guide

Embarking on your stock trading journey involves a structured approach. Here’s a step-by-step guide to get you started:

- Choose a Broker

Select a platform based on fees, usability, research tools, support, available investments, and minimum deposit. - Open & Fund Account

Complete the application, verify identity, choose an account type, and deposit funds via available methods. - Research Stocks

Study company fundamentals, technical indicators, and understand diversification and your risk tolerance. - Trade & Monitor

Learn order types (market, limit, stop), place your trades carefully, and continuously monitor your investments and the market.

Always, remember that stock trading involves risk, and you can lose money. Start with a small amount of capital that you can afford to lose, and gradually increase your investment as you gain experience and confidence.

Best stock trading apps and platforms for 2025

Navigating the landscape of stock trading apps and platforms in 2025 offers a plethora of choices, each with its own strengths. The following is an overview of some prominent contenders, keeping in mind the needs of both beginners and advanced traders.

Best stock trading platforms and apps

- Robinhood: Known for its user-friendly interface and commission-free trading for stocks, ETFs, and options (though stock options trading involves risks). It’s a popular choice for beginners due to its simplicity and accessibility. However, advanced traders might find its analytical tools somewhat limited.

- E*TRADE: Offers a more comprehensive platform suitable for both beginners and advanced traders. It provides a wider range of investment products, robust research tools, and educational resources. While it may have some commission fees (depending on the account and trading volume), its depth of features is a significant advantage.

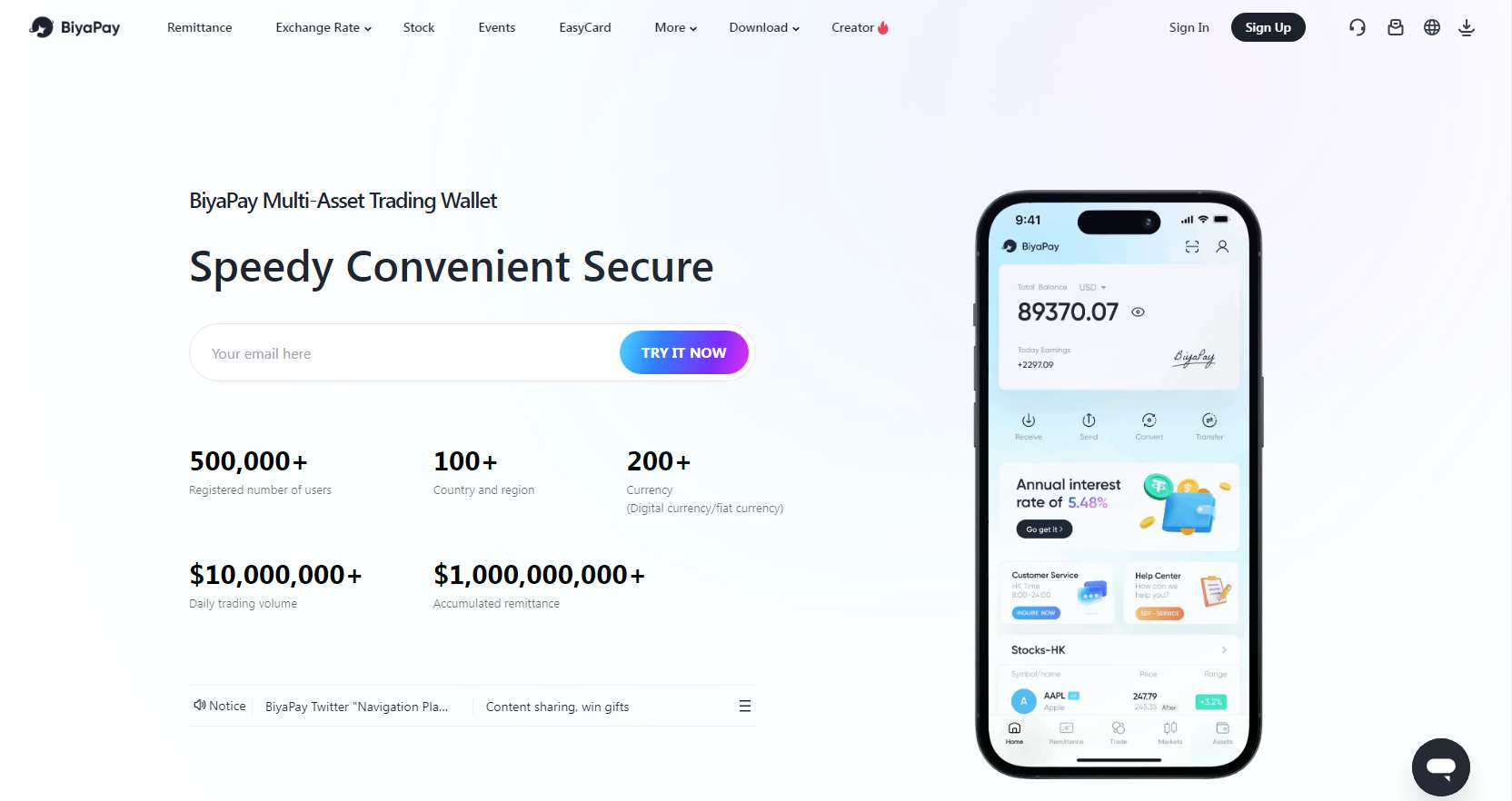

- BiyaPay: While primarily a multi-asset digital wallet facilitating global transactions and cryptocurrency, BiyaPay is increasingly recognized for its integrated international stock trading features. It aims to simplify access to global markets, particularly US and HK stocks, offering a unique proposition for users looking beyond their local exchanges. Its strength lies in its seamless integration of various financial services, including stock trading, within a single app.

Other Notable Platforms: Depending on specific needs, best stock trading sites and apps like Fidelity, Charles Schwab, and TD Ameritrade (now part of Schwab) also offer strong contenders with extensive research, diverse investment options, and robust trading tools.

Features to Look for in a Trading App

When choosing a stock trading app, several key features can significantly impact your trading experience:

- Ease of use (user interface): A clean, intuitive interface is crucial, especially for beginners. The app should be easy to navigate, allowing you to quickly find information, place trades, and monitor your portfolio. Look for clear charts, understandable order entry screens, and customizable layouts.

- Low fees and commissions: Transaction costs can eat into your profits, especially if you trade frequently. Consider the commission structure for stocks, ETFs, options, and other assets. Be aware of other potential fees, such as account maintenance fees, inactivity fees, and wire transfer fees. Commission-free trading has become increasingly common.

- Customer support: Reliable and responsive customer support is essential, particularly when you encounter issues or have questions. Check the availability of support channels (phone, email, live chat) and read reviews about the quality of their service.

- Educational resources: For beginners, access to educational materials like articles, videos, tutorials, and webinars can be invaluable for learning the fundamentals of stock trading and investment strategies.

- Research and analysis tools: Access to real-time market data, charting tools with technical indicators, analyst ratings, and news feeds can help you make more informed trading decisions. Advanced traders may look for more sophisticated tools for in-depth analysis.

- Security and reliability: Ensure the app has robust security measures to protect your personal and financial information. The platform should also be reliable and stable, especially during periods of high market volatility.

- Mobile accessibility: A well-functioning mobile app allows you to manage your portfolio and trade on the go, providing flexibility and convenience.

- Order types: The availability of various order types (market, limit, stop-loss, etc.) allows for more control over your trades and risk management.

How BiyaPay simplifies international stock trading?

BiyaPay offers a unique value proposition by simplifying access to international stock markets, particularly US and Hong Kong stocks, in several ways:

- Real-time market data: BiyaPay provides users with real-time market data for the international stocks it offers, allowing traders to make timely decisions based on up-to-the-minute price movements and market trends. This eliminates the need to rely on potentially delayed or fragmented data from multiple sources.

- Low transaction costs: BiyaPay often boasts competitive and transparent transaction costs for international stock trading compared to traditional brokerage accounts that might involve higher fees for cross-border transactions, currency conversions, and other complexities. This can significantly reduce the overall cost of investing in international markets.

- Simplified access: Traditionally, investing in international stock markets can involve opening accounts with foreign brokers, navigating different regulatory environments, and dealing with currency exchange processes. BiyaPay streamlines this process by offering access to these markets directly within its user-friendly app, eliminating many of these hurdles.

- Integrated platform: By offering stock trading alongside other financial services like cryptocurrency trading and global payments, BiyaPay provides a convenient, all-in-one platform for managing diverse financial activities. This integration can simplify portfolio management and offer a holistic view of your assets.

- Currency conversion: BiyaPay typically handles the necessary currency conversions when trading international stocks, often at competitive rates, making the process seamless for users who may not be familiar with foreign exchange markets.

AI in stock trading: the rise of AI stock trading bots

Artificial Intelligence (AI) is rapidly transforming the landscape of stock trading, with AI stock trading bots at the forefront of this revolution (Built In). These sophisticated software programs utilize complex algorithms and machine learning techniques to analyze vast amounts of real-time and historical market data, identify patterns, and execute trades with the goal of generating profits. By processing information such as price movements, trading volumes, news sentiment, and economic indicators at speeds far exceeding human capabilities, AI bots can make trading decisions in fractions of a second.

Benefits of using AI trading bots

The increasing adoption of AI trading bots stems from several compelling advantages:

- Automation of trades: AI bots can execute trades automatically based on pre-programmed strategies and real-time market analysis, eliminating the need for manual intervention. This allows traders to capitalize on opportunities 24/7, even while they are away from their trading terminals, taking advantage of global market movements across different time zones.

- Reduction of human error: Human traders are susceptible to emotional biases like fear and greed, which can lead to impulsive and irrational trading decisions. AI bots operate based on logic and data, removing these emotional influences and adhering strictly to the defined trading strategy. This can lead to more consistent and disciplined trading outcomes.

- Enhanced speed and efficiency: AI algorithms can analyze massive datasets and execute trades at lightning-fast speeds, identifying and acting upon fleeting market opportunities that human traders might miss. This speed is particularly advantageous in high-frequency trading (HFT) strategies.

- Backtesting and strategy optimization: Many AI trading platforms offer backtesting capabilities, allowing users to simulate their trading strategies on historical data to assess their potential performance before deploying them with real capital. This enables traders to refine and optimize their strategies for various market conditions.

The role of free AI stock trading bots and platforms

For beginners eager to explore the potential of AI in stock trading, several free AI stock trading bots and platforms offer an accessible entry point:

- Paper trading with AI features: Some established brokers and platforms provide paper trading accounts that incorporate AI-driven features, allowing beginners to experiment with simulated AI-powered trades without risking real money. This provides a valuable learning environment to understand how AI algorithms function and evaluate their effectiveness.

- Community-driven and open-source bots: Some open-source projects and online communities offer AI trading bots free tools or frameworks that beginners can explore and potentially customize with some programming knowledge. However, these often require a higher degree of technical expertise to set up and manage. Examples include platforms like Superalgos, which is a community-owned, open-source crypto trading software that allows users to design, test, and execute trading bots for free.

- Educational platforms with AI simulations: Some educational platforms focused on finance and trading offer AI-driven simulations and tools to help beginners understand algorithmic trading concepts and the role of AI in market analysis.

Stock market trading for beginners: common pitfalls to avoid

Embarking on your stock trading journey can be exciting, but it’s also fraught with potential missteps, especially for newcomers. Avoiding these common pitfalls is crucial for preserving capital and building a solid foundation for long-term success.

- Chasing hot stocks (FOMO - Fear Of Missing Out): A frequent mistake is jumping into a stock that has already experienced a significant price surge, driven by hype or news. Beginners often fear missing out on potential gains, but buying at inflated prices significantly increases the risk of losses when the hype fades and the stock corrects. This often leads to buying high and selling low, the opposite of the fundamental trading principle.

- Not using stop-loss orders: A stop-loss order is an essential risk management tool that automatically sells a stock if it falls to a certain predetermined price. Many beginners neglect to use stop-loss orders, hoping the price will recover. However, without this safety net, potential losses can escalate dramatically, sometimes wiping out a significant portion of their capital.

- Investing without adequate research: Blindly following tips from friends, social media, or online forums without conducting independent research is a recipe for disaster. Beginners often fail to understand the company’s financials, business model, competitive landscape, and overall industry trends. Informed investment decisions require thorough due diligence, which is why undertaking stock trading courses for beginners is critical.

- Overtrading: Engaging in excessive buying and selling, often driven by the urge to make quick profits, can lead to higher transaction costs (commissions, fees) that erode potential gains. Beginners may also overreact to short-term market fluctuations, leading to poor trading decisions.

- Ignoring trading costs: New traders sometimes overlook the impact of trading fees and commissions on their overall returns. These costs can accumulate, especially for frequent traders, and significantly reduce profitability.

- Investing money they can’t afford to lose: The stock market inherently involves risk. Investing funds that are needed for essential expenses or debt repayment can lead to significant financial stress and forced selling at unfavorable times.

BiyaPay: revolutionizing stock trading with secure and low-cost transactions

BiyaPay is establishing itself as a comprehensive trading platform, offering competitive rates and streamlined access to global markets, particularly US and Hong Kong equities. This multi-asset digital wallet aims to democratize international investing by providing cost-effective solutions and simplifying the complexities often associated with traditional cross-border transactions. Its potential for seamless integration with existing popular stock trading apps and platforms promises a smoother flow of investment and payment processing, potentially reducing fees and enhancing user convenience through efficient currency conversions.

Beyond cost-effectiveness, BiyaPay prioritizes user experience with an intuitive interface, real-time market data, and robust multi-currency support tailored for international traders. This focus on accessibility and functionality aims to revolutionize stock trading by breaking down barriers to global markets. By combining secure transactions, low costs, and a user-friendly design, BiyaPay empowers a wider range of investors to participate in international stock trading with greater ease and efficiency in today’s interconnected financial landscape.

Key Features

- Access to global markets: Enables users to directly invest in international stock markets, specifically highlighting access to US and Hong Kong equities.

- Competitive low-cost transactions: Offers potentially lower transaction fees and competitive currency exchange rates for international stock trading compared to traditional brokers.

- Seamless integration capabilities: Designed to integrate with popular existing stock trading apps and platforms for efficient investment and payment processing.

- User-friendly interface: Provides an intuitive and easy-to-navigate platform, simplifying the complexities of international stock trading for all user levels.

- Real-time market data & multi-currency support: Equips traders with up-to-the-minute market information and the ability to manage funds in multiple currencies, crucial for informed international trading decisions.

Steps to use BiyaPay for stock trading

Step 1: Download the BiyaPay app

The primary step involves downloading the BiyaPay app on your smartphone. The app is available for both Android and iOS devices.

Step 2: Register and verify your identity

After successfully downloading and installing the app, launch it and sign-up using your email address. After that, complete the identity verification process and fill out your user profile to activate all features securely.

Step 3: Navigate to the stock trading section

Then, from the homepage, select the “Trade” option and you will be transported to the trading section of the BiyaPay app. Be sure to familiarize yourself with the interface, where you should be able to view real-time market data, search for stocks (primarily US and Hong Kong), and see order placement options.

Step 4: Add funds to your BiyaPay Wallet

Proceed to infuse your BiyaPay Wallet with necessary funds to successfully transact your stocking buying process. You can use payment methods like bank transfer, debit/credit cards, or use any region-specific methods.

Step 5: Search for the desired stock and place your order

Be sure to use the search functionality within the stock trading section to find the specific stock you wish to trade (e.g., Apple - AAPL, Tesla - TSLA, or Hong Kong-listed companies). Once you’ve selected a stock, proceed to purchase the requisite quantity (number of shares) as well as choose your order type (market order or limit order). Once done, review your purchase order and complete the transaction using your BiyaPay Wallet.

Step 6: Remember to monitor your trades and portfolio

After placing a trade, you can monitor its status and the overall performance of your stock portfolio within the BiyaPay app. Real-time market data helps you stay informed.

User Reviews

“BiyaPay has completely changed how I invest in international stocks! I used to find it so complicated and expensive to buy US stocks from my region, but BiyaPay makes it incredibly simple and the transaction costs are surprisingly low. The availability of real-time data is a huge plus, and I love that I can manage both my crypto and stock investments in one place. Highly recommend for anyone looking to diversify globally without the hassle!”

“As a beginner looking to dip my toes into the stock market, BiyaPay has been a fantastic discovery. The app’s interface is super intuitive, making it easy to navigate even for someone new to trading. I particularly appreciate multi-currency support, which simplifies everything when dealing with international assets. It truly feels like a one-stop shop for my financial needs, from payments to investing.”

“I’m genuinely impressed with BiyaPay’s efficiency and security. Funding my account and getting into US and HK stock trading was much faster than I anticipated, and the real-time quotes are spot on. I feel very confident with my assets on the platform, thanks to their robust security measures. It’s a reliable and cost-effective solution for anyone serious about expanding their investment portfolio globally.”

Conclusion

In conclusion, embarking on the stock trading journey requires a foundational understanding of market mechanics, a strategic approach to buying and selling shares, and a keen awareness of potential pitfalls. Prioritizing education, selecting appropriate trading apps and platforms, and rigorously applying risk management principles are paramount for navigating the complexities of the stock market.

As you venture into this dynamic landscape, consider BiyaPay as a secure and potentially cost-effective gateway to expand your investment horizons. Its integrated platform offers access to international stock markets, alongside other financial services, empowering you to explore a wider range of opportunities and potentially maximize your investment growth in the global arena. So, what are you waiting for? Start using BiyaPay today and take your global investments to the next stratosphere!

FAQs

- How do I start stock trading with little money?

Begin with fractional shares or ETFs and explore low-minimum deposit brokers. Focus on learning about the market before investing heavily. For accessing global investment opportunities with potentially lower costs, consider BiyaPay’s integrated platform for international stock trading.

- What is the best stock trading app for beginners?

User-friendly apps like Robinhood and parts of E*TRADE are often suggested, emphasizing ease of use and education. For a simplified experience accessing US and HK stock markets alongside crypto and global payments, explore BiyaPay.

- How can AI help with stock trading?

AI analyzes data and automates trades, potentially improving speed and reducing bias. Experiment with paper trading or basic AI tools to learn. BiyaPay integrates these advancements, offering real-time data for informed international trading decisions.

- What should beginners focus on when starting stock trading?

Prioritize education on market basics, strategies, and risk management, starting with small capital and a trading plan. Consider BiyaPay for a platform that also provides access to international stock markets, expanding your investment horizons.

- Can I use BiyaPay for stock trading?

Yes, BiyaPay allows trading in international stock markets, specifically US and Hong Kong stocks, within its multi-asset wallet. Its key advantage lies in providing simplified access and potentially lower costs for these global equities alongside other financial services.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.