- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Stock Tickers: What They Are and How to Use Them in Stock Market Trading

What is a stock ticker?

A stock ticker is a concise and unique identifier assigned to publicly traded companies on stock exchanges. Think of it as a company’s shorthand name in the financial world. Typically, these tickers are short symbols, often comprising a combination of letters. For instance, Apple Inc. trades under the ticker AAPL on the NASDAQ, while TSLA represents Tesla, Inc.

Historically, the term “ticker” originates from the mechanical ticker tape machines invented in the late 19th century, which printed stock symbols and their corresponding price information on a continuous paper strip (Wikipedia). While physical ticker tapes are largely symbolic today, the concept lives on in the scrolling electronic displays seen on financial news channels and trading platforms.

Stock tickers are more than just abbreviations; they are gateways to real-time market data. When you see a stock ticker, it’s usually accompanied by crucial information such as:

- Current price: The latest price at which the stock was traded.

- Change: The difference in the stock’s price from the previous day’s closing price, often indicated with a “+” (up) or “-” (down) sign, and sometimes with color-coding (green for positive, red for negative).

- Percentage change: The percentage of increase or decrease in the stock’s price.

- Volume: The number of shares that have been traded during the current trading day.

- Market capitalization: The total market value of a company’s outstanding shares (calculated by multiplying the current share price by the total number of outstanding shares). For example, as of late 2024, Apple’s market capitalization hovered around $3 trillion (Companies Market Cap), making it one of the world’s most valuable companies.

Different stock exchanges have their own conventions for ticker symbols. For example, stocks listed on the New York Stock Exchange (NYSE) generally have tickers with one to four letters, while those on the NASDAQ can have up to five letters (Investopedia). Sometimes, additional letters are appended to a ticker to indicate specific characteristics of the stock, such as different share classes (e.g., GOOGL and GOOG for Alphabet Inc.'s Class A and Class C shares) or special conditions like warrants being attached (e.g., a “W” suffix).

How does a stock market ticker work?

A stock market ticker is a continuous, scrolling display that shows updates about the latest trades of stocks. When a company is publicly traded, its stock symbol (ticker) is displayed along with real-time data, such as its trading price and trading volume. This information is updated constantly throughout market hours, allowing investors to monitor the performance of their stocks in real time.

The live stock ticker system works through exchanges such as the NYSE (New York Stock Exchange) and NASDAQ, which provide real-time price data to ticker displays around the world. Each stock ticker symbol, such as AAPL for Apple or GOOG for Alphabet (Google), represents a company’s shares, and the price displayed updates according to market fluctuations.

When you look at a stock ticker display, you will often see the stock symbol, current price, the price change from the previous trading session, and the volume of trades for that day. These updates allow investors and traders to react quickly to market changes.

Live stock market ticker: real-time updates

Live stock market tickers are crucial for investors who need up-to-the-minute updates on market performance. These live stock tickers provide investors with real-time information on stock prices, volume, and other critical metrics. This allows them to make timely decisions, especially when volatility is high or there’s a sudden market shift.

Many platforms, such as Bloomberg and Yahoo Finance, provide live stock tickers that allow you to follow stock price movements in real-time. The ability to track stocks instantly can help you capitalize on price changes and make more informed investment decisions. BiyaPay is one such platform that integrates live stock market tickers into its services, enabling users to stay on top of stock performance as part of a broader financial management platform.

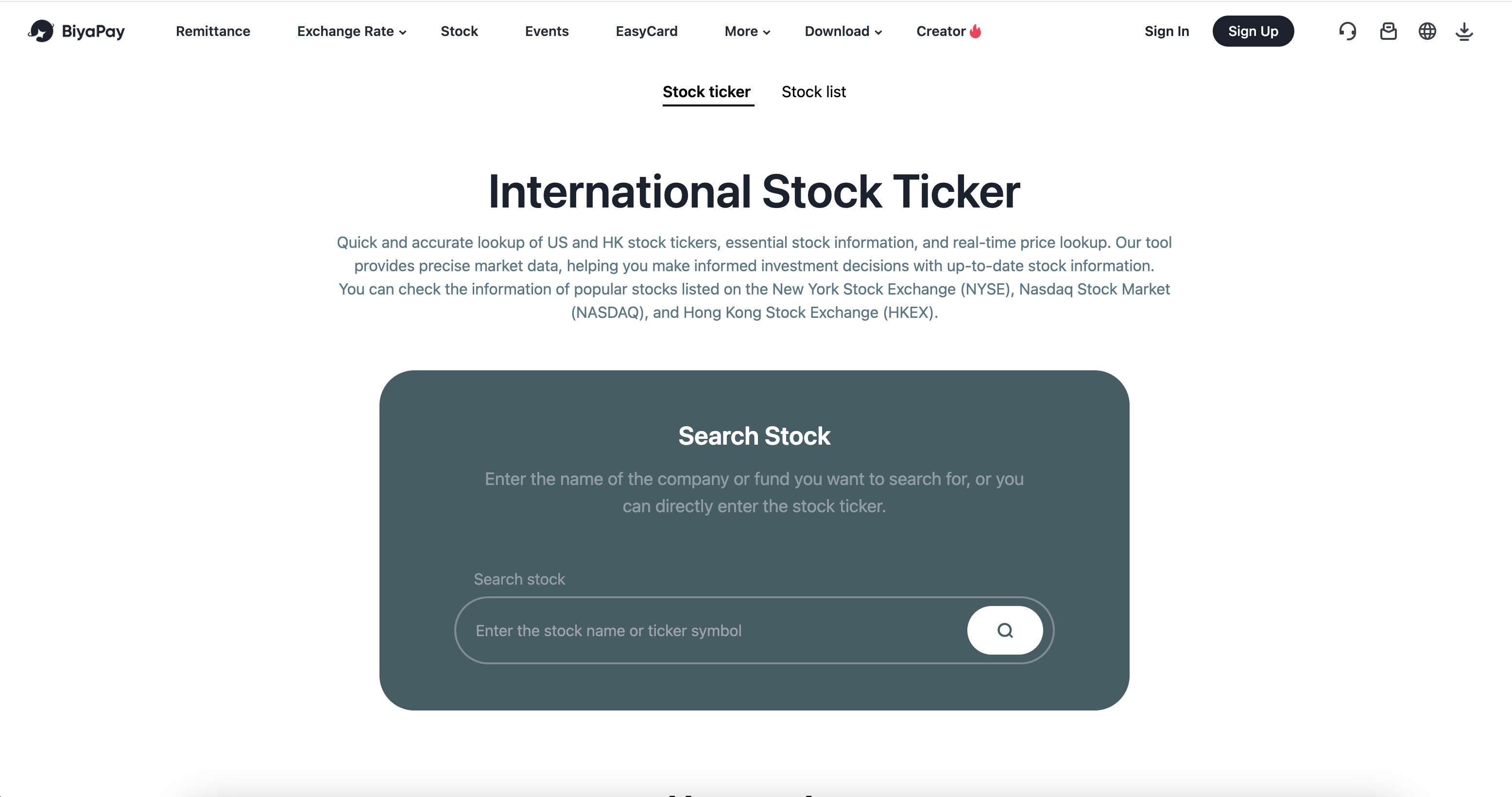

Stock ticker lookup: how to find stock information

Understanding stock ticker symbols is crucial for identifying companies on the stock exchange. Here are a few well-known stock ticker symbols and the companies they represent:

- AAPL: Apple

- AMZN: Amazon

- GOOG: Alphabet (Google)

- TSLA: Tesla

- MSFT: Microsoft

To track a stock’s performance, you need to know its ticker symbol. Stock ticker lookup tools are available on many financial platforms, allowing you to easily search for a company’s stock symbol. These lookup tools allow investors to identify the exact ticker symbol of the company they want to monitor, providing access to real-time data, stock prices, and historical trends.

Popular platforms for stock ticker lookup include Google Finance, MarketWatch, and the official websites of stock exchanges like NASDAQ and the NYSE. By using these tools, you can quickly find the ticker symbol for any publicly traded company and monitor its performance throughout the day.

Stock ticker display: how it helps investors

The following are some of the major ways through which a stock ticker display is a boon for investors.

- Real-time price monitoring: The primary benefit is the continuous updating of stock prices. Investors can see the very latest price at which a stock is trading, allowing them to react quickly to price movements. For instance, if an investor is waiting for a stock to reach a specific price point to buy or sell, the ticker display provides instant notification.

- Tracking price changes and trends: Ticker displays often show the change in price from the previous day’s close, both in absolute terms (e.g., +$0.50) and as a percentage (e.g., +1.2%). Many platforms use color-coding (green for gains, red for losses) to make this information immediately apparent. This helps investors quickly assess the current trend of their holdings or stocks they are interested in.

- Monitoring trading volume: The volume of shares being traded is another crucial piece of information often displayed alongside the ticker. A high trading volume can indicate strong interest in a stock, which might accompany significant price movements. Investors use volume data to gauge the strength behind a price trend. For example, a price increase accompanied by high volume is often seen as a stronger signal than an increase with low volume.

- Identifying market activity and opportunities: By displaying tickers of various actively traded or closely watched stocks, investors can get a sense of the overall market sentiment and identify potential trading opportunities. Rapidly moving tickers or those with significant price changes and high volume can signal events that warrant further investigation.

- Portfolio tracking: Many trading platforms allow investors to create customized ticker displays that show the stocks in their portfolio. This enables them to monitor the overall performance of their investments at a glance without having to navigate through multiple screens or constantly refresh data.

How to read a stock ticker

Understanding how to read a stock ticker is essential for interpreting the information it displays. Here’s a breakdown of the key components of a stock ticker:

- Stock Symbol: This is the unique identifier for a company’s stock. It is typically made up of 1-5 letters and represents the company on the exchange (e.g., AAPL for Apple or TSLA for Tesla).

- Price: This is the current price of the stock, reflecting the most recent trade. The price updates constantly throughout market hours.

- Change: The difference in price since the previous session, typically indicated with a green or red color. A green number indicates a positive change, while red indicates a loss.

- Volume: The number of shares traded during the current session. Higher volume often indicates increased market interest or price volatility.

To help you understand better, we have specifically designed the below example for you:

Imagine an investor holding shares of “Tech Innovations Inc.” (ticker symbol TII). Their trading platform displays the TII ticker with the following information:

TII $155.25 +1.50 (+0.98%) Vol: 1.2M

This display tells the investor that the last traded price for TII is $155.25, it has increased by $1.50 or 0.98% since the previous day’s close, and 1.2 million shares have been traded so far today. The upward arrow (or green color, depending on the platform) visually confirms the positive price movement.

BiyaPay: enhancing stock market monitoring with real-time ticker data

BiyaPay offers a seamless experience for investors looking to stay updated on stock prices and market trends. By integrating live stock tickers into its platform, BiyaPay provides users with immediate access to global stock data, making it easier for both personal and business users to track stock price movements and analyze trends. The app’s real-time stock ticker functionality helps users monitor market trends and make informed decisions, whether they are buying stocks, analyzing performance, or tracking investments. With

BiyaPay, users can access secure money transfers alongside live stock data, creating an integrated financial management platform. Its low-cost transactions and secure international payment options, combined with real-time stock data, offer a complete solution for investors and traders looking to streamline their financial activities.

Key Features

- Real-time global stock ticker data: BiyaPay integrates live stock tickers, providing users with immediate access to stock prices and market trends from around the world. This allows for timely monitoring of stock performance and market movements.

- Integrated financial management platform: BiyaPay combines live stock data with secure money transfer capabilities, offering a unified platform for managing investments and conducting financial transactions.

- Low-cost transactions: The platform emphasizes low-cost transactions, making it a cost-effective solution for both trading and international payments.

- Secure international payment options: BiyaPay provides secure options for international payments, facilitating cross-border financial activities for users engaged in global stock markets or other international transactions.

- Facilitates informed investment decisions: By providing real-time stock data and market analysis tools, BiyaPay empowers users to make well-informed decisions regarding buying, selling, and tracking their stock investments.

Steps to use BiyaPay to reveal stock ticker information

Step 1: Download the BiyaPay app

The first step should be to download the BiyaPay app on your smartphone. The app is available for both Android and iOS devices.

Step 2: Register and verify your identity

After successfully downloading and installing the app, launch it and sign-up using your email address. Once done, complete the identity verification process and fill out your user profile to activate all features securely.

Step 3: Head over to the markets section

From the homepage, click on the “Markets” option and from there you will be able to search for the ticker symbol of the company whose stock information you want to see (e.g., AAPL for Apple, TSLA for Tesla).

Step 4: Analyze the data

Once you have searched for and selected a stock ticker, the app should display real-time or near real-time data related to that stock. This will include the current price of the stock, any price change and percentage of change, trading volume, and high-low prices.

Step 5: Add stocks to watchlist

Lastly, BiyaPay offers the option to create a personalized watchlist of stocks you want to track regularly.

User Reviews

“I’ve been using BiyaPay for a few months now, and it’s truly a game-changer for anyone serious about global investing. The real-time stock ticker information is incredibly accurate and fast – I can see price movements and volume data for my US and Hong Kong stocks instantly. What really sets it apart is how seamlessly it integrates with secure money transfer features. I no longer need multiple apps to manage my investments and send funds internationally.”

“BiyaPay has become my go-to app for keeping a pulse on the stock market. The live stock ticker display is fantastic; it’s clean, easy to read, and provides all the essential data like current price, daily change, and trading volume at a glance. I particularly appreciate how simple it is to switch between different global markets and track specific tickers.”

“As someone who frequently trades, access to immediate and reliable stock ticker information is paramount, and BiyaPay delivers exactly that. The availability of real-time data helps me analyze trends and make quick, informed decisions. I love the intuitive interface for looking up any stock ticker and instantly seeing its performance metrics.”

Conclusion

In summary, stock tickers play a crucial role in the stock market by providing real-time updates on a company’s stock price, trading volume, and other key metrics. Understanding how to read and interpret these tickers is essential for both novice and experienced investors. Live stock tickers are particularly important for traders who need to make fast decisions based on the latest market data. Platforms like BiyaPay offer seamless access to live stock data, providing investors with the tools they need to track their investments and make informed decisions.

If you’re looking for a secure money transfer app that integrates live stock ticker data and offers a complete financial solution, BiyaPay is an excellent choice. It allows you to manage your stock investments and execute international transactions on one platform.

FAQs

Q1. What is the meaning of a stock ticker symbol? A stock ticker symbol is a unique identifier assigned to each publicly traded company. It is used to represent a company’s stock on the stock exchange.

Q2. How can I track stock prices with live tickers? You can track stock prices using live stock tickers available on platforms like BiyaPay, Yahoo Finance, or Bloomberg.

Q3. Can I customize the stock ticker display to track specific stocks? Yes, platforms like BiyaPay allow you to customize your stock ticker display to follow specific stocks, sectors, or market indices.

Q4. What are the differences between stock tickers on the NYSE and NASDAQ? Stock ticker symbols on the NYSE are typically 1-4 letters, while those on the NASDAQ are often 5 letters. Additionally, ticker symbols can differ in terms of how they’re structured on each exchange.

Q5. How does BiyaPay help with accessing stock market data and trading? BiyaPay integrates live stock tickers into its platform, providing real-time stock data, making it easier for users to manage investments and execute transactions securely.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.