- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Safe Money Transfer: How to Choose the Best Way to Send Money Securely

Why is safe money transfer important?

The undeniable convenience of online money transfers comes hand-in-hand with significant risks in today’s digital landscape, where fraud and scams are alarmingly prevalent. A primary concern revolves around the safeguarding of personal and financial information.

Consider this: in 2023 alone, the Federal Trade Commission (FTC) reported that consumers lost over $10 billion to fraud, a staggering increase of over 30% compared to 2020 (Federal Trade Comission, 2024), with a significant portion linked to online payment and money transfer scams. As digital transactions become the norm, the global digital payment transaction value is projected to reach over $15 trillion in 2024 (Juniper Research, 2024), sophisticated hackers and fraudsters are constantly evolving their tactics, targeting weak points in the transfer process. This escalating threat underscores the critical importance of individuals and businesses prioritizing secure money transfer options.

Robust safe money transfer solutions act as a vital shield against these ever-growing risks, offering strong protection against fraud, identity theft, and unauthorized access. Reputable secure platforms employ advanced encryption techniques, such as end-to-end encryption, which scrambles data from the sender to the recipient, making it virtually unreadable to unauthorized parties. This ensures that your sensitive details, including bank account information and personal identification, are not exposed during the transaction.

When selecting a transfer method, choosing trusted and reputable services with established security protocols is paramount. For instance, services employing multi-factor authentication (MFA) add an extra layer of security, reducing the risk of unauthorized access by over 99% in some studies (Intercede, 2024). By making informed choices and utilizing secure transfer methods, individuals and businesses can significantly mitigate the risk of substantial financial losses and effectively safeguard their valuable personal data in an increasingly interconnected world.

Is money transfer safe? How to ensure your transfer is secure

It’s natural to feel apprehensive about the safety of money transfers, especially with the increasing sophistication of cyber threats. Let’s address some common risks and highlight how you can bolster the security of your transactions:

- Fraud and scams: Fraud remains a significant threat in the realm of money transfers. The FTC’s 2023 data reveals that imposter scams, often involving requests for money transfers, accounted for the highest number of reported fraud cases, with losses exceeding $2.7 billion (CNBC, 2024). Scammers frequently impersonate legitimate transfer services or construct convincing fake platforms to deceive users. To safeguard yourself, always verify the legitimacy of the platform you’re using. Reputable services, such as BiyaPay, PayPal, and the likes, often boast high customer satisfaction ratings and a long-standing track record. For example, established players in the money transfer industry typically invest millions annually in security infrastructure and anti-fraud measures. Before initiating a transfer, take a moment to check independent reviews and ensure the platform has robust security certifications.

- Data security: The process of transferring money inevitably involves sharing sensitive personal and financial data. If your chosen service lacks adequate security protocols, this information could be vulnerable to breaches. It’s crucial to prioritize secure money transfer apps and platforms that employ strong encryption. End-to-end encryption, a standard in many leading secure transfer services, ensures that your data is scrambled from the moment it leaves your device until it reaches the recipient’s, rendering it unreadable to unauthorized interception. Look for explicit mentions of encryption protocols (like AES-256) (Progress Software, 2022) in the service’s security policy. Studies have shown that platforms utilizing strong encryption methods experience significantly lower rates of data breaches compared to those with weaker security measures.

- Verification methods: A critical step in securing your money transfer account is the implementation of robust verification methods. Always opt for services that offer multi-factor authentication (MFA). According to Microsoft, enabling MFA can block over 99.9% of account compromise attacks (Learn Microsoft, 2025). This added layer of security typically requires you to provide two or more verification factors, such as a password and a one-time code sent to your mobile device, before granting access to your account or authorizing transactions. While it might add a brief extra step to your login process, the enhanced security provided by MFA is a highly effective deterrent against unauthorized access and potential financial losses.

The safest money transfer apps

There are many secure money transfer apps available, each offering various features. The following is an overview of some of the most trusted apps for sending money securely.

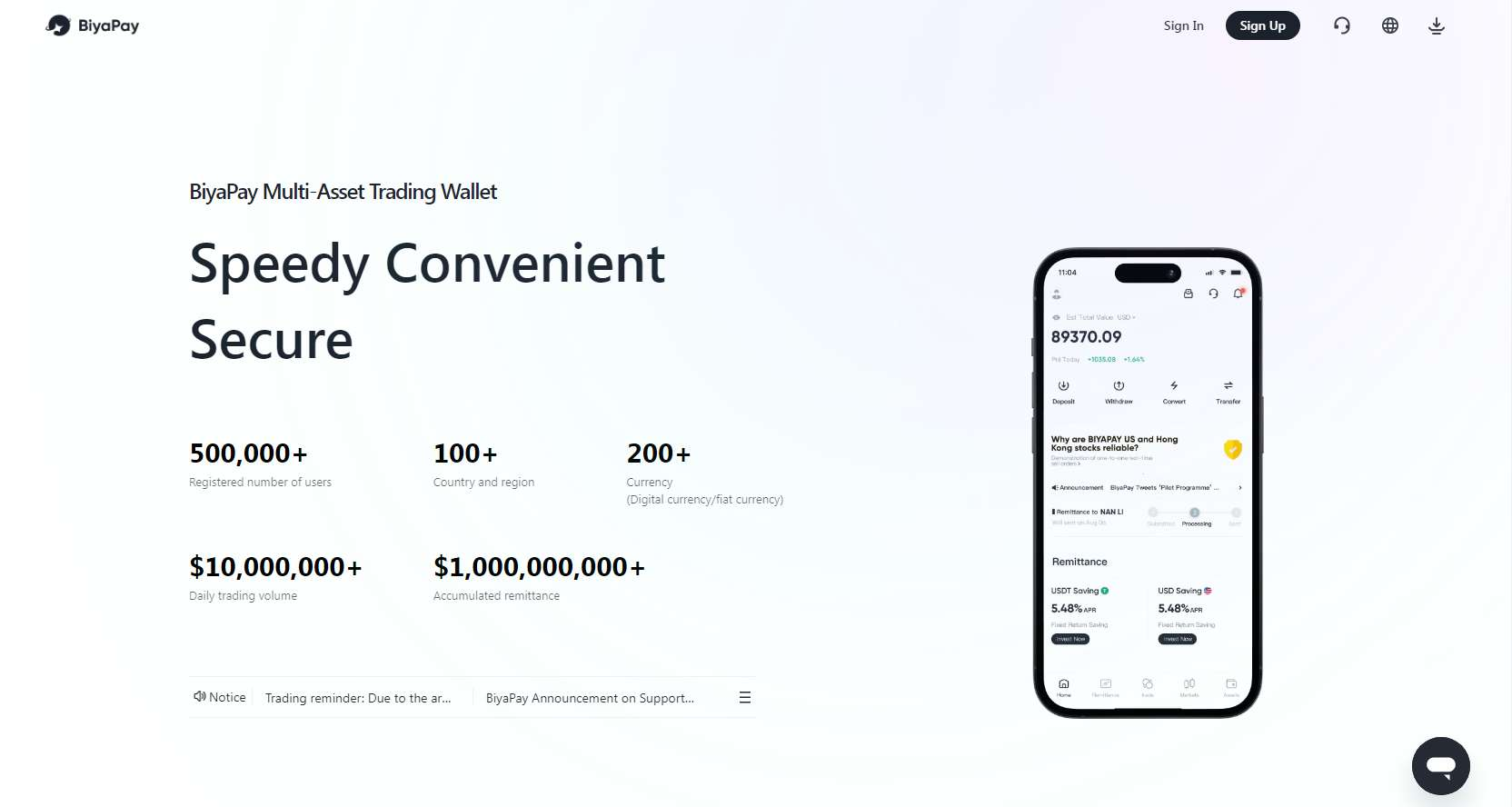

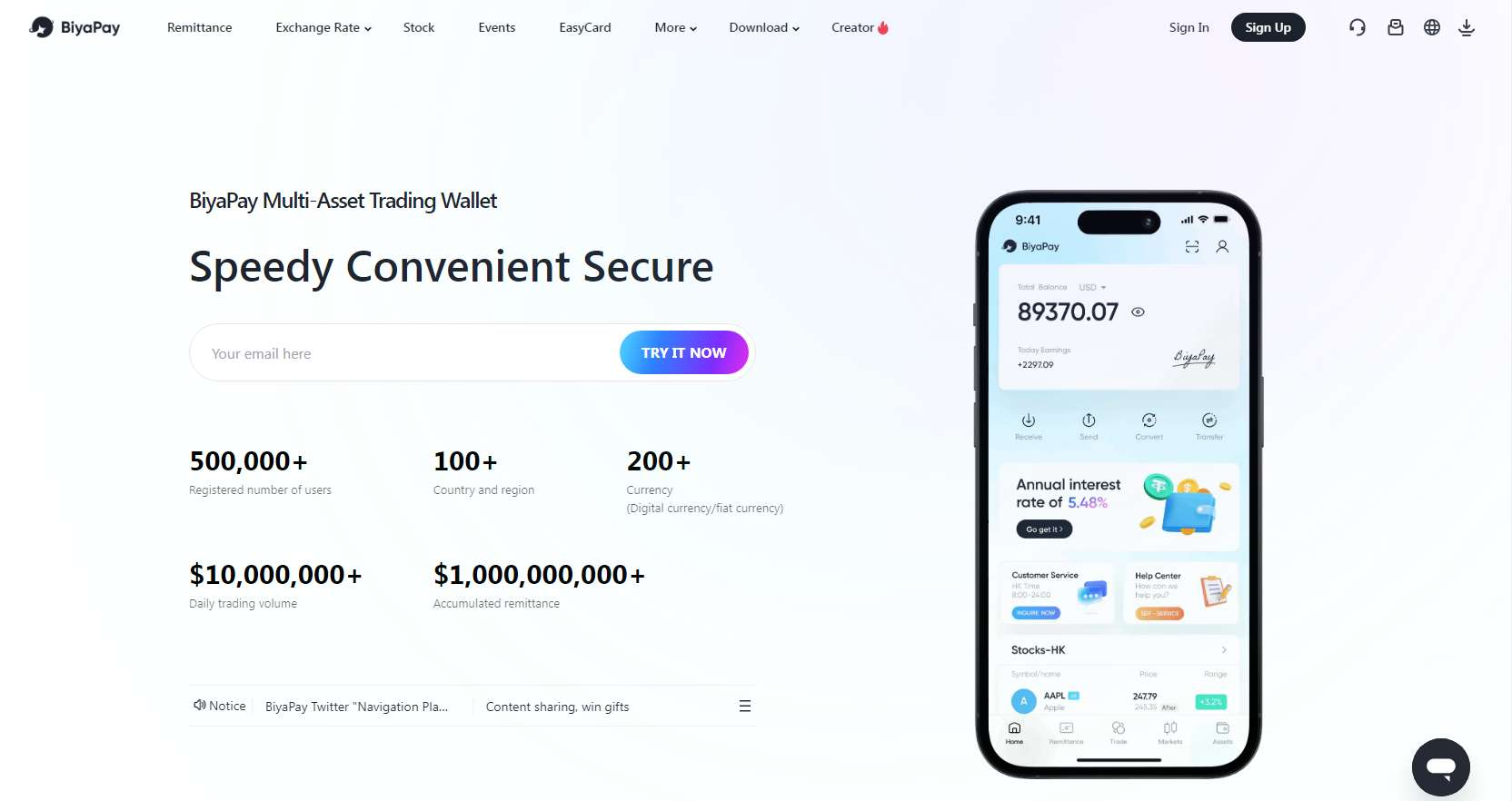

1. BiyaPay

BiyaPay is a secure, low-fee app designed for international money transfers. It allows users to send funds instantly to recipients in different currencies. Being the most secure way to send money, BiyaPay ensures real-time tracking, encryption, and multi-factor authentication, making it a reliable choice for secure, global transactions. Whether you’re sending money to the USA or Japan, BiyaPay ensures that funds are transferred safely and promptly. For instance, you can send 10,000 HKD to the USA using BiyaPay’s real-time transfer service.

Key Features

- Low transaction fees for international transfers

- Real-time tracking of transactions

- Multi-currency support for cross-border payments

- Safest way to transfer money with its encryption and multi-factor authentication for security

- User-friendly interface

Pros

- Instant global money transfers

- Secure and reliable

- Competitive exchange rates

- Low fees

Cons

- Limited availability in some regions

- Recipient needs compatible payment methods

2. PayPal

PayPal is one of the most recognized and trusted money transfer platforms. It’s widely used for online payments and offers safe money transfer services, including buyer protection and fraud detection. However, PayPal’s fees for international transfers can be higher than some alternatives.

Key Features

- Instant payments to PayPal users

- Available in over 200 countries

- Buyer and seller protection

- Multi-currency support

Pros

- Secure with encryption and fraud protection

- Fast and widely accepted

- Easy to use

Cons

- High fees for international transactions

- Exchange rates may not be favorable

3. Wise (formerly TransferWise)

Wise is a secure and reliable app that allows international money transfers with low fees and real-time tracking. It’s known for its transparency and competitive exchange rates. Wise supports multiple currencies and ensures safe money transfers globally.

Key Features

- Transparent exchange rates

- Low fees for international transfers

- Real-time tracking

- Multi-currency support

- Easy-to-use interface

Pros

- Low transfer fees

- Real-time tracking

- Excellent customer service

Cons

- Limited availability in some countries

- Transfer limits on free accounts

4. Revolut

Revolut is a digital banking app that supports instant money transfers globally. It offers multi-currency support, low transfer fees, and an integrated exchange rate system, making it a great choice for individuals who need secure money transfers.

Key Features

- Instant international transfers

- Built-in exchange rate system

- Multi-currency support

- Mobile banking and financial management features

Pros

- Fast transfers with competitive rates

- User-friendly mobile app

- Supports cryptocurrency transfers

Cons

- Limited free transfers on lower plans

- Higher fees for premium features

BiyaPay: a secure and efficient money transfer platform

If you are wondering about what is the safest money transfer app, then remember that BiyaPay is a highly trusted platform for secure money transfers. With its competitive fees, real-time exchange rate tracking, and low transaction costs, BiyaPay provides a seamless way to send funds globally. Whether you are sending money to family, friends, or clients, BiyaPay ensures that your transaction is both secure and fast. With built-in encryption and fraud protection, BiyaPay is an excellent choice for those looking for a safe and reliable money transfer solution.

Key Features

- Real-time exchange rate tracking: Stay informed and make the most of your transfers with up-to-the-minute visibility into currency exchange rates.

- Secure payment processing with encryption: Your financial data is protected through robust encryption protocols, ensuring the confidentiality and integrity of every transaction.

- Low transaction fees for international transfers: Enjoy cost-effective global money transfers with competitively low transaction fees.

- Multi-currency support for global transactions: Send and receive money in a wide range of currencies, facilitating seamless international transactions.

- Fraud protection and multi-factor authentication: Benefit from advanced fraud detection systems and multi-factor authentication, adding crucial layers of security to safeguard your funds and account.

Why BiyaPay stands out for international transfers

BiyaPay offers instant fund delivery with real-time tracking, which ensures that both the sender and recipient can monitor the progress of their money at every step. Whether you are sending funds to the USA or Japan, BiyaPay ensures a fast, low-fee, and secure transfer experience. Sending money from the USA to Japan has never been easier, and the app ensures that you can send money safely to recipients around the world.

Steps to follow when using BiyaPay for safe money transfers

Step 1: Download the BiyaPay app Before you can begin sending money, you need to first download the BiyaPay app on your smartphone. It’s currently available for both Android and iOS devices.

Step 2: Register and verify your identity After installing, launch the app and then sign up using your email address. Once done, you need to complete the identity verification process. Additionally, don’t forget to fill out your profile details.

Step 3: Select the send or transfer option

In the next step, select the “Send” or “Transfer” option from the homescreen and then proceed to fill out the details of the recipient, such as the name, bank account, bank branch ID, SWIFT/BIC codes, etc.

Step 4: Enter the requisite amount

After that, you will need to enter the respective amount that you are planning to send and the currency in which you will be sending it. Additionally, you will need to add your bank account or bank card (debit or credit card), which will act as the main source of funds. Alternatively, if you have sufficient funds in your BiyaPay Wallet, you can use that as well.

Step 5: Confirm, verify, and complete the payment

Finally, confirm your transaction and then verify the same with the respective authorization process. Once done, your funds will be transferred to the recipient’s account safely.

User Reviews

“I’ve been using BiyaPay for a few months now to send money to my family overseas, and I honestly couldn’t be happier. The biggest relief is security – knowing my money is protected by their encryption and multi-factor authentication gives me immense peace of mind. The real-time exchange rate tracking is fantastic; I can always send when the rates are favorable. Plus, the fees are genuinely low compared to other services I’ve tried, which saves me a good amount over time.”

“As a small business owner dealing with international suppliers, finding a reliable and affordable money transfer service was crucial. BiyaPay has been a game-changer. Their low transaction fees for international transfers have significantly cut down my operational costs. What truly stands out is their multi-currency support, which simplifies payments across different regions. I also appreciate robust fraud protection; it’s clear they take security seriously, which is vital when handling business funds.”

“I was a bit hesitant about sending money online, but BiyaPay made the entire process so simple and reassuring. From signing up to completing my first transfer, the app’s interface is incredibly intuitive and easy to navigate. What impressed me most was the emphasis on security – the multi-factor authentication and clear explanations of their encryption made me feel very safe. I love that I can track the exchange rates in real-time and that the fees are so transparent and low.”

How to choose the safest money transfer method for your needs

Talking about safe ways to transfer money, choosing the right transfer method involves considering multiple factors to ensure the transaction is secure, fast, and affordable. Here are key points to consider when selecting the safest money transfer method:

- Transfer Speed: How quickly does the service process the transfer? Keep in mind that faster transfer speeds come with higher fees, so make sure that you weigh your options. For urgent transfers, real-time transfer services like BiyaPay are ideal, since it offers global transfers at minimal costs.

- Fees: Compare fees across services to find a cost-effective solution. Some apps charge higher fees for international transfers, while others offer lower or even fee-free transfers.

- Security: Look for platforms with end-to-end encryption and multi-factor authentication to keep your data safe. Additionally, look for industry-standard security certifications (like PCI DSS for payment card data).

- Global Coverage: Ensure the service operates in the countries involved in your transaction, particularly if you’re sending money internationally. In addition to that, confirm that the service handles the currencies you need to send and receive.

- Ease of Use: Choose a platform that’s intuitive and easy to use, so you don’t face any difficulties when sending funds. Also, ensure that the platform has proper availability of support channels (e.g., phone, email, live chat).

Conclusion

In today’s digital age, where the convenience of online money transfers is increasingly targeted by fraudulent activities, prioritizing security is paramount. Selecting the most robust and reliable method for transferring funds is no longer just a preference, but a necessity for safeguarding your hard-earned money and sensitive personal information.

While various options exist, platforms like BiyaPay underscore the importance of choosing services that integrate security, speed, and user-friendliness into their core offerings. By opting for secure transfer methods, you actively mitigate the risks associated with online fraud and identity theft, ensuring peace of mind with every transaction. For your next financial transfer, consider exploring the features and security protocols of platforms like BiyaPay, which strive to provide a safe, dependable, and intuitive experience for your global payment needs.

FAQs:

- Is it safe to send money online?

Yes, sending money online is safe if you use a trusted and secure platform that offers encryption, fraud protection, and multi-factor authentication, like BiyaPay.

- How do I know if a money transfer app is secure?

The best way to transfer cash is to look for apps with encryption, fraud protection, and multi-factor authentication to ensure the safety of your transactions. Apps like BiyaPay are designed with these features in mind.

- What is the safest way to send money internationally?

The safest way to send money internationally is through trusted and secure money transfer apps like BiyaPay, which offer low fees, real-time tracking, and secure processing.

- How does BiyaPay ensure the security of my transactions?

BiyaPay uses encryption and multi-factor authentication to protect every transaction, ensuring that your money and personal data are safe.

- Can I track my money transfer with BiyaPay?

Yes, BiyaPay offers real-time tracking for all transfers, so you can monitor the status of your money and ensure it reaches the recipient securely and promptly.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.