- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Virtual Payment Cards: The Future of Secure Online Transactions

What Are Virtual Payment Cards?

A virtual payment card is a digital-only payment solution that provides a unique 16-digit card number, expiration date, and CVV, generated instantly through platforms like BiyaPay or Revolut. Unlike physical credit or debit cards, virtual cards exist solely online, offering enhanced convenience and security for online purchases and vendor payments. Virtual card payment has become increasingly popular, with 68% of businesses adopting virtual cards by 2024 for their ability to reduce fraud risk and streamline expense management. These cards allow users to control spending limits and easily cancel or replace cards without physical reissues, making them ideal for modern digital transactions.

How Do Virtual Payment Cards Work?

Now that you know the basics, let’s move toward the actual implementation of these virtual payment cards and how you can put them to work in real life. This process mainly begins when a user requests or generates a virtual card for online payment. Here’s how it actually works.

Step 1: Create a virtual payment card

To create a virtual payment card, you log in to your bank or card provider’s app or website and request a virtual card number. The system generates a unique 16-digit card number, expiration date, and CVV, which you can use instantly for online purchases.

Step 2: Using the virtual payment card

Once you get the virtual card for online payment, simply enter the virtual card details at checkout, just as you would with a physical card. The payment request is routed to the virtual card provider, who verifies the transaction against any pre-set controls like spending limits or merchant restrictions. Be mindful that the payment will be initiated only if the authorization seems valid.

Benefits of Using Virtual Cards for Online Payments

There are a myriad of benefits of using virtual payment cards, including high security, enhanced convenience, and utmost flexibility. Here’s a quick rundown of the advantages you can enjoy when using these payment cards. Let’s have a closer look.

- Increased security: You might be surprised to know that losses from online payment fraud have exceeded $200 billion in 2024 in APAC. That’s where virtual cards come into the role. These offer a robust defense against this rising tide of digital crime by fundamentally changing how payment data is handled. Beyond simple masking, virtual cards employ several specific features that create multiple layers of security, such as single-use numbers, merchant locking, spending limits, and custom expiration dates.

- Convenience: Undoubtedly, virtual payment cards are highly convenient to set up, unlike other traditional payment options. All you have to do is enter your details and request the card from your financial institution. It further makes it perfect for one-time purchases or recurring payments without the hassle of waiting for a physical card to arrive. This ease of use streamlines online shopping and bill payments.

- Flexibility: Another advantage that makes virtual cards worth choosing over traditional options is their flexibility. Virtual cards can be tailored for specific payments, such as subscription services, online shopping, or business expenses. Whatever your requirement is, a virtual payment card is all set to make your financial transaction experience easier than ever.

- Budget management: What’s better than setting spending limits on your cards to control expenses? Well, virtual payment does exactly the same for you. It allows you to restrict your spending amount by inserting a specific limit, thus allowing for budget management and savings. Users can set precise spending limits on each virtual card, either a total limit for the card’s lifetime, a limit per transaction, or a limit within a specific timeframe.

Virtual Cards for Business: A Smarter Way to Manage Expenses

While individuals primarily benefit from security and convenience, businesses can realize direct financial advantages with virtual cards for business. Here’s how businesses can use these virtual payment cards and make the most of them.

- Manage expenses: Businesses issue virtual cards to employees for travel, meals, office supplies, and other expenses, allowing instant access to funds with built-in controls and real-time tracking.

- Cashback rebates: A major driver for B2B adoption is the potential to earn substantial cashback rebates on virtual card spending. Do you know some providers offer significant rebate programs? This is mainly done to effectively turn the accounts payable function from a cost center into a potential revenue generator.

- Manage recurring subscriptions: Virtual cards are commonly assigned to manage recurring subscriptions or vendor payments. Each subscription or vendor can have a dedicated card, making it easy to track, control, or cancel payments without disrupting other services.

- Working capital optimization: Do you know that a virtual card for businesses can help you optimize working capital? Yes, you read it right!! These offer flexibility in managing the cash flow, thus allowing businesses to pay suppliers promptly, potentially securing early payment discounts, while still benefiting from the credit card grace period.

Using Virtual Cards for Online Shopping

In addition to businesses, you can also use virtual cards for online shopping and pamper the shopaholic inside you. Use these cards at the time of checkout, and enjoy secure transactions without having to carry your physical cards. Here’s how virtual cards are relevant for online shopping and other personal uses.

- Safer shopping: Unlike traditional payment cards, virtual cards mask the banking details at the time of shopping, thus eliminating the risk of online fraud or cyber attack. This means your real credit or debit card details are never shared with the retailer, protecting your sensitive financial information.

- Protection against unauthorized charges: Because virtual cards for online shopping can be single-use or locked to a specific merchant, even if the card details are stolen or the retailer’s database is compromised, the card cannot be used elsewhere. What else do you need?

- Budgeting: Since virtual cards allow users to set limits for specific purchases, it automatically helps you stay within your budget and avoid indulging in unnecessary shopping or expenses. It also prevents overcharges and helps you manage your personal budget.

Simply put, virtual cards provide strong security, control, and convenience for online shopping, helping you avoid fraud and unwanted recurring payments.

Are Virtual Payment Cards Safe?

The simple answer is yes. Virtual card payments are extremely safe and convenient compared to traditional card payments for many reasons. First of all, these cards mask your sensitive information from the merchant or wherever you make the payment, thus eliminating the chance of online fraud.

Besides, these cards generate unique, temporary card numbers for each transaction or merchant. Many are single-use or can be locked to a specific vendor, so if the card details are stolen, they become useless for any other purchase. Additionally, virtual cards use encryption to protect data during transactions, ensuring that sensitive information is unreadable if intercepted.

BiyaPay: A Comprehensive Solution for Virtual Card Payments

Looking forward to a comprehensive solution for virtual card payments? Well, in that case, BiyaPay EasyCard can help!! It provides a robust and intuitive platform for managing virtual payment cards, designed to keep your personal and business information private and secure. The platform uses bank-grade encryption and multi-factor authentication to safeguard user assets and data.

With biyapay, users can instantly create virtual cards tailored for online shopping or business expenses. This process is streamlined and accessible through a minimalist interface.

Key features of the BiyaPay virtual payment card

- Flexible payments: BiyaPay supports mainstream payment platforms, such as eBay and PayPal.

- Instant global payments: This virtual payment card covers more than 190 countries with payments in more than 40 local currencies, thus making online payments easier than ever.

- Smart exchange calculator: BiyaPay has a smart exchange calculator and real-time currency conversion for efficient cross-border payments.

- Allows setting spending limits: The card allows customizable spending limits for each card, enhancing budget control.

All in all, BiyaPay is well-suited for both consumers and businesses seeking a secure, flexible way to manage virtual cards. Individuals benefit from privacy and fraud protection during online shopping, while businesses can streamline expenses, manage subscriptions.

How to Apply for BiyaPay virtual card

Step 1: Log into Your BiyaPay Account Sing upfor a BiyaPay account in just a few minutes and log in to get started.

Step 2: Apply for the Biya EasyCard Choose your preferred card number range, enter the necessary card details, and complete the top-up process.

Step 3: Start Using the Biya EasyCard Once your application is approved, your virtual BiyaPay card is ready for immediate use—no activation needed.

User Review

“BiyaPay’s EasyCard made managing my online expenses effortless. I love the ability to set spending limits for each virtual card, which helps me stay on budget. The real-time currency conversion is a game-changer for my international purchases.” — Emily R., Small Business Owner

“I feel much safer shopping online using BiyaPay EasyCard. The virtual card protects my main bank account details, and the real-time exchange rates help me get the best value when buying from international stores.” —Sophia L., Online Shopper

“As a freelancer working with clients worldwide, BiyaPay’s virtual card has been invaluable. Instant global payments and multi-currency support save me time and money. Plus, the spending limits give me peace of mind when managing different projects.” — John M., Freelancer

Where to Get Virtual Payment Cards?

Got convinced by virtual payment cards but have no idea how to acquire them? Don’t worry, this guide is here to help. There are plenty of ways to request your virtual cards for business or personal purposes. You can either get them from financial institutions or use a modern solution, like BiyaPay and others. Let’s find some quick options to get your virtual payment card.

Popular platforms to get virtual cards for payments.

- BiyaPay: BiyaPay is well-known for its secure, comprehensive virtual card management, supporting instant card creation, customizable limits, and multi-currency transactions. To apply for the card, simply log into your BiyaPay account and select the card number range. Fill in the card details and complete the top-up.

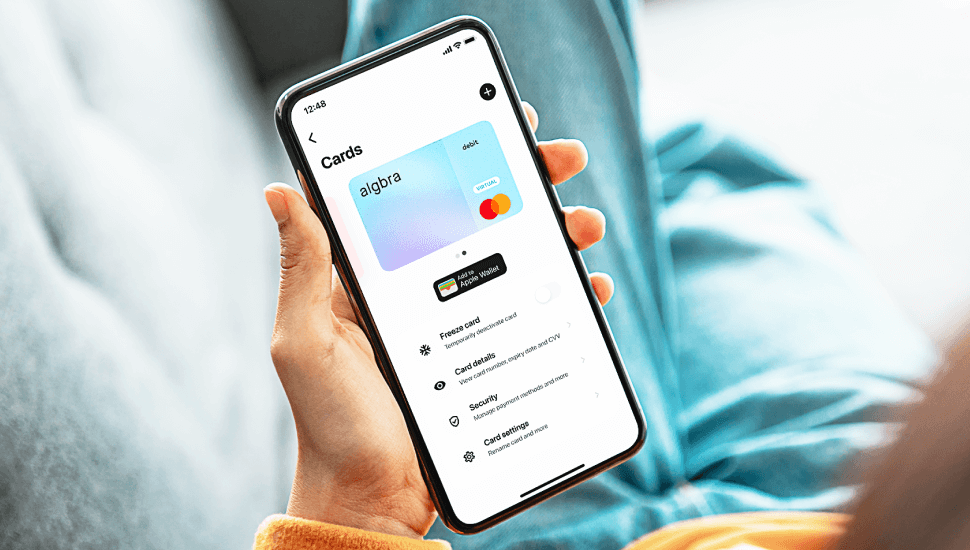

- Revolut Revolut is yet another best app to apply for your virtual cards. It lets you create multiple virtual cards, including disposable cards for extra security. Cards can be used instantly for online purchases or added to Apple Pay/Google Pay for contactless payments. Revolut supports over 30 currencies and offers both multi-use and single-use cards.

- Wise Create your Wise virtual debit card and spend it safely online, in-store, and abroad. It offers virtual cards linked to its multi-currency account, ideal for international shopping and travel, with competitive exchange rates and broad global acceptance. The card is available to all personal and business customers.

Conclusion

In conclusion, the guide has covered all the insights into the virtual payment card, its benefits, and how you can get it easily using popular platforms. Virtual cards mark a significant advancement in digital payments, offering enhanced security, granular control, and user convenience. While there are plenty of options to get a virtual card for payment, we still count on BiyaPay for many reasons. It provides instant card creation, multi-currency support, customizable spending controls, and seamless integration with various financial services, making it ideal for individuals and businesses alike. Get started with BiyaPay and unlock the full potential of secure global transactions.

FAQs:

What is the difference between a virtual card and a physical card?

A virtual card exists only in digital form and is designed mainly for online payments. It cannot be used for cash withdrawals or most in-person transactions, unlike a physical card, which is a tangible plastic card you can use at stores, ATMs, and online. Looking for the best virtual payment card with flexible payments? Opt for BiyaPay EasyCard and streamline your financial transactions.

Can I use a virtual payment card for international transactions?

Yes, of course. Virtual payment cards support international transactions, so you can make cross-border payments without any risks. If you are looking for a safer international transaction, opt for BiyaPay and use its smart exchange calculator to enjoy precise cross-border payments without any online threat or cyberattack.

Are virtual payment cards safer than traditional credit cards?

Absolutely yes. Virtual payment cards are way more safer than traditional methods, since they mask your sensitive information at the time of checkout, thus eliminating the threat of online fraud or breach. BiyaPay offers secure financial transactions, thus reducing fraud risk and administrative overhead.

How do I create a virtual card for online shopping?

You can create a virtual card by logging into your bank’s online platform, digital wallet app, or a fintech provider’s app. The process usually involves a few clicks to generate a new card number, which you can use immediately for online purchases. For those looking for a simple solution, opt for BiyaPay and fill in the card details to apply for the virtual payment card for online shopping.

Can businesses use virtual cards to manage employee expenses?

Yes, definitely. Virtual cards can be customized for each employee or project, making expense management more transparent and secure. Besides, businesses can put restrictions on specific purchases, thus allowing for budget management. BiyaPay offers a secure, user-friendly platform for businesses to manage virtual payment cards.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.