- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Mixed Signals in June 2025: Stock Market Outlook Explained

Image Source: pexels

June 2025 presents a perplexing landscape for investors, with the stock market 2025 reflecting a blend of optimism and uncertainty. While some major indexes like the S&P 500 showed resilience earlier this year, recent trends reveal a stark contrast. On June 5, the Nasdaq fell sharply, driven by a selloff in Tesla, which saw its stock price plummet by 14%. The Dow Jones Industrial Average also dropped 130 points on the same day. These movements highlight the challenges investors face in interpreting the market’s direction amid conflicting signals.

Understanding these fluctuations is crucial for navigating the complexities of a volatile market environment.

Key Takeaways

- The stock market in June 2025 shows mixed signals. Big indexes like the S&P 500 and Nasdaq are moving differently. Investors should keep track of these changes.

- The market is unstable because of world issues and money data. Tools can help investors understand feelings about the market and make smart choices.

- Recent events, like new tariffs and strong tech company profits, affect stocks a lot. Watching these events is important for investors.

- Jobs are steady, but problems like high unemployment might hurt spending. Knowing these things helps investors see how the economy is doing.

- New areas like green energy and AI offer chances to invest. Investors should look at these for future growth possibilities.

Key Market Movements in the Stock Market 2025

Image Source: pexels

Performance of Major Indexes (Dow, S&P 500, Nasdaq)

The performance of major indexes in 2025 has been a mixed bag, reflecting the broader uncertainty in the stock market. The S&P 500, often seen as a barometer of the U.S. economy, has shown resilience, with a price target of $6,500 by mid-year. However, the Dow Jones Industrial Average has struggled to maintain momentum, with nominal price growth of just 3.9% over the past decade. Meanwhile, the Nasdaq has outperformed its peers, driven by strong gains in the technology sector, achieving a nominal price change of 9.6% over the same period.

| Index | Nominal Price Change | Inflation Adjusted Change | Real Growth (Last 10 Years) |

|---|---|---|---|

| S&P 500 | 6.2% | 5.8% | 106% |

| Dow 30 | 3.9% | 3.6% | 92% |

| Nasdaq | 9.6% | 9.2% | 101% |

These figures highlight the divergence in performance among the indexes, with the Nasdaq benefiting from its tech-heavy composition, while the Dow has lagged due to its reliance on industrial and blue-chip stocks.

Volatility Trends and Investor Sentiment

Volatility has been a defining feature of the stock market in June 2025. Investors have faced heightened uncertainty due to geopolitical tensions and fluctuating economic indicators. A proprietary sentiment indicator, which tracks various financial metrics, revealed a steady decline in investor confidence leading up to the announcement of new tariffs. This decline was followed by a sharp drop, underscoring the market’s sensitivity to policy changes.

Key observations include:

- Increased market swings, particularly in response to macroeconomic data releases.

- A growing reliance on machine learning tools to analyze investor sentiment and predict market behavior.

- The importance of comprehensive data in navigating a volatile market environment.

These trends suggest that investors are becoming more cautious, with many adopting defensive strategies to mitigate risk.

Notable Market Events Driving Movements

Several significant events have shaped the stock market in 2025. The introduction of new tariffs on imported goods disrupted global trade flows, leading to a selloff in export-dependent sectors. Additionally, the Federal Reserve’s decision to pause interest rate hikes provided temporary relief to growth stocks, particularly in the technology sector.

Other notable developments include:

- A sharp decline in Tesla’s stock price, which fell 14% in a single day, dragging down the Nasdaq.

- Renewed optimism in the renewable energy sector, driven by government incentives and increased adoption of green technologies.

- The release of strong earnings reports from major tech companies, which helped offset losses in other sectors.

These events underscore the complexity of the stock market 2025, where both macroeconomic and company-specific factors play a crucial role in shaping investor behavior.

Economic Data and Its Impact on the Stock Market

Jobs Report and Unemployment Trends

The May nonfarm payrolls report revealed a mixed picture of the U.S. labor market. While the unemployment rate stood at 4.2%, indicating relative stability, the number of unemployed individuals remained significant at 7.2 million. Long-term unemployment, a critical metric for assessing economic health, affected 1.7 million people. The labor force participation rate, at 62.6%, showed a slight improvement but still lagged behind pre-pandemic levels.

| Metric | Value |

|---|---|

| Unemployment Rate | 4.2% |

| Number of Unemployed Individuals | 7.2 million |

| Long-term Unemployed (27 weeks or more) | 1.7 million |

| Labor Force Participation Rate | 62.6% |

| Employment-Population Ratio | 60.0% |

| Part-time Employment for Economic Reasons | 4.7 million |

| Individuals Not in Labor Force Wanting Job | 5.7 million |

Note: The labor market’s resilience has historically supported stock market growth. Since 1970, years with positive economic growth and lower policy rates have led to an average S&P 500 gain of 20%, compared to a 9% gain in all years. This trend underscores the importance of labor market stability in driving investor confidence.

Despite these figures, challenges persist. The high number of part-time workers for economic reasons (4.7 million) and individuals not in the labor force but wanting a job (5.7 million) highlight underlying weaknesses. These factors could weigh on consumer spending, a key driver of the U.S. economy.

Trade Deficit and Export/Import Data

Trade dynamics continue to influence the stock market in 2025. The U.S. trade deficit remains a point of concern, with its implications extending beyond economic theory to tangible market impacts. Historical data reveals the profound effects of trade imbalances on domestic industries and employment.

- Research by the Economic Policy Institute shows that increased Chinese imports from 2001 to 2018 resulted in the loss of 3.7 million U.S. jobs.

- A Stanford University study attributes 59.3% of U.S. manufacturing job losses from 2001 to 2019 to the ‘China Shock.’

- Joseph Gagnon from the Peterson Institute warned in 2017 that the debt incurred to finance the trade deficit was nearing unsustainable levels, posing risks to economic stability.

These findings highlight the interconnectedness of trade policies, domestic employment, and stock market performance. Export-dependent sectors, such as manufacturing and agriculture, remain particularly vulnerable to shifts in trade dynamics. Investors should monitor developments in trade negotiations and tariff policies closely, as these factors could significantly impact sector-specific trends.

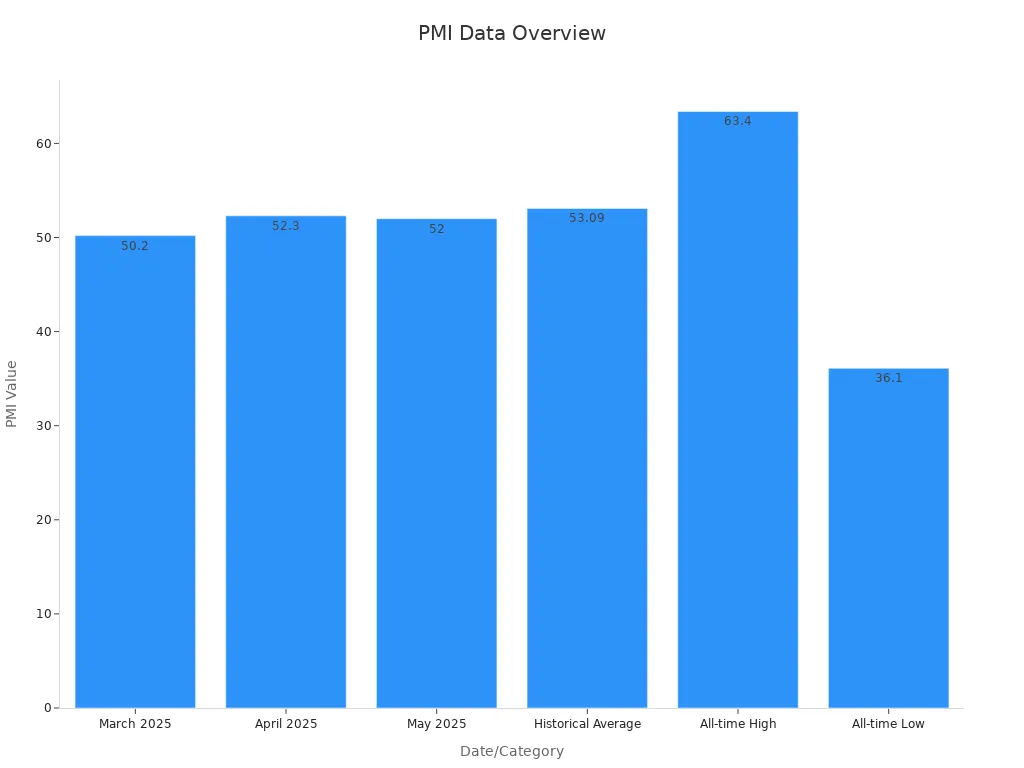

PMI Figures and Manufacturing Activity

Manufacturing activity, as measured by the Purchasing Managers’ Index (PMI), provides valuable insights into the health of the industrial sector. In May 2025, the PMI stood at 52, slightly down from April’s 52.3 but still above the critical threshold of 50, which indicates expansion. This suggests that the manufacturing sector continues to grow, albeit at a slower pace.

| Date | Manufacturing PMI | Change from Previous Month | Economic Implication |

|---|---|---|---|

| May 2025 | 52 | -0.3 | Above 50 indicates expansion in manufacturing activity |

| April 2025 | 52.3 | +2.1 | Continued growth in new orders and output |

| March 2025 | 50.2 | +0.2 | Stabilization in manufacturing sector |

| Historical Average | 53.09 | N/A | Long-term growth trend in manufacturing |

| All-time High | 63.40 | N/A | Peak manufacturing activity in July 2021 |

| All-time Low | 36.10 | N/A | Significant contraction in April 2020 |

The PMI’s decline from April reflects challenges such as supply chain disruptions and rising input costs. However, the sector’s resilience, supported by steady demand and technological advancements, bodes well for long-term growth. Investors should consider the PMI as a leading indicator of economic trends, particularly for industrial and export-oriented stocks.

Political and Global Influences on the Stock Market

Image Source: pexels

Trade Negotiations and Tariff Updates

Trade negotiations and tariff policies continue to play a pivotal role in shaping stock market trends in 2025. The United States has adjusted tariffs on key trading partners, impacting industries reliant on global supply chains. For instance, tariffs on steel and aluminum remain at 25%, affecting manufacturing and construction sectors. Similarly, Canada and Mexico maintain high tariffs on U.S. goods, despite adjustments under the USMCA agreement.

| Country/Region | Tariff Rate (%) | Impact on U.S. Exports |

|---|---|---|

| Canada | 25 (adjusted for USMCA) | High tariffs on U.S. goods |

| Mexico | 25 (adjusted for USMCA) | High tariffs on U.S. goods |

| China | Up to 20 | Exceptionally steep tariffs exceeding 50% |

| All Trading Partners | 25 on steel and aluminum | Varies based on bilateral trade deficits |

These policies have created challenges for export-dependent sectors, leading to increased costs and reduced competitiveness. Investors should monitor ongoing trade negotiations closely, as any resolution or escalation could significantly influence market dynamics.

Key Political Events Impacting Markets

Political decisions in 2025 have introduced heightened uncertainty into the stock market. The lack of clarity surrounding U.S. trade policies has raised concerns about economic stability. For example, disappointing jobs data in May, with only 37,000 private jobs added, underscored the impact of political uncertainty on economic indicators. Additionally, geopolitical tensions, such as the ongoing conflict in Ukraine and instability in the Middle East, have further complicated the global economic outlook.

Political factors often act as catalysts for market volatility. Investors should remain vigilant, as policy shifts can create both risks and opportunities across various sectors.

Global Economic Developments and Their Effects

The global economy in 2025 faces a challenging environment, with growth projected to slow compared to previous years. The World Economic Outlook highlights that effective tariff rates have reached historic levels, directly influencing stock market performance. While global headline inflation is expected to decline, the pace of this reduction remains slower than anticipated. These factors contribute to a cautious investment climate.

In addition, geopolitical risks continue to weigh on investor sentiment. The conflict in Ukraine and other regional instabilities have disrupted supply chains and increased energy prices. These developments emphasize the interconnected nature of global markets, where international events can ripple through domestic economies and stock markets.

By understanding these global influences, investors can better navigate the complexities of the current market environment and identify potential opportunities amidst the challenges.

Stock Market News: Individual Stock Performances and Sector Trends

Notable Movers: Tesla, Apple, and Amazon

Tesla shares have faced significant challenges in 2025, with the company ranking last among the Magnificent Seven stocks. Despite its innovative strides in electric vehicles, Tesla’s stock performance has lagged, reflecting broader market pullbacks. Apple and Amazon have also struggled to maintain momentum, with none of these companies appearing in the top-50 best-performing stocks this year. U.S. stocks, in general, have experienced mid-to-high single-digit drawdowns at the index level, further highlighting the difficulties faced by these market leaders.

The underperformance of these tech giants underscores the importance of diversification in investment strategies. While these companies remain industry leaders, their recent struggles demonstrate the impact of market volatility and shifting investor sentiment.

Sector-Specific Trends: Tech, Energy, and Healthcare

The technology sector continues to drive innovation, with artificial intelligence (AI) emerging as a key focus. In healthcare, 77% of executives have identified AI as one of their top three investment priorities for the next 12 months. This trend aligns with the growing adoption of consumer-driven healthcare models, as evidenced by a 30% increase in individual coverage health reimbursement accounts (ICHRA). However, affordability remains a pressing issue, with 70% of healthcare consumers reporting financial strain due to rising costs.

The energy sector has also seen notable developments. Clean energy initiatives have gained momentum, driven by corporate decarbonization targets and government incentives. Utilities are prioritizing renewable energy to meet the demands of data center growth, signaling a shift toward sustainable practices.

Emerging Opportunities in Renewable Energy and AI

Renewable energy and AI represent two of the most promising sectors in 2025. Nearly 97% of utilities have prioritized clean energy to support data center expansion, highlighting the growing demand for sustainable solutions. Deloitte’s 2024 power and utilities survey suggests that tech companies with decarbonization goals will drive further renewable energy deployment. Additionally, efforts to address supply and demand constraints in clean energy are expected to create significant investment opportunities.

In the AI sector, advancements in machine learning and automation continue to transform industries. Companies investing in AI technologies are well-positioned to capitalize on these trends, particularly in healthcare and manufacturing. These emerging opportunities underscore the importance of forward-looking investment strategies in a rapidly evolving market.

The stock market in 2025 has exhibited a mix of resilience and volatility, shaped by economic, political, and sector-specific factors. Key takeaways include:

- U.S. large-cap stocks, represented by the S&P 500, achieved a 2.4% return in Q4 2024, despite a December pullback of over 2%.

- ETFs have gained momentum as mutual funds experience ongoing outflows.

Staying informed and adaptable remains critical in this environment. Analysts project positive earnings growth of 7% for the year, though interest rate dynamics may limit further upside. Consumer spending is expected to rise by 2.9%, driven by durable goods and services. Investors should monitor these trends closely to navigate the complexities of the market effectively.

Multi-Asset Wallet: BiyaPay

In a stock market with intensified volatility, seizing investment opportunities precisely requires efficient trading tools. As a global multi-asset trading platform, BiyaPay supports direct conversion of USDT to USD/HKD, providing 0-threshold access to US and Hong Kong stock markets. Without the need for an offshore account, users can trade popular stocks like Tesla and Apple in real time, while managing digital currency and stock funds integratively in a single account.

Now register with BiyaPay to embark on a convenient global stock investment journey and gain a competitive edge in the complex market environment.

FAQ

What are the main factors driving stock market volatility in 2025?

Economic data, geopolitical tensions, and policy changes are the primary drivers of volatility. For example, fluctuating interest rates and trade negotiations have significantly impacted investor sentiment. Monitoring these factors helps investors anticipate market movements.

How do political events influence stock market trends?

Political events, such as trade agreements or conflicts, create uncertainty that affects investor confidence. For instance, tariff adjustments or geopolitical instability can disrupt global supply chains, leading to market fluctuations. Staying informed about political developments is crucial for strategic investment decisions.

Why is Tesla’s stock underperforming in 2025?

Tesla’s stock has faced challenges due to broader market pullbacks and sector-specific pressures. Despite its leadership in electric vehicles, increased competition and shifting investor sentiment have contributed to its underperformance. Diversification remains essential for mitigating such risks.

What opportunities exist in renewable energy and AI sectors?

Renewable energy and AI offer significant growth potential. Government incentives and corporate decarbonization goals drive clean energy investments. Similarly, advancements in AI technologies create opportunities in healthcare, manufacturing, and other industries. These sectors represent promising areas for long-term investment.

How can investors navigate a volatile market environment?

Investors should focus on diversification, monitor economic and political developments, and adopt a long-term perspective. Utilizing tools like sentiment analysis and staying informed about sector-specific trends can help mitigate risks and identify opportunities in uncertain markets.

June 2025’s volatile stock market, with the S&P 500 hitting 6,000 before retreating and Tesla plunging 14%, demands agile tools to seize opportunities amid tariffs and geopolitical risks. BiyaPay empowers investors with a seamless, cost-effective platform for global markets. Convert USDT to USD/HKD instantly to trade stocks like Tesla or Apple without offshore accounts, with fees as low as 0.5% across 190+ countries. Enjoy same-day transfers arriving on the day of initiation, bypassing costly bank delays of 1-5 days. The intuitive interface minimizes errors, and real-time tracking ensures control. Sign up for BiyaPay in one minute to streamline tuition, shopping, or supplier payments, secured by robust multi-factor verification. Earn a 5.48% annualized yield on flexible savings. Licensed under U.S. MSB and New Zealand FSP, BiyaPay meets global standards. Join BiyaPay today to navigate market swings with confidence!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.