- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Avoid Common Mistakes When Sending Remittances to Canada

Image Source: unsplash

In the process of sending remittances to Canada, accurately filling out information is the key to ensuring funds arrive smoothly. Incorrect information may lead to remittance delays or even failures. The following are several filling details that require special attention:

- Payer Information: Verify the payer’s country code and name to avoid issues due to information errors.

- Recipient Name: Ensure the recipient’s name is consistent with their identification documents, and do not use nicknames.

- Bank Account Number: Carefully verify the bank account number, comparing it with bank statements.

- Source of Income: Clearly specify the type of income and prepare relevant supporting documents.

- Amount Filling: Ensure the amount and currency unit are correct without errors.

- Transaction Code: Select the correct transaction code based on the nature of the income.

- Declaration Date: The filled date must match the actual date the documents are submitted to the bank.

In addition, fees, exchange rates, and limits also have a significant impact on the success rate of remittances. For example, according to Bank of China regulations, cross-border remittance limits and fees directly determine the amount received. Choosing the appropriate remittance method, such as Canadian immigration remittance methods, can effectively optimize costs and improve remittance success rates.

Precautions for Filling Out Remittance Information

Accuracy of Recipient Name and Account Information

When filling out recipient information, you need to pay special attention to the accuracy of the name and account information. Even a small error may lead to remittance failure or funds being returned. The following are some common issues and solutions:

- Name Consistency with ID Documents: Ensure the recipient’s name is completely consistent with their identification documents. Do not use nicknames or abbreviations.

- Account Number Verification: Banks check whether the account number matches the name during clearing. If the account number is incorrect, even if the name is correct, the funds will not arrive.

- Cross-Bank Remittance Notes: For cross-bank remittances, incorrect account information will cause funds to be returned within three business days, but handling fees are usually non-refunded.

According to statistics from the China Internet Network Information Center, many users fail to carefully verify information when using convenient transfer methods like WeChat Pay, leading to erroneous remittances. For example, in 2018, Mr. Huang mistakenly transferred 87,500 yuan to a friend with the same name and was unable to recover the funds. Such incidents remind you to remain cautious when filling out information.

Correctness of Remittance Amount and Currency Selection

The choice of remittance amount and currency unit directly affects the received amount. Incorrect amounts or currency units may lead to insufficient or excess funds, or even trigger legal issues. The following are some key points:

- Amount Filling: Ensure the filled amount is consistent with the actual remittance needs. Avoid transaction failures due to amount errors.

- Currency Unit Selection: Choose the correct currency unit based on the recipient’s country. For example, Canada typically uses the Canadian Dollar (CAD).

- Transaction Code: Select the correct transaction code based on the nature of the income. Incorrect codes may lead to banks refusing to process the remittance.

You can refer to the remittance guides provided by banks to ensure the amount and currency unit are filled correctly. Hong Kong banks usually provide detailed currency conversion information to help you optimize the remittance process.

Requirements for Filling Out SWIFT Code and Bank Address

SWIFT codes and bank addresses are necessary information for international remittances. Filling errors may lead to remittance failure or delays. The following are matters to note when filling:

- Accuracy of SWIFT Code: The SWIFT code is the bank’s unique identifier. Filling it incorrectly will cause funds to fail to reach the designated bank.

- Completeness of Bank Address: Provide the detailed bank address, including the branch name and address. Missing this information may lead to remittance failure.

- Remitter Information Requirements: When processing foreign exchange remittances, banks usually require the remitter’s name and address. These details are necessary parts of SWIFT messages.

According to relevant data, failure to provide SWIFT codes or bank addresses will prevent banks from providing corresponding services. You can obtain accurate SWIFT codes and address information through the bank’s official website or customer service.

Impact of Fees and Exchange Rates on Remittances

Image Source: unsplash

How to Calculate and Compare Fees

Remittance fees are an important factor affecting the final received amount. You need to understand the fee calculation methods and compare the costs of different remittance channels. The following are some key points:

- Fixed Fees vs. Percentage Fees: Some banks charge fixed handling fees, while other banks charge based on a percentage of the remittance amount. You can choose the more cost-effective fee method based on the remittance amount.

- Hidden Fees in Cross-Border Remittances: Some remittance methods may include hidden fees, such as currency conversion fees or intermediary bank fees. These fees are usually not directly displayed on the statement but will affect the final received amount.

- Fee Comparison Tools: Using online remittance fee comparison tools can help you quickly find the lowest-cost remittance method. For example, TransferWise and PayPal provide transparent fee structures, suitable for small remittances.

By carefully calculating and comparing fees, you can save remittance costs and ensure funds arrive smoothly.

Impact of Real-Time Exchange Rate Changes on Remittance Amounts

Exchange rate fluctuations will directly affect remittance amounts. You need to monitor real-time exchange rate changes and choose the appropriate remittance timing. The following are some suggestions:

- Impact of Exchange Rate Fluctuations: Exchange rate changes may cause the remittance amount to increase or decrease. For example, when the CAD to RMB exchange rate drops from 5.2 to 5.0, remitting 1000 CAD will result in 200 yuan less in RMB.

- Correlation Between Exchange Rates and Trade Volume: According to research data, the correlation value between exchange rates and import and export volumes is 0.456, with significance less than 0.05. This indicates that exchange rate fluctuations have a significant impact on cross-border transactions. The following are relevant data:

Variable Correlation Value Significance (sig) Exchange Rate and Import Volume 0.456 < 0.05 Exchange Rate and Export Volume 0.456 < 0.05 Import and Export Volume 0.99 < 0.05 - Rate-Locking Services: Some banks and remittance platforms provide rate-locking services, which can help you avoid losses due to exchange rate fluctuations. For example, when using Canadian immigration remittance methods, you can choose to lock the exchange rate to ensure a stable remittance amount.

Monitoring exchange rate changes and choosing the appropriate remittance timing can help you optimize remittance amounts.

Cost Optimization Suggestions for Canadian Immigration Remittance Methods

Choosing the appropriate remittance method can significantly reduce costs. The following are some optimization suggestions for Canadian immigration remittance methods:

- Choose Low-Fee Platforms: Canadian immigration remittance methods usually include bank wire transfers, online remittance platforms, and third-party payment tools. You can choose platforms with lower fees, such as TransferWise or Remitly.

- Optimize Currency Conversion Fees: Some platforms offer favorable currency conversion rates. For example, when using PayPal for remittances, you can choose the real-time exchange rate provided by the platform to avoid additional fees.

- Split Remittance Strategy: If the remittance amount is large, consider splitting remittances to reduce per-transaction fees. This can reduce remittance costs while lowering fund risks.

- Plan Remittance Timing in Advance: Choose remittance times based on exchange rate fluctuation trends. For example, remitting when the CAD exchange rate is high can yield higher converted amounts.

By reasonably selecting remittance methods and optimizing costs, you can ensure fund safety and save expenses.

Remittance Limits and Related Regulations

Remittance Limit Requirements in China and Canada

Remittance limits are important regulations that must be understood for cross-border remittances. China and Canada have clear restrictions on individual remittance amounts. You need to be familiar with these requirements to avoid violations.

In China, the annual foreign exchange limit per individual through bank wire transfers is 50,000 USD. If you need to remit beyond this limit, banks will require additional supporting documents, such as proof of income or purchase contracts. On the Canadian side, although there is no explicit individual remittance limit, banks may review large remittances. You need to consult the bank in advance to ensure compliance with relevant regulations.

Understanding these limits can help you plan remittance amounts and avoid delays or additional fees due to exceeding limits.

Necessity of Preparing Additional Documents in Advance

During cross-border remittances, banks usually require additional documents to verify fund sources or purposes. You need to prepare these documents in advance to ensure smooth remittances.

The following are some common document requirements:

- Proof of Income: If the remittance amount is large, banks may require pay stubs or tax records.

- Contracts or Agreements: For example, purchase contracts or tuition payment proofs, used to explain the remittance purpose.

- Identity Proof: Including passport or ID copies, used to verify the remitter’s identity.

Preparing these documents in advance can save time and avoid remittance delays due to incomplete documentation.

How to Handle Exceeding Limit Situations

If your remittance amount exceeds the regulated limit, you can take the following measures to resolve the issue:

- Split Remittances: Divide large remittances into multiple transactions, each within the limit, to avoid additional scrutiny.

- Use Canadian Immigration Remittance Methods: Choose platforms suitable for immigration, such as TransferWise or bank wire transfers. These methods usually offer more flexible limits and fee structures.

- Apply for Special Approval: Submit additional documents to the bank, applying for approval of excess remittances. For example, provide purchase contracts or tuition proofs to explain the fund purpose.

By reasonably planning and choosing appropriate remittance methods, you can effectively handle situations exceeding limits and ensure funds arrive safely.

Specific Operation Steps for the Remittance Process

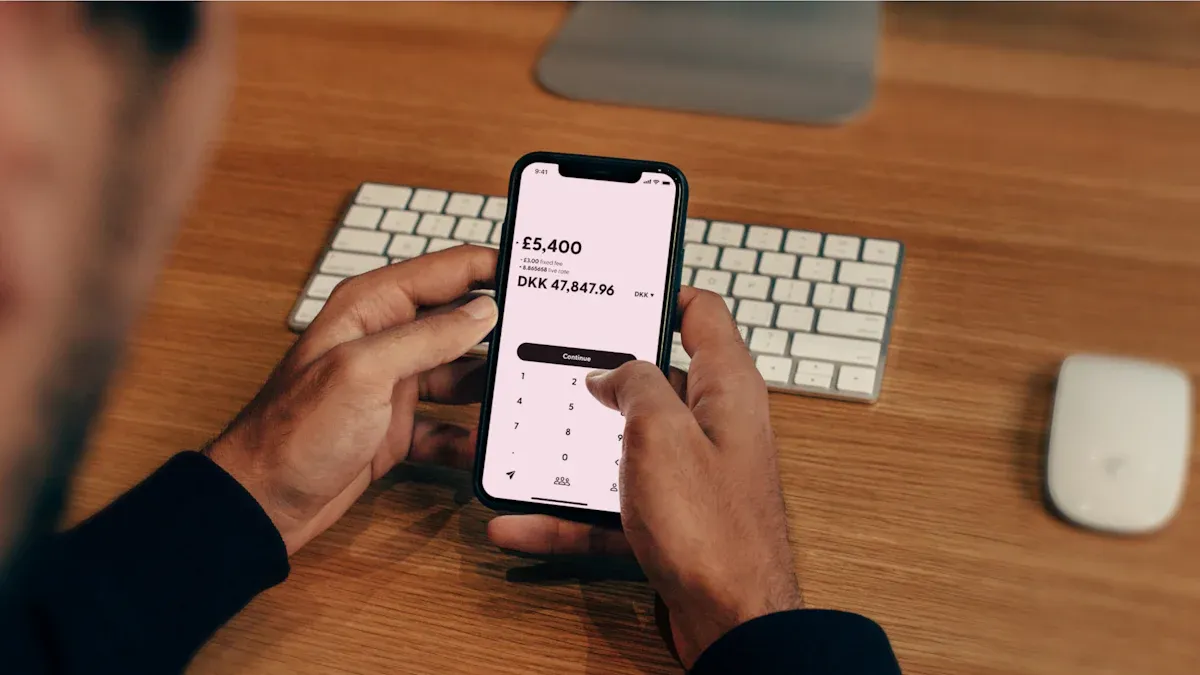

Image Source: unsplash

Choosing Bank Wire Transfers or Other Remittance Methods

Choosing the appropriate remittance method is the first step to ensuring funds arrive smoothly. You can decide to use bank wire transfers or other methods based on remittance amount, arrival speed, and cost. The following are the characteristics of different remittance methods:

- Bank wire transfers are suitable for large remittances. They are usually more expensive, with longer processing cycles, but have high security.

- Professional international remittance companies provide faster arrival speeds, usually T+1, suitable for situations requiring quick receipt.

- Digital cross-border payment platforms provide lower-cost, faster options for small and medium-sized enterprises and individuals, meeting high-frequency, small-amount transaction needs.

If you are a Canadian immigrant, choosing suitable remittance methods is particularly important. Canadian immigration remittance methods usually include bank wire transfers and digital payment platforms. You can choose the optimal solution based on specific needs.

Preparing and Verifying Necessary Remittance Information

Before remitting, preparing and verifying information is a key step to ensuring remittance success. You need to fill out a foreign income declaration form, confirming the legality of fund sources. This not only prevents money laundering and tax evasion but also avoids legal risks and fund losses. The following are the main information points to verify:

- Recipient name and bank account number. Ensure the information is accurate to avoid fund returns.

- SWIFT code and bank address. Fill in complete bank information to ensure funds accurately arrive.

- Remittance amount and currency unit. Choose the correct amount and currency unit based on needs, such as Canadian Dollar (CAD).

Carefully verifying this information can reduce errors and improve remittance success rates.

Steps for Tracking Status After Confirming Remittance

After completing the remittance, you need to track the fund status to ensure funds arrive safely. The following are specific operation steps:

- Save remittance vouchers. Vouchers contain transaction numbers and remittance amounts, serving as important references for status inquiries.

- Use online tools provided by banks or remittance platforms to check remittance status. Most platforms provide real-time status update functions.

- If delays or issues are found, immediately contact the bank or platform’s customer service for resolution.

Through these steps, you can stay informed about fund status and avoid unnecessary trouble.

Avoiding Common Oversights in the Operation Process

Importance of Verifying Remittance Information

Verifying remittance information is a key step to ensuring funds arrive safely. Incorrect information may lead to fund returns or delays, or even trigger legal disputes. You need to pay special attention to the following points:

- The recipient’s name and bank account number must completely match. Any spelling errors will cause banks to refuse to process the remittance.

- The filling of SWIFT codes and bank addresses needs to be accurate without errors. Incorrect codes may cause funds to flow to the wrong bank.

You can avoid similar issues by carefully checking each piece of information.

Solutions for Handling Remittance Failures or Delays

Remittance failures or delays may affect your fund usage plans. You need to take effective measures to resolve these issues. The following are proven solutions:

- Business Process Testing: Ensure smooth submission and processing of remittance applications.

- Exception Handling Testing: When errors or failures occur, the system can provide correct prompts and solutions.

- Security Testing: Ensure the security of remittance information to prevent information leaks and fund losses.

These measures can help you quickly resolve issues and reduce the impact of fund delays. Choosing reliable remittance platforms and banks can also lower the risk of failure.

Ensuring Receipt of Remittance Confirmation Notifications

After completing a remittance, you need to confirm whether funds have arrived safely. The following are steps to ensure receipt of remittance confirmation notifications:

- Save remittance vouchers. Vouchers contain transaction numbers, serving as important references for status inquiries.

- Use online tools provided by banks or remittance platforms to check remittance status. Most platforms provide real-time update functions.

- Contact bank customer service. If issues are found, immediately communicate with customer service to resolve them.

Through these steps, you can stay informed about fund status and ensure remittance completion smoothly. Maintaining communication with the bank can help you quickly resolve any potential issues.

In the process of sending remittances to Canada, you need to pay special attention to the accuracy of information filling, the impact of fees and exchange rates, and limit regulations. The following are some key points:

- Verify the recipient’s name, bank account number, and SWIFT code to ensure information is accurate.

- Compare the handling fees of different remittance methods and choose the lowest-cost solution.

- Prepare additional documents in advance to avoid delays due to incomplete documentation.

Staying cautious during remittances is the key to ensuring funds arrive safely. Errors may lead to fund returns or losses.

By referring to the suggestions in this article, you can effectively avoid common mistakes and ensure smooth remittance completion. Through reasonable planning and meticulous operations, you will be able to easily accomplish cross-border remittance tasks.

FAQ

1. How to Choose the Most Suitable Remittance Method?

When choosing a remittance method, you need to consider the amount, arrival speed, and fees. Bank wire transfers are suitable for large remittances, and online platforms like TransferWise are suitable for small, fast remittances.

Tip: Compare the fees and exchange rates of different platforms to choose the most cost-effective solution.

2. What to Do If a Remittance Fails?

If a remittance fails, immediately contact the bank or platform’s customer service. Provide the transaction number and relevant vouchers, explaining the issue. Banks usually assist you in identifying the cause and resolving the issue.

Note: Save all remittance records to facilitate subsequent inquiries.

3. How to Avoid Losses Due to Exchange Rate Fluctuations?

Monitor real-time exchange rates and choose to remit when the exchange rate is high. Some platforms provide rate-locking services, which can help you avoid amount losses due to exchange rate fluctuations.

Suggestion: Use exchange rate alert tools to stay updated on exchange rate changes at any time.

4. What Solutions Are Available When Exceeding Remittance Limits?

You can split remittances to avoid exceeding the single-transaction limit. If you need to remit large amounts, prepare proof of income or contracts in advance and apply for bank approval.

Tip: Consult bank customer service to understand specific requirements and processes.

5. Why Are SWIFT Codes and Bank Addresses Important?

SWIFT codes and bank addresses are key information to ensure funds accurately arrive. Incorrect codes may cause funds to flow to the wrong bank, delaying the arrival time.

Note: Confirm the accuracy of SWIFT codes and addresses through the bank’s official website or customer service.

In 2025, remittances to Canada face issues with incorrect information, high fees, delayed arrivals, and costs driven by exchange rate volatility, with bank transfers incurring high fees, taking days to arrive, and errors in names or SWIFT codes risking funds being returned. BiyaPay offers a seamless, cost-effective solution! Exchange over 30 fiat currencies and 200+ cryptocurrencies with real-time rate tracking to minimize volatility, enjoy fees as low as 0.5% across 190+ countries, and benefit from same-day initiated, same-day delivered transfers. Sign up for BiyaPay in just one minute to effortlessly manage tuition, living expenses, or investment transfers. Earn a 5.48% annualized yield on flexible savings to grow idle funds. Secured by blockchain technology and backed by U.S. MSB and New Zealand FSP licenses, BiyaPay ensures transparent, compliant transactions with minimal risks. Start today—join BiyaPay for a secure, efficient Canada remittance experience!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.