- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Innovative Methods and Practical Experience to Break Through Annual Remittance Limits

Image Source: pexels

The annual $50,000 foreign exchange quota limit may pose significant challenges for your needs in immigration, studying abroad, or cross-border fund requirements. You may have already discovered that breaking through this “immigration overseas remittance limit” requires not only clever methods but also ensuring compliance. Whether it’s paying tuition, purchasing property, or supporting family life, these needs make the flexibility of fund flows particularly important. Understanding the root of these challenges and finding innovative solutions will help you achieve your goals more efficiently.

Core Points

- Every Chinese resident enjoys an annual $50,000 foreign exchange quota, and understanding this limit helps in rationally planning fund needs.

- Using the foreign exchange quotas of family and friends can break through remittance limits, but transactions must be transparent to avoid legal risks.

- New remittance tools like Panda Remit provide fast and secure services, suitable for users needing to urgently process large funds.

- Opening an offshore account is an effective method for flexibly managing funds, choosing reputable banks and preparing necessary documents.

- Combining multiple methods and tools can more flexibly address remittance needs, ensuring the compliance and security of fund flows.

Rules and Background of the $50,000 Foreign Exchange Quota

Basic Definition and Scope of Application of the Foreign Exchange Quota

You may have heard of the annual $50,000 foreign exchange quota, but what exactly does it mean? According to the regulations of the China State Administration of Foreign Exchange, every resident within China enjoys an annual foreign exchange convenience quota equivalent to $50,000. This quota applies to individuals and resets annually, with no accumulation allowed. Within this quota, you can complete foreign exchange purchases without providing any supporting documents. However, if the purchase amount exceeds this limit, you need to submit relevant supporting documents to the bank for review before processing.

Understanding the scope of application of the foreign exchange quota is also important. It mainly targets individuals’ daily needs, such as paying tuition, purchasing overseas property, or supporting family life. If you need more detailed data or policy background, you can refer to the announcements issued by the Foreign Exchange Bureau and bank foreign exchange settlement data, which can help you better understand the definition and application of the foreign exchange quota.

Main Purposes and Regulatory Logic of Policy Restrictions

Why is there such a restriction? The core purpose of the policy is to maintain the stability of the financial market while promoting social fairness. Chinese regulatory authorities ensure the transparency of fund flows through penetrating supervision and reduce policy uncertainty. The regulatory logic also emphasizes balancing corporate autonomy with policy constraints.

For individuals, this restriction can prevent excessive capital outflows, protecting national economic security. Regulatory authorities are also striving to avoid excessive prevention, ensuring that rules are carefully considered. You can learn more about the policy purposes and regulatory logic through the Foreign Exchange Bureau’s announcements.

Impact of Quota Limits on Immigration and Cross-Border Fund Needs

If you are planning to immigrate or need to make large cross-border remittances, this restriction may cause trouble for your fund flows. For example, immigration overseas remittance limits may create pressure when paying the down payment for overseas property or supporting family life. For students studying abroad, tuition and living expenses may also be affected.

Addressing these issues requires finding legal and compliant alternative solutions, such as using Hong Kong bank services or exploring innovative remittance tools. These methods can not only help you break through restrictions but also ensure the security and compliance of fund flows.

Common Breakthrough Methods and Risk Analysis

Operation Methods and Potential Risks of Using Family and Friend Quotas

You can break through the annual remittance limit by using the foreign exchange quotas of family and friends. This method typically involves dispersing funds to multiple family or friend accounts, with each person purchasing foreign exchange and remitting to a designated overseas account. This approach is simple to operate and usually does not trigger regulatory alerts within the quota range. However, this method also carries potential risks.

First, the cooperation and trust level of family and friends are crucial. If they are unfamiliar with the process or unwilling to participate, it may lead to operation failure. Additionally, dispersing funds may increase management complexity, especially when multiple accounts are involved. More importantly, if the fund flows are deemed by regulatory authorities as evading policies, you may face legal risks. Therefore, when using family and friend quotas, you need to ensure the transparency of each transaction and avoid any behavior that may trigger violations.

Feasibility of Utilizing Cross-Border E-Commerce Pilot Policies

Cross-border e-commerce pilot policies provide new possibilities for fund flows. Through this policy, you can use the settlement mechanisms of cross-border e-commerce platforms to legally transfer funds to offshore accounts. This method is particularly suitable for business users, as it can optimize fund flows by combining market competition analysis.

For example, teams can use SWOT analysis to identify the strengths and weaknesses of enterprises, combine Porter’s Five Forces model to understand market competition patterns, and use PESTLE analysis to study the impact of policy and economic environments on the industry. These tools can help enterprises formulate more effective fund transfer strategies under cross-border e-commerce policies. For individual users, choosing reputable cross-border e-commerce platforms and understanding relevant policy details are crucial.

Legal Consequences and Risks of Using Underground Channels

Underground channels may seem like a quick way to break through immigration overseas remittance limits, but the legal consequences and risks they bring cannot be ignored. In the “5·05” case, the task force, through cooperation with public security organs, cracked down on multiple underground money laundering cases. These cases not only imposed legal sanctions on operators but also investigated traders who transferred funds through underground channels, creating a strong deterrent effect.

Operations through underground channels typically lack transparency, and fund flows are likely to trigger regulatory alerts. More importantly, this method may involve money laundering or other illegal activities, leading to severe legal consequences. The task force’s experience shows that the efficiency of cracking down on underground channels is improving, and enforcement risks are gradually decreasing. Therefore, you should avoid using underground channels and choose legal and compliant fund transfer methods to ensure fund safety and personal rights.

Detailed Explanation of Innovative Solutions

Image Source: unsplash

Advantages and Operation Steps of Using New Remittance Tools (e.g., Panda Remit)

New remittance tools are changing the way cross-border funds are transferred. Panda Remit is a remittance tool designed specifically for individuals and businesses. It provides fast, secure, and transparent fee services. Using Panda Remit, you can easily break through annual remittance limits while ensuring the compliance of fund flows.

Advantages of Panda Remit:

- Fast Speed: Remittances are usually completed within hours, far faster than traditional bank processing times.

- Transparent Fees: Panda Remit’s fees are clear, with no hidden charges.

- Simple Operation: Remittances can be completed via mobile phone or computer, without complex procedures.

Operation Steps:

- Register Account: Visit the Panda Remit official website, fill in personal information, and complete account registration.

- Verify Identity: Upload identity proof documents to ensure account compliance.

- Select Remittance Amount and Destination: Enter the remittance amount and recipient information.

- Pay Remittance Fees: Choose a payment method and complete fee payment.

- Confirm Remittance: Submit the remittance application and wait for system processing.

Tip: When using Panda Remit, ensure the recipient information is accurate to avoid remittance failure or delays.

Process and Precautions for Opening Offshore Accounts

Opening an offshore account is another effective method to break through remittance limits. Through an offshore account, you can manage funds more flexibly while enjoying more financial services. Hong Kong banks are often the preferred choice, as they offer various account types and convenient cross-border services.

Process for Opening an Offshore Account:

- Choose a Bank: Select a suitable Hong Kong bank based on your needs, such as HSBC or Standard Chartered.

- Prepare Documents: Typically requires identity proof, address proof, and proof of fund source.

- Book Appointment: Schedule an account opening time through the bank’s website or by phone.

- Submit Application: Visit the bank branch to submit application materials and complete identity verification.

- Activate Account: After the account is opened, deposit initial funds to activate it.

Precautions:

- Understand Fees: Some banks may charge account maintenance or transaction fees.

- Comply with Regulations: Ensure the account’s use is legal to avoid account freezing due to violations.

- Choose Suitable Account Type: Select a savings or investment account based on fund needs.

Note: Opening an offshore account may require time and fees; plan the process in advance.

Specific Methods for Utilizing Cross-Border E-Commerce Policies to Achieve Fund Transfers

Cross-border e-commerce policies provide a new legal way for individuals and businesses to transfer funds. Through cross-border e-commerce platforms, you can use their settlement mechanisms to transfer funds to offshore accounts. This method is not only compliant but also reduces remittance costs.

Specific Methods:

- Choose Platform: Select a reputable cross-border e-commerce platform, such as Alibaba International Station or Amazon Global Selling.

- Register Account: Complete platform account registration and upload necessary identity verification documents.

- List Products or Services: Sell products or services through the platform to generate income.

- Settle Funds: Use the platform’s settlement mechanism to transfer income to an offshore account.

Advantages:

| Advantage | Description |

|---|---|

| High Compliance | Complies with China’s cross-border e-commerce policies, with transparent fund flows. |

| Low Cost | Lower fees, suitable for small and medium-sized enterprises and individual users. |

| Convenient Operation | Platforms provide one-stop services, no complex operations required. |

Suggestion: When using cross-border e-commerce policies, ensure you understand the platform’s fee structure and policy requirements to avoid unnecessary costs.

Comprehensive Strategy Combining Multiple Methods

When breaking through annual remittance limits, a single method may not meet complex fund needs. Combining multiple methods can address different scenarios more flexibly while reducing risks and improving efficiency. The following are key points of a comprehensive strategy to help you achieve better results in practice.

Data Analysis and Strategy Optimization

Through data comparison analysis, you can more clearly understand the effectiveness of different methods and optimize your comprehensive strategy accordingly. The following are several commonly used data analysis methods:

- Year-on-Year Comparison Over Time Dimension: Eliminates the impact of cyclical factors like seasonality, helping you assess fund flow growth or decline trends over longer time spans.

- Month-on-Month Comparison: Quickly reflects short-term data change trends, used to monitor recent fluctuations in fund flows.

- Multi-Dimensional Comparison: Compares fund transfer efficiency across different channels, regions, or tools, allocating resources rationally to optimize the overall strategy.

For example, a company compared the settlement efficiency of different cross-border e-commerce platforms and found that Platform A had a shorter settlement cycle, while Platform B had lower fees. By combining these advantages, the company chose Platform A for urgent fund needs and Platform B for large fund transfers, achieving a balance of efficiency and cost.

Flexible Combination of Tools and Channels

In practice, you can flexibly combine multiple remittance tools and channels based on your needs. The following are some common combination methods:

- New Remittance Tools Combined with Family and Friend Quotas: Use tools like Panda Remit to handle large funds while dispersing small amounts through family and friend foreign exchange quotas to reduce pressure on a single channel.

- Offshore Accounts Combined with Cross-Border E-Commerce Policies: Receive settlement funds from cross-border e-commerce platforms through offshore accounts, meeting fund flow needs while enjoying policy benefits.

- Digital Tools Combined with Precision Marketing: A joint-stock commercial bank, through a precision marketing platform, increased new customer acquisition by 20% and improved customer retention by 15%. Similar digital tools can help you manage fund flows more efficiently.

Tip: When combining tools, ensure the compliance of each method and understand related fees and processes in advance.

Practical Cases and Application Effects

Comprehensive strategies combining multiple methods have achieved significant results in practice. For example:

- Ping An Bank, through digital transformation and precision marketing, built a vast database system to fully understand customer needs and formulate precise strategies.

- A company successfully optimized fund flows by combining cross-border e-commerce policies and offshore accounts, significantly reducing remittance costs.

These cases show that comprehensive strategies not only improve fund transfer efficiency but also help you better address policy restrictions.

Formulating Personalized Comprehensive Strategies

Everyone’s fund needs and operational environment are different, so you need to formulate personalized comprehensive strategies based on your situation. The following are some suggestions:

- Clarify Goals: Determine the purpose of funds, such as paying tuition, purchasing property, or supporting family life.

- Evaluate Methods: Compare the costs, efficiency, and risks of different methods to choose the most suitable combination.

- Dynamic Adjustment: Optimize strategies promptly based on policy changes and actual needs.

Note: When formulating strategies, always prioritize compliance to avoid legal risks due to violations.

By combining multiple methods, you can more flexibly break through annual remittance limits while ensuring the security and compliance of fund flows. Whether you are an individual or a business user, this comprehensive strategy can provide you with more comprehensive solutions.

Practical Experience Sharing

Image Source: pexels

Success Case: How a User Achieved Large Remittances Through Panda Remit

Panda Remit user Xiao Li is a young person planning to immigrate. He needed to pay the down payment for an overseas property, but the annual $50,000 foreign exchange quota limit caused him trouble. Through Panda Remit, he successfully completed a large remittance, and the entire process was efficient and compliant.

Xiao Li’s operation steps were as follows:

- Register Account: He completed account registration on the Panda Remit official website and uploaded identity proof documents.

- Verify Identity: The system quickly completed identity verification, ensuring account compliance.

- Select Remittance Amount: Xiao Li entered the amount to be paid and recipient information.

- Pay Fees: He chose the most suitable payment method and completed the fee payment.

- Confirm Remittance: After submitting the application, Panda Remit completed the remittance within hours.

Tip: Panda Remit’s transparent fees and fast arrival features are particularly suitable for users needing to urgently process large funds.

Through Panda Remit, Xiao Li not only broke through immigration overseas remittance limits but also avoided the cumbersome procedures and high fees of traditional banks. This case shows that new remittance tools can provide users with more flexible fund solutions.

How Business Users Optimize Fund Flows Using Cross-Border E-Commerce Policies

A foreign trade company successfully optimized fund flows through cross-border e-commerce policies. The company mainly sold products through Alibaba International Station, using the platform’s settlement mechanism to directly transfer income to an offshore account in a Hong Kong bank.

The following are the company’s specific operation methods:

- Register on Cross-Border E-Commerce Platform: The company completed account registration on Alibaba International Station and uploaded necessary identity verification documents.

- List Products: Published product information on the platform to attract overseas buyers.

- Complete Transactions: After buyers placed orders, the company completed transaction settlements through the platform.

- Fund Transfer: Using the platform’s settlement mechanism, the company transferred income to a Hong Kong bank account.

The advantages of this method include:

- High Compliance: Complies with China’s cross-border e-commerce policies, with transparent fund flows.

- Low Cost: Platform fees are low, suitable for small and medium-sized enterprises.

- High Efficiency: Short settlement cycles with fast fund arrivals.

Case Data: Over the past year, the company completed over 410 foreign trade orders through the cross-border e-commerce platform, with a total trade volume reaching 120 million CNY. This success case shows that cross-border e-commerce policies can significantly enhance business fund flow efficiency.

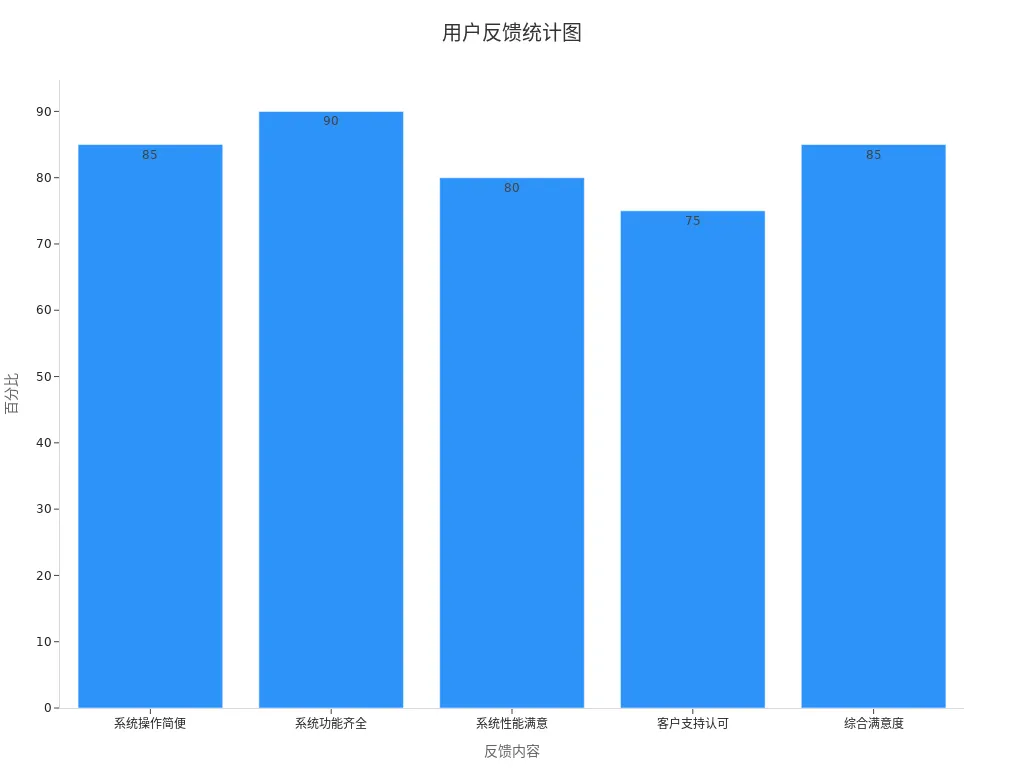

Common Issues and Solutions Based on Real Feedback

During cross-border remittances, users often encounter some issues. The following are the main problems reported by users and their solutions:

- Payment Experience: Some users reported that cross-border payment processes are complex, affecting user experience. The solution is to choose user-friendly tools like Panda Remit.

- Compliance: Some users faced compliance risks due to account freezes. It is recommended to complete remittances through formal channels and avoid underground channels.

- Cost: High fees burden users. Choosing platforms with transparent fees can effectively reduce costs.

- Efficiency: Long arrival times affect fund turnover. Using fast-arrival tools like Panda Remit can address this issue.

- System Operation Simplicity: 85%

- System Functionality Completeness: 90%

- System Performance Satisfaction: 80%

- Customer Support Recognition: 75%

- Overall Satisfaction: 85%

Through user feedback analysis, businesses can better optimize services. For example, a company found that some users reduced login frequency due to poor network environments. After improvements, user experience significantly improved.

These real feedback and solutions show that choosing appropriate tools and channels can effectively address common issues in cross-border remittances while enhancing user satisfaction.

Precautions and Clarification of Misconceptions

Importance of Compliance and Potential Consequences of Violations

In cross-border remittances, compliance is a core issue you must prioritize. Compliant operations not only protect your fund safety but also avoid legal risks due to violations. China’s foreign exchange management policies have strict regulations on fund flows, and any attempt to evade policies may lead to serious consequences.

To ensure compliance, you can leverage some advanced tools and technologies:

- Automated audit tools can quickly scan fund flows to detect non-compliance with policy requirements.

- Data analysis technology can uncover compliance issues across systems, helping you optimize fund management processes.

- Audits will check the design and implementation effectiveness of anonymization schemes to ensure legal compliance.

The consequences of non-compliant operations may include account freezes, fines, or even criminal liability. You need to stay vigilant, choose legal remittance methods, and avoid paying a high price for momentary negligence.

Impact of Fees and Exchange Rate Fluctuations

The actual cost of cross-border remittances depends not only on the remittance amount but also on fees and exchange rate fluctuations. You may find that small exchange rate changes can significantly affect the final received amount.

The following are the specific impacts of fees and exchange rate fluctuations on costs:

- Exchange rate fluctuations may force foreign trade companies to recalculate income, extending repayment cycles.

- Cross-border payments involve multiple banks and intermediary banks, increasing time constraints on payments.

- Each payment incurs additional fees, including bank handling fees and foreign exchange fees, increasing overall costs.

To mitigate these impacts, you can choose platforms with transparent fees, such as Panda Remit, or purchase foreign exchange in advance when rates are low. Understanding fee structures and exchange rate trends will help you better control costs.

Avoiding Common Misconceptions: Such as Trusting Illegal Channels or Ignoring Tax Issues

When breaking through annual remittance limits, many may mistakenly trust the “shortcuts” offered by illegal channels. These channels may seem convenient but often hide significant legal risks. Underground money changers operate with a lack of transparency and may involve money laundering or other illegal activities. Once investigated, you may face severe legal consequences.

Another common misconception is ignoring tax issues. Cross-border remittances may involve tax declarations, especially when funds are used for investment or commercial purposes. You need to understand relevant tax policies in advance and ensure timely declarations.

Tip: Choose formal channels to complete remittances to avoid unnecessary trouble due to trusting illegal channels or ignoring tax issues.

By understanding these precautions, you can complete cross-border remittances more safely and efficiently while avoiding common pitfalls and misconceptions.

Breaking through annual remittance limits is not difficult as long as you master the core methods and pay attention to compliance. Whether using new remittance tools, opening offshore accounts, or combining cross-border e-commerce policies, you can find solutions that suit you. Compliant operations are particularly important, as they not only protect your fund safety but also avoid legal risks.

- Compliance audits help businesses avoid legal liabilities and protect the rights of relevant parties.

- Promptly fixing security vulnerabilities reduces the risk of personal information leaks.

- Publicly committing to personal information protection enhances user trust and boosts brand value.

Choose the optimal solution based on your needs to ensure safe and efficient fund flows. Although immigration overseas remittance limits exist, through legal and compliant methods, you can fully achieve flexible fund management.

FAQ

1. How to Choose a Remittance Tool That Suits You?

When choosing a remittance tool, you need to consider fees, speed, and compliance. Panda Remit is suitable for quickly processing large funds, while bank remittances suit traditional needs. Compare the features of different tools and choose the solution that best meets your fund needs.

2. How to Avoid Losses Due to Exchange Rate Fluctuations During Remittances?

Monitor exchange rate trends in advance and purchase foreign exchange when rates are low. Using rate-locking services can also reduce the impact of fluctuations. Panda Remit offers transparent exchange rates, helping you better control costs.

3. What Documents Are Needed to Open an Offshore Account?

Opening an offshore account typically requires identity proof, address proof, and proof of fund source. Prepare these documents in advance and book an appointment for account opening. Choose reputable banks, such as HSBC or Standard Chartered.

4. Is It Safe to Remit Using Family and Friend Quotas?

Remitting using family and friend quotas is safe within the compliant range, but transactions must be transparent. Avoid fund flows being deemed as policy evasion, choose trusted family or friends, and clarify the operation process.

5. Are Cross-Border E-Commerce Policies Suitable for Individual Users?

Cross-border e-commerce policies are suitable not only for businesses but also for individual users. By selling products or services through platforms, you can legally transfer funds. Choose reputable platforms, such as Alibaba International Station, to ensure compliant operations.

In 2025, cross-border remittances face high fees, delayed arrivals, compliance risks, and legal consequences from underground channels, with bank transfers incurring high costs, taking days to arrive, and requiring strict adherence to the annual $50,000 forex limit. BiyaPay offers a secure, efficient solution! Exchange over 30 fiat currencies and 200+ cryptocurrencies with real-time rate tracking to minimize volatility, enjoy fees as low as 0.5% across 190+ countries, and benefit from same-day initiated, same-day delivered transfers. Sign up for BiyaPay in just one minute to effortlessly manage tuition, property payments, or living expenses. Earn a 5.48% annualized yield on flexible savings to grow idle funds. Secured by blockchain technology and backed by U.S. MSB and New Zealand FSP licenses, BiyaPay ensures transparent, compliant transactions, avoiding the risks of underground channels. Start today—join BiyaPay for a safe, seamless remittance experience!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.