- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Latest Changes to IBAN Numbers in International Remittances in 2025

Image Source: unsplash

IBAN numbers are an essential part of international remittances. Their design makes cross-border transfers more efficient and accurate. By using IBAN numbers for international remittances, you can ensure that funds are securely delivered to the designated account while saving on transaction fees and exchange rate costs. In 2025, with technological advancements, the use of IBAN numbers continues to grow. These numbers not only simplify the remittance process but also enhance the reliability of transfers, providing greater assurance for your international remittances.

Key Points

- IBAN numbers are a critical part of international remittances, ensuring funds reach their destination safely.

- By 2025, IBAN numbers will become digitized, leveraging new technologies for faster and more secure transactions.

- New regulations require banks to use consistent validation methods to reduce errors.

- Use online tools to verify the accuracy of IBAN numbers to avoid transfer failures.

- When making remittances, always confirm the IBAN number is correct to ensure the safety of funds.

Basics of IBAN Numbers for International Remittances

What is an IBAN Number?

An IBAN number, or International Bank Account Number, is a standardized coding system used to identify bank accounts. It was developed by the International Organization for Standardization (ISO) to simplify the cross-border remittance process. By using an IBAN number, you can ensure that funds are accurately transferred to the target account while reducing the occurrence of transfer errors.

The design of IBAN numbers not only enhances transaction security but also speeds up the transfer of funds. It acts like a “house number” for bank accounts, facilitating international remittances.

Currently, 77 countries and regions worldwide have adopted the IBAN numbering system. The length of IBAN numbers in these countries ranges from 15 characters (e.g., Norway) to 34 characters, depending on the regulations of the country where the bank is located.

Structure and Components of IBAN Numbers

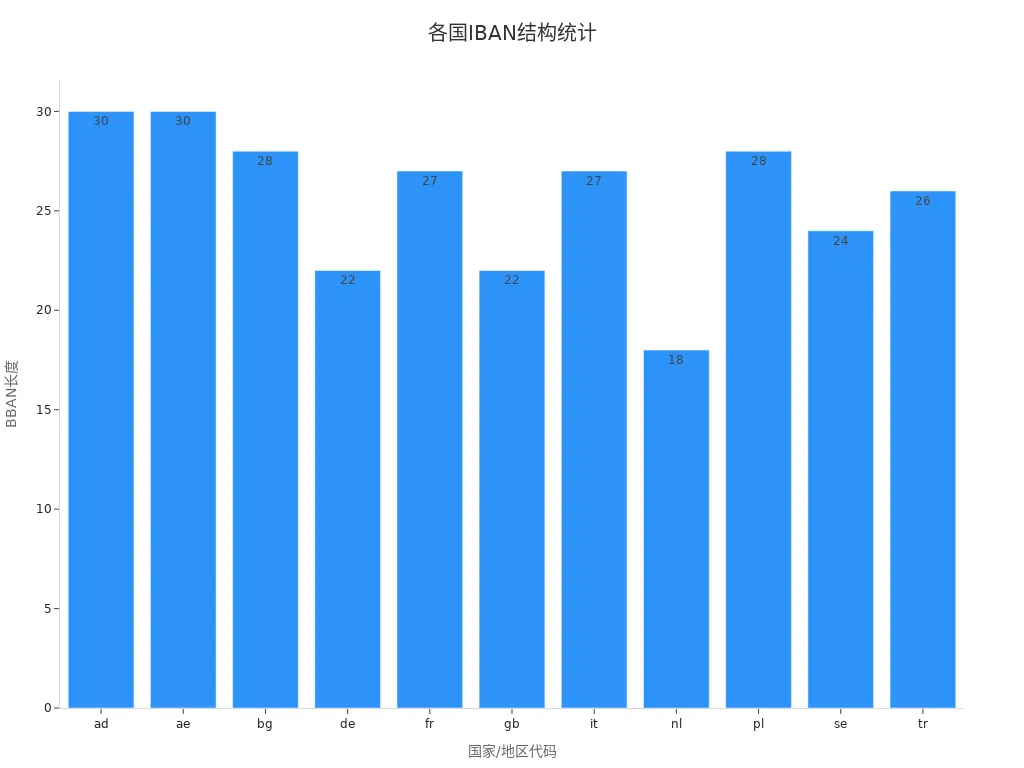

The structure of an IBAN number consists of multiple components, each serving a specific function. Below are the main components of an IBAN number:

- Country Code: Two letters that identify the country where the account is located. For example, China’s country code is CN.

- Check Digits: Two digits used to validate the accuracy of the IBAN number.

- Basic Bank Account Number (BBAN): Includes the bank code and account number, with length and format varying by country.

Below are examples of IBAN number structures for some countries:

| Country/Region Code | Check Digits | BBAN Length and Format |

|---|---|---|

| ad | 2 | 30 characters |

| ae | 2 | 30 characters |

| bg | 2 | 28 characters |

| de | 2 | 22 characters |

| fr | 2 | 27 characters |

| gb | 2 | 22 characters |

| it | 2 | 27 characters |

| nl | 2 | 18 characters |

| pl | 2 | 28 characters |

| se | 2 | 24 characters |

| tr | 2 | 26 characters |

Through these structures, you can easily identify the country and bank associated with an account and verify the validity of the number.

The Role of IBAN Numbers in International Remittances

In international remittances, IBAN numbers play a crucial role. They not only simplify the cross-border remittance process but also significantly enhance transaction security and efficiency. Below are the main functions of IBAN numbers:

- Simplify the remittance process, making fund transfers faster.

- Reduce transfer errors, ensuring funds reach the correct account.

- Enhance transaction security, protecting your funds from fraud.

- Provide a standardized account identification method, facilitating cooperation between banks.

By using IBAN numbers for international remittances, you can avoid transfer failures or delays due to incorrect numbers. This standardized system provides reliable support for global financial transactions.

Latest Changes to IBAN Numbers in International Remittances in 2025

Image Source: unsplash

Technological Updates: The Digitization Trend of IBAN Numbers

In 2025, the use of IBAN numbers in international remittances is gradually moving toward full digitization. Banks and financial institutions are adopting more advanced technologies to improve the processing efficiency and security of IBAN numbers. You may have noticed that many banks have started using blockchain technology to manage and validate IBAN numbers. This technology not only enhances data transparency but also reduces the likelihood of human errors.

Additionally, artificial intelligence (AI) and machine learning (ML) are optimizing the validation process for IBAN numbers. For example, banks in Hong Kong have introduced intelligent systems that automatically detect whether an entered IBAN number is correct. These systems analyze historical data to quickly identify potential errors and provide correction suggestions. For you, this means less time spent verifying numbers and a reduced risk of remittance failures.

Tip: When using IBAN numbers for international remittances, try to choose banks that support digital validation. This will help you save time and ensure the safety of your funds.

Standard Adjustments: New Regulations Among International Banks

In 2025, international banks have made significant adjustments to IBAN number standards. The Bank for International Settlements (BIS) issued new guidelines requiring all banks involved in international remittances to adhere to stricter IBAN format rules. These rules include:

- Unified Validation Algorithm: All banks must use the same validation algorithm to ensure global consistency of IBAN numbers.

- Standardized Format: Banks must ensure that IBAN numbers are displayed in a clear format, such as adding spaces every four characters, making it easier for you to verify.

- Real-Time Validation Requirement: Banks must validate the authenticity of IBAN numbers in real-time during international remittances.

The implementation of these new regulations aims to reduce error rates in cross-border remittances. If you frequently make international remittances, these changes will significantly improve your user experience. For example, banks in Hong Kong have begun complying with these new standards, ensuring that every remittance from customers is completed smoothly.

New Policies: Regulatory Changes for IBAN Numbers by Country

Governments worldwide are also strengthening oversight of IBAN numbers in international remittances. In 2025, major economies such as China, the United States, and the European Union introduced new policies requiring banks to more rigorously verify the authenticity of IBAN numbers during international remittances. These policies include:

- Higher Compliance Requirements: Banks must ensure that every IBAN number undergoes multiple validations to prevent funds from flowing to illegal accounts.

- Data Protection Measures: Countries have strengthened protections for IBAN number-related data to prevent information leaks. For example, banks in China have adopted encryption technologies to ensure your IBAN number information is not misused.

- Cross-Border Cooperation: Regulatory authorities across countries are collaborating more closely, sharing best practices for IBAN number validation.

For you, the implementation of these policies means greater fund security. While they may add some verification steps, they effectively prevent fraud and erroneous remittances.

Note: When making international remittances, always ensure the provided IBAN number is accurate. If unsure, contact the bank for confirmation.

How to Ensure the Accuracy of IBAN Numbers for International Remittances

Image Source: pexels

Using Online Tools to Validate IBAN Numbers

You can verify the accuracy of IBAN numbers using online tools. These tools are typically provided by banks or third-party financial institutions. Simply enter the complete IBAN number, and the system will automatically check its validity and provide feedback. Online tools can not only validate the number but also display related information, such as the country and bank code associated with the account.

Some common online validation tools include IBAN checkers on bank websites and third-party platforms like IBAN.com. When using these tools, ensure the entered number is accurate. Avoid omitting characters or adding extra spaces during copying and pasting.

Tip: Choose reputable online tools for validation to ensure data security. For example, banks in Hong Kong often provide official validation tools, which are more reliable.

Confirming IBAN Number Accuracy with Banks

If you have any doubts about the provided IBAN number, contacting the bank directly is the safest option. Banks can help you confirm the authenticity of the number and ensure it complies with the latest international standards. Especially for large remittances, verifying the number with the bank can effectively prevent errors.

Banks in Hong Kong typically offer multiple contact methods, such as phone, online customer service, or in-person visits to branches. Choose the most convenient method to communicate with the bank. Provide the complete IBAN number and related account information, and the bank will quickly verify and provide confirmation.

Note: When communicating with the bank, ensure the provided information is accurate. This will help the bank process your request more efficiently.

Avoiding Common Errors: Input and Format Issues

Input errors are one of the main reasons for international remittance failures. You need to pay special attention to the format and characters of the IBAN number. Below are some common errors and their solutions:

- Missing Characters: Ensure the complete IBAN number is entered without omitting any parts.

- Extra Spaces: Avoid adding unnecessary spaces or symbols to the number.

- Incorrect Format: Enter the number in the standard format, such as adding spaces every four characters, to facilitate verification.

Below are examples of correct and incorrect formats:

| Correct Format | Incorrect Format |

|---|---|

| GB29 NWBK 6016 1331 9268 19 | GB29NWBK60161331926819 |

By carefully checking the entered number, you can reduce the likelihood of errors. Using online tools or bank-provided validation services can also help you quickly identify issues.

Tip: When entering an IBAN number, verify it segment by segment to ensure each part is correct.

IBAN numbers vary depending on banks and countries. Each country’s bank account structure and coding rules determine the length and format of IBAN numbers. You need to understand these differences to ensure remittances are completed smoothly.

The changes to IBAN numbers in 2025 will significantly impact international remittances. Technological updates and standard adjustments have improved the security and efficiency of remittances. You will find that using the correct IBAN number reduces errors and saves time.

Important Reminder: Entering the IBAN number accurately is crucial. An incorrect number may lead to remittance failure or delay. Use online tools or contact the bank to verify the number, ensuring funds reach the target account safely.

FAQ

1. What are the check digits in an IBAN number? Why are they important?

The check digits in an IBAN number are two digits used to validate the accuracy of the number. They detect input errors through an algorithm, ensuring funds are accurately transferred to the target account. The importance of check digits lies in reducing the risk of remittance failures and protecting your funds.

Tip: When entering an IBAN number, carefully verify the check digits.

2. What happens if the IBAN number format is incorrect?

An incorrect format may lead to remittance failure or delay. Banks cannot recognize an erroneous IBAN number, and funds may be returned or sent to the wrong account. You need to ensure the entered number complies with the standard format, such as adding spaces every four characters.

| Correct Format | Incorrect Format |

|---|---|

| GB29 NWBK 6016 1331 9268 19 | GB29NWBK60161331926819 |

3. What is the difference between an IBAN number and a SWIFT code?

An IBAN number is used to identify a specific bank account, while a SWIFT code identifies the bank itself. Both are often used together in international remittances. The IBAN number ensures funds reach the correct account, while the SWIFT code ensures funds reach the correct bank.

Note: For international remittances, you typically need to provide both the IBAN number and the SWIFT code.

4. Why do IBAN number lengths vary by country?

The length of an IBAN number depends on each country’s bank account structure and coding rules. For example, Norway’s IBAN numbers have 15 characters, while France’s have 27. These differences accommodate the needs of each country’s financial system.

| Country/Region | IBAN Length |

|---|---|

| Norway | 15 characters |

| France | 27 characters |

| Germany | 22 characters |

5. How can I protect my IBAN number information?

Protecting your IBAN number information is critical. Avoid sending the number to untrusted third parties. Use secure channels provided by banks for remittances. Ensure your device has the latest security software to prevent information leaks.

Tip: Regularly check your bank account to ensure there are no unauthorized transactions.

In 2025, international remittances face challenges from IBAN errors, high costs, delays, and data security risks. BiyaPay offers an efficient solution, supporting conversions across 30+ fiat currencies and 200+ cryptocurrencies with remittance fees as low as 0.5%, covering 190+ countries with same-day delivery.BiyaPay ensures fund safety and minimizes losses. Join BiyaPay now to streamline cross-border transfers! You can also invest in U.S. and Hong Kong stocks directly on the BiyaPay platform without needing an additional overseas account, optimizing capital efficiency. Idle funds can earn a 5.48% APY through current investment products, backed by BiyaPay’s U.S. MSB and SEC licenses. Sign up with BiyaPay for secure, low-cost global payments!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.