- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Choose the Cheapest Korea International Remittance Method in 2025

Image Source: unsplash

When choosing the cheapest Korea international remittance method, you need to focus on fees, exchange rates, and settlement times. Banks are generally secure but have high fees, wire transfers are fast but costly, and third-party platforms attract users with low fees and convenient operations. Understanding the advantages and disadvantages of these methods can help you find the most suitable remittance solution.

The Importance of Fee Transparency

Fee Structures of Different Remittance Methods

Understanding the fee structure can help you calculate remittance costs more clearly. Different Korea international remittance methods typically include the following fees:

| Cost Component | Description |

|---|---|

| Fixed Fee | Basic transaction fee |

| Exchange Rate Markup | Additional fee during currency conversion |

| Intermediary Bank Fee | Fee for transfers via intermediary banks |

| Recipient Fee | Fees that may be charged by the recipient |

Banks typically charge fixed fees and exchange rate markups, while wire transfers may involve intermediary bank fees. Third-party platforms have simpler fee structures, but you still need to watch for exchange rate markups. By comparing these fees, you can choose a more economical remittance method.

How to Identify Hidden Fees

Hidden fees are a cost source often overlooked by users. You can identify these fees through the following methods:

- Carefully read the platform’s fee terms, especially sections related to exchange rates and intermediary bank fees.

- Use fee calculators to simulate the cost of remittances for different amounts.

- Pay attention to potential additional fees charged by the recipient, such as bank account deposit fees.

Some platforms may hide additional fees in the exchange rate, increasing actual costs. Choosing a platform with high transparency can help avoid these issues.

Impact of Fee Transparency on Total Costs

Fee transparency directly affects your remittance costs. Digital CNY in cross-border payments offers zero fees and transparent exchange rates, significantly reducing enterprises’ payment costs. For example, using digital CNY for payments in China-Germany auto parts trade saved 4.1% in costs, offsetting approximately 21% of tariff losses.

For individual users, choosing platforms with high transparency can reduce unnecessary expenses. By comparing the fee structures of different platforms, you can find the most suitable Korea international remittance method. Transparent fees not only provide peace of mind but also help you save more money.

Comparison of Exchange Rate Advantages

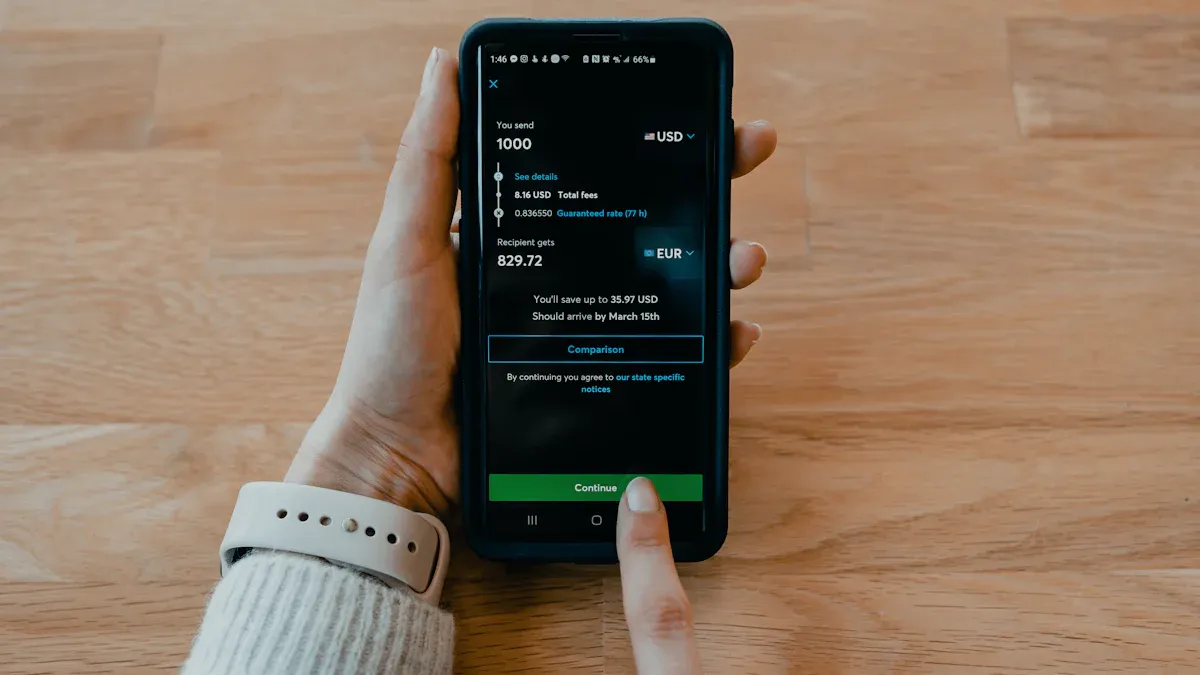

Image Source: unsplash

Traditional Banks vs. Emerging Platforms’ Exchange Rate Differences

Traditional banks typically offer lower exchange rates, meaning you may need to pay more to complete a remittance. Bank exchange rates often include high markups to cover operational costs and profits. In contrast, emerging platforms (such as Wise or Paysend) generally use real-time exchange rates with lower or no markups. This difference can significantly impact your remittance costs, especially for larger amounts.

For example, when remitting 4,000 euros, traditional banks’ fees may range from 45.59 euros to 61.89 euros, while emerging platforms’ fees are typically lower. This difference makes emerging platforms the preferred choice for many users.

How to Choose a Platform with Better Exchange Rates

When choosing a platform with better exchange rates, you need to focus on the following points:

- Real-Time Exchange Rates: Prioritize platforms offering real-time exchange rates to avoid increased costs due to rate markups.

- Fee Transparency: Ensure the platform clearly lists all fees, including exchange rate-related markups.

- User Reviews: Check feedback from other users to understand the platform’s actual exchange rate performance.

Through these methods, you can find a more cost-effective Korea international remittance method.

Impact of Exchange Rate Fluctuations on Remittance Costs

Exchange rate fluctuations directly affect your remittance costs. Exchange rates may change multiple times within a day, meaning the timing of your remittance is critical. If the exchange rate is unfavorable, you may need to pay more. To reduce this risk, you can:

- Use the platform’s exchange rate lock feature to ensure a fixed rate during the remittance.

- Avoid remitting during periods of high exchange rate volatility, such as during major economic events or policy changes.

By planning remittance timing wisely, you can effectively reduce additional costs caused by exchange rate fluctuations.

Comparison of Settlement Speeds

Average Settlement Times of Various Remittance Methods

Remittance settlement time is a key factor in choosing a remittance method. The average settlement times vary significantly across methods, as shown below:

| Remittance Method | Average Settlement Time |

|---|---|

| EoS | Approximately 0.5 seconds |

| Bank Wire Transfer | Approximately 3-5 days |

| Professional Remittance Company | Approximately 10-15 minutes |

| International Credit Card Company | Approximately 2 days |

| Third-Party Payment Company | Approximately 3-5 days |

For example, using a Hong Kong bank for wire transfers typically takes 3 to 5 working days, while professional remittance companies like Wise can complete remittances in 10 to 15 minutes. For situations requiring fast settlement, choosing professional remittance companies or real-time payment systems is more effective.

Best Choices for Urgent Remittances

In emergencies, you need to choose the fastest remittance method to ensure funds arrive promptly. Below are several options suitable for urgent remittances:

- Wise: Offers instant settlement services, ideal for users needing quick transfers.

- Professional Remittance Companies: Typically complete remittances within 15 minutes, with fast speeds and low fees.

- International Credit Card Companies: Settlement times are around 2 days, suitable for moderately urgent situations.

If you need to complete a remittance in seconds, consider using the EoS system. This method is suitable for rapid inter-business payments, but individual users may need to opt for more common platforms. For Korea international remittances, Wise and professional remittance companies are the best choices in emergencies.

Trade-Off Between Settlement Speed and Fees

The faster the remittance speed, the higher the fees typically are. You need to balance speed and cost based on your actual needs. For example:

- If you choose a bank wire transfer, fees may range from $20 to $50, but settlement times are longer.

- Using professional remittance companies, fees may be as low as $5, with faster speeds.

- Third-party payment companies like PayPal have moderate fees but may take 3 to 5 days for settlement.

For larger remittances, bank wire transfers may be more secure but are more expensive and slower. For small remittances or emergencies, professional remittance companies or real-time payment platforms are more cost-effective. By comparing settlement times and fees of different methods, you can find the most suitable solution.

Security and Convenience

How to Ensure Fund Security

Ensuring fund security is the top priority when choosing a Korea international remittance platform. You can protect your funds through the following methods:

- Choose platforms that support end-to-end encryption to ensure data is not stolen during transmission.

- Use multi-factor authentication to enhance account security.

- Confirm whether the platform provides real-time transaction notifications to help you detect abnormal activities promptly.

Many international remittance platforms adopt advanced data security measures, such as end-to-end encryption and multi-factor authentication. These technologies effectively prevent fund theft or information leaks, making your remittances safer.

Importance of User Experience and Operational Convenience

User experience and operational convenience directly impact your remittance efficiency. A well-designed platform allows you to complete remittances easily without a complex learning process. Below are key factors that enhance user experience:

- Multilingual Support: Ensures you can operate the platform in a familiar language.

- Multi-Currency Interface: Facilitates quick selection of target currencies.

- Mobile and Cloud Services: Enables you to complete remittances anytime, anywhere.

These features not only improve user experience but also significantly reduce operation time. Choosing a convenient platform can make your Korea international remittance process smoother.

Choosing Regulated Remittance Platforms

Choosing a regulated platform ensures your funds and personal information are protected by law. Below are some key regulatory bases:

| Evidence Type | Specific Content |

|---|---|

| Compliance and Regulatory Reports | Must comply with regulatory requirements of different countries and regions, cooperating with foreign regulators to provide relevant business data. |

| Laws and Regulations | Includes the Cybersecurity Law, Data Security Law, Personal Information Protection Law, etc., ensuring business compliance. |

| Data Export Pathways | Personal information processors must meet security assessments, certifications, or sign standard contracts before exporting data. |

Regulated platforms not only comply with local laws but also offer higher fund security and transparency. Choosing such platforms can make your remittances more reassuring.

Recommended Korea International Remittance Platforms and Tools

Image Source: pexels

Wise (TransferWise): Low Fees and Real-Time Exchange Rates

Wise is a platform renowned for low fees and real-time exchange rates. In its 2023 fiscal year, it processed approximately $130 billion in cross-border transactions, demonstrating its significant advantages in fees and exchange rates. Wise’s fee structure is transparent, allowing users to clearly see the breakdown of each transaction’s costs.

Compared to traditional banks, Wise offers exchange rates closer to the market mid-rate, avoiding high markups. Below is a comparison of Wise and other platforms in terms of fees and exchange rates:

| Platform | Fee Structure | Exchange Rate Information |

|---|---|---|

| Wise | Lower fees, specific details not provided | Specific exchange rate details not provided |

| Payoneer | Fees 1%-1.2%, deposit fees 0-1%, withdrawal fees 1-2% | Bank of China real-time buying rate is variable and non-transparent |

| PingPong | Cross-border collection fee 1%, deposit fee 0, withdrawal fee 1% | Uses Bank of China real-time exchange rate |

Wise’s real-time exchange rates and low fees make it an ideal choice for Korea international remittances, especially for users needing high transparency and low costs.

Paysend: Economical Choice for Small Remittances

Paysend is a platform designed for small remittances, with a fee of just 1 GBP, far lower than other platforms. For example, Wise’s small remittance fee is 4.75 GBP. Below is a fee comparison for Paysend:

| Service | Fee |

|---|---|

| Paysend | 1 GBP |

| Wise | 4.75 GBP |

Paysend’s low fee structure makes it highly suitable for small remittance users. Whether for family expenses or small business transactions, Paysend can help you save more money.

XOOM: High-Quality Platform for Fast Settlements

XOOM, a PayPal service, is known for fast settlements and convenient operations. Its settlement times typically range from minutes to hours, making it ideal for urgent remittance needs. XOOM offers multiple payment methods, including bank transfers and cash withdrawals, catering to diverse user needs.

Although XOOM’s fees may be slightly higher than other platforms, its fast settlement feature compensates for this. If you need to complete a Korea international remittance in a short time, XOOM is a worthy option.

Remitly: Flexible Platform for Various Remittance Needs

Remitly offers flexible remittance services, suitable for users with diverse needs. Its advantages include no message fees, fewer intermediary steps, and flexible exchange rate options. Additionally, Remitly frequently launches promotional activities to further reduce remittance costs.

Below are Remitly’s main features:

- No message fees

- Significantly reduced intermediary steps

- Flexible exchange rates with frequent promotional offers

Whether for personal or business purposes, Remitly provides fast and economical solutions. Like Wise and Paysend, it is an excellent choice for Korea international remittances.

Conclusion

When choosing a cheap and fast Korea international remittance method, you need to focus on fees, exchange rates, settlement times, and security. Below is a comparison of the main methods:

| Aspect | Wise | Bank |

|---|---|---|

| Fees | Only one fee | Multiple wire transfer fees |

| Exchange Rate | Market mid-rate | Custom exchange rate |

| Settlement Speed | Fastest instant | Within 2 working days |

| Security | Regulated by multiple financial authorities | May have hidden fees |

Choose a solution based on the amount, frequency, and urgency of your remittances. Regularly compare fees and exchange rates across platforms to maintain flexibility and save more costs.

FAQ

1. How to Choose a Suitable Remittance Platform?

You can compare platforms based on remittance amount, settlement time, and fees. Choosing a platform with high transparency and positive user reviews is more reliable.

2. How to Avoid Exchange Rate Losses During Remittances?

Use platforms with real-time exchange rates to avoid rate markups. Exchange rate lock features can reduce additional costs from fluctuations.

3. What to Do If a Remittance Fails?

Contact the platform’s customer service and provide transaction details. Choosing a regulated platform ensures issues are resolved quickly.

High fees, exchange rate markups, and delays often complicate international transfers to South Korea, with cumbersome processes adding frustration. BiyaPay offers the ultimate cost-effective solution! Exchange over 30 fiat currencies and 200+ cryptocurrencies with transparent real-time rates, and enjoy transfer fees as low as 0.5% across 190+ countries, with same-day initiated, same-day delivered transfers. Sign up for BiyaPay in just one minute to access seamless remittances and US/HK stock investments without complex account setups. Plus, grow idle funds with a 5.48% annualized yield on flexible savings. Secured by U.S. MSB and SEC licenses and blockchain technology, BiyaPay ensures trust and safety. Start now—join BiyaPay to eliminate costly fees and delays for a fast, affordable Korea transfer experience!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.