- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

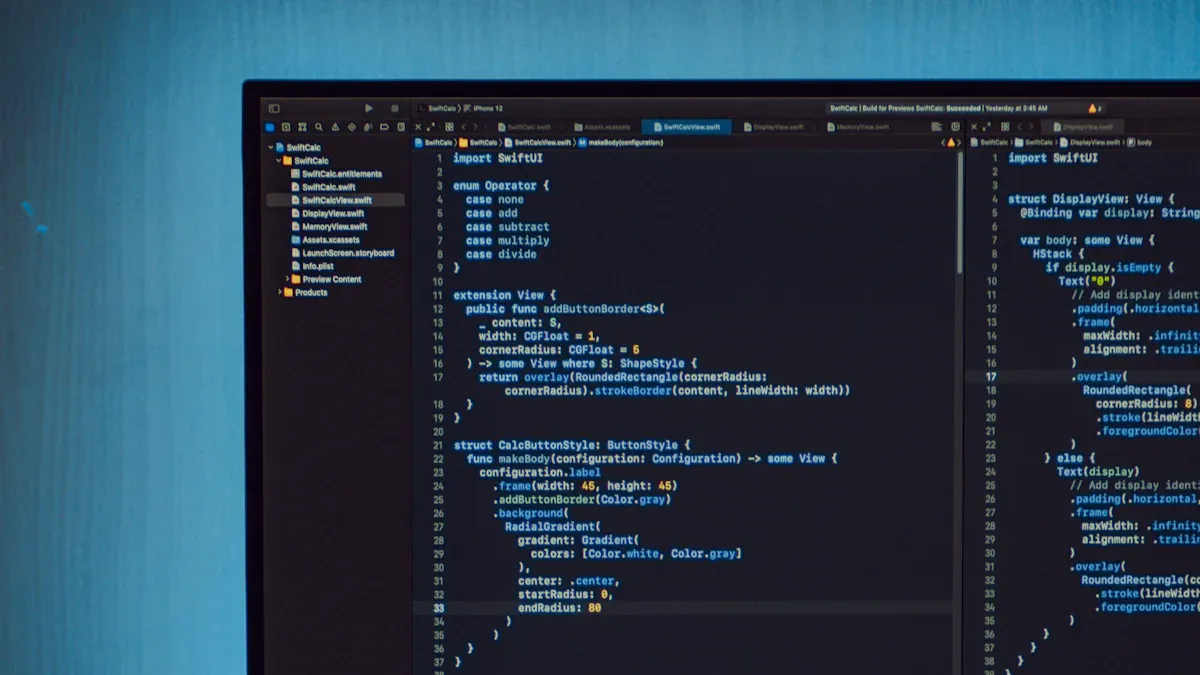

Core Components and Use Cases of SWIFT Codes

Image Source: unsplash

SWIFT codes are unique codes used in the global banking system to identify financial institutions. You can think of them as a bank’s “ID card,” enabling banks worldwide to quickly and accurately identify transaction parties and complete fund transfers. SWIFT codes typically consist of 8 to 11 characters, with each part carrying specific information.

In the international financial system, the importance of SWIFT codes cannot be overstated. According to the latest statistics released by SWIFT, in December 2022, the total amount of global cross-border settlements increased by 2.49% month-on-month. Although the amount of cross-border CNY payments decreased, the U.S. dollar accounted for 41.89% of international payments, further demonstrating the central role of SWIFT codes in international transactions. Whether it’s the use of SWIFT codes in bank wire transfers or the widespread adoption of cross-border payments, the SWIFT network provides efficient and secure support for global financial transactions.

Key Points

- SWIFT codes are unique identifiers for global banks, ensuring the security and accuracy of international transactions.

- SWIFT codes consist of bank codes, country codes, location codes, and branch codes, each with specific functions.

- Using SWIFT codes allows for quick completion of international remittances, reducing transaction errors and delays.

- The SWIFT network covers over 200 countries, supporting more than 11,000 financial institutions, enhancing the efficiency of cross-border payments.

- In the future, SWIFT codes may integrate with blockchain technology, further optimizing financial services and bringing more possibilities.

What is a SWIFT Code?

Definition and Function of SWIFT Codes

SWIFT codes are an integral part of the global financial communication network. They consist of 8 to 11 characters and are used to identify the identity of a bank or financial institution. Through SWIFT codes, you can ensure the secure transfer of funds internationally while minimizing errors in transactions.

The function of SWIFT codes is not limited to identifying banks; they also play a significant role in cross-border payments. For example, SWIFT codes for bank wire transfers can help you quickly complete international remittances. Through the SWIFT network, approximately $5 trillion in funds flow globally each day, highlighting its importance in international payments.

Additionally, SWIFT codes support communication and settlement between banks. They ensure the accurate transmission of payment instructions through standardized secure messages. For instance, the Industrial and Commercial Bank of China uses the SWIFT gpi project to send notifications to customers via SMS or Rong E Lian when funds reach the recipient bank. This feature enhances customer experience while increasing transaction transparency.

The Significance of SWIFT Code Standardization

The standardization of SWIFT codes brings significant convenience to the global financial system. They adopt a unified format, allowing banks in different countries and regions to easily identify each other. You can use SWIFT codes to quickly complete cross-border transactions without worrying about errors in information transmission.

This standardization also enhances the efficiency of global financial communication. In 2021, SWIFT processed 10.6 billion financial messages, with an average daily processing volume exceeding 42 million messages. These data indicate that SWIFT code standardization not only improves transaction speed but also reduces operational risks.

In terms of currency market share, the U.S. dollar accounts for 39.92% of the SWIFT network, followed by the euro at 36.56%. The CNY’s market share is 3.2%. The following bar chart illustrates the market share of different currencies in the SWIFT network:

Through the standardization of SWIFT codes, financial institutions like Hong Kong banks can integrate cross-border payment product lines, building a smart financial services ecosystem. This ecosystem not only enhances banks’ service capabilities but also supports the stable development of the global financial system.

Core Components of SWIFT Codes

Image Source: unsplash

SWIFT codes consist of multiple components, each carrying specific information. These components work together to ensure the accuracy and efficiency of cross-border financial transactions. Below is a detailed explanation of the core components of SWIFT codes.

Bank Code

The bank code is the first four characters of a SWIFT code, used to identify a specific bank or financial institution. It typically consists of letters representing the bank’s abbreviated name. For example, the SWIFT code for a Hong Kong bank might start with “HSBC,” indicating it belongs to HSBC. Through the bank code, you can quickly identify the target bank of a transaction, avoiding funds being sent to the wrong institution.

The bank code’s role is not limited to identifying banks; it also improves transaction efficiency. When you perform an international remittance, the bank code helps the system quickly match the recipient bank’s information. This precision reduces delays and errors in transactions, providing reliable support for cross-border payments.

Country Code

The country code is the fifth and sixth characters of a SWIFT code, used to identify the country or region where the bank is located. It adopts the ISO 3166-1 standard two-letter code. For example, “CN” represents China, and “US” represents the United States. The country code enables cross-border transactions to quickly locate financial institutions in the target country.

The country code also reflects differences in financial markets across countries. The following table shows the International Monetary Fund (IMF) requirements for financial data transparency in various countries:

| SDDS Dimension | Description |

|---|---|

| Data Coverage | Covers key indicator data for the real, fiscal, financial, and external sectors. |

| Publication Frequency and Timeliness | Countries can choose appropriate data publication frequency and timeliness based on their circumstances. |

| Public Accessibility | Data must be accessible to the public to ensure transparency. |

| Integrity and Quality | Data must meet the IMF’s specific requirements for transparency and quality. |

Through the country code, you can better understand the financial environment of the target country. This information is crucial for cross-border investment and trade decisions.

Location Code

The location code is the seventh and eighth characters of a SWIFT code, used to identify the specific location of a bank. It can be a combination of letters or numbers, helping you determine the city or region of the bank. For example, a Hong Kong bank’s SWIFT code may include “HK,” indicating its location in Hong Kong.

The location code plays a significant role in cross-border financial transactions. The following table illustrates the specific outcomes of location codes in various application scenarios:

| Application Scenario | Specific Outcomes |

|---|---|

| Export Accounts Receivable Financing | Helps banks manage financing risks, supporting increased financing volume, broader coverage, and lower costs for foreign trade enterprises. |

| Electronic Tax Filing Verification for Service Trade | Enhances banks’ verification capabilities, facilitating enterprises’ cross-border payment operations. |

| Total Financing Application Scenarios | 9 |

| Total Facilitation Application Scenarios | 4 |

| Cumulative Financing Amount | Over $360 billion |

| Supported Facilitated Payment Amount | Over $1.7 trillion |

| Participating Enterprises | Over 100,000 small and medium-sized enterprises |

Through the location code, you can ensure funds are accurately sent to the specific branch of the target bank. This precision is particularly important for large cross-border transactions and complex financial operations.

Branch Code

The branch code is the last three characters of a SWIFT code, primarily used to identify a specific branch of a bank. If a SWIFT code is only 8 characters, it refers to the bank’s main branch; if it is 11 characters, the last three characters are the branch code. Through the branch code, you can more precisely direct funds to a specific branch of the target bank.

Role of the Branch Code

The branch code plays a critical role in cross-border transactions. Below are the main functions of the branch code:

- Precise Targeting

The branch code helps you direct funds to a specific branch of the target bank. For example, a branch of a Hong Kong bank may use “XXX” as its branch code, ensuring funds are not sent to other branches. - Improved Transaction Efficiency

Using the branch code reduces intermediary steps in transactions. The banking system quickly matches the recipient account’s branch through the branch code, speeding up fund processing. - Reduced Error Rate

In international remittances, incorrect branch information may lead to fund delays or returns. The use of branch codes effectively reduces this risk, ensuring transaction accuracy.

Practical Applications of Branch Codes

Branch codes play a significant role in multiple scenarios. Below are some common application scenarios:

- Corporate Cross-Border Payments

When a company needs to pay overseas suppliers, the branch code ensures funds are sent directly to the supplier’s designated branch. This precision is particularly important for large transactions. - Personal International Remittances

If you need to send money to overseas friends or family, the branch code helps you avoid sending funds to the wrong account. For example, when remitting to a specific branch of a Hong Kong bank, the branch code ensures the funds arrive accurately. - Cross-Border E-Commerce Settlements

Cross-border e-commerce platforms often need to collaborate with banks in multiple countries. The use of branch codes helps platforms complete settlements quickly, improving fund turnover efficiency.

How to Obtain a Branch Code?

Obtaining a branch code is straightforward. Below are some common methods:

- Contact the Bank

You can directly contact the target bank to obtain its branch code. For example, customers of Hong Kong banks can inquire through customer service hotlines or the bank’s official website. - Check Bank Documents

Banks typically provide branch codes in account opening documents or transaction confirmations. - Use Online Tools

Many financial websites offer SWIFT code lookup tools, where you can enter the bank’s name and location to obtain the branch code.

Precautions for Branch Codes

When using branch codes, you need to pay attention to the following points:

- Ensure the accuracy of the branch code. Incorrect input may lead to fund delays or returns.

- Verify that the branch code matches the recipient account information. The banking system validates the account’s accuracy based on the branch code.

- When filling out international remittance forms, the branch code usually needs to be provided along with the bank code, country code, and location code to ensure complete information.

Through the branch code, you can complete cross-border transactions more efficiently and securely. This precision not only enhances the transaction experience but also provides support for the stable operation of the global financial system.

Main Use Cases of SWIFT Codes in Bank Wire Transfers

Image Source: unsplash

Applications in International Remittances

SWIFT codes play a critical role in international remittances. Through the SWIFT network, you can quickly and securely transfer funds from one country to another. The efficiency of the SWIFT system is reflected in the following data:

- In cross-border remittances processed by the SWIFT system, 89% can be completed within 1 hour.

- In 2023, the CNY cross-border payment system processed 6.6133 million transactions, with a total amount of 123.06 trillion yuan, representing year-on-year increases of 50.29% and 27.27%, respectively.

- The CNY’s international payment share slightly increased to 2.54% in 2024, ranking fifth globally.

These data demonstrate that SWIFT codes for bank wire transfers not only enhance the speed of international remittances but also improve transaction reliability. Whether for personal remittances or corporate payments, SWIFT codes ensure funds reach the target account accurately.

Role in Cross-Border Transactions

In cross-border transactions, SWIFT codes for bank wire transfers provide secure and reliable payment solutions for businesses and financial institutions. The following table illustrates the coverage and functionality of the SWIFT network:

| SWIFT Features | Details |

|---|---|

| Countries and Regions Covered | Over 200 countries and regions worldwide |

| Number of Financial Institutions | Over 11,000 financial institutions |

| Main Functions | Secure, reliable, and fast cross-border payment and communication services |

Through SWIFT codes, you can easily complete cross-border payments without worrying about errors in information transmission. Institutions like Hong Kong banks leverage the SWIFT network to provide efficient cross-border settlement services for clients. These services not only reduce transaction costs but also improve fund turnover efficiency.

Communication and Settlement Between Financial Institutions

SWIFT codes for bank wire transfers play an irreplaceable role in communication and settlement between financial institutions. Since its establishment in 1973, the SWIFT network has covered 206 countries and regions, with over 8,000 financial institutions. Below is the specific performance of SWIFT codes in this area:

- Transmits 11 million messages daily, with approximately 5 million actual transmissions, involving funds in the trillions of dollars.

- The standardized message format has become the standard language for data exchange between international banks, supporting real-time payment and clearing systems in over 80 countries and regions.

Through SWIFT codes, institutions like Hong Kong banks can quickly complete cross-border fund settlements, ensuring transaction security and transparency. You can use this system to track fund movements in real-time, avoiding transaction risks due to information asymmetry.

Importance of SWIFT Codes

Indispensability in the Global Financial System

SWIFT codes are an indispensable part of the global financial system. They not only connect banks and financial institutions worldwide but also provide efficient solutions for cross-border payments and settlements. The SWIFT network covers 206 countries and regions, with over 8,000 financial institutions using this system. It also supports real-time payment and clearing systems in over 80 countries and regions. This extensive coverage makes SWIFT codes a core tool in international financial transactions.

Since 1987, the SWIFT system has provided secure message transmission services for global financial institutions. It supports cross-border settlements and letter-of-credit operations, significantly promoting the modernization of international trade and currency circulation. For example, Hong Kong banks use the SWIFT network to provide fast and secure cross-border payment services for clients. These services not only improve transaction efficiency but also reduce operational risks.

The role of SWIFT codes extends beyond daily transactions to international financial regulation. After the 9/11 attacks, the U.S. used the SWIFT system to track the fund flows of terrorist organizations, strengthening oversight of international finance. Additionally, after North Korea was excluded from the SWIFT system, it was unable to conduct international payments. This example fully illustrates the critical role of SWIFT codes in enforcing financial sanctions.

Ensuring Transaction Security with SWIFT Codes

SWIFT codes ensure the security of international transactions by providing secure message transmission services. They adopt a standardized message format, becoming the standard language for data exchange between international banks. This standardization not only reduces errors in information transmission but also enhances transaction transparency.

Below is the specific performance of the SWIFT system in reducing transaction risks:

- Provides secure message transmission services, ensuring accurate delivery of payment instructions.

- Addresses the needs of international payment and clearing, reducing delays in fund transfers.

- Reduces operational risks through standardized message formats.

SWIFT codes for bank wire transfers are particularly important in international remittances. They help you quickly complete cross-border payments while ensuring funds reach the target account accurately. For example, Hong Kong banks use the SWIFT network to provide real-time fund tracking services for clients. These services not only enhance customer experience but also improve transaction security.

The security and reliability of SWIFT codes make them an irreplaceable tool in the global financial system. Whether for personal remittances or corporate payments, SWIFT codes provide efficient and secure solutions.

SWIFT codes are a core tool in international financial transactions. Through bank codes, country codes, location codes, and branch codes, they ensure the efficiency and accuracy of cross-border payments. You can use them to quickly complete international remittances, avoiding funds being sent to the wrong account.

SWIFT codes not only enhance transaction efficiency but also ensure fund security.

In the future, SWIFT codes may integrate with blockchain technology, further optimizing cross-border payment processes. You will see faster and more transparent financial services, bringing more possibilities to the global economy.

FAQ

Are SWIFT Codes Applicable to All Banks?

SWIFT codes are applicable to most banks and financial institutions worldwide. You can use SWIFT codes to complete international remittances and cross-border payments. Some smaller banks may not be part of the SWIFT network, but they typically complete related transactions through partner banks.

How to Look Up a Bank’s SWIFT Code?

You can look up a SWIFT code through the following methods:

- Contact the bank’s customer service, such as the customer service hotline of Hong Kong banks.

- Check the bank’s official website.

- Use online SWIFT code lookup tools by entering the bank’s name and location.

Do SWIFT Codes Affect Remittance Fees?

SWIFT codes themselves do not directly affect remittance fees, but they can improve transaction efficiency and reduce errors. Banks typically charge fees based on the remittance amount and destination, with fees calculated in dollars. You can consult the bank in advance to understand specific fee structures.

Do SWIFT Codes Support Real-Time Payments?

SWIFT codes support fast payments, but whether they are real-time depends on the bank’s processing speed. In most cases, the SWIFT network can complete cross-border remittances within 1 hour. You can use services from institutions like Hong Kong banks to track fund movements in real-time.

Are SWIFT Codes Secure and Reliable?

SWIFT codes adopt standardized message formats to ensure the accurate delivery of payment instructions. You can confidently use the SWIFT network to complete international transactions. Institutions like Hong Kong banks provide secure cross-border payment services through the SWIFT system, reducing transaction risks.

SWIFT codes ensure accurate international transfers, but errors, delays, and complex validation often frustrate users. BiyaPay offers an efficient solution, supporting conversions across 30+ fiat currencies and 200+ cryptocurrencies with remittance fees as low as 0.5%, covering 190+ countries with same-day delivery. BiyaPay ensures fund safety and minimizes losses. Join BiyaPay now for seamless cross-border payments! You can also invest in U.S. and Hong Kong stocks directly on the BiyaPay platform without needing an additional overseas account, optimizing capital efficiency. Idle funds can earn a 5.48% APY through current investment products, backed by BiyaPay’s U.S. MSB and SEC licenses. Sign up with BiyaPay for secure, efficient global transfers!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.