- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Analysis of Stablecoin Applications in Cross-Border Payments

Image Source: unsplash

In cross-border payments, stablecoins are becoming an efficient solution. They can achieve peer-to-peer value transfer through blockchain technology, significantly improving transaction speed and cost efficiency. For example, stablecoin transfers are typically completed in less than 1 hour, while traditional bank cross-border remittances may take up to 5 business days. Additionally, the transfer cost of stablecoins is only about $0.00025, saving significant funds compared to the average 6.35% fee rate under traditional models.

Stablecoins also address the issue of insufficient transparency in traditional cross-border payments. The traceability supported by blockchain technology makes fund flows more open and transparent. You will find that cryptocurrency cross-border transfers also benefit from the low cost and high efficiency of stablecoins, reducing the complexity of intermediaries and enhancing the convenience of global fund flows.

Key Points

- Stablecoins achieve fast, low-cost cross-border payments through blockchain technology, with transfer times typically ranging from a few seconds to a few minutes.

- Using stablecoins can significantly reduce transaction fees, as traditional bank fees may reach up to 6.35%, while stablecoin fees are usually below $1.

- Stablecoins provide transparent transaction records, allowing users to track fund flows in real-time, enhancing trust.

- Stablecoins show immense potential in cross-border e-commerce and international remittances, simplifying payment processes and improving fund flow efficiency.

- In the future, the stablecoin market will continue to expand, with technological innovation and improved regulatory frameworks driving broader applications.

Basic Concepts and Types of Stablecoins

Definition and Characteristics of Stablecoins

A stablecoin is a cryptocurrency pegged to the value of fiat currency or other assets. It combines the convenience of digital currency with the stability of fiat currency, aiming to reduce price volatility. You can think of stablecoins as a “digital fiat currency substitute,” playing a significant role in cross-border payments, cryptocurrency trading, and asset management.

The characteristics of stablecoins are mainly reflected in the following aspects:

- Value Stability: By pegging to the U.S. dollar or other assets, stablecoins avoid the drastic fluctuations of cryptocurrencies like Bitcoin.

- Efficiency: Based on blockchain technology, stablecoins support fast, low-cost global transfers.

- Transparency: The public ledger of blockchain makes every transaction traceable, enhancing trust.

According to research by the Bank for International Settlements, stablecoins improve time efficiency by over 100 times and reduce transfer costs by over 10 times in cross-border payments. These characteristics make stablecoins a powerful complement to traditional payment methods.

Main Categories of Stablecoins: Fiat-Collateralized, Crypto-Collateralized, and Algorithmic

Stablecoins are primarily divided into three types based on their mechanisms for maintaining price stability:

- Fiat-Collateralized

This type of stablecoin is issued by centralized institutions and backed by fiat currency reserves. For example, USDT and USDC are the most common fiat-collateralized stablecoins in the market. Their value is pegged 1:1 to the U.S. dollar, with the issuing institution holding equivalent dollar reserves. - Crypto-Collateralized

This type of stablecoin locks crypto assets as collateral through smart contracts. Users need to deposit collateral at a ratio higher than 1:1 to account for market volatility. DAI is a typical example, supported by crypto assets like Ethereum and operating on decentralized platforms. - Algorithmic

Algorithmic stablecoins do not rely on any collateral assets but use algorithms to adjust supply to maintain price stability. For example, when the price exceeds the target value, the system increases supply; when the price falls below the target, the system reduces supply. This mechanism is similar to how central banks regulate money supply.

Below is a summary of the characteristics of stablecoin types:

| Stablecoin Type | Characteristics |

|---|---|

| Fiat-Collateralized | Issued by centralized institutions, with reserve assets pegged 1:1 to stablecoins. |

| Crypto-Collateralized | Locks crypto assets via smart contracts, requiring over-collateralization to address volatility. |

| Algorithmic | Adjusts supply through algorithms, requiring no collateral assets. |

Currently, fiat-collateralized stablecoins dominate the market, particularly USDT and USDC. According to Deutsche Bank’s forecast, the stablecoin market size will grow from $20 billion in 2020 to $250 billion by 2025, demonstrating significant growth potential.

Application Scenarios of Stablecoins in Cross-Border Payments

Image Source: unsplash

Cross-Border E-Commerce Payments: Supporting Transactions Between Global Consumers and Merchants

Stablecoins demonstrate immense potential in cross-border e-commerce payments. You can see that global consumers and merchants complete transactions using stablecoins, saving both time and costs. Traditional cross-border payment methods typically involve multiple intermediaries, resulting in high fees and long settlement times. The emergence of stablecoins has changed this landscape.

Below are the advantages of stablecoins in cross-border e-commerce payments:

- Real-Time Settlement: Stablecoins achieve payment speeds of a few seconds to tens of seconds through blockchain technology, far surpassing the days required for traditional wire transfers.

- Low Cost: Traditional cross-border payment fees can reach up to 30%, while stablecoin transfer fees are typically below $1.

- Transparency: Blockchain’s public ledger makes every transaction clearly visible, avoiding hidden fees.

For example, overseas consumers can directly use stablecoins to pay for goods on the JD platform, saving currency exchange fees. Merchants can also quickly recover payments through stablecoins, accelerating fund turnover. This efficient, low-cost payment method provides cross-border e-commerce businesses with greater competitive advantages.

International Remittances: Reducing Fees and Shortening Settlement Times

International remittances are another key application scenario for stablecoins. You may know that traditional bank cross-border remittance processes are complex, with high fees and long settlement times. The emergence of stablecoins has brought revolutionary changes to this field.

Below is the actual performance of stablecoins in international remittances:

- Significantly Reduced Fees: Traditional bank cross-border remittance fees average 6.35%, while stablecoin transfer fees are almost negligible.

- Shortened Settlement Times: Through stablecoins, users can achieve near-real-time fund transfers, while traditional methods may take several days.

For example, PayPal users can use its launched stablecoin PYUSD for low-cost cross-border transfers and payments. Hong Kong importers, through the mBridge platform, directly exchange digital Hong Kong dollars for digital Thai baht, completing payments almost in real-time. This method not only improves fund liquidity but also reduces the complexity of intermediaries.

Trade Settlement: Simplifying Fund Flows Between Multinational Enterprises

In international trade, stablecoins provide an efficient solution for fund settlement between enterprises. You will find that traditional trade settlements typically involve multiple currency conversions and bank intermediaries, making the process cumbersome and costly. The use of stablecoins simplifies all of this.

Below are the advantages of stablecoins in trade settlement:

- Simplified Process: Enterprises can directly use stablecoins for payments, bypassing multiple intermediaries.

- Reduced Costs: Stablecoin transfer fees are below $1, far lower than traditional bank fees.

- Improved Efficiency: Through blockchain technology, fund flows between enterprises can be completed in seconds.

According to statistics, stablecoin settlement volumes are expected to reach $5.28 trillion in 2024, highlighting their importance in the financial system. For example, small and medium-sized enterprises in Indonesia use stablecoins for international payments, bypassing the high fees of traditional banks. This approach not only reduces operational costs but also enhances enterprise competitiveness.

Cryptocurrency Cross-Border Transfers: Improving Payment Efficiency and Reducing Intermediaries

Cryptocurrency cross-border transfers are transforming the way global payments are conducted. You will find that traditional cross-border payments typically require multiple intermediaries, such as banks and clearinghouses. These intermediaries not only increase time costs but also incur high fees. The emergence of stablecoins provides an efficient solution to this problem.

Stablecoins achieve payment and settlement simultaneously through blockchain technology. This means that funds are settled at the same time as the transfer, without waiting for bank processing times. Using stablecoins for cryptocurrency cross-border transfers improves time efficiency by over 100 times and reduces transfer costs by over 10 times. For example, an international payment completed via stablecoin may take only a few seconds, with fees typically below $1.

Another advantage of blockchain payment systems is peer-to-peer direct settlement. You can directly transfer funds from one account to another without going through intermediary banks. This approach not only reduces intermediaries but also minimizes losses due to exchange rate fluctuations. For import-export enterprises and multinational companies, this efficient payment method is particularly important.

Below are the specific advantages of stablecoins in cryptocurrency cross-border transfers:

- Improved Efficiency: Through blockchain technology, payment and settlement are completed simultaneously, avoiding delays in traditional banking.

- Reduced Costs: Stablecoin transfer fees are far lower than traditional bank fees, especially suitable for small payments.

- Enhanced Transparency: Blockchain’s public ledger makes every transaction clearly visible, reducing uncertainty in fund flows.

For example, an export enterprise in Hong Kong can use stablecoins to directly receive payments from U.S. clients. The entire process does not require bank clearing, and funds arrive almost in real-time. This approach not only accelerates fund turnover but also reduces high cross-border payment fees.

The growing popularity of cryptocurrency cross-border transfers is injecting new vitality into the global payment system. You can foresee that as technology continues to develop, stablecoins will play a role in more fields, further improving payment efficiency and reducing intermediaries.

Analysis of Stablecoin Advantages

Timeliness: Real-Time Settlement, Reducing Fund Delays

Have you ever been frustrated by delays in cross-border payments? Traditional payment methods typically take several days to complete fund transfers, especially when multiple intermediaries are involved. Stablecoins achieve real-time settlement through blockchain technology, significantly reducing fund delay times.

Below are the advantages of stablecoins in payment timeliness:

- Stablecoins can quickly complete cross-border payments, typically taking a few seconds to a few minutes.

- Blockchain technology reduces friction costs, improving payment efficiency.

- Compared to traditional payment methods, stablecoins demonstrate outstanding timeliness in cross-border payments.

For example, in cryptocurrency cross-border transfers, the real-time settlement function of stablecoins allows funds to reach the recipient’s account quickly. This efficient payment method not only saves time but also enhances user experience.

Cost: Reducing Transaction Fees, Eliminating Intermediaries

High fees in cross-border payments have always been a pain point for users. Traditional payment methods often involve multiple intermediaries, with each step adding extra costs. Stablecoins significantly reduce transaction costs through decentralized blockchain networks.

Below is a comparison of stablecoins and traditional payment methods in terms of cost:

| Transaction Cost Range | Daily Return of Non-Liquidity Loss Portfolio | Daily Return of Liquidity Winner Portfolio | Information Ratio Change |

|---|---|---|---|

| 0 to 100 Basis Points | Decreased from 1.07% to 0.95% | Smoother performance decline | IR decreased from 1.59 to 1.27 |

Through stablecoins, you can complete peer-to-peer payments directly, without relying on intermediaries like banks. This approach not only reduces fees but also avoids additional losses due to exchange rate fluctuations. For example, enterprises in Hong Kong use stablecoins for international trade settlements, with payment fees typically below $1, while traditional bank fees can reach up to 6% of the transaction amount.

Transparency: Traceability Supported by Blockchain Technology

In traditional payment systems, fund flow transparency is low, and users struggle to track the specific flow of each transaction. Stablecoins, relying on blockchain technology, provide unprecedented transparency and traceability.

Below is the performance of blockchain technology in improving transaction transparency:

- All transaction records are stored on a distributed ledger, allowing anyone to trace and audit transaction history.

- The immutability of blockchain ensures the authenticity of transaction data.

- Each node holds a complete copy of transaction records, further enhancing transparency.

For example, in cryptocurrency cross-border transfers, the transparency of stablecoins allows users to clearly understand the flow and status of funds. This transparency not only boosts user trust but also provides regulators with more efficient audit tools.

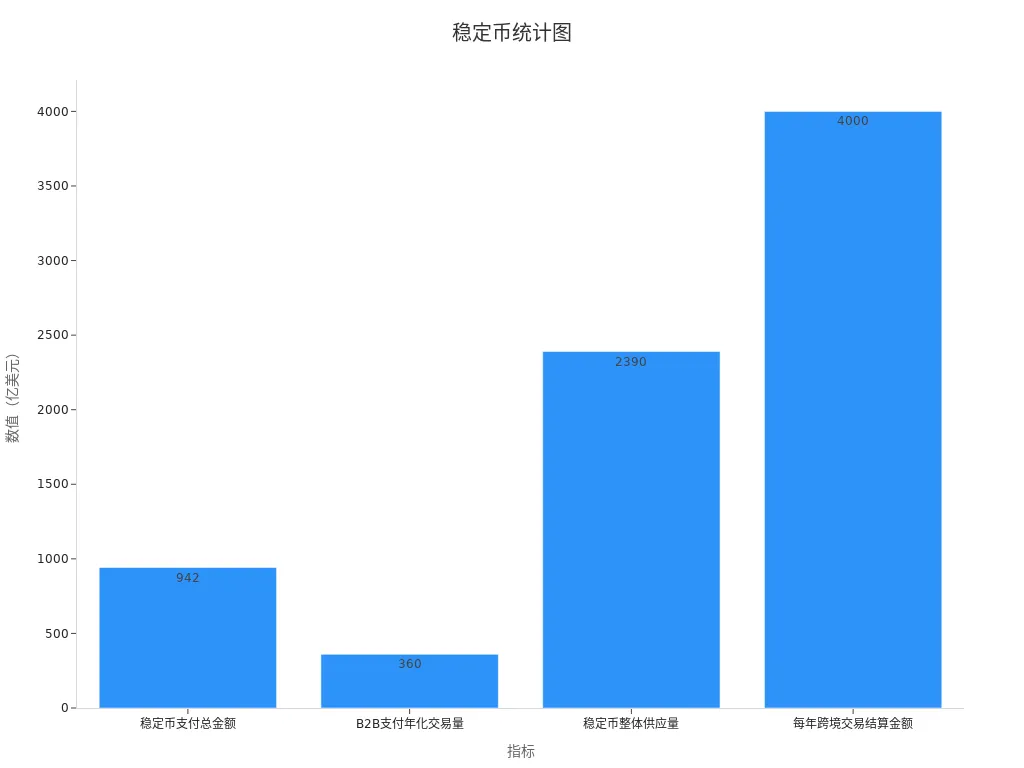

Additionally, the following data further illustrates the overall advantages of stablecoins:

| Metric | Value |

|---|---|

| Total Stablecoin Payment Amount | $94.2 billion |

| B2B Payment Annualized Transaction Volume | $36 billion |

| Total Stablecoin Supply | $239 billion |

| Annual Cross-Border Transaction Settlement Amount | $400 billion |

| Number of Stablecoin Holders | Over 150 million addresses |

Through these data, you can clearly see the significant advantages of stablecoins in timeliness, cost, and transparency. They not only optimize the efficiency of cross-border payments but also provide users with lower costs and higher transparency in payment experiences.

Comparison with Traditional Payment Methods: Significant Improvements in Efficiency, Cost, and Transparency

In the field of cross-border payments, stablecoins demonstrate significant advantages compared to traditional payment methods. Whether in efficiency, cost, or transparency, stablecoins offer users a superior choice. Below is a detailed comparative analysis:

1. Efficiency: Significant Improvement in Payment Speed

Traditional payment methods typically require multiple intermediaries, such as banks and clearinghouses. Each step adds processing time. For example, with Hong Kong banks, cross-border remittances may take 3 to 5 business days to arrive. Stablecoins achieve peer-to-peer payments through blockchain technology, with funds transferable in seconds to minutes.

Tip: If you need to complete international payments quickly, stablecoins are an ideal choice. They significantly reduce waiting times, especially in urgent situations.

Below is a comparison of stablecoins and traditional payment methods in payment speed:

| Payment Method | Average Settlement Time | Number of Intermediaries |

|---|---|---|

| Traditional Bank Transfer | 3 to 5 business days | Multiple |

| Stablecoin Payment | Seconds to minutes | None |

2. Cost: Significantly Reduced Transaction Fees

High fees in traditional payment methods are a persistent issue for users. For international remittances, banks typically charge 6% to 10% in fees. Additionally, currency conversion incurs extra costs. Stablecoin transfer fees are usually below $1, making them highly competitive regardless of transaction size.

Below is a comparison of stablecoins and traditional payment methods in cost:

| Payment Method | Average Fee (USD) | Currency Conversion Fee | Total Cost Proportion |

|---|---|---|---|

| Traditional Bank Transfer | $30 to $50 | Up to 3% | High |

| Stablecoin Payment | Typically below $1 | No conversion needed | Extremely low |

Case Study: A user working in the U.S. needs to remit $1,000 to family in China. Using a traditional bank transfer, fees could reach $50. With stablecoins, fees may be less than $1, saving nearly 98% of the cost.

3. Transparency: Traceability of Fund Flows

Traditional payment methods lack transparency in fund flows. Users often cannot track funds’ status in real-time, and delays from intermediaries may create uncertainty. Stablecoins, relying on blockchain technology, record every transaction on a public ledger, allowing users to check fund flows and status at any time.

Below are the advantages of stablecoins in transparency:

- Real-Time Tracking: Users can view transaction status via blockchain explorers.

- Immutability: Blockchain records cannot be altered, ensuring data authenticity.

- Enhanced Trust: Transparent transaction records reassure users and businesses.

Note: For businesses, stablecoin transparency can also streamline financial audits, reducing compliance costs.

Technical and Regulatory Challenges

Technical Bottlenecks: Blockchain Scalability and Stability Issues

Blockchain technology faces scalability and stability challenges in stablecoin applications. You may have heard of the “trilemma,” which states that blockchain cannot simultaneously achieve efficiency, security, and decentralization with limited resources. This limitation directly impacts stablecoin performance in cross-border payments.

Below are the specific manifestations of current technical bottlenecks:

- Insufficient Scalability: Traditional public chains can become congested when processing large transaction volumes, causing transfer delays.

- Stability Challenges: Blockchain networks may experience interruptions due to node failures or attacks, affecting payment reliability.

- High Cost Issues: The cost of storing and verifying data is high, especially with large transaction volumes.

Some innovative technologies are attempting to address these issues. For example, modular blockchain technology optimizes scalability and transaction costs by assigning different functions to specialized modules. Celestia’s Data Availability Sampling (DAS) technology allows light nodes to verify data availability without downloading entire block data. This approach significantly reduces data storage costs while ensuring blockchain integrity.

Regulatory Challenges: Policy Differences and Compliance Requirements Across Countries

The global application of stablecoins faces challenges from differing national policies. Different countries have significant variations in their definitions and regulatory frameworks for stablecoins, which may lead to compliance issues in cross-border payments.

Below are regulatory policies in some countries:

- United States: Issued the “GENIUS Act,” requiring stablecoin issuers to have technical capabilities to comply with legal orders.

- United Kingdom: Ensures the security of virtual currency transactions through the Money Laundering, Terrorist Financing, and Transfer of Funds (Information on the Payer) Regulations 2017.

- China: Issued the “Financial Distributed Ledger Technology Security Specification,” promoting standardized construction of financial blockchains.

- Other Countries: The EU, Japan, Singapore, and others treat stablecoins as payment instruments and have established corresponding regulations.

These policy differences may affect the global circulation of stablecoins. For example, regulatory frameworks in the U.S. and Europe involve not only financial regulation but may also impact monetary policy and financial stability. To address these challenges, establishing international unified standards is particularly important.

User Perception Issues: Public Acceptance and Trust in Stablecoins

Public acceptance and trust in stablecoins directly affect their adoption rate. Many people are still unfamiliar with the concept of stablecoins, and some question their security and legality.

Below are the main factors affecting user perception:

- Technical Complexity: The technical nature of blockchain makes it difficult for ordinary users to understand its operational principles.

- Security Concerns: Users may worry about whether stablecoin asset reserves are genuine and reliable.

- Legal Risks: Inconsistent judicial recognition of stablecoin nature may lead to transactions being deemed illegal.

To enhance public trust, stablecoin issuers need to increase transparency, ensuring the openness and authenticity of asset reserves. Educating users about the advantages and application scenarios of blockchain technology can also help improve acceptance.

Future Trends of Stablecoins in Cross-Border Payments

Image Source: pexels

Technological Evolution and Innovation in Algorithmic Stablecoins

Algorithmic stablecoins are driving rapid advancements in cross-border payment technology. You may have noticed that the application scope of blockchain technology is expanding, covering financial services, supply chain management, and more. The number of global blockchain patent applications is also growing rapidly. As of July 2019, the number of disclosed blockchain patent applications exceeded 18,000, with China accounting for over 50%, three times that of the U.S. These data indicate that technological innovation in algorithmic stablecoins is accelerating.

Market data also highlights the potential of algorithmic stablecoins. The stablecoin market size has exceeded $230 billion, with over 250 million active accounts. In the past 12 months, stablecoin transaction volumes reached $7 trillion, with 14 trillion transactions. By 2030, the market size is expected to reach $3.7 trillion. These figures reflect the penetration rate and technological evolution speed of algorithmic stablecoins in cross-border payments.

You can foresee that in the future, algorithmic stablecoins will further enhance payment efficiency and stability through more efficient algorithmic mechanisms and smart contract technology. This technological evolution will bring more innovation opportunities to cross-border payments.

Impact of Central Bank Digital Currencies (CBDCs) on Stablecoins

The introduction of Central Bank Digital Currencies (CBDCs) is reshaping the stablecoin market landscape. You may wonder whether CBDCs will replace stablecoins. In reality, CBDCs and stablecoins are more likely to form a complementary relationship. The flexibility and decentralization of stablecoins in cross-border payments give them unique advantages in certain scenarios.

For example, the U.S.-passed “GENIUS Act” will promote the development of the stablecoin market, while Hong Kong’s digital RMB shopping festival is exploring the possibility of integrating stablecoins into its ecosystem. These cases show that the introduction of CBDCs has not diminished the role of stablecoins but instead provided more opportunities for collaboration.

In the future, CBDCs may enhance the efficiency and transparency of cross-border payments by integrating with stablecoins. You can expect stablecoins to continue playing a significant role in the global payment system with CBDC support.

Market Potential and Possibilities for Industry Collaboration

The market potential of stablecoins is rapidly expanding. According to Orient Securities, the global stablecoin market size is expected to exceed $250 billion by 2025, an increase of $40 billion from the end of 2024. This indicates that stablecoins are becoming increasingly important in bridging traditional finance and crypto ecosystems.

Industry collaboration is also driving stablecoin development. For example, Bank of China Hong Kong is exploring the application of stablecoins in cross-border payments and trade settlements. Such collaborations not only enhance the international status of the RMB but also provide enterprises with more efficient payment solutions.

Below are forecasted market size data:

| Forecast Year | Market Size (USD) | Notes |

|---|---|---|

| 2026 | $50 billion | Hong Kong stablecoin market size forecast |

| 2030 | $4.8–8 trillion | Global RWA market size forecast, with stablecoins accounting for 30%–50% |

You can see that the market potential and industry collaboration opportunities for stablecoins are continuously increasing. In the future, stablecoins will further drive innovation in the global payment system through integration with traditional financial institutions and emerging technologies.

Stablecoins demonstrate significant value in cross-border payments. They improve payment efficiency, reduce transaction costs, and enhance fund flow transparency. The following cases further illustrate their application potential:

- Checkout.com supports merchants settling with USDC, reducing bank transfer costs and delays.

- A manufacturing company used stablecoins to pay suppliers, shortening settlement time from 3 days to 5 minutes, saving 1.2% in fees.

- A tech service provider used stablecoins for monthly contract payments, saving $50,000 in bank fees and reducing operational team manpower by 60%.

In the future, technological innovation and improved regulatory frameworks will drive broader stablecoin applications. Do you think stablecoins will become a mainstream tool for global payments?

FAQ

Are Stablecoins Suitable for Individual Users in Cross-Border Payments?

Stablecoins are very suitable for individual users. They enable fast payments with fees typically below $1. You can transfer funds directly through a digital wallet without bank intermediaries. This method saves both time and costs.

Is Stablecoin Payment Secure?

Stablecoin payments rely on blockchain technology, offering high security. All transaction records are stored on a distributed ledger and cannot be tampered with. You can track fund flows in real-time through blockchain explorers, ensuring transaction transparency.

How Do Stablecoins Address Exchange Rate Volatility?

Stablecoins maintain value stability by pegging to fiat currencies or assets. For example, USDT is pegged 1:1 to the U.S. dollar. You don’t need to worry about losses due to exchange rate fluctuations, making cross-border payments more reliable.

Do Stablecoin Payments Require Additional Fees?

Stablecoin payment fees are extremely low, typically below $1. You can complete peer-to-peer payments directly, avoiding high bank fees. This method is particularly suitable for small cross-border transactions.

Are Stablecoins Regulated?

Stablecoin regulation varies by country. For example, the U.S. requires stablecoin issuers to comply with relevant laws, while China promotes blockchain technology standardization. You need to understand your country’s policies to ensure compliant use of stablecoins.

Stablecoins offer low-cost and efficient cross-border payments, but high fees, transaction delays, and regulatory complexities still challenge users. BiyaPay provides a superior solution, supporting conversions across 30+ fiat currencies and 200+ cryptocurrencies with remittance fees as low as 0.5%, covering 190+ countries with same-day delivery. BiyaPay ensures fund safety and accelerates processing, addressing transparency issues and delays in traditional payments. Join BiyaPay now for efficient, low-cost cross-border remittances! You can also invest in U.S. and Hong Kong stocks directly on the BiyaPay platform without needing an additional overseas account, enhancing capital efficiency. Idle funds can earn a 5.48% APY through current investment products, backed by BiyaPay’s U.S. MSB and SEC licenses. Sign up with BiyaPay for a transparent, fast global payment experience!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.