- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Reasons for International Remittance Failures and Coping Strategies

Image Source: unsplash

There are many reasons for international remittance failures, with the most common being incorrect account information. Entering an incorrect account number or recipient name can prevent funds from being transferred to the designated account. Additionally, exceeding the bank or platform’s remittance limits can also trigger a failure. You may find that bank policies or international sanctions can affect the success rate of remittances.

So, how long does an international remittance take? The settlement time depends on multiple factors, such as the initiation time, amount, currency type, and the recipient’s location. Weekday processing is faster, and small transactions are generally quicker. The bank’s processing efficiency and the number of intermediary banks also directly impact settlement speed.

Common Reasons for International Remittance Failures

Image Source: pexels

Incorrect Account Information

Incorrect account information is one of the primary reasons for international remittance failures. Entering an incorrect account number, recipient name, or bank code (such as a SWIFT code) can prevent funds from being correctly transferred to the target account. You need to pay special attention to the accuracy of this information. Even a minor spelling mistake can make it impossible for the bank to identify the recipient account.

To avoid this, you should carefully verify all information before submitting the remittance. If you’re unsure about certain details, you can directly contact the recipient or bank for confirmation. Many banks and remittance platforms also offer information verification features to help reduce the likelihood of errors.

Tip: When entering the SWIFT code, ensure it matches the actual code of the recipient bank. SWIFT codes typically consist of 8 to 11 characters, representing specific bank branches.

Exceeding Remittance Amount Limits

Exceeding remittance amount limits is another common issue. Different banks and countries have varying restrictions on international remittance amounts. For example, Hong Kong banks may set clear limits on single transactions and daily cumulative amounts. If your remittance amount exceeds these limits, the bank may refuse to process it.

Below are some common remittance amount limits:

| Remittance Function | Single Transaction Limit | Daily Cumulative Limit |

|---|---|---|

| Remittance to Overseas VISA Card | 2,500 USD or equivalent foreign currency | 50,000 USD or equivalent foreign currency |

| Overseas Remittance Function | 50,000 USD (inclusive) or equivalent foreign currency | 50,000 USD or equivalent foreign currency |

| Currency Conversion (Within Territory, Outside Customs) | 1,000 USD | N/A |

| Currency Conversion (Other Locations) | 500 USD | N/A |

| Wire Transfer Minimum Amount | 100 USD (or equivalent) | N/A |

| UK Region Minimum Remittance Amount | 200 USD, 180 GBP | N/A |

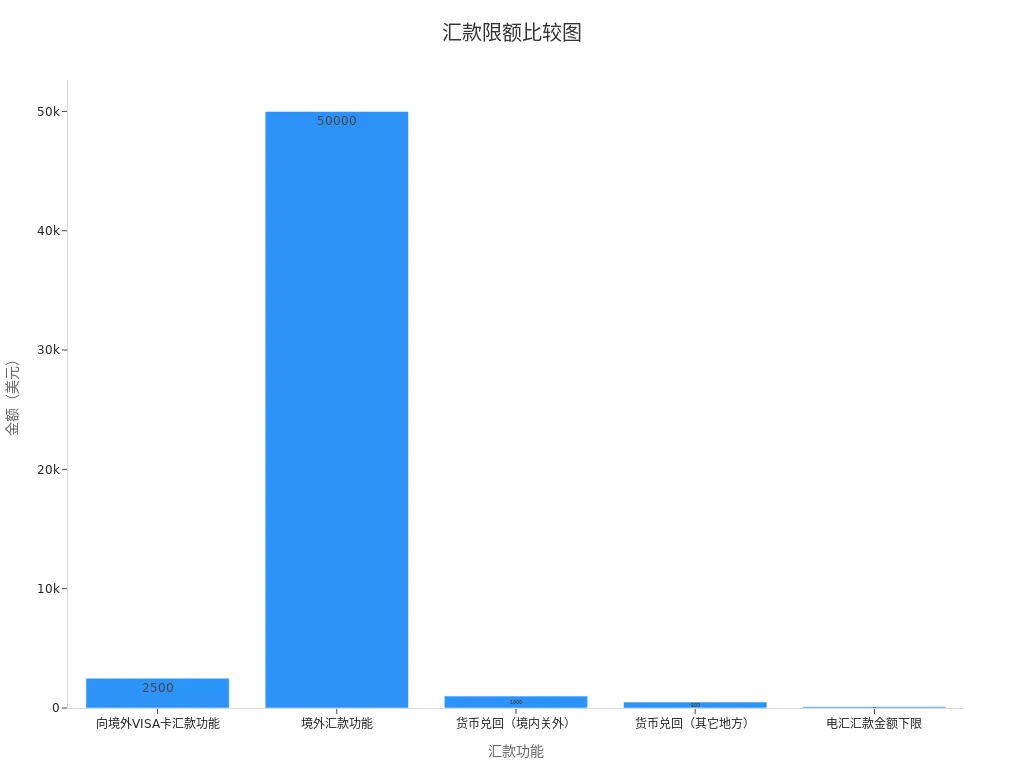

Additionally, the differences in single transaction limits for various remittance functions can be intuitively understood through the following bar chart:

If your remittance amount exceeds the limit, you can consider splitting the remittance into multiple transactions or applying in advance to increase the limit. Many banks allow customers to adjust remittance limits based on their needs, but this requires providing relevant documentation.

Bank Policies or International Sanctions

Bank policies and international sanctions can also lead to remittance failures. Certain countries or regions may be subject to international sanctions due to political or economic reasons, preventing funds from being transferred to bank accounts in those areas. For example, some banks may restrict remittances to accounts in sanctioned countries.

You need to research the remittance policies and restrictions of the destination country in advance. You can obtain the latest information through the bank’s website or customer service. If the destination country poses a sanction risk, choosing other legal channels may be safer.

Note: Before initiating an international remittance, ensure the destination is not on a sanctioned list. This can prevent unnecessary fund freezes or delays.

Technical Issues with Remittance Platforms

Technical issues with remittance platforms are another common cause of international remittance failures. Whether it’s a bank’s online system or a third-party platform, technical glitches can disrupt the smooth processing of transactions. Below are some typical technical issues and their possible solutions:

- System Maintenance or Upgrades

Many banks and remittance platforms conduct periodic system maintenance or upgrades. If you initiate a remittance during maintenance, the transaction may be delayed or fail.Tip: Before remitting, check the platform’s announcements or notifications to ensure the system is operating normally.

- Network Connectivity Issues

Unstable networks can prevent a remittance request from being successfully submitted. This is particularly common when using mobile devices or public networks.Solution: Use a stable network environment to complete the remittance and avoid transactions in areas with poor signal.

- Platform Software Errors

Some platforms may have software bugs or compatibility issues, leading to transaction failures. For example, certain app versions may not properly handle remittances in specific currencies.Suggestion: Regularly update the remittance platform’s application to ensure you’re using the latest version. If issues persist, contact platform customer service for assistance.

- Payment Gateway Issues

The payment gateway is a critical component in processing transactions. If the gateway fails, the remittance may not complete.Note: If payment gateway issues occur frequently, consider switching to a more reliable remittance platform.

While technical issues are unavoidable, you can reduce risks by choosing reputable platforms, keeping software updated, and staying informed about platform announcements.

Issues with Recipient Accounts

Issues with the recipient’s account can also cause international remittance failures. Below are common recipient account problems and their solutions:

- Account Frozen or Closed

If the recipient’s account is frozen or closed, the remittance cannot succeed. Banks typically return the funds to your account.Solution: Before remitting, confirm the recipient’s account status is normal. If the account is frozen, advise the recipient to contact their bank to resolve the issue.

- Account Type Not Supporting International Remittances

Some account types may not support receiving international remittances. For example, certain savings or student accounts may have restrictions.Tip: Before remitting, verify whether the recipient’s account supports international remittances. If not, suggest the recipient switch to a compatible account type.

- Incomplete or Incorrect Account Information

Incomplete or incorrect information provided by the recipient (e.g., account number, bank name, or SWIFT code) can lead to remittance failure.Suggestion: Before remitting, verify all account information with the recipient to ensure accuracy.

- Recipient Bank Policy Restrictions

Some banks may impose special requirements or restrictions on receiving international remittances. For example, certain banks may require the recipient to provide additional documents or information.Note: If the recipient bank has specific requirements, advise the recipient to communicate with their bank in advance to meet all conditions.

By maintaining good communication with the recipient and verifying all information before remitting, you can effectively reduce the risk of failures due to account issues.

How Long Does an International Remittance Take?

Main Factors Affecting Settlement Time

The settlement time for international remittances is not fixed and is typically influenced by multiple factors. Below are some key factors:

- Remittance Method: Different remittance methods directly affect settlement time. For example, international bank transfers usually take 1 to 5 working days, while online banking remittances may take only 1 to 3 working days.

- Processing Speed of Intermediary and Recipient Banks: Remittances require processing by intermediary and recipient banks. If there are multiple intermediary banks or their processing is slow, settlement time will be extended.

- Holidays and Time Differences: International remittances are generally processed only on working days. If you initiate a remittance on weekends or holidays, it may cause delays.

- Remittance Amount: Large remittances may require additional review processes, extending processing time.

Below are specific statistical data on settlement times and influencing factors for different remittance methods:

| Remittance Method | Settlement Time | Influencing Factors |

|---|---|---|

| International Bank Transfer | 1 to 5 working days | Remittance method, bank processing speed, etc. |

| Wire Transfer | 1 to 3 working days | Bank processing speed, international settlement time |

| Currency Conversion Remittance | 2 to 5 working days | Currency conversion, bank processing speed |

| Online Banking Remittance | 1 to 3 working days | Bank processing time, holidays |

| Check Remittance | 10 to 15 working days | Bank processing speed, holidays |

Tip: When choosing a remittance method, prioritize those with shorter settlement times, such as online banking remittances or wire transfers.

How to Shorten International Remittance Processing Time

If you want to shorten the processing time for international remittances, you can take the following measures:

- Choose Fast Remittance Methods

Online banking remittances and wire transfers are generally faster than traditional international bank transfers. You can prioritize these methods to speed up settlement. - Avoid Holidays and Weekends

Initiating remittances on working days can avoid delays due to holidays or time differences. Knowing the holiday schedule of the destination country is particularly important. - Ensure Information Accuracy

Before submitting a remittance, carefully verify account information, SWIFT code, and recipient name. Incorrect information can extend processing time or cause remittance failure. - Choose Efficient Banks or Platforms

Different banks and remittance platforms have varying processing efficiencies. Selecting reputable banks or platforms with faster processing can significantly reduce remittance time. - Communicate with the Recipient in Advance

Ensure the recipient’s account is in normal status and understand the processing requirements of the recipient bank. This can avoid delays due to account issues.

Note: While you can take various measures to shorten processing time, some uncontrollable factors (e.g., intermediary bank processing speed) may still affect settlement time.

Common Delay Issues and Solutions

Delays are common in international remittances. Below are some typical delay causes and their solutions:

- Credit Risk

Geographic distance and communication barriers may increase credit risk, leading to payment delays.Solution: Choose reputable banks or platforms and ensure remittance information is accurate.

- Liquidity Risk

Insufficient liquidity of settlement assets can cause payment delays, especially in real-time gross settlement systems.Solution: Select banks or platforms with strong liquidity and avoid initiating remittances during peak periods.

- Operational Risk

Errors by system participants or force majeure events (e.g., natural disasters) may disrupt payment systems.Solution: Check platform announcements before remitting to ensure the system is operating normally.

- Recipient Bank Processing Time

The recipient bank requires time to process incoming funds, which may delay settlement confirmation.Solution: Communicate with the recipient in advance to understand the recipient bank’s processing time.

By understanding these common issues and taking corresponding measures, you can effectively reduce the likelihood of delays, ensuring smooth completion of international remittances.

Solutions for Incorrect Account Information

Key Steps for Verifying Account Information

Incorrect account information is one of the main causes of international remittance failures. To avoid this issue, you need to carefully verify every piece of information. Below are key steps for verifying account information:

- Confirm Recipient Name: Ensure the entered name exactly matches the name registered with the recipient bank, including capitalization and spelling.

- Check Account Number: Verify the account number digit by digit to avoid errors causing remittance failure.

- Validate Bank Name and Address: Ensure the entered bank name and address match the information provided by the recipient.

- Verify Currency Type: Confirm the remittance currency matches the currency type supported by the recipient account.

Tip: When entering information, you can use the automatic verification features provided by banks or remittance platforms. This can help you quickly identify obvious errors.

Ensuring Correct International Bank Codes (e.g., SWIFT Codes)

The SWIFT code is an essential part of international remittances. It consists of 8 to 11 characters and identifies the specific branch of a bank. Entering an incorrect SWIFT code can prevent funds from reaching the target account.

- How to Obtain SWIFT Codes: You can request it from the recipient or check it on the bank’s website.

- Common Errors: Incorrect character order or missing required digits in the SWIFT code.

- Verification Method: Before submitting the remittance, use verification tools provided by banks or platforms to ensure the SWIFT code’s accuracy.

Note: Some banks may use multiple SWIFT codes depending on branches or service types. You need to confirm you’re using the correct code.

Contacting Banks or Remittance Platforms for Information Confirmation

If you have doubts about the accuracy of account information, contacting the bank or remittance platform promptly is the most effective solution. Below are steps you can take:

- Call Customer Service Hotline: Contact the bank or platform’s customer service directly, provide remittance details, and confirm if the information is correct.

- Use Online Customer Service: Many banks and platforms offer online customer service, allowing you to get help quickly via chat tools.

- Visit a Bank Branch: If the issue is complex, visiting a bank branch in person may be more efficient.

Suggestion: When contacting the bank, have all relevant information ready, such as recipient name, account number, and SWIFT code. This helps customer service quickly identify and resolve the issue.

Through these methods, you can effectively reduce the risk of remittance failures due to incorrect account information, ensuring funds reach the target account smoothly.

Strategies for Handling Remittance Amount Limits

Understanding Remittance Platform or Bank Amount Limit Policies

Before initiating an international remittance, you need to understand the amount limit policies of the chosen platform or bank. Different banks and platforms have varying restrictions on single transactions and daily cumulative amounts. For example, Hong Kong banks typically set caps on single remittance amounts, and some platforms may impose additional limits on specific currencies.

Below are some common amount limit policies:

| Platform/Bank Type | Single Transaction Limit | Daily Cumulative Limit |

|---|---|---|

| Hong Kong Banks | 50,000 USD | 100,000 USD |

| Third-Party Remittance Platforms | 20,000 USD | 50,000 USD |

| International Wire Transfers | 100,000 USD | No Explicit Limit |

Tip: Before choosing a remittance method, visit the bank or platform’s website to review the latest amount limit policies. You can also contact customer service for more detailed information.

Feasibility Analysis of Splitting Remittances

If your remittance amount exceeds the limit, splitting the remittance into multiple transactions may be a feasible solution. This approach divides large funds into several transactions to avoid triggering amount limits. However, there are some considerations to keep in mind.

Advantages:

- Avoids failures due to exceeding single transaction limits.

- Easier to pass bank review processes.

Disadvantages: - Each transaction may incur additional fees. For example, Hong Kong banks’ international remittance fees typically range from 20 to 50 USD.

- Processing time may be extended, especially if multiple transactions involve different intermediary banks.

Suggestion: Before splitting remittances, calculate the total fees to ensure the cost is within an acceptable range.

Process for Applying to Increase Remittance Limits

If splitting remittances doesn’t meet your needs, you can apply to increase your remittance limit. Many banks allow customers to adjust limits based on actual needs, but this requires providing relevant documentation.

Below are common steps for the application process:

- Prepare Materials: Include identification, proof of income, or proof of fund sources.

- Contact the Bank: Submit the application via phone, online customer service, or in person at a branch.

- Complete Application Form: Provide detailed remittance needs and reasons.

- Await Approval: Banks typically take 1 to 3 working days to complete the review.

Note: Applying to increase limits may involve additional fees, depending on the bank’s policies.

By understanding policies and planning remittance methods wisely, you can effectively address amount limits, ensuring smooth fund transfers.

Measures to Prevent International Remittance Failures

Image Source: unsplash

Regularly Updating Account Information

Regularly updating account information is a critical measure to prevent international remittance failures. Bank account details may change due to personal information updates or bank policy adjustments. If you fail to update this information in time, it may lead to remittance failures or delays.

Below are some pieces of information that need regular checking and updating:

- Contact Information: Ensure the phone number and email address on file with the bank are up to date.

- Address Information: If you move or change your address, notify the bank promptly.

- Account Status: Periodically check if the account is in normal status to avoid remittance failures due to account freezes or restrictions.

Tip: Check your account information at least once a year, especially before planning large international remittances, to effectively reduce failure risks.

Choosing Reliable Remittance Platforms or Banks

Selecting a reliable remittance platform or bank is an important step in ensuring smooth remittances. Different platforms and banks vary in service quality and processing efficiency. Choosing reputable institutions can reduce the likelihood of technical issues and delays.

Below are factors to consider when choosing a platform or bank:

- Fees: Compare fees across platforms and select cost-effective services. For example, Hong Kong banks’ international remittance fees typically range from 20 to 50 USD.

- Settlement Time: Prioritize platforms with faster processing, such as those supporting wire transfers.

- Customer Service: Choose platforms offering 24-hour customer support for prompt issue resolution.

Note: Before selecting a platform, review user feedback and the platform’s track record to ensure it has a strong reputation in international remittances.

Understanding the Destination Country’s Remittance Requirements and Restrictions

Different countries may have varying requirements and restrictions for international remittances. Understanding the destination country’s policies in advance can prevent failures due to non-compliance.

Below are key considerations:

- Amount Limits: Some countries set caps on single or cumulative remittance amounts. Confirm the destination country’s policies to avoid exceeding limits.

- Currency Requirements: Ensure the remittance currency matches the destination’s accepted currency or choose a bank supporting currency conversion.

- Documentation Requirements: Some countries may require additional documents, such as proof of identity or fund sources.

Suggestion: Before remitting, confirm all necessary information with the recipient and consult the bank or platform’s customer service to ensure compliance with the destination country’s requirements.

By regularly updating account information, choosing reliable remittance platforms, and understanding the destination country’s policies, you can effectively prevent international remittance failures, ensuring funds reach their destination smoothly.

Retaining Remittance Records for Future Reference

During the international remittance process, retaining remittance records is a crucial step. Complete records not only help you track fund flows but also provide strong evidence in case of issues. Below are key points to understand:

Why Retain Remittance Records?

- Track Fund Status: If a remittance is delayed or fails, records help you quickly identify the cause. Banks or platforms typically require transaction numbers or other details.

- Meet Legal or Tax Requirements: Some countries may require remittance records to prove fund sources or purposes. For example, China’s tax authorities may request related documents.

- Avoid Duplicate Payments: Records help you confirm whether a payment has been completed, preventing fund losses from duplicate remittances.

How to Effectively Retain Remittance Records?

- Save Electronic Receipts: Most banks and platforms provide electronic receipts after transactions. Save these in cloud storage or on a local hard drive.

- Record Key Information: Ensure you document the following:

- Remittance date and time

- Remittance amount and currency type

- Recipient account information

- Transaction number or reference number

- Regular Backups: Periodically back up all records to secure locations, such as encrypted USB drives or cloud storage services.

Tip: If you use a Hong Kong bank for international remittances, you typically receive a detailed transaction confirmation. Be sure to retain this document, as it contains all necessary information.

Using Tools to Manage Records

You can use spreadsheets or dedicated financial management software to organize remittance records. For example, Google Sheets or Microsoft Excel can help categorize and search records. Below is a simple record template:

| Date | Remittance Amount | Recipient Name | Transaction Number | Platform/Bank Name |

|---|---|---|---|---|

| 2023-10-01 | 500 USD | John Doe | TXN123456789 | Hong Kong Bank |

| 2023-10-15 | 1,000 USD | Jane Smith | TXN987654321 | Some Remittance Platform |

This format allows you to quickly locate needed information, saving time and effort.

Note: Retain records for at least one year. For large remittances, consider keeping them longer for future needs.

Properly retaining remittance records not only helps you manage finances better but also provides support when needed. Whether for personal or business purposes, this is an essential habit.

Conclusion

The main reasons for international remittance failures include incorrect account information, amount limits, and bank policies. You can address these issues by carefully verifying account information, understanding remittance policies, and choosing reliable platforms. Preventive measures are equally important, such as regularly updating account information and retaining remittance records, which can help avoid future failures.

If you want to know how long an international remittance takes, refer to the remittance method and bank processing times. Typically, online banking remittances and wire transfers settle faster. Choosing the right method can ensure your funds reach their destination more quickly.

Tip: Before remitting, always verify all information to ensure fund security.

FAQ

1. Will Funds Be Refunded After an International Remittance Failure?

Typically, funds will be refunded to your account, but a fee may be deducted. The refund time depends on the bank or platform’s processing speed. Contact bank customer service and provide the transaction number to expedite the inquiry.

Tip: Retaining remittance records helps resolve refund issues quickly.

2. Why Is a SWIFT Code Required for International Remittances?

The SWIFT code identifies the specific branch of the recipient bank, ensuring funds reach the correct account. An incorrect code may cause failure or delay. You can obtain the correct SWIFT code from the recipient or the bank’s website.

Note: SWIFT codes typically consist of 8 to 11 characters; verify accuracy before submission.

3. How to Check the Status of an International Remittance?

You can check remittance status through the following methods:

- Log into your bank or platform account to view transaction records.

- Contact bank customer service and provide the transaction or reference number.

- Use online tracking tools provided by the bank.

Tip: Hong Kong banks often offer real-time tracking services for easy fund status updates.

4. How Much Are International Remittance Fees?

Fees vary by bank and platform. For example, Hong Kong banks’ international remittance fees typically range from 20 to 50 USD. Some platforms may also charge additional currency conversion fees.

| Platform/Bank Type | Fee Range |

|---|---|

| Hong Kong Banks | 20 to 50 USD |

| Third-Party Remittance Platforms | 10 to 30 USD |

Suggestion: Compare fees across platforms before remitting to choose a cost-effective service.

5. What to Do If the Recipient’s Account Is Frozen?

If the recipient’s account is frozen, funds cannot be deposited and are typically refunded to your account. Advise the recipient to contact their bank to resolve the issue promptly, then reinitiate the remittance.

Note: Confirm the recipient’s account status before remitting to avoid unnecessary delays.

International transfers often falter due to incorrect account details, steep fees, or delays, with complex verifications adding frustration. BiyaPay delivers a seamless global finance solution! Exchange over 30 fiat currencies and 200+ cryptocurrencies with transparent real-time rates, and enjoy transfer fees as low as 0.5% across 190+ countries, with same-day initiated, same-day delivered transfers. Sign up for BiyaPay in just one minute to access effortless remittances and US/HK stock investments without needing offshore accounts. Plus, grow idle funds with a 5.48% annualized yield on flexible savings. Backed by U.S. MSB and SEC licenses, BiyaPay ensures robust security. Start today—join BiyaPay to eliminate transfer woes and unlock efficient financial opportunities!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.