- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Comparison of Usage Scenarios for IBAN Numbers and SWIFT Codes

Image Source: pexels

In international remittances, you may encounter two important codes: IBAN numbers and SWIFT codes. Their purposes are different, and they have clear distinctions:

- IBAN numbers are mainly used to identify specific bank accounts, ensuring funds reach the designated account accurately.

- SWIFT codes are used to identify banks or financial institutions, ensuring funds are sent to the correct bank or branch.

IBAN numbers are widely used in Europe and some Middle Eastern countries, especially indispensable for remittances in the Eurozone. However, Chinese banks do not use IBAN numbers, which highlights its regional limitations. In contrast, SWIFT codes are accepted globally, suitable for international transfers in non-European regions.

Key Points

- IBAN numbers are used to identify specific bank accounts, ensuring funds reach the target account accurately, primarily in Europe.

- SWIFT codes are used to identify banks or financial institutions, applicable for global international transfers, ensuring funds are securely sent to the correct bank.

- The structure of IBAN numbers includes check digits, effectively reducing payment errors and improving the efficiency of international remittances.

- The standardized design of SWIFT codes makes them a core tool for international payments, supporting rapid fund transfers.

- When choosing a code, consider the requirements of the recipient bank’s region; European accounts typically require IBAN numbers, while other regions primarily use SWIFT codes.

Definition and Structure of IBAN Numbers

Definition of IBAN Numbers

IBAN number is an abbreviation for International Bank Account Number. It was developed by the European Committee for Banking Standards (ECBS) to provide a unified bank account identification method for cross-border payments. Bank accounts in member countries participating in the ECBS have corresponding IBAN numbers.

Through IBAN numbers, you can ensure funds reach the target account accurately. They not only reduce payment errors but also improve the efficiency of international remittances.

Structure and Example of IBAN Numbers

The structure of an IBAN number consists of multiple components, each with a specific function. Below are the main components of an IBAN number:

| Component | Description |

|---|---|

| Country Code | Indicates the country to which the IBAN belongs |

| Check Digits | Used to verify the validity of the IBAN |

| Bank Identifier | Code identifying a specific bank |

| Account Identifier | Unique identifier for the customer’s account |

For example, a German IBAN number might look like this: DE89 3704 0044 0532 0130 00.

- Country Code: DE, indicating Germany

- Check Digits: 89, used to verify the validity of the IBAN

- Bank Code: 37040044, indicating the specific bank

- Account Number: 0532013000, indicating the customer’s bank account

The total length of an IBAN number can be up to 34 characters, but the length may vary by country. Through this standardized structure, you can easily identify the country, bank, and specific account information of an account.

Definition and Structure of SWIFT Codes

Definition of SWIFT Codes

SWIFT code, fully known as the Society for Worldwide Interbank Financial Telecommunication code, is a unique identifier used internationally to recognize specific banks or financial institutions. It is established by the SWIFT organization (Society for Worldwide Interbank Financial Telecommunication) and widely used in international remittances and financial transactions. Through SWIFT codes, you can ensure funds are accurately sent to the target bank or branch.

The definition of SWIFT codes includes the following key points:

- Bank Code: Consists of 4 letters, usually an abbreviation of the bank’s name.

- Country Code: Consists of 2 letters, indicating the bank’s country, compliant with ISO 3166-1 standards.

- Location Code: Consists of 2 letters or numbers, indicating the city or region where the bank is located.

- Branch Code: Consists of 3 letters or numbers, used to identify specific branches. For bank headquarters, it is typically displayed as “XXX”.

The standardized design of SWIFT codes makes them a core tool for global bank identification. Whether you are remitting to a Hong Kong bank or transferring to a financial institution in the U.S., SWIFT codes ensure the accuracy and security of transactions.

Structure and Example of SWIFT Codes

The structure of a SWIFT code consists of multiple components, each with a clear function. Below are the main components of a SWIFT code and their descriptions:

| Component | Description |

|---|---|

| Institution or Bank Code | 4 English letters |

| Country Code | 2 English letters (ISO 3166-1) |

| Location Code | 2 English letters or numbers |

| Branch Code | 3 English letters or numbers (optional, XXX represents headquarters) |

Additionally, the character count and function of SWIFT codes can be further broken down as follows:

| Component | Character Count | Description |

|---|---|---|

| Bank Code | 4 | Represents a specific bank |

| Country Code | 2 | Represents the country where the bank is located |

| Location Code | 2 | Represents the city or region where the bank is located |

| Branch Code | 3 | Represents a specific branch (optional) |

For example, the SWIFT code for HSBC in Hong Kong is HSBCHKHHXXX:

- Bank Code: HSBC, indicating HSBC Hong Kong.

- Country Code: HK, indicating Hong Kong.

- Location Code: HH, indicating the specific location in Hong Kong.

- Branch Code: XXX, indicating the bank headquarters.

The following chart illustrates the character distribution of SWIFT code components:

Through this standardized structure, SWIFT codes not only enhance the efficiency of international payments but also reduce the risk of errors in transactions. Whether you are an individual or a business user, understanding the components and functions of SWIFT codes can help you better complete international financial transactions.

Usage Scenarios for IBAN Numbers

Image Source: pexels

Cross-Border Remittances in Europe

In Europe, IBAN numbers are a core tool for cross-border remittances. They provide a unique identifier for bank accounts, ensuring funds reach the recipient’s account accurately. Through IBAN numbers, you can quickly identify the account holder and their bank information, significantly improving the efficiency and accuracy of remittances.

Below are the specific roles of IBAN numbers in European cross-border remittances:

- They contain the recipient’s bank information, ensuring remittances are accurate.

- In the Eurozone, IBAN numbers are a necessary condition for international bank transfers.

- Many remittance platforms prioritize using IBAN numbers for fund transfers.

For example, when you remit from France to Germany, the IBAN number helps the banking system precisely identify the recipient’s account. This standardized approach not only reduces errors but also allows you to track the transfer status in real-time.

Advantages in Reducing Payment Errors

Another significant advantage of using IBAN numbers is their ability to reduce payment errors. Due to the inclusion of check digits in their structure, banking systems can verify the validity of the number before processing a transfer. This mechanism effectively prevents fund delays or failures due to input errors.

Below are key points on how IBAN numbers reduce payment errors:

- The check digit function ensures the entered number is correct.

- Banking systems can quickly identify errors and prompt users to correct them.

- They reduce additional costs or time losses caused by erroneous transfers.

Suppose you need to remit to a Hong Kong bank account; although Hong Kong does not use IBAN numbers, in similar European scenarios, IBAN numbers significantly reduce error rates. Their standardized design gives you peace of mind during international transfers, especially when handling large amounts.

Through IBAN numbers, you can enjoy more efficient cross-border remittance services and avoid unnecessary hassles and costs.

Usage Scenarios for SWIFT Codes

Image Source: unsplash

Global Bank Identification

SWIFT codes are a critical tool for global bank identification. Their standardized design allows you to easily identify banks and branches, ensuring funds are transferred accurately to the target bank. SWIFT codes consist of 8 to 11 characters, with each part serving a specific function:

- The first 4 characters represent the bank code, identifying the specific bank.

- The next 2 characters are the country code, compliant with ISO 3166-1 standards, indicating the bank’s country.

- The following characters identify the branch, helping locate specific branches.

This structured design makes SWIFT codes a key player in cross-border payments. They not only improve payment efficiency but also reduce intermediary steps. ISO query messages have a high degree of automation and large information capacity, supporting complex queries. These features enable global banks to process transactions efficiently while enhancing transparency and traceability.

In recent years, the cross-border payment market has grown significantly. The use of SWIFT codes allows banks to complete fund transfers quickly, improving customer experience. For example, when you remit from the U.S. to a Hong Kong bank, the SWIFT code helps the system identify the target bank and branch, ensuring funds arrive safely.

International Transfers in Non-European Regions

In non-European regions, SWIFT codes are the core tool for international transfers. They provide secure fund and information transmission between banks, ensuring smooth transaction completion. The remittance process of the Bank of China is a typical example:

- The remitter sends a remittance message via SWIFTNet.

- SWIFTNet validates, stores, and provides feedback on the message.

- The message enters the Bank of China’s SWIFT direct connection system, completing the fund transfer.

- If the remittance fails, the system sends a refund message.

This process not only ensures fund security but also improves transfer efficiency. Whether you are remitting to a Hong Kong bank or other international financial institutions, SWIFT codes facilitate transactions. Their global applicability allows non-European countries to participate easily in international financial activities, reducing additional costs due to errors or delays.

Through SWIFT codes, you can enjoy safer and more efficient international transfer services. Their standardized design gives you confidence when handling complex cross-border payments, whether for personal remittances or business transactions.

Functions and Limitations of IBAN Numbers and SWIFT Codes

Convenience of IBAN Numbers

IBAN numbers provide significant convenience for international remittances. Their standardized structure allows banks to quickly identify account information, reducing the risk of errors in transfers. Especially in Europe, IBAN numbers have become a core tool for cross-border payments. Through the check digit function, banks can verify the validity of the number before processing transfers, avoiding fund delays or failures due to input errors.

Moreover, the use of IBAN numbers enhances payment efficiency. They consolidate account information into a single number, simplifying the cross-border payment process. For individuals or businesses frequently conducting international transfers, IBAN numbers are undoubtedly a reliable choice.

Limitations of IBAN Numbers

Despite their excellence in international remittances, IBAN numbers have some limitations. First, their usage is primarily concentrated in Europe and some Middle Eastern countries. In non-European regions, especially Asia and the Americas, IBAN numbers have limited applicability. For example, Chinese banks do not use IBAN numbers, restricting their global adoption.

Second, IBAN numbers are less flexible when facing emerging technologies. With the rise of blockchain technology, traditional bank transfer methods are being challenged. The following table illustrates the limitations of IBAN numbers and the SWIFT system in the face of new technologies:

| Evidence Type | Description |

|---|---|

| Limitations of the SWIFT System | The SWIFT system faces challenges from blockchain technology in cross-border payment efficiency, prompting the launch of the SWIFT gpi project to improve service efficiency. |

| IBAN Standardization | As a standardized customer account format, IBAN is widely used in international remittances but appears less flexible in the face of new technologies. |

Versatility of SWIFT Codes

The widespread global use of SWIFT codes makes them a vital tool in the international banking industry. Their standardized design enables banks to quickly identify target banks and branches, ensuring funds reach their destination safely. According to statistics, the SWIFT system processes 10.6 billion financial messages annually, with an average of over 42 million messages processed daily.

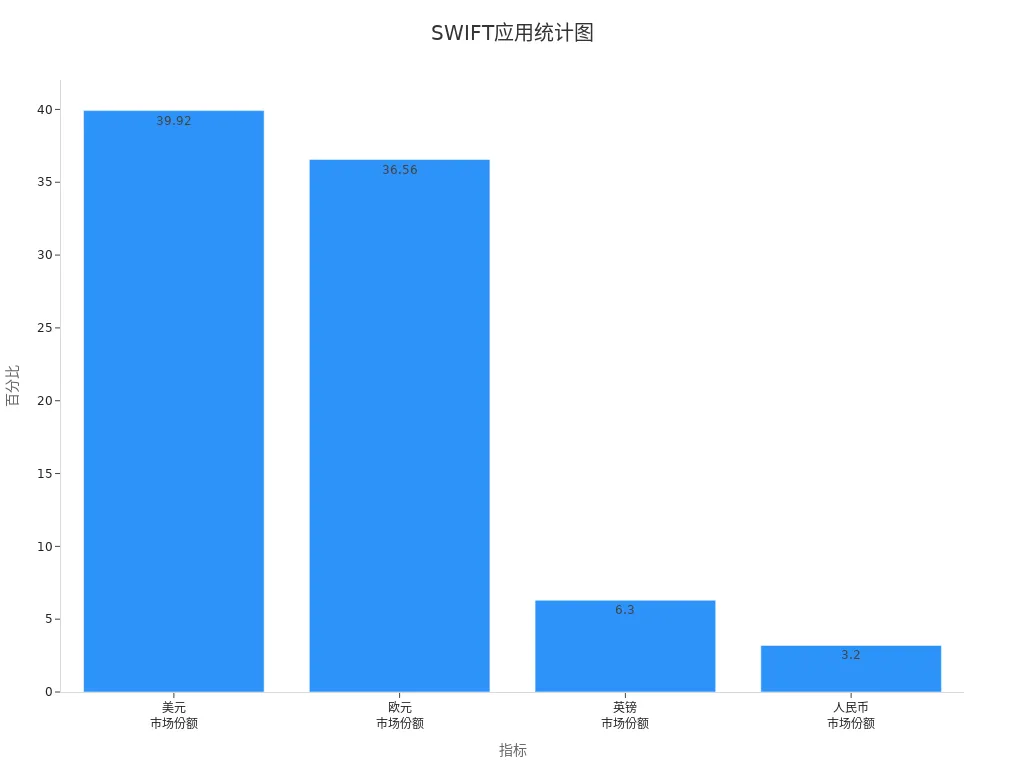

The market share of SWIFT codes also highlights their importance in international payments. The market shares of USD, EUR, and GBP in the SWIFT system are 39.92%, 36.56%, and 6.3%, respectively. The following chart illustrates the market share distribution of SWIFT codes globally:

Through SWIFT codes, you can easily complete international transfers in non-European regions. Whether for personal remittances or business transactions, SWIFT codes provide efficient and secure services.

Limitations of SWIFT Codes

Although SWIFT codes are widely used globally, they are not flawless. You may encounter some limitations when using SWIFT codes, which can affect the efficiency and convenience of international payments.

1. Slower Processing Speed

The SWIFT system’s transaction processing speed is relatively slow, especially when multiple intermediary banks are involved. Each intermediary bank adds extra processing time. This multi-layered transfer process may delay fund arrivals, particularly in urgent payment scenarios.

Tip: If you need to complete international transfers quickly, consider using SWIFT gpi services, which significantly improve payment speed.

2. Higher Fees

SWIFT transactions typically involve multiple banks, each charging a fee. These fees include intermediary bank fees, remitting bank fees, and receiving bank fees. For small transfers, these fees may seem uneconomical.

| Fee Type | Description |

|---|---|

| Intermediary Bank Fees | Fees charged by each intermediary bank |

| Remitting Bank Fees | Fees charged by the bank initiating the transfer |

| Receiving Bank Fees | Fees charged by the bank receiving the funds |

3. Lack of Transparency

The traditional SWIFT system lacks real-time tracking capabilities. You may not be able to know the exact location or status of funds at any time. This lack of transparency may cause unease while awaiting fund arrivals.

4. Challenges from New Technologies

The rise of blockchain technology poses challenges to the SWIFT system. Blockchain offers faster and more transparent payment methods. In comparison, the SWIFT system appears more traditional, struggling to meet certain modern payment needs.

Note: SWIFT is addressing these challenges by launching the SWIFT gpi project to enhance service efficiency and transparency.

Despite these limitations, SWIFT codes remain one of the most reliable tools for international payments. Understanding these limitations can help you better plan cross-border payment strategies and avoid unnecessary issues.

IBAN numbers and SWIFT codes each have unique usage scenarios in international remittances. You can choose the appropriate code based on the following characteristics:

- IBAN Numbers: Primarily used in Europe, especially in Eurozone countries like Germany. Their standardized design reduces payment errors, suitable for cross-border remittances to European accounts.

- SWIFT Codes: More prevalent globally, particularly in non-European regions like North America and China. When remitting from Europe to China, only a SWIFT code is needed to complete the transaction.

If you need to remit from China to overseas, choose the code based on the recipient bank’s regional requirements. For example, European accounts typically require IBAN numbers, while other regions primarily use SWIFT codes. Understanding these differences can help you complete international payments more efficiently.

FAQ

1. Can IBAN Numbers and SWIFT Codes Be Used Interchangeably?

No. IBAN numbers are used to identify bank accounts, primarily in Europe. SWIFT codes are used to identify banks or branches, applicable globally. You need to choose the correct code based on the remittance region’s requirements.

2. What Should I Do If I Don’t Know the Recipient’s IBAN Number?

You can contact the recipient or their bank to obtain the IBAN number. If remitting to a non-European region, a SWIFT code is usually sufficient to complete the transaction.

3. Are Both IBAN Numbers and SWIFT Codes Required?

It depends on the remittance region and bank requirements. In Europe, both IBAN numbers and SWIFT codes are typically required. In non-European regions, a SWIFT code is usually enough.

4. How Can I Verify the Validity of a SWIFT Code?

You can verify a SWIFT code’s validity through the bank’s official website or the SWIFT website. After entering the code, the system will display the corresponding bank and branch information.

5. Is the Length of an IBAN Number Fixed?

The length of an IBAN number varies by country, up to 34 characters. You need to ensure the entered IBAN number complies with the recipient’s country standards.

In international remittances, IBAN and SWIFT code errors cause a 67% failure rate, while high fees and transfer delays (1-5 days) add costs and inconvenience. BiyaPay streamlines global payments, ensuring accurate and efficient cross-border transfers, supporting conversions across 30+ fiat currencies and 200+ cryptocurrencies with remittance fees as low as 0.5%, covering 190+ countries with same-day delivery. You can also invest in U.S. and Hong Kong stocks directly on the BiyaPay platform without needing an additional overseas account, expanding your global portfolio. Join BiyaPay now for efficient, low-cost remittances! Licensed by U.S. MSB and SEC, BiyaPay uses advanced encryption, with real-time exchange rate tracking to minimize costs and a 5.48% APY through current investment products. Sign up with BiyaPay for worry-free transfers!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.