- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Practical Tips to Avoid International Remittance Failures

Image Source: unsplash

Cross-border remittance failures often stem from incorrect information, unreliable channels, or unclear regulations.

You need to choose a secure remittance method to ensure all recipient information is accurate.

It’s also important to understand the regulations of the destination country in advance to avoid unnecessary trouble.

Operate each step carefully, especially when filling in account information.

If you encounter issues, such as not knowing what to do when an international remittance fails, promptly contact the bank or service provider to avoid delays in resolution.

Key Points

- Ensure information is accurate. Verify the recipient’s name, bank account number, and SWIFT code to avoid delays or returns due to errors.

- Choose secure and reliable remittance channels. Prioritize well-known banks or payment platforms to ensure fund safety and transparent fees.

- Understand fees and hidden costs. Carefully review fee details to avoid exceeding your budget and choose channels with transparent fee disclosures.

- Pay attention to time differences and delivery times. Plan remittance timing in advance and avoid transactions on weekends or holidays to improve delivery efficiency.

- Monitor remittance status in real time. Use the transaction reference number to track progress and promptly identify and resolve issues by contacting relevant institutions.

Basic Steps for Cross-Border Remittance

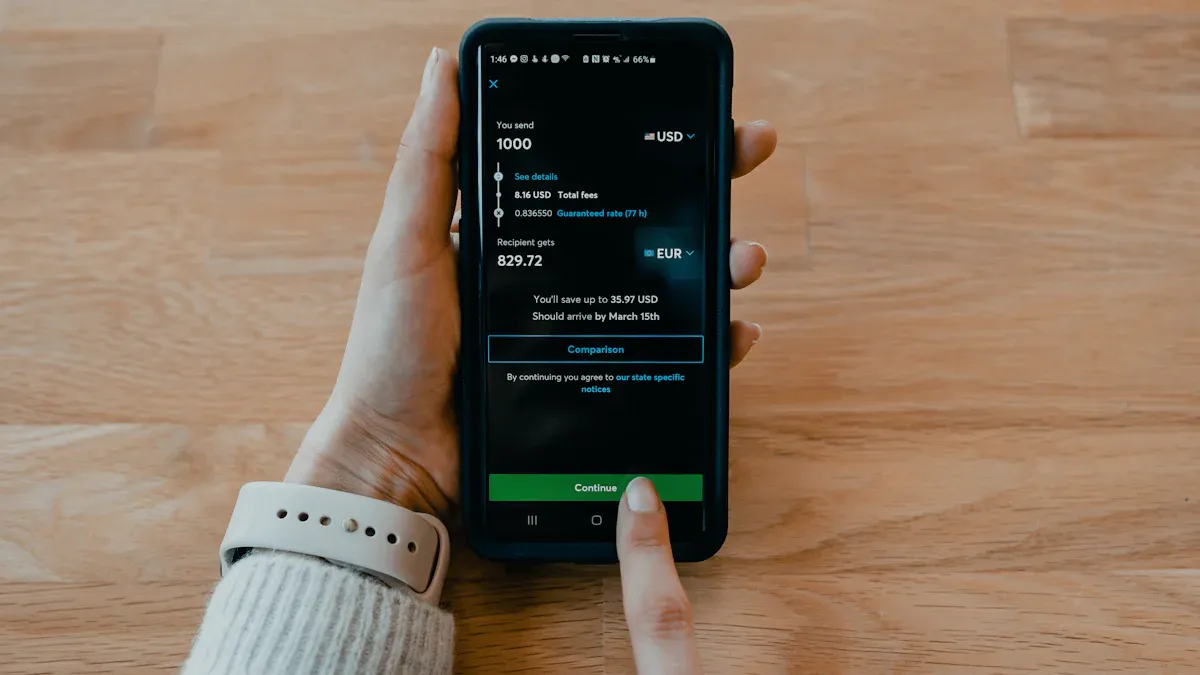

Image Source: unsplash

Choosing the Right Remittance Method

When choosing a remittance method, you need to consider cost, speed, and security.

Different remittance methods have their own advantages and disadvantages.

For example, cross-border remittances through banks are generally more secure but may have higher fees, while using online payment platforms like PayPal or Wise offers lower fees but may involve exchange rate fluctuation risks.

Here is some data to help you better understand the costs and risks of different methods:

| Item | Data |

|---|---|

| Bank Foreign Income on Behalf of Clients (USD) | $5,259.4 billion |

| Bank Foreign Payments on Behalf of Clients (USD) | $5,256.6 billion |

| Foreign Receipts and Payments Surplus (USD) | $2.8 billion |

| Foreign Exchange Settlement (USD) | $1,676.2 billion |

| Foreign Exchange Sales (USD) | $1,797.5 billion |

| Foreign Exchange Settlement and Sales Deficit (USD) | $121.3 billion |

| Settlement Rate | 62.1% |

| Sales Rate | 68.9% |

Through this data, you can see the importance of banks in cross-border remittances while also noting the impact of settlement and sales costs and exchange rate changes on funds.

When choosing a suitable method, be sure to balance the relationship between speed and cost.

Preparing Necessary Remittance Information

Accurate remittance information is the key to ensuring successful fund delivery.

You need to prepare the following information:

- The recipient’s name and address

- The name and address of the recipient’s bank

- The recipient’s bank account number or IBAN

- The recipient bank’s SWIFT code or other international identification code

Ensuring this information is correct can significantly improve the success rate of delivery.

Studies show that information accuracy directly affects the success rate of delivery.

If filled in incorrectly, it may lead to delays or returns of funds.

To avoid these issues, you can carefully verify each piece of information before submission.

Submitting the Application and Paying Fees

After preparing the information, you need to submit the remittance application and pay the relevant fees.

Typically, banks or payment platforms provide detailed fee disclosures, including transaction fees and exchange rate costs.

For example, with Hong Kong banks, cross-border remittance fees are usually between $20 and $50, depending on the transfer amount and destination country.

When paying fees, you can choose to deduct directly from your account or use a credit card.

After submitting the application, the system will generate a transaction reference number, which you can use to track the remittance status.

Tip: Before paying fees, carefully review the fee details to avoid hidden costs impacting your budget.

Tracking Status and Confirming Receipt

After completing the remittance application, you need to closely monitor the remittance status to ensure the funds arrive smoothly.

Tracking the status not only helps you understand the real-time location of the funds but also allows you to identify and resolve potential issues promptly.

Here are some practical tracking methods and considerations:

Using the Transaction Reference Number for Queries

After submitting the remittance application, the bank or payment platform typically provides a transaction reference number.

You can use this number to check the remittance status on the official website or mobile app.

Here are the common query steps:

- Log in to the bank or payment platform’s account.

- Find the “Transaction History” or “Remittance Status” option.

- Enter the transaction reference number to view detailed information.

Through this method, you can keep track of the remittance progress at any time.

If you notice an abnormal status, such as “processing for too long” or “failed,” contact the relevant institution immediately.

Importance of Real-Time Monitoring

Real-time monitoring of remittance status can significantly improve the success rate of delivery.

Here are the key roles of real-time monitoring in cross-border remittances:

| Function | Importance |

|---|---|

| Real-Time Monitoring of Financial Transactions | Ensures successful delivery and reduces fraud risks |

| Monitoring Activities and Anomalies | Improves risk mitigation and increases delivery success rate |

| Issuing Alerts | Promptly addresses potential risks or suspicious activities |

Through real-time monitoring, you can quickly identify issues and take action.

For example, if the system issues an alert indicating “incorrect account information,” you can immediately contact the bank to correct the information, avoiding fund returns or delays.

Steps After Confirming Receipt

The remittance process is truly complete only when the recipient confirms receipt of the funds.

Here are some suggestions:

- Save Transaction Records: Keep the transaction reference number, receipt, or email confirmation for future reference.

- Verify Received Amount: Ensure the amount received by the recipient matches expectations. If the amount is less, it may be due to fees or exchange rate fluctuations; contact the bank to verify.

- Record the Experience: Summarize the experience of this remittance to avoid similar issues in the future.

Tip: If the recipient does not receive the funds for an extended period, immediately contact the bank or payment platform’s customer service team, providing the transaction reference number and relevant information to expedite processing.

Through these steps, you can effectively track the remittance status and ensure the funds arrive safely.

This not only reduces unnecessary trouble but also makes your cross-border remittance experience smoother.

What to Do If an International Remittance Fails: Common Issues and Solutions

Handling Incorrect Information

Incorrectly filled information is one of the main reasons for international remittance failures.

Incorrect account numbers, SWIFT codes, or recipient names may lead to fund delays or returns.

You need to take the following steps to resolve the issue:

- Contact the Bank or Payment Platform Immediately: Provide the transaction reference number and explain the issue. The bank will usually check the remittance status and inform you if the information can be corrected.

- Verify and Correct Information: Confirm whether the account information, SWIFT code, and recipient name are correct. If errors are found, request the bank’s assistance to correct them. Some banks may charge additional fees.

- Wait Patiently for Processing: After correcting the information, the bank needs time to reprocess the remittance. This typically takes 1 to 5 business days, depending on the bank’s efficiency.

To avoid such issues, you can carefully verify all information before submitting the remittance application.

Many banks and payment platforms offer a preview function, which can help reduce errors.

Tip: If you are unsure about the accuracy of certain information, contact the recipient or their bank in advance to confirm.

Handling Amount Limits or Regulatory Violations

Different countries have varying restrictions on international remittance amounts.

For example, China imposes a $50,000 annual foreign exchange purchase limit for individuals.

If your remittance amount exceeds the limit, the bank may refuse to process it.

Here are the solutions:

- Split the Remittance: Divide large remittances into multiple smaller ones, ensuring each amount is within the regulatory limit.

- Provide Additional Proof: Some countries allow excess remittances but require supporting documents, such as contracts or invoices. Consult the bank to understand the required materials.

- Choose Alternative Remittance Channels: If the bank cannot process excess remittances, consider using online payment platforms. These platforms often have fewer amount restrictions but require attention to fees and exchange rate costs.

Understanding the regulations of the destination country can help you avoid such issues.

For example, in Hong Kong, banks often require clients to provide proof of fund sources to ensure compliance with local regulations.

Tip: Consult the bank or payment platform in advance to understand remittance amount limits and related requirements, saving time and effort.

Solutions for Bank Processing Delays

Bank processing delays are another common cause of international remittance failures.

Delays may be caused by various factors, such as compliance checks, incomplete information, or technical issues.

Here are some solutions:

- Contact the Bank Proactively: If you notice the remittance status hasn’t updated for a long time, immediately contact the bank’s customer service. Provide the transaction reference number and request an investigation into the cause.

- Provide Additional Information: The bank may require additional transaction background information, such as the purpose of the funds or recipient identity documents. Submit this information promptly to speed up processing.

- Choose More Efficient Message Formats: Using ISO 20022 message formats can significantly improve processing efficiency. This format provides richer transaction background information, reducing the likelihood of manual entry errors. In contrast, traditional SWIFT MT standards, due to limited data, can lead to information gaps and compliance check delays.

Here are some key points to improve bank processing efficiency:

- Provide complete remittance information to avoid delays due to missing data.

- Use ISO 20022 message formats to ensure comprehensive transaction background information.

- Proactively provide additional information to shorten fund review times.

Through these methods, you can effectively reduce the risk of bank processing delays and ensure smooth remittance completion.

Tip: Choosing a bank or payment platform with high processing efficiency, such as major Hong Kong banks, can significantly reduce the likelihood of delays.

Handling Issues Caused by Exchange Rate Fluctuations

Exchange rate fluctuations are a common challenge in cross-border remittances.

They may cause the amount received by the recipient to differ from expectations or even lead to remittance failures.

You need to take measures to address the risks caused by exchange rate fluctuations.

Understanding the Impact of Exchange Rate Fluctuations

Exchange rate fluctuations directly affect the actual value of the remittance amount.

For example, when the USD to EUR exchange rate changes from 1:0.9 to 1:0.85, a $1,000 remittance will result in the recipient receiving 50 euros less.

This change can cause financial losses for the recipient, especially for large remittances.

You need to closely monitor exchange rate changes and choose the right timing for remittances.

Using Fixed Exchange Rate Services

Many banks and payment platforms offer fixed exchange rate services.

For example, Hong Kong banks allow clients to select a fixed exchange rate during remittances.

This service can help you avoid amount changes due to exchange rate fluctuations.

Here are the advantages and disadvantages of fixed exchange rate services:

| Advantages | Disadvantages |

|---|---|

| Avoids exchange rate fluctuation risks | May incur additional fees |

| Improves amount prediction accuracy | Fixed rates may be slightly higher than market rates |

If you need to remit large amounts, fixed exchange rate services are a worthwhile option.

Although they may incur additional fees, they provide greater fund security.

Choosing the Right Remittance Timing

Exchange rates may fluctuate multiple times within a day.

You can observe exchange rate trends and choose a stable or favorable time for remittances.

For example, many financial institutions offer rates closer to the market during peak trading hours on weekdays.

Avoid remitting on weekends or holidays, as rates during these times are typically higher and more volatile.

Using Exchange Rate Alert Tools

Some banks and payment platforms offer exchange rate alert functions.

For example, you can set a target exchange rate, and the system will notify you when the rate reaches your desired value.

This tool can help you seize the best remittance timing and reduce losses due to exchange rate fluctuations.

Planning Remittances in Advance

If you know you’ll need to make cross-border remittances in the future, you can plan ahead.

For example, splitting foreign exchange purchases can reduce the risk of single large purchases.

You can also consult banks or financial advisors to understand current exchange rate trends and market forecasts.

Through advance planning, you can better control remittance costs.

Tip: If you encounter issues due to exchange rate fluctuations during remittances, promptly contact the bank or payment platform’s customer service team to explore solutions. Many institutions offer remedies to help you minimize losses.

Through these methods, you can effectively address challenges caused by exchange rate fluctuations and ensure smooth cross-border remittances.

If you’re still unsure about what to do when an international remittance fails, consult professionals for more detailed advice.

Cross-Border Remittance Considerations

Image Source: pexels

Ensuring Information Accuracy

Information accuracy is the foundation of successful cross-border remittances.

Filling in incorrect account numbers or SWIFT codes may lead to fund delays or returns.

To avoid these issues, you need to carefully verify each piece of information, including the recipient’s name, bank account number, and international identification code.

Studies show that errors in information entry significantly reduce remittance success rates.

Here is related data:

| Metric | Definition | Calculation Method |

|---|---|---|

| Error Rate | Proportion of erroneous samples to total samples | Number of Errors / Total Samples |

| Accuracy | Proportion of correct samples to total samples | Number of Correct / Total Samples |

| Precision | Proportion of relevant information in retrieved information | Number of Relevant Information / Total Retrieved Information |

| Recall | Proportion of retrieved relevant information to all relevant information | Number of Relevant Information / Total Relevant Information |

To improve success rates, you can use the bank or payment platform’s preview function before submitting the application to ensure all information is correct.

Tip: If you’re unsure about the accuracy of certain information, contact the recipient or their bank in advance to confirm.

Understanding Fees and Hidden Costs

Cross-border remittance fees include not only transaction fees but also potential exchange rate differences and other hidden costs.

You need to carefully review fee details to avoid exceeding your budget.

For example, cross-border remittances through Hong Kong banks typically have fees between $20 and $50, but exchange rate fluctuations may lead to additional costs.

Here are some common fee types:

- Transaction Fees: Fixed fees charged by banks or payment platforms.

- Exchange Rate Differences: The difference between the remittance exchange rate and the market rate.

- Intermediary Bank Fees: Some banks process remittances through intermediary banks, which may incur additional fees.

Tip: Choosing channels with transparent fee disclosures can help you better control costs.

Paying Attention to Time Differences and Delivery Times

Cross-border remittances involve time zone differences across countries and regions, which may affect delivery times.

Here are some common influencing factors:

- Time differences between regions may lead to mismatches in transaction dates and times.

- Time differences may cause transaction data to not be recorded promptly.

- Exchange rate differences may also affect delivery times and reconciliation accuracy.

To reduce the impact of time differences, you can choose remittance channels with faster processing speeds.

For example, some online payment platforms can complete remittances within hours, while banks typically require 1 to 3 business days.

Tip: Plan remittance timing in advance and avoid transactions on weekends or holidays, as processing speeds are usually slower during these times.

By paying attention to these considerations, you can significantly improve the success rate of cross-border remittances while reducing unnecessary trouble.

Choosing Secure and Reliable Channels

Choosing a secure and reliable remittance channel is key to successful cross-border remittances.

You need to evaluate the reliability of channels from multiple aspects, including security, fee transparency, and user reviews.

Here are some practical suggestions:

- Prioritize Well-Known Institutions

Well-known banks and payment platforms typically have higher security standards. For example, Hong Kong banks provide strict identity verification and encryption technology for cross-border remittances to ensure fund safety. - Check Fee Transparency

Reliable channels clearly list all fees, including transaction fees and exchange rate differences. Avoid platforms with high hidden costs. You can compare fee details from different channels to find the most cost-effective option. - Read User Reviews

User reviews can reflect the service quality and processing efficiency of a channel. You can search online for relevant feedback to understand other users’ real experiences. - Confirm Compliance

Ensure the chosen channel complies with the destination country’s laws and regulations. For example, some countries require proof of fund sources, and reliable channels will inform you in advance and assist with preparing relevant documents.

Tip: Avoid using unknown or uncertified platforms, as they may pose security risks or provide unstable services.

Through these methods, you can select a secure and reliable channel to ensure smooth cross-border remittances.

Preventing Fraud and Information Leaks

Fraud and information leaks are common risks in cross-border remittances.

You need to take measures to protect personal information and fund safety.

Here are some prevention suggestions:

- Beware of Suspicious Links and Emails

Do not click on links or emails sent by strangers. These links may contain malware that steals your account information. - Enable Two-Factor Authentication

Many banks and payment platforms offer two-factor authentication. For example, Hong Kong banks require users to enter a dynamic verification code during login. This method can effectively prevent account theft. - Avoid Operations on Public Networks

Public Wi-Fi networks are vulnerable to hacker attacks. You should complete remittance operations in a secure private network environment. - Regularly Check Account Activity

Regularly review account transaction records to ensure no unauthorized operations. If you notice anomalies, immediately contact the bank or payment platform to freeze the account.

Tip: If you receive calls or messages claiming to be from a bank or payment platform requesting account information or passwords, verify the sender’s identity. Legitimate institutions will not request sensitive information via phone or text.

Through these measures, you can effectively prevent fraud and information leaks, ensuring the security of cross-border remittances.

To avoid cross-border remittance failures, keep the following core tips in mind:

- Ensure Information Accuracy: Verify the recipient’s name, bank account number, and SWIFT code to avoid delays due to errors.

- Choose Reliable Channels: Prioritize well-known banks or platforms to ensure fund safety.

- Pay Attention to Fees and Timing: Understand transaction fees and exchange rate costs, and plan remittance timing in advance.

Tip: Preparation is key to success. Carefully check each step to ensure accuracy.

Through these methods, you can significantly improve remittance success rates and reduce unnecessary trouble.

Take action now, prepare thoroughly, and ensure every cross-border remittance is completed smoothly!

FAQ

1. How Long Does It Take for a Cross-Border Remittance to Arrive?

The delivery time for cross-border remittances depends on the chosen channel and destination country.

Banks typically require 1 to 3 business days, while online payment platforms may complete within hours.

Choosing fast-processing services can shorten the time.

2. Will Funds Be Lost If a Remittance Fails?

No. When a remittance fails, funds are typically returned to your account.

You need to contact the bank or payment platform and provide the transaction reference number to expedite the refund process.

3. How to Avoid Paying High Transaction Fees?

Choose platforms with transparent fees and compare the transaction fees and exchange rate costs of different channels.

Some platforms offer promotional activities or membership discounts to help you save on fees.

4. How to Ensure Information Accuracy During Remittances?

Before submitting the application, carefully verify the recipient’s name, bank account number, and SWIFT code.

Use the bank or payment platform’s preview function to ensure all information is correct.

If necessary, contact the recipient to confirm.

5. Are Cross-Border Remittances Safe?

Choosing well-known banks or regulated payment platforms can ensure safety.

Enable two-factor authentication, avoid operations on public networks, and regularly check account activity to prevent fraud.

Tip: If you encounter any issues, promptly contact the bank or payment platform’s customer service team for assistance.

Cross-border remittance failures often stem from incorrect information (67% failure rate), high fees, or exchange rate fluctuations, causing delays or returns. BiyaPay streamlines payments for tuition or family support, supporting conversions across 30+ fiat currencies and 200+ cryptocurrencies with remittance fees as low as 0.5%, covering 190+ countries with same-day delivery. You can also invest in U.S. and Hong Kong stocks directly on the BiyaPay platform without needing an additional overseas account, expanding your global portfolio. Join BiyaPay now for transparent, low-cost remittances! Licensed by U.S. MSB and SEC, BiyaPay ensures compliance, with real-time exchange rate tracking to minimize costs and a 5.48% APY through investment products. Sign up with BiyaPay to ensure successful transfers and optimize your cross-border payment experience!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.