- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How Southeast Asia International Remittance Fees Impact Life

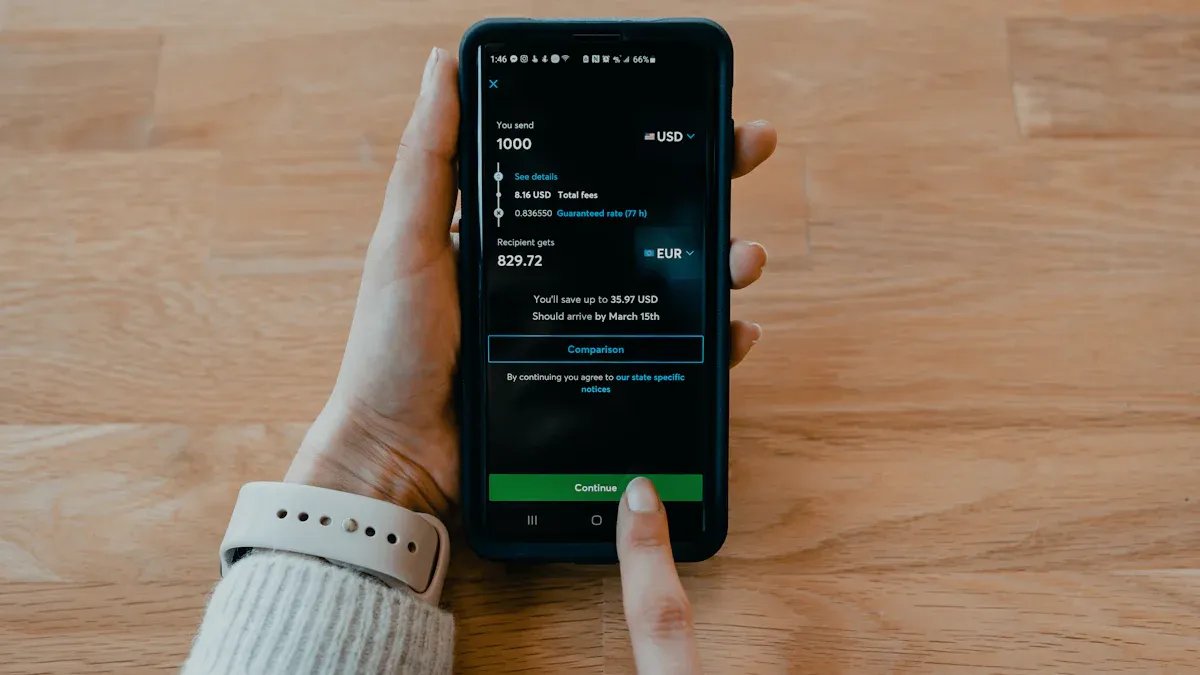

Image Source: unsplash

Southeast Asia international remittance fees directly relate to your financial situation.

Transaction fees are typically charged as a percentage of the remittance amount, ranging from 0.1% to 0.5%.

If you transfer $1,000, the transaction fee could be as high as $50, significantly reducing the actual amount received.

For families relying on remittances, every dollar is crucial.

Choosing low-cost remittance methods can help you alleviate financial pressure and improve quality of life.

Structure of Southeast Asia International Remittance Fees

Main Types of Transaction Fees

In Southeast Asia international remittances, transaction fees are one of the most common costs.

Banks and third-party platforms typically charge service fees based on a percentage of the remittance amount.

Here are some common types of transaction fees:

- Fixed Transaction Fee: Some banks charge a fixed fee regardless of the remittance amount. For example, Hong Kong banks may charge a fixed fee of $50 per transfer.

- Percentage Transaction Fee: Most banks charge a fee based on a percentage of the remittance amount, usually around 0.1%. For example, a $1,000 transfer may incur a $1 fee.

- Telegraphic Transfer Fee: When processing international remittances, banks send transfer messages to overseas banks, and this fee typically ranges from 80 to 150 CNY.

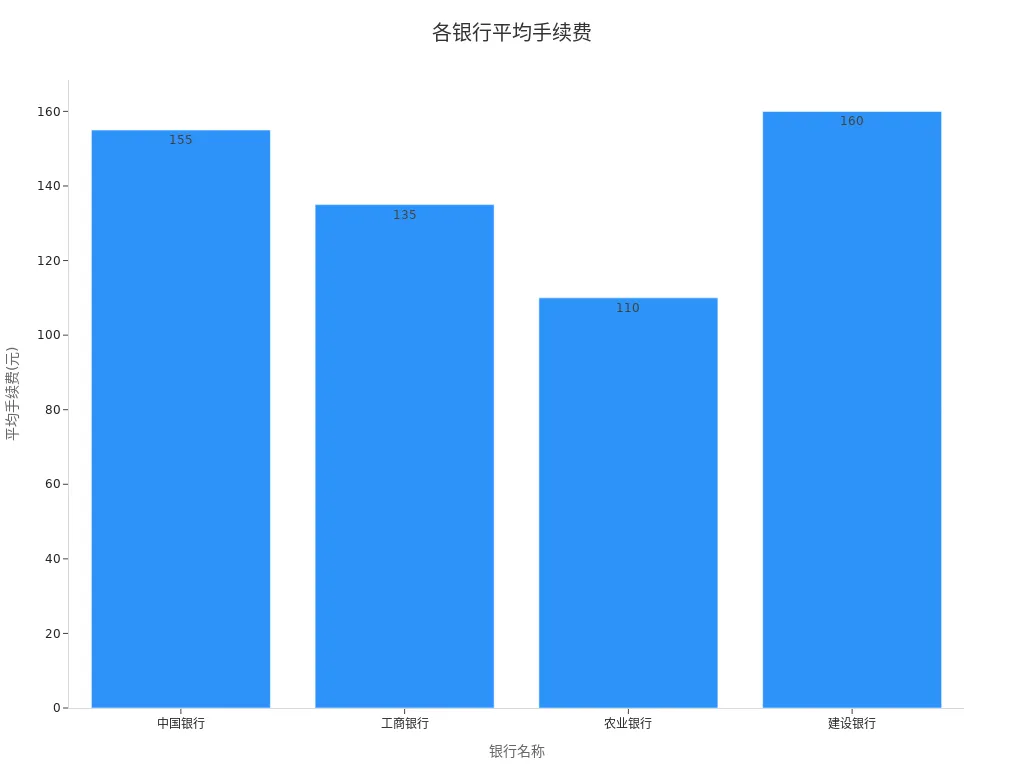

Here is specific data on bank transaction fees:

| Bank Name | Fee Rate | Minimum Fee | Maximum Fee |

|---|---|---|---|

| Bank of China | 0.1% | ¥50 | ¥260 |

| ICBC | 0.1% | ¥20 | ¥250 |

| Agricultural Bank | 0.1% | ¥20 | ¥200 |

| China Construction Bank | 0.1% | ¥20 | ¥300 |

The level of transaction fees directly affects your remittance costs.

Choosing banks or platforms with lower fees can effectively reduce expenses.

Actual Impact of Exchange Rate Differences

Exchange rate differences are another significant source of fees in Southeast Asia international remittances.

Banks and remittance platforms typically set different buying and selling exchange rates, earning profits from the spread.

Suppose you need to convert $1,000 into Thai Baht, with the bank’s buying rate at 1 USD to 35 THB and the selling rate at 1 USD to 34 THB.

Through this exchange rate difference, the bank profits from each transaction.

Although the difference per transaction may seem small, for frequent remitters, these fees accumulate over time, creating a considerable financial burden.

To reduce the impact of exchange rate differences, you can choose platforms with transparent exchange rates or remit when exchange rate fluctuations are minimal.

Common Forms of Hidden Fees

Hidden fees are often overlooked by many when making Southeast Asia international remittances.

These fees are typically not explicitly shown on bills but affect the actual amount received through other means.

Here are some common forms of hidden fees:

- Intermediary Fees: When a remittance requires an intermediary bank, additional intermediary fees may apply. These fees typically depend on agreements and the remittance amount.

- Cash-to-Account Conversion Fee: If you use a foreign currency cash account for remittances, you may incur additional fees due to the price difference between cash and account transfers.

- Platform Implicit Charges: Some unregulated platforms may charge extra fees by manipulating exchange rates or fabricating transactions. For example, underground money changers may charge fees as high as 3% to 5% of the remittance amount.

Here is statistical data on hidden fees across different platforms:

| Remittance Platform | Hidden Fee Type | Fee Range |

|---|---|---|

| Underground Money Changers | Transaction Fees | 3%~5% |

| Large Funds | Transaction Fees | Up to 10% |

| International Trade | Price Manipulation, Fictitious Transactions | Varies |

To avoid hidden fees, you can choose reputable remittance platforms and carefully review the terms and conditions.

Differences in Remittance Fees Across Southeast Asian Countries

Image Source: unsplash

Characteristics of Remittance Fees in Singapore

As a financial hub in Southeast Asia, Singapore’s remittance fees have certain unique characteristics.

You will find that Singapore banks typically offer multiple remittance options, including real-time transfers and standard transfers.

Real-time transfers are fast but have higher fees, usually between $10 and $30.

Standard transfers have lower fees, around $5 to $15, but delivery may take 2 to 3 business days.

Additionally, exchange rate differences in Singapore are relatively small, with many banks and platforms providing transparent exchange rate information.

For example, Singapore’s DBS Bank and UOB Bank update exchange rates in real time on their websites, making it convenient for you to choose the best timing for remittances.

If you frequently need to make Southeast Asia international remittances, consider using Singapore’s digital remittance platforms like TransferWise or Revolut.

These platforms typically have lower fees than traditional banks and no hidden charges.

Cost Analysis of Remittances in Malaysia

Malaysia’s remittance fees are relatively low, but you still need to pay attention to the fee standards of different banks and platforms.

Most Malaysian banks charge fixed transaction fees, typically between $10 and $20.

Additionally, some banks may charge percentage-based fees, around 0.1% to 0.2%, depending on the remittance amount.

Exchange rate differences in Malaysia are more significant, especially when using non-bank channels.

For example, some small remittance companies may offer lower fees but profit through exchange rate spreads.

To avoid unnecessary expenses, you can choose reputable banks or platforms like Maybank or CIMB Bank.

If you need to remit frequently, pay attention to promotional activities in Malaysia.

Some banks offer fee discounts or more favorable exchange rates during specific holidays.

Fee Comparison Between Thailand and Vietnam

Remittance fees in Thailand and Vietnam vary significantly.

Thai banks typically charge higher fixed fees, around $15 to $25.

Additionally, exchange rate differences in Thailand are relatively small, making it suitable for large remittances.

You can choose Siam Commercial Bank (SCB) or Kasikornbank (KBank) for remittances, as these banks offer relatively stable services.

In contrast, Vietnam’s remittance fees are lower, but hidden fees are more common.

For example, some Vietnamese banks may charge intermediary or additional fees, reducing the actual amount received.

To avoid these issues, you can choose international remittance platforms like PayPal or Western Union, which have more established services in Vietnam.

If you need to remit between Thailand and Vietnam, it’s advisable to compare exchange rates and fees in both countries in advance to choose the most cost-effective method.

Impact of Southeast Asia International Remittance Fees on Life

Image Source: unsplash

Direct Pressure on Personal Finances

Southeast Asia international remittance fees create direct pressure on your personal finances.

Each remittance’s transaction fees and exchange rate differences reduce the actual amount received.

If you remit $1,000 monthly, transaction fees could be as high as $50, and exchange rate differences might cause an additional $20 loss.

These fees accumulate, significantly impacting your savings and daily expenses.

To alleviate this pressure, you can choose low-fee platforms or banks.

For example, fixed-fee options from Hong Kong banks may be more suitable for small remittances.

You can also monitor exchange rate fluctuations and remit when rates are higher to reduce losses.

Long-Term Impact on Family Finances

Remittance fees not only affect you personally but also have a long-term impact on family finances.

High fees may reduce household income, thereby affecting quality of life and spending capacity.

Studies show that monetary policy impacts different households differently.

Some households may reduce consumption due to high remittance fees, even affecting children’s education and healthcare expenses.

Here are findings from related studies:

- High-frequency micro-behavioral big data shows that household consumption changes dynamically after monetary policy implementation.

- New Keynesian theory suggests that policy shocks have heterogeneous effects on households with different constraints.

- Big data on corporate investments helps understand the distributional effects of policies on household finances, providing a basis for precise credit policies.

By choosing more cost-effective remittance methods, you can reduce the burden on family finances and improve overall living standards.

Economic Burden on Cross-Border Workers

If you engage in cross-border work, remittance fees can become a significant economic burden.

Many cross-border workers need to regularly send income back home to support family expenses.

However, frequent remittances increase costs due to transaction fees and exchange rate differences.

For example, a Filipino worker in Singapore remitting $500 monthly may pay $15 to $30 in fees, equivalent to 3% to 6% of their monthly income.

Over the long term, these fees significantly reduce their savings capacity and may even affect future financial planning.

To reduce this burden, you can choose digital remittance platforms like TransferWise or Revolut.

These platforms typically offer lower fees and more transparent exchange rate information, helping you save more funds.

How to Reduce Southeast Asia International Remittance Costs

Choosing Low-Fee Remittance Platforms

Choosing the right remittance platform can significantly reduce your remittance costs.

Many digital remittance platforms offer lower fees than traditional banks while reducing hidden fees.

For example, platforms like TransferWise and Revolut attract users with transparent fee structures and real-time exchange rates.

Here are some points to consider when choosing low-fee platforms:

- Compare Transaction Fees: Fee differences across platforms can be significant. You can check specific fee standards on official websites or through user reviews.

- Focus on Exchange Rate Transparency: Choose platforms offering real-time exchange rates to avoid additional costs from rate differences.

- Evaluate Delivery Time: Some platforms have low fees but longer delivery times. Choose a service that suits your needs.

By selecting low-fee remittance platforms, you can reduce the financial burden of Southeast Asia international remittances while improving fund usage efficiency.

Seizing the Best Timing for Exchange Rate Fluctuations

Exchange rate fluctuations directly affect your remittance costs.

Choosing the right exchange rate timing can help you save more funds.

Businesses and individuals can track exchange rate changes in real time and adjust remittance strategies promptly.

Here are some effective exchange rate management methods:

- Track Exchange Rate Changes in Real Time: Using exchange rate data analysis tools, you can quickly identify exchange rate fluctuation trends. For example, Global Trade Co., Ltd. integrates historical and real-time data through visualization charts, improving decision-making efficiency.

- Remit During Stable Exchange Rate Periods: Remittance costs are lower when exchange rates are less volatile. You can follow exchange rate forecasts provided by platforms to choose the best timing for remittances.

- Avoid Peak Period Remittances: During periods of high exchange rate volatility, remittance costs may increase. Planning remittance timing in advance can reduce risks.

Through these methods, you can better seize the best timing for exchange rate fluctuations, reducing Southeast Asia international remittance costs.

Practical Tips to Avoid Hidden Fees

Hidden fees are often overlooked by remitters but significantly increase actual expenses.

Understanding common forms of hidden fees and taking measures to avoid them can help you save more funds.

Here are practical tips to avoid hidden fees:

- Request a Detailed Fee Breakdown: Suppliers may overlook costs like implementation, training, and maintenance, leading to actual expenses exceeding budgets. During negotiations, you can request a detailed fee breakdown to ensure all costs are transparent.

- Clarify Handling of Additional Fees: Some platforms may attract clients with low initial prices but add fees later. You can request a detailed project plan and specify how additional fees are handled in the contract.

- Ensure Complete Quotes for Functional Modules: Suppliers may quote only for basic modules initially, adding fees for others later. You can ensure all functional modules are included in the quote to avoid subsequent fee increases.

- Pay Attention to Data Migration Fees: Data migration fees are often underreported or omitted. You can discuss workload and fees in detail during negotiations and specify them in the contract.

Through these tips, you can effectively avoid hidden fees, ensuring Southeast Asia international remittance costs remain within a reasonable range.

Southeast Asia international remittance fees have a significant impact on your financial situation.

High transaction fees and hidden costs reduce the actual amount received, increasing financial pressure.

Understanding the fee structure is the first step to reducing costs.

Choosing transparent, low-fee platforms and monitoring exchange rate fluctuations can help you save more funds.

By adopting these measures, you can optimize remittance costs and improve family quality of life.

Tip: Regularly compare fees and exchange rates across different platforms to find the remittance method best suited to your needs.

FAQ

1. How to Choose the Most Suitable Remittance Platform?

When choosing a platform, you need to focus on transaction fees, exchange rate transparency, and delivery time.

Compare the fee structures of multiple platforms and select the one that best meets your needs.

Reputable digital remittance platforms like TransferWise or Revolut are recommended, as they typically have lower fees and no hidden charges.

2. How to Avoid Hidden Fees During Remittances?

Methods to avoid hidden fees include:

- Carefully review platform terms

- Choose platforms with transparent fees

- Avoid using unregulated channels

Tip: Request a detailed fee breakdown from the platform to ensure all costs are clear.

3. How Much Do Exchange Rate Fluctuations Affect Remittances?

Exchange rate fluctuations directly affect the actual amount received.

When exchange rates are low, you may lose more funds.

It’s recommended to use real-time exchange rate tools and remit when rates are stable or high to minimize losses.

4. Are There Low-Cost Methods for Small Remittances?

Some platforms are designed for small remittances, such as PayPal or Western Union.

They offer lower fees and flexible remittance options.

You can also choose bank services with fixed fees, which are more cost-effective.

5. Does Remittance Frequency Affect Fees?

Frequent remittances may lead to accumulated transaction fees.

You can reduce total fees by decreasing remittance frequency and increasing the amount per transfer.

Some platforms also offer promotional activities for frequent remitters.

Note: Regularly check platform promotions, as they may help you save more fees.

International remittance fees in Southeast Asia directly impact household finances, with high costs and hidden exchange rate margins reducing funds available for essentials. In the Philippines, remittance costs average 5.8%, limiting spending on education and healthcare. BiyaPay offers efficient, low-cost cross-border transfers, supporting conversions across 30+ fiat currencies and 200+ cryptocurrencies with remittance fees as low as 0.5%, covering 190+ countries with same-day delivery. You can also invest in U.S. and Hong Kong stocks without an overseas account, expanding your global portfolio. Join BiyaPay now for transparent, low-cost remittances! Licensed by U.S. MSB and SEC, BiyaPay ensures compliance, with real-time exchange rate tracking to optimize costs and a 5.48% APY on idle funds via flexible savings. Sign up with BiyaPay to ease financial burdens and enhance your quality of life!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.