- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Introduction to the Basic Framework and Key Participants of Cross-Border Payments

Image Source: unsplash

The basic framework of cross-border payments can be clearly defined through the latest statistical data. It encompasses the interaction model of CBDC (Central Bank Digital Currency), the establishment of industry standards, and the construction of supporting systems. For instance, the interconnected model allows information and funds to flow directly across different blockchain platforms, adopting shared technical interfaces and common clearing mechanisms to effectively reduce settlement risks. To achieve this goal, countries need to collaborate extensively and establish consistent industry standards to ensure the interoperability and shareability of cross-border payment systems.

In the context of globalization, the importance of cross-border payments is increasingly evident. According to the 2024 Real-Time Payment Report, global real-time payment transactions reached 266.2 billion in 2023, a year-on-year increase of 42.2%. The widespread adoption of real-time payment infrastructure has significantly improved capital turnover efficiency. For example, an Indonesian textile importer can complete payments for fabric purchased from China on the same day through a real-time payment system, significantly shortening the payment cycle and optimizing cash flow. You can see that cross-border payments not only connect the global economy but also provide businesses and consumers with a more efficient payment experience.

Key Points

- Cross-border payments, through CBDC and industry rules, make payments faster and safer.

- Real-time payment systems accelerate capital flow, helping businesses save money and manage cash.

- Banks are key to cross-border payments, handling currency exchange and transfers to ensure fund security.

- Payment companies use new technologies to simplify cross-border payments, making them more user-friendly.

- Compliance and security are foundational, requiring businesses to protect user information and reduce risks.

Basic Framework of Cross-Border Payments

Image Source: pexels

Core Components

The basic framework of cross-border payments consists of multiple key components. These components collectively ensure the efficiency, security, and global adaptability of the payment process. Below are the main components and their functions:

| Key Component | Basic Modules |

|---|---|

| Commitment of Public and Private Sectors | Establishing a shared vision and goals for cross-border payments; implementing international guidelines and principles; defining common characteristics of cross-border payment service levels. |

| Regulatory and Oversight Framework | Aligning oversight, regulation, and monitoring frameworks for cross-border payments; consistently and comprehensively implementing AML/CFT rules; reviewing the interaction between data frameworks and cross-border payments. |

| Current Payment Infrastructure and Arrangements | Developing secure payment corridors; increasing the adoption rate of cross-border synchronized settlements; exploring liquidity bridges. |

| Data and Market Practices | Adopting unified ISO 20022 messaging standards; harmonizing API protocols for data exchange; exploring the feasibility of new multilateral platforms for cross-border payments. |

| New Payment Infrastructure and Arrangements | Promoting the robustness of global stablecoin arrangements for cross-border payments; incorporating international dimensions into central bank digital currency designs. |

These components not only enhance the efficiency of cross-border payments but also provide a solid foundation for the interconnectivity of the global economy. For example, the unification of the ISO 20022 messaging standard enables seamless integration of payment systems across different countries and regions, reducing errors and delays in information transmission.

Moreover, the market size of cross-border payments continues to expand. According to data, the global cross-border payment market reached USD 39 trillion in 2022, an 11% increase from the previous year. This growth reflects the importance of cross-border payments in the modern economy.

Operational Logic

The operational logic of cross-border payments involves multiple stages, each optimized through technology and data support. Below are the main stages and their functions:

- Foreign Exchange Management System: You can access real-time exchange rates, quote spreads, and foreign exchange routing options through the foreign exchange management system. These functions help optimize transaction gains and losses, ensuring the lowest cost for capital flow.

- Fund Allocation System: Real-time fund allocation to meet business needs. The fund allocation system ensures the efficiency of capital flow, reducing transaction delays due to insufficient funds.

- Risk Control System: The risk control system integrates with merchants’ CRM systems to obtain detailed order data. It ensures the authenticity and compliance of transactions, reducing risks in cross-border payments.

The synergy of these stages enables cross-border payments to operate efficiently in complex international environments. For example, Hong Kong banks have achieved real-time fund transfers through fund allocation systems, helping businesses complete international transactions quickly.

The operational logic of cross-border payments also reflects the growth in its market share. Data shows that in the fourth quarter of 2023, cross-border payment transactions reached 123.27 billion, with a transaction value of CNY 87.08 trillion, representing year-on-year increases of 21.41% and 10.39%, respectively. These figures indicate the rising prominence of cross-border payments in the global economy.

Key Participants in Cross-Border Payments

Image Source: pexels

Role of Banks

Banks play a central role in cross-border payments. They are not only the primary channels for fund transfers but also responsible for providing services such as foreign exchange, clearing, and settlement. You can see that banks connect financial systems across different countries through their global networks, offering secure and reliable payment solutions for businesses and individuals.

Take Hong Kong banks as an example: they typically process cross-border payments through the SWIFT network. The SWIFT system enables banks to quickly transmit payment instructions, ensuring funds reach the target account accurately. Additionally, Hong Kong banks utilize their foreign exchange management systems to provide clients with real-time exchange rates and foreign exchange services. These services help businesses reduce risks from exchange rate fluctuations and optimize the cost of cross-border transactions.

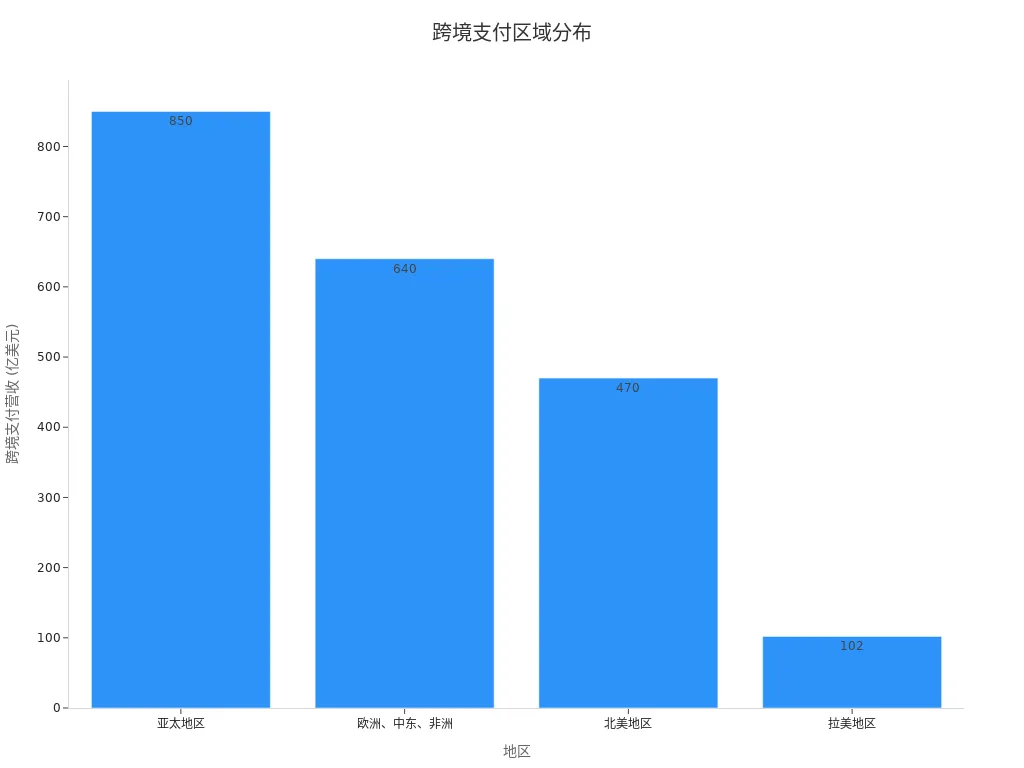

From a global market perspective, banks account for a significant portion of cross-border payment revenue. Below is the revenue data for banks in cross-border payments across different regions:

| Region | Cross-Border Payment Revenue (USD Billion) | Market Ranking |

|---|---|---|

| Asia-Pacific | 850 | 1 |

| Europe, Middle East, Africa | 640 | 2 |

| North America | 470 | 3 |

| Latin America | 102 | 4 |

| Global Total Revenue | 2063 | - |

| Global Payment Market Size | 19000 | - |

From the table and chart, it is clear that banks in the Asia-Pacific region lead the cross-border payment market. This advantage stems from the region’s rapid economic growth and frequent trade activities.

Role of Payment Institutions

Payment institutions play a significant complementary role in cross-border payments. Through technological innovation and flexible service models, they provide users with a more convenient payment experience. For example, payment institutions like PayPal and Stripe allow users to complete international payments with simple operations, significantly lowering the barriers to cross-border payments.

You may notice that the strengths of payment institutions lie in their efficiency and coverage. The following points illustrate their impact:

- The continuous growth of cross-border CNY settlement amounts has increased international recognition, creating a positive feedback loop.

- Economic and financial factors (such as the development level of financial markets and currency stability) significantly affect the level of cross-border payments.

- The efficiency, security, and low-cost characteristics of digital CNY have the potential to replace traditional cross-border payment methods.

These features have made payment institutions a significant player in the global market. Take digital CNY as an example: it not only reduces payment costs but also enhances transaction transparency and security through blockchain technology. This innovation injects new vitality into cross-border payments.

Gateway Companies and Technical Support Providers

Gateway companies and technical support providers are indispensable parts of the cross-border payment ecosystem. They provide the technical infrastructure to ensure smooth transaction processes.

Gateway companies are typically responsible for processing payment requests and transmitting them to relevant payment networks. For example, when you shop on a cross-border e-commerce platform, the gateway company verifies your payment information and completes transaction authorization. This service not only improves the success rate of payments but also protects users’ sensitive data.

Technical support providers focus on developing and maintaining the software and hardware required for payment systems. For instance, the application of blockchain technology makes cross-border payments more transparent and efficient. You may have heard of Ripple, which achieves real-time cross-border payments through distributed ledger technology. This technology reduces intermediaries, lowering transaction costs.

Overall, gateway companies and technical support providers drive the development of cross-border payments through technological innovation. Their efforts make payment processes more efficient and secure, providing strong support for the interconnectivity of the global economy.

How Cross-Border Payments Work

Payment Process

The payment process for cross-border payments is typically divided into export mode and import mode. You can understand their specific operations through the following steps:

- Export Mode:

- Overseas consumers purchase goods through their local payment platforms (e.g., PayPal), and funds are transferred to the settlement account of the overseas e-commerce platform.

- Funds are settled in foreign currency to the foreign currency account of a domestic payment institution, then converted to a Chinese bank account.

- Third-party payment institutions distribute the funds to Chinese merchants.

- Import Mode:

- Buyers in China pay in CNY, and third-party payment institutions, in collaboration with banks, convert CNY to foreign currency.

- Funds are settled to the overseas seller’s bank account.

These processes, supported by technology and efficient fund flows, ensure the smooth completion of cross-border payments.

Technical Support and Fund Flow

Technical support is the core driver of cross-border payments. You will find that payment gateways and blockchain technology play a significant role in optimizing fund flows. Payment gateways enhance payment success rates by verifying payment information and authorizing transactions. Blockchain technology achieves real-time payments through distributed ledgers, reducing intermediaries and lowering transaction costs.

The efficiency of fund flows also relies on foreign exchange management systems and fund allocation systems. The foreign exchange management system provides real-time exchange rates and foreign exchange routing options, helping you optimize transaction costs. The fund allocation system ensures funds reach the target account quickly, avoiding transaction delays due to insufficient funds.

For example, Hong Kong banks have achieved real-time settlement for cross-border payments through advanced fund allocation systems. This efficient fund flow provides businesses and consumers with a more convenient payment experience.

Compliance and Security

Compliance and security are the foundation of cross-border payments. To ensure payment security, businesses need to take the following measures:

- Establish data security and compliance roles, conduct regular employee training, and enhance risk prevention awareness.

- Perform at least one cybersecurity assessment annually and report to relevant authorities.

- Develop data security emergency mechanisms to ensure rapid response in case of security incidents.

These measures not only protect users’ sensitive information but also reduce risks in the payment process. According to the Data Security Management Regulations, businesses must strictly comply with relevant regulations to ensure the compliance and security of the payment process.

Through technical support and strict compliance measures, cross-border payments achieve efficient and secure fund flows globally.

Challenges and Solutions in Cross-Border Payments

Security Issues

Cross-border payments face multiple security challenges. You may encounter issues such as customer information leaks, payment fraud, and data loss. Complex business processes and outdated cross-border payment infrastructure also increase cybersecurity risks. Below are common security issues:

- Customer information and payment data are not adequately protected.

- Payment fraud incidents occur frequently, affecting user trust.

- Data breaches may lead to the loss of personal information and transaction amounts.

- Cybersecurity vulnerabilities make cross-border payment systems susceptible to attacks.

To address these issues, you can take the following measures:

- Strengthen encryption technology for payment systems to ensure secure data transmission.

- Conduct regular cybersecurity assessments to identify and fix potential vulnerabilities.

- Enhance employee security awareness to avoid human operational errors.

Through these methods, you can effectively reduce security risks, providing users with a more reliable cross-border payment experience.

Compliance Requirements

Compliance is a core requirement for cross-border payments. Significant differences in regulatory policies across countries require financial institutions to invest substantial resources to meet various compliance standards. Below are some typical compliance challenges:

| Challenge Type | Specific Impact |

|---|---|

| Rising Compliance Costs | Inconsistent AML/CFT regulations across countries lead to high technical costs for financial institutions to meet diverse requirements. |

| Restricted Market Access | Regulatory requirements in different countries limit market entry opportunities for some institutions, creating an uneven competitive landscape. |

| Reduced Transparency | Incomplete information records in some countries’ clearing systems affect payment transparency, and data protection requirements limit information sharing. |

Moreover, non-compliance can lead to hefty fines. For example, Amazon was fined EUR 746 million for GDPR violations, and T-Mobile was fined USD 340 million for user information leaks. These cases highlight the need for businesses to establish robust compliance frameworks to avoid economic losses and reputational damage.

Technological Innovations for Efficiency

Technological innovations have significantly improved the efficiency of cross-border payments. You will find that the application of blockchain technology and payment gateways has substantially reduced operational costs. For example, the operational cost per account has dropped to below CNY 1, saving over CNY 1 billion in cumulative operational costs. Below are the specific outcomes of technological innovations:

| Area | Cost Reduction Data |

|---|---|

| Per-Account Operational Cost | Reduced to below CNY 1 |

| Cumulative Operational Cost Savings | Over CNY 1 billion |

| Customs Clearance Time | Reduced from 5-7 days to 2 days |

| Customs Declaration Cost | Reduced by 30% |

Blockchain technology achieves real-time payments through distributed ledgers, reducing intermediaries and enhancing payment transparency. Payment gateways optimize payment processes, improving transaction success rates. Through these technologies, you can significantly enhance the efficiency of cross-border payments, providing businesses and consumers with more convenient services.

Future Trends in Cross-Border Payments

Digital Currency and Blockchain Technology

Digital currency and blockchain technology are transforming the way cross-border payments operate. You will find that blockchain technology can significantly reduce payment costs while improving payment efficiency. It achieves real-time payments through distributed ledger technology, reducing intermediaries and ensuring the security of payment settlements. This technology is particularly suitable for cross-border e-commerce, providing convenient, fast, and timely payment services for consumers and merchants.

Moreover, the application of digital currencies is expanding. As an efficient and secure payment tool, digital CNY is becoming a new option for cross-border payments. It not only reduces payment fees but also enhances transaction transparency through blockchain technology. You can see that the integration of digital currency and blockchain technology injects new vitality into cross-border payments, driving the digital transformation of the global payment system.

Payment Demand in the Context of Globalization

The acceleration of globalization has led to a continuous increase in demand for cross-border payments. You may notice that traditional foreign trade enterprises are seeking digital payment solutions to improve efficiency while exploring emerging markets such as Southeast Asia and Latin America. The rapid development of these markets has created new growth opportunities for the cross-border payment industry.

Below is the historical growth data for cross-border payment transaction volumes:

| Year | Transaction Volume (CNY Billion) | Growth Rate |

|---|---|---|

| 2013 | 31,000 | N/A |

| 2014 | 40,000 | 30% |

From the table, it is evident that the cross-border payment market grew by 30% in just one year. This growth reflects the rapid expansion of payment demand in the context of globalization. You will find that businesses, through digital transformation and market expansion, not only meet the needs of global consumers but also drive the continued development of the cross-border payment industry.

Policy and Regulatory Directions

Changes in policies and regulations are critical to the development of cross-border payments. In recent years, cross-border data transfer compliance has become a key focus for regulatory authorities. You will find that supportive policies have continuously optimized compliance mechanisms, providing businesses with greater regulatory certainty. This optimization not only reduces compliance costs but also improves data quality and the feasibility of business models.

Investors and businesses are increasingly aware of the importance of compliance. Clear data compliance mechanisms provide a stable development environment for the cross-border payment industry. You can see that policy and regulatory directions are promoting the security and transparency of cross-border payments, laying the foundation for the further development of the global payment system.

The basic framework and key participants of cross-border payments play an indispensable role in the global economy. You can feel its importance through the following data and examples:

- In the first quarter of 2024, China’s cross-border e-commerce imports and exports reached CNY 577.6 billion, a 9.6% increase.

- Global trade volume grew from USD 51.0 trillion in 2018 to USD 64.0 trillion in 2022, with a compound annual growth rate of 5.8%.

- The global cross-border e-commerce penetration rate is expected to reach 12.2% by 2027.

Additionally, the functions of participants provide strong support for cross-border payments:

| Participant | Function Description |

|---|---|

| Bank Wire Transfers | Conduct cross-border remittances through SWIFT channels, suitable for large transactions, with capped fees but slower processing. |

| Remittance Companies | Collaborate with banks, post offices, etc., to provide convenient remittance services, suitable for small transactions, with numerous agent networks. |

| International Credit Cards | Issued by international card organizations, support overdraft spending, primarily settled in USD, suitable for global merchants. |

| Third-Party Payment Companies | Rely on technological and service advantages to provide secure and convenient payment solutions, meeting the needs of SMEs and individual consumers. |

Cross-border payments not only connect the global economy but also drive industry development through technological innovation and policy support. You will find that the application of blockchain technology enables real-time settlement, reducing payment costs and improving user experience. Meanwhile, the standardized development of cross-border data flows optimizes fund settlement services, simplifying foreign exchange procedures for small and micro enterprises.

In the future, with the further development of digital currencies and artificial intelligence technologies, cross-border payments will become more efficient and secure. Policy support will also provide a more stable environment for the industry. You can expect that cross-border payments will continue to play a key role in the globalization process, creating more value for businesses and consumers.

FAQ

1. What are the main advantages of cross-border payments?

Cross-border payments can help you complete international transactions quickly. They improve capital turnover efficiency and reduce transaction costs. With technical support, you can enjoy a safer and more transparent payment experience.

2. Are cross-border payments suitable for small businesses?

Yes, cross-border payments are highly suitable for small businesses. You can complete low-cost international transactions through third-party payment platforms. These platforms provide flexible solutions to help you enter global markets.

3. How to ensure the security of cross-border payments?

You can use encryption technology to protect data transmission. Conduct regular cybersecurity assessments to identify potential risks. By training employees to enhance security awareness, you can effectively reduce payment fraud and information leaks.

4. How do digital currencies impact cross-border payments?

Digital currencies can significantly reduce payment costs. They enable real-time payments through blockchain technology, reducing intermediaries. You can use digital currencies to complete more efficient and secure international transactions.

5. How are cross-border payment fees calculated?

Fees typically include exchange rate spreads, handling fees, and service fees. You can compare the fee structures of different payment platforms to choose the optimal solution. Some platforms offer transparent fee structures to help you optimize costs.

Cross-border payments often face high fees, delays (2-5 days), and security or compliance challenges, increasing costs and risks. BiyaPay streamlines international transfers for e-commerce or family support, supporting conversions across 30+ fiat currencies and 200+ cryptocurrencies with remittance fees as low as 0.5%, covering 190+ countries with same-day delivery. You can also invest in U.S. and Hong Kong stocks without an overseas account, expanding your global portfolio. Join BiyaPay now for efficient, low-cost payments! Licensed by U.S. MSB and SEC, BiyaPay ensures compliance, with real-time exchange rate tracking to optimize costs and a 5.48% APY on idle funds via flexible savings. Sign up with BiyaPay to eliminate complex processes and high fees, enjoying seamless cross-border payments!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.