- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

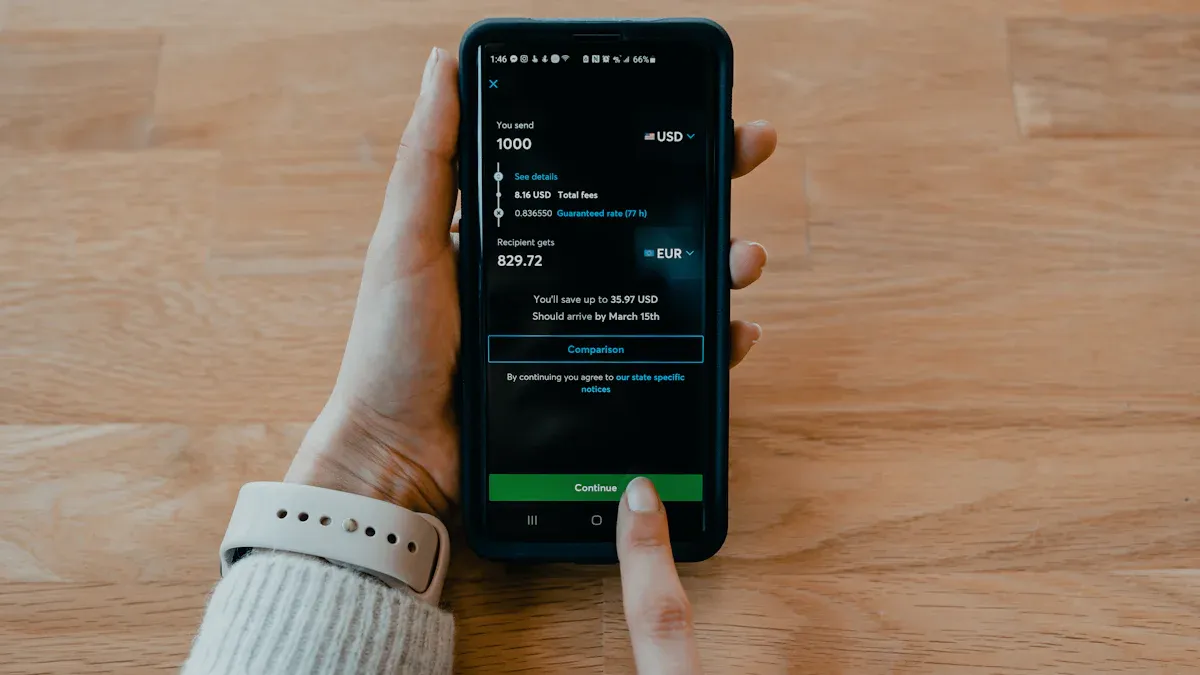

Comparison of Fees and Speed for European International Remittance Platforms

Image Source: unsplash

Choosing the right European international remittance platform is crucial for your financial management. Fees and transfer speed directly impact your remittance experience. Different platforms have distinct fee structures, with some offering low fees but slower speeds, while others prioritize fast transfers but charge higher fees. You need to weigh these factors based on your needs to find the optimal solution. Understanding the pros and cons of platforms can help you avoid unnecessary cost waste while improving capital flow efficiency.

For example, if you frequently send remittances to China or other countries, choosing an efficient and cost-effective platform is particularly important.

Key Points

- Choosing the right remittance platform can save fees and improve capital flow efficiency.

- Understanding the components of remittance fees, including fixed fees, exchange rate spreads, and cross-border fees, helps make informed choices.

- For small remittances, platforms like Wise with low fees are more cost-effective, avoiding high fixed fees.

- For large remittances, traditional banks like Hong Kong banks offer high security, though fees are higher.

- For urgent remittances, Western Union’s instant transfer feature is the best choice, suitable for situations requiring fast transfers.

Fee Comparison of European International Remittance Platforms

Image Source: unsplash

Components of Remittance Fees

Remittance fees typically consist of multiple components. The fees you need to pay include fixed handling fees, exchange rate spreads, and potential cross-border fees. Fixed handling fees are the basic fees charged by platforms, usually calculated per transaction. Exchange rate spreads are the hidden costs incurred during currency conversion. Cross-border fees are additional charges for international remittances, especially when involving different countries’ banking systems.

Below are examples of common fee components:

- Fixed Handling Fee: For example, some platforms charge a fixed amount per transaction, regardless of the remittance amount.

- Exchange Rate Spread: The exchange rate offered by platforms is usually lower than the market mid-rate, and this spread translates into additional costs.

- Cross-Border Fees: Some platforms charge extra fees based on the remittance country and currency type.

By understanding these fee components, you can better evaluate the cost structures of different platforms and choose the most suitable remittance method.

Fee Comparison of Major Platforms

Fee differences between platforms are significant. Below is a fee comparison for some major European international remittance platforms:

| Platform | Fee Rate | Fee Description | Advantages | Disadvantages |

|---|---|---|---|---|

| Wise | 0.5%~1% | Low fees, exchange rate close to market mid-rate | Fast speed, transparent fees | Limited supported currencies, restricted transfer amounts |

| PayPal | 2.9%~3.9% | Fixed fee per transaction plus cross-border surcharge | Convenient operation, secure and reliable | Higher fees, potentially longer transfer times |

| Bank Transfer | 1%~3% | Higher fees, noticeable exchange rate spread | High security, supports large transfers | Complex process, non-transparent fees |

Additionally, remittance fees vary between different currencies. For example:

| Sending Currency | Receiving Currency | Fees for Sending USD 1,000, GBP, or EUR |

|---|---|---|

| USD (ACH Payment) | CNY | USD 14.81 (USD 4.78 + 1.01%) |

| GBP (Bank Transfer) | CNY | GBP 10.81 (GBP 3.64 + 0.72%) |

| EUR (Bank Transfer) | CNY | EUR 12.83 (EUR 4.58 + 0.83%) |

Through these data, you can clearly see the fee differences across platforms and currencies, allowing you to choose the appropriate remittance method based on specific needs.

Analysis of Reasons for Fee Variations

The level of remittance fees depends on multiple factors. The platform’s operational model is one of the main reasons. Platforms like Wise adopt a low-cost operational model focused on digital services, resulting in lower fees. Traditional bank transfers, due to their involvement in complex cross-border banking systems, typically have higher fees.

Another important factor is the exchange rate spread. Some platforms offer exchange rates close to the market mid-rate, such as Wise, which keeps total costs lower. Other platforms may earn additional profits through exchange rate spreads, leading to increased fees.

Additionally, the remittance amount and currency type also affect fees. Large remittances typically incur higher fixed handling fees, while some platforms have limited support for specific currencies, potentially requiring additional conversion fees.

Understanding these reasons can help you better choose a suitable remittance platform. For example, if you need fast and low-cost remittances, Wise may be a good choice. For large remittances or scenarios requiring higher security, bank transfers may be more appropriate.

Applicable Scenarios for Different Fee Levels

Remittance methods with different fee levels are suitable for various use cases. Choosing the right platform can help you save costs while meeting your needs. Below are some common scenarios and their recommended fee levels:

1. Small Remittances

If you need to send a small amount, such as a few hundred dollars, choosing a platform with low fixed handling fees is more cost-effective. Platforms like Wise, with their low fees and exchange rates close to the market mid-rate, are ideal for small remittances.

Tip: For small remittances, avoid platforms with high fixed fees, such as some traditional banks, as these fees may account for a large proportion of the remittance amount.

2. Large Remittances

When you need to send large amounts, choosing a platform that supports large transfers and has transparent fees is crucial. Bank transfers are typically the preferred choice for large remittances, especially institutions like Hong Kong banks that offer high security and stability. Although fees are higher, their security and ability to handle large funds are unmatched by other platforms.

Note: For large remittances, pay close attention to exchange rate spreads, as some platforms may increase costs through non-transparent spreads.

3. Frequent Remittances

If you need to send remittances regularly to China or other countries, choosing a platform with low fees and convenient operations is essential. Wise and PayPal are good options. Wise’s low fees are suitable for frequent small remittances, while PayPal is popular due to its global reach and ease of use.

4. Urgent Remittances

When you need to complete a remittance quickly, speed is more important than fees. Platforms like Western Union, with their instant transfer feature, are ideal for urgent situations. Although fees are higher, their fast processing meets urgent needs.

5. Specific Currency Needs

If you need to send remittances to specific currency accounts, such as CNY or EUR, choosing a platform that supports the currency and offers reasonable fees is crucial. Wise, with its multi-currency support and transparent fee structure, is suitable for such scenarios.

By analyzing your remittance needs and amount, you can select the most appropriate fee level and platform. Whether for small or large remittances, finding the right balance is key.

Speed Comparison of European International Remittance Platforms

Image Source: unsplash

Factors Affecting Transfer Speed

Transfer speed is a key consideration when choosing a remittance platform. The speed of different platforms may vary due to multiple factors. Below are some main influencing factors:

- Technical Support: The technology used by the platform directly determines transfer speed. For example, the application of blockchain technology can significantly reduce transaction times. In April 2017, a German bar, Room77, completed a transfer via the Bitcoin Lightning Network in just a few milliseconds.

- Remittance Path: Cross-border remittances typically involve multiple intermediary banks or payment institutions. The more complex the path, the longer the transfer time.

- Currency and Region: Some currency pairs may require additional clearing time. For example, remittances from Europe to an CNY account in China may be delayed due to time zone differences and bank processing times.

- Platform Operational Model: Digital platforms like Wise, which directly connect to local bank accounts, are usually faster than traditional bank transfers.

Understanding these factors can help you better predict transfer times and choose the appropriate remittance method.

Speed Comparison of Major Platforms (e.g., Wise, PayPal, Western Union)

Transfer speeds vary significantly across platforms. Below is a comparison of transfer speeds for some major platforms:

| Platform | Average Transfer Time | Advantages | Disadvantages |

|---|---|---|---|

| Wise | 1-2 working days | Fast speed, suitable for small and medium remittances | Limited supported currencies |

| PayPal | 1-5 working days | High global reach, convenient operation | Unstable transfer times, potential delays |

| Western Union | Minutes to hours | Instant transfers, suitable for urgent remittances | High fees, suitable for small remittances |

| Hong Kong Banks | 2-5 working days | High security, supports large funds | Complex process, longer transfer times |

Additionally, some platforms can achieve faster transfers in specific cases. For example, in May 2017, after Litecoin activated SegWit, a transfer from Zurich to San Francisco took only 1 second. This speed was primarily due to optimizations in blockchain technology.

Recommendations for Different Speed Needs

Choosing the appropriate transfer speed is crucial based on your actual needs. Below are some common scenarios and recommended platforms:

1. Urgent Remittances

If you need to complete a remittance within minutes, Western Union is the best choice. Its instant transfer feature meets urgent needs, though fees are higher.

2. Daily Remittances

For daily small or medium remittances, Wise is a good option. Its fast transfer speed and transparent fees are suitable for users needing frequent remittances.

3. Large Remittances

When sending large funds, traditional banks like Hong Kong banks are more reliable. Although transfer times are longer, their high security and stability ensure fund safety.

4. Specific Currency Needs

If you need to send remittances to specific currency accounts, such as CNY or EUR, choosing a platform that supports the currency and offers fast speeds is crucial. Wise, with its multi-currency support and shorter transfer times, is an ideal choice.

By analyzing your remittance needs and time requirements, you can select the most suitable remittance platform. Whether for urgent or daily remittances, finding the right balance is key.

Comprehensive Analysis: Pros and Cons of Fees and Speed

Summary of Fees and Speed Pros and Cons for Each Platform

When choosing a European international remittance platform, you need to consider the pros and cons of fees and speed simultaneously. Different platforms have distinct performances in these areas. Below is a comprehensive analysis of major platforms:

| Platform | Fee Advantages | Fee Disadvantages | Speed Advantages | Speed Disadvantages |

|---|---|---|---|---|

| Wise | Low fees, exchange rate close to market mid-rate | Limited supported currencies, restricted transfer amounts | Fast transfer speed, suitable for daily remittances | Not suitable for urgent remittances |

| PayPal | Convenient operation, high global reach | Higher fees, noticeable exchange rate spread | Suitable for frequent remittances | Unstable transfer times, potential delays |

| Western Union | Instant transfers, suitable for urgent cases | High fees, suitable for small remittances | Fastest transfer speed, completed within minutes | Not suitable for large remittances |

| Hong Kong Banks | High security, supports large funds | High fees, complex process | Suitable for large remittances | Longer transfer times, typically 2-5 working days |

Through this table, you can quickly understand the pros and cons of each platform regarding fees and speed. Choose the most suitable remittance method based on your needs.

Tip: If you need to complete remittances quickly, Western Union is a good choice. For large funds, the security and stability of Hong Kong banks are more advantageous.

Recommended Platforms for Different Scenarios (e.g., Personal Remittances, Large Transfers)

Based on different remittance scenarios, you can choose the most suitable European international remittance platform. Below are some common scenarios and recommended platforms:

- Personal Small Remittances

If you need to send small amounts, Wise is an ideal choice. Its low fees and fast processing are well-suited for individual users. - Large Fund Transfers

When sending large funds, Hong Kong banks are the best choice. Their high security and ability to handle large funds ensure your money’s safety. - Urgent Remittances

If you need to complete a remittance within minutes, Western Union is the best option. Its instant transfer feature meets urgent needs. - Frequent Remittances

For users needing regular remittances, both PayPal and Wise are worth considering. PayPal is suitable for frequent use due to its high global reach, while Wise is more cost-effective due to its low fees. - Specific Currency Needs

If you need to send remittances to specific currency accounts, such as CNY or EUR, Wise is a good choice. It supports multi-currency remittances with transparent fees and fast speeds.

By selecting the appropriate platform based on your actual needs and remittance scenarios, you can save costs while meeting your speed requirements.

The performance of European international remittance platforms varies significantly in terms of fees and speed. You need to choose the appropriate platform based on your needs.

- If you prioritize low fees, Wise may be a good choice.

- If you value transfer speed, Western Union’s instant transfer feature is worth considering.

- For large fund transfers, the security and stability of Hong Kong banks provide assurance.

Tip: When choosing a platform, consider not only fees and speed but also security and supported currency ranges. A comprehensive evaluation of these factors will help you find the most suitable remittance method.

FAQ

1. How to choose the right remittance platform for yourself?

When choosing a platform, focus on fees, transfer speed, and security. For small remittances, choose Wise for low fees and fast speed; for large remittances, opt for Hong Kong banks for high security; for urgent remittances, Western Union offers rapid processing.

Tip: Prioritize platforms with transparent fees based on remittance amount and urgency.

2. Why do fees vary greatly across platforms?

Fee variations stem from platforms’ operational models and exchange rate strategies. Digital platforms like Wise, with low-cost operations and exchange rates close to the market mid-rate, have lower fees; traditional banks, due to complex intermediary processes, have higher fees.

3. Does transfer speed vary by currency?

Yes, clearing times differ for different currencies. For example, remittances from Europe to an CNY account in China may be delayed due to time zone differences and bank processing times. Choosing digital platforms with local clearing support can speed up transfers.

4. Which platform is fastest for urgent remittances?

Western Union is the best choice for urgent remittances. Its instant transfer feature can complete transfers within minutes, though fees are higher, making it suitable for small urgent remittances.

Note: In urgent cases, prioritize platforms with fast speeds, though fees may increase.

5. How to avoid hidden fees in remittances?

Choose platforms with transparent fees, like Wise, to avoid costs from exchange rate spreads or hidden fees. Carefully review fee terms before transferring, especially regarding cross-border fees and exchange rate conditions.

Suggestion: Use fee calculators to estimate total costs in advance and avoid unexpected expenses.

European international remittances often face high fees (1%-3%), delays (2-5 days), or currency limitations. BiyaPay offers an efficient solution, streamlining cross-border transfers for tuition or family support, supporting conversions across 30+ fiat currencies and 200+ cryptocurrencies with remittance fees as low as 0.5%, covering 190+ countries with same-day delivery. You can also invest in U.S. and Hong Kong stocks without an overseas account, expanding your global portfolio. Join BiyaPay now for transparent, low-cost remittances! Licensed by U.S. MSB and SEC, BiyaPay ensures compliance, with real-time exchange rate tracking to optimize costs and a 5.48% APY on idle funds via flexible savings. Sign up with BiyaPay to eliminate high fees and delays, enjoying a seamless remittance experience!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.