- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Quickly Understand the Process and Precautions for Japan International Remittances

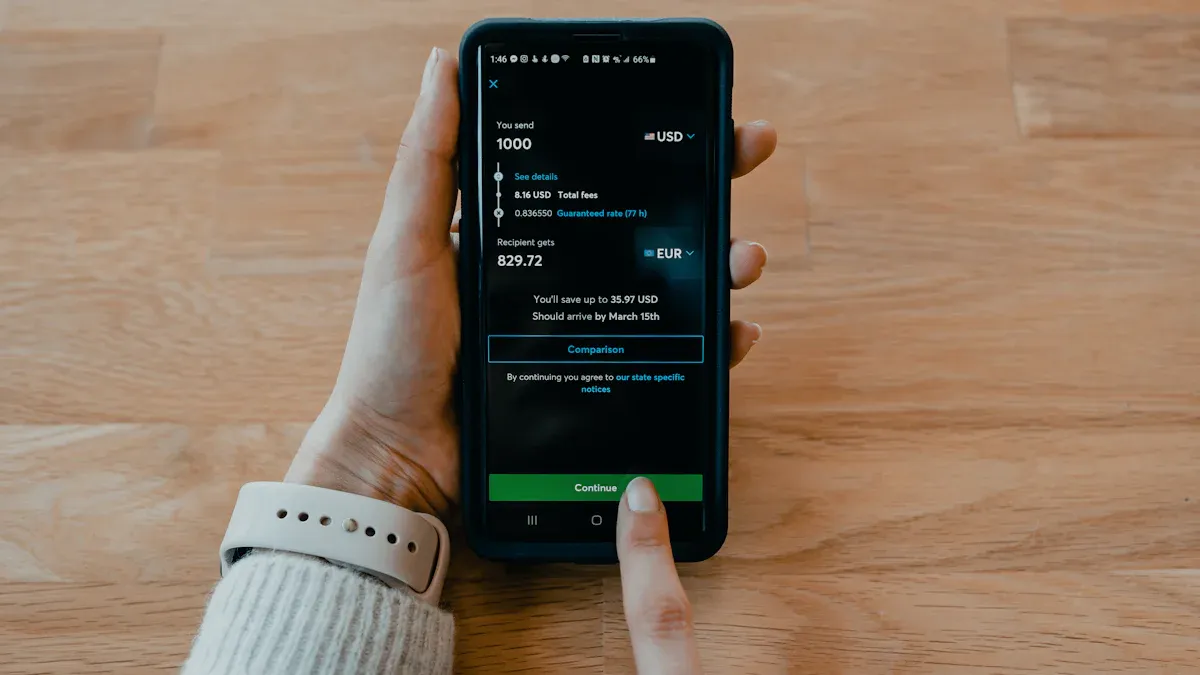

Image Source: pexels

When conducting Japan international remittances, clearly understanding the relevant process and precautions is crucial. You need to be familiar with each step to ensure the accuracy of remittance information and avoid unnecessary complications. Incorrect information may lead to delays or financial losses, and overlooking fees and exchange rates may increase costs. By mastering this knowledge, you can complete remittances more efficiently and reduce potential risks.

Specific Process for Japan International Remittances

Image Source: pexels

Choosing the Right Remittance Service Provider

When conducting Japan international remittances, selecting the appropriate remittance service provider is the first step. Different service providers vary in fees, transfer times, and remittance limits. Below is a comparison of remittance methods offered by Mitsubishi UFJ Bank:

| Item | Mitsubishi UFJ Direct (Online Banking) | TV Counter | Specialty Store Counter |

|---|---|---|---|

| Overseas Remittance Fee | JPY 2,500 | JPY 6,000 | JPY 7,500 |

| Remittance to Another Overseas Bank | JPY 3,000 | JPY 6,500 | JPY 7,500 |

| Remittance Limit (Per Transaction) | Equivalent to JPY 1 million or less | JPY 5 million or less | No limit |

| Remittance Limit (Daily) | JPY 2 million or less | No limit | No limit |

| Processing Time | Generally executed on the same day, may take days or longer | N/A | N/A |

By comparing the fees and service features of different providers, you can choose the most suitable method based on your needs. If you want to save on fees, prioritize online banking. If you need a higher remittance limit, choose the specialty store counter.

Preparing Required Remittance Information

After selecting a service provider, you need to prepare complete remittance information. Below is a common list of required documents:

| Specific Data and Requirements | Description |

|---|---|

| Declaring Entity’s Basic Information | Includes the “Basic Information Form” and relevant proof documents, such as the “Organization Code Certificate” or “Business License.” |

| Remittance Application Form | Need to fill out the “Overseas Remittance Application Form.” |

| Review Requirements | The bank must review the application form filled out by the declaring entity to ensure the accuracy and consistency of the information. |

Ensure all information is accurate, especially the recipient’s name, bank account, and address. Any errors may lead to remittance failure or delays.

Submitting the Remittance Application and Confirming Information

When submitting a remittance application, you need to fill out the relevant forms as required by the service provider and confirm the accuracy of all information. Below are the processing times and precautions for submitting applications:

| Submission Time | Processing Status |

|---|---|

| Weekdays 8:00-18:00 | The system processes the remittance instruction immediately and sends an SMS notification. |

| Weekdays 18:00-8:00 | Processing begins at 8:00 the next business day. |

| Weekends/Holidays | Processing begins at 8:00 the next business day. |

After submitting the application, it is recommended to carefully review the remittance amount, recipient information, and exchange rate. If errors are found, contact the bank immediately for corrections. After successful submission, keep the transaction receipt for future reference.

Confirming Exchange Rates and Fees

When conducting Japan international remittances, confirming exchange rates and fees is a critical step. The exchange rate directly affects how much of the target currency your remitted amount will convert to, while fees determine your total cost. Ignoring these factors may lead to unnecessary financial losses.

How to Confirm Exchange Rates?

You can confirm exchange rates through the following methods:

- Bank Website or Mobile App: Most banks provide real-time exchange rate updates on their websites or apps. For example, Hong Kong banks’ mobile apps offer real-time exchange rate lookup functions.

- Service Provider’s Customer Service: Directly contact the service provider’s customer service to obtain the latest exchange rate information.

- Third-Party Exchange Rate Tools: Online tools like XE or OANDA can also help you quickly understand current exchange rates.

When confirming exchange rates, distinguish between the “buying rate” and “selling rate.” For remittances, the “selling rate” is typically used, which is the rate at which the bank converts your JPY to the target currency.

Components of Fees

Fees typically consist of the following components:

- Bank Handling Fee: This is a fixed fee charged by the bank, which may vary depending on the service method. For example, online banking remittance fees are usually lower than counter remittances.

- Telegraph Fee: Used to cover communication costs between banks.

- Intermediary Bank Fees: If the remittance requires processing through an intermediary bank, this fee may be borne by you or the recipient.

When choosing a service provider, it is recommended to compare the fees of different institutions. For example, some online remittance platforms may offer lower fees but have longer processing times.

Completing the Transfer and Keeping the Transaction Receipt

After completing the transfer, keeping the transaction receipt is an important step. This serves not only as proof of a successful remittance but also as a basis for future inquiries or issue resolution.

Contents of the Transaction Receipt

Below is a standard transaction receipt sample:

| Item | Content |

|---|---|

| Entity Number | 08102 |

| Entity Name | Zhejiang University of Finance and Economics |

| Customer Number | Student ID number |

| Customer Name | Student name |

| Grade | Year of admission |

| Class | Name of admitted college and major |

| Payment Amount | (Amount in words) |

| ¥ | (Amount in figures) |

| Payment Method | (Cash or transfer) |

| Customer Account | |

| Customer Signature | |

| Bank Seal |

Precautions for Keeping Transaction Receipts

- Electronic Copy: Take a photo or scan the transaction receipt and save it on your phone or computer for easy access.

- Physical Copy: Properly store the paper receipt to avoid loss or damage.

- Long-Term Storage: In some cases, transaction receipts may need to be kept for several years, such as for tax declarations or proof of fund sources.

Tip: After remittance, ensure the information on the receipt is correct. If errors are found, contact the bank immediately for corrections.

By following these steps, you can ensure the remittance process is completed smoothly and provide safeguards for future inquiries or issue resolution.

Required Information for Japan International Remittances

Recipient Information (Name, Bank Account, Address, etc.)

When conducting Japan international remittances, recipient information is essential. You need to provide detailed information such as the recipient’s name, bank account, and address. This information must match the registered information of the recipient’s bank account exactly. Any errors may lead to remittance failure or delays.

Below are precautions for filling out recipient information:

- Name: Ensure the spelling is correct and avoid using nicknames or abbreviations.

- Bank Account: Verify every digit of the account number to avoid input errors.

- Address: Provide a complete address, including city and postal code.

If the recipient’s bank requires additional information, such as bank code or branch name, you need to prepare these details in advance.

Remittance Amount and Currency Type

The remittance amount and currency type directly affect your remittance costs and the amount received. You need to specify the exact remittance amount and select the target currency type.

Below are suggestions for choosing currency types:

- If the recipient’s country has significant currency exchange rate fluctuations, consider using a stable currency for remittance, such as USD.

- If the exchange rate between the target currency and JPY is low, it may result in the recipient receiving a smaller amount.

When filling out the remittance amount, ensure it complies with the service provider’s remittance limits. For example, Hong Kong banks’ online banking typically limits single remittances to the equivalent of USD 10,000 or less.

Explanation of Remittance Purpose (if Necessary)

In some cases, you need to provide an explanation of the remittance purpose. This is an important basis for banks to review remittance applications. Common remittance purposes include tuition payments, family support, or business transactions.

To improve the approval rate, ensure the remittance purpose explanation is clear and complies with relevant regulations. For example, if the remittance is for tuition payment, include the school’s admission letter or tuition bill as proof.

By preparing complete information, you can ensure a smoother remittance process and reduce delays due to incomplete information.

Personal Identification Documents

When conducting Japan international remittances, you need to provide personal identification documents. This is a critical step for banks to verify the remitter’s identity and ensure the security of the remittance. Below are common types of identification documents and their requirements:

Common Types of Identification Documents:

- Passport: The passport is the most commonly used identification document for international remittances. Ensure the passport is within its validity period and the information is clear and readable.

- Residence Permit: If you are a foreign resident, a residence permit can serve as a supplementary identification document. Ensure the information on the residence permit matches the passport.

- ID Card: For Chinese citizens, an ID card can also be used as a valid identification document for remittances.

Precautions for Submitting Identification Documents:

- Ensure the scanned or copied documents are clear and error-free. Blurry documents may lead to review failure.

- If the bank requires original document verification, prepare the originals and visit the bank in person.

- In some cases, banks may require additional documents, such as proof of employment or income. Provide the relevant documents based on specific requirements.

Tip: Hong Kong banks typically require a passport and residence permit as primary identification documents. If you are unsure which documents are needed, consult bank customer service in advance.

Role of Identification Documents:

Identification documents are used not only to verify your identity but also to help banks prevent money laundering and other illegal activities. By providing accurate identification, you can ensure the remittance process is completed smoothly.

After preparing these documents, you can proceed with the other steps of Japan international remittances. Ensure all information is authentic and valid to avoid delays due to documentation issues.

Fees and Processing Times for Japan International Remittances

Image Source: unsplash

Components of Fees (Bank Handling Fees, Telegraph Fees, etc.)

When conducting Japan international remittances, fees are a key aspect to focus on. The fee structure typically includes the following components:

- Bank Handling Fee

The bank handling fee is the most common fee, usually a fixed amount or a percentage of the remittance amount. For example, when remitting through Hong Kong banks, fees may vary depending on the remittance method. - Telegraph Fee

The telegraph fee covers communication costs between banks. This fee is typically borne by the remitter, and the specific amount varies by bank. - Intermediary Bank Fees

If the remittance requires processing through an intermediary bank, additional fees may apply. These fees may sometimes be borne by the recipient but could also be your responsibility. - Hidden Fees

Some service providers may include hidden fees in the exchange rate. For example, the displayed exchange rate may seem favorable, but the actual converted amount may be lower than expected.

Tip: When choosing a remittance service, carefully review the fee details to avoid increased costs due to hidden fees.

Fee Comparison Across Different Service Providers

Fees vary significantly across different service providers. Below is a comparison of fees for several common providers:

| Service Provider | Handling Fee (%) | Exchange Rate Cost (%) | Other Hidden Fees (%) |

|---|---|---|---|

| TransferWise | 0.67 | 0.0 | 0.0 |

| Global Average | 6.94 | Included | Included |

| Traditional Banks | N/A | N/A | N/A |

As shown in the table, TransferWise has lower handling and hidden fees, making it suitable for users looking to save costs. Traditional banks typically have higher fees but may offer greater security and service assurances.

Suggestion: When selecting a service provider, weigh fees, exchange rates, and processing times based on your needs to choose the most cost-effective method.

Key Factors Affecting Remittance Processing Times

Remittance processing times vary due to several factors. Below are the main influencing factors:

- Remittance Method

Wire transfers typically take 1 to 3 business days to arrive, while currency conversion remittances may take 2 to 5 business days. - Bank Processing Speed

Different banks have varying processing speeds. Some banks may complete processing on the same day, while others may take longer. - Holidays and Weekends

Holidays and weekends can extend remittance processing times. It’s recommended to submit remittance applications on business days. - Time Zone Differences

Time zone differences between countries may affect remittance speed. For example, remittances from Japan to the US may be delayed due to time zone differences. - Remittance Amount

The size of the remittance amount may also affect processing time. Larger amounts may require additional review time.

Typically, international bank transfers take 1 to 5 business days to arrive. To ensure timely fund arrival, check the bank’s processing times in advance and avoid submitting applications during holidays.

Tip: If you need funds to arrive quickly, consider expedited services, but these usually incur additional fees.

How to Choose a Cost-Effective Remittance Method

When conducting Japan international remittances, selecting a cost-effective remittance method can help you save costs and improve efficiency. Below are practical suggestions to help you find the most suitable method.

1. Compare Fees and Services of Different Providers

Different remittance service providers vary in fees, exchange rates, and processing times. You can compare them through the following methods:

- Handling Fees: Check the fixed fees and percentage-based charges of each provider. For example, Hong Kong banks’ international remittance fees are typically higher than some online platforms.

- Exchange Rates: Pay attention to whether exchange rates include hidden fees. Some providers may offer seemingly favorable rates but deliver lower converted amounts.

- Processing Times: If you need funds to arrive quickly, choose providers offering expedited services.

Below is a simple comparison table to help you understand the features of different providers:

| Service Provider | Handling Fee (USD) | Exchange Rate Cost | Processing Time |

|---|---|---|---|

| TransferWise | 5.00 | No hidden fees | 1-2 business days |

| Hong Kong Banks | 20.00 | May include fees | 2-5 business days |

| PayPal | 10.00 | Includes fees | Instant |

2. Choose Based on Remittance Amount

The size of the remittance amount affects your choice. For smaller amounts, online platforms may be more cost-effective due to lower fees. For larger amounts, traditional banks may be more secure and reliable.

Tip: When selecting a service, ensure the remittance amount complies with the provider’s limits. For example, some platforms may restrict single remittances to USD 10,000 or less.

3. Consider Remittance Purpose and Frequency

The purpose and frequency of remittances also affect your choice. For regular remittances, choose providers offering subscription services or discount packages. For one-time remittances, select the method with the lowest fees.

4. Use Online Tools for Fee Calculation

Many online tools can help you quickly calculate remittance fees and exchange rates. For example, XE and OANDA provide real-time exchange rate lookup functions. You can input the remittance amount and target currency to see the final received amount.

5. Avoid Hidden Fees

Some providers may hide fees in exchange rates or other aspects. You can avoid these fees through the following methods:

- Carefully review the terms of service to understand all fee components.

- Use platforms with high transparency, such as TransferWise.

- Consult customer service to confirm whether additional fees apply.

By using these methods, you can select the most cost-effective remittance method, ensuring fund security while saving costs.

Precautions for Japan International Remittances

Remittance Limits and Legal Regulations

When conducting Japan international remittances, you need to understand remittance limits and relevant legal regulations. According to the Foreign Exchange Management Regulations, the annual foreign exchange purchase limit for individuals is USD 50,000. Exceeding this limit may result in administrative penalties or criminal liability.

Below are some relevant legal information and cases:

| Evidence Type | Content |

|---|---|

| Legal Regulations | According to the Foreign Exchange Management Regulations, the annual foreign exchange purchase limit for individuals is USD 50,000, and violations may result in administrative penalties or criminal liability. |

| Violation Cases | The cases of Chen and Hu involved illegal transfers of large funds and foreign exchange trading. |

| Penalties | Violating foreign exchange regulations may result in fines and criminal liability. |

Additionally, the following cases are worth noting:

- Chen Case: Involved illegal foreign exchange operations with a total amount of CNY 476 million, resulting in 3 to 5 years imprisonment and a fine of CNY 300,000.

- Hu Case: Involved 19 illegal foreign exchange transactions through underground channels, totaling USD 3.331 million, with a fine of CNY 2.157 million.

To avoid legal risks, ensure remittance amounts stay within legal limits. For large remittances, consider splitting them into multiple transactions or consulting professional institutions.

Impact of Exchange Rate Fluctuations on Amounts

Exchange rate fluctuations directly affect your remittance costs and the amount received by the recipient. Changes in exchange rates may require you to pay more JPY or result in the recipient receiving less of the target currency. For example, when the JPY depreciates, you need to pay more JPY to convert to the same amount of USD.

To minimize the impact of exchange rate fluctuations, you can take the following measures:

- Choose Fixed Exchange Rate Services: Some banks or platforms offer fixed exchange rate services to lock in rates and avoid fluctuation risks.

- Monitor Exchange Rate Trends: Use bank websites or third-party tools (e.g., XE) to track exchange rates in real time and remit when rates are lower.

- Split Remittances: For large amounts, split remittances into multiple transactions to reduce the impact of single exchange rate fluctuations.

Tip: Before remitting, consult the bank or professionals to understand current exchange rates and market trends.

Identifying and Avoiding Hidden Fees

Hidden fees are a common issue in international remittances and may include exchange rate spreads, additional handling fees, or intermediary bank fees. These fees are often not explicitly shown on statements but can affect your total costs.

Below are methods to identify and avoid hidden fees:

- Carefully Review Fee Details: When choosing a remittance service, review all fee details, especially regarding exchange rates and handling fees.

- Choose Transparent Platforms: For example, TransferWise is known for its transparent fee structure, suitable for users looking to save costs.

- Consult Customer Service: If unsure about fee components, contact the bank or platform’s customer service to confirm whether additional fees apply.

By using these methods, you can effectively reduce remittance costs and ensure fund security.

Tax Implications and Declaration Requirements

When conducting Japan international remittances, you need to understand the relevant tax implications and declaration requirements. This relates not only to fund security but also to legal compliance.

Tax Implications

International remittances may trigger tax issues, especially for large amounts. According to Chinese tax law, remittances received by individuals may be considered income and subject to personal income tax. Below are some common tax scenarios:

- Gift Tax: If the remittance is made as a gift, the recipient may need to pay gift tax, with rates depending on the gift amount and relevant laws.

- Income Tax: If the remittance involves wages, investment income, or other income, the recipient must declare and pay personal income tax.

- Value-Added Tax: Some commercial remittances may involve VAT, especially for transactions related to cross-border services.

To avoid tax issues, consult a tax expert or bank customer service in advance to understand specific tax policies.

Declaration Requirements

According to the Foreign Exchange Management Regulations, individuals conducting international remittances must fulfill declaration obligations. Below are key declaration requirements:

- Amount Declaration: When the remittance amount exceeds a certain limit (typically USD 50,000), you need to provide detailed proof of fund sources.

- Purpose Explanation: Banks may require you to provide an explanation of the remittance purpose, such as tuition payment, family support, or business transactions.

- Document Preparation: You need to provide identification documents, proof of income, or other relevant materials to meet the bank’s review requirements.

Tip: Hong Kong banks typically require you to complete all declaration procedures before remitting. If documents are incomplete, the bank may refuse to process your application.

By understanding tax implications and declaration requirements, you can ensure the remittance process is legally compliant and avoid unnecessary complications.

Common FAQs for Japan International Remittances

Are There Restrictions on Remittance Purposes?

When conducting Japan international remittances, remittance purposes may be subject to certain restrictions. Financial institutions review remittance purposes based on relevant laws and regulations to ensure the legality of fund flows. Below are some common legal regulations and requirements:

- According to the Personal Information Protection Law, remittances involving personal information leaving the country must meet requirements for security assessment, personal information protection certification, or signing standard contracts.

- When handling important data leaving the country, financial institutions must conduct a security assessment to ensure data compliance.

- Regulatory authorities, under laws such as the Banking Law and Insurance Law, are responsible for protecting the personal information of financial consumers.

If your remittance involves common purposes like tuition payment, family support, or business transactions, you typically won’t encounter issues. However, for large remittances or unclear purposes, banks may require additional proof documents. To avoid delays, consult bank customer service in advance to ensure the purpose complies with regulations.

When Are Exchange Rates Determined?

The timing of exchange rate determination directly affects your remittance costs. Typically, banks lock in the exchange rate when you submit the remittance application. Through Hong Kong banks’ online banking services, the exchange rate is displayed and fixed immediately after submission. For counter remittances, the exchange rate may be determined when the bank processes the application.

To obtain a more favorable exchange rate, you can use the following methods:

- Use the bank’s real-time exchange rate lookup tool to submit applications when rates are lower.

- Monitor exchange rate trends and avoid remitting during periods of high volatility.

- Consult the bank to see if they offer fixed exchange rate services to reduce risks from fluctuations.

What to Do If a Remittance Fails?

Remittance failure may result from various reasons, such as incorrect information, bank review failure, or intermediary bank issues. In such cases, you can take the following steps:

- Verify Information: Check the recipient’s name, bank account, and address for accuracy. If errors are found, contact the bank immediately to correct them.

- Contact the Bank: Reach out to bank customer service to understand the reason for the failure and resubmit the application as advised.

- Request a Refund: If the funds were not successfully transferred, the bank typically refunds the amount to your account. Refund processing times may take 1 to 5 business days.

To avoid remittance failures, carefully verify all information before submitting the application and keep the transaction receipt for reference.

Can a Remittance Be Canceled or Modified?

When conducting Japan international remittances, you may need to cancel or modify a remittance. Understanding the relevant procedures and precautions can help you resolve issues quickly and avoid unnecessary complications.

Conditions and Process for Remittance Cancellation

Whether a remittance can be canceled depends on its processing status. If the bank has not yet completed the remittance instruction, you can request cancellation. Below is the common cancellation process:

- Contact Bank Customer Service: Call the bank’s customer service hotline and provide the transaction receipt and relevant information. Hong Kong banks typically require you to provide the transaction number and remittance amount.

- Confirm Remittance Status: The bank will verify whether the remittance has been processed. If it has not been sent to an intermediary or recipient bank, the cancellation request can usually take effect immediately.

- Refund Processing: The bank will refund untransferred funds to your account. Refund times typically range from 1 to 5 business days, depending on the bank.

Tip: If the remittance has already been completed, cancellation requests may not be processed. You will need to negotiate with the recipient or recipient bank to resolve the issue.

Precautions for Remittance Modification

Remittance modifications typically involve changing recipient information or the remittance amount. Below are precautions for modifying remittances:

- Apply Promptly: Contact the bank immediately after discovering errors. Hong Kong banks usually require modification requests to be submitted before the remittance instruction is processed.

- Provide Proof Documents: The bank may require identification documents and transaction receipts to verify the authenticity of the modification request.

- Additional Fees: Some banks may charge a modification fee. For example, Hong Kong banks typically charge USD 20 for modifications.

How to Avoid Canceling or Modifying Remittances

To reduce the need for cancellations or modifications, you can take the following measures:

- Carefully verify remittance information, including recipient name, bank account, and amount.

- Use the bank’s preview function to ensure all information is correct.

- Consult bank customer service before submitting the remittance application to confirm the process and precautions.

By understanding the conditions and procedures for canceling and modifying remittances, you can better handle unexpected situations and ensure a smooth remittance process.

Japan international remittances involve several key steps. You need to choose the appropriate remittance service provider, prepare complete information, and confirm exchange rates and fees. After completing the remittance, keep the transaction receipt for reference. Select a cost-effective remittance method based on your needs. Carefully verify information before remitting to ensure security and accuracy. Through these methods, you can effectively reduce risks and complete remittances smoothly.

FAQ

Are There Restrictions on Remittance Purposes?

Remittance purposes typically include tuition payments, family support, or business transactions. Banks review whether the purpose is legal. You need to provide relevant proof documents, such as tuition bills or contracts. Some special purposes may require additional approval. Consulting bank customer service in advance can avoid delays.

Tip: Hong Kong banks have stricter reviews for large remittance purposes, so prepare detailed documents in advance.

When Are Exchange Rates Determined?

Exchange rates are typically locked in when the remittance application is submitted. You can check real-time exchange rates through bank websites or mobile apps. For counter remittances, the exchange rate may be determined when the bank processes the application. Choosing fixed exchange rate services can reduce fluctuation risks.

Suggestion: Monitor exchange rate trends and submit applications when rates are lower.

What to Do If a Remittance Fails?

Remittance failure may result from incorrect information or bank review failure. You need to verify information and contact bank customer service to resolve the issue. Banks typically refund untransferred funds to your account, with refund times of 1 to 5 business days.

Tip: Keep the transaction receipt for reference when addressing failure reasons.

Can a Remittance Be Canceled or Modified?

Remittance cancellation or modification must be requested before the bank processes the instruction. Contact bank customer service with the transaction number and relevant information. Some banks may charge a modification fee, such as USD 20 for Hong Kong banks.

Note: Completed remittances cannot be canceled, requiring negotiation with the recipient.

What Are the Remittance Limits?

According to the Foreign Exchange Management Regulations, the annual foreign exchange purchase limit for individuals is USD 50,000. Exceeding this limit requires proof of fund sources and bank review. Splitting remittances into multiple transactions can avoid exceeding the limit.

Tip: Hong Kong banks also have specific limits on single remittances, so consult customer service in advance.

Japan’s international remittances face high fees, 1-5 day delays, and risks of errors. BiyaPay streamlines cross-border transfers for tuition or family support, supporting conversions across 30+ fiat currencies and 200+ cryptocurrencies with remittance fees as low as 0.5%, covering 190+ countries with same-day delivery. You can also invest in U.S. and Hong Kong stocks without an overseas account, expanding your global portfolio. Join BiyaPay now for seamless remittances! Licensed by U.S. MSB and SEC, BiyaPay ensures compliance, with real-time exchange rate tracking to optimize costs and a 5.48% APY on idle funds via flexible savings. Sign up with BiyaPay for a cost-effective, efficient remittance solution!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.