- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Top 10 U.S. Stock Trading Platforms Recommended to Help Chinese Investors Easily Enter the Market

Image Source: pexels

Opening a U.S. stock trading account is a crucial step for many Chinese investors to enter the global market. Data shows that U.S. stocks account for a weighting of 56%-65% in global investment portfolios, reflecting the high importance international investors place on U.S. stocks. For Chinese investors, the U.S. stock market not only offers abundant investment opportunities but also attracts increasing attention due to the strong performance of its technology stocks. S&P 500 index data shows that its average return in the 12 months following a new high reaches 13.2%, further boosting investor confidence. Choosing a suitable trading platform can help you more easily seize these market opportunities.

Top 10 U.S. Stock Trading Platforms Recommended

Image Source: unsplash

Tiger Brokers - Offers One-Stop Global Investment Services, Suitable for Beginners and Active Traders

Tiger Brokers is a platform focused on global investment services, particularly suitable for beginners and active traders. Its U.S. stock market share reaches 58%, with the number of account holders growing from less than 20,000 to over 500,000, demonstrating its popularity among investors. The platform’s trading volume has also been expanding, increasing from USD 16.3 billion in 2016 to USD 119.2 billion in 2018.

The advantage of Tiger Brokers lies in its one-stop service. You can easily invest in U.S. stocks, Hong Kong stocks, and other international markets through a single account. The platform provides a Chinese interface and customer support, facilitating operations for Chinese investors. For active traders, Tiger Brokers’ trading tools are powerful and capable of meeting complex investment needs.

| Metric | Data |

|---|---|

| U.S. Stock Market Share | 58% |

| Number of Account Holders | Grew from less than 20,000 to over 500,000 |

| Trading Volume | USD 119.2 billion in 2018, USD 63.3 billion in 2017, USD 16.3 billion in 2016 |

Futu Securities - User-Friendly Interface, Supports Multiple Investment Products, Suitable for Young Investors

Futu Securities is known for its user-friendly interface and technology-driven approach, attracting a large number of young investors. Data shows that 20-25-year-old users account for about 20% of Futu Securities’ user base. Although these users have less disposable capital, they have begun learning securities investment and wealth management knowledge. Futu’s customer satisfaction exceeds 98%, with a quarterly retention rate also reaching 98%, indicating strong user approval of the platform’s services.

Futu Securities supports multiple investment products, including U.S. stocks, Hong Kong stocks, and funds. You can easily open a U.S. stock account through Futu Securities and enjoy a smooth trading experience. The platform is also committed to delivering an exceptional user experience, making investing simple and efficient.

- Futu Securities’ 20-25-year-old users account for about 20%.

- Customer satisfaction exceeds 98%, with a quarterly retention rate also exceeding 98%.

- Futu is committed to empowering brokers through technology to deliver an exceptional user experience.

BBI Securities - Focused on the U.S. Stock Market, Supports Chinese Services, Suitable for Mainland Investors

BBI Securities is a platform focused on the U.S. stock market, particularly suitable for Chinese investors. The platform provides a Chinese interface and customer support, helping you easily complete the U.S. stock account opening process. BBI Securities’ trading fees are transparent, suitable for both beginners and experienced investors.

The advantage of BBI Securities lies in its deep research into the U.S. stock market. You can access rich market analysis and investment recommendations through the platform, helping you make more informed decisions. For users who want to focus on U.S. stock investments, BBI Securities is a worthy option.

Interactive Brokers - Low Fees, Powerful Features, Suitable for Professional Investors

Interactive Brokers is a platform designed for professional investors. It is renowned for its low fees and powerful features, attracting seasoned traders worldwide. You can easily open a U.S. stock account through Interactive Brokers and enjoy highly competitive trading costs.

The platform’s commission structure is very transparent. The fee for U.S. stock trading is as low as USD 0.005 per share, with no minimum transaction amount requirement. This low-cost advantage makes Interactive Brokers a top choice for high-frequency traders. In addition, Interactive Brokers offers a wide range of investment products, including stocks, options, futures, and forex, meeting the needs of different investors.

Interactive Brokers’ trading tools are highly functional. You can use its proprietary trading platform, TWS (Trader Workstation), for complex investment analysis and strategy formulation. The platform also supports API interfaces, suitable for users needing customized trading solutions.

Tip: If you are a professional investor or have high requirements for trading tools, Interactive Brokers is a platform worth considering. Its low fees and powerful features can help you optimize investment efficiency.

Charles Schwab - Suitable for Long-Term Investors, Offers Rich Research Tools

Charles Schwab is a platform focused on long-term investing. It is known for its rich research tools and high-quality customer service, suitable for users aiming to achieve wealth growth through long-term investments.

Charles Schwab provides free stock research reports and market analysis tools. You can use these resources to gain a deep understanding of U.S. stock market dynamics and formulate scientific investment strategies. The platform also supports automated investment services, such as robo-advisors, helping you easily manage your investment portfolio.

Charles Schwab’s fee structure is very friendly for long-term investors. U.S. stock trading is commission-free, and account management fees are low. You can focus on your investment goals without worrying about high trading costs.

Suggestion: If you aim to achieve stable wealth growth through long-term investing, Charles Schwab is an ideal choice. Its research tools and customer service can help you better plan your investment path.

Fidelity - No Minimum Account Requirement, Suitable for Infrequent Traders

Fidelity is a platform suitable for infrequent traders. Its biggest feature is the absence of a minimum account requirement, lowering the investment threshold. You can easily complete a U.S. stock account opening and start your investment journey.

The platform offers various investment products, including stocks, ETFs, and mutual funds. For infrequent traders, Fidelity’s zero-commission policy is very friendly. You can focus on selecting investment products that suit you without worrying about trading fees.

Fidelity also provides robust educational resources. You can learn investment knowledge and understand market trends through the platform. These resources are very helpful for beginners and users looking to enhance their investment skills.

Note: If you are an infrequent trader, Fidelity’s zero-commission policy and educational resources can help you easily get started and optimize your investment experience.

Firstrade - Zero-Commission Trading, No Minimum Deposit Requirement, Suitable for Beginners

Firstrade is a U.S. stock trading platform designed for beginners. Its biggest highlight is zero-commission trading and no minimum deposit requirement. These low-threshold features allow you to start investing easily without the pressure of high initial capital.

The platform supports various investment products, including stocks, ETFs, options, and mutual funds. For investors new to the U.S. stock market, Firstrade offers a simple and user-friendly interface and rich educational resources. You can learn basic investment knowledge through the platform and quickly master trading skills.

Additionally, Firstrade provides Chinese customer service to help you resolve issues during account opening and trading. The platform’s mobile application is fully functional, allowing you to manage your investment portfolio anytime, anywhere.

Tip: If you are a beginner, Firstrade’s zero-commission policy and no minimum deposit requirement will help you get started easily and quickly gain investment experience.

Longbridge Securities - Offers a Convenient Account Opening Process, Suitable for Hong Kong and U.S. Stock Investors

Longbridge Securities attracts a large number of Hong Kong and U.S. stock investors with its convenient account opening process and high-quality user experience. You can complete the account opening through simple online operations without cumbersome paper documents.

The platform is committed to providing users with a new trading experience and value-added services. This service model has significantly reduced customer churn rates while attracting more new users. Over the past year, Longbridge Securities has achieved continuous growth in user numbers, further proving the improvement in its account opening convenience and service quality.

- Provides a new trading experience

- Value-added services reduce customer churn

- Continuous growth in user numbers

Longbridge Securities also supports various investment products, including U.S. stocks, Hong Kong stocks, and ETFs. You can easily manage a diversified investment portfolio through the platform and seize global market opportunities.

Suggestion: If you want to quickly complete account opening and invest in Hong Kong and U.S. stocks, Longbridge Securities is a trustworthy choice. Its convenience and service quality will provide assurance for your investment journey.

Vantage Securities - Supports Multi-Market Trading, Suitable for Diversified Investors

Vantage Securities is a platform that supports multi-market trading, particularly suitable for users pursuing diversified investments. You can invest in U.S. stocks, Hong Kong stocks, and A-shares through a single account, easily achieving global asset allocation.

The platform provides rich investment tools and market analysis resources to help you formulate scientific investment strategies. Whether it’s stocks, ETFs, or funds, Vantage Securities can meet your investment needs.

Vantage Securities also focuses on user experience. The platform’s interface is clean and intuitive, with smooth trading operations. You can view market dynamics and complete trades quickly through the mobile application.

Tip: If you want to diversify your investments across multiple markets, Vantage Securities is an ideal choice. Its multi-market support and high-quality services will help you achieve your investment goals.

Snowball Securities - Offers High-Quality Customer Service, Suitable for Investors Needing Chinese Support

Snowball Securities is a U.S. stock trading platform focused on serving Chinese investors. It is known for its high-quality customer service and comprehensive Chinese support, helping you easily complete account opening and trading operations. Whether you are a beginner or an experienced investor, Snowball Securities can provide you with attentive service and an efficient trading experience.

Key Advantages of Snowball Securities

- Comprehensive Chinese Support

Snowball Securities offers a fully Chinese interface and customer service for Chinese investors. You can quickly resolve issues related to account opening, trading, or account management through Chinese customer support. This language support makes your investment process more seamless. - High-Quality Customer Service

Snowball Securities’ customer service team responds quickly and can promptly address your questions. Whether through online chat, email, or phone, you can receive professional assistance. - Diversified Investment Products

Snowball Securities supports various investment products, including U.S. stocks, Hong Kong stocks, ETFs, and options. You can flexibly choose products that suit your investment goals and risk preferences. - Convenient Trading Tools

Snowball Securities provides a powerful trading platform that supports real-time market data viewing and quick order placement. You can also manage your investment portfolio anytime, anywhere through the mobile application.

Snowball Securities’ Fee Structure

Snowball Securities’ trading fees are transparent and competitive. U.S. stock trading commissions start at USD 0.01 per share, with a minimum charge of USD 1.99. For active traders, this low-cost structure can significantly reduce investment costs.

| Fee Type | Fee Standard |

|---|---|

| U.S. Stock Commission | Starts at USD 0.01 per share, minimum USD 1.99 |

| Hong Kong Stock Commission | 0.03% per trade, minimum USD 3 |

| Platform Usage Fee | Free |

Who Is Snowball Securities Suitable For?

- Investors Needing Chinese Support: If you prefer operating and communicating in Chinese, Snowball Securities is an ideal choice.

- Investors Seeking High-Quality Service: Snowball Securities’ customer service team provides fast and professional support.

- Diversified Investors: If you want to invest in U.S. stocks, Hong Kong stocks, and ETFs, Snowball Securities can meet your needs.

Tip: If you value customer service quality and need Chinese support, Snowball Securities is a trustworthy platform. Its low commissions and diversified products can also help you achieve your investment goals.

Key Factors in Choosing a U.S. Stock Trading Platform

Choosing a suitable U.S. stock trading platform is the foundation of successful investing. The following key factors can help you evaluate the strengths and weaknesses of different platforms to find the one best suited for you.

Regulatory Qualifications and Platform Security

The platform’s regulatory qualifications directly affect the safety of your funds. You need to choose platforms regulated by authoritative bodies, such as the U.S. Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA). These institutions’ oversight ensures the platform’s legality and transparency.

In addition, platform security is also critical. You can check whether the platform offers two-factor authentication (2FA) and data encryption technologies. These measures can effectively protect your account from cyberattacks.

Tip: When choosing a platform, prioritize those with a strong reputation and robust security measures. This can make your investments more secure.

Trading Fees and Commission Structures

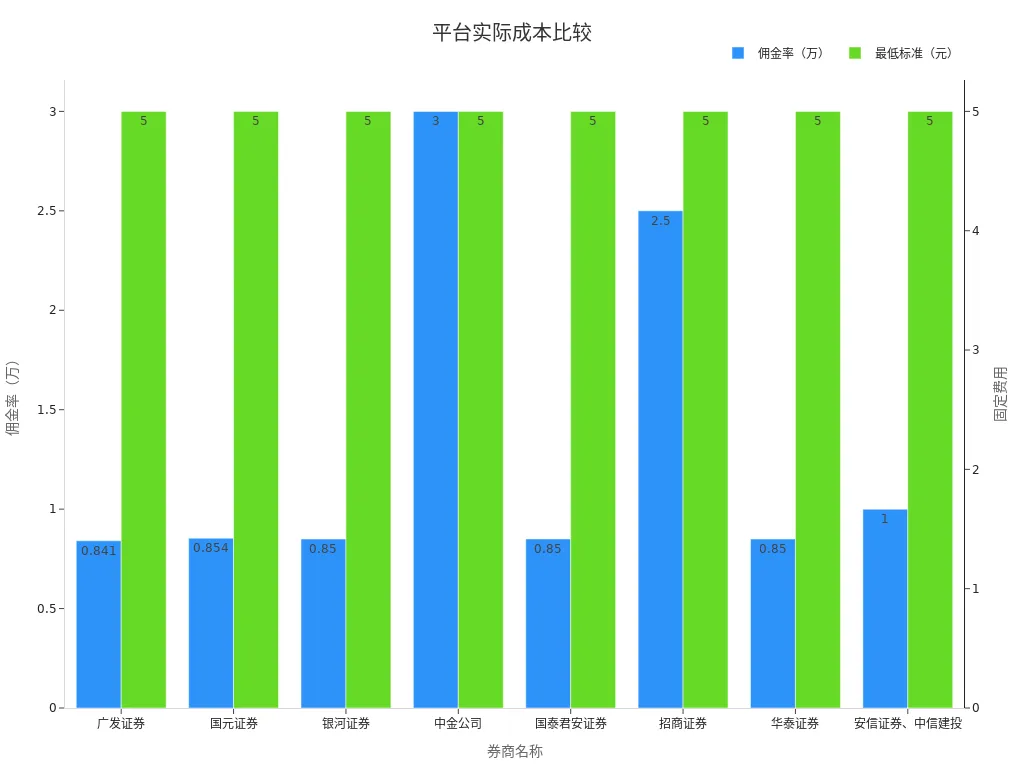

Trading fees are a significant component of investment costs. Different platforms’ commission structures may significantly impact your returns. Below are commission comparison data for some common platforms:

| Broker Name | A-Share Commission Rate (Standard) | Minimum Standard (Per Trade) |

|---|---|---|

| GF Securities | 0.0841% | USD 5 |

| Guoyuan Securities | 0.0854% | USD 5 |

| Galaxy Securities | 0.085% (After Negotiation) | USD 5 |

| CICC | 0.3% (Default) | USD 5 |

| Guotai Junan Securities | 0.085% (After Negotiation) | USD 5 |

| China Merchants Securities | 0.25% (Standard) | USD 5 |

| Huatai Securities | 0.085% (After Negotiation) | USD 5 |

| Anxin Securities, CITIC Securities | 0.1% (Standard) | USD 5 |

From the table and chart, it is evident that commission rates vary significantly across platforms. If you are a high-frequency trader, choosing a low-commission platform can significantly reduce costs.

Platform Features and User Experience

Platform features and user experience directly affect your trading efficiency. An excellent platform should have the following characteristics:

- Intuitive Interface Design: A clean and smooth interface can help you complete trades quickly.

- Rich Feature Support: Such as real-time market data, technical analysis tools, and automated trading functions.

- Diversified Investment Products: Supports stocks, ETFs, options, and other products to meet various investment needs.

Below are quantitative metrics for platform features and user experience:

| Metric Dimension | Description |

|---|---|

| Differences in User Types | Variations in user demographics, user numbers, and usage environments across platforms. |

| Differences in Platform Features | Feature categories include portals and consoles, affecting the focus of experience metrics. |

| User Experience Measurement System | The importance of scientifically establishing a user experience measurement system to improve product quality and design efficiency. |

Suggestion: When choosing a platform, prioritize those with comprehensive features and excellent user experience. This can make your trading more efficient and convenient.

Customer Service and Support

When choosing a U.S. stock trading platform, the quality of customer service is an important consideration. High-quality customer service can help you resolve issues related to account opening, trading, and account management, enhancing the overall investment experience. Below are key points for evaluating customer service quality:

- Whether the platform collects customer data and feedback to understand user needs.

- Whether it maps out customer journeys and analyzes them to optimize service processes.

- Whether the customer service team builds emotional connections with users, providing attentive service.

- Whether issue resolution is efficient and can quickly respond to user needs.

- Whether there is a continuous improvement mechanism to constantly enhance service quality.

An excellent U.S. stock trading platform typically offers multiple communication channels, such as online chat, email, and phone support. You can choose the most convenient way to contact the customer service team based on your preferences. Additionally, Chinese support is particularly important for Chinese investors. It can help you complete account opening and trading operations more easily, reducing language barriers.

Tip: When choosing a platform, prioritize those with high-quality customer service and fast response times. Good service not only resolves issues but also makes your investment process smoother.

Suitable Investment Product Types

Different U.S. stock trading platforms offer varying types of investment products. When choosing a platform, you need to evaluate the diversity of products based on your investment goals and risk preferences. Below are common investment product types:

- Stocks: Suitable for investors seeking capital appreciation. You can choose technology stocks, blue-chip stocks, or growth stocks.

- ETFs: Suitable for investors looking to diversify risk. ETFs typically cover multiple industries or markets, reducing the impact of individual stock fluctuations.

- Options: Suitable for experienced investors. Options trading can offer higher return potential but comes with greater risk.

- Mutual Funds: Suitable for long-term investors. Funds are managed by professional managers, ideal for users seeking stable growth.

- Hong Kong Stocks: Some platforms support Hong Kong stock trading, suitable for users interested in investing in Chinese companies.

When choosing a platform, you also need to pay attention to the trading fees and minimum investment requirements for products. For example, some platforms offer zero-commission trading for ETFs, while options trading may incur additional fees. Understanding these details can help you optimize investment costs.

Suggestion: If you want to invest in multiple products, choose a platform that supports stocks, ETFs, options, and funds. This can make your investment portfolio more diversified, reducing overall risk.

U.S. Stock Account Opening Process and Precautions

Image Source: pexels

Basic Materials Required for Account Opening

Before opening a U.S. stock account, you need to prepare some basic materials. These materials are key to successfully completing the account opening process, ensuring you can smoothly proceed. Below are common required materials:

- Identity Proof Documents: Scanned copies of your passport or ID card, used to verify your identity.

- Address Proof: Utility bills or bank statements from the past three months, showing your residential address.

- Tax Information: U.S. tax residents need to provide a Social Security Number (SSN), while non-tax residents need to complete a W-8BEN form.

- Bank Account Information: Used for depositing funds and withdrawals, preferably a bank account that supports international transfers, such as a Hong Kong bank account.

Tip: Ensure all documents are clear and readable to avoid delays in account opening due to material issues.

Detailed Account Opening Steps

The U.S. stock account opening process typically involves the following steps. You can follow these steps to complete the account opening operation:

- Choose a Platform: Select a suitable platform based on your investment needs, such as Interactive Brokers or Futu Securities.

- Fill Out the Application Form: Log in to the platform’s official website and fill out personal and tax information. Ensure the information is accurate.

- Upload Materials: Upload identity proof, address proof, and other documents to the platform. Some platforms support online photo uploads.

- Identity Verification: The platform will review your materials, typically taking 1-3 business days.

- Account Activation: Upon approval, you will receive an account activation notification. Complete the initial fund deposit to start trading.

Note: Specific processes may vary slightly across platforms, so it’s recommended to review the platform’s account opening guide in advance.

Precautions: Identity Verification and Fund Security

Identity verification is a critical step in U.S. stock account opening. You need to ensure that the submitted materials are authentic and valid to avoid audit failures due to mismatched information. Below are key points for identity verification:

- The submitted identity proof documents must be within their validity period.

- Address proof must show your actual residential address, avoiding the use of false information.

Fund security is equally important. You can choose regulated platforms to ensure your funds are protected by law. Additionally, using two-factor authentication (2FA) can further enhance account security.

| Security Measure | Description |

|---|---|

| Two-Factor Authentication | Verifies login via SMS or an application |

| Data Encryption Technology | Prevents account information from being stolen |

| Platform Regulatory Qualifications | Ensures the platform is legal and compliant |

Suggestion: When choosing a platform, prioritize those with robust security measures, such as Interactive Brokers or Charles Schwab. This can make your investments more secure.

Practical Tips for Investing in U.S. Stocks

How to Choose Suitable Stocks or ETFs

When choosing stocks or ETFs, you need to clarify your investment goals. If you pursue high growth, you can focus on technology stocks or growth companies, such as Apple or Tesla. These companies typically have high market potential. If you prefer stable returns, you can choose blue-chip or dividend-paying stocks, such as Coca-Cola or Johnson & Johnson. Their performance is relatively stable, suitable for long-term holding.

ETFs are another suitable option for investors. They typically cover multiple industries or markets, helping you diversify risk. For example, the S&P 500 Index ETF (SPY) tracks the performance of 500 major U.S. companies, ideal for users wanting to invest in the entire market.

Tip: When selecting stocks or ETFs, research the company’s financial condition and market prospects. You can also use the analytical tools provided by the platform to make more informed decisions.

Diversified Investing and Risk Management

Diversified investing is a key strategy for reducing risk. You can allocate funds across different industries, regions, and asset classes. For example, invest part of your funds in technology stocks and another part in healthcare or consumer goods stocks. This way, even if one industry underperforms, gains in other industries can offset losses.

Below is a comparison of annualized returns and volatility between U.S. stocks and other markets:

| Market | Annualized Return | Annualized Volatility | Maximum Drawdown |

|---|---|---|---|

| U.S. Stocks | 11.56% | N/A | 33.92% |

| A-Shares | 0.74% | 22.01% | 46% |

From the data, it is clear that U.S. stocks have higher annualized returns and relatively lower volatility. Diversified investing not only reduces risk but also enhances the stability of overall returns.

Suggestion: You can choose to invest in ETFs to achieve diversification, such as the Vanguard Total World Stock ETF (VT), which covers multiple countries and industries.

Long-Term Investing vs. Short-Term Trading Strategies

Long-term investing is suitable for users aiming to accumulate wealth. You can select high-quality stocks or index funds and hold them for years or even decades. The advantage of long-term investing lies in the compounding effect. Over time, returns accumulate, helping you achieve wealth growth.

Short-term trading is suitable for experienced investors. You need to closely monitor market dynamics and seize opportunities from short-term fluctuations. For example, use technical analysis to determine the timing for buying and selling stocks. Short-term trading carries higher risks but can also bring quick returns.

Tip: If you are a beginner, start with long-term investing. As you gain experience, you can try short-term trading strategies.

Staying Informed About Market Dynamics and Economic Trends

When investing in U.S. stocks, staying informed about market dynamics and economic trends is crucial. Market changes are often influenced by various factors, including economic data, policy adjustments, and international events. You need to stay updated with this information to adjust your investment strategies in a timely manner.

How to Stay Informed About Market Dynamics?

- Follow Financial News

You can access the latest market dynamics through financial websites, news apps, or TV programs. For example, CNBC, Bloomberg, and Reuters provide real-time market analysis and news reports. - Use Market Analysis Tools on Investment Platforms

Many U.S. stock trading platforms offer market analysis tools. For example, Interactive Brokers’ TWS platform and Charles Schwab’s research tools can help you track stock performance and industry trends. - Subscribe to Economic Reports

U.S. economic indicators, such as non-farm payroll data, consumer confidence index, and GDP growth rate, significantly impact the market. Subscribing to these reports can help you better predict market trends.

Why Are Economic Trends Important?

Economic trends directly affect corporate profitability and stock prices. For example, when interest rates rise, corporate borrowing costs increase, potentially leading to profit declines. You need to monitor the Federal Reserve’s interest rate policies and inflation data to assess market risks.

Tip: You can identify investment opportunities by observing industry trends. For example, the renewable energy sector may continue to grow under policy support, while traditional energy sectors may face challenges.

Practical Suggestions

- Regularly Review Your Investment Portfolio

Adjust your investment portfolio based on market changes. For example, when technology stocks perform strongly, you can appropriately increase their allocation. - Avoid Emotional Decisions

Staying calm during market fluctuations is crucial. You can reduce risk through diversified investing, avoiding mistakes due to short-term volatility.

By staying informed about market dynamics and economic trends, you can better seize investment opportunities while reducing potential risks. This is an important step toward becoming a successful investor.

Choosing the right U.S. stock trading platform is the first step in investing in U.S. stocks. A good platform not only enhances trading efficiency but also helps you avoid unnecessary risks. Over 50% of investors rely on corporate disclosures for stock selection, while more than 40% use fundamental and technical analysis. You can combine these methods with the tools provided by the platform to formulate scientific investment strategies. Avoid relying on friend recommendations or insider tips, as these behaviors may lead to herd effects and increase investment risks. Based on your needs and goals, choose a suitable platform, embark on your U.S. stock trading journey, and seize global market opportunities.

FAQ

1. How Long Does It Take to Open a U.S. Stock Account?

Typically, the review time for opening a U.S. stock account is 1 to 3 business days. Some platforms offer expedited review services, which may complete within 24 hours. You can prepare identity proof and address proof documents in advance to speed up the review process.

Tip: Uploading clear documents can reduce review delays.

2. How to Deposit Funds After Opening an Account?

You can deposit funds into your account via international wire transfer. It’s recommended to use a bank that supports international transfers, such as a Hong Kong bank. Some platforms also support third-party payment tools. Deposit processing times are typically 1 to 3 business days.

| Method | Processing Time | Fees |

|---|---|---|

| International Wire Transfer | 1-3 business days | Approximately USD 25-50 per transfer |

| Third-Party Payment Tools | Instant | Fees vary by platform |

3. Is There a Minimum Investment Amount for U.S. Stock Trading?

Most platforms do not have a minimum investment amount requirement for U.S. stock trading. You can purchase lower-priced stocks or even invest small amounts through platforms that support fractional share trading. For example, some platforms allow you to buy partial shares with USD 10.

Note: Fractional share trading may not be available for all stocks.

4. How to Handle Tax Issues for U.S. Stock Trading?

As a non-U.S. tax resident, you need to complete a W-8BEN form to enjoy tax benefits. U.S. stock dividends are typically subject to a 30% withholding tax. Some countries have tax treaties with the U.S., which may reduce the tax rate to 10%.

Suggestion: Consult a professional tax advisor to ensure compliance.

5. How to Contact Platform Customer Service If Issues Arise?

Most platforms offer multiple customer service channels, including online chat, email, and phone support. You can choose Chinese customer service for quick issue resolution. Some platforms also provide 24/7 support to ensure timely responses to your needs.

Tip: When choosing a platform, prioritize those with fast customer service response times.

Chinese investors can seize global market opportunities through U.S. stocks like S&P 500 ETFs, Apple, or Tesla, but high remittance fees and complex account setups can be barriers. BiyaPay enables you to invest in U.S. and Hong Kong stocks without an overseas account, seamlessly accessing markets supported by platforms like Tiger Brokers, Futu, and Firstrade. The platform supports conversions across 30+ fiat currencies and 200+ cryptocurrencies, with remittance fees as low as 0.5%, covering 190+ countries for swift fund transfers. Join BiyaPay now for secure, efficient global investing. Licensed by U.S. MSB and SEC, BiyaPay ensures compliance, with real-time exchange rate tracking to optimize costs. Idle funds can grow via a 5.48% APY flexible savings product. Sign up with BiyaPay to unlock your U.S. stock investment potential!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.