- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Hong Kong International Wire Transfer Guide: A Complete Process Breakdown from Account Opening to Remittance

Image Source: pexels

Do you know what a Hong Kong international wire transfer is? It is a method of transferring funds to other countries or regions through Hong Kong banks. This method is not only safe and reliable but also highly efficient. With Hong Kong international wire transfers, you can easily complete cross-border fund transfers without worrying about complex processes or cumbersome procedures.

Choosing a Hong Kong bank for international wire transfers offers many advantages. Hong Kong banks have a well-established international payment network and support multi-currency transactions. Whether you are an individual or a business, Hong Kong banks can provide flexible wire transfer services to meet your diverse needs. Additionally, Hong Kong’s stable financial system provides extra security for your funds.

Key Points

- Choosing the right Hong Kong bank is the first step in international wire transfers. Compare fees and transfer times to ensure you select the most cost-effective service.

- Prepare identity proof, address proof, and income proof when opening an account to ensure a smooth process.

- When filling in recipient information, ensure every detail is accurate to avoid transfer failures due to errors.

- Using online banking or mobile banking for wire transfers is simple and supports 24-hour service, allowing you to complete transfers anytime, anywhere.

- Understand the fees and transfer times of different banks; choosing a bank with low fees can significantly reduce remittance costs.

Account Opening Preparation: The First Step in Hong Kong International Wire Transfers

How to Choose the Right Bank?

Choosing the right bank is the first step in Hong Kong international wire transfers. You need to consider whether the bank’s international wire transfer services are comprehensive. Hong Kong banks such as HSBC, Standard Chartered, and Hang Seng Bank offer multi-currency support, suitable for various remittance needs. You can also compare the fees and transfer times of different banks to choose the most cost-effective service. Some banks provide dedicated relationship manager services to help you quickly resolve issues. If you frequently conduct international wire transfers, choosing a bank with a stable international network will be more advantageous.

List of Required Documents for Account Opening

When opening an account with a Hong Kong bank, you need to prepare the following documents:

- Identity Proof: Such as a passport or Hong Kong ID card.

- Address Proof: Utility bills or bank statements from the past three months.

- Income Proof: Such as payslips or tax documents.

- Account Opening Application Form: Standard form provided by the bank.

Ensure all documents are clear and valid. Some banks may require additional documents, such as company registration documents or proof of business. Preparing these documents in advance will make the account opening process smoother.

Account Opening Process and Precautions

The account opening process typically includes the following steps:

| Step | Average Processing Time |

|---|---|

| Upload document photos | 3-5 minutes |

| Fill in basic information | 3-5 minutes |

| Third-party custody | 3-5 minutes |

| Risk assessment | 3-5 minutes |

| Video recording | 3-5 minutes |

You need to follow the bank’s instructions to complete each step. When uploading document photos, ensure the images are clear and meet requirements. When filling in basic information, carefully verify your name, address, and contact details to avoid errors. The third-party custody and risk assessment stages may involve financial knowledge tests, so preparing in advance will be helpful. The video recording stage is typically used for identity verification; ensure a stable internet connection to avoid interruptions.

Note that some banks may require you to visit a branch in person to complete certain steps. Booking an appointment in advance can save time. Choosing a bank that offers online account opening services will make the process more convenient.

Pre-Transfer Preparation: Ensuring Accurate Information

Before conducting a Hong Kong international wire transfer, ensuring all information is accurate is a critical step. Any errors in the information could lead to transfer failures or delays. Therefore, you need to pay special attention to the following aspects.

Specific Requirements for Recipient Information

When filling in recipient information, ensure every detail is accurate. Below are the common requirements for recipient information:

- Recipient Name: Must match the registered name on the recipient’s bank account exactly.

- Recipient Account Number: Verify carefully to avoid numerical errors.

- Recipient Bank Name: Include the full name of the bank and branch information (if applicable).

- Recipient Address: Some banks may require the recipient’s detailed address.

Tip: When filling in information, it’s recommended to refer directly to the bank account information document or screenshot provided by the recipient to avoid issues due to manual input errors.

SWIFT Code and Its Importance

The SWIFT code is an essential part of international wire transfers. It is an 8 to 11-character code composed of letters and numbers used to uniquely identify banks worldwide. Through the SWIFT code, banks can quickly and accurately transfer funds to the target bank.

For example, SWIFT codes for Hong Kong banks typically end with “HK,” such as HSBC’s code, “HSBCHKHHXXX.” When filling in the SWIFT code, ensure it matches the recipient bank’s actual code. If the SWIFT code is incorrect, funds may be returned or transferred to the wrong account.

Note: If you’re unsure about the SWIFT code, you can check with the recipient or their bank directly. Some banks’ websites also offer SWIFT code lookup functions.

Considerations for Transfer Amount and Currency Selection

When selecting the transfer amount and currency, consider the following points:

- Transfer Amount: Ensure your account balance is sufficient to cover the transfer amount and related fees. Some banks may require you to maintain a minimum balance in your account.

- Currency Selection: Choose the appropriate currency based on the recipient’s needs. If the recipient’s account supports multiple currencies, prioritize the currency matching their account to avoid additional conversion fees.

- Exchange Rate Impact: If currency conversion is required, monitor exchange rate fluctuations in advance. Some Hong Kong banks offer real-time exchange rate lookup functions to help you choose the optimal transfer timing.

Tip: When entering the amount, pay close attention to the decimal point to avoid errors in the transfer amount.

By completing these preparations, you can significantly reduce the risk of issues during the transfer process, laying a solid foundation for successfully completing a Hong Kong international wire transfer.

Specific Steps for Hong Kong International Wire Transfers

Image Source: unsplash

Conducting Wire Transfers via Online Banking

Conducting wire transfers via online banking is the preferred method for many. You simply need to log in to the bank’s website and follow these steps to complete the transfer:

- Log in to your online banking account and navigate to the “Transfer” or “International Remittance” page.

- Enter the recipient’s information, including name, account number, SWIFT code, etc.

- Select the transfer amount and currency type, confirming that your account balance is sufficient to cover the fees.

- Carefully review all information and submit the transfer request once confirmed correct.

- The system will prompt you to enter a dynamic verification code or use a security device for authentication. After verification, the transfer will be processed.

The advantage of online banking is its simplicity and 24-hour availability. You can complete Hong Kong international wire transfers anytime, anywhere, without visiting a bank branch.

Tip: When using online banking, ensure your internet connection is secure and avoid operating in public Wi-Fi environments to prevent information leaks.

Conducting Wire Transfers via Mobile Banking

Mobile banking offers a more convenient way to conduct wire transfers. You simply need to download and log in to the bank’s mobile application to complete the transfer. Here are the specific steps:

- Open the mobile banking app and navigate to the “Transfer” or “International Remittance” function.

- Enter the recipient’s information, including name, account number, SWIFT code, etc.

- Select the transfer amount and currency type, confirming that your account balance is sufficient to cover the fees.

- Review the information and click “Submit.” The system will require identity verification, such as entering a dynamic verification code or using fingerprint recognition.

- After verification, the system will display a confirmation of the successful transfer.

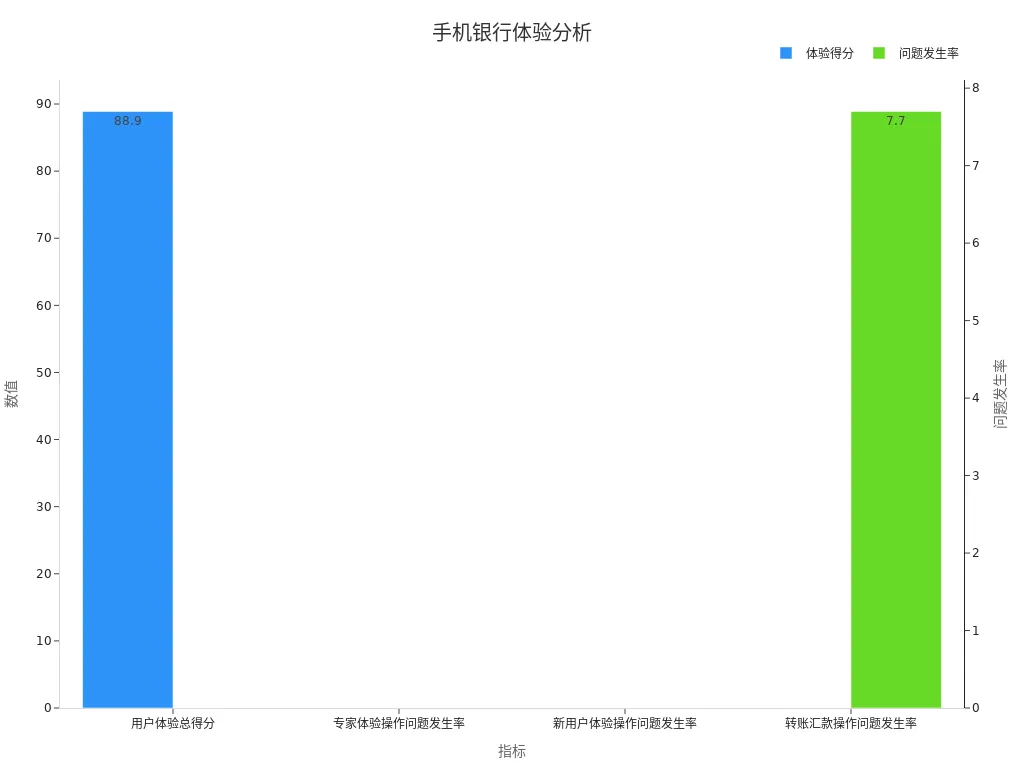

According to statistics, mobile banking scores a high user experience rating of 88.9, with both experts and new users encountering almost no issues during operation. The issue rate for transfer operations is only 7.7%. This indicates that mobile banking’s operation process is very user-friendly, suitable for most users.

| Metric | Score |

|---|---|

| Overall User Experience Score | 88.9 |

| Expert Operation Issue Rate | 0% |

| New User Operation Issue Rate | 0% |

| Transfer Operation Issue Rate | 7.7% |

Additionally, the following chart illustrates the comparison between mobile banking user experience scores and issue rates:

Tip: When using mobile banking, ensure the app is updated to the latest version for the best user experience and security.

Conducting Wire Transfers via Bank Counter

If you’re unfamiliar with online or mobile banking, you can choose to conduct wire transfers through a bank counter. Here is the process:

- Visit a bank branch and take a queue number to wait for service.

- Inform the counter staff that you need to perform an international wire transfer and provide the recipient’s information.

- Submit relevant documents, such as identity proof and account information.

- Confirm the transfer amount and currency type, and pay the associated fees.

- The staff will review the information and process the transfer. Upon completion, you will receive a transfer receipt.

The advantage of conducting wire transfers through a bank counter is the assistance of professional staff, making it suitable for users performing Hong Kong international wire transfers for the first time. You can consult the staff directly to ensure every step is accurate.

Note: Bank counter service hours are limited, so check the operating hours in advance and plan your visit accordingly.

Through these three methods, you can choose the most suitable wire transfer option based on your needs. Whether it’s online banking, mobile banking, or bank counter services, each method has its unique advantages.

Fees and Transfer Times: Cost Analysis of Hong Kong International Wire Transfers

Comparison of Fees Across Different Banks

When conducting Hong Kong international wire transfers, fees are a key cost to consider. Different banks have varying fee structures, which may influence your choice. Below is market share data to help you understand their competitiveness in the payment sector:

| Bank | Market Share |

|---|---|

| Alipay | 34.5% |

| WeChat Pay | 29% |

| UnionPay Commerce | 10.2% |

The international wire transfer fees of mainstream Hong Kong banks typically range from $5 to $45, depending on the transfer amount, currency type, and bank policies. By comparing the fee structures of different banks, you can choose the most suitable service.

Key Factors Affecting Transfer Times

Transfer times are not fixed and are influenced by multiple factors. Below are some key factors:

- Payment Method: Online and mobile banking typically have faster transfer times than bank counter services.

- Transfer Amount: Large transfers may require additional reviews, leading to delays.

- Economic Development Level: The maturity of the financial system in the destination country affects transfer times.

For example, countries with higher levels of economic development typically have more efficient payment settlement systems, which can shorten transfer processing times. Understanding these factors can help you better plan transfer times and avoid unnecessary delays.

How to Save on Fees?

If you want to reduce the costs of Hong Kong international wire transfers, try the following methods:

- Choose Banks with Low Fees: Some banks offer discounted international wire transfer services with fees as low as $5.

- Use Digital Currencies: For example, Bitcoin’s transfer fees are only $0.7, significantly lower than traditional bank fees.

- Avoid Currency Conversion: Transfer directly in the currency supported by the recipient’s account to reduce additional fees from exchange rate differences.

Through these methods, you can significantly reduce transfer costs while improving the efficiency of fund transfers.

Comparison of International Wire Transfer Services of Major Hong Kong Banks

Image Source: pexels

Features of HSBC’s Wire Transfer Services

HSBC is one of the most prominent banks in Hong Kong, known for its efficient and secure international wire transfer services. You can easily complete wire transfers via HSBC’s online or mobile banking. HSBC supports multi-currency transactions, covering major countries and regions worldwide.

Below are the key features of HSBC’s wire transfer services:

- Real-Time Exchange Rate Updates: HSBC offers real-time exchange rate lookup functions to help you choose the optimal transfer timing.

- Multiple Channel Support: Whether through online banking, mobile banking, or bank counters, HSBC meets your needs.

- Global Network Coverage: HSBC’s extensive international network ensures fast fund transfers.

Additionally, HSBC offers tailored foreign exchange solutions for corporate clients, helping businesses manage cross-border cash flows.

Tip: If you frequently conduct large transfers, HSBC’s VIP client services can offer lower fees and higher transfer limits.

Features of Standard Chartered’s Wire Transfer Services

Standard Chartered’s international wire transfer services are known for innovation and flexibility. You can complete wire transfers through Standard Chartered’s fully online platform without visiting a bank. Standard Chartered is particularly suitable for cross-border e-commerce and corporate users, with the following service features:

- Offers fully online, real-time cross-border foreign exchange settlement services, leveraging its global network advantages.

- Data connectivity with platforms like Amazon ensures secure and efficient cash flow for cross-border e-commerce.

- Develops specialized financial products in collaboration with digital partners to support innovation in foreign trade.

- Provides foreign exchange forward and lock-in products to help businesses manage foreign exchange risks.

Standard Chartered also supports cross-border business integration through customized foreign exchange solutions. If you are involved in cross-border e-commerce, Standard Chartered’s services can provide strong support for your business.

Tip: Standard Chartered’s relationship manager services offer professional foreign exchange consultation to help you better plan cash flows.

Features of Hang Seng Bank’s Wire Transfer Services

Hang Seng Bank is known for its localized services and high cost-effectiveness. You can complete wire transfers through Hang Seng’s online or mobile banking, enjoying a convenient service experience. The features of Hang Seng Bank’s wire transfer services include:

- Low Fees: Hang Seng Bank’s international wire transfer fees are typically lower than those of other mainstream banks, making it suitable for individual users and SMEs.

- Localized Support: Focused on the Hong Kong market, Hang Seng Bank provides services tailored to local users’ needs.

- Fast Transfers: Hang Seng Bank’s wire transfer services typically complete fund transfers within 1-2 business days.

Hang Seng Bank also offers real-time exchange rate lookups and foreign exchange consultation services to help you better plan cross-border cash flows. If you prioritize cost-effectiveness, Hang Seng Bank is a great choice.

Note: Some of Hang Seng Bank’s services may require prior appointments, so confirm the specific process with the bank before transferring.

Features of Bank of China (Hong Kong) (BOC HK)’s Wire Transfer Services

Bank of China (Hong Kong) (BOC HK) is one of the major institutions in Hong Kong offering international wire transfer services. Its services are known for stability and extensive coverage. If you need to conduct cross-border remittances, BOC HK is a worthy option.

Service Features

- Global Coverage: BOC HK has an extensive international network, covering over 100 countries and regions. Regardless of the recipient’s location, you can complete transfers through BOC HK.

- Multi-Currency Support: You can transfer in currencies such as USD, EUR, GBP, and more to meet various cross-border payment needs.

- High Security: BOC HK uses advanced encryption technology to ensure your funds are secure during transfer.

Fees and Transfer Times

BOC HK’s international wire transfer fees typically range from $20 to $40, depending on the transfer amount and destination country. Transfer times are generally 1 to 3 business days. If you opt for expedited services, funds may arrive within 24 hours, but additional fees apply.

Tip: Before transferring, you can check real-time exchange rates and fee details on BOC HK’s website to better plan transfer costs.

Usage Methods

You can complete wire transfers through the following methods:

- Online Banking: Log in to BOC HK’s online banking platform, fill in recipient information, and submit the transfer request.

- Mobile Banking: Download BOC HK’s mobile app to complete transfers anytime, anywhere.

- Bank Counter: Visit a branch, and staff will assist in completing the transfer.

BOC HK also offers relationship manager services. If you need large transfers or customized foreign exchange solutions, you can contact a relationship manager for professional advice.

Note: When filling in transfer information, ensure the recipient’s name, account number, and SWIFT code are accurate to avoid transfer failures or delays.

Common Issues and Solutions

Common Reasons for Transfer Failures and Solutions

Transfer failures can be frustrating, but understanding common reasons can help you resolve issues quickly. Below are some common causes and their solutions:

- Incorrect Recipient Information: If the recipient’s name, account number, or SWIFT code is incorrect, the bank will reject the transfer.

- Solution: Carefully verify the information to ensure it matches the recipient’s provided details exactly.

- Insufficient Account Balance: If the account balance is insufficient to cover the transfer amount and fees, the transfer will fail.

- Solution: Check your account balance before transferring and ensure sufficient funds.

- Bank System Issues: System maintenance or network failures may cause transfer failures.

- Solution: Contact bank customer service to confirm system status and retry the transfer.

- Transfer Amount Exceeds Limits: Some banks set caps on single transfer amounts.

- Solution: Split the transfer into smaller amounts or contact the bank to request a higher limit.

Tip: Before transferring, confirm all information with the bank to avoid delays due to minor errors.

How to Check Transfer Status?

Checking the transfer status helps you confirm whether funds have been successfully transferred. Hong Kong banks typically offer multiple inquiry methods, including online banking, mobile banking, and customer service hotlines. Below are common inquiry steps:

- Log in to online or mobile banking and navigate to the “Transaction History” or “Transfer Status” page.

- Enter the transfer reference number or transaction date, and the system will display the transfer status.

- If online channels are unavailable, call the bank’s customer service hotline and provide relevant information for assistance.

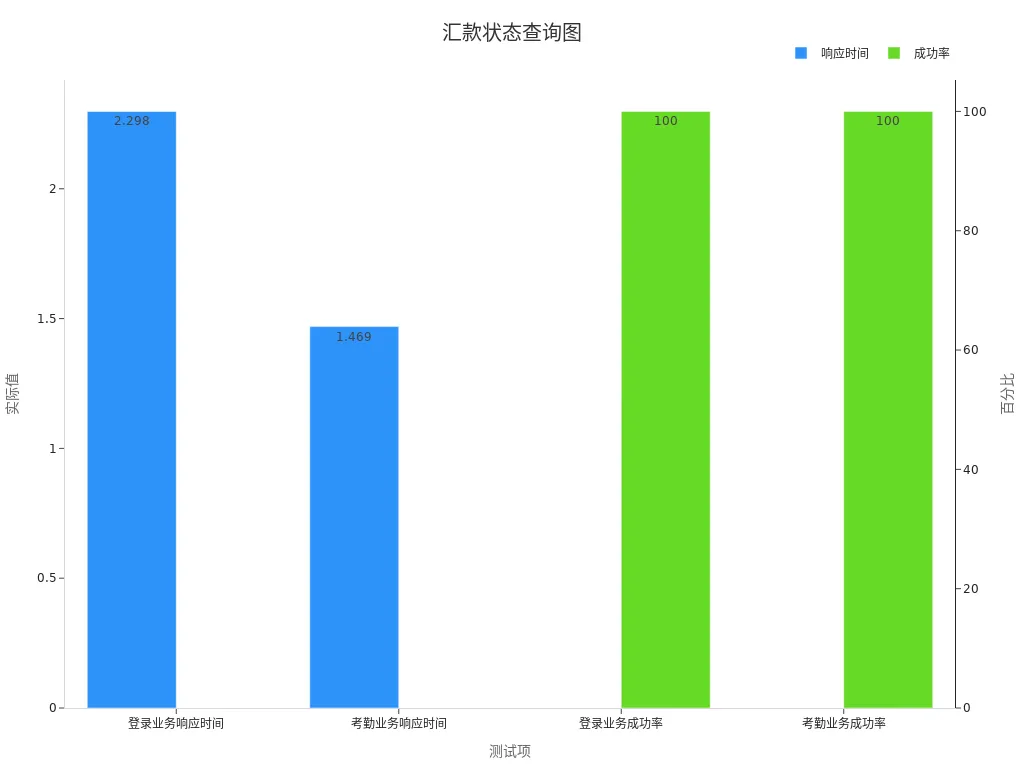

According to statistics, most banks’ inquiry systems respond quickly with high success rates. Below are test results:

| Test Item | Target Value | Actual Value | Pass/Fail |

|---|---|---|---|

| Login Response Time | <=3 seconds | 2.298 seconds | Y |

| Attendance Response Time | <=3 seconds | 1.469 seconds | Y |

| Login Success Rate | 100% | 100% | Y |

| Attendance Success Rate | 100% | 100% | Y |

Additionally, the following chart illustrates response times and success rates of inquiry systems:

Tip: When inquiring, ensure you have the transfer reference number or transaction receipt on hand for quick results.

Remedies for Incorrectly Filled Transfer Information

If you discover errors in the transfer information, don’t worry. Below are some remedies:

- Contact the Bank Immediately: Call the bank’s customer service hotline, explain the situation, and provide the transfer reference number. Banks can often modify information before funds are transferred.

- Request a Refund: If funds have been transferred but not yet received, you can request a refund. The bank will contact the recipient’s bank to process the refund.

- Resend the Transfer: After the refund is processed, re-enter the correct information and resend the transfer.

Note: Processing refunds may take several business days, depending on the bank’s policies. To avoid such issues, carefully review all information before submitting the transfer request.

By following these methods, you can effectively address common issues during Hong Kong international wire transfers, ensuring funds arrive smoothly.

The entire process of Hong Kong international wire transfers is not complex. You simply need to start with account opening, gradually complete document preparation, transfer operations, and fee planning. Choosing the right bank and transfer method is crucial. The service features and fee differences of various banks will affect your experience. Preparing all documents in advance can make transfers more efficient. By learning these steps, you can easily complete cross-border fund transfers and enjoy the high-quality services provided by Hong Kong banks.

FAQ

1. How can I confirm my transfer was successful?

You can confirm through the following methods:

- Log in to online or mobile banking to check transaction records.

- Contact the bank’s customer service with the transfer reference number to check the status.

- The recipient will typically notify you once the funds are received.

Tip: Keep the transfer receipt for easy reference during inquiries.

2. Will funds be refunded if the transfer fails?

Yes, funds are typically refunded to your account. The bank will notify you after processing the failure. Refund times may take 1 to 5 business days, depending on the bank’s policies.

Note: Ensure the information is accurate to avoid unnecessary delays.

3. Can I cancel a submitted transfer?

If the funds have not yet been transferred, you can contact customer service to request cancellation. Some banks may charge a fee. If the funds have already been transferred, cancellation becomes complex and may require coordination with the recipient’s bank.

Tip: Carefully review all information before submitting the transfer.

4. Why is my transfer taking longer than expected?

Transfer times may be affected by the following factors:

- The recipient country’s bank processes transfers slowly.

- Large transfer amounts require additional reviews.

- Holidays or bank system maintenance occur.

Suggestion: Plan transfer times in advance to avoid delays impacting fund usage.

5. How can I avoid high transfer fees?

You can try the following methods:

- Choose banks with lower fees, such as Hang Seng Bank.

- Avoid currency conversion by transferring in the currency supported by the recipient’s account.

- Use promotional offers or membership services for fee discounts.

Tip: Check with bank customer service in advance for the latest promotional policies.

Hong Kong international wire transfers face high fees, errors causing failures, delivery delays, and exchange rate losses. BiyaPay offers a streamlined cross-border remittance solution, supporting conversions across 30+ fiat currencies and 200+ cryptocurrencies with remittance fees as low as 0.5%, covering 190+ countries with same-day delivery. With real-time exchange rate tracking and advanced encryption, BiyaPay ensures fund safety and minimizes losses. Join BiyaPay now to simplify your transfers! You can also invest in U.S. and Hong Kong stocks directly on the BiyaPay platform without needing an additional overseas account, enhancing capital efficiency. Idle funds can earn a 5.48% APY through current investment products, backed by BiyaPay’s U.S. MSB and SEC licenses. Sign up with BiyaPay for cost-effective, secure global remittances!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.