- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

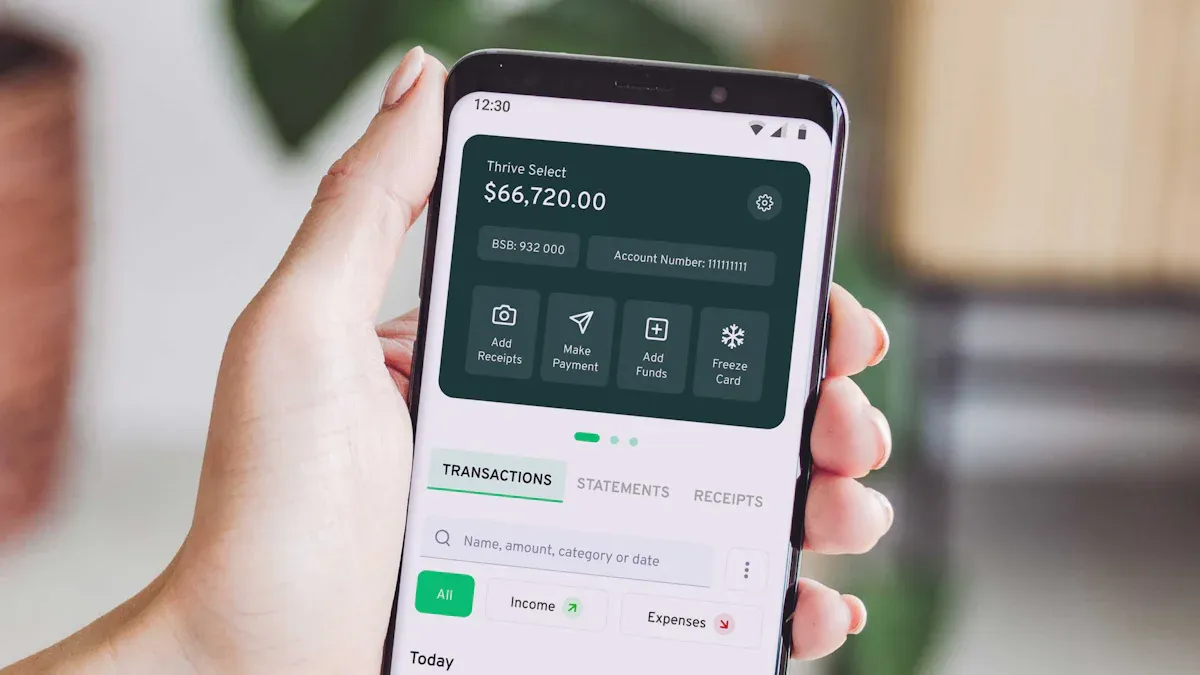

How to Quickly Unfreeze a Bank Card: International Remittance Guide

Image Source: pexels

When a bank card is frozen, many people feel anxious and unsure how to resolve the issue quickly. Data shows that in 2020, Yiwu City had over 10,000 frozen accounts, with total frozen funds exceeding 1 billion yuan, doubling compared to 2019. This trend highlights the severity of the issue, especially in international remittances. In recent years, the U.S. has intensified financial oversight of non-bank payment and e-commerce businesses, and the increase in frozen cases is closely tied to strengthened anti-money laundering enforcement.

If your bank card is frozen during an international remittance, understanding the specific steps for “how to unfreeze a bank card involved in international remittances” is crucial. By mastering the correct methods, you can unfreeze your account faster and avoid financial losses.

Common Reasons for a Bank Card Being Frozen

Abnormal Transactions or Suspicious Activities

Banks closely monitor account transaction behaviors. If your account shows abnormal transactions, such as multiple large transfers in a short period or frequent cross-border transactions, the system may flag them as suspicious activities. In such cases, banks typically freeze the account to protect fund security.

Tip: If you plan to conduct large transactions, it’s advisable to notify the bank in advance to avoid triggering the system’s risk alerts.

Additionally, using a bank card for illegal activities, such as money laundering or fraud, can lead to account freezing. Even if you unintentionally participate in illegal activities but your account is exploited by others, it may trigger freezing issues. Therefore, protecting account information is very important.

Exceeding Remittance Limits or Violating Foreign Exchange Regulations

When conducting international remittances, exceeding regulated amounts or violating foreign exchange policies is a common reason for bank card freezing. According to relevant regulations, individuals and businesses must comply with strict rules during foreign exchange transactions. Below are some common violations and their consequences:

| Violation Type | Impact and Consequences |

|---|---|

| Failure to Register Foreign Exchange | May face administrative penalties, affecting normal business operations |

| Violating Foreign Exchange Account Management Rules | May lead to restricted use of foreign exchange accounts, affecting fund flow |

| Evading Foreign Exchange or Illegal Foreign Exchange Trading | Involves serious violations, may face heavy fines and legal liabilities |

Note: The consequences of violations may also depend on the following factors:

- The relationship between the violation and shareholder contributions

- The severity of the violation

- Whether rectification has been completed and penalties accepted

To avoid freezing, you need to understand the foreign exchange policies of the target country in advance and ensure all transactions comply with regulations.

Bank System Errors or Technical Issues

Sometimes, a bank card is frozen not due to your fault but because of bank system errors or technical issues. For example, system upgrades or maintenance may cause abnormal account freezing. In such cases, banks usually proactively contact you and provide solutions.

Suggestion: If you find your account frozen without abnormal transactions, contact bank customer service promptly to confirm whether it’s a system issue.

By understanding these common reasons, you can better prevent bank card freezing situations.

Legal or Regulatory Requirements

Bank card freezing is sometimes directly related to legal or regulatory requirements. State authorities may freeze accounts during law enforcement to investigate economic crimes, protect creditors’ rights, or maintain financial order. You need to understand relevant legal provisions to better handle such situations.

Below are some legal provisions related to account freezing:

| Provision | Content |

|---|---|

| Article 88 | During the reorganization of a bankrupt enterprise, tax authorities should automatically lift the non-compliant household status. |

| Article 90 | People’s Procuratorates should correct illegal seizures, detentions, or freezing of corporate assets in accordance with the law. |

| Article 91 | Supervisory authorities should strengthen oversight and accountability of public officials in optimizing the business environment. |

These provisions indicate that state authorities must follow legal procedures when imposing freezing measures to avoid unnecessary impact on normal business or personal activities. If you believe your account was frozen due to improper actions, you can appeal to relevant departments based on these provisions.

Additionally, the state has specified conditions and procedures for implementing freezing measures:

| Provision | Content |

|---|---|

| Article 60 | State authorities and their staff conducting investigations or requesting assistance should avoid or minimize impact on normal production and business activities. |

| Article 62 | Seizure, detention, or freezing of involved assets should comply with legal authority, conditions, and procedures, strictly distinguishing between legal assets and illicit gains. |

These regulations emphasize that freezing measures must be legal and compliant, minimizing impact on unrelated assets. If your account is frozen, you can request the bank or relevant authorities to provide the basis for the freeze and verify compliance with the above regulations.

When facing such issues, timely communication with the bank and relevant institutions is crucial. Understanding legal provisions not only helps you protect your rights but also enables you to handle issues more confidently.

Specific Steps to Unfreeze a Bank Card Involved in International Remittances

Image Source: unsplash

Identifying the Reason for Freezing

When a bank card is frozen during an international remittance, the first step is to identify the specific reason for the freeze. You can obtain preliminary information by checking notifications or SMS sent by the bank. If no notifications are received, logging into online banking or mobile banking to check account status is also important. Common reasons for freezing include abnormal transactions, violations of foreign exchange regulations, or legal requirements.

To understand the situation more accurately, you need to review recent transaction records. Check for large transfers, frequent cross-border transactions, or other activities that may trigger the bank’s risk controls. If you identify an issue related to a specific transaction, note down details such as time, amount, and recipient.

Tip: If you’re unsure about the reason for the freeze, avoid further operations to prevent worsening the issue. Contact bank customer service promptly for detailed information.

Contacting Bank Customer Service or Relevant Institutions

After identifying the reason for the freeze, you need to immediately contact bank customer service or relevant institutions. Calling the bank’s official customer service hotline is the quickest method. For example, with Hong Kong banks, you can communicate directly with staff through their 24-hour hotline. When calling, prepare your identity documents and bank card information for quick verification.

If the issue involves international remittances, you may need to contact the remittance platform or intermediary institution. For example, when using PayPal or Western Union for remittances, their customer service can also provide assistance.

When communicating with the bank or institution, clearly describe the issue and provide relevant information. Below is an effective communication template:

Hello, my bank card was frozen during an international remittance. I’ve identified that the reason may be related to [specific reason]. What documents do I need to provide to unfreeze the account?

Note: Always contact the bank or institution through official channels to avoid disclosing personal information to unverified third parties.

Providing Necessary Identity and Transaction Proof

Banks typically require you to provide a series of documents to verify your identity and confirm the legitimacy of transactions. Below are common documents:

- Proof of Identity: Copies of your passport or ID.

- Transaction Records: Detailed proof of the frozen transaction, such as remittance receipts or email confirmations.

- Proof of Fund Source: If the bank suspects unclear fund origins, you may need to provide payslips, contracts, or other income proof.

Organize these documents and submit them through the bank’s specified method, such as uploading to the online banking system or visiting a bank branch in person. For example, some Hong Kong banks allow customers to submit documents via email, but you need to ensure the email address is authentic.

Suggestion: After submitting documents, proactively follow up on the unfreezing progress. Banks typically require several business days to review documents, but your timely communication can expedite the process.

By following these steps, you can more efficiently resolve issues with a frozen bank card in international remittances. Mastering these methods not only helps you unfreeze your account quickly but also provides valuable experience for future transactions.

Following Bank Requirements to Complete the Unfreezing Process

The final step in unfreezing a bank card is to strictly follow the bank’s requirements. Each bank’s unfreezing process may vary slightly, but it typically includes the following key steps:

- Submitting Required Documents

The bank will clearly specify the list of required documents. You need to ensure all documents are complete and meet requirements. For example, identity proof documents need clear copies, and transaction records should indicate specific times and amounts. If the bank requires proof of fund source, you can submit payslips, contracts, or bank statements.Tip: Before submitting documents, carefully verify their accuracy to avoid delays due to errors.

- Choosing the Appropriate Submission Method

Banks typically offer multiple ways to submit documents, including online uploads, email, or in-person submission. Choose the most convenient method and follow the bank’s instructions. For example, when uploading files through online banking, ensure the file format meets requirements (e.g., PDF or JPG). If submitting in person, bring originals for verification.Suggestion: If unsure about the submission method, call the bank’s customer service hotline to clarify and avoid delays due to incorrect submissions.

- Cooperating with Further Verification

During the review process, the bank may request additional information or supplementary documents. For example, if the transaction involves international remittances, the bank may further verify the remittance’s legitimacy. You need to respond promptly to the bank’s requests and submit supplementary documents within the specified timeframe.Note: If the bank requires an in-person interview or phone verification, remain patient and answer questions truthfully. Clear communication helps expedite the unfreezing process.

- Confirming Account Unfreezing Status

After submitting all documents, the bank will conduct a review. Upon approval, the bank will notify you that the account has been unfrozen. You can confirm the account status through online banking, mobile banking, or by calling customer service. If the account remains frozen, contact the bank promptly to understand the reason.Tip: After unfreezing, change your account password immediately and check for any abnormal transaction records to ensure fund security.

By following these steps, you can successfully complete the bank card unfreezing process. Whether for domestic transactions or international remittances, adhering to the bank’s requirements is key to resolving the issue. Mastering these methods allows you to unfreeze your account quickly and gain valuable experience for future transactions. If you encounter similar issues again, you’ll handle them with greater confidence.

Documents Required to Unfreeze a Bank Card

When a bank card is frozen, the unfreezing process requires submitting necessary documents. These documents not only help the bank verify your identity but also prove the legitimacy of transactions. Below are the specific items you need to prepare:

Identity Proof Documents

Identity proof documents are the primary materials required to unfreeze a bank card. The bank needs to confirm your identity to ensure account security. You can prepare the following documents:

- ID Card or Passport: Provide clear copies or scans.

- Proof of Residence: If required by the bank, you can submit utility bills or rental contracts as supplementary proof.

Tip: Ensure all document information matches the registered information of the bank account. If your ID documents have expired, update them promptly before submission.

Bank Card and Account Information

Bank card and account information are essential parts of the unfreezing process. The bank needs to verify the specific details of the frozen account. You need to prepare the following:

- Photos of Bank Card Front and Back: Ensure the card number is clearly visible, but cover the CVV code to protect privacy.

- Account Information: Include account name, account number, and issuing bank name.

Suggestion: If you have multiple accounts, ensure you submit the correct account information to avoid delays in the unfreezing process.

Transaction Records or Remittance Receipts Involved

Transaction records and remittance receipts are critical materials to prove transaction legitimacy. Especially in cases where international remittances are frozen, these documents help the bank quickly verify the issue. Below are items you can submit:

- Transaction Details: Provide recent transaction records, including time, amount, and recipient information.

- Remittance Receipts: If the frozen transaction involves international remittances, submit email confirmations or receipts from the remittance platform.

- Proof of Fund Source: Such as payslips or contracts to prove the legal origin of funds.

Note: When organizing these materials, ensure the information is complete and clear. Banks typically require originals or copies, depending on their specific requirements.

By preparing the above materials, you can complete the unfreezing process more smoothly. Whether for domestic transactions or international remittances, submitting complete documents is key to resolving the issue. Mastering these methods allows you to handle similar issues more efficiently.

Other Documents the Bank May Require

Different banks may require additional documents when unfreezing a bank card. These documents are typically used to further verify account information or transaction legitimacy. You need to prepare relevant materials based on the bank’s specific requirements to ensure a smooth unfreezing process. Below are common additional document types:

1. Proof of Fund Usage

The bank may require a detailed explanation of fund usage. This is to ensure transactions comply with relevant regulations and avoid illegal activities. Below are common proofs of fund usage:

- Contracts or Agreements: If the transaction involves business activities, submitting relevant contracts or agreements can prove the legitimate use of funds.

- Invoices or Receipts: Used to prove funds were used for legitimate purchases of goods or services.

- Project Proposals: If funds are used for investments or project development, submitting a proposal can help the bank verify usage.

Tip: When preparing these documents, ensure the content is clear and consistent with transaction records. The bank will carefully verify the authenticity of the information.

2. Tax-Related Documents

Some banks may require tax-related documents, especially for large transactions or international remittances. These documents help the bank confirm compliance with tax regulations. Below are common tax documents:

- Tax Registration Certificate: Used to prove the enterprise or individual is legally registered for tax purposes.

- Tax Payment Certificate: If the transaction involves taxes, submitting a tax payment certificate can avoid additional scrutiny.

- Tax Declaration Forms: Used to verify whether transaction amounts align with declared amounts.

Note: If you cannot provide tax documents, you may need additional time to communicate with tax authorities to resolve the issue.

3. Associated Account Information

The bank may require information about other accounts linked to the frozen account. This is to verify whether fund flows between accounts are normal. Below are possible associated account details to submit:

- Transaction Records of Associated Accounts: Including time, amount, and transaction type.

- Proof of Associated Account Opening: Used to confirm the account’s legitimacy.

- Account Holder Information: If the associated account belongs to someone else, you may need to provide the holder’s identity proof.

Suggestion: When submitting associated account information, ensure all data is accurate to avoid affecting the unfreezing progress.

4. Industry-Specific Documents

If your account involves special industries, such as finance, real estate, or cross-border e-commerce, the bank may require additional industry-related documents. These documents help the bank better understand the transaction context. Below are common industry documents:

- Industry Licenses: Used to prove the enterprise or individual’s legal operating qualifications in the relevant industry.

- Business Reports: If the transaction involves complex business processes, submitting detailed business reports can help the bank verify the situation.

- Industry Regulatory Documents: Such as filing proofs for cross-border e-commerce or compliance reports for the financial industry.

Tip: If you operate in a special industry, preparing relevant documents in advance can save unfreezing time.

5. Other Document Types the Bank May Require

Different banks may have varying requirements. Below are other possible document types:

| Document Type | Purpose Description |

|---|---|

| Proof of Assets | To verify the account holder’s financial status |

| Proof of Family Relationship | If the account involves co-holders, proof of relationship is needed |

| Legal Documents | If the account freeze involves legal issues, relevant documents are required |

Suggestion: Before submitting documents, carefully read the bank’s requirement list to ensure all materials comply with regulations.

By preparing these additional documents, you can better meet the bank’s review requirements. Whether for domestic transactions or international remittances, complete materials are key to unfreezing the account. Mastering this information allows you to complete the unfreezing process more efficiently and avoid similar issues in the future.

How to Avoid Bank Card Freezing During International Remittances

Image Source: unsplash

Complying with Remittance Amount and Frequency Regulations

In international remittances, complying with amount and frequency regulations is key to avoiding bank card freezing. Banks closely monitor transactions, and below are common monitoring elements:

| Monitoring Standard Element | Description |

|---|---|

| Customer Identity | Monitoring customer identity information |

| Behavior | Monitoring customer transaction behavior |

| Fund Source | Monitoring the source of transaction funds |

| Amount | Monitoring transaction amounts |

| Frequency | Monitoring transaction frequency |

| Flow Direction | Monitoring the direction of fund flows |

| Nature | Monitoring the nature of transactions |

Data from 2023 shows that approximately 240 institutions were penalized for violating anti-money laundering regulations, with fines totaling up to 5 billion yuan. The banking sector accounted for the highest proportion of violations, followed by payment institutions. The dual penalty rate for institutions and individuals reached 99%. These data indicate that banks monitor transaction amounts and frequencies very strictly.

Tip: Before remitting, understand the bank’s limit regulations. Avoid frequent small transfers or single large remittances, as these behaviors easily trigger the bank’s risk control system.

Understanding the Target Country’s Foreign Exchange Policies in Advance

Foreign exchange policies vary across countries. Understanding the target country’s regulations in advance can effectively prevent transactions from being rejected or accounts from being frozen. For example, some countries impose strict restrictions on foreign exchange inflows, while others require detailed proof of fund sources.

Suggestion: Before remitting, check the target country’s foreign exchange management policies. You can obtain the latest information through the bank’s website or by consulting professionals. Ensure all transactions comply with local regulations to avoid fund blockages due to policy non-compliance.

Using Legitimate Channels for Remittances

Choosing legitimate channels for remittances not only increases transaction success rates but also reduces the risk of freezing. Wire transfers are a common legitimate channel, simple to operate and fast, suitable for quick transfers of large funds. However, wire transfers also carry risks of being exploited by criminals, particularly in customer identity verification and transaction authenticity reviews. In contrast, underground money changers, while low-cost, are highly risky due to their covert nature, making them a preferred choice for illegal fund transfers.

Note: Always choose reputable banks or remittance platforms for transactions. Legitimate channels not only ensure fund safety but also provide comprehensive after-sales support. If you doubt a platform’s legitimacy, stop the transaction immediately and consult professionals.

By complying with remittance regulations, understanding foreign exchange policies, and choosing legitimate channels, you can effectively reduce the risk of bank card freezing. These methods not only protect your funds but also make international remittances smoother.

Keeping All Transaction Records for Reference

Keeping transaction records is an important step to ensure fund safety. By maintaining detailed transaction information, you can quickly respond to inquiries from banks or regulatory authorities. This not only helps prove transaction legitimacy but also prevents account freezing due to insufficient information.

Why Keep Transaction Records?

Keeping transaction records helps you provide necessary information at critical moments. Below are specific suggestions:

- Record the time, amount, and recipient information for each transaction.

- Save remittance receipts, such as email confirmations or receipts.

- Regularly back up transaction records to prevent data loss due to device failure.

Some financial institutions fail to provide detailed information on customer identity, fund sources, and destinations when submitting suspicious transaction reports. This can lead to account freezing or transaction blockages. Therefore, complete transaction records not only protect your rights but also increase the bank’s trust in you.

Requirements for Transaction Record Retention Across Countries

Different countries have clear regulations on transaction record retention. Below is a common suggestion:

| Suggestion Content | Description |

|---|---|

| Retain Transaction Records | Countries should require financial institutions to retain all necessary domestic and international transaction records for at least five years to promptly provide information required by competent authorities. |

You can follow this suggestion to ensure your transaction records meet international standards. The longer you retain records, the more confidently you can handle future inquiries.

How to Efficiently Manage Transaction Records?

To better manage transaction records, you can adopt the following measures:

- Use spreadsheets or dedicated software to categorize transaction information.

- Periodically check the completeness of records to ensure nothing is missing.

- Store important transaction records in the cloud to prevent data loss.

By implementing these methods, you can easily manage transaction records and ensure fund safety. Whether for domestic or international remittances, complete records are key to resolving issues. Developing a habit of keeping transaction records provides strong support for your financial management.

Safety Tips for International Remittances

Choosing Reputable Banks or Remittance Platforms

Choosing a reputable bank or remittance platform is the first step to ensuring international remittance safety. Reputable institutions typically have robust risk control systems and strict customer identity verification processes, effectively preventing fund theft or account misuse.

When choosing a bank or platform, consider the following:

- Check User Reviews: Search online or consult friends to understand the platform’s reputation.

- Verify Credentials: Ensure the platform holds a valid financial license and is supervised by relevant regulatory authorities.

- Understand Fee Structures: Legitimate platforms transparently list fees and exchange rates, avoiding hidden charges.

Tip: Avoid using unknown or uncertified platforms, even if they offer lower fees or faster services. Fund safety should always be your top priority.

Avoiding Transactions on Public Networks

Public networks have lower security, making them vulnerable to hackers and leading to sensitive information leaks. When conducting international remittances, avoid using public Wi-Fi or unencrypted networks.

Below are real cases illustrating the severity of public network security risks:

| Case Number | Date | Location | Incident Description | Outcome |

|---|---|---|---|---|

| 3 | March 2023 | Huaihua City, Hunan Province | A gas company’s payment system stored sensitive customer data without a boot password, used weak passwords, and lacked a data security management system. | Warning and ordered to rectify within a deadline |

| 5 | March 10, 2023 | Zhuzhou City | A software school’s website had data leak risks and lacked technical protection measures. | Warning and ordered to rectify within a deadline |

| 8 | May 30, 2023 | Xupu County | A mobile phone store stored sensitive customer data on an unprotected computer, posing leak risks. | Administrative penalty |

Suggestion: Use private networks or mobile data for transactions and ensure devices have the latest security patches and antivirus software installed.

Regularly Checking Account Status

Regularly checking account status helps you detect abnormal transactions promptly, avoiding greater losses. By reviewing account details, you can confirm whether there are unauthorized transfers or other suspicious activities.

Regular account checks can effectively identify potential risks. You can set a fixed weekly or monthly time to log into online or mobile banking to review account details.

Tip: Enable transaction alert functions to receive immediate notifications for each transaction. If you detect anomalies, contact bank customer service immediately.

Setting Up Transaction Alert Functions

Setting up transaction alert functions is an effective way to protect account safety. By receiving real-time transaction notifications, you can detect abnormal activities promptly and take action. Below are specific steps and suggestions for setting up transaction alerts:

- Enable SMS or Email Alerts

Log into online or mobile banking, navigate to “Account Settings” or “Security Center,” and select the “Transaction Alerts” function. Enable SMS or email notifications and set alert conditions, such as every transaction, transactions exceeding a certain amount, or international remittances. - Customize Alert Content

Some banks allow you to customize alert content. You can choose to receive details like transaction amount, time, and location. This helps you quickly determine whether a transaction is normal.Tip: If you frequently conduct international remittances, enable alerts for all cross-border transactions to stay informed about fund movements.

- Use Bank App Push Notifications

Download and log into the bank’s official app and enable push notifications. This method is fast and avoids delays from SMS or email.Note: Ensure your phone system and bank app are updated to avoid security vulnerabilities.

- Periodically Check Alert Settings

Regularly verify your alert settings to ensure they function properly. If you change your phone number or email address, update the information promptly.

By setting up transaction alerts, you can proactively manage account safety. Whether for daily spending or international remittances, real-time alerts provide peace of mind. Combining regular account checks with alert functions effectively reduces risks and protects your funds.

When a bank card is frozen, the key to quick unfreezing lies in identifying the reason and taking the right measures. You need to communicate with the bank promptly, provide complete documents, and follow the unfreezing process. The success rate depends on the case nature and the bank’s review efficiency. The normal cycle is 1 to 3 months, and promises of quick unfreezing are often unreliable. When choosing professional teams, beware of claims guaranteeing 100% unfreezing.

Understanding the reasons for freezing helps prevent future issues. Especially in international remittances, complying with remittance regulations, using legitimate channels, and keeping transaction records are effective ways to reduce risks. Developing good transaction habits ensures greater fund safety.

Tip: Prevention is better than remedy. Regularly check account status and set transaction alerts to keep every transaction under your control.

FAQ

1. Why Was My Bank Card Suddenly Frozen?

Bank cards are typically frozen due to abnormal transactions, violations of foreign exchange regulations, or legal requirements. You can review recent transaction records to identify suspicious activities. If unsure, contact bank customer service promptly.

2. How Long Does It Take to Unfreeze a Bank Card?

Unfreezing time varies by case. It generally takes 1 to 3 months, depending on the bank’s review speed and the completeness of submitted documents. Proactively following up can ensure a smoother process.

3. What If My Transaction Records Are Incomplete?

Incomplete transaction records may delay unfreezing. Try obtaining supplementary records from the remittance platform or bank. If still unable to provide complete information, contact the bank to explain and seek solutions.

4. How Can I Avoid Bank Card Freezing?

Comply with remittance amount and frequency regulations, use legitimate channels, and retain all transaction records. These methods effectively reduce freezing risks. Understanding the target country’s foreign exchange policies is also important.

5. Can I Use a Third-Party Agency for Quick Unfreezing?

Third-party agencies may claim quick unfreezing, but caution is needed. Many cannot guarantee results and may involve scams. It’s recommended to communicate directly with the bank and follow official procedures.

Bank account freezes, often due to suspicious transactions, forex violations, or legal requirements, affected over 10,000 accounts in Yiwu in 2020, highlighting international remittance risks. BiyaPay enables you to invest in U.S. and Hong Kong stocks without an overseas account, minimizing freeze risks with secure, efficient cross-border transactions. Supporting conversions across 30+ fiat currencies and 200+ cryptocurrencies, BiyaPay offers remittance fees as low as 0.5%, covering 190+ countries for swift transfers. Join BiyaPay now for compliant remittances. Licensed by U.S. MSB and SEC, BiyaPay provides real-time exchange rate tracking to optimize costs, with idle funds earning a 5.48% APY via flexible savings. Adhere to remittance rules, keep transaction records, and sign up with BiyaPay to ensure secure, cost-effective transfers!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.