- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

UK International Remittance 2025: A Detailed Guide to the Latest Process

Image Source: unsplash

UK international remittances in 2025 have seen significant process optimizations. The application of open banking technology has made remittances more convenient while reducing reliance on traditional payment methods. According to the UK payment market report, the transformation of payment methods has accelerated, and consumer experience has significantly improved. You can enjoy safer remittance services through simpler identity verification processes. Although the total payment volume is growing slowly, technological innovations have boosted the efficiency of peer-to-peer transfers, offering more options. Understanding these changes can help you better plan your remittance process and avoid unnecessary hassles.

Key Points

- In 2025, the UK international remittance process has become simpler, with open banking technology making remittances more convenient.

- Choosing the right remittance method can save on fees. Third-party platforms are suitable for small transfers, while bank counters are ideal for large transactions.

- Ensure accurate recipient information to avoid transfer failures or delays due to errors.

- Monitor exchange rate changes and transfer when rates are favorable to receive more of the target currency.

- Understand remittance limits and declaration requirements to ensure compliance with relevant laws and avoid unnecessary issues.

Basic Concepts of International Remittance

Definition of International Remittance

International remittance refers to the process of transferring funds from one country to another. Both individuals and businesses can complete this operation through banks, third-party payment platforms, or other financial institutions. International remittances are commonly used for cross-border transactions, supporting family members, or overseas investments.

In the modern financial system, international remittances rely on global banking networks and technology platforms. By using the International Bank Account Number (IBAN) and the Society for Worldwide Interbank Financial Telecommunication code (SWIFT code), funds can be transferred quickly and securely to their destination.

Below are some key statistics related to international remittances:

| Statistical Indicator | Description |

|---|---|

| International Remittance App Revenue | Revenue of major providers |

| Market Share | Market share of major providers |

| Ranking | Market ranking of major providers |

| Regional Analysis | Scale and trends of major regions over the past and next five years |

These data indicate that the international remittance market is growing rapidly, particularly in mobile apps and digital payments.

Applicable Scenarios for International Remittance

International remittances are suitable for various scenarios, meeting diverse user needs. Below are some common use cases:

- Cross-Border Trade: Businesses use international remittances to pay suppliers or receive customer payments.

- Family Support: Individuals send money to family or friends abroad, such as for tuition or living expenses.

- Overseas Investment: Investors transfer funds to other countries for purchasing real estate or financial products.

According to statistical data, the usage proportion for different scenarios is as follows:

| Applicable Scenario | Usage Proportion |

|---|---|

| Use of “UK” in Address Field | 78% |

| Use of “GB” in SWIFT Code | 100% |

These data show that UK international remittances play a significant role in cross-border payments. Whether for individuals or businesses, choosing the right remittance method can enhance efficiency and reduce costs.

Latest Process for UK International Remittance

Image Source: unsplash

Bank Counter Process

Processing international remittances through a bank counter is one of the most traditional methods. You need to visit a bank branch in person and follow these steps:

- Prepare Necessary Documents: Bring valid identification (e.g., passport) and the bank account details required for the remittance, including the recipient’s IBAN and SWIFT code.

- Fill Out the Remittance Application Form: Obtain and complete the international remittance application form at the counter, ensuring all information is accurate.

- Submit Application and Pay Fees: Submit the completed form to the bank staff and pay the relevant fees. Fees typically depend on the remittance amount and destination country.

- Confirm Remittance Information: The bank will provide a remittance confirmation slip, which you should review carefully and sign to confirm accuracy.

The advantage of bank counter processing is high security, making it suitable for users unfamiliar with online operations. However, this method may involve longer waiting times, especially during peak hours.

Online Banking or Mobile Banking Process

The popularity of online and mobile banking has made international remittances more convenient. You can complete transfers anytime, anywhere, without visiting a bank branch. Here are the specific steps:

- Log In to Your Account: Log in to your online or mobile banking account. Ensure a secure internet connection and avoid operating in public Wi-Fi environments.

- Select International Remittance Service: Navigate to the “International Remittance” option in the menu and access the operation page.

- Enter Remittance Information: Fill in the recipient’s name, bank account details (IBAN and SWIFT code), and the remittance amount and currency.

- Confirm and Pay: Review all information, confirm the remittance, and pay the fees. The system will generate an electronic confirmation slip, which you can save for future reference.

This method’s advantages include simplicity, flexible timing, and generally lower fees than counter services. You can also track the remittance status in real-time through mobile banking to monitor the funds’ arrival progress.

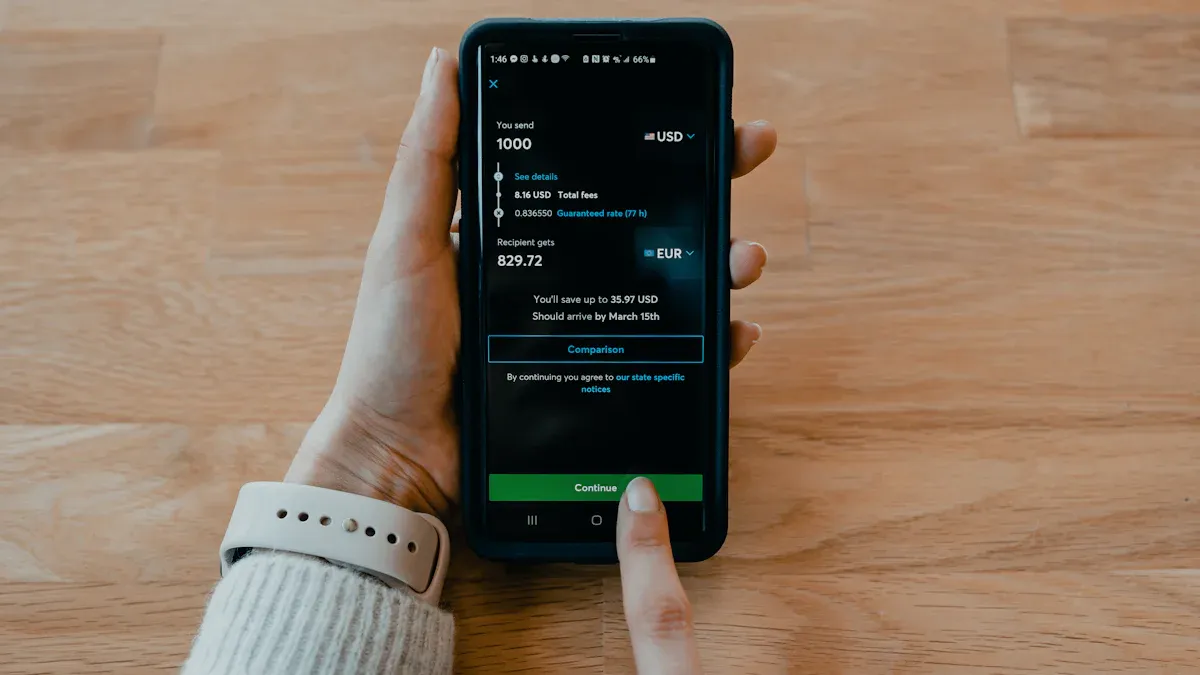

Process for Using Third-Party Platforms (e.g., Wise, PayPal)

Third-party platforms have become a popular choice for UK international remittances in recent years, attracting users with low fees and fast transfer times. Below is the basic process for using these platforms:

- Register an Account: Sign up for an account on the platform’s website or app and complete identity verification.

- Add Payment Method: Link your bank account or credit card, ensuring sufficient balance.

- Enter Remittance Information: Input the recipient’s name, bank account details, and the remittance amount and currency.

- Confirm and Pay: Review the information, confirm the remittance, and pay the fees. Platforms typically provide real-time exchange rates to help you calculate the final cost.

Below is a comparison of fees and transfer speeds for some common platforms:

| Platform | Remittance Amount | Fees | Transfer Time |

|---|---|---|---|

| Wise | $1,000 | $13.93 | 1-2 business days |

| PayPal | $1,000 | $4.99-$49.99 | Instant or within 1 day |

| Revolut | $1,000 | Free (within limits) | Instant |

Compared to traditional banks, third-party platforms offer lower fees and faster transfer times. You can choose the most suitable platform based on your needs.

Required Information for UK International Remittance

Basic Information of the Remitter and Recipient

When conducting UK international remittances, accurately filling in the remitter’s and recipient’s basic information is crucial. This includes names, addresses, and contact details. Any errors could lead to transfer failures or delays.

Below are some common issues and case studies:

- In 45 erroneous remittance cases, many issues stemmed from incomplete or incorrect recipient information.

- Two Supreme Court cases indicate that the legal relationship between the remitter and the receiving bank is critical, and errors in recipient information may result in unrecoverable funds.

- If the remitter issues incorrect payment instructions, banks typically bear no responsibility after executing them.

To avoid these issues, you need to carefully verify all information to ensure it matches the recipient’s provided details exactly. Spelling errors in names are a leading cause of failures.

Bank Account Information (IBAN, SWIFT Code, etc.)

Bank account information is the core component of international remittances. You need to provide the recipient’s International Bank Account Number (IBAN) and Society for Worldwide Interbank Financial Telecommunication code (SWIFT code). These details ensure funds reach the correct account accurately.

According to statistical data:

| Data Type | Volume | Error Rate |

|---|---|---|

| Sources of Cross-Border Transfer Errors | 67% | Non-standard information entry |

| Total Cross-Border Payment Requests | 120 million | 0.3% |

| Name Errors in Remittance Complaints | 38% | Spelling errors |

| IBAN Error Cases | £170,000 held up | N/A |

| Mobile Banking App Error Rate | 0.18% | N/A |

These data show that the accuracy of IBAN and SWIFT codes directly impacts remittance success rates. You can obtain these details through official bank channels to avoid using unofficial sources.

Additionally, standardized financial institution names can improve remittance success rates. A 2021 global payment system report noted that using standardized names can increase success rates by 42%. Therefore, when filling in bank names, refer to the official English names.

Remittance Amount and Currency

The choice of remittance amount and currency is equally important. You need to specify the exact remittance amount and select the appropriate currency. In most cases, banks convert currencies based on real-time exchange rates.

When entering the amount, ensure it aligns with actual needs. Over- or under-entering amounts may incur additional fees or delays. Below are some considerations:

- Ensure sufficient account balance to avoid transfer failures due to insufficient funds.

- Verify that the currency meets the requirements of the recipient’s country. For example, remittances to China typically require USD or CNY.

Additionally, understanding remittance amount limits is important. Some banks or third-party platforms set caps on single transfer amounts. You should consult the relevant institution in advance to ensure a smooth transfer.

Fees and Transfer Times for UK International Remittance

Image Source: pexels

Fee Comparison of Different Remittance Methods

When choosing an international remittance method, fees are a key consideration. Different channels have varying fee structures and advantages. Below is a comparison of several common remittance methods:

| Remittance Method | Fee Structure | Advantages | Disadvantages |

|---|---|---|---|

| Wire Transfer | 1‰ fee + 3% cash-to-foreign exchange fee + $150 telegraph fee | Supports most countries globally, high security | High fees, not suitable for small transactions |

| PayPal | Per-transaction fees and processing fees | Fully online, wide applicability | High fees, risk of account freezing |

| Western Union | Fees vary by country and amount | Available in most countries globally | High fees, inconsistent transfer times |

Choosing the right remittance method can help you save on fees. For example, wire transfers are suitable for large transactions, while PayPal is better for frequent small payments.

Additionally, online and mobile banking fees are generally lower, especially for services offered by Hong Kong banks, with fees ranging from $5 million to $50 million. In contrast, international GBP transfers have higher fees, suitable for specific needs.

Expected Transfer Times

Transfer times vary depending on the method and processing procedures. Below are the transfer times and influencing factors for common remittance methods:

| Remittance Method | Transfer Time | Influencing Factors |

|---|---|---|

| Wire Transfer | 1 to 3 business days | Bank processing speed, international settlement time |

| Currency Conversion Remittance | 2 to 5 business days | Currency conversion process |

| Online Banking Remittance | 1 to 3 business days | Some banks may experience delays |

| Check Remittance | 10 to 15 business days | Longer processing time |

Wire transfers are typically one of the fastest methods, suitable for situations requiring quick delivery. Online banking remittances are also highly efficient but may be affected by bank processing peaks or holidays.

To ensure timely fund delivery, you can process transfers in the morning on business days and check the recipient country’s bank operating hours in advance.

Precautions for UK International Remittance

Impact of Exchange Rate Fluctuations

During international remittances, exchange rate fluctuations directly affect the final amount received. Exchange rates change daily, especially during periods of economic instability or significant market volatility. You need to monitor real-time exchange rate changes and choose an appropriate time for remittance.

For example, when exchange rates are favorable, the remittance amount can be converted into more of the target currency, making it more cost-effective. Conversely, low exchange rates may result in the recipient receiving less. Some banks or third-party platforms offer rate-locking services, allowing you to lock in a favorable rate in advance to avoid losses due to fluctuations.

Remittance Limits and Declaration Requirements

UK international remittances are typically subject to amount limits and declaration requirements. Different banks and platforms set caps on single transfer amounts. For example, some platforms may limit single transfers to $5,000, while banks may allow higher limits.

Additionally, transfers exceeding certain amounts may require declarations to relevant authorities. For instance, remittances to China exceeding $50,000 typically require proof of fund source and purpose. You need to understand the regulations of the destination country in advance to ensure compliance.

Avoiding Common Errors (e.g., Incorrect Account Information)

When filling in account information, any errors can lead to transfer failures or fund losses. You need to pay special attention to the accuracy of the recipient’s IBAN and SWIFT code.

Below are some common issues:

- Altered Payment Information: Account details may be maliciously tampered with, leading to funds being transferred to incorrect accounts, making recovery difficult.

- Fake Account Risks: If the recipient provides false account information, funds may be transferred incorrectly, resulting in losses.

To avoid these issues, verify the recipient’s account information through official channels and carefully review all entries before submission. Some platforms offer dual verification features to further enhance security.

The UK international remittance process has become more efficient and diverse. You can choose bank counters, online banking, or third-party platforms to complete transfers, each with its unique advantages and applicable scenarios. During operations, ensure accurate account information, monitor exchange rate fluctuations, and understand relevant fee and time requirements.

To select the most suitable remittance method, consider the transfer amount, speed, and fees comprehensively. For example, third-party platforms are ideal for small, fast transfers, while bank counters are better for large transactions. With proper planning, you can save costs and improve efficiency.

FAQ

1. How to Choose the Most Suitable Remittance Method?

You can choose based on the remittance amount, transfer speed, and fees. Small transfers are suitable for third-party platforms like Wise, while large transfers can be processed through bank counters. Understand the fees and transfer times of each channel in advance to ensure they meet your needs.

2. What to Do If a Remittance Fails?

If a remittance fails, contact the remittance platform or bank customer service immediately. Provide transfer records and relevant information to assist in investigating the cause. Ensure the recipient information is accurate to avoid repeated errors.

3. How to Avoid Exchange Rate Losses During Remittance?

Monitor real-time exchange rate changes and transfer when rates are favorable. Some platforms offer rate-locking services, allowing you to secure a desirable rate in advance. Avoid operating during periods of high market volatility.

4. What to Do If the Remittance Amount Exceeds the Limit?

When the remittance amount exceeds the platform or bank’s limit, you need to split the transfer or provide proof of fund source. For remittances to China exceeding $50,000, you typically need to declare the purpose and submit relevant documents.

5. Are Additional Fees Required for Remittance?

Yes, remittances typically incur fees. Fees for bank counters, wire transfers, and third-party platforms vary. For example, Wise charges about $13.93 for a $1,000 transfer. Understanding the fee structure in advance can help you save costs.

In 2025, UK international money transfers are streamlined by open banking technology, with platforms like Wise offering fees as low as $13.93 per $1,000, compared to bank wire fees up to $150. BiyaPay enables you to invest in U.S. and Hong Kong stocks without an overseas account, supporting cross-border trade, family remittances, and overseas investments. With conversions across 30+ fiat currencies and 200+ cryptocurrencies, BiyaPay offers remittance fees as low as 0.5%, covering 190+ countries with 1-2 day delivery. Join BiyaPay now for seamless transfers! Licensed by U.S. MSB and SEC, BiyaPay ensures compliance and real-time exchange rate tracking to optimize timing, with idle funds earning a 5.48% APY via flexible savings. Sign up with BiyaPay for a cost-effective, efficient 2025 remittance experience!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.