- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Undervalued AI Stocks Recommendations: These Companies Could Be Future Winners

Image Source: pexels

In the rapid development of artificial intelligence, many U.S. AI concept stocks show tremendous growth potential but are undervalued due to market sentiment or short-term fluctuations. For example, Dell Technologies (DELL) achieved revenue of $11.4 billion in its Infrastructure Solutions Group (ISG) for fiscal year 2025, a year-over-year increase of 22%. Its AI server order backlog surged from $4.1 billion in mid-2024 to $9 billion, indicating strong market demand for AI infrastructure. Nevertheless, some investors have not fully recognized the value behind these figures.

By investing in these undervalued stocks, you can achieve significant returns in the early stages of industry growth. For instance, AppLovin’s stock price has risen over 700% year-to-date, with its market capitalization exceeding $100 billion, demonstrating the potential return space for investors in the AI sector. Seizing these opportunities allows you not only to share in the dividends of the AI industry but also to gain a head start in future technological transformations.

Key Takeaways

- Investing in undervalued AI stocks can yield significant returns in the early stages of industry growth, allowing you to share in the dividends of the AI industry.

- Focus on companies’ financial health, selecting those with stable cash flow and low debt ratios to reduce investment risks.

- Diversifying investments across different AI sectors, such as hardware, software, and services, can effectively reduce risks and ensure portfolio stability.

- Regularly evaluate portfolio performance and adjust strategies promptly to address market changes, maintaining flexibility to respond to market fluctuations.

- Utilize investment methods like dollar-cost averaging and ETFs to simplify the investment process, reduce the impact of market volatility, and easily participate in the overall growth of the AI industry.

Market Status of U.S. AI Concept Stocks

Image Source: pexels

Growth Trends in the AI Industry

The AI industry is in a phase of rapid expansion, with market size and growth rate data clearly reflecting this trend. According to industry research reports, the global AI core industry market size was 150 billion yuan in 2020 and is expected to grow to 400 billion yuan by 2025. Meanwhile, from 2022 to 2027, the global AI market size is projected to surge from $2.2 billion to $225 billion, with a compound annual growth rate of up to 152%. The following table provides a detailed breakdown of the relevant data:

| Year | Core Industry Size (Billion Yuan) | Projected Market Size (Billion Yuan) | Compound Annual Growth Rate (%) |

|---|---|---|---|

| 2020 | 150 | 1000 | - |

| 2025 | 400 | 5000 | 24.8 |

| 2027 | - | 225 | 152 |

These figures indicate that the AI industry is not only a rapidly growing market but also a high-quality field for long-term investment. By focusing on U.S. AI concept stocks, you can seize the investment opportunities brought by this industry’s expansion.

Investment Popularity and Market Performance of AI Stocks

In recent years, the investment popularity of AI stocks has continued to rise, with market performance showing significant volatility. The Nasdaq Composite Index reached a historical high last December, reflecting optimistic market sentiment. However, due to DeepSeek’s technological breakthroughs in the AI field, the market experienced turbulence, indicating investor concerns about tech stocks. The following is a summary of recent market sentiment and capital flows:

- The Nasdaq Composite Index has recently recovered about half of its decline, indicating a warming of market sentiment.

- The global tariff policy announced by Trump once led to an accelerated decline in tech stocks, reflecting negative investor sentiment.

- The returns of AI-related investment strategies vary, with the DeepSeek strategy yielding 8.71%, while the ChatGPT strategy yielded 2.67%.

These data suggest that despite market fluctuations, U.S. AI concept stocks remain attractive, especially for long-term investors.

Reasons Why AI Stocks Are Undervalued in the Current Market

Despite the rapid growth of the AI industry, some U.S. AI concept stocks remain undervalued by the market. The following are some key reasons:

- Bias in Valuation Models: Valuation metrics such as price-to-earnings (P/E) and enterprise value-to-EBITDA (EV/EBITDA) ratios show that some AI stocks are valued below their reasonable range. For example, companies with an EV/EBITDA below 8x may be undervalued.

- Impact of Market Sentiment: Investor concerns about tech stocks have caused some stock prices to fail to reflect their true value.

- Financial Health: Some companies, despite having high return on equity (ROE), have stock prices that do not fully reflect their intrinsic value due to market underestimation of their future growth potential.

By deeply analyzing these reasons, you can uncover undervalued investment opportunities and achieve higher returns when market sentiment improves.

Recommended Undervalued U.S. AI Concept Stocks

Image Source: pexels

Amazon (AMZN): Core Business and AI Strategy

Amazon (AMZN), as a global leading tech giant, has core businesses spanning e-commerce, cloud computing, and smart devices. In recent years, Amazon’s strategic focus on the AI field has been particularly noteworthy. You may have noticed that Amazon Web Services (AWS) is not only the world’s largest cloud service provider but also holds a significant position in AI technology research and application. AWS offers machine learning services like Amazon SageMaker, which help businesses quickly build and deploy AI models. This technological advantage positions Amazon as a leader in the AI infrastructure market.

Additionally, Amazon’s smart device business fully demonstrates its potential in AI technology applications. For example, Alexa, its smart voice assistant, has become one of the most popular AI products globally. By continuously optimizing natural language processing (NLP) and speech recognition technologies, Alexa’s user experience keeps improving. You can see that Amazon not only invests heavily in technological research but also integrates AI technology into consumers’ daily lives through practical products.

Amazon (AMZN): Valuation Analysis and Future Growth Potential

Amazon’s valuation analysis reveals its immense future growth potential. According to market forecasts, Amazon’s return rate could reach up to 5 times over the next six years. The following are some key data points to help you better understand its growth prospects:

- Projected stock price growth potential of 57% in 2025, 87% in 2026, and 127% in 2027.

- Over the next five years, Amazon’s annual return potential is 33%.

- By 2029, sales growth is expected to be 11%; by 2030, sales growth is projected at 9%, earnings growth at 12%, and operating cash flow growth at 17%.

- If you invest $1 now, it could grow to nearly $5 by 2030, with a total return potential of up to 392%.

These data indicate that Amazon not only has significant short-term growth potential but also exceptional long-term investment value. By focusing on the continued development of its AI business, you can seize this growth opportunity.

Meta (META): Unique Competitiveness in AI

Meta (META)’s competitiveness in the AI field is primarily reflected in its dual focus on hardware and software. You may have heard of Meta’s leading position in virtual reality (VR) and augmented reality (AR), but its performance in AI smart hardware is equally noteworthy. For example, Meta’s AI smart glasses achieved global sales of 600,000 units in the first quarter of 2025, a year-over-year increase of 216%. It is projected that full-year sales in 2025 will reach 5.5 million units, with Meta contributing 80% of the market growth. These figures clearly demonstrate Meta’s strong competitive advantage in the AI hardware market.

In addition to hardware, Meta continues to innovate in AI algorithms and data processing capabilities. Its AI-driven advertising platform provides businesses with more efficient ad delivery solutions through precise user profiling and data analysis. You can see that Meta not only holds an advantage in the hardware sector but also enhances the profitability of its core business through AI technology.

Meta’s success relies not only on technological innovation but also on its vast user base and ecosystem. By integrating AI technology into social media, advertising, and hardware products, Meta offers users a richer experience while creating more value for investors.

Meta (META): Market Prospects and Financial Performance

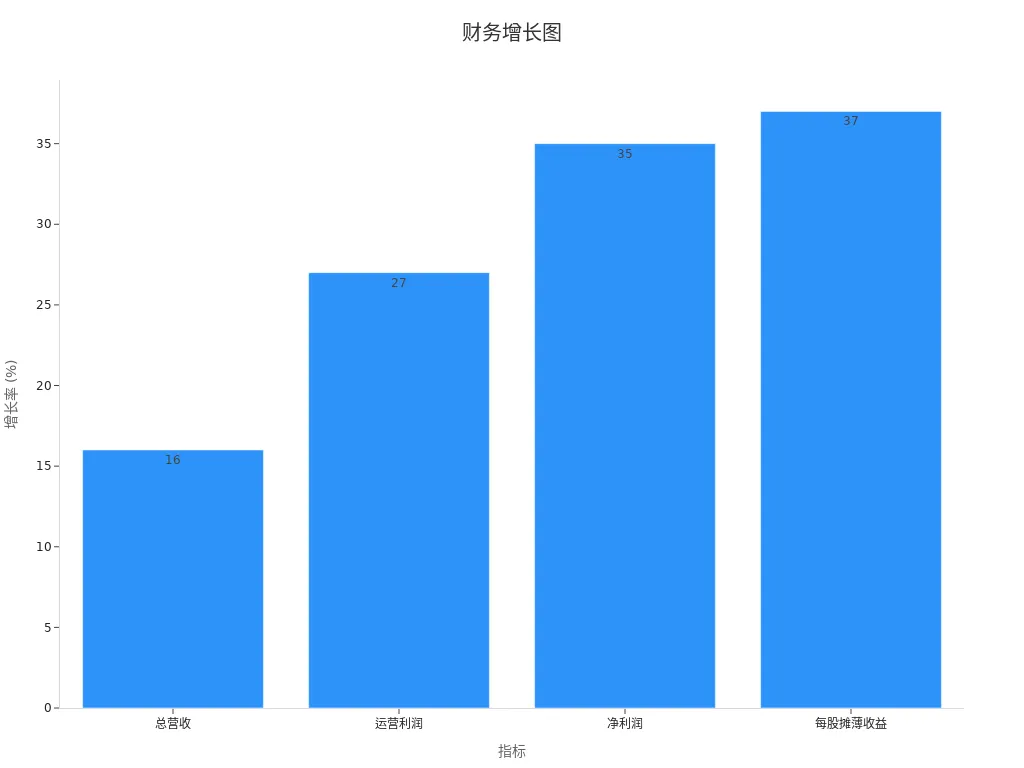

Meta (META)’s market prospects show strong growth momentum, and its financial performance provides investors with confidence. You can clearly see Meta’s significant growth in the first quarter of 2025 from the following data:

| Metric | Q1 2025 | Q1 2024 | Growth Rate |

|---|---|---|---|

| Total Revenue | $42.314 billion | $36.455 billion | 16% |

| Operating Profit | $17.555 billion | $13.818 billion | 27% |

| Operating Margin | 41% | 38% | Up |

| Net Income | $16.644 billion | $12.369 billion | 35% |

| Diluted Earnings Per Share | $6.43 | $4.71 | 37% |

From the table, it is evident that Meta’s total revenue and net income both achieved double-digit growth, with the operating margin rising from 38% to 41%. This indicates that Meta is not only expanding its revenue scale but also continuously improving its profitability.

Furthermore, driven by both AI hardware and advertising businesses, Meta’s future market potential is even more promising. The following is a financial bar chart showing total revenue and profit growth rates, helping you visualize Meta’s growth trends more intuitively:

Meta’s success relies not only on technological innovation but also on its unique position among U.S. AI concept stocks. By focusing on its financial performance and market strategy, you can uncover more investment opportunities.

CommScope Holding Company, Inc. (COMM): Financial Health and Reasons for Being Undervalued

CommScope Holding Company, Inc. (COMM) may not be as prominent in the AI field as Meta or Amazon, but its financial health and reasons for being undervalued are equally worth your attention. CommScope’s core businesses include network infrastructure and communication solutions, which play a critical role in the widespread adoption of AI technology.

Despite CommScope’s price-to-earnings (P/E) and enterprise value-to-EBITDA (EV/EBITDA) ratios being below industry averages, this does not mean its growth potential is limited. On the contrary, this low valuation may provide you with an excellent investment entry point. The following are the main reasons why CommScope is undervalued:

- Impact of Market Sentiment: Investors’ lower focus on the traditional communications industry has caused CommScope’s stock price to fail to fully reflect its potential in the AI infrastructure sector.

- Short-Term Financial Pressure: Although CommScope has a relatively high level of long-term debt, its stable cash flow supports future research and expansion plans.

- Lag in Technological Transformation: The market has some misconceptions about CommScope’s AI technology strategy, overlooking its technical advantages in network optimization and data transmission.

By deeply analyzing these factors, you can uncover CommScope’s long-term investment value and achieve higher returns when market sentiment improves.

CommScope Holding Company, Inc. (COMM): Technological Innovation and Long-Term Growth Potential

CommScope’s efforts in technological innovation lay a solid foundation for its long-term growth. You may not know that CommScope holds multiple patents in fiber optic communication and wireless network optimization, which provide critical support for AI application deployment. For example, its newly launched high-performance fiber optic solutions significantly enhance data transmission speeds, providing more efficient infrastructure for AI model training and inference.

Additionally, CommScope is actively involved in 5G network construction, offering more possibilities for its future growth. As AI technology increases demands for network bandwidth and latency, CommScope’s products and services will become even more indispensable. The following are some highlights of CommScope’s technological innovations:

- Fiber Optic Communication: Next-generation fiber optic technology supports higher data transmission rates, meeting the needs of AI applications.

- Wireless Network Optimization: Through smart antennas and signal enhancement technologies, it improves network coverage and stability.

- Sustainability: CommScope is committed to developing environmentally friendly communication equipment, aligning with global green development trends.

These technological innovations not only enhance CommScope’s market competitiveness but also provide assurance for its long-term growth in the AI field. By focusing on its technological progress and market dynamics, you can seize this potential investment opportunity.

Credo Technology Group Holding Ltd (CRDO): Core Business and AI Strategy

Credo Technology Group Holding Ltd (CRDO)’s core business in the AI field focuses on semiconductors and active cable technology. You may have noticed that with the rapid development of AI technology, demand in the semiconductor industry has significantly increased, and Credo Technology has secured a significant position in this field with its technological advantages. Active cable technology is one of its core competencies, capable of significantly improving data transmission speed and stability, supporting cloud computing and AI clusters.

The following are key points of Credo Technology’s AI strategy:

- Active Cable Technology: Credo’s active cable solutions meet the demand for efficient data transmission in cloud computing and AI clusters.

- Semiconductor Innovation: Its semiconductor products excel in performance and energy efficiency, providing reliable hardware support for AI model training and inference.

- Market Demand Driven: The widespread adoption of AI technology has driven growth in cloud computing services, and Credo’s products align perfectly with this trend.

Through these technological advantages, Credo not only secures a place among U.S. AI concept stocks but also provides investors with a noteworthy growth opportunity.

Credo Technology Group Holding Ltd (CRDO): Valuation Analysis and Future Growth Potential

Credo Technology’s valuation analysis reveals its immense future growth potential. You can discover its investment value from the following points:

- According to Bank of America analyst Vivek Arya’s report, Credo’s financial results may exceed market expectations.

- The development of AI technology has driven a recovery in the value of the semiconductor industry, particularly in demand for cloud computing services.

- Credo’s technological advantage in the active cable market enables it to meet the needs of cloud computing and AI clusters.

These factors indicate that Credo’s market positioning and technological innovation lay a solid foundation for its future growth. By focusing on its financial performance and market dynamics, you can uncover more investment opportunities.

Dell Technologies (DELL): AI Server Orders and Enterprise Customer Resources

Dell Technologies (DELL) excels in the AI server field. You may have noticed that as enterprises’ demand for AI infrastructure grows, Dell’s AI server order volume continues to increase. The following are Dell’s order data across different markets:

| Market | Order Volume | Market Share |

|---|---|---|

| North American Market | $20,000 cheaper per machine | N/A |

| Southeast Asian Market | $120 million project orders | 70% |

| Latest Quarterly Shipments | $1.7 billion | N/A |

| New Orders Signed | $2.6 billion | 30% growth |

These data show that Dell performs strongly not only in the North American market but also dominates in the Southeast Asian market. You can see that Dell’s growth in AI server order volume and market share provides assurance for its future profitability.

Additionally, Dell’s enterprise customer resources support the expansion of its AI business. Through partnerships with large enterprises, Dell can better meet customers’ demands for AI infrastructure while enhancing its market competitiveness. By focusing on Dell’s order growth and customer resources, you can uncover more investment opportunities.

Dell Technologies (DELL): Market Prospects and Financial Performance

Dell Technologies (DELL)’s market prospects in the AI field are remarkable. You may have noticed that as AI technology becomes more widespread, enterprises’ demand for high-performance computing and data storage continues to grow. Dell, with its deep expertise in AI servers and enterprise solutions, is rapidly capturing market share. The following are Dell’s latest financial data, which can help you better understand its growth potential:

| Metric | Value |

|---|---|

| Revenue | $107.03 billion |

| Year-over-Year Growth | 15.8% |

| Gross Margin | 27.5% |

| Net Income | $4.89 billion |

| Earnings Per Share | $5.46 |

| Future Growth Rate | 3-4% |

From the table, it is clear that Dell’s revenue grew 15.8% year-over-year to $107.03 billion, demonstrating its strong market performance. The gross margin of 27.5% indicates high profitability for its products and services. Net income reached $4.89 billion, with earnings per share at $5.46, further proving Dell’s financial stability.

Dell’s future growth potential is equally noteworthy. Over the next few years, its annual growth rate is expected to remain stable at 3-4%. You can see that this growth is driven by the following factors:

- Continued Growth in AI Server Demand: As enterprises deepen their reliance on AI infrastructure, Dell’s AI server order volume continues to climb. Its strong performance in North American and Southeast Asian markets provides assurance for future revenue growth.

- Expansion of Enterprise Customer Resources: Dell has established long-term partnerships with multiple global enterprises, enhancing its market competitiveness and providing more opportunities for its AI business expansion.

- Technological Innovation: Dell continues to invest in AI hardware and software research, ensuring its products meet market demands for high-performance computing.

Tip: If you are looking for a stable investment with long-term growth potential, Dell Technologies may be a worthy choice. Its AI strategy and financial performance provide strong support for investors.

By analyzing Dell’s market prospects and financial performance, you can discover its unique advantages in the AI industry. Whether it’s short-term revenue growth or long-term technological innovation, Dell demonstrates strong competitiveness. By focusing on its market dynamics and financial data, you can seize this potential investment opportunity.

Investment Strategies and Risk Warnings

Specific Recommendations for Investing in U.S. AI Concept Stocks

When investing in U.S. AI concept stocks, you need to develop clear strategies to maximize returns and reduce risks. First, select companies with long-term growth potential. Focus on enterprises with technological advantages and market share in the AI field, such as Amazon and Meta. Second, analyze the financial health of companies. Prioritize those with stable cash flow and low debt ratios to mitigate financial pressures from market fluctuations.

Additionally, diversification is a key way to reduce risks. You can allocate funds across different AI sectors, such as hardware, software, and services. This way, even if one sector underperforms, growth in other areas can offset losses. Finally, regularly evaluate portfolio performance and adjust strategies promptly to address market changes.

Dollar-Cost Averaging and ETF Selection

If you want to reduce investment complexity, dollar-cost averaging and ETFs are good options. Dollar-cost averaging helps smooth out the impact of market volatility. By investing a fixed amount regularly, you can buy more shares when the market is down, lowering the average cost.

ETFs offer diversified investment options. For example, AIETF covers leading companies in multiple AI sectors, including CICC and Hikvision. These companies perform steadily during market fluctuations, making them suitable for long-term investors. Since its inception in 2019, AIETF has achieved a return of 15.35%, with a one-month return of 9.53%, demonstrating its growth potential. By investing in ETFs, you can easily participate in the overall growth of the AI industry without needing to deeply analyze each company’s financial data.

Potential Risks: Market Volatility and Technological Uncertainty

Despite the promising prospects of the AI industry, investing in U.S. AI concept stocks carries certain risks. Market volatility is a primary risk. For example, the stock prices of iFlytek and Sugon have experienced significant declines due to market sentiment, reflecting investor uncertainty about individual stocks’ prospects. Additionally, the development of new technologies poses challenges. Technologies like generative AI and no-code software development offer new investment opportunities, but their maturity and market acceptance remain uncertain.

To address these risks, you need to remain cautious. Avoid concentrating all funds in a single stock or technology. Monitor market trends and technological progress, and adjust your portfolio promptly. This way, you can enjoy the industry’s growth dividends while minimizing risks.

Undervalued U.S. AI concept stocks offer unique investment opportunities. These companies demonstrate strong potential in technological innovation, market strategy, and financial performance. By deeply analyzing companies like Amazon, Meta, and CommScope, you can discover their unique value in the AI industry.

The long-term growth potential of the AI industry cannot be ignored. In the coming years, AI technology is expected to continue driving global economic transformation, bringing significant returns to investors.

When investing, you need to align your financial goals and risk tolerance to develop reasonable strategies. Stay rational, diversify investments, and monitor market dynamics to seize more opportunities in the rapidly evolving AI field.

FAQ

1. Why is investing in AI stocks a good long-term choice?

The AI industry is growing rapidly, with market size expected to continue expanding. By investing in AI stocks, you can share in the dividends of technological transformation while gaining opportunities for long-term capital appreciation.

2. How to choose AI stocks that suit you?

You need to focus on a company’s core business, technological advantages, and financial health. Select companies with competitive edges in the AI field, such as Amazon and Meta. Diversifying investments can also reduce risks.

3. What are the risks of investing in AI stocks?

Market volatility and technological uncertainty are the main risks. You need to monitor industry dynamics, avoid concentrating investments in a single stock, and adjust your portfolio regularly to address changes.

4. Are ETFs suitable for AI stock investments?

ETFs offer diversified investment options, suitable for investors looking to reduce risks. For example, AIETF covers leading companies in multiple sectors, helping you easily participate in industry growth.

5. How to evaluate the valuation of AI stocks?

You can use metrics like price-to-earnings (P/E) and enterprise value-to-EBITDA (EV/EBITDA) ratios. Focus on companies with valuations below industry averages but with growth potential, such as CommScope and Credo Technology.

The AI sector’s rapid expansion unlocks opportunities in undervalued U.S. and Hong Kong stocks like Amazon and Meta, yet high remittance fees and complex account setups can hinder your investment efficiency. BiyaPay offers a seamless cross-border payment platform, supporting conversions across 30+ fiat currencies and 200+ cryptocurrencies with remittance fees as low as 0.5%, spanning 190+ countries for swift fund access. No overseas account is needed to invest in U.S. and Hong Kong markets, capturing AI stock growth. Join BiyaPay now for secure, efficient transactions. Licensed by U.S. MSB and SEC, BiyaPay ensures compliance, with real-time exchange rate tracking to optimize costs. Idle funds can grow via a 5.48% APY flexible savings product. Sign up with BiyaPay to access global AI markets effortlessly today!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.