- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

2025 Guide to Saving on International Transfer Intermediary Bank Fees

Image Source: unsplash

When making international transfers, you need to carefully choose the transfer channel, as the wrong choice may increase your costs. Cross-border transfers typically involve handling fees, intermediary bank fees, and other hidden costs, which vary depending on the bank and transfer method. Choosing reputable banks and services can help you reduce these fees while ensuring the safety of your funds. Using services with no intermediary bank fees is an effective way to lower costs. By reasonably planning the transfer amount and frequency, you can further mitigate the impact of intermediary bank fees for international transfers.

Key Points

- Choosing reputable banks and services can reduce intermediary bank fees for international transfers, ensuring the safety of funds.

- Using direct banks or partner networks can avoid intermediary bank fees and increase transfer speed.

- Choosing highly liquid currencies for transfers can lower processing costs and ensure funds arrive quickly.

- Utilizing P2P transfer platforms and digital payment tools can significantly reduce international transfer fees and improve efficiency.

- Reasonably planning transfer amounts and frequency, and consolidating small transfers, can effectively reduce handling fee expenses.

Choosing the Right Transfer Channel

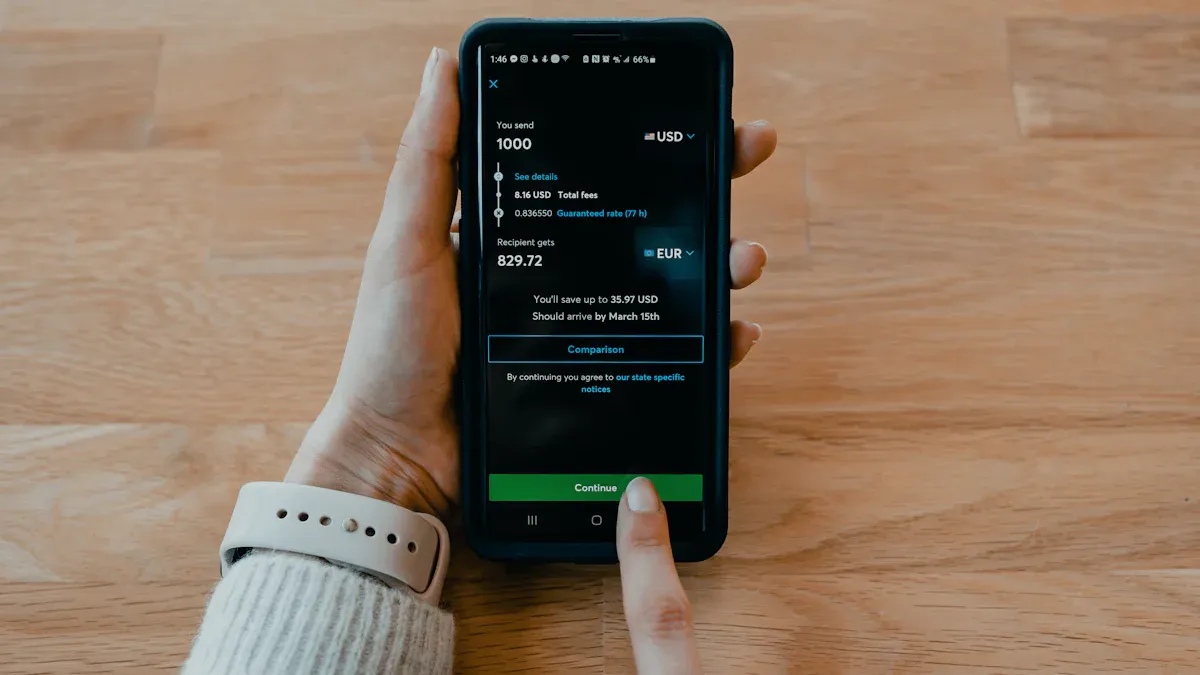

Image Source: pexels

Understanding the Mechanism of Intermediary Bank Fees for International Transfers

Intermediary bank fees for international transfers are an unavoidable part of cross-border transactions. You need to understand the mechanism of these fees to better control costs. Cross-border transfers typically involve two types of fees: handling fees and intermediary bank fees. Handling fees are directly charged by the sending bank, and the amount is usually related to the transfer amount and the bank’s fee structure. Intermediary bank fees, on the other hand, are charged by the intermediary banks through which the funds pass, with specific amounts varying based on the bank’s policies.

For example, when you transfer money from a Hong Kong bank to the US, the funds may pass through one or more intermediary banks. These intermediary banks charge fees based on their policies, typically ranging from $10 to $50. Understanding the source and calculation method of these fees can help you make wiser decisions when choosing a transfer channel.

Comparing Fee Structures of Different Banks and Financial Institutions

When selecting a transfer channel, comparing the fee structures of different banks and financial institutions is crucial. You can evaluate them based on the following aspects:

- Handling Fees: Handling fees vary significantly among banks. For example, some Hong Kong banks may charge a fixed $20 handling fee, while others may charge a percentage of the transfer amount.

- Intermediary Bank Fees: Some banks clearly disclose the range of intermediary bank fees, while others may not provide specific information.

- Exchange Rate Differences: Although exchange rates are not directly part of intermediary bank fees, they affect your total costs. Choosing institutions with better exchange rates can indirectly save costs.

By comparing these factors, you can select a lower-cost transfer channel. For example, digital payment platforms often offer lower handling fees and more transparent fee structures compared to traditional banks.

Prioritizing Direct Banks or Partner Networks

Choosing direct banks or partner networks can significantly reduce intermediary bank fees for international transfers. When two banks have a direct partnership, funds can be transferred directly from the sending bank to the receiving bank without passing through intermediary banks. This method not only saves fees but also speeds up the transfer process.

For example, if you need to transfer money from China to Europe, you can prioritize Hong Kong banks that have partnerships with European banks. This way, your funds may only pass through one intermediary bank, or none at all, reducing additional fees.

Additionally, some banks and financial institutions are part of global payment networks, such as SWIFT GPI. These networks optimize the flow of funds, reducing the involvement of intermediary banks and thereby lowering costs. You can consult your bank before transferring to check if they support these networks.

Choosing More Liquid Currencies to Reduce Processing Costs

In international transfers, choosing more liquid currencies can effectively reduce processing costs. Highly liquid currencies typically refer to those with large global transaction volumes and high market acceptance, such as the US dollar (USD), Euro (EUR), and British pound (GBP). Due to their widespread use and stable market demand, these currencies generally have lower handling fees and faster processing times in cross-border transactions.

Why Does Liquidity Affect Costs?

Highly liquid currencies are more readily accepted in international markets. When banks and financial institutions process these currencies, fewer operational steps are required, and the risk is lower. As a result, they typically charge lower handling fees. Conversely, less liquid currencies may require more intermediary banks for conversion and transfer, increasing additional costs.

Tip: If you need to transfer money to a country that uses a less common currency, consider converting the funds to USD or EUR first before transferring. This approach may be more cost-effective than direct transfers.

How to Choose the Right Currency?

- Understand the Currency Acceptance in the Destination Country

Before transferring, confirm whether the recipient’s country accepts highly liquid currencies. For example, many developing countries’ banks prefer receiving USD or EUR over local currencies. - Consult Your Bank or Transfer Service Provider

You can ask your bank or transfer platform about the handling fees and exchange rate differences for different currencies. Choose the currency with the lowest fees and best exchange rate for the transfer. - Monitor Exchange Rate Fluctuations

Highly liquid currencies generally have more stable exchange rates but may still be affected by market fluctuations. Before transferring, monitor exchange rate trends and choose a favorable time to transact questio.

Comparison of Common Highly Liquid Currencies

| Currency | Advantages | Applicable Scenarios |

|---|---|---|

| US Dollar (USD) | Highest global acceptance, low handling fees | Suitable for most international transfers |

| Euro (EUR) | Preferred currency for European countries, stable exchange rates | More cost-effective for transfers to EU countries |

| British Pound (GBP) | Main currency for the UK and some Commonwealth countries | More suitable for transfers to the UK or related regions |

By choosing more liquid currencies, you can significantly reduce the processing costs of international transfers while improving the efficiency of fund arrivals. This not only saves costs but also makes your transfer experience smoother.

Using Services with No Intermediary Bank Fees

Understanding the Advantages of P2P Transfer Platforms

P2P (peer-to-peer) transfer platforms have become a popular choice for international transfers in recent years. These platforms directly connect the sender and recipient, eliminating the involvement of intermediary banks, thus effectively reducing fees. Through these platforms, you can enjoy lower handling fees, faster transfer times, and more transparent fee structures.

A significant advantage of P2P platforms is their cost-saving potential. According to statistical data, using services with no intermediary bank fees can significantly reduce total costs. For example:

| Storage Type | Total Cost (CNY) | Cost Savings (%) |

|---|---|---|

| Standard Storage | 13,837.2 | 10.1 |

| Infrequent Access Storage | 6,450.3 | 53.4 |

As shown in the table, the cost savings for infrequent access storage can reach up to 53.4%. This demonstrates that choosing the right P2P platform can not only reduce intermediary bank fees for international transfers but also optimize overall costs.

Additionally, P2P platforms typically support multiple currency conversion options with more competitive exchange rates. You can check the real-time exchange rates provided by the platform before transferring to ensure you get the best conversion value.

Recommending Low or Zero-Fee Digital Payment Tools

Digital payment tools are another effective way to save on international transfer fees. These tools often provide low or even zero-fee withdrawal services, making them particularly suitable for small cross-border payments. Below is a cost comparison of some common digital payment tools:

| Payment Tool | Withdrawal Cost | Remarks |

|---|---|---|

| Digital RMB | 0 | Superior to third-party payment platforms, but benefits go to the recipient |

| Third-Party Payment Platforms | >0 | Senders prefer tools with higher convenience |

As shown in the table, Digital RMB has a clear advantage in withdrawal costs. If you need to make frequent small transfers, you can prioritize this tool. For third-party payment platforms, although withdrawal costs are slightly higher, their ease of use and widespread user base remain key factors in attracting users.

Tip: When choosing digital payment tools, prioritize the recipient’s needs. If the recipient prefers a specific tool, using it can improve transfer efficiency while avoiding additional conversion fees.

Exploring Blockchain-Based Cross-Border Payment Services

Blockchain technology is transforming the traditional model of cross-border payments. Blockchain-based payment services connect senders and recipients directly through a decentralized network, completely bypassing intermediary banks. This approach not only significantly reduces fees but also enhances transaction transparency and security.

A core advantage of blockchain payments is their speed. Traditional bank transfers may take several days, while blockchain payments can typically be completed within minutes. Additionally, services supported by blockchain technology have fixed fees, making costs relatively low regardless of the transfer amount.

For example, some blockchain payment platforms charge fees that are only 10%-20% of those of traditional banks. You can achieve more efficient and cost-effective international transfers through these platforms.

Note: When choosing blockchain payment services, ensure the platform’s legitimacy and security. Prioritize well-known blockchain payment providers to avoid potential financial risks.

By understanding P2P platforms, digital payment tools, and blockchain-based services, you can choose the most suitable method based on your needs. These emerging technologies and tools not only help you save on intermediary bank fees for international transfers but also enhance the overall transfer experience.

Using Local Accounts for Receiving to Reduce Intermediary Bank Fees

In international transfers, using local accounts for receiving is an effective way to reduce intermediary bank fees. This method avoids the need for funds to pass through multiple intermediary banks, thereby lowering costs and speeding up the transfer process.

Why Can Local Accounts Reduce Fees?

The advantage of local accounts is that they allow direct receipt of funds without intermediary bank processing. For example, when transferring money to a friend in the US, if they have a US local bank account, the funds can be transferred directly from your sending bank to their account. This method not only reduces intermediary bank involvement but also avoids additional handling fees.

Tip: When choosing a transfer method, prioritize confirming whether the recipient has a local account. If not, you can suggest they open one to make future transfers more cost-effective and efficient.

How to Optimize Transfers Using Local Accounts?

- Choose Transfer Services Supporting Local Accounts

Many international transfer platforms support direct transfers to local accounts, such as Wise and WorldRemit. These platforms typically offer lower handling fees and more transparent fee structures. - Open a Multi-Currency Account

If you frequently transfer to different countries, consider opening a multi-currency account. For example, multi-currency accounts provided by Revolut and Payoneer allow you to receive local currencies in multiple countries. These accounts not only reduce intermediary bank fees but also avoid additional costs from exchange rate conversions. - Negotiate with the Recipient

Before transferring, communicate with the recipient to confirm their account type and accepted currency. If they don’t have a local account, suggest they open one suitable for their needs. Many banks offer free local account opening services that are simple and quick.

Real-World Case Study

Suppose you need to pay a supplier in the UK. If they have a UK local account, you can transfer funds directly through a service supporting GBP transfers. The funds will go directly from your bank to their account without passing through intermediary banks. In contrast, if they use a non-local account, the funds may need to pass through multiple intermediary banks, each charging fees. In this case, using a local account can save you at least $20-$50 in intermediary bank fees.

Notes

- Ensure the recipient’s local account information is accurate, including account number and bank code.

- Before transferring, confirm whether the transfer platform supports local accounts in the destination country.

- If using a multi-currency account, ensure you select the correct currency to avoid unnecessary exchange rate conversion fees.

By using local accounts for receiving, you can significantly reduce intermediary bank fees for international transfers while improving the efficiency of fund arrivals. This method is suitable not only for personal transfers but also for business cross-border payments.

Optimizing Transfer Amount and Frequency

Reasonably Planning Transfer Amounts to Reduce Handling Fee Proportions

In international transfers, handling fees are typically proportional to the transfer amount. By reasonably planning transfer amounts, you can effectively reduce the proportion of handling fees. For example, many banks charge a higher handling fee proportion for small transfers, while the proportion for large transfers is relatively lower.

Below are several benefits of reasonably planning transfer amounts:

- Reducing handling fee rates to 0.2% can significantly lower payment costs.

- Compared to a standard 0.6% fee rate, lower handling fees directly improve your fund utilization rate.

- The net income per transaction increases, helping you better control cost expenditures.

Tip: Before transferring, consult your bank or transfer platform’s fee structure and choose the optimal amount range for transfers. Avoid overly fragmented small transfers to reduce unnecessary handling fees.

Reducing the Frequency of Small, High-Frequency Transfers

Frequent small transfers can lead to accumulated handling fees, increasing your total costs. Each transfer may involve fixed handling fees and intermediary bank fees, which add up significantly after multiple transfers.

You can reduce the frequency of small, high-frequency transfers through the following methods:

- Consolidate Transfers: Combine multiple small transfers into a single large transfer.

- Plan Transfers: Plan transfer times and amounts in advance to avoid temporary small transfers.

- Use Batch Transfer Services: Many platforms offer batch transfer options suitable for users requiring frequent payments.

Note: Reducing small transfers not only saves fees but also improves fund utilization efficiency. This is particularly effective for business users, as optimizing transfer frequency can significantly lower operational costs.

Using Batch Transfer Services to Lower Costs

Batch transfer services are an effective tool for saving international transfer fees. Many banks and transfer platforms offer batch transfer options for businesses and high-frequency users. These services allow you to process multiple transfers at once, reducing the handling fees per transaction.

The advantages of batch transfers include:

- Lower Fees: Batch transfers typically offer discounted rates, suitable for large or multiple transactions.

- Convenient Operation: Submitting multiple transfer details at once saves time and effort.

- Improved Efficiency: Reducing intermediary bank involvement speeds up fund arrivals.

For example, if you need to pay multiple suppliers, you can use batch transfer services to process all payments together. This not only saves handling fees but also avoids time loss from repeated operations.

Tip: When choosing batch transfer services, prioritize providers supporting multi-currency and local accounts. This will further reduce costs and improve transfer efficiency.

Choosing the OUR Fee Payment Method to Avoid Additional Fees

In international transfers, choosing the right fee payment method can help you avoid additional intermediary bank fees. Fee payment methods are typically divided into three types: SHA, BEN, and OUR. Choosing the OUR method is an effective way to reduce additional fees.

What is the OUR Fee Payment Method?

The OUR method means the sender bears all fees, including the sending bank’s handling fees, intermediary bank fees, and the receiving bank’s fees. This ensures the recipient receives the full transfer amount without deductions due to intermediary or receiving bank fees.

Tip: If you want to ensure the recipient receives the exact amount, choosing the OUR method is the safest option.

Why Choose the OUR Method?

Choosing the OUR method can avoid additional fees deducted by intermediary and receiving banks. This method is particularly suitable for the following scenarios:

- Contract Payments: Ensures suppliers receive the full amount, avoiding contract disputes due to fee deductions.

- Family Transfers: Ensures relatives or friends receive the full amount, reducing communication hassles.

- Urgent Transfers: Avoids issues with insufficient funds due to fee deductions.

Cost Comparison of Fee Payment Methods

Below is a cost comparison of the three fee payment methods:

| Fee Payment Method | Sender’s Fees | Recipient’s Received Amount | Applicable Scenarios |

|---|---|---|---|

| SHA | Sender bears partial fees | Recipient bears intermediary fees | Regular transfers |

| BEN | Sender bears no fees | Recipient bears all fees | Small transfers |

| OUR | Sender bears all fees | Recipient receives full amount | Large or important transfers |

As shown in the table, while the OUR method involves higher fees for the sender, it ensures the recipient receives the full amount. This method is suitable for transfers requiring precise amounts.

How to Choose the OUR Method?

- Consult Your Bank or Transfer Platform

Before transferring, confirm whether the OUR method is supported. Many banks and platforms offer this option but may require additional applications. - Understand the Fee Structure

Learn about the sending bank’s handling fees and intermediary bank fees to ensure the total cost is within an acceptable range. - Communicate with the Recipient

Before transferring, confirm the recipient’s amount requirements. If they need the full amount, the OUR method is the best choice.

By choosing the OUR fee payment method, you can avoid additional fees, ensuring the recipient receives the exact amount. This method not only reduces communication hassles but also improves the efficiency and reliability of transfers.

Recommended Tools: Practical Platforms for Saving Intermediary Bank Fees

Image Source: unsplash

Wise (formerly TransferWise): Transparent Fee Structure

Wise is an international transfer platform known for its transparent fee structure. It offers real market exchange rates, avoiding hidden markups, so you know exactly where every cent goes. Compared to traditional banks, Wise’s fee structure is more economical, with fees only one-third of those of banks.

Below are Wise’s main advantages:

- Offers real market exchange rates, avoiding hidden costs in exchange rate differences.

- Fast transfer speeds, with 52% of transactions arriving within 20 seconds.

- Low handling fees, with ACH transfers at just 0.13% and wire transfer fees at $3.52.

| Item | Wise | Traditional Banks |

|---|---|---|

| Exchange Fee | From 0.43% | 1.5%-3% |

| Transfer Handling Fee | ACH 0.13%, Wire $3.52 | Fixed fee $20-$50 + 1%-2% |

| Arrival Speed | 52% of transactions arrive within 20 seconds | 3-5 business days |

| Transparency | Displays full fees in real-time | Many hidden fees |

With Wise, you can not only save fees but also ensure funds arrive quickly and securely.

Revolut: Ideal for Multi-Currency Account Users

Revolut is a digital banking platform designed for multi-currency accounts. If you frequently handle multiple currencies, Revolut is an ideal choice. It supports instant conversion of over 30 currencies and offers highly competitive exchange rates.

Revolut’s main features include:

- Free multi-currency account opening, suitable for cross-border workers and business users.

- Real-time exchange rates to avoid losses due to rate fluctuations.

- Supports borderless payments globally with transparent and low fees.

Additionally, Revolut offers virtual cards and spending analysis tools to help you better manage cross-border funds.

PayPal: Suitable for Small Cross-Border Payments

PayPal is a widely used tool for small cross-border payments. Its operation is simple, making it suitable for individual users and small businesses. With PayPal, you can quickly complete international payments without complex banking procedures.

PayPal’s advantages include:

- Wide global coverage, supporting over 200 countries and regions.

- Suitable for small payments with relatively low handling fees.

- Offers buyer protection to ensure transaction security.

However, PayPal’s exchange rates may include a markup, making it suitable for smaller payment scenarios. For large payments, you can compare it with other tools.

By choosing the right tool, you can save intermediary bank fees for international transfers while improving transfer efficiency and experience based on your needs.

OFX: Competitive Exchange Rates and Low Handling Fees

OFX is a platform specializing in international transfers, known for its competitive exchange rates and low handling fees. You can enjoy more cost-effective cross-border payment services while ensuring fund security. Compared to traditional banks, OFX’s fee structure is more transparent, suitable for both individual and business users.

Why Choose OFX?

- Zero Transfer Fees: OFX charges no transfer fees, meaning you can save fixed costs per transaction.

- Competitive Exchange Rates: OFX’s rates are comparable to mainstream market platforms, helping you reduce hidden costs from exchange rate differences.

These features make OFX a cost-effective choice, especially for users needing frequent large transfers.

Tip: If you need to transfer to multiple countries, OFX’s global coverage can meet your needs. It supports over 50 currencies, suitable for diverse payment scenarios.

How to Optimize Transfers with OFX?

- Register an Account: You can easily register an OFX account online, with a simple and quick process.

- Choose Currency: Select the appropriate currency based on the destination country to ensure the lowest transfer costs.

- Submit Transfer Details: Enter the recipient’s account information, and OFX will automatically calculate fees and exchange rates.

Through these steps, you can quickly complete international transfers while enjoying favorable fees and exchange rates.

WorldRemit: Supports Multiple Payment Methods with Low Fees

WorldRemit is a flexible international transfer platform that supports multiple payment methods, including bank transfers, mobile wallets, and cash pickups. You can choose the most suitable payment method based on your needs while enjoying low fees.

WorldRemit’s Advantages

- Diverse Payment Methods: Whether to a bank account or mobile wallet, WorldRemit meets your needs.

- Transparent Fees: The platform displays all fees before the transfer, helping you avoid hidden costs.

- Fast Arrival: Many transactions can be completed within minutes, suitable for urgent transfer scenarios.

These features make WorldRemit a convenient and cost-effective choice, especially for users needing small transfers.

Note: When using WorldRemit, ensure the recipient’s account information is accurate to avoid delays or failures.

How to Maximize WorldRemit’s Advantages?

- Choose the Right Payment Method: Select bank transfers or mobile wallets based on the recipient’s needs.

- Monitor Exchange Rate Changes: Check real-time exchange rates before transferring and choose the best time for transactions.

- Take Advantage of Promotions: WorldRemit often offers handling fee discounts or exchange rate promotions, so stay updated on the platform’s latest offers.

By using WorldRemit wisely, you can significantly reduce international transfer costs while improving fund arrival efficiency.

Notes: Avoiding Hidden Fees and Common Pitfalls

Beware of Hidden Costs from Exchange Rate Differences

Exchange rate differences are one of the easily overlooked hidden costs in international transfers. Many banks and transfer platforms add a markup to the exchange rate, which is often not explicitly shown in the fee list. You may think you’re only paying handling fees, but in reality, exchange rate differences have already increased your total costs.

To avoid this, you can take the following measures:

- Choose Platforms Offering Real Exchange Rates: Platforms like Wise display market exchange rates directly, avoiding hidden markups.

- Check Exchange Rates in Advance: Before transferring, use online exchange rate tools to compare rates across platforms and choose the best option.

- Monitor Exchange Rate Fluctuations: If exchange rates fluctuate significantly, transfer when rates are lower to save costs.

Through these methods, you can better control transfer costs and avoid additional fees from exchange rate differences.

Understanding Additional Fees Charged by Intermediary Banks

Intermediary bank fees are an unavoidable part of international transfers. These fees are charged by intermediary banks through which funds pass, with specific amounts varying based on bank policies and often not disclosed in advance. Below are common intermediary bank fee types and their fee structures:

| Fee Type | Fee Standard |

|---|---|

| Handling Fee | 1‰ of the transfer amount, minimum $50 per transaction, maximum $260 per transaction |

| Telegraph Fee | $80 per transaction for Hong Kong, Macau, and Taiwan; $150 per transaction for international transfers |

| Intermediary Fee | Subject to the intermediary bank’s fee standards, may be directly deducted |

To reduce these fees, you can request an international transfer roadmap in advance to understand the specific transfer process and related fees. Below are some suggestions:

- Consult your bank or transfer platform in advance and request a detailed fee list.

- Comply with relevant regulations and submit necessary documents and credentials.

- Before transferring, understand the transfer fees, exchange rates, and transfer times.

These measures can help you better understand the fee structure and avoid unnecessary expenses.

Ensuring Transparency in Recipient Bank Fees

The recipient bank’s fees may also affect your transfer amount. If the recipient bank charges additional fees, the final received amount may be lower than expected. To avoid this, you need to ensure transparency in the recipient bank’s fees.

Below are some practical suggestions:

- Communicate with the Recipient: Before transferring, confirm whether the recipient bank will charge additional fees. If so, calculate the total cost in advance.

- Choose Platforms with Transparent Fees: Some transfer platforms display all fees, including recipient bank fees, before the transaction.

- Prioritize Local Accounts: If the recipient has a local account, it can reduce additional fees from intermediary and recipient banks.

Through these methods, you can ensure the recipient receives the exact amount while avoiding disputes caused by non-transparent fees.

Requesting an International Transfer Roadmap to Understand Fee Structures

When making international transfers, requesting an international transfer roadmap in advance is a key step to understanding the fee structure. The roadmap details the path of funds from the sending bank to the receiving bank, including intermediary banks involved. This helps you clearly understand the potential fees at each stage.

You can obtain the roadmap through the following methods:

- Consult the Sending Bank: Request the international transfer roadmap directly from the bank’s customer service. Most banks provide detailed fee explanations, including potential intermediary bank fees.

- Use Online Tools: Some international transfer platforms offer fee calculators or route simulation functions to help you understand the fund flow path in advance.

- Refer to User Feedback: Before choosing a transfer channel, review other users’ experiences to learn about potential hidden fees.

Tip: If the bank cannot provide a complete roadmap, you can choose platforms with higher fee transparency, such as Wise or OFX. These platforms typically display all fees before the transfer, avoiding unnecessary expenses.

By requesting a roadmap, you can better plan the transfer path and reduce unnecessary intermediary bank fees for international transfers. This not only saves costs but also gives you a clearer understanding of the fund flow process.

Agreeing on Fee Payment Methods with the Recipient in Advance to Avoid Future Hassles

In international transfers, the fee payment method directly affects the received amount. Agreeing on the fee payment method with the recipient in advance can avoid misunderstandings and hassles. Common fee payment methods include SHA, BEN, and OUR.

- SHA: Sender and recipient each bear their respective fees.

- BEN: Recipient bears all fees.

- OUR: Sender bears all fees, and the recipient receives the full amount.

When choosing a fee payment method, consider the following factors:

- Sensitivity of the Transfer Amount: If the recipient needs the exact amount, the OUR method is more suitable.

- Fee-Bearing Capacity of Both Parties: Communicate with the recipient to confirm whether they are willing to bear some fees.

- Purpose of the Transfer: For commercial transactions, the OUR method can avoid contract disputes due to insufficient amounts; for personal transfers, the SHA method may be more economical.

Note: Before transferring, ensure both parties agree on the fee payment method and document it in a written agreement. This can effectively avoid future disputes.

By agreeing on the fee payment method in advance, you can ensure the transfer process goes smoothly while reducing unnecessary communication costs. This approach is suitable not only for personal transfers but also for business cross-border transactions.

Choosing the right transfer channel is key to saving intermediary bank fees for international transfers. Fee differences between channels are significant, for example:

| Channel | Transfer Fees (%) | Remarks |

|---|---|---|

| TransferWise | 0.67 | Nearly 10 times cheaper |

| Banks | >2 | Comprehensive costs up to 3% due to exchange rate spreads |

| Established Currency Channels | <0.4 | Further reduces capital costs |

Using digital payment tools and blockchain technology can significantly lower costs. Pay attention to hidden fees and common pitfalls to ensure each transfer is efficient and economical. Follow the guide to take action, optimize the process, and reduce unnecessary expenses.

FAQ

1. Why do international transfers incur intermediary bank fees?

International transfers involve fund transfers between multiple banks. Intermediary banks handle the flow of funds and charge fees. These fees are typically used to cover the intermediary banks’ operational costs and service fees.

2. How to choose the most suitable transfer platform?

Compare the platform’s handling fees, exchange rates, and arrival times. Prioritize platforms with transparent fees, such as Wise or OFX. You can find the most suitable option through user reviews and platform features.

Tip: Choosing services that support local accounts can further reduce fees.

3. How to avoid hidden fees during transfers?

Check exchange rates and handling fees in advance. Choose platforms offering real exchange rates, such as Wise. Request an international transfer roadmap to understand the fund flow path and potential fees.

4. What is the OUR fee payment method?

The OUR method means the sender bears all fees, and the recipient receives the full amount. This method is suitable for transfers requiring precise amounts, such as contract payments or urgent transfers.

5. Are digital payment tools suitable for large transfers?

Digital payment tools are generally suitable for small transfers. For large transfers, choose platforms supporting batch transfers and favorable exchange rates, such as OFX, for greater cost-efficiency.

Note: Before transferring, confirm the platform’s fee structure to avoid additional costs.

High intermediary bank fees and complex processes in international remittances can erode your financial efficiency, especially when investing in U.S. stocks or Hong Kong markets. BiyaPay offers a streamlined cross-border payment platform, supporting conversions between over 30 fiat currencies and 200+ cryptocurrencies, with transfer fees as low as 0.5% across 190+ countries, ensuring swift fund availability for investments or business needs. Real-time exchange rate tracking empowers you to manage currency fluctuations effectively. Try BiyaPay now for transparent, secure transactions. Licensed by U.S. MSB and SEC, BiyaPay guarantees compliance and trust. Idle funds can grow with a 5.48% APY flexible savings product, accessible anytime, aligning with dynamic cross-border needs. Sign up with BiyaPay to optimize your global financial strategy today!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.