- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Guide to Short-Term Investment Strategies in a U.S. Stock Bear Market

Image Source: unsplash

In U.S. stock bear market investment strategies, you can achieve returns through short-term investment strategies. Significant market volatility creates opportunities for short-term trading, especially when prices significantly deviate from short-term value, creating arbitrage opportunities. Selecting suitable assets and strategies is critical. Continuous sharp declines are not entirely negative; they can actually create favorable conditions for short-term trading. By flexibly responding to market changes and seizing these short-term opportunities, you can significantly enhance your investment returns.

Definition and Characteristics of a U.S. Stock Bear Market

Image Source: pexels

Basic Definition of a Bear Market

A bear market typically refers to a period when the stock market falls more than 20% from its recent high. This market condition is usually accompanied by declining investor confidence and slowing economic growth. You will notice that a bear market is not just about price declines; it also reflects changes in market sentiment and deteriorating economic fundamentals. Since 1950, the U.S. stock market has experienced ten bear market cycles, with an average duration of about 14 months and an average drawdown of 35.6% for the S&P 500. The longest bear market lasted 30 months, while the shortest lasted only one month. These data indicate significant variability in the duration and drawdown of bear markets.

Main Characteristics of a U.S. Stock Bear Market

In a U.S. stock bear market, you will observe several prominent characteristics:

- High Volatility: During a bear market, market volatility increases significantly. High volatility typically indicates heightened market uncertainty.

- Decline in Valuations and Earnings: The average valuation decline during a bear market cycle is about 24.2%, with earnings falling by an average of approximately 0.6%.

- Phased Changes: Bear markets typically unfold in three stages: valuation decline, valuation recovery combined with earnings decline, and earnings recovery.

Additionally, before a bear market bottoms out, the unemployment rate typically rises within six months, and the PMI declines for an average of about nine months before the S&P 500 reaches its bottom. These indicators can help you judge the occurrence and conclusion of a bear market.

Impact of a Bear Market on Short-Term Investing

A bear market provides unique opportunities for short-term investors. The market’s sharp volatility creates short-term arbitrage opportunities. The following are the impacts of a bear market on short-term investing:

| Research Finding | Description |

|---|---|

| Investor Sentiment as a Risk Factor | Investor sentiment can play a role in asset pricing. |

| Relationship Between Short-Term Returns and Sentiment | Short-term returns in A-shares are significantly positively correlated with the current investor sentiment index and significantly negatively correlated with the previous period’s sentiment index. |

| Impact on Small-Cap Stocks | Daily investor sentiment is more likely to affect small-cap mainboard stocks and has a greater impact on strong index returns. |

In a bear market, investor sentiment fluctuates significantly. You can leverage these sentiment changes, combined with technical analysis, to find short-term trading opportunities. By focusing on trending sectors and high-volatility stocks, you can better capture short-term gains.

Core Principles of Short-Term Investing

Importance of Rapid Decision-Making and Execution

The success of short-term investing relies heavily on rapid decision-making and efficient execution. In a U.S. stock bear market, market volatility is intense, and opportunities are fleeting. You need to analyze market dynamics and take decisive action within a short period.

- Rapid Decision-Making: When the market experiences abnormal fluctuations, timely trend judgment is crucial. Delays may lead to missing the optimal entry or exit points.

- Efficient Execution: Once a trading plan is determined, execute it immediately. Using advanced trading tools and platforms can help you reduce trading time and improve efficiency.

Additionally, short-term investing requires you to maintain a high level of focus. Reviewing market trends daily and monitoring changes in trending sectors can help you capture opportunities faster. Remember, speed and execution are the core competencies of short-term investing.

Role of Technical Analysis in Short-Term Investing

Technical analysis is a foundational tool for short-term investing. By analyzing price movements and trading volume, you can better predict short-term market trends. The following are key roles of technical analysis in short-term investing:

- Trend Identification: Technical analysis helps you determine whether the market is in an uptrend or downtrend. Short-term trading tends to follow the trend.

- Finding Entry and Exit Points: Through technical indicators (such as RSI, MACD, etc.), you can identify suitable entry and exit points.

- Risk Control: Technical analysis can also help you set stop-loss points to reduce trading risks.

Historical data shows that technical analysis in short-term investing has a certain success rate pattern:

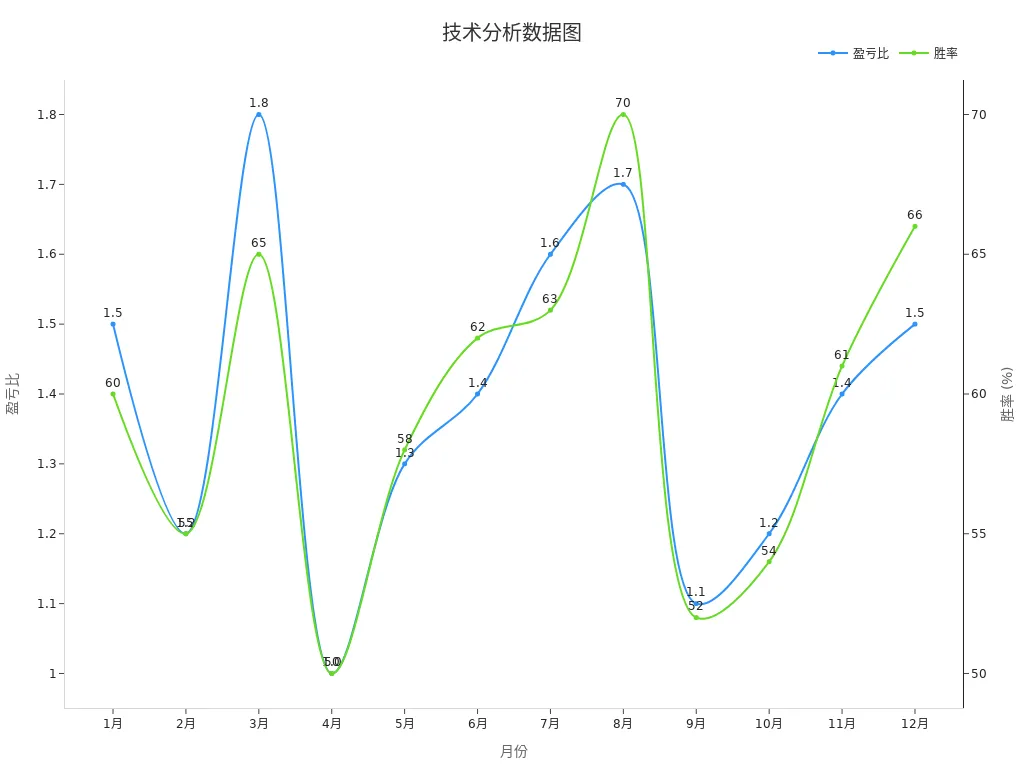

| Month | Profit-Loss Ratio | Win Rate |

|---|---|---|

| January | 1.5 | 60% |

| February | 1.2 | 55% |

| March | 1.8 | 65% |

| April | 1.0 | 50% |

| May | 1.3 | 58% |

| June | 1.4 | 62% |

| July | 1.6 | 63% |

| August | 1.7 | 70% |

| September | 1.1 | 52% |

| October | 1.2 | 54% |

| November | 1.4 | 61% |

| December | 1.5 | 66% |

As shown in the table, the win rate and profit-loss ratio of technical analysis vary across months. You can optimize your trading strategy by combining these data.

How to Leverage Market Sentiment and Trending Sectors

Market sentiment and trending sectors are key factors in short-term investing. In a U.S. stock bear market, investor sentiment fluctuates significantly, and the performance of trending sectors is particularly prominent. You can leverage these factors in the following ways:

- Monitor Market Sentiment: Investor sentiment often influences short-term stock price fluctuations. When market sentiment is overly pessimistic, opportunities for oversold rebounds may arise.

- Seize Trending Sectors: Trending sectors typically have higher upside potential. For example, tech stocks or renewable energy sectors may become market focal points during specific periods.

The following are key points to note in short-term investing:

- Short-term trading has a higher success probability in stocks with intact medium- to long-term trends, especially when the stock price is above the 60-day moving average.

- Trending sector stocks typically have higher upside than non-trending stocks, making it critical to seize trending opportunities for short-term investing success.

- Short-term trading should focus on trends rather than price, making decisions based on comprehensive analysis.

- In a weak overall market, contrarian trading carries high risks and low success rates, so it’s better to select stocks in line with the broader market trend.

By combining market sentiment and trending sectors, you can more accurately seize short-term trading opportunities and improve investment returns.

Specific Methods for U.S. Stock Bear Market Investment Strategies

Selection and Application of Technical Analysis Tools

In a U.S. stock bear market, technical analysis tools are the core of short-term investing. They help you quickly understand market trends and make timely decisions. The following are key features of technical analysis tools:

- Technical analysis combines historical data and market depth to help you understand market trends and price behavior.

- Historical data shows that bear markets have an average decline of about 35%, occurring every three to four years. One to two market corrections of 10%–20% occur annually, and technical analysis can help you seize these opportunities.

- Technical analysis is suitable for mainstream stocks with high trading volume and liquidity, enabling more accurate reflection of market dynamics.

For short-term investors, technical analysis tools such as candlestick charts, moving averages, and the Relative Strength Index (RSI) are essential. They help you identify entry and exit points and set stop-loss levels. Technical charts can also provide a basis for wiser investment decisions when fundamental information is lacking.

You can optimize the application of technical analysis tools in the following ways:

- Select Suitable Tools: Choose appropriate technical analysis tools based on the stock’s liquidity and trading volume.

- Combine with Market Sentiment: Technical analysis not only focuses on price but can also incorporate market sentiment indicators to further improve prediction accuracy.

- Continuous Learning: Technical analysis requires ongoing learning and practice. By reviewing historical data, you can better understand the effectiveness of tool applications.

How to Identify Trending Sectors in a Bear Market

Trending sectors are key to short-term investing. In a U.S. stock bear market, trending sectors typically exhibit higher volatility and upside potential. You can identify trending sectors using the following methods:

- Monitor Industry Trends: Tech stocks, renewable energy, and healthcare sectors often perform strongly in bear markets, typically driven by policy support or market demand.

- Analyze Capital Flows: Capital flows reflect the market’s attention to a specific sector. By observing the volume of capital inflows, you can identify which sectors may become trending.

- Leverage News and Data: News reports and market data can help you quickly understand market hotspots. For example, when an industry’s earnings expectations significantly improve, it may become a focus for short-term investing.

Identifying trending sectors requires keen market insight. By combining technical analysis and market sentiment, you can more accurately seize investment opportunities in trending sectors. Remember that the performance of trending sectors is often phased, so you need to adjust strategies promptly to adapt to market changes.

Risk Management Techniques in Short-Term Trading

Risk management is key to successful short-term trading. In a U.S. stock bear market, market volatility is intense, making risk management particularly important. The following are several common risk management techniques:

| Risk Management Technique | Related Statistical Data and Models |

|---|---|

| Setting Stop-Loss Points | Use technical analysis tools to set reasonable stop-loss points to reduce loss risks. |

| Diversified Investment | Invest Hawkins in multiple sectors or stocks to reduce the risk of single assets. |

| Capital Management | Control the proportion of funds allocated to a single trade to avoid over-investment. |

You can optimize risk management in the following ways:

- Develop a Clear Trading Plan: Before each trade, clearly define target prices for entry and exit.

- Use Risk Control Models: Combine historical data and market dynamics to optimize the application of risk control models.

- Maintain Discipline: Strictly adhere to the trading plan to avoid emotional trading.

Risk management not only reduces losses but also helps you maintain stable investment returns in a bear market. By combining technical analysis and capital management, you can better address market uncertainties.

Case Studies and Data Analysis

Image Source: pexels

Success Case: How Short-Term Trading Achieves Profits

In a U.S. stock bear market, successful short-term trading cases are not uncommon. During the 2022 bear market, an investor achieved significant returns by focusing on oversold rebound opportunities in the tech sector. They used technical analysis tools, such as RSI and MACD, to accurately capture entry points for several stocks. When market sentiment was extremely pessimistic, they selected tech stocks with low valuations but solid fundamentals. Subsequently, these stocks experienced strong short-term rebounds. They sold decisively when prices approached resistance levels, locking in profits.

This case demonstrates that the success of short-term trading relies on keen insight into market sentiment and proficient use of technical analysis. You can use similar methods to find short-term opportunities in a bear market.

Failure Case: Common Mistakes and Avoidance Methods

In short-term trading, failure cases are equally noteworthy. Some investors suffered losses in a bear market due to frequent trading without proper risk management. For example, some blindly chased trending sectors without setting stop-loss points. When the market suddenly reversed, they failed to stop losses in time, leading to amplified losses.

To avoid similar mistakes, you need to:

- Develop a clear trading plan, including target prices for entry and exit.

- Strictly execute stop-loss strategies to avoid emotional trading.

- Avoid over-reliance on a single indicator and use multiple analysis methods to improve decision accuracy.

Through these methods, you can effectively reduce the risk of failure in short-term trading.

How Data Analysis Optimizes Short-Term Investment Strategies

Data analysis plays a crucial role in short-term investing. Through scientific mathematical models, you can develop more precise trading strategies. The following are several common methods and their functions:

| Method | Function Description |

|---|---|

| Short-Term Price Trend Indicator | Identifies and tracks emerging trend movements in real-time while dynamically adjusting indicator calculations to adapt to volatility. |

| Market Sentiment Filter | Quantitatively calculates investor sentiment to predict potential market direction, improving strategy success rates. |

| Efficient Stop-Loss and Take-Profit | Combines short- and medium-term strategy signal cycles to select optimal stop-loss and take-profit logic, enabling timely exits during rapid rebound movements. |

These methods help you better address the challenges in U.S. stock bear market investment strategies. For example, short-term price trend indicators allow you to quickly identify short-term market trends, while market sentiment filters improve trading success rates. By combining these tools, you can optimize short-term investment strategies and enhance overall returns.

In a U.S. stock bear market, the key points of short-term investment strategies include the following aspects:

- Flexible Response to Market Changes: The high volatility in a bear market creates opportunities for short-term trading. Through technical analysis tools, you can quickly identify trends and find entry and exit points.

- Rational Investment Decisions: Successful cases show that combining market sentiment and trending sectors can significantly improve returns. Failure cases remind you that risk management is essential.

- Data-Driven Strategy Optimization: Historical data indicates that bear markets have an average decline of about 35%, occurring every three to four years. By combining these data, you can develop more precise trading plans.

By combining data and case analysis, you can better understand the potential and risks of short-term investing. Developing an investment plan tailored to your situation can help you achieve stable returns in a bear market.

FAQ

1. What is the best time for short-term investing in a bear market?

The best time for short-term investing is typically during periods of intense market volatility. You can focus on the first 30 minutes after the market opens and the last 30 minutes before it closes. These periods have higher trading volumes and significant price fluctuations, making it easier to find short-term trading opportunities.

2. How can you quickly identify trending sectors in a bear market?

You can identify trending sectors by observing capital flows and news reports. Focus on industry trends and sectors supported by policies, such as tech stocks or renewable energy. By combining technical analysis tools, you can more accurately find investment opportunities in trending sectors.

3. How do you set stop-loss points in short-term investing?

Setting stop-loss points requires combining technical analysis tools. You can use moving averages or the Relative Strength Index (RSI) to determine reasonable stop-loss positions. Maintaining discipline and strictly executing stop-loss strategies can effectively reduce loss risks.

4. Is short-term investing in a bear market suitable for everyone?

Short-term investing requires rapid decision-making and efficient execution. If you are skilled in technical analysis and can tolerate higher risks, short-term investing may be suitable for you. If you prefer stable returns, medium- to long-term strategies are more appropriate in a bear market.

5. How can you avoid emotional trading in short-term investing?

Develop a clear trading plan, including target prices for entry and exit. Use technical analysis tools to assist decision-making and avoid relying on intuition. Staying calm and strictly adhering to the plan can help you reduce risks from emotional trading.

The sharp fluctuations in the U.S. stock market bear market have created arbitrage opportunities for short-term investors. However, high cross-border transfer fees and slow capital flows may cause you to miss trading opportunities. BiyaPay empowers you with seamless financial tools to act swiftly. Convert over 30 fiat currencies with 200+ cryptocurrencies and track real-time fiat exchange rates to stay ahead, all with transfer fees as low as 0.5% try now. Licensed by U.S. MSB and SEC, BiyaPay ensures secure, compliant transactions. Your idle funds can grow with a 5.48% APY flexible savings product, accessible anytime. Join BiyaPay to enhance your short-term trading success! Sign up today

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.