- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Must-Read for Investors: 2025 US Semiconductor Stock Recommendations

Image Source: pexels

In 2025, which US semiconductor stocks are worth your attention? With the development of artificial intelligence, autonomous driving, and 5G technologies, The semiconductor industry is welcoming new growth opportunities. You can identify high-potential investment targets by observing industry trends, technological innovations, and changes in market demand. For example, the rapid adoption of AI chips and the surging demand for automotive chips are driving the expansion of the entire industry. These changes provide excellent reasons for investors to deeply research US semiconductor stocks.

Key Points

- In 2025, the semiconductor industry will experience significant growth, and investors should focus on opportunities driven by market size and technological innovation.

- The surging demand for AI chips and automotive chips is a key driver of semiconductor industry expansion, offering investors opportunities to find high-potential stocks.

- Geopolitical issues and supply chain challenges may impact semiconductor stock performance, and investors need to closely monitor related developments to mitigate risks.

- Choosing companies with significant R&D investments, such as NVIDIA and Broadcom, can help investors capitalize on long-term growth opportunities.

- Focusing on changes in downstream demand, particularly growth trends in 5G and IoT, can help seize investment opportunities in US semiconductor stocks.

2025 Semiconductor Industry Outlook

Image Source: pexels

Market Size Forecast

In 2025, the market size of the semiconductor industry is expected to experience significant growth. According to industry data, 92% of semiconductor executives predict overall industry revenue growth, with 46% expecting growth to exceed 10%. This optimism reflects an increase in the industry confidence index, rising from 54 in 2023 to 59 in 2025.

Specifically, shipment volumes and growth rates for different device types also confirm this trend:

| Device Type | 2023 Shipments (Billions) | Year-over-Year Growth Rate (%) |

|---|---|---|

| 5G Terminal Devices | 14.8 | 31.7 |

| IoT Devices | N/A | 38.5 |

| Automotive Electronics | N/A | 35.1 |

These data indicate that the rapid development of 5G, IoT, and automotive electronics will be key drivers of semiconductor market expansion.

AI Chip Growth Potential

The widespread adoption of artificial intelligence technologies is reshaping the semiconductor industry landscape. AI chips, as a core driver, are expected to achieve rapid growth in the coming years. For example, NVIDIA projects a compound annual revenue growth rate of 27.5% over the next five years, with a net profit compound annual growth rate of 25.3%.

The demand growth for AI chips is primarily driven by the following factors:

- The widespread application of artificial intelligence in cloud computing, autonomous driving, and robotics.

- Advancements in high-bandwidth memory technology, meeting the high data processing requirements of AI models.

- Increased corporate investment in AI chips, further expanding market size.

You can see that AI chips not only drive technological innovation but also provide long-term growth opportunities for investors.

Automotive Chip Demand Drivers

With the rising popularity of new energy vehicles and autonomous driving technologies, the automotive chip market is experiencing explosive growth. Data shows that the global automotive chip market size is expected to grow from $310 billion in 2023 to $600 billion by 2030, with a compound annual growth rate of 15%.

Additionally, the rapid growth in new energy vehicle sales provides strong support for automotive chip demand:

| Year | Market Size (Billions CNY) | New Energy Vehicle Sales (Millions) | Year-over-Year Growth Rate |

|---|---|---|---|

| 2023 | 820.8 | - | - |

| 2024 | 905.4 | 12.866 | 35.5% |

You can observe that the demand for automotive chips comes not only from traditional automotive electronics but also from emerging areas such as battery management systems and autonomous driving sensors. These trends bring new growth momentum to the semiconductor industry while offering investors more options.

Geopolitical and Supply Chain Impacts

The impact of geopolitical issues and supply chain challenges on the semiconductor industry cannot be ignored. You may have noticed that in recent years, the fragility of global supply chains has been frequently exposed, particularly in the context of the COVID-19 pandemic and international trade tensions. Supply chain disruptions have not only affected chip production and delivery but also driven up commodity prices, further exacerbating market uncertainty.

The following data can help you more intuitively understand the trend of supply chain pressure changes:

| Time | Global Supply Chain Pressure Index | Commodity Inflation Change |

|---|---|---|

| End of 2021 | Historical Peak | Followed Closely |

| 2022 | Index Gradually Recovered | Significant Correlation |

| 2030 Forecast | Manufacturing Capacity Doubled | New Jobs Created |

As shown in the table, supply chain pressure reached a historical peak at the end of 2021, directly leading to commodity price increases. Although pressure eased in 2022, supply chain recovery still requires time. By 2030, manufacturing capacity is expected to double, bringing more opportunities to the market.

Additionally, the global share of US semiconductor manufacturing has declined from 37% in 1990 to 12% in 2020. To address this challenge, the US introduced the CHIPS and Science Act, aiming to double manufacturing capacity over the next decade. This policy not only seeks to enhance domestic production but also aims to reduce reliance on foreign supply chains.

You may wonder, what does this mean for investors? First, geopolitical events may lead to supply chain disruptions, affecting the balance of chip supply and demand. Second, policy support may create more development opportunities for domestic companies. For example, companies investing in domestic manufacturing capacity may benefit from this.

In summary, geopolitical and supply chain issues are both challenges and opportunities. You need to closely monitor these dynamics to gain an edge in investment decisions.

US Semiconductor Stock Recommendation List

Image Source: pexels

Leading Companies in the AI Sector

In the AI sector, several US semiconductor stock companies have become industry leaders. With their strong R&D capabilities and market share, they continue to drive innovation and application of AI technologies. Below is some key data to help you better understand the strength of these companies:

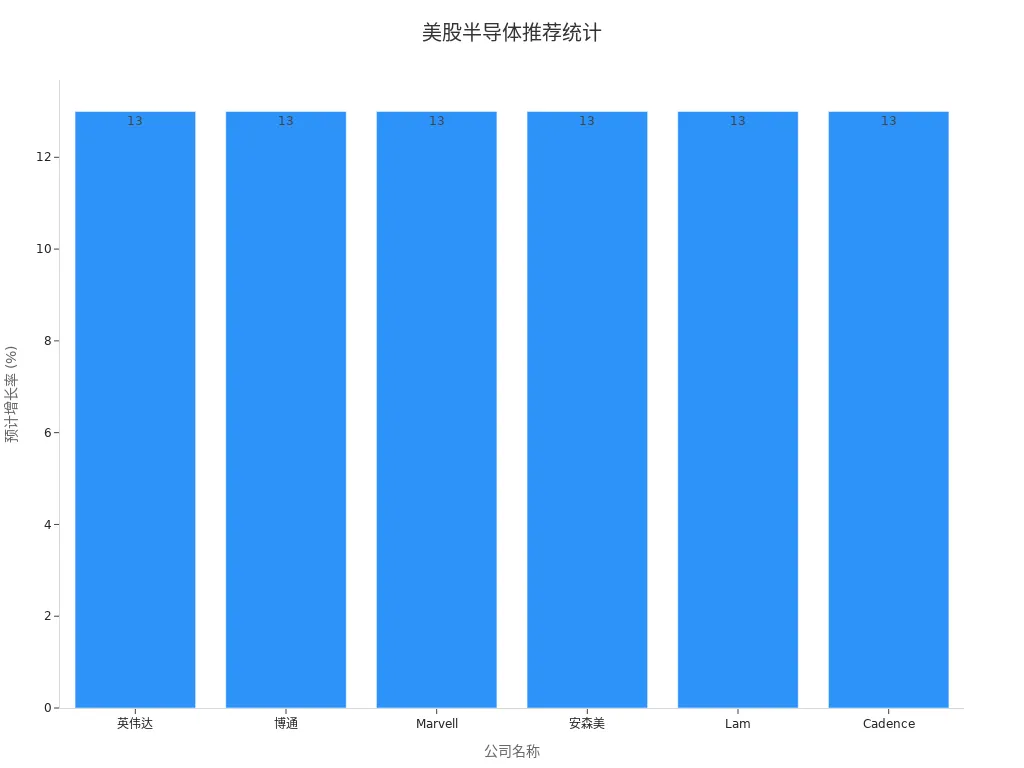

| Company Name | Recommendation Reason | Projected Growth Rate |

|---|---|---|

| NVIDIA | Leader in the AI sector, bullish on AI development prospects | Projected growth of 13% |

| Broadcom | Key player in AI semiconductors | Projected growth of 13% |

| Marvell Technology | Key player in AI semiconductors | Projected growth of 13% |

| ON Semiconductor | Leader in automotive and electric vehicle sectors, cyclical recovery | Projected growth of 13% |

| Lam Research | Leading position in flash memory tools | Projected growth of 13% |

| Cadence Design | Sustained double-digit growth, especially as AI hardware cycles slow | Projected growth of 13% |

As shown in the table, NVIDIA and Broadcom stand out in the AI sector. They not only invest heavily in R&D but also dominate in market share.

Additionally, the widespread adoption of AI technologies has driven rapid development in related fields. For example, the number of globally connected IoT devices has reached 900 million, with over 18.3 million users owning five or more connected devices. These data indicate that AI technologies are profoundly transforming our lifestyles while offering investors significant market opportunities.

NVIDIA’s Technological Advantages

As a leading company in the AI sector, NVIDIA’s technological advantages are indisputable. Below is some key data to help you understand NVIDIA’s market position and R&D strength:

- NVIDIA’s R&D expenses reached $7.34 billion in fiscal year 2023, 1.47 times that of AMD.

- As of Q3 2022, NVIDIA held an 88% share of the global GPU market, compared to AMD’s 8%.

- In the Chinese market, NVIDIA’s GPU server market share is close to 95%.

NVIDIA’s success is inseparable from its continuous innovation in deep learning and GPU technologies. Since 2007, NVIDIA has focused on R&D in mobile GPUs and deep learning, a strategy that led to a significant increase in patent applications after 2011. Today, NVIDIA is the absolute leader in the AI chip market, offering investors long-term growth potential.

Tip: If you’re looking for a company with long-term competitiveness in the AI sector, NVIDIA is undoubtedly a US semiconductor stock worth considering.

Broadcom’s Business Layout

Broadcom’s business layout in the AI semiconductor sector is equally noteworthy. As a diversified semiconductor company, Broadcom excels not only in AI but also holds significant positions in communications, storage, and networking equipment. Below are some key business data for Broadcom:

- Broadcom’s projected growth rate in the AI chip market is 13%.

- Its products are widely used in high-growth areas such as data centers, cloud computing, and 5G networks.

Broadcom’s success stems from its diversified business layout and strong technological capabilities. For example, in the 5G network equipment sector, Broadcom’s chip solutions are widely adopted, providing stable revenue streams. Additionally, Broadcom continues to expand its market share and technological advantages through acquisitions and strategic partnerships.

Tip: Broadcom’s diversified business layout makes it more resilient to market volatility. If you’re looking to invest in a steadily growing US semiconductor stock company, Broadcom is a good choice.

Texas Instruments’ Position in Analog Chips

Texas Instruments holds a prominent position in the analog chip sector. You may have noticed that analog chips are increasingly widely used in industrial and automotive markets, and Texas Instruments is a leader in this field. Below are its core competitive advantages in the industry:

- Leading Market Share: Texas Instruments has long maintained a leading market share in the analog chip market, particularly in industrial and automotive applications.

- R&D Investment: The company continues to increase investment in high-efficiency power management and data conversion technologies. These technologies are the core of analog chips, directly impacting product performance.

- Clear Competitive Advantage: Major competitors include Microchip Technology, Analog Devices, and NXP, but Texas Instruments maintains its industry-leading position through technological innovation and market share advantages.

Texas Instruments’ success comes not only from its technological strength but also from its precise grasp of market demand. You can see that with the rapid development of new energy vehicles and industrial automation, the demand for analog chips will continue to grow. This provides strong momentum for Texas Instruments’ future development.

Tip: If you’re looking for a US semiconductor stock with long-term competitiveness in the analog chip sector, Texas Instruments is a choice worth considering.

Qualcomm’s Leadership in Communication Chips

Qualcomm’s leadership in the communication chip sector is indisputable. As a core driver of 5G technology, Qualcomm’s products are widely used in smartphones, IoT devices, and automotive communication systems. Below are Qualcomm’s main advantages:

- First-Mover Advantage in 5G Technology: Qualcomm leads in 5G chip technology reserves and market share. Its Snapdragon series chips have become a benchmark in the smartphone market.

- Diversified Product Layout: Beyond smartphones, Qualcomm has made significant progress in IoT and automotive communication sectors. For example, its automotive communication chips have been adopted by several leading global automakers.

- Sustained R&D Investment: Qualcomm allocates over 20% of its revenue to R&D annually, ensuring its leadership in communication technologies.

You may wonder, where are Qualcomm’s future growth points? The answer lies in the rapid expansion of IoT and automotive communication markets. Data shows that by 2030, the global number of IoT devices is expected to reach 25 billion, and the automotive communication market’s compound annual growth rate will exceed 20%. These trends provide Qualcomm with significant market opportunities.

Tip: Qualcomm’s communication chip business is not only technologically advanced but also widely applied in the market. If you’re optimistic about the prospects of 5G and IoT, Qualcomm is a US semiconductor stock worth considering.

Micron Technology’s Market Recovery Potential

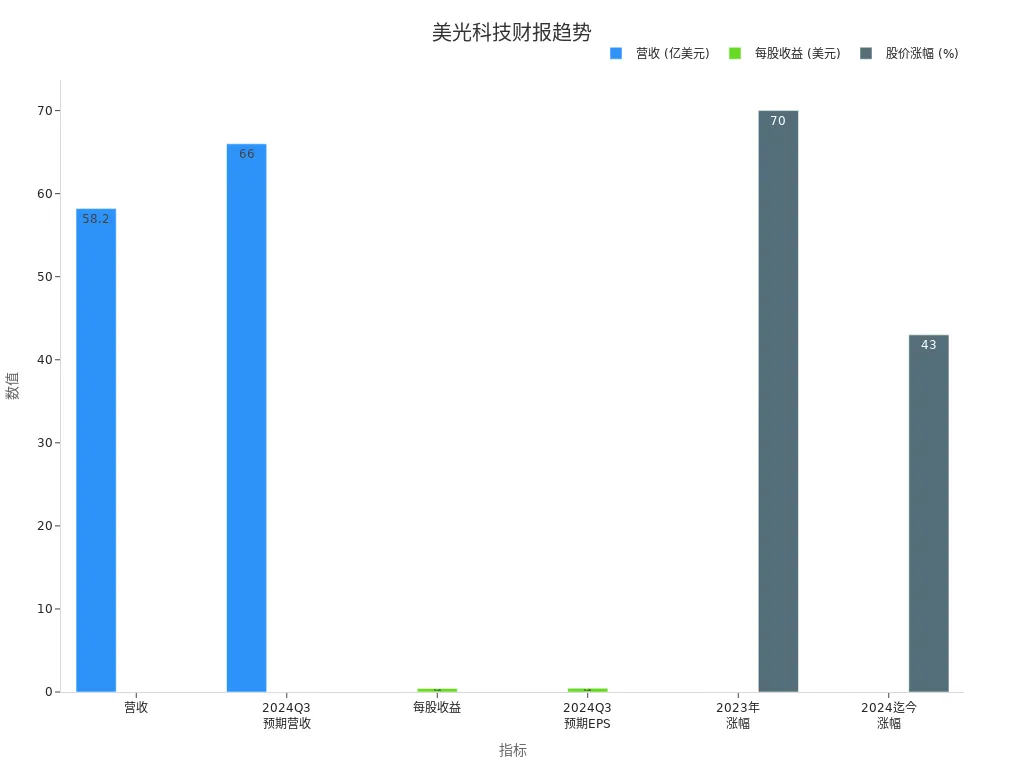

Micron Technology’s performance in the memory chip market is gradually recovering. You may have noticed that with the global economic recovery and rising demand for memory chips, Micron’s performance is rapidly improving. Below are its recent financial data:

| Metric | Value |

|---|---|

| Revenue | $5.82 billion (QoQ +23% / YoY +57.7%) |

| Earnings Per Share | $0.42 (QoQ +114.2% / YoY +121.9%) |

| 2023 Stock Price Gain | 70% |

| 2024 YTD Gain | 43% |

| Q3 FY2024 Expected Revenue | $6.6 billion (QoQ +13.4% / YoY +76%) |

| Q3 FY2024 Expected EPS | $0.45 (QoQ +7.1% / YoY +131.4%) |

As shown in the table, Micron’s revenue and earnings per share have achieved significant growth. This is primarily due to the following factors:

- Rising Market Demand: With the adoption of AI technologies and data center expansion, demand for memory chips is growing rapidly.

- Technological Innovation: Micron’s breakthroughs in high-bandwidth memory and low-power memory have won it more market share.

- Cost Control: The company has effectively reduced operating costs through optimized production processes and supply chain management.

You can see that Micron’s market recovery potential is reflected not only in its financial data but also in its technological innovation and market demand growth. For investors, Micron is a US semiconductor stock worth considering.

Tip: If you’re looking to invest in a company with market recovery potential, Micron Technology is a good choice.

NXP Semiconductors’ Automotive Chip Innovation

NXP Semiconductors’ innovation in the automotive chip sector is impressive. You may have noticed that with the rapid development of new energy vehicles and autonomous driving technologies, competition in the automotive chip market is intensifying. NXP, with its deep technological expertise and market insight, has become a key player in this field.

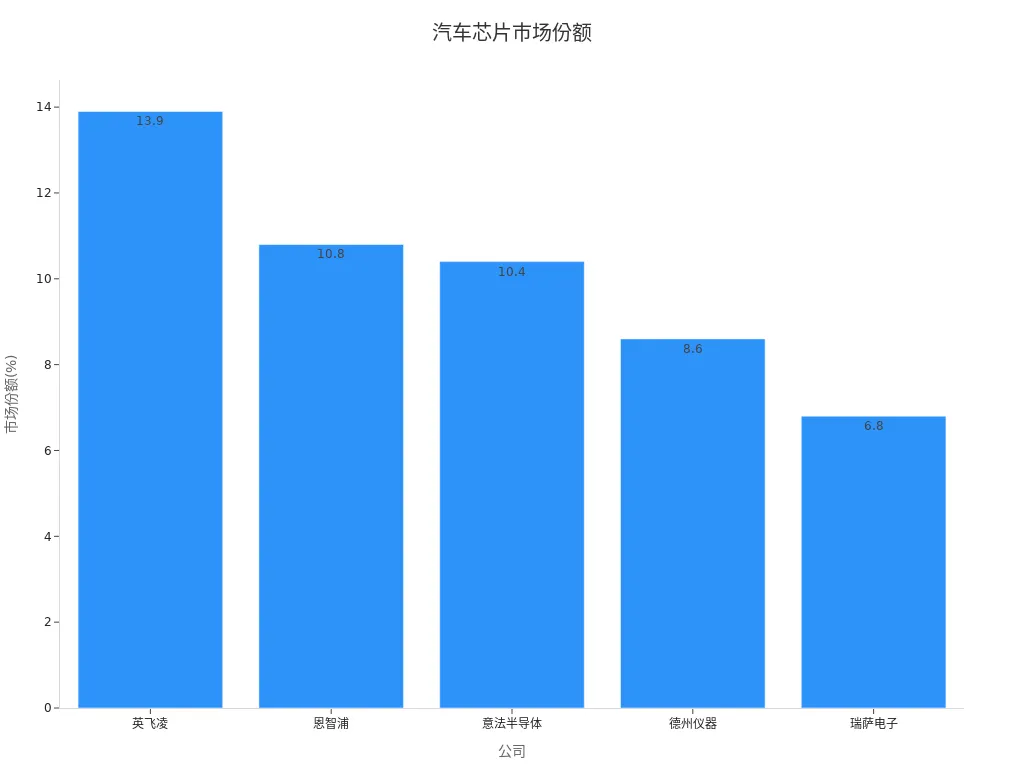

Market Share and Competitiveness

NXP holds a significant position in the global automotive chip market. Below is the market share data for major companies in the automotive chip market:

| Company | Market Share |

|---|---|

| Infineon | 13.9% |

| NXP | 10.8% |

| STMicroelectronics | 10.4% |

| Texas Instruments | 8.6% |

| Renesas Electronics | 6.8% |

As shown in the table and chart, NXP ranks second in market share, just behind Infineon. This demonstrates NXP’s strong competitiveness in the automotive chip sector.

Technological Innovation and Partnerships

NXP’s technological innovation focuses primarily on vehicle-to-everything (V2X) communication and security technologies. Below are specific manifestations of its technological advantages:

- In V2X communication technologies, NXP’s products enable real-time information exchange between vehicles, enhancing driving safety.

- In security technologies, NXP provides reliable protection for autonomous driving systems through encryption chips and security protocols.

- NXP closely collaborates with automotive OEMs and Tier 1 suppliers, offering comprehensive solutions to meet market demands.

These technological innovations not only enhance NXP’s product competitiveness but also drive the development of the entire automotive chip industry. You can see that NXP’s technological breakthroughs offer investors long-term growth potential.

Tip: If you’re optimistic about the future development of the automotive chip market, NXP Semiconductors is a US semiconductor stock worth considering.

Qorvo (QRVO)’s RF Chip Advantages

Qorvo (QRVO)’s technological advantages in the RF chip sector are significant. You may already know that with the adoption of 5G technologies and the rapid growth of IoT devices, demand for RF chips continues to rise. Qorvo, with its leading technology and wide market applications, is a standout in this field.

Technological Advantages

Qorvo’s technologies meet the 5G market’s demands for multi-band and high-data-rate communications. Below are its main technical features:

- BAW and SAW Filters: Support multi-band communication, ensuring signal quality.

- Gallium Arsenide PAs: Provide high-efficiency power amplification solutions.

- SOI Antenna Tuners and Switches: Optimize signal transmission efficiency.

These technologies not only enable advanced communication technologies like multi-band carrier aggregation and MIMO but also meet the high-performance RF chip demands of 5G smartphones.

Market Performance and Applications

Qorvo’s performance in the RF chip market is impressive. Below are highlights of its market performance:

- The RF market size exceeded $20 billion in 2022, with Qorvo’s market share significantly increasing.

- In base stations, Qorvo’s GaN devices reduce power consumption by 40%, cut die space by 94%, and save 80% in costs.

- Qorvo has enhanced its competitiveness in IoT and defense sectors through multiple acquisitions.

You can see that Qorvo’s technology and market performance not only meet the demands of 5G communication but also achieve wide applications in WiFi 6, IoT, and defense sectors. These advantages provide investors with diversified options.

Tip: If you’re looking to invest in a company with leading technological advantages in the RF chip sector, Qorvo is a US semiconductor stock worth considering.

Key Factors Influencing US Semiconductor Stock Performance

Downstream Demand Changes

You may have noticed that the semiconductor industry’s performance is closely tied to changes in downstream demand. Demand from consumer electronics, automotive electronics, and IoT devices directly impacts the performance of US semiconductor stocks. Below are some key data to help you understand downstream demand growth trends:

- Global 5G terminal device shipments reached 1.48 billion units in 2023, with a year-over-year growth of 31.7%.

- IoT device shipments grew by 38.5% year-over-year.

- Automotive electronics shipments grew by 35.1% year-over-year.

These data indicate that the adoption of 5G technologies and the rapid growth of IoT devices are driving semiconductor market expansion. You can see that with the rising popularity of new energy vehicles and smart homes, downstream demand will continue to grow strongly in the coming years. This provides investors with more opportunities.

Tip: Focusing on changes in downstream demand, particularly growth trends in 5G and IoT, can help you better seize investment opportunities in US semiconductor stocks.

The Driving Role of Technological Innovation

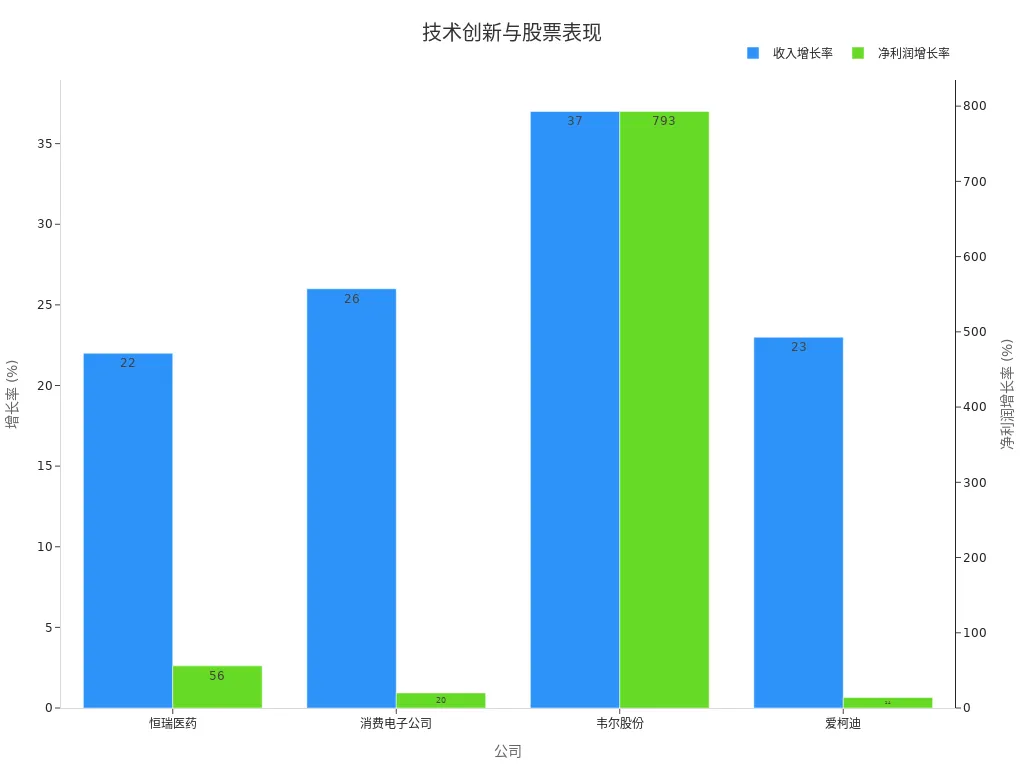

Technological innovation is the core driver of semiconductor industry development. You may wonder how technological innovation affects the performance of US semiconductor stocks. The answer lies in the strong correlation between technological investment and company performance. Below is a set of data showcasing the driving role of technological innovation in company revenue and net profit:

| Company | Technological Innovation Description | Revenue Growth Rate | Net Profit Growth Rate |

|---|---|---|---|

| Fuyao Glass | 5G antenna glass integration, up to 800 Mbps | N/A | N/A |

| Hengrui Medicine | 16 Class 1 innovative drugs launched, revenue growth of 22% | 22% | 56% |

| Sci-Tech Board Pharma | Revenue growth of 67%, over 50 drugs approved | 67% | N/A |

| VeriSilicon | Revenue and net profit growth of 37% and 793% | 37% | 793% |

As shown in the table and chart, technological innovation significantly boosts company revenue and net profit. For example, VeriSilicon achieved a 793% net profit growth through technological breakthroughs. You can see that semiconductor companies enhance market competitiveness and create more value for investors by developing new technologies and optimizing product performance.

Tip: Investing in companies with significant R&D investments can help you capitalize on long-term growth opportunities in the semiconductor industry.

Impact of the Macroeconomic Environment

Changes in the macroeconomic environment have a profound impact on the performance of US semiconductor stocks. You may find that economic cycles, monetary policies, and fiscal policies directly or indirectly affect the demand and supply in the semiconductor industry. Below are some key points to help you understand the impact of the macroeconomic environment on the semiconductor industry:

- Economic upcycles typically increase demand for consumer electronics and automotive electronics, boosting semiconductor product sales.

- Economic downturns lead to reduced investment by consumers and businesses, weakening semiconductor demand.

- Loose monetary policies lower financing costs, stimulating investment and consumption, and driving semiconductor sales.

- Active fiscal policies, such as tax cuts and increased public spending, can boost market demand and promote semiconductor industry growth.

You can see that changes in the macroeconomic environment affect not only consumer purchasing power but also corporate investment decisions. For example, loose monetary policies may encourage companies to increase investment in semiconductor technologies, while economic recessions may lead to reduced demand. Therefore, closely monitoring macroeconomic indicators, such as GDP growth rates, interest rates, and government policies, can help you better predict the performance of US semiconductor stocks.

Tip: When investing in US semiconductor stocks, paying attention to changes in the macroeconomic environment can help you mitigate risks and seize market opportunities.

Investment Risk Analysis

Intensifying Technological Competition

Technological competition in the semiconductor industry is becoming increasingly fierce. You may have noticed that with the rapid development of technologies like AI, 5G, and autonomous driving, R&D investment and technological innovation have become the core of competition among companies. Below are some case studies to help you better understand the state of technological competition:

| Case Name | Company Basic Info | Industry Outlook Analysis | Venture Capital Process Analysis | Success Factors Analysis |

|---|---|---|---|---|

| 7 Days Inn | Introduction Info | Industry Outlook | Process Analysis | Success Factors |

| Rainbow Fine Chemical | Introduction Info | Industry Outlook | Process Analysis | Success Factors |

| Jingyi Shares | Partnership Reasons | Company Info | Decision Basis | Success Factors |

| Yuchai Construction Machinery | Partnership Info | Project Evaluation | Process Analysis | Success Factors |

| Blue Ocean Hotel | Introduction Info | Industry Outlook | Process Analysis | Success Factors |

As shown in the table, companies need to continuously optimize R&D strategies to secure a place in the market amid technological competition. You need to focus on companies with significant R&D investments, as they are more likely to stand out in future competition.

Tip: While technological competition brings innovation opportunities, it may also lead to rising R&D costs and market share redistribution. Be cautious in assessing a company’s technological strength and market positioning when investing.

Market Demand Volatility

Market demand volatility is another major risk in the semiconductor industry. You may find that economic cycles, consumer behavior, and technological updates significantly impact market demand. Below are statistical data for key economic indicators:

| Indicator Name | Unit | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| GDP | Billion CNY | 67,812.5 | 18,625.3 | 34,908.3 | 101,356.4 |

| Industrial Added Value | Billion CNY | 31,322.6 | 8,745.8 | 15,346.7 | 53,745.6 |

| Fixed Asset Investment | Billion CNY | 56,763.2 | 13,045.7 | 28,846.3 | 93,213.5 |

| Total Retail Sales of Consumer Goods | Billion CNY | 33,678.1 | 7,696.3 | 15,708.7 | 59,672.2 |

| CPI | % | 102.2 | 3.7 | 98.6 | 110.6 |

| Urban Per Capita Disposable Income | CNY | 30,793.5 | 6,242.1 | 19,109 | 43,851 |

As shown in the table, the volatility of GDP and retail sales directly affects semiconductor product demand. You need to closely monitor changes in these economic indicators to better predict market demand trends.

Tip: During periods of high market demand volatility, choosing companies with diversified businesses and strong risk resistance may reduce investment risks.

Industry Cyclicality

The semiconductor industry exhibits significant cyclicality. You may not know that the industry’s fluctuation cycle typically lasts 64 months, influenced by macroeconomic conditions and investment acceleration effects. Below are some historical data and analyses:

- Analysis of global GDP growth over the past 62 years shows a significant impact of economic cycles on the semiconductor industry.

- Analysis of global semiconductor industry growth over the past 32 years reveals the industry’s cyclical patterns.

- Analysis of global semiconductor market growth over the past 512 months shows clear cyclical fluctuations in demand and supply.

Dr. He Xinyu’s research indicates that the semiconductor industry’s cyclicality is primarily driven by technological updates, market demand, and macroeconomic conditions. You can see that this cyclicality brings both investment opportunities and increased market uncertainty.

Tip: Investing during the industry cycle’s troughs may yield higher returns. However, you need a clear judgment of market trends to avoid blindly chasing highs during peak periods.

In 2025, investment opportunities in US semiconductor stocks primarily stem from technological innovation and sustained market demand growth. Recommended stocks like NVIDIA, Broadcom, and Texas Instruments demonstrate strong competitiveness in their respective fields. By focusing on these companies’ R&D and market performance, you can capitalize on the industry’s growth dividends.

Tip: When investing, closely monitor industry dynamics, such as demand changes in AI and automotive chips. Also, be mindful of risks posed by geopolitical issues and supply chain challenges. Maintain rational investing and avoid blindly chasing highs to achieve long-term returns in the semiconductor industry.

FAQ

1. Why is the semiconductor industry considered a good choice for long-term investment?

The semiconductor industry drives the development of technologies like AI, 5G, and new energy vehicles. Sustained market demand growth and continuous technological innovation make the industry highly attractive for long-term investment.

2. What indicators should investors focus on when investing in US semiconductor stocks?

You need to focus on a company’s R&D investment, market share, and financial performance. In particular, revenue growth rates, net profit margins, and technological innovation capabilities help assess a company’s competitiveness and future potential.

3. How do geopolitical issues affect semiconductor stock performance?

Geopolitical issues may lead to supply chain disruptions or policy changes. For example, the US CHIPS and Science Act supports domestic manufacturing, potentially enhancing the competitiveness of related companies. You need to closely monitor policy developments.

4. What risks does the semiconductor industry’s cyclicality bring?

Industry cyclicality may lead to demand and price fluctuations. During peak periods, oversupply may suppress profits. In troughs, reduced demand may impact revenue. You need to choose companies with strong anti-cyclical capabilities.

5. How should new investors choose semiconductor stocks?

New investors can start with industry leaders like NVIDIA or Broadcom. These companies have leading technologies, high market shares, and strong risk resistance. Diversifying investments can also reduce risks.

The 2025 semiconductor boom beckons, but high cross-border fees and slow transfers can limit your opportunities. BiyaPay simplifies your investment journey with support for converting over 30 fiat currencies with 200+ cryptocurrencies and real-time rate tracking for multiple fiat currencies. With transfer fees as low as 0.5%, your funds arrive swiftly to seize market moments. Licensed by U.S. MSB and SEC, BiyaPay ensures secure transactions. Plus, a 5.48% APY flexible savings product lets you grow funds with anytime access. Discover BiyaPay’s seamless platform sign up today and start your semiconductor investment journey! Join now

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.