- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Analysis of Investment Opportunities in the Nasdaq Composite Index for 2025

Image Source: unsplash

The Nasdaq Composite Index holds a pivotal position in global stock markets. Data from 2024 shows that the index gained over 31% year-to-date, significantly outperforming the S&P 500’s 25% and the Dow Jones’ 14%. This performance not only highlights its driving role in the technology sector but also solidifies its influence in international markets. For you, the unique attributes of the Nasdaq Composite Index mean more investment opportunities in 2025, particularly driven by technological innovation and industry breakthroughs.

Key Points

- The Nasdaq Composite Index performed exceptionally in 2024, with gains exceeding 31%, showcasing the strong momentum of technology stocks.

- In 2025, the technology sector will continue to lead the market, with innovations in artificial intelligence and green technology bringing more investment opportunities.

- Diversified investing is an effective strategy for reducing risk, and investors should focus on different asset classes and industries to balance their portfolios.

- A long-term holding strategy can leverage the compounding effect, suitable for investors seeking stable returns.

- Focusing on undervalued stocks can uncover potential investment opportunities during market corrections, especially in financially sound companies.

Current Status and Trends of the Nasdaq Composite Index

Image Source: pexels

Historical Performance and Growth Drivers

The historical performance of the Nasdaq Composite Index is remarkable, particularly its long-term growth stability. Over the past 40 years, the Nasdaq 100 Index has achieved an average annual return of 13.7%, far surpassing many other major stock market indices. This growth is primarily driven by the rapid development of the technology sector. Technological breakthroughs in areas such as artificial intelligence, big data, cloud computing, the Internet of Things, and 5G communications have provided strong momentum for the index’s continued rise.

Moreover, the constituents of the Nasdaq Composite Index are predominantly innovative companies that invest heavily in research and development and market expansion. For example, tech giants like Apple, Microsoft, and Amazon have repeatedly hit new market capitalization highs, directly boosting the index’s overall performance. You can see that the success of these companies not only reflects the vitality of the industry but also delivers substantial returns for investors.

Current Market Status and Key Influencing Factors

Currently, the Nasdaq Composite Index is showing strong growth momentum. Below are some key data points to help you better understand the primary factors influencing the current market:

- The market share of the Nasdaq Composite Index continues to expand, attracting global investor attention.

- ETF index fund sales revenue has grown significantly, indicating investor confidence in the index.

- The performance of the Nasdaq 100 Index is closely tied to the market capitalization, revenue, and profit growth of its constituents. For example, the profitability of companies like Apple and Microsoft continues to strengthen, providing stable support for the index.

The robust performance of the technology sector is the core driver of the current market. Especially in the post-pandemic era, the increased demand for digital transformation and remote work has further fueled the growth of related companies.

2025 Market Trend Forecast

Looking ahead to 2025, the Nasdaq Composite Index is expected to maintain its growth momentum. According to forecast reports, the following trends are worth your attention:

- Growth in liquid assets and sales revenue will be key factors in driving the index upward.

- The pace of innovation in the technology sector will not slow, particularly in artificial intelligence and green technology.

- Regional market analysis shows that the market size of the data services industry in regions like East China and South China will significantly expand, providing more development opportunities for related companies.

You can anticipate that, with the global economic recovery and further technological breakthroughs, the Nasdaq Composite Index will remain a top choice for investors.

2025 Potential Industries and Company Analysis

Image Source: pexels

Continued Growth and Key Areas in the Technology Sector

The technology sector will continue to be a major engine of economic growth in 2025. You will find that digital transformation and technological innovation are accelerating improvements in corporate efficiency and market expansion. According to the results of the Fifth National Economic Census, the deepening of corporate digital transformation directly reflects the close relationship between technological innovation and sustained industry growth. Particularly in artificial intelligence, big data, and cloud computing, technological breakthroughs provide companies with new business models and competitive advantages.

Moreover, case studies in manufacturing and logistics demonstrate the transformative power of technology. Under traditional data management models, decision lag rates reached as high as 47%. Through big data visualization platforms, corporate operational efficiency improved by over 35%. These data indicate that the continued growth of the technology sector relies not only on the technology itself but also on its value creation in practical applications, which you should focus on.

Innovation and Investment Opportunities in the Healthcare Sector

The innovation trends in the healthcare sector offer vast opportunities for investors. It is projected that by 2030, the output value growth rate of China’s healthcare industry will remain at a high level, reflecting the sector’s immense potential. The 2022-2023 Healthcare Investment Competitiveness Report notes that investment dynamics and market size in the pharmaceutical and healthcare fields are rapidly evolving, providing you with insights into the industry’s future development.

Financing data further supports this view. From July 2022 to June 2023, China’s healthcare sector recorded 1,823 financing events with a total financing amount of approximately 318.8 billion yuan. Although the number of financing events in the first half of 2023 decreased by 26% compared to the second half of 2022, this does not diminish the sector’s long-term appeal. You can focus on subsectors like biotechnology, precision medicine, and digital health, where innovation capabilities will be the core drivers of future growth.

The Rise of Renewable Energy and Green Technology

As global attention to sustainability intensifies, the renewable energy and green technology industries are rapidly rising. You may have already noticed that more and more companies are investing resources in the development of clean energy technologies, such as solar, wind, and energy storage. These technologies not only reduce carbon emissions but also create new revenue streams for companies.

Driven by both policy support and market demand, the growth potential of the green technology industry cannot be overlooked. Through innovations like intelligent early-warning systems and multi-source data integration, companies can manage energy resources more efficiently, reducing operational costs. The application of these technologies provides managers with clear transformation pathways while offering investors quantifiable returns.

Prospects for Artificial Intelligence and the Semiconductor Industry

The development prospects for artificial intelligence and the semiconductor industry in 2025 are highly anticipated. You will find that the rapid growth of these two sectors not only drives technological progress but also offers rich opportunities for investors. As global demand for high-performance computing and intelligent applications continues to rise, the semiconductor industry has become the critical foundation supporting AI development.

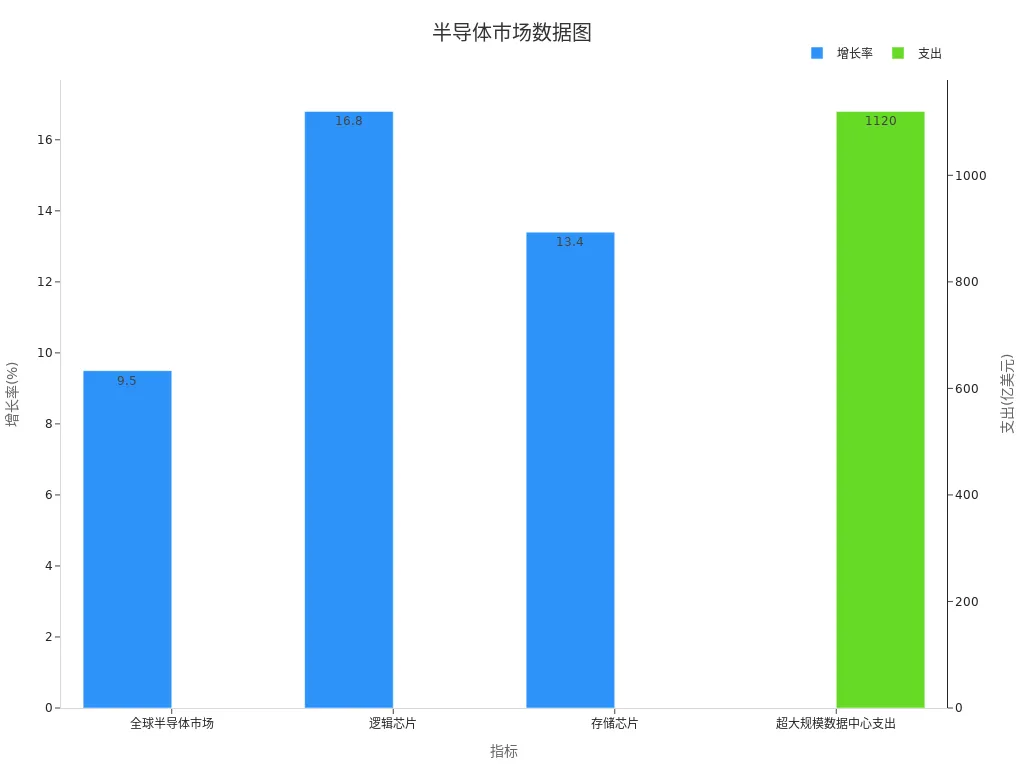

Growth Potential of the Semiconductor Industry

The market size of the semiconductor industry is expanding rapidly. According to the latest data, the global semiconductor market’s annual growth rate is expected to reach 9.5%. Among these, logic chips and memory chips have growth rates of 16.8% and 13.4%, respectively. These data indicate that technological innovation and market demand in the semiconductor industry are rising in tandem.

| Indicator | Growth Rate |

|---|---|

| Global Semiconductor Market | 9.5% |

| Logic Chips | 16.8% |

| Memory Chips | 13.4% |

| Hyperscale Data Center Spending | $112 billion (2024) |

Furthermore, hyperscale data center spending is projected to reach $112 billion in 2024. These data centers provide robust computational power to support the training and deployment of AI models. You can gain a more intuitive understanding of the semiconductor market’s growth trends through the chart below:

Technological Breakthroughs and Applications of Artificial Intelligence

Breakthroughs in artificial intelligence technologies are transforming the operations of multiple industries. From autonomous driving to smart manufacturing, AI’s application scenarios continue to expand. You may have noticed that advancements in generative AI and natural language processing technologies enable companies to process data and optimize decision-making processes more efficiently.

In the healthcare sector, AI is driving the development of precision medicine. By analyzing vast amounts of genetic data and patient records, AI algorithms can help doctors formulate more personalized treatment plans. In the financial industry, AI technologies are widely applied in risk management and market forecasting, providing companies with more reliable decision-making bases.

Investor Focus Areas

For investors, the convergence of artificial intelligence and the semiconductor industry creates immense potential. You can focus on the following key areas:

- Chip Design and Manufacturing: Demand for high-performance chips continues to grow, particularly in AI training and inference tasks.

- Data Centers and Cloud Computing: As AI models become more complex, data center expansion will become a significant investment direction.

- Edge Computing: The widespread adoption of AI technologies is driving demand for edge computing devices, creating new market opportunities for the semiconductor industry.

The Nasdaq Composite Index includes several leading AI and semiconductor companies, such as NVIDIA, AMD, and TSMC. The technological innovation and market performance of these companies will directly influence the index’s future trajectory.

You can foresee that, with continuous technological advancements and growing market demand, artificial intelligence and the semiconductor industry will continue to lead the global technology development trend in 2025.

Investment Risks and Challenges

Potential for Market Volatility and Its Impact

Market volatility is one of the risks investors cannot ignore. You may find that market volatility not only affects the short-term value of assets but also has a profound impact on long-term investment strategies. To quantify this risk, many investors use the Value at Risk (VaR) model to assess the maximum potential loss of a portfolio over a specific period. Additionally, Monte Carlo simulations predict the behavior of complex systems through random sampling, providing you with a more comprehensive risk assessment perspective. Option pricing models help investors hedge market volatility risks, particularly during high-volatility periods. Through correlation analysis, you can understand the relationships between different assets, enabling the construction of a more diversified portfolio to reduce systemic risk.

Potential Risks from Policy and Regulatory Changes

The impact of policy and regulatory changes on the market cannot be underestimated. You may have noticed that since China implemented the registration-based IPO system in 2016, the number of delisted companies has increased year by year. In 2022, the number of delisted companies reached 46, accounting for 38.33% of the total over the past decade. This trend indicates that strengthened regulation may directly affect companies’ listing qualifications and market performance. Moreover, the number of regulatory penalties surged from 142 cases in 2015 to 2,442 in 2021, highlighting the profound impact of policy changes on market behavior. For investors, closely monitoring policy dynamics and regulatory trends will help mitigate potential risks.

Impact of the Global Economic Environment on the Nasdaq Composite Index

Changes in the global economic environment directly affect the performance of the Nasdaq Composite Index. The Consumer Confidence Index is an important indicator that reflects consumers’ confidence in the economy and may influence market sentiment. Inflation expectations provide you with clues about future economic trends, helping you adjust investment strategies. Personal spending, as a direct driver of economic growth, reflects consumers’ purchasing power and market vitality. Additionally, the core PCE price index, closely watched by the Federal Reserve, significantly influences monetary policy and market expectations. By leveraging these indicators, you can better understand the potential impact of the global economic environment on the market and optimize investment decisions.

Investment Strategy Recommendations

Importance and Methods of Diversified Investing

Diversified investing is one of the core strategies for reducing investment risk. By allocating funds across different asset classes, industries, and regions, you can effectively reduce the impact of a single asset’s volatility on the overall portfolio. Research shows that portfolios using equal-weight and random-weight methods can significantly improve stability. Additionally, Guo Zixuan’s study notes that incorporating Bayesian forecasting into risk analysis, combined with diversified capital allocation, can effectively reduce uncertainty in returns.

Here are several common methods for diversified investing:

- Asset Class Diversification: Allocate funds to different asset classes such as stocks, bonds, and real estate investment trusts (REITs). For example, the global REIT market’s excess return success rate reaches 64%, far surpassing the stock market’s 28%, demonstrating the significant advantages of diversified investing.

- Industry Diversification: Invest in stocks from multiple industries to avoid the impact of single-sector volatility on the portfolio.

- Geographic Diversification: Invest in markets across different countries and regions to spread geopolitical and economic risks.

Through reasonable diversified investing, you can balance risk and return across different market cycles, building a more robust portfolio.

Pros and Cons Analysis of Long-Term Holding vs. Short-Term Trading

Long-term holding and short-term trading are two distinct investment strategies, each with its own advantages and disadvantages. You need to choose the strategy that suits your risk tolerance and investment goals.

| Investment Strategy | Number of Holdings | Holding Period | Success Rate | Annualized Excess Return | Maximum Cumulative Return |

|---|---|---|---|---|---|

| Long-Term Investors | ≥5 | >4 quarters | N/A | 10.30% | 169.32% |

| Short-Term Traders | ≥5 | <4 quarters | 40.72% | 16.39% | N/A |

The advantage of long-term holding lies in leveraging the compounding effect, reducing transaction costs, and minimizing the interference of market volatility on investment decisions. For example, investors holding for more than four quarters achieve an annualized excess return of 10.30%, with a maximum cumulative return as high as 169.32%. However, long-term holding requires strong patience and confidence in the market.

Short-term trading is better suited for investors seeking high returns. Data shows that short-term traders achieve an annualized excess return of 16.39%, but with a success rate of only 40.72%. This indicates that while short-term trading may yield higher returns, it also comes with greater risks. You need sharp market insight and quick decision-making skills to profit from short-term trading.

Regardless of the strategy chosen, the key is to define clear goals and strictly adhere to the plan, avoiding emotional operations.

How to Use ETFs and Index Funds to Reduce Risk

ETFs (Exchange-Traded Funds) and index funds are ideal tools for diversified investing. By tracking specific indices (such as the Nasdaq Composite Index), they provide you with a low-cost, efficient investment method.

Here are several ways to use ETFs and index funds to reduce risk:

- Select Diversified Funds: By investing in ETFs that cover multiple industries and regions, you can effectively diversify risk. For example, ETFs related to the Nasdaq Composite Index typically include leading companies from sectors like technology and healthcare.

- Dollar-Cost Averaging: Through regular fixed-amount investments, you can smooth the impact of market volatility and reduce purchase costs.

- Focus on Expense Ratios: Choose funds with lower expense ratios to minimize costs over the long term.

Another advantage of ETFs and index funds is their high liquidity. You can buy and sell ETFs like stocks, allowing flexible portfolio adjustments. Additionally, these tools are suitable for beginners, as they do not require professional stock-picking skills.

By effectively utilizing ETFs and index funds, you can enjoy the benefits of overall market growth while reducing risk.

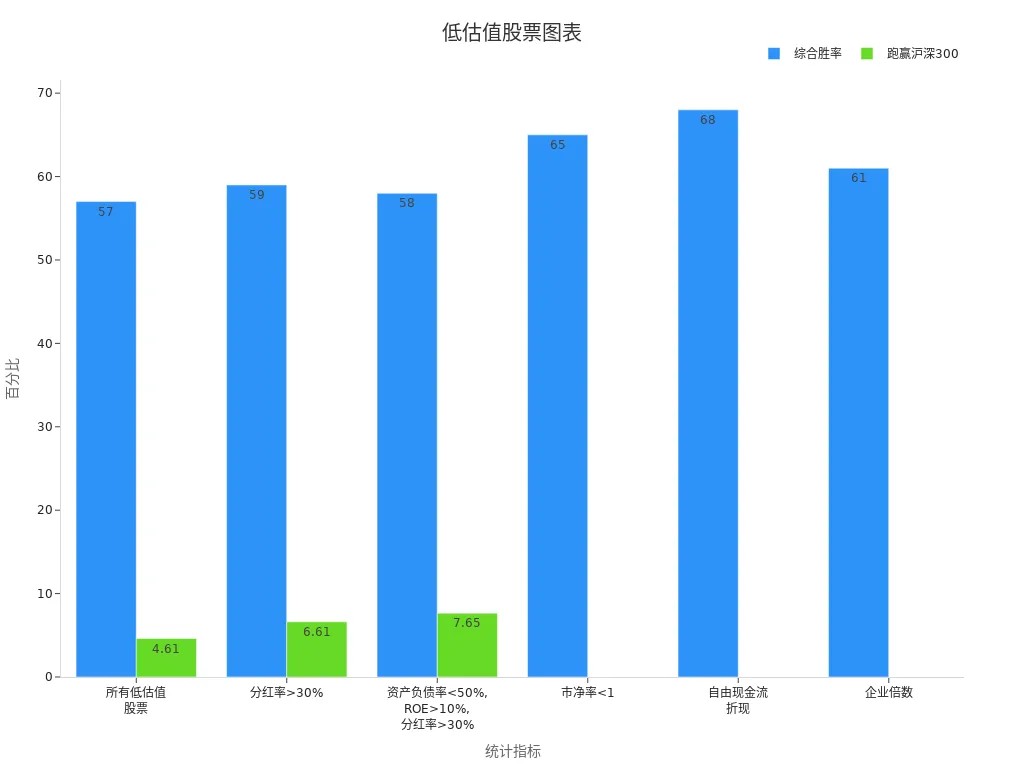

Focusing on Undervalued Stocks During Market Corrections

During market corrections, undervalued stocks often become a focal point for investors. You may find that these stocks are typically priced below their intrinsic value, offering a high risk-reward ratio. Through careful screening and analysis, you can identify investment targets with long-term growth potential during market volatility.

Why Focus on Undervalued Stocks?

The appeal of undervalued stocks lies in their lower market pricing and higher margin of safety. During market corrections, investor sentiment fluctuations may cause high-quality stocks to be undervalued, providing you with opportunities to buy at a discount. Additionally, undervalued stocks typically have the following characteristics:

- High Dividend Yield: Stocks with dividend yields exceeding 30% have a composite success rate of 59%, outperforming the median of the CSI 300 Index by 6.61%.

- Robust Financial Metrics: Stocks with debt-to-asset ratios below 50%, return on equity (ROE) above 10%, and dividend yields over 30% have a success rate of 58%, outperforming the median by 7.65%.

The table below shows key statistical data for undervalued stocks, helping you better understand their investment potential:

| Statistical Indicator | Composite Success Rate | Outperformance of CSI 300 Median | Remarks |

|---|---|---|---|

| All Undervalued Stocks | 57% | 4.61% | 3 percentage points higher |

| Dividend Yield >30% | 59% | 6.61% | 5 percentage points higher |

| Debt-to-Asset Ratio <50%, ROE >10%, Dividend Yield >30% | 58% | 7.65% | Outperforms median by 4.2 percentage points |

| Price-to-Book Ratio <1 | 65% | - | Dropped to 58% in recent two rounds |

| Discounted Free Cash Flow | 68% | - | Non-ferrous metals success rate 77% |

| Enterprise Multiple | 61% | - | Suitable for capital-intensive industries |

How to Screen Undervalued Stocks?

When screening undervalued stocks, you need to focus on the following key metrics:

- Price-to-Book Ratio (P/B): Stocks with a P/B ratio below 1 are typically considered undervalued. Although the success rate for such stocks dropped from 65% to 58% in recent market corrections, they remain highly attractive.

- Discounted Free Cash Flow (DCF): The DCF method helps you assess a company’s true value. Data shows that the non-ferrous metals industry has a success rate of 77%, providing a clear investment direction.

- Enterprise Multiple (EV/EBITDA): The enterprise multiple is suitable for capital-intensive industries, with a success rate of 61%, demonstrating its value in specific sectors.

The chart below illustrates key statistical data for undervalued stocks, further highlighting their investment potential:

Strategies for Investing in Undervalued Stocks

When investing in undervalued stocks, you can adopt the following strategies:

- Focus on High-Dividend Stocks: Stocks with dividend yields over 30% provide stable cash flow and have higher success rates.

- Prioritize Financially Sound Companies: Companies with low debt-to-asset ratios and high ROE typically have stronger risk resistance.

- Screen Based on Industry Characteristics: For example, the enterprise multiple is an important reference metric in capital-intensive industries.

Through in-depth analysis and careful screening, you can identify undervalued stocks with long-term growth potential during market corrections. This not only helps you reduce investment risk but also brings higher returns to your portfolio.

In 2025, the Nasdaq Composite Index will continue to demonstrate its strong potential in technology and innovation. The following points are worth your attention:

- Global economic growth and liquidity injections will provide support for stock markets.

- The index gained 28.64% in 2024, reflecting its outstanding performance in the technology sector.

- Declining risk-free interest rates will further enhance market attractiveness.

You need to rationally assess risks and formulate an investment plan based on your goals. Through diversified investing and long-term holding strategies, you can better seize market opportunities and achieve stable returns.

FAQ

1. What basic knowledge is required to invest in the Nasdaq Composite Index?

To invest in the Nasdaq Composite Index, you need to understand the index’s composition, major industries, and constituent stocks. Additionally, familiarity with market trends and economic indicators helps you better judge investment timing. Learning basic financial analysis methods can also assist in assessing potential risks.

2. What is the difference between ETFs and index funds?

ETFs can be bought and sold like stocks during trading hours, offering higher liquidity. Index funds are typically purchased and redeemed at net asset value, suitable for long-term investors. Both track index performance, but ETFs are more flexible, while index funds generally have lower fees.

3. How to address the high volatility of the Nasdaq market?

High volatility may bring risks but also offers opportunities. You can reduce risk through diversified investing or use dollar-cost averaging to smooth market fluctuations. Additionally, focusing on companies with strong fundamentals helps mitigate the impact of short-term volatility.

4. Which industries are more worth focusing on in 2025?

Technology, healthcare, artificial intelligence, and green technology are key industries to watch in 2025. You can focus on leading companies and innovative firms in these sectors, which typically have high growth potential and market competitiveness.

5. What is the minimum threshold for investing in the Nasdaq Composite Index?

Through ETFs or index funds, you can invest in the Nasdaq Composite Index at a low cost. Some funds have minimum investment amounts as low as a few hundred yuan, making them suitable for beginners. Directly purchasing constituent stocks requires more capital, depending on stock prices.

Tip: Before investing, ensure you understand your risk tolerance and establish clear investment goals.

The Nasdaq Composite Index, with over 31% year-to-date gains in 2024, shines as an investment hotspot driven by tech and green technology, yet market volatility and policy risks call for agile fund management. BiyaPay offers a seamless financial platform, enabling trading in U.S. and Hong Kong stocks without offshore accounts, helping you leverage USD, HKD, and other assets to seize AI and semiconductor opportunities.

Supporting 30+ fiat and digital currencies with real-time exchange rate transparency, plus global remittances to 190+ countries with remittance fees as low as 0.5%. A 5.48% annualized yield savings product with no lock-in period ensures flexibility. Sign up for BiyaPay today to combine Nasdaq market trends with BiyaPay’s versatile tools for efficient, secure investments!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.