- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Profit in the U.S. Stock Market Using Options

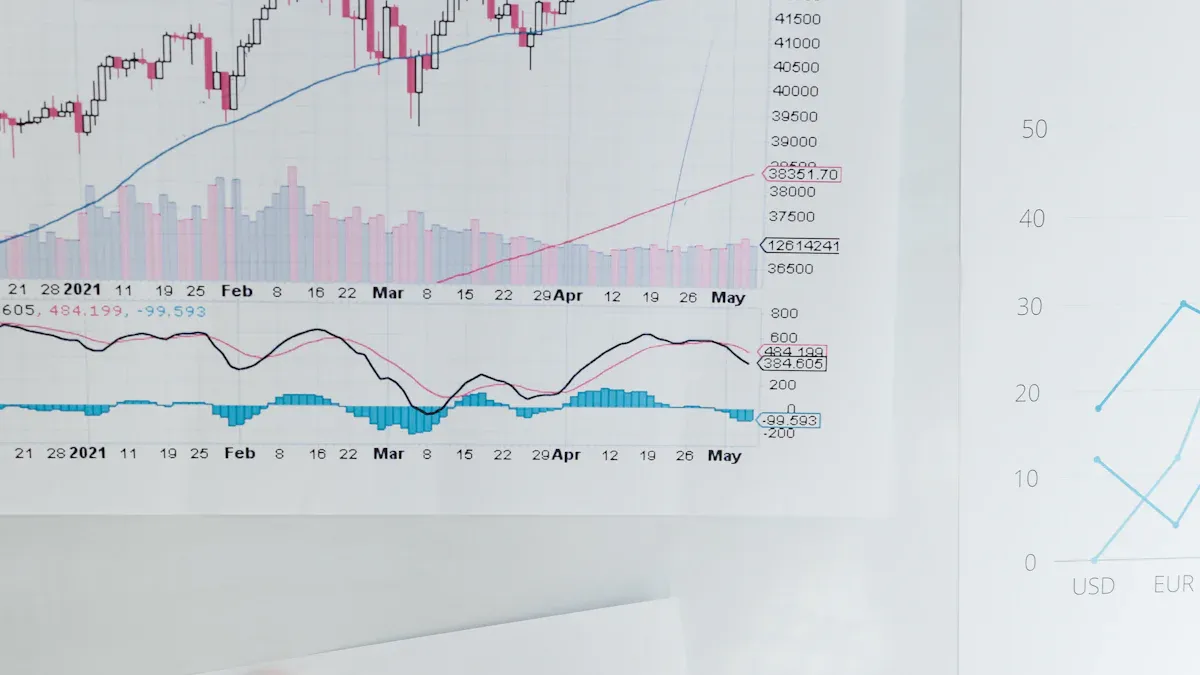

Image Source: unsplash

Options are a flexible investment tool that you can use to profit when the market declines.

Through options trading, you can effectively hedge risks while seizing opportunities presented by market volatility.

In the U.S. stock market, in particular, options provide various methods for shorting stocks, helping you generate returns when stock prices fall.

Understanding the basic principles and operations of options is a critical step toward successful investing.

U.S. Stock Shorting Methods: Basics of Options

Image Source: pexels

What Are Options?

An option is a financial derivative that grants you the right, but not the obligation, to buy or sell an asset at a specific price at a certain time in the future.

It is divided into two types: call options and put options.

Call options allow you to buy an asset at a fixed price, while put options allow you to sell an asset at a fixed price.

Through options, you can flexibly manage investment risks while capturing opportunities from market volatility.

The price of an option is determined by multiple factors, including the price of the underlying asset, volatility, remaining time, and interest rates.

For example, during the 2008 financial crisis, the market volatility index (VIX) once surged above 80, while in the 1990s, it was as low as 9.

This volatility directly affects option pricing.

Differences Between Call Options and Put Options

The main difference between call options and put options lies in their functions and use cases.

Call options are suitable when you believe the price of the underlying asset will rise, while put options are suitable when you predict the price will fall.

Here is a comparison of the two:

| Metric | Buying Call Options | Selling Put Options |

|---|---|---|

| Annualized Return | 18.47% | N/A |

| Maximum Drawdown | 11.11% | N/A |

| Calmar Ratio | 1.64 | N/A |

From these data, you can see that call options perform better in bull markets, while put options are an important tool in U.S. stock shorting methods.

Role of Options in the U.S. Stock Market

Options play multiple roles in the U.S. stock market, helping investors achieve different goals:

- Risk Management: Options can hedge potential losses. For example, when you hold a stock, you can buy a put option to protect your investment.

- Speculative Tool: Options allow you to profit from market volatility, whether the market rises or falls.

- Market Trend Analysis: Historical data shows that the activity level of options trading is closely related to market volatility. By analyzing the options market, you can better predict market trends.

For example, Amazon’s at-the-money options were priced at $130 in 2010, but today they reach $1,000.

This non-linear growth reflects changes in the company’s value and profitability, highlighting the importance of options in capturing long-term trends.

By understanding these basics, you can better master U.S. stock shorting methods and find investment strategies that suit you in the market.

How to Short U.S. Stocks Using Options

Basic Principles of Using Put Options

Put options are one of the most commonly used tools in U.S. stock shorting methods.

They grant you the right to sell an underlying asset at a fixed price at a specific time in the future.

When you predict that a stock’s price will fall, you can profit by buying put options.

The basic principle is that when the stock price falls below the strike price, you can sell the stock at the higher strike price, earning the difference.

For example, if a stock’s current price is $100, you buy a put option with a strike price of $90.

When the stock price drops to $80, you can sell the stock at $90, earning a $10 per share profit.

Through this method, you can profit from a market decline without directly holding the stock.

Another advantage of put options is limited risk.

Even if the stock price rises, your maximum loss is limited to the premium paid for the option.

This feature makes put options a relatively safe U.S. stock shorting method.

Choosing the Right Underlying Asset and Strike Price

Choosing the right underlying asset and strike price is key to successful options trading.

Here are some practical suggestions:

- Choosing the Underlying Asset:

- Prioritize stocks or indices with high volatility. Higher volatility offers greater potential returns for options.

- Pay attention to market sentiment and fundamental analysis. For example, when the market is pessimistic about a company, its stock may be more suitable for shorting.

- Choosing the Strike Price:

- The strike price should be determined based on your risk tolerance and market predictions. If you expect a significant price drop, you can choose a lower strike price.

- According to a study, the implied tail return factor has significant negative predictive power for one-month future returns. This suggests that when the market is overly optimistic about call options, choosing put options may be more advantageous.

By reasonably selecting the underlying asset and strike price, you can improve the success rate of options trading and achieve higher returns in a declining market.

Specific Steps for Options Trading

To short U.S. stocks through options trading, you need to follow these steps:

- Data Collection

Use APIs to obtain real-time or historical options data. You can access this data through professional options trading platforms or financial data providers. - Data Analysis

Calculate key metrics like implied volatility to identify potential arbitrage opportunities. For example, when a stock’s implied volatility is significantly higher than its historical volatility, a trading opportunity may exist. - Strategy Development

Set trading strategies based on market predictions and risk tolerance. For instance, you can set a price threshold to automatically execute trades when the stock price falls below it. - Backtesting

Evaluate your strategy’s performance using historical data. Backtesting helps you identify the strengths and weaknesses of your strategy and optimize it. - Risk Management

Set stop-loss points and monitor market dynamics in real time. Even if the market moves against your predictions, stop-loss mechanisms can help minimize losses.

By following these steps, you can systematically conduct options trading and achieve profits in a declining market.

This approach is widely used by both individual and institutional investors.

Real-World Case Studies

Image Source: pexels

Case Study 1: Profiting from a Market Decline Using Put Options

In a declining market, put options are an effective tool for generating profits.

The case of Luckin Coffee is a classic example.

Luckin was targeted by short-seller Muddy Waters due to financial fraud.

Muddy Waters released an 89-page report detailing issues with Luckin’s operational data.

This report directly caused Luckin’s stock price to plummet by over 20%.

If you had bought Luckin’s put options during this period, you could have profited from the stock price decline.

Here is specific statistical data illustrating the process of profiting from put options:

| Item | Single Arbitrage 1 | Hedged Arbitrage Total Investment | Return/Rate |

|---|---|---|---|

| Stock Price | 1.5150 | 1.5150 | |

| Put Option Premium | 0.0873 | 0.0005/0.0873 | |

| Call Option Premium | 0.0329 | 0.1557/0.0329 | |

| Strike Price | 1.60 | 1.35 | |

| Stock Holding | Buy | None | |

| Total Capital Investment (USD) | 17,444 | 4,798 | |

| Portfolio Return (USD) | 306 | 404 | |

| Return Rate | 1.75% | 8.42% |

As shown in the table, by offsetting with the underlying stock, the total capital requirement is significantly reduced, and the return rate is substantially improved.

This strategy is suitable for use in a declining market.

Case Study 2: Hedging Risks with Combined Options Strategies

Options can not only be used for profit but also help you hedge risks.

The effectiveness of hedging risks with combined options strategies can be analyzed through the following key parameters:

| Key Parameter | Influencing Factor | Result Description |

|---|---|---|

| Replication Efficiency U | Mean and volatility of replication costs | Key indicator of overall quantitative strategy performance |

| Forecast Volatility Bias | Directly determines profit/loss of replication strategy | Volatility forecast error is the fundamental risk source |

| Trading Fees | Limits feasibility of frequent adjustments | Cost control is a key constraint for replication success |

| Investor Risk Preference | Leads to diversification in hedging strategy implementation | Generates operational and execution risks |

| Gamma Changes | Traditional Delta hedging struggles to address | Requires multi-dimensional replication like Gamma hedging |

| Whalley-Wilmott | Improves hedging utility | Dynamically adjusts hedging frequency and precision, reducing costs |

| Simulation Results | W-W method outperforms fixed-time hedging | Highest replication efficiency with reasonable risk aversion coefficients and fees |

By dynamically adjusting hedging frequency and precision, you can reduce costs while improving hedging utility.

This strategy is suitable for highly volatile market environments.

Key Lessons from the Case Studies

From the above case studies, you can summarize the following key lessons:

- Choose the Right Tools: Put options are suitable for declining markets, while hedging strategies can help reduce risks.

- Monitor Market Data: By analyzing financial reports and market sentiment, you can identify potential shorting opportunities.

- Optimize Capital Use: Using stock offsets or dynamic hedging strategies can significantly reduce capital requirements and improve investment returns.

These lessons can help you better utilize options to profit in the U.S. stock market while effectively managing risks.

Risk Management Strategies

In options trading, risk management is the key to success.

Through effective risk control, you can protect capital, reduce losses, and achieve stable returns over the long term.

Here are some core risk management strategies to help you better navigate market uncertainties in options trading.

Controlling Position Sizing and Setting Stop-Losses

Controlling position sizing and setting stop-losses are the foundation of risk management.

Reasonable position allocation helps you stay calm during market volatility, while stop-loss strategies effectively limit potential losses.

- Position Sizing Control:

Position allocation should be determined based on your risk tolerance and market judgment.

When initially building positions, allocate funds across multiple underlying assets to avoid concentrating all capital in a single asset.- When the market moves against you, consider whether to add to positions and the proportion of additional funds.

- When the market breaks out, decide whether to increase positions and the weight of additional investments.

- Stop-Loss Settings:

Establish clear stop-loss rules.

When the underlying asset’s price hits the stop-loss point, execute the trade immediately to avoid larger losses.

For example, if you buy a put option and the underlying asset’s price rises to a preset level, you can sell the option to reduce losses.

Tip: A comprehensive trading plan should include steps for building positions, adding to positions, and setting stop-losses. By strictly following the plan, you can maintain discipline during market volatility and avoid emotional trading.

Understanding Option Time Value and Volatility Risk

Option time value and volatility risk are two critical factors affecting option prices.

Understanding how these factors change can help you better evaluate the potential returns and risks of options.

- Time Value (Theta):

Time value is the portion of an option’s price derived from its remaining time.

As the expiration date approaches, time value gradually decreases, a phenomenon known as “time decay.”- During reviews, monitor Theta changes to ensure the contract’s value decreases as expected.

- If your option contract is nearing expiration and its time value has significantly declined, consider closing the position or adjusting the strategy.

- Volatility Risk (Vega):

Volatility is another key driver of option prices.

Implied volatility (IV) reflects the market’s expectations for future price fluctuations.- When IV is at historical highs, selling options may be more advantageous, as high volatility typically means higher premiums.

- When IV is at historical lows, buying options may be more favorable, as low volatility usually means lower premiums.

- By analyzing anomalies in the volatility curve, you can capture differences in market expectations, enabling more precise trading strategies.

Recommendation: Volatility typically rises significantly before major economic events or company earnings releases. Preparing strategies in advance can help you better manage time value and volatility risks.

Avoiding Common Investment Pitfalls

In options trading, avoiding common investment pitfalls can significantly improve your success rate.

Here are some common mistakes and their countermeasures:

- Over-Reliance on Historical Data:

Markets are dynamic, and historical data cannot fully predict the future.

Improve prediction accuracy by using diverse data sources and regularly updating models. - Ignoring Trading Costs:

Trading costs significantly impact actual returns.

Incorporate trading costs into strategy evaluations and optimize trading frequency to improve net returns. - Ignoring Market Sentiment:

Market sentiment’s impact on price fluctuations cannot be overlooked.

Incorporate sentiment indicators or event-driven strategies to better grasp market trends. - Single Risk Management Strategy:

A single strategy may not address all market conditions.

Combine multiple risk management strategies, such as dynamic position adjustments and stress testing, to comprehensively respond to market changes.

Note: Model interpretability is crucial for investors to understand trading strategies. Choose transparent models and enhance your understanding of strategy logic through education and communication.

By avoiding these pitfalls, you can better manage risks in options trading and improve investment success rates.

Practical Suggestions and Considerations

Entry-Level Advice for New Investors

If you’re new to options trading, the following suggestions can help you get started quickly and avoid common mistakes:

- Start with the Basics:

Understand fundamental concepts like call options, put options, strike prices, and expiration dates.

You can learn these through books or online courses. - Begin with Small Capital:

In the early stages, use small amounts for trading to reduce risk while familiarizing yourself with market operations. - Practice with Simulated Trading:

Before investing real funds, practice with a demo account.

Many trading platforms offer free simulated trading features to help you get accustomed to the process. - Develop a Trading Plan:

Before each trade, clarify your goals, risk tolerance, and exit strategy.

Strictly follow the plan to avoid emotional trading.

Tip: Patience is key to success. Don’t rush for quick wins; gradually build experience and confidence.

How to Choose a Suitable Options Trading Platform

Choosing a reliable options trading platform is critical to your investment success.

Here are some factors to consider when selecting a platform:

- Fee Structure:

Compare trading fees, option premiums, and other hidden costs across platforms.

For example, some platforms charge fixed fees per trade, while others charge based on trading volume. - User Interface:

Is the interface intuitive and easy to use?

For beginners, choosing a platform with simple operations can reduce the learning curve. - Data and Tools:

Does the platform provide real-time market data, charting tools, and option pricing models?

These features help you make more informed decisions. - Customer Support:

Ensure the platform offers timely customer service.

For example, 24-hour online chat or phone support can assist you when issues arise.

Note: When choosing a platform, prioritize those certified by regulatory authorities, such as FINRA or SEC-accredited platforms in the U.S.

Importance of Continuous Learning and Monitoring Market Dynamics

The options market changes rapidly, and continuous learning and monitoring market dynamics are key to staying competitive.

Here are some practical methods:

- Read Professional Articles and Reports:

Follow financial news websites and options trading blogs to stay updated on market trends and analyses. - Participate in Community Discussions:

Join online communities or forums for options traders to exchange experiences and insights with other investors. - Regularly Review Trades:

Review your trading records weekly or monthly to analyze the reasons for successes and failures.

This helps you continuously optimize strategies. - Monitor Economic Events:

For example, Federal Reserve interest rate decisions or major company earnings releases.

These events often significantly impact market volatility.

Recommendation: Make learning and market analysis a daily habit. Even spending 15 minutes a day can help you stay attuned to the market.

By following these suggestions, you can continuously improve your skills and judgment in options trading, achieving greater success in the U.S. stock market.

Conclusion

Options are a flexible and powerful tool.

They help you navigate different market conditions in the U.S. stock market while achieving both profit and risk management goals.

With reasonable strategies, you can protect capital and generate returns in a declining market.

The following data showcases the long-term performance of options strategies:

| Strategy Type | Annualized Return | Annualized Volatility | Maximum Drawdown | Sharpe Ratio |

|---|---|---|---|---|

| Comprehensive Strategy | 6.07% | 7.07% | 7.26% | 0.86 |

| 300ETF-Related Strategy | 10.73% | N/A | 3.48% | 1.23 |

Starting with small investments is a wise choice.

You can gradually build experience, learn market dynamics, and optimize trading strategies.

Through continuous learning and practice, you’ll master options trading techniques and achieve long-term success in the U.S. stock market.

FAQ

1. What is an option’s “premium”?

The premium is the fee you pay when purchasing an option.

Its price is determined by factors such as the underlying asset’s price, volatility, and remaining time.

The premium is the cost of options trading, and this fee is non-refunded even if you don’t exercise the option.

Tip: Higher premiums indicate greater potential returns but also higher risks.

2. Can options completely eliminate investment risks?

Options can help reduce risks but cannot eliminate them entirely.

Market volatility, time value decay, and changes in implied volatility all affect option performance.

With reasonable risk management, you can minimize losses and improve returns.

Note: Even hedging strategies require periodic adjustments to adapt to market changes.

3. Which options strategy should new investors choose?

Beginners can start with simple strategies, such as buying call or put options.

These strategies have limited risk, are easy to operate, and are suitable for quick learning.

- Call Options: Suitable for predicting price increases.

- Put Options: Suitable for predicting price decreases.

4. How much capital is needed for options trading?

The capital required for options trading varies depending on the underlying asset and premium.

Typically, you can start trading with a few hundred dollars.

Compared to directly buying or selling stocks, options trading has a lower capital threshold.

Example: A put option for a stock with a $50 premium requires only that amount to participate in the trade.

5. How to choose an appropriate option expiration date?

When choosing an expiration date, consider your trading goals and market predictions.

Short-term options are suitable for quick profits, while long-term options (LEAPS) are suitable for capturing long-term trends.

| Expiration Type | Characteristics | Applicable Scenarios |

|---|---|---|

| Short-Term Options | Fast time value decay, low cost | Short-term volatility trading |

| Long-Term Options | Slow time value decay, high cost | Long-term trend investing |

Recommendation: Beginners can choose expiration dates of 1 to 3 months to balance risk and return.

Options trading in the U.S. stock market offers flexible opportunities for profit and risk management, whether shorting or hedging, where efficient fund management and low-cost trading are critical. BiyaPay provides a seamless financial solution, enabling trading in U.S. and Hong Kong stocks without offshore accounts, allowing you to participate in the market cost-effectively, whether for high-frequency options trading or long-term investment strategies.

It supports USD, HKD, and 30+ fiat and digital currencies with real-time exchange rate transparency. With remittance fees as low as 0.5% across 190+ countries, it ensures flexible fund allocation to navigate market volatility. A 5.48% annualized yield savings product with no lock-in period optimizes capital use during trading gaps, boosting return potential. Sign up for BiyaPay today to pair options strategies with BiyaPay’s low-cost tools for an efficient, secure investment experience!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.