- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Avoiding Cyber Risks: Online Banking Security Tips

Image Source: pexels

With technological advancements, online banking has become an essential part of daily life for consumers worldwide. According to statistics, 65% of global consumers choose mobile banking as their primary financial transaction method, and in Japan, 80% of users utilize smartphones for online banking activities. However, cyber fraud and data breaches are also increasing simultaneously. Regulatory authorities note that the number and volume of transactions related to telecom fraud through online channels are rising sharply. To safeguard your financial security, adopting effective security measures is crucial.

Key Points

- Setting strong passwords and changing them regularly can effectively prevent identity theft and unauthorized account access.

- Enabling two-factor authentication provides an additional layer of security for your online banking account, reducing the risk of hacking.

- Avoiding online banking transactions on public Wi-Fi and using mobile data networks can more securely protect your personal information.

Common Cyber Risks in Online Banking

Phishing Websites and Emails

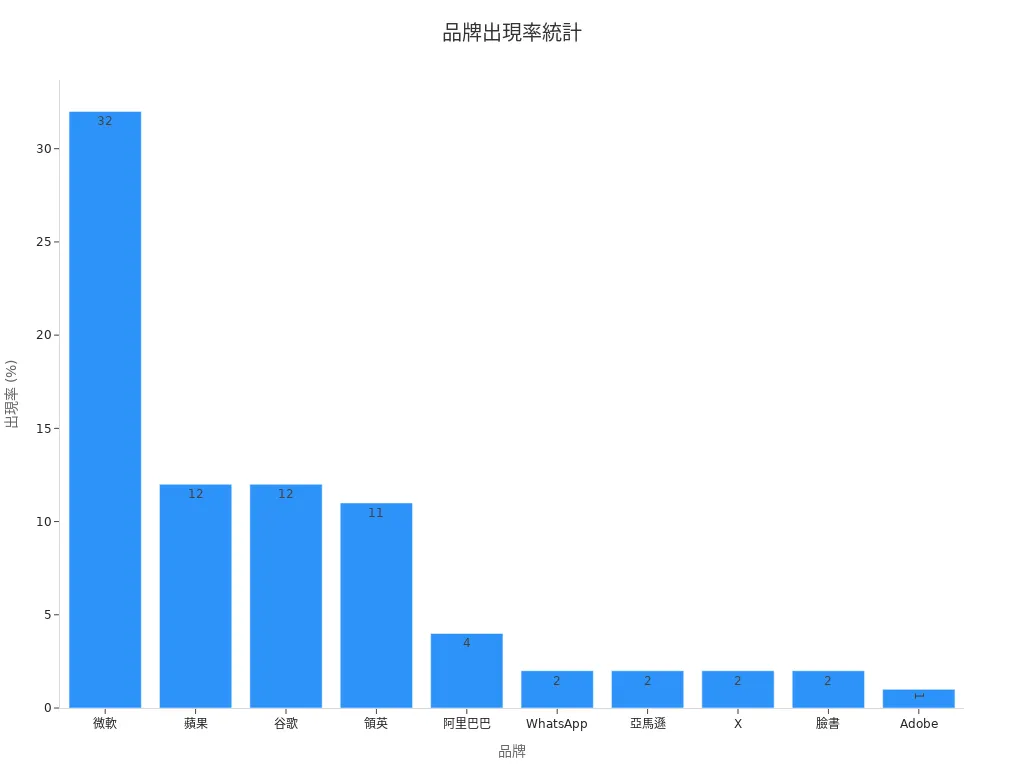

Phishing attacks are one of the primary threats faced by online banking users. Hackers often use fake websites or emails to trick you into entering sensitive information, such as passwords or credit card numbers. According to statistics, in Q4 2024, the most commonly targeted brands for phishing attacks included Microsoft (32%), Apple (12%), and Google (12%). Below is the appearance rate of brands in phishing attacks:

| Rank | Brand | Appearance Rate |

|---|---|---|

| 1 | Microsoft | 32% |

| 2 | Apple | 12% |

| 3 | 12% | |

| 4 | 11% | |

| 5 | Alibaba | 4% |

| 6 | 2% | |

| 7 | Amazon | 2% |

| 8 | X (formerly Twitter) | 2% |

| 9 | 2% | |

| 10 | Adobe | 1% |

Hackers typically use social engineering tactics, sending emails with links to phishing websites to steal your account credentials. You should carefully verify website URLs, avoid clicking suspicious links, and use official applications for online banking operations.

Hacker Attacks and Malware

Hacker attacks and malware are another common cyber risk. Globally, 75% of organizations have been hacked at least once in the past 12 months. Below are some typical cases:

- Hospital Ransomware Incident: On August 28, 2019, 22 hospitals were hit by ransomware, causing widespread disruptions to medical systems.

- GlobeImposter Ransomware: This virus is targeted, specifically exploiting security vulnerabilities in the healthcare industry.

Malware may spread through emails or shared files, designed to damage your data or steal sensitive information. You should install antivirus software and update it regularly, avoiding the use of insecure public networks for online banking transactions.

Password Leaks and Identity Theft

The impact of password leaks and identity theft is extensive. Below are some data points:

| Incident Name | Impact Scope | Affected Population |

|---|---|---|

| AT&T Data Breach | Affected numerous customers and non-customers | 73 million customers and 110 million people |

| Change Healthcare | Medical data of most Americans stolen | Potentially over one-third of Americans |

| Ticketmaster Hack | Data theft | 560 million records |

Hackers may use leaked passwords for identity theft, further infiltrating your online banking accounts. You should set strong passwords and change them regularly, avoiding storing passwords in browsers. Additionally, enabling two-factor authentication can effectively reduce risks.

Security Tips for Protecting Personal Information

Never Share Your Password with Anyone

Your password is the first line of defense for your online banking account. No one, whether friends, family, or individuals claiming to be bank staff, should know your password. According to expert Dong Ximiao, strengthening personal information protection is key to combating telecom fraud. You should avoid writing passwords on paper or storing them in phone notes, as these places are easily accessible to others.

Additionally, Hong Kong banks often remind users that banks will not request passwords via phone or email. If you receive such a request, you should immediately be cautious and contact the bank to verify the situation. Remember, only you should know your password to effectively prevent identity theft and financial loss.

Avoid Using Online Banking in Public Places

Public network environments are often insecure, and hackers may exploit public Wi-Fi to steal your personal information. When in cafes, airports, bookstores, or other public places, you should avoid conducting online banking transactions. These networks may be monitored by hackers, leading to the theft of your account information.

If you must use online banking outside, it’s recommended to use mobile data networks instead of public Wi-Fi. Additionally, ensure your device has a firewall and antivirus software installed to further reduce risks. Protecting your personal information not only safeguards your financial security but also effectively reduces the risk of banking fraud.

Enable Two-Factor Authentication

Two-factor authentication provides an additional layer of security for your online banking account. Once enabled, even if a hacker obtains your password, they will still need a second verification step to access your account. For example, many banks in Hong Kong offer SMS verification codes or biometric authentication as two-factor authentication options.

According to research, strengthening government regulation and establishing personal data protection standards can effectively combat privacy violations. By enabling two-factor authentication, you can actively participate in protecting your personal information. This not only enhances your account security but also gives you greater peace of mind when using online banking.

Technical Measures to Enhance Security

Install Firewalls and Antivirus Software

Firewalls and antivirus software are essential tools for protecting the security of online banking transactions. A firewall can block unauthorized access, preventing hackers from attacking your device. Antivirus software can detect and remove malware, preventing data theft or damage.

You should choose reliable antivirus software and ensure it automatically updates its virus database. This allows it to effectively counter new virus threats. Additionally, enabling a personal firewall can further enhance network security. These technical measures provide robust protection for your online banking operations.

Use Browsers with Encryption Technology

Encryption technology protects the security of your sensitive data during transmission. When using online banking, choosing a browser that supports end-to-end encryption is critical. This technology prevents hackers from intercepting your transaction data, ensuring information is only transmitted between you and the bank.

Some browsers also offer behavioral analysis technology, which can monitor abnormal activities and flag unauthorized access. These features further enhance your account security. You can check your browser’s security settings to ensure it uses the latest encryption protocols.

Regularly Update Operating Systems and Applications

Updates to operating systems and applications often include security patches that fix known vulnerabilities. Regular updates can effectively reduce cyber risks, preventing hackers from exploiting vulnerabilities to attack your device.

For example, many users have fallen victim to ransomware attacks due to outdated software. You should enable automatic updates to ensure your device is always up to date. Additionally, remain cautious of unsolicited messages and verify their authenticity through official channels. These measures make your online banking operations more secure.

Best Practices for Password Management

Principles for Setting Strong Passwords

Setting a strong password is the first step in protecting your online banking account. You should choose a password that includes uppercase and lowercase letters, numbers, and special characters, avoiding birthdays or simple letter combinations. The longer the password, the more effective it is at resisting brute-force attacks. For example, “P@ssw0rd!2023” is more secure than “123456”. Hong Kong banks typically recommend passwords of at least 12 characters and advise against using personal information-related content. This reduces the likelihood of passwords being guessed, making your account more secure.

Importance of Regularly Changing Passwords

Regularly changing passwords can effectively prevent unauthorized account access. You should update your password every three to six months, ensuring the new password is completely different from the old one. This reduces the risk of identity theft due to password leaks. According to cybersecurity experts, password change frequency should be adjusted based on usage and sensitivity. For example, online banking account passwords should be updated more frequently than those for regular social media accounts. You can set reminders to help you remember when to change your password.

Avoid Storing Passwords in Browsers

While storing passwords in browsers is convenient, it may increase the risk of password leaks. You should avoid storing online banking passwords in browsers, especially on public or shared devices. Below are some security recommendations:

- Only autofill personal information on trusted websites.

- Avoid using autofill functions or only store information that won’t cause significant harm if leaked.

- Use browsers that can verify form autofill information.

- Check the webpage source code before submitting forms.

- Stored information should be data you’re comfortable with being exposed.

Staying vigilant can effectively reduce the risk of password leaks. You can opt to use professional password management tools to securely store and manage passwords.

Ensuring the Security of Online Banking Transactions

Verify Payment Information Accuracy

Verifying payment information is a critical step in ensuring the security of online banking transactions. Before every transfer or payment, you should carefully check the recipient’s name, account number, and amount for accuracy. Incorrect payment information may result in funds being sent to unknown accounts, making recovery difficult.

Hong Kong banks typically recommend double-checking all information before confirming payments, especially for large transactions. You can use the transaction preview function provided by banks to ensure all details are correct before submission. This reduces the risk of financial loss due to negligence.

Tip: If you notice errors in payment information, stop the transaction immediately and contact bank customer service for assistance.

Enable Transaction SMS Notifications

Enabling transaction SMS notifications allows you to stay instantly informed about your account’s fund movements. Whenever a transaction occurs, you’ll receive an SMS from the bank with details such as the transaction amount, time, and recipient information. This helps you quickly identify unauthorized transactions and take action.

Below are the benefits of enabling transaction SMS notifications:

- Timely awareness of account fund changes.

- Quick detection of suspicious transactions.

- Greater control over account security.

Many Hong Kong banks offer free SMS notification services, which you can enable through online banking or mobile apps. This is a simple yet effective way to significantly reduce fraud risks.

Regularly Check Account Balance and Transaction Details

Regularly checking your account balance and transaction details is an important measure to prevent fraud. You should review your account records weekly or monthly to ensure all transactions are authorized by you. This helps you detect anomalies early, such as unauthorized deductions or deposits from unknown sources.

Below are recommendations for checking account records:

- Verify the amount and recipient of each transaction for accuracy.

- Ensure the account balance matches your expectations.

- Flag any suspicious transactions and contact the bank for investigation.

Hong Kong banks typically provide detailed transaction inquiry functions, allowing you to easily view account records through online banking platforms. Regular checks not only safeguard your financial security but also help you better manage personal funds.

Preventing Phishing and Fake Websites

Image Source: unsplash

Techniques for Identifying Fake Websites

You need to learn how to identify fake websites to avoid falling into scam traps. Below are practical techniques to help you quickly determine a website’s authenticity:

- Be skeptical of titles: Fake websites often use sensational titles to attract attention.

- Investigate the source: Understand the background of the organization or entity behind the website to confirm its credibility.

- Check related reports: If multiple credible sources report the same content, the website’s authenticity is likely higher.

- Only share verified information: Avoid sharing content from unverified websites.

- Use fact-checking tools: Leverage tools like Google Fact Check to verify a website’s reliability.

These methods can effectively reduce the risk of mistakenly visiting phishing websites, protecting your personal information and financial security.

Tip: When encountering unfamiliar websites, stay vigilant and verify through multiple sources to avoid unnecessary losses.

Verify URLs and Security Indicators

Verifying URLs and security indicators is a key step in identifying the authenticity of websites. You should check if the URL begins with “https://”, as this indicates the website uses encryption to protect data transmission. Also, watch for spelling errors or unusual letter combinations in the URL, which may be signs of a phishing website.

Browser security indicators provide important clues. For example, a lock icon next to the address bar indicates the website has passed security certification. You can click the icon to view certificate details and confirm whether the website belongs to a legitimate organization. These simple checks help you quickly identify potential fake websites.

Note: If a website lacks security indicators or has an unusual URL, stop operations immediately and avoid entering any personal information.

Importance of Using Official Applications

Using official applications significantly reduces the risk of falling victim to scams. For example, the “Website Check” function, launched by the Criminal Investigation Bureau in collaboration with Whoscall, automatically assesses website fraud risks and provides warnings. This feature effectively prevents you from visiting scam websites, reducing the chances of personal data leaks and account theft.

Official applications typically offer higher security, as they undergo rigorous testing and certification. You should download applications from official sources, such as bank websites or app stores, and avoid third-party sources. This ensures greater security when performing online banking operations.

Recommendation: Regularly update official applications to ensure you’re using the latest version, further enhancing security.

Device and Network Security Tips

Image Source: unsplash

Enable Personal Firewalls

A personal firewall is a vital tool for protecting devices from unauthorized access. It can block hacker attacks and monitor network traffic to prevent malware intrusions. You should enable the firewall function and regularly check its settings for accuracy.

Below are the main functions of a firewall:

- Block unauthorized network connections.

- Provide real-time alerts for suspicious activities.

- Help manage data traffic entering and leaving the device.

According to a case study, after China Trust Real Estate adopted Akamai AAP and CDN technologies, attack incidents decreased by 16.9%, and webpage loading speed improved by 50%. This demonstrates that firewalls and related technologies significantly enhance network security and efficiency.

Tip: After enabling a firewall, regularly review its log records to identify any suspicious activities.

Measures to Protect Home Networks

The security of your home network directly impacts your online banking operations. You should take the following measures to protect your home network:

- Change the router’s default password: Use a strong password instead of the default to prevent unauthorized access.

- Enable encryption: Choose the WPA3 encryption protocol for higher security.

- Regularly update router firmware: Firmware updates fix known vulnerabilities, reducing the risk of attacks.

The security challenges of IoT devices also require special attention. These devices may become attack targets due to poor design or lack of protection. You should enhance physical security, such as using robust materials and encrypting data, and regularly update device software to patch vulnerabilities.

Recommendation: Restrict home network access to trusted devices to further enhance security.

Avoid Using Untrusted Public Wi-Fi

Public Wi-Fi often lacks security protections, making it a prime target for hacker attacks. You should avoid using online banking in cafes, airports, or other public places. These networks may be monitored, leading to the theft of your personal information.

If you must use public Wi-Fi, take the following measures:

- Use a VPN (Virtual Private Network) to encrypt your network traffic.

- Ensure your device has the latest antivirus software installed.

- Avoid entering sensitive information, such as passwords or account numbers.

The security challenges of IoT devices have a significant impact on daily life. Malicious attackers may exploit poorly designed vulnerabilities, causing system downtime and unauthorized access to sensitive information. Therefore, protecting your devices from interference is critical.

Note: If you notice unusual activity on public Wi-Fi, stop using it immediately and switch to a mobile data network.

The security of online banking depends on your actions. You should adopt all recommended measures to protect personal information and transaction security. Staying vigilant and developing good security habits can effectively reduce risks. If you detect any anomalies, contact your bank immediately to ensure the safety of your funds.

FAQ

How to Identify Phishing Websites?

Check if the URL starts with “https://” and watch for spelling errors or unusual letter combinations. Use browser security indicators to confirm the website’s authenticity.

Tip: Stay vigilant and avoid clicking suspicious links.

Should I Use Public Wi-Fi for Online Banking Transactions?

Avoid using public Wi-Fi for online banking transactions. If necessary, enable a VPN to encrypt network traffic and avoid entering sensitive information.

How to Set a Secure Password?

Choose a password with uppercase and lowercase letters, numbers, and special characters, avoiding birthdays or simple letter combinations. Change passwords regularly to reduce risks.

Note: Using password management tools can enhance security.

Electronic banking simplifies transactions, but secure fund management and data protection are critical for successful investing. BiyaPay offers an efficient and secure financial solution, enabling trading in U.S. and Hong Kong stocks without offshore accounts, allowing you to participate in the market cost-effectively, whether capitalizing on short-term opportunities in Hong Kong markets or pursuing long-term stable asset growth.

Its platform supports USD, HKD, and 30+ fiat and digital currencies with real-time exchange rate insights, ensuring secure and efficient cross-border transactions while mitigating exchange rate risks. With remittance fees as low as 0.5% across 190+ countries, it streamlines fund allocation without high costs eroding profits. A flexible 5.48% annualized yield savings product with no lock-in period ensures idle funds grow while awaiting trading opportunities, backed by advanced encryption technology, perfectly aligning with electronic banking security needs. Sign up for BiyaPay today to combine secure electronic banking with BiyaPay’s efficient tools for a safe, flexible global investment journey!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.