- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Fixed Deposit Rate Comparison 2025: Practical Tips for Choosing High-Interest Deposits

Image Source: pexels

Understanding market trends is crucial when choosing high-interest deposits. In 2025, fixed deposit rates have undergone significant changes, with many banks’ large-sum certificate of deposit rates dropping to single digits. The rates for 3-year large-sum certificates of deposit generally range between 1.55% to 1.8%, down by about 80 basis points compared to 2024. This trend reminds you that relying solely on high rates is not enough; multiple factors must be considered.

Comparing fixed deposit rates is the first step in selecting the best deposit plan. By comprehensively analyzing different banks’ rates and promotions, you can more easily find options that meet your needs, achieving steady growth of your funds.

Basics of Fixed Deposits

What is a Fixed Deposit?

A fixed deposit (commonly referred to as a term deposit) is a type of deposit offered by banks, distinct from demand deposits. When you choose a fixed deposit, you must place your funds in the bank for a fixed period and receive the principal and interest upon maturity. The interest rate for this deposit method is typically higher than that of demand deposits because the funds cannot be freely withdrawn during the deposit period.

Key characteristics of fixed deposits include:

- Fixed Interest Rate: The interest rate remains unchanged during the deposit period, allowing you to accurately predict returns.

- Impact of Early Withdrawal: If you withdraw funds early, the bank may only pay the demand deposit rate or even charge a handling fee.

- Flexible Term Options: You can choose different deposit terms, such as 3 months, 6 months, 1 year, or longer, with longer terms generally offering higher rates.

Fixed deposits are suitable for those who want steady growth and do not urgently need to use their funds. They offer a low-risk way to manage funds, especially for investors seeking stable returns.

Common Types of Fixed Deposits and Their Features

There are various types of fixed deposit products available, each with its own characteristics. Below are several common types of fixed deposits:

- Standard Fixed Deposit

This is the most basic type of fixed deposit. You choose a deposit term with a fixed interest rate, suitable for those seeking stable returns. - Large-Sum Certificate of Deposit

Requires a higher minimum deposit amount, typically offering higher interest rates. Suitable for depositors with ample funds who want higher returns. - Foreign Currency Fixed Deposit

Denominated in foreign currencies, with rates potentially higher than local currency deposits, but subject to exchange rate fluctuation risks. - Digital Bank Fixed Deposit

Many digital banks offer high-interest fixed deposit products with convenient operations, suitable for users who prefer online banking.

Tip: When choosing a fixed deposit type, be sure to consider your own funding needs, risk tolerance, and interest rate levels to find the most suitable plan.

By understanding these fixed deposit types, you can confidently choose the deposit method that suits you best, achieving steady growth of your funds.

Fixed Deposit Rate Comparison: 2025 Market Trends

Image Source: unsplash

Overview of Fixed Deposit Rates at Major Banks

In 2025, fixed deposit rates at major banks show clear differentiation trends. Some large banks offer relatively stable rates, but smaller banks and digital banks provide more competitive rates. You may notice that 3-year fixed deposit rates fluctuate between 1.55% and 1.8%, while short-term fixed deposit rates are slightly lower.

Below is an overview of fixed deposit rates at some major banks:

- Large Banks: Large banks typically offer stable rates but fewer promotional offers. For example, some banks offer around 1.2% for 1-year fixed deposits and 1.6% for 3-year terms.

- Small and Medium-Sized Banks: These banks offer more attractive rates, especially for large-sum certificates of deposit. Some banks’ 3-year fixed deposit rates can reach 1.8%.

- Digital Banks: Digital banks’ fixed deposit products generally have higher rates and are easy to operate. For instance, some digital banks offer short-term fixed deposit rates as high as 2%.

You should choose the most suitable bank based on your funding needs and deposit term. When comparing fixed deposit rates across banks, remember to check for additional promotional offers, such as rate bonuses or fee waivers.

Key Factors Affecting Fixed Deposit Rates

Fixed deposit rates are influenced by multiple factors. Understanding these factors can help you more accurately predict market trends and choose the best deposit plan. Here are some key economic indicators affecting fixed deposit rates:

| Economic Indicator | Impact Explanation |

|---|---|

| Unemployment Rate | A rising unemployment rate indicates a weak labor market, signaling reduced consumption and impacting overall economic development. |

| Average Hourly Wage Growth Rate | Wage growth exceeding expectations indicates a healthy economy, affecting inflation and currency appreciation. |

| Price Indices | Rising PPI and CPI signal upward economic conditions, influencing currency appreciation and inflation. |

| Interest Rates | Central bank rate adjustments affect monetary policy, with rising rates promoting currency appreciation. |

You can use these indicators to gauge future trends in fixed deposit rates. For example, when a central bank raises benchmark rates, banks’ fixed deposit rates typically increase as well. Conversely, if the unemployment rate rises or price indices fall, fixed deposit rates may face downward pressure.

Additionally, banks’ competitive strategies are also significant factors affecting fixed deposit rates. Some banks may launch short-term high-rate promotions to attract new customers. You can closely monitor market dynamics to seize these opportunities and enhance your deposit returns.

Practical Tips for Choosing High-Interest Deposits

Image Source: unsplash

Tip 1: How to Choose Between Floating and Fixed Rates?

When selecting a fixed deposit, you need to understand the differences between floating and fixed rates. Floating rates adjust with market interest rate changes, suitable for use during rising rate cycles. Fixed rates remain unchanged during the deposit period, ideal for depositors seeking stable returns.

Below are the main characteristics of the two:

| Type | Advantages | Disadvantages |

|---|---|---|

| Floating Rate | Rates may rise with the market, offering higher returns | Returns may decrease if rates fall |

| Fixed Rate | Stable returns, suitable for long-term planning | Cannot benefit from rising market rates |

If you predict that future rates will rise, a floating rate may be more suitable. If you prefer stable returns, a fixed rate is a better choice. For example, a Hong Kong bank’s 3-year fixed-rate deposit plan offers a 1.6% rate, while a floating-rate plan may fluctuate between 1.5% and 2%. Choose the most suitable rate type based on your funding needs and risk preferences.

Tip: Before choosing a rate type, monitor market rate trends and economic indicators, such as central bank rate policies.

Tip 2: Leverage Bank Promotions to Boost Rates

Banks frequently launch promotional offers to help you secure higher fixed deposit rates. These promotions may include rate bonuses, fee waivers, or additional rewards. For example, some Hong Kong digital banks offer short-term deposit plans with rate bonuses reaching up to 2.2%.

How to effectively utilize these promotions? Here are some practical suggestions:

- Stay Informed About Bank Announcements

Regularly check bank websites or subscribe to email notifications to stay updated on the latest promotions. - Compare Promotions Across Banks

Promotional offers may vary significantly between banks. You can use fixed deposit rate comparison tools to quickly identify the most attractive plans. - Choose Specific Deposit Terms

Some promotions may apply only to specific terms, such as 6-month or 1-year deposits. Select a term that aligns with your liquidity needs.

Reminder: Before participating in promotions, carefully read the terms and conditions to ensure eligibility and understand any restrictions.

Tip 3: Diversify Deposit Amounts to Enhance Security and Returns

Diversifying deposit amounts is a strategy to reduce risk and boost returns. Spreading funds across different banks or deposit products can effectively mitigate the risk associated with a single bank or product.

Below are some benefits of diversifying deposits:

- Enhanced Security

In Hong Kong, the Deposit Protection Scheme (DPS) provides up to USD 125,000 in coverage per depositor. Diversifying deposits across multiple banks ensures more funds are protected. - Increased Returns

Different banks may offer varying fixed deposit rates. Diversifying deposits to higher-rate banks can boost overall returns. For example, splitting funds between two banks—one offering 1.8% and another offering 2%—results in higher average returns. - Flexibility

Diversifying deposits across different terms allows more flexibility to meet funding needs. For instance, allocate some funds to short-term deposits for emergencies and others to long-term deposits for higher rates.

Suggestion: When diversifying deposits, use fixed deposit rate comparison tools to ensure you select the most competitive plans.

Tip 4: Foreign Currency Deposits and High-Interest Savings Options from Digital Banks

Foreign currency deposits and high-interest savings accounts from digital banks are two effective ways to boost deposit returns. You can flexibly utilize these options based on your funding needs and risk preferences.

Advantages and Risks of Foreign Currency Deposits

Foreign currency deposits are denominated in currencies like USD or EUR, often offering higher rates than local currency deposits. Below are the main advantages of foreign currency deposits:

- High Rates: Some Hong Kong banks offer USD deposit rates up to 2.5%, significantly higher than HKD deposits.

- Exchange Rate Gains: If the foreign currency appreciates, the value of your deposit increases.

However, foreign currency deposits also carry risks:

- Exchange Rate Fluctuations: A depreciating currency may reduce deposit value.

- Fees: Currency conversion and deposits may incur additional costs.

Tip: When choosing foreign currency deposits, monitor exchange rate trends and fees to ensure returns offset potential risks.

High-Interest Savings Options from Digital Banks

High-interest savings accounts offered by digital banks provide high flexibility and attractive rates. You can access funds anytime and enjoy rates higher than those of traditional banks. For example, a Hong Kong digital bank offers savings rates up to 2.2%, far exceeding typical demand deposit rates.

Key advantages of digital banks include:

- Convenience: Deposits and withdrawals can be managed via mobile apps.

- High Rates: Promotional offers for new customers often include rate bonuses.

- Low Threshold: High rates are available without requiring large deposits.

Reminder: When choosing a digital bank, ensure it is regulated by the Hong Kong Monetary Authority and understand the scope of the Deposit Protection Scheme.

Tip 5: Strategies for Choosing Between Short-Term and Long-Term Deposits

Short-term and long-term deposits each have their advantages. You can choose the most suitable deposit term based on liquidity needs and return goals.

When Short-Term Deposits Are Suitable

Short-term deposits typically have terms of 3 months to 1 year, ideal for depositors needing flexible cash flow. Below are the main features of short-term deposits:

- High Flexibility: Funds can be quickly unlocked for emergencies or short-term investments.

- Lower Rates: Some Hong Kong banks offer around 1.2% for 6-month deposits.

Short-term deposits are suitable for:

- When you need funds in the near term.

- When you predict rising rates and want to reselect higher-rate plans later.

When Long-Term Deposits Are Suitable

Long-term deposits typically have terms of 1 to 5 years, offering higher rates. For example, a Hong Kong bank’s 3-year deposit may reach 1.8%. Below are the main features of long-term deposits:

- Stable Returns: Fixed rates are ideal for depositors seeking steady returns.

- Locked Funds: Funds cannot be flexibly used during the deposit period.

Long-term deposits are suitable for:

- When you have idle funds not needed in the short term.

- When you want higher rates and are willing to accept fund lock-in restrictions.

Suggestion: If unsure about funding needs, consider splitting funds between short-term and long-term deposits to balance flexibility and returns.

Common Questions and Answers on Fixed Deposit Rate Comparison

Impact of Early Withdrawal on Returns

Early withdrawal of a fixed deposit can significantly impact your returns. Most banks pay only the demand deposit rate upon early withdrawal, which is typically much lower than the fixed deposit rate. For example, if you choose a 1.7% fixed deposit but withdraw early, the bank may only pay a 0.01% demand deposit rate. This means your actual returns will be substantially reduced.

Additionally, some banks may charge a handling fee for early withdrawal, further lowering your returns. Therefore, when selecting a fixed deposit, ensure the funds will not be needed during the deposit period. If you have liquidity needs, consider short-term deposits or high-interest savings accounts for greater flexibility.

Tip: Before withdrawing early, confirm the terms with the bank to understand potential losses and avoid unnecessary financial setbacks.

How to Choose a Deposit Method That Suits You?

Choosing a deposit method that suits you requires considering multiple factors, including funding needs, risk tolerance, and return goals. Below are some practical suggestions to help you make informed decisions:

- Assess Liquidity Needs

If you need access to funds at any time, a high-interest savings account may be more suitable. Conversely, if funds are not needed in the short term, fixed deposits offer higher rates. - Compare Rates Across Banks

Fixed deposit rates may vary between banks. - Consider Deposit Terms

Short-term deposits suit depositors with high liquidity needs, while long-term deposits are ideal for those seeking stable returns.

Reminder: When choosing a deposit method, evaluate based on your needs to avoid financial planning disruptions due to unsuitable choices.

Comparison of Fixed Deposits and High-Interest Savings Accounts

Fixed deposits and high-interest savings accounts each have their advantages, catering to different financial needs. Below is a comparison table to help you understand the key differences:

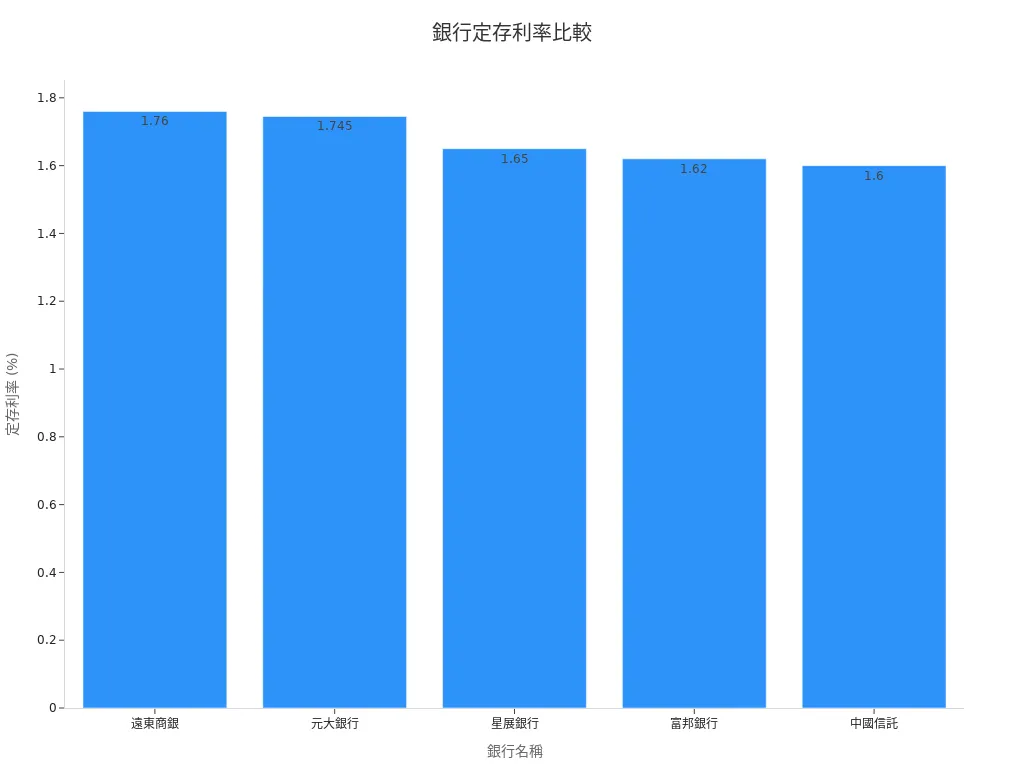

| Bank Name | Fixed Deposit Rate | Deposit Term | Restrictions |

|---|---|---|---|

| Far East Commercial Bank | 1.76% | 12 months | Limited to individual clients, new funds only, minimum threshold: 200,000 |

| Yuanta Bank | 1.745% | 12 months | Limited to individual clients, in-branch/online/mobile banking only, minimum threshold: 100,000 |

| DBS Bank | 1.65% | 6 months | New funds only, minimum threshold: 1,000,000 |

| Fubon Bank | 1.62% | 6 months | Limited to wealth management clients, new funds only, minimum threshold: 100,000 |

| CTBC Bank | 1.6% | 6 months | New funds only, minimum threshold: 1,000,000 |

Advantages of Fixed Deposits: Offer stable rates, suitable for long-term planning.

Advantages of High-Interest Savings Accounts: High flexibility, ideal for depositors needing access to funds at any time.

Suggestion: If you seek stable returns, fixed deposits are a better choice. If you need flexibility, high-interest savings accounts are more suitable.

When selecting high-interest deposits, you should master several key techniques, including comparing rates across banks, leveraging promotions, diversifying deposit amounts, and flexibly using foreign currency deposits or digital banks’ high-interest savings options. These methods can help you boost returns while minimizing risks.

Action Suggestion: Immediately assess your funding needs, use fixed deposit rate comparison tools, and choose the most suitable deposit plan. Start today to take a steady step toward your financial goals!

FAQ

What Are the Losses from Early Withdrawal of a Fixed Deposit?

Early withdrawal can significantly reduce your returns. Banks typically pay only the demand deposit rate, and may even charge a handling fee. For example, a 1.7% fixed deposit withdrawn early may only yield a 0.01% demand deposit rate. Ensure funds can remain locked until maturity before depositing.

Tip: If funding needs are uncertain, opt for short-term deposits or high-interest savings accounts.

How to Choose a Suitable Fixed Deposit Term?

When choosing a term, consider liquidity needs and return goals. Short-term deposits suit situations requiring high flexibility, while long-term deposits are ideal for seeking stable returns. If needs are unclear, split funds across different terms.

Are Foreign Currency Deposits Suitable for Everyone?

Foreign currency deposits suit investors with some understanding of exchange rate fluctuations. They offer high rates, but currency depreciation may lead to losses. If unfamiliar with forex markets, choose local currency deposits to reduce risks.

Reminder: Before opting for foreign currency deposits, monitor exchange rate trends and related fees.

Are Digital Bank Fixed Deposits Safe?

The safety of digital bank fixed deposits depends on whether they are regulated by the Hong Kong Monetary Authority. Regulated digital banks are covered by the Deposit Protection Scheme (DPS). You can choose with confidence but verify the bank’s regulatory status.

How to Compare Fixed Deposit Rates Across Banks?

You can use fixed deposit rate comparison tools to quickly identify high-rate plans. Pay attention to bank promotions, such as rate bonuses or fee waivers. Choose based on deposit term and funding needs to align with your financial goals.

Suggestion: Regularly check bank websites for the latest rate information.

With fixed deposit rates declining in 2025, balancing flexible fund management with stable returns is key. BiyaPay offers an efficient financial solution, enabling trading in U.S. and Hong Kong stocks without offshore accounts, allowing you to participate in the market cost-effectively, whether seizing short-term opportunities in Hong Kong markets or pursuing long-term stable asset growth.

Its platform supports USD, HKD, and 30+ fiat and digital currencies with real-time exchange rate insights, ensuring transparent and efficient cross-border transactions while minimizing exchange rate risks. With remittance fees as low as 0.5% across 190+ countries, it streamlines fund allocation without high costs impacting returns. A flexible 5.48% annualized yield savings product with no lock-in period, surpassing traditional fixed deposit rates, allows idle funds to grow flexibly, perfectly aligning with the need for low-risk, high-yield savings. Sign up for BiyaPay today to combine fixed deposit strategies with BiyaPay’s versatile tools for a stable and efficient wealth-building journey!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.