- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Savings Account Interest Rates Comparison: Top Offers from Hong Kong Banks in 2025

Image Source: pexels

In 2025, the Hong Kong savings account market is highly competitive, with interest rates significantly rising. You may have noticed that virtual banks offer rates far exceeding those of traditional banks, attracting more customers. According to the latest data, some banks’ savings account interest rates have reached 5% or higher, showing an overall upward trend. With intensified market competition, banks are rolling out higher rates and promotional policies. Ping An OneConnect Bank offers an annual interest rate of 6.88%, making it the highest-rate option currently available.

Key Points

- In 2025, Hong Kong savings account interest rates are generally rising, with some banks offering rates of 5% or higher; virtual banks like Ping An OneConnect Bank provide the highest annual rate of 6.88%.

- When choosing a savings account, besides interest rates, you should consider promotional conditions such as minimum deposit amounts and new customer offers, as these can affect your returns.

- Standard Chartered’s “High-Interest Marathon” plan and Mox Bank’s FlexiBoost campaign offer flexible deposit options, suitable for customers with different needs.

- The flexibility of savings accounts makes them ideal for short-term fund management, allowing funds to be accessed anytime to meet daily expense needs.

- When selecting a bank, it’s recommended to compare interest rates, promotional conditions, and operational convenience to find the savings account plan that best suits your needs.

Savings Account Interest Rates Comparison Table

Image Source: pexels

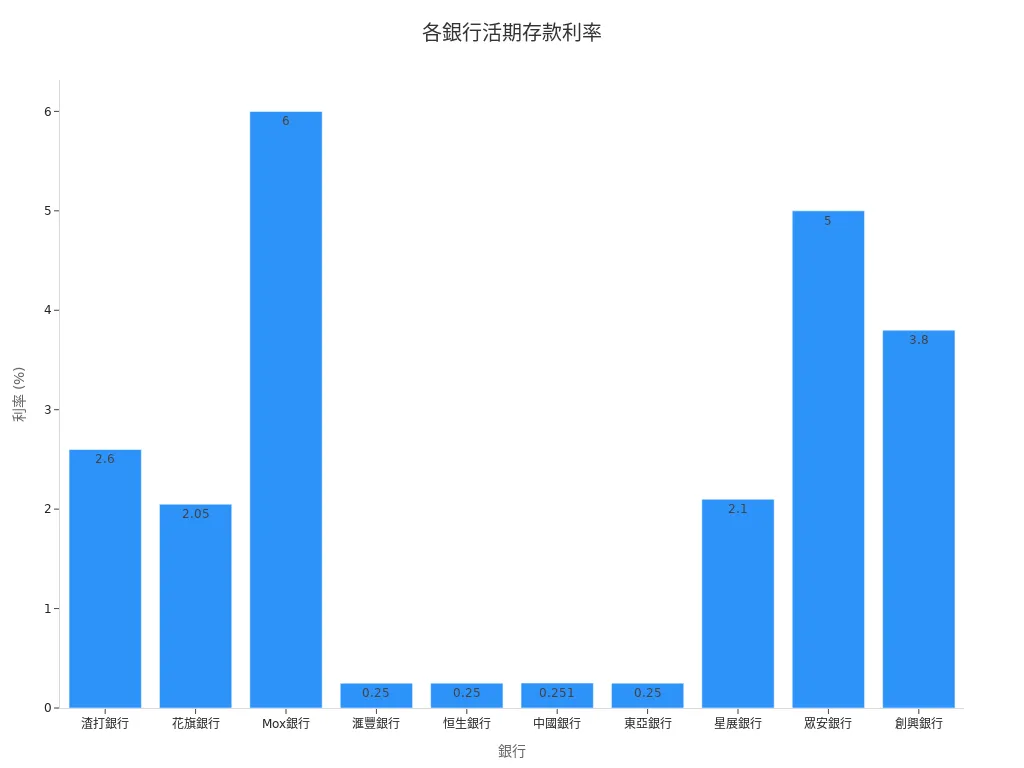

Overview of Major Banks’ Savings Account Interest Rates

When choosing a savings account, understanding the interest rates offered by major banks is crucial. Below is a comparison table of HKD savings account interest rates from major Hong Kong banks in 2025:

| Bank | HKD Savings Account Interest Rate |

|---|---|

| Standard Chartered Bank | 2.6% |

| Citibank | Up to 2.05% |

| Mox Bank | Up to 6% |

| HSBC | Up to 0.25% |

| Hang Seng Bank | Up to 0.25% |

| Bank of China | Up to 0.251% |

| Bank of East Asia | Up to 0.25% |

| DBS Bank | Up to 2.1% |

| ZA Bank | Up to 5% |

| Chong Hing Bank | Up to 3.8% |

Additionally, the following bar chart clearly illustrates the comparison of savings account interest rates across banks, helping you quickly understand the market situation:

Comparison of Promotional Conditions (New Customers, New Funds, Minimum Deposit Amounts, etc.)

In addition to interest rates, the promotional conditions offered by banks are also factors you need to consider. Below is a comparison of promotional conditions from major banks:

- Standard Chartered Bank: Offers the “High-Interest Marathon” plan for new customers, with higher rates for larger deposit amounts, no minimum deposit requirement.

- Citibank: Citi Plus users can enjoy an Interest Booster, requiring new funds and maintaining a certain deposit amount.

- Mox Bank: The FlexiBoost campaign offers up to 6% interest, applicable to new funds, with no minimum deposit requirement.

- ZA Bank: The “Money Jar” plan offers up to 5% interest, with a deposit cap of HKD 800,000.

- Chong Hing Bank: New customers can enjoy a promotional rate of 3.8%, subject to a minimum deposit requirement.

These promotional conditions vary by bank, and you should choose the most suitable plan based on your needs. For example, if you are a new customer with new funds, Mox Bank and Citibank’s offers may be more attractive.

Detailed Overview of Bank Promotions

Standard Chartered Bank: High-Interest Marathon Savings Account

Standard Chartered Bank’s “High-Interest Marathon” plan is designed for customers seeking stable returns. This promotion not only offers flexible savings account options but also allows you to enjoy higher rates based on deposit amounts. The highlight of the plan is that it does not require a minimum deposit amount, giving you the freedom to choose your deposit level. For new customers, Standard Chartered Bank offers an additional rate boost, making it highly appealing.

Additionally, the plan’s rate structure is tiered based on deposit amounts. For example, the higher the deposit amount, the higher the corresponding annual interest rate. This design is ideal for customers looking to gradually increase their savings. If you’re seeking a stable and flexible savings account plan, Standard Chartered Bank’s “High-Interest Marathon” is worth considering.

Citibank: Citi Plus Interest Booster

Citibank’s Citi Plus Interest Booster plan is tailored for younger generations and digital users. The core of the plan lies in the rate enhancement for new funds, allowing you to earn higher returns in the short term. By maintaining a certain deposit amount, you can enjoy an annual interest rate of up to 2.05%.

Another attractive feature of Citi Plus is its digitalized operations. You can easily manage your deposits through Citibank’s mobile app, checking rate changes and returns anytime. This is highly convenient for users accustomed to digital tools. If you’re looking to earn higher interest rates on a savings account while enjoying digital convenience, Citi Plus Interest Booster is a solid choice.

Mox Bank: FlexiBoost Promotion

Mox Bank’s FlexiBoost promotion, with its up to 6% annual interest rate, has become a market highlight. This campaign is designed for new funds and does not set a minimum deposit requirement, allowing you to participate flexibly. FlexiBoost’s rate structure is divided into three phases, enabling you to enjoy different returns over different time periods:

| FlexiBoost Offer Period | FlexiBoost Annual Interest Rate (HKD) | FlexiBoost Annual Interest Rate (USD) |

|---|---|---|

| First 30 Days | 0.5% | 1.5% |

| Next 30 Days | 0.75% | 3.5% |

| Final 30 Days | 1% | 6% |

This phased rate design not only enhances your return potential but also allows flexible fund planning. Mox Bank’s digital platform also provides a convenient user experience. You can check your deposit status anytime via the mobile app and adjust fund allocations as needed. If you’re looking for a high-return and flexible savings account plan, Mox Bank’s FlexiBoost promotion is one of the top choices.

HSBC: Savings Account Interest Rates and Promotion Highlights (5.7% Annual Rate)

HSBC’s savings account plan attracts customers with its stability and high interest rate. With an annual rate of up to 5.7%, it’s one of the competitive options in the market. This promotion is suitable for customers seeking stable returns from a savings account.

HSBC’s savings account plan offers a straightforward deposit process. You can easily open an account and start depositing without complicated procedures. The highlight of the plan is its flexibility, allowing you to withdraw funds anytime without affecting interest earnings.

Additionally, HSBC provides extra customer service support. You can manage deposits through its online banking platform or mobile app, checking rate changes and returns anytime. This convenient operation is ideal for busy urbanites.

Hang Seng Bank: PayDay+ Plan (Up to 5% Annual Rate, Extra Savings Rates from 1.55% to 4.75%)

Hang Seng Bank’s PayDay+ plan is designed for customers looking to manage funds flexibly. The plan offers an annual interest rate of up to 5%, with additional savings rates ranging from 1.55% to 4.75%. These rates are competitive in the market.

Below is the interest rate data for Hang Seng Bank’s PayDay+ plan:

| Bank Name | Annual Interest Rate | Extra Savings Rate |

|---|---|---|

| Hang Seng Bank | Up to 5% | 0.2500% |

Another highlight of the PayDay+ plan is its flexibility. You can choose deposit amounts based on your needs and enjoy different rate tiers. The plan is particularly suitable for customers seeking high returns in the short term.

Hang Seng Bank also offers a convenient digital platform. You can easily manage deposits via the mobile app, checking returns anytime. This digital convenience allows you to plan funds more efficiently.

DBS Bank: Savings Account Interest Rates and Promotion Highlights

DBS Bank’s savings account plan is known for its stability and flexibility. With an annual interest rate of up to 2.1%, it’s suitable for customers seeking stable returns from a savings account.

DBS Bank’s savings account plan offers a simple deposit process. You can easily open an account and start depositing without complicated procedures. The highlight of the plan is its flexibility, allowing you to withdraw funds anytime without affecting interest earnings.

Additionally, DBS Bank provides extra customer service support. You can manage deposits through its online banking platform or mobile app, checking rate changes and returns anytime. This convenient operation is ideal for busy urbanites.

Ping An OneConnect Bank: 6.88% Annual Savings Account Interest Rate

Ping An OneConnect Bank, with its 6.88% annual savings account interest rate, has become a market highlight. This rate is among the highest in Hong Kong banks, attracting a large number of customers. You can enjoy this offer by simply opening an account and depositing funds. The bank’s savings account plan is particularly suitable for customers seeking high returns.

Another highlight of Ping An OneConnect Bank is its new customer promotions. If you’re opening an account for the first time, the bank offers an additional rate boost. This allows you to earn higher returns in the short term. Below are the main features of the bank’s savings account:

- High Interest Rate: An annual rate of 6.88%, highly competitive in the market.

- New Customer Promotion: First-time account holders can enjoy an additional rate boost.

- Flexibility: Withdraw funds anytime without worrying about affecting interest earnings.

Ping An OneConnect Bank also offers a convenient digital platform. You can manage deposits via the mobile app, checking rate changes and returns anytime. If you’re looking for a high-return savings account plan, Ping An OneConnect Bank is your best choice.

ZA Bank: “Money Jar” Savings Account Plan (Up to 5% Annual Rate, Maximum Deposit of HKD 800,000)

ZA Bank’s “Money Jar” savings account plan, with its up to 5% annual interest rate and flexible deposit limits, has attracted many customers. The plan’s deposit cap is HKD 800,000, suitable for customers seeking stable returns in the short term. You can choose deposit amounts based on your needs and enjoy high interest rates.

Below are the main features of the “Money Jar” plan:

- High Interest Rate: Up to 5% annual rate, with stable returns.

- Flexible Deposit Limits: Maximum deposit of HKD 800,000, suitable for various needs.

- Convenient Operations: Manage deposits via the mobile app, checking returns anytime.

ZA Bank’s digital platform allows you to easily manage funds. You can withdraw funds anytime without affecting interest earnings. If you’re looking for stable high returns from a savings account, the “Money Jar” plan is a worthy option.

Bank of East Asia: 4.88% Annual Savings Account Interest Rate

Bank of East Asia’s savings account plan, with its stability and 4.88% annual interest rate, has attracted many customers. This plan is suitable for customers seeking stable returns from a savings account. You can easily open an account and start depositing without complicated procedures.

Below are the main features of Bank of East Asia’s savings account plan:

- Stable Returns: Annual rate of up to 4.88%, suitable for long-term deposit needs.

- Simple Process: Easy and quick account opening without cumbersome procedures.

- Flexibility: Withdraw funds anytime without worrying about affecting interest earnings.

Bank of East Asia also provides additional customer service support. You can manage deposits through its online banking platform or mobile app, checking rate changes and returns anytime. If you’re looking for a stable savings account plan, Bank of East Asia is a good choice.

Citibank: 4.68% Annual Savings Account Interest Rate

Citibank’s savings account plan, with its stable 4.68% annual interest rate, has attracted many customers. This rate is above average in the market, particularly suitable for those seeking stable returns in the short term. Whether for daily savings or short-term fund management, Citibank’s plan can meet your needs.

Key Features of Citibank’s Savings Account

- Stable Returns

Citibank offers a 4.68% annual interest rate, allowing you to enjoy stable returns from a savings account. This is a great option for those who want flexible fund usage. - Flexible Deposit Conditions

The plan has no minimum deposit requirement, enabling you to freely choose deposit amounts based on your financial situation. Whether for small or large deposits, you can enjoy the same rate. - Convenient Digital Operations

Citibank’s digital platform allows you to manage deposits anytime, anywhere. Through the mobile app, you can check deposit status, rate changes, and even withdraw funds, with simple and convenient operations.

Target Audience for Citibank’s Savings Account

- Short-Term Fund Managers: If you need flexible fund usage and stable returns in the short term, this plan is ideal for you.

- Digital Users: Citibank’s digital services make it easy to manage deposits, suitable for those accustomed to using mobile or online banking.

- Beginner Savers: If you’re just starting to save, the plan’s no-minimum-deposit requirement makes it easy to get started.

Comparison of Citibank’s Savings Account with Other Banks

Below is a simple comparison table to help you understand the differences in savings account interest rates between Citibank and other major banks:

| Bank Name | Annual Interest Rate | Minimum Deposit Requirement |

|---|---|---|

| Citibank | 4.68% | None |

| Standard Chartered Bank | 2.6% | None |

| Ping An OneConnect Bank | 6.88% | None |

| ZA Bank | 5% | None |

As shown in the table, while Citibank’s rate is not as high as Ping An OneConnect Bank or ZA Bank, its stability and flexibility remain appealing. If you seek stable returns and value convenient digital services, Citibank’s savings account plan is worth considering.

Tip: When choosing a savings account plan, consider deposit conditions and operational convenience in addition to interest rates. Citibank’s plan performs well in these areas, making it suitable for a variety of customer needs.

Comparison of Savings Accounts and Fixed Deposits

Image Source: pexels

Flexibility and Liquidity of Savings Accounts

The greatest advantage of savings accounts is their flexibility. You can deposit or withdraw funds anytime without prior notice to the bank. This liquidity is ideal for situations requiring frequent fund usage, such as covering daily expenses or emergency fund needs.

Additionally, savings accounts typically have no minimum deposit requirements, allowing you to choose deposit amounts based on your financial situation. Many Hong Kong banks, such as Standard Chartered and Mox Bank, offer convenient digital platforms, enabling you to manage deposits anytime. These features make savings accounts an ideal choice for short-term fund management.

Tip: If you need flexible fund usage, a savings account is the best choice.

Higher Rates and Stability of Fixed Deposits

Compared to savings accounts, fixed deposits offer higher interest rates. You can choose deposit terms, such as three months, six months, or one year, and receive fixed returns upon maturity. This stability is ideal for those aiming for long-term savings.

For example, Hong Kong’s Ping An OneConnect Bank and HSBC offer attractive fixed deposit rates, allowing you to earn higher returns during the lock-in period. While fixed deposits have lower liquidity, their high rates can help you achieve financial goals.

Note: When choosing a fixed deposit, ensure you won’t need to access the funds during the deposit term.

How to Choose a Deposit Method Based on Your Needs

When selecting a deposit method, you should make decisions based on your financial needs and goals. If you need flexible fund usage, a savings account is a better choice. Its liquidity and convenience meet daily cash flow and short-term needs.

If your goal is long-term savings with higher returns, a fixed deposit is more suitable. Its higher rates and stability can help you grow your wealth.

Below is a simple comparison table to help you quickly understand the differences between the two deposit methods:

| Deposit Method | Advantages | Stability |

|---|---|---|

| Savings Account | High flexibility, liquidity | Short-term funds management |

| Fixed Deposit | High interest rates, stable returns | Long-term savings and wealth growth |

Recommendation: Choose a deposit method based on your financial needs, and regularly review your deposit plan to ensure it aligns with your goals.

In 2025, Ping An OneConnect Bank leads the savings account market with a 6.88% annual interest rate. HSBC and Hang Seng Bank follow closely with rates of 5.7% and 5%, respectively. If you’re chasing high rates, Ping An OneConnect Bank is the best choice. If flexibility is a priority, Hang Seng Bank’s PayDay+ plan is more suitable. When choosing, select the plan that best matches your financial needs and goals.

FAQs

1. What Are the Main Differences Between Savings Accounts and Fixed Deposits?

Savings accounts offer flexibility, allowing you to deposit or withdraw funds anytime. Fixed deposits have a fixed term with higher rates, but funds are locked until maturity. Choose based on your fund liquidity needs and savings goals.

2. How Do I Choose the Most Suitable Savings Account Bank?

Compare interest rates, promotional conditions, and operational convenience. For high rates, consider Ping An OneConnect Bank (6.88% annual rate). For flexibility, Hang Seng Bank’s PayDay+ plan may be more suitable.

3. Do Savings Accounts Incur Any Fees?

Most Hong Kong banks’ savings accounts do not charge fees. However, some banks may impose management fees for accounts below a minimum deposit threshold. Review the terms carefully before opening an account.

4. How Is Interest Calculated for Savings Accounts?

Banks typically calculate interest based on the daily balance, paid monthly or quarterly. For example, with a 5% annual rate, daily interest is calculated as (deposit amount × 5%) ÷ 365.

5. Can I Have Multiple Savings Accounts Simultaneously?

Yes, you can open multiple savings accounts at different banks to enjoy various rates and promotions. However, consider the convenience of managing multiple accounts and any potential fees.

In 2025, Hong Kong’s competitive current account market emphasizes high yields and flexible fund management. BiyaPay offers an efficient financial solution, enabling trading in U.S. and Hong Kong stocks without offshore accounts, allowing you to participate in the market cost-effectively, whether seizing short-term opportunities in Hong Kong markets or pursuing long-term stable asset growth.

Its platform supports USD, HKD, and 30+ fiat and digital currencies with real-time exchange rate insights, ensuring transparent and efficient cross-border transactions while minimizing exchange rate risks. With remittance fees as low as 0.5% across 190+ countries, it streamlines fund allocation without high costs impacting returns. A flexible 5.48% annualized yield savings product with no lock-in period surpasses most current account rates, offering greater flexibility and returns, perfectly aligning with digital banking and high-yield deposit needs. Sign up for BiyaPay today to combine the flexibility of current accounts with BiyaPay’s versatile tools for a high-yield, convenient wealth management journey!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.