- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Use Term Deposit Calculation Methods to Earn High Interest

Image Source: unsplash

You can use term deposit calculation methods to earn high interest. This method helps you accurately calculate deposit interest, allowing you to choose the most advantageous deposit plan. The term deposit interest calculation formula can calculate the relationship between the deposit principal and interest, providing clear data support. When you master these formulas, you can find the most suitable plan based on different deposit conditions, thereby maximizing returns.

Detailed Explanation of Term Deposit Calculation Methods

Image Source: unsplash

Term Deposit Interest Calculation Formula

To calculate the interest on a term deposit, you need to master a simple formula:

Interest = Principal × Annual Interest Rate × Deposit Term

In this formula, the principal is the amount you deposit in the bank, the annual interest rate is the rate offered by the bank, and the deposit term is the duration of the deposit you choose (in years). This formula helps you quickly calculate the total return on your deposit, allowing you to better understand the returns of different deposit plans.

When the interest rate changes, the final return will also be affected:

- When interest rates rise, the final return on deposits increases.

- When interest rates fall, the return decreases.

- The longer the deposit term, the greater the impact of interest rate changes on returns.

Therefore, choosing the appropriate deposit term and interest rate is very important. After mastering these basic concepts, you can more flexibly apply term deposit calculation methods to find the most advantageous deposit plan.

Practical Example of Interest Calculation

Let’s use a simple example to illustrate how to apply term deposit calculation methods. Suppose you deposit HKD 100,000, the bank offers an annual interest rate of 2%, and the deposit term is 3 years. According to the formula:

Interest = 100,000 × 0.02 × 3 = 6,000 HKD

This example clearly shows the impact of interest rate changes on final returns. When choosing a term deposit, you should closely monitor market interest rate changes and select a suitable deposit plan based on your financial goals.

Moreover, when the deposit term is longer, the impact of interest rate fluctuations on returns becomes more significant. For example, if the deposit term is 5 years instead of 3 years, and the interest rate rises to 3%, the interest will increase to:

Interest = 100,000 × 0.03 × 5 = 15,000 HKD

These data show that choosing a long-term deposit may yield higher returns but also involves the risk of interest rate fluctuations. You can flexibly apply term deposit calculation methods based on your risk tolerance and financial needs to maximize returns.

Latest Term Deposit Promotions and Offers in 2025

Image Source: unsplash

Market Overview

In 2025, the global economic environment continues to change, and bank deposit interest rates fluctuate accordingly. According to the latest data, several private banks in China have adjusted deposit interest rates multiple times this year, with some banks’ 5-year term deposit rates dropping from 2.65% at the beginning of the year to 2% by the end of the year. This trend reflects a reduced demand for long-term deposits, while short-term deposit rates remain relatively stable or even slightly increase.

Additionally, there is an inversion phenomenon between 3-year and 5-year deposit rates, with some banks offering higher 1-year deposit rates than 5-year rates. For example, Fujian Huatong Bank’s 3-year and 5-year term deposit rates are 2.80% and 2.90%, respectively. This situation provides you with more options for short-term investments, especially when you want to flexibly manage funds.

Currently, banks in Hong Kong have also launched various promotional activities to attract customers to choose term deposit plans. These activities not only offer higher interest rates but also include other favorable conditions, such as fee waivers or additional rewards. Below, we will compare the promotional activities of major banks in detail to help you find the most suitable deposit plan.

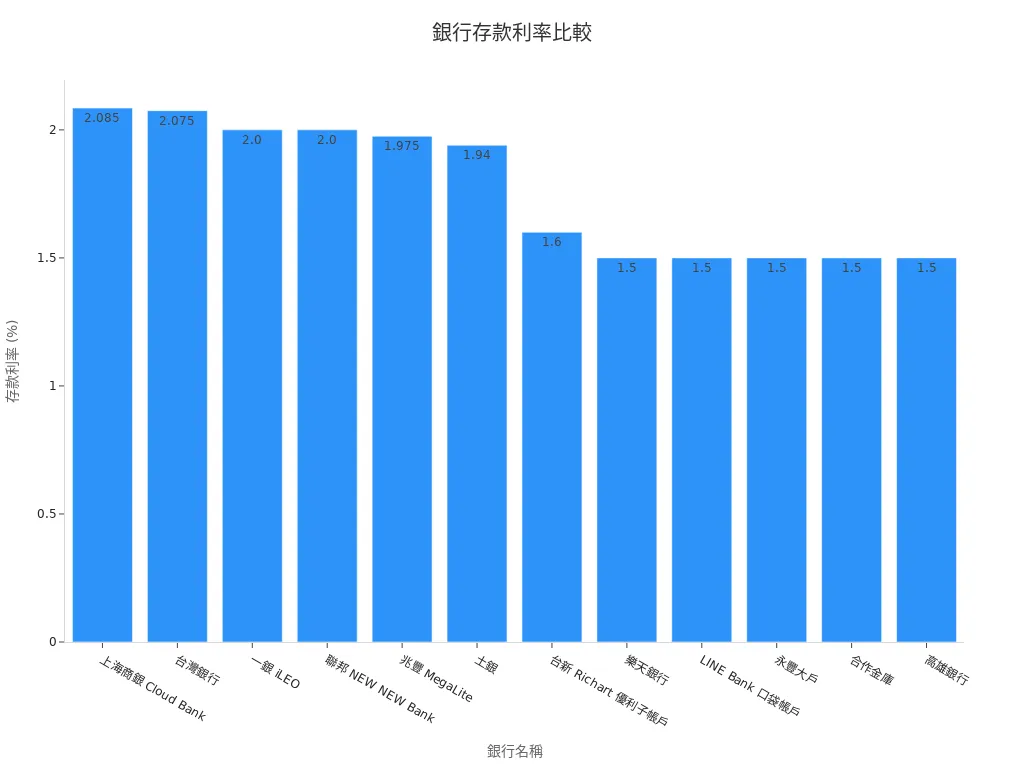

Comparison of Promotional Activities by Major Banks

When choosing a term deposit, you need to consider multiple factors, including interest rates, minimum deposit amounts, and promotion deadlines. Below is a comparison of promotional activity data for some banks in 2025:

| Bank Name | Deposit Rate | Minimum Deposit Amount | Promotion Deadline |

|---|---|---|---|

| Shanghai Commercial Bank Cloud Bank | 2.085% | 200,000 | ~2025/6/30 |

| Bank of Taiwan | 2.075% | 100,000 | ~2025/12/31 |

| First Bank iLEO | 2% | 120,000 | ~2025/12/31 |

| Union Bank NEW NEW Bank | 2% | 100,000 | ~2025/6/30 |

| Mega Bank MegaLite | 1.975% | 100,000 | ~2025/12/31 |

| Land Bank of Taiwan | 1.94% | 100,000 | ~2025/12/31 |

| Taishin Richart High-Interest Account | 1.6% | 300,000 | ~2025/7/3 |

| Rakuten Bank | 1.5% | No Upper Limit | ~2025/06/30 |

| LINE Bank Pocket Account | 1.5% | 300,000 | ~2025/6/30 |

| Yongfeng Bank DAWHO | 1.5% | 100,000~300,000 | ~2025/6/30 |

From the table, it can be seen that Shanghai Commercial Bank Cloud Bank and Bank of Taiwan offer higher deposit rates of 2.085% and 2.075%, respectively. If your deposit amount is large, these banks may be better choices. Meanwhile, Rakuten Bank offers no upper limit on deposit amounts, suitable for customers who want flexible deposits.

Additionally, some banks have introduced higher promotional rates for new customers. For example, Taichung Bank Lolly Bank offers up to 3% deposit rates for new customers, but the promotional quota is limited to 50,000. Such activities are suitable for first-time account holders, especially those looking for high returns in the short term.

When choosing a bank, you should also pay attention to other conditions, such as interest payment frequency and fee waivers. Some banks offer monthly interest payments, suitable for customers needing stable cash flow, while others provide fee-free interbank transfer services, which are very practical for customers who frequently move funds.

In summary, the term deposit market in 2025 offers diverse options. You can flexibly apply term deposit calculation methods based on your deposit amount, term requirements, and other preferences to choose the most suitable promotional activity.

How to Choose the Most Suitable Term Deposit Plan

Choosing Based on Deposit Amount and Term

When choosing a term deposit plan, you need to make decisions based on your deposit amount and term requirements. Different deposit amounts and terms directly affect your interest earnings. For example, if you have a large deposit amount, choosing a long-term deposit plan with a high interest rate may be more advantageous. Suppose you deposit USD 50,000, choosing a 5-year deposit with a 2.5% annual interest rate, the final interest earnings will be much higher than a short-term deposit.

Short-term deposits are suitable for those who need flexible fund management. If you expect to need funds within a year, you can choose a 1-year or 3-year deposit plan. This allows you to earn stable interest while maintaining liquidity.

Tip: When choosing a deposit term, consider the trend of market interest rate changes. If interest rates are likely to rise, short-term deposits may be more flexible, allowing you to choose higher-yield plans after rates increase.

Pay Attention to Hidden Terms and Other Influencing Factors

In addition to interest rates and terms, you also need to pay attention to hidden terms and other factors affecting term deposits. Some banks may impose additional conditions, such as penalties for early withdrawal or restrictions on minimum deposit amounts. These terms may affect your actual returns.

Below are some common influencing factors you should pay special attention to:

- Early Withdrawal Penalties: Some banks charge high penalties for early withdrawals, which may result in the loss of some interest earnings.

- Minimum Deposit Amount: Certain promotional rates only apply to higher deposit amounts, and if your deposit is insufficient, you may not enjoy the offer.

- Interest Payment Frequency: Some banks offer monthly or quarterly interest payments, which are more attractive to those needing stable cash flow.

According to a survey by Manulife Investment Management, investors in major Asian markets hold about 40% of their asset allocation in cash and deposits. This indicates that term deposits play an important role in asset allocation. You should choose the most suitable plan based on your financial goals and risk tolerance.

Note: Before signing a deposit contract, be sure to carefully read all terms to avoid losses due to overlooked details.

When choosing a term deposit plan, flexibly apply term deposit calculation methods and combine them with your needs and market conditions to maximize returns.

By using term deposit calculation methods, you can easily master the calculation of interest earnings and choose the most suitable deposit plan based on the latest promotional activities in 2025. This not only helps you maximize returns but also makes your fund management more efficient.

When choosing a high-interest term deposit plan, the following data indicators are very important:

- Interest Rate Changes

- Yield

- Economic Growth Trends

- Inflation Rate

- Market Returns

These indicators can help you assess the market environment and make more informed choices. Based on your deposit amount and term requirements, flexibly apply the calculation formula and pay attention to hidden terms to maximize returns on a stable basis. Take action now and choose the term deposit plan that best suits you to achieve your financial goals faster!

FAQ

1. How to Calculate Term Deposit Interest?

You can use the following formula:

Interest = Principal × Annual Interest Rate × Deposit Term

By substituting the principal, interest rate, and term into the formula, you can quickly calculate the interest amount. This helps you clearly understand deposit returns.

2. Are There Risks with Term Deposits?

Term deposits have relatively low risks, but you should still pay attention to the following factors:

- Bank Failure Risk

- Interest Rate Fluctuations Affecting Returns

- Penalties for Early Withdrawal

Choosing a protected bank and a suitable deposit term can reduce risks.

3. How to Choose the Most Suitable Deposit Term?

When choosing a deposit term, consider the following factors:

- Liquidity Needs

- Market Interest Rate Trends

- Financial Goals

Short-term deposits are suitable for flexible fund management, while long-term deposits can yield higher returns.

4. What Are the Impacts of Early Withdrawal?

Early withdrawal may lead to the following consequences:

- Penalties Deducting Part of Interest Earnings

- Inability to Enjoy Promotional Rates

Carefully reading the terms before signing a contract can avoid unnecessary losses.

5. How Do Deposit Rates Affect Returns?

Deposit rates directly affect the interest amount. The higher the rate, the greater the return. You should closely monitor market interest rate changes and choose plans with higher rates to maximize returns.

In 2025, the fixed deposit market faces volatility, with Shanghai Commercial Bank offering 2.085% and Bank of Taiwan 2.075%, yet 5-year rates dropping to 2% and early withdrawal penalties limiting flexibility—how can you balance high returns with liquidity? BiyaPay offers a digital financial platform, enabling seamless trading of U.S. and Hong Kong stocks without offshore accounts, helping you capture market opportunities to enhance fixed deposit yields.

Supporting USD, HKD, and 30+ currencies with real-time exchange rate tracking for transparency, plus global remittances to 190+ countries with remittance fees as low as 0.5%, it outperforms traditional banks’ costly and complex processes. A 5.48% annualized yield savings product with no lock-in period perfectly balances liquidity and steady returns. Sign up for BiyaPay now to combine the stability of fixed deposits with BiyaPay’s global financial solutions for efficient, low-cost wealth growth!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.