- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

The Secret to Calculating Interest on a One-Million Fixed Deposit Revealed

Image Source: unsplash

Calculating deposit interest is not complicated, but understanding its formula can help you better manage financial planning. The formula is: Interest = Principal × Annual Interest Rate × (Deposit Days / 365). For example, if you deposit a principal of one million for a fixed deposit with an annual interest rate of 4% for 90 days, your interest income will be approximately $9,589.04. Interest rates, deposit terms, and bank selection are the main factors affecting interest income. Different banks offer plans, such as Minsheng Direct Bank’s Flexible Deposit Service or China Construction Bank’s Special Savings, which can maximize your capital returns. Choosing the right plan can help you achieve ideal financial goals in the short or long term.

Key Points

- Understand the interest calculation formula: Interest = Principal × Annual Interest Rate × (Deposit Days / 365). Mastering this formula can help you calculate interest for different deposit plans.

- Choose the appropriate annual interest rate: Higher annual interest rates lead to greater returns. Compare interest rates from different banks to select the most advantageous plan.

- Consider the impact of deposit terms: Short-term deposits offer flexibility but lower interest, while long-term deposits provide higher interest but lower liquidity. Choose the appropriate term based on your financial needs.

- Use online calculation tools: Utilize calculators provided by banks or financial websites to quickly calculate interest income, helping you make informed choices.

- Evaluate additional bank benefits: Some banks offer fee waivers or extra interest rate rewards, which can further enhance your returns.

Formula and Influencing Factors for Calculating Interest on a One-Million Fixed Deposit

Detailed Explanation of the Interest Calculation Formula

The interest calculation formula is the foundation for understanding fixed deposit returns. The formula is:

Interest = Principal × Annual Interest Rate × (Deposit Days / 365)

Suppose you deposit one million dollars in a bank with a 4% annual interest rate for 90 days; the interest income will be approximately $9,589.04. Each variable in this formula directly affects your interest income:

- Principal: The higher the deposit amount, the greater the interest income.

- Annual Interest Rate: The higher the rate, the greater the returns.

- Deposit Days: The longer the deposit term, the higher the interest income.

You can use this formula to calculate interest for different deposit plans, helping you choose the most suitable fixed deposit plan.

Difference Between Annual Interest Rate and Other Interest Types

When choosing a fixed deposit, you need to understand the difference between the annual interest rate and other interest types. Below is a comparison of two common interest rates:

- Nominal Interest Rate: Does not account for inflation. For example, a nominal interest rate of 2% with an inflation rate of 8% means your purchasing power actually decreases.

- Real Interest Rate: Accounts for inflation, more accurately reflecting your returns. The calculation formula is: Nominal Interest Rate - Expected Inflation Rate.

For example, if a bank offers a fixed deposit plan with a nominal interest rate of 2% and the inflation rate is 8%, the real interest rate is negative, indicating a decrease in the actual purchasing power of your funds. When choosing a fixed deposit plan, prioritize the real interest rate to ensure your funds maintain or increase their value.

Impact of Deposit Term on Interest Income

The deposit term is a significant factor affecting the interest on a one-million fixed deposit. Short-term deposits offer flexibility but may yield lower interest income; long-term deposits provide higher interest income but reduce liquidity. Below is a comparison of different deposit terms:

| Deposit Term | Advantages | Disadvantages |

|---|---|---|

| Short-term Deposit | High flexibility, suitable for short-term financial needs | Usually lower interest rates, limited interest income |

| Long-term Deposit | Higher interest rates, more interest income | Lower liquidity, early withdrawal may incur penalties |

For example, if you choose a 90-day short-term deposit with a 4% annual interest rate, the interest income is approximately $9,589.04; whereas a one-year deposit could double the interest income. Choosing the appropriate deposit term based on your financial goals and funding needs can help maximize returns.

Case Study Analysis of Interest on a One-Million Fixed Deposit

Image Source: unsplash

Interest Income from High-Interest Short-Term Deposits

Short-term deposits are typically suitable for those needing liquidity. Suppose you choose a short-term deposit plan with a 5% annual interest rate for 90 days, depositing a principal of one million dollars. Based on the interest calculation formula, the interest income is approximately $12,328.77. High-interest short-term deposits can yield higher returns in a short period.

However, short-term deposit interest rates may vary by bank. Some Hong Kong banks offer short-term deposit plans with additional benefits, such as fee waivers or higher interest rates. Choosing the right bank can further enhance your returns.

Interest Income from Low-Interest Long-Term Deposits

Long-term deposits are suitable for those seeking stable returns. Suppose you choose a long-term deposit plan with a 2% annual interest rate for one year, depositing a principal of one million dollars. Based on the interest calculation formula, the interest income is approximately $20,000. Although the interest rate is lower, long-term deposits provide stable returns, ideal for situations where funds are not urgently needed.

Another advantage of long-term deposits is that the interest rate is usually fixed, helping you hedge against market fluctuations. Some Hong Kong banks also offer additional benefits, such as flexible early withdrawal options or higher interest rates. These factors can ensure stable growth of your funds over the long term.

Comparison of Fixed Deposit Interest Rates Across Different Banks

Choosing a bank is a critical factor affecting the interest on a one-million fixed deposit. Below is a comparison of fixed deposit interest rates from three Hong Kong banks:

| Bank Name | Annual Interest Rate (Short-Term Deposit) | Annual Interest Rate (Long-Term Deposit) |

|---|---|---|

| HSBC Hong Kong | 4.5% | 2.2% |

| Standard Chartered Bank | 5.0% | 2.0% |

| Bank of China Hong Kong | 4.8% | 2.1% |

For example, if you choose Standard Chartered Bank’s short-term deposit plan with a 5% annual interest rate, the interest income after 90 days is approximately $12,328.77. In contrast, choosing HSBC Hong Kong’s long-term deposit plan with a 2.2% annual interest rate yields approximately $22,000 after one year. Selecting the right bank based on your financial needs can help maximize returns.

How to Choose the Best One-Million Fixed Deposit Plan

Balancing Interest Rates and Deposit Terms

When choosing a one-million fixed deposit plan, you need to balance interest rates and deposit terms. High-interest short-term deposits can provide higher returns in a short time, but less flexible long-term deposits are suitable for those seeking stable returns.

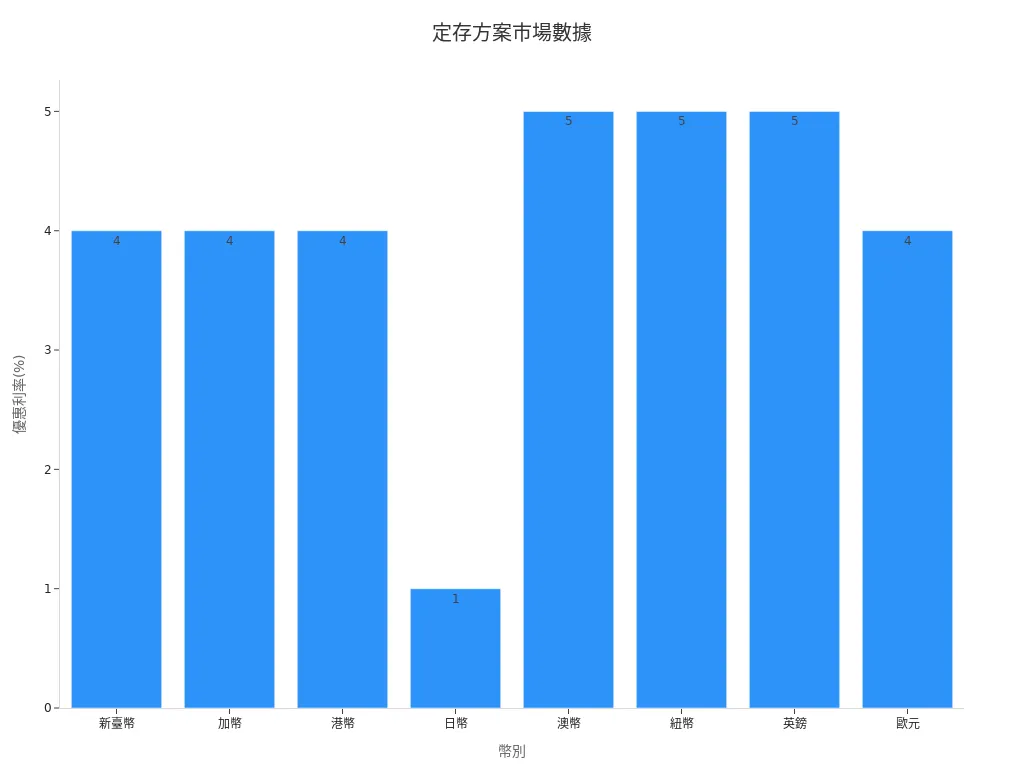

Below is a reference to market data showing fixed deposit plans for different currencies:

| Currency | Deposit Term | Promotional Interest Rate (Annual) | Minimum Deposit Amount | Maximum Deposit Limit |

|---|---|---|---|---|

| NTD | 3 Months | 4% | 30,000 | 1,000,000 |

| CAD | 3 Months | 4% | 30,000 | 1,000,000 |

| HKD | 3 Months | 4% | 100,000 | 5,000,000 |

| JPY | 3 Months | 1% | 500,000 | 5,000,000 |

| AUD | 3 Months | 5% | 30,000 | 1,000,000 |

| NZD | 3 Months | 5% | 30,000 | 1,000,000 |

| GBP | 3 Months | 5% | 30,000 | 1,000,000 |

| EUR | 3 Months | 4% | 30,000 | 1,000,000 |

From the table, it is evident that AUD, NZD, and GBP offer higher short-term deposit interest rates, reaching 5%. If you aim to earn higher interest income in the short term, these currencies may be ideal choices. However, if you prioritize fund stability, choosing long-term deposit plans in HKD or NTD may be more suitable.

Evaluating Additional Benefits Offered by Banks

Additional benefits offered by banks are also important considerations when choosing a fixed deposit plan. Some Hong Kong banks may provide the following benefits:

- Fee Waivers: Some banks waive fees for opening a fixed deposit or early withdrawal, reducing your additional costs.

- Extra Interest Rate Rewards: For example, banks may offer higher interest rates if you use online banking services or meet a certain deposit amount.

- Flexible Withdrawal Options: Some banks allow partial withdrawals without affecting the interest rate, increasing fund flexibility.

When choosing a bank, carefully compare these benefits to ensure the selected plan maximizes your returns. For instance, if a bank offers additional interest rate rewards, it could significantly increase your interest income, especially with a principal of one million dollars.

Recommendations for Using Fixed Deposit Calculators

Fixed deposit calculators can help you quickly calculate interest income for different plans, making it easier to understand the pros and cons of various options. Below are some usage recommendations:

- Choose Reliable Tools: Use calculators provided by bank official websites or reputable financial platforms to ensure data accuracy.

- Input Accurate Data: Include principal, annual interest rate, and deposit term to ensure the calculation results meet your actual needs.

- Compare Multiple Plans: Try inputting different interest rates and terms to find the most suitable fixed deposit plan.

For example, if you use an online calculator from a Hong Kong bank, inputting a principal of one million dollars, a 4% annual interest rate, and a 90-day term will show an interest income of approximately $9,589.04. Such tools help you quickly compare different plans, saving time and effort.

Fixed Deposit Interest Calculation Tools and Resources

Image Source: unsplash

Recommended Online Calculation Tools

Using online calculation tools allows you to quickly calculate fixed deposit interest income, saving time and effort. Below are some recommended tools:

- HSBC Hong Kong Online Calculator: Offers a simple, user-friendly interface where you input principal, annual interest rate, and deposit term to obtain accurate interest calculation results.

- Standard Chartered Bank Fixed Deposit Calculator: Supports calculations for multiple currencies, suitable for those comparing interest rates across different currencies.

- Third-Party Financial Websites: Platforms like MoneyHero or GoBear provide calculators to help compare fixed deposit plans from multiple banks.

Tip: Prioritize calculators on bank official websites for more accurate and frequently updated data.

How to Use Bank Interest Calculators

Bank interest calculators are easy to use, even for those without a financial background. Below are the basic steps:

- Visit the Bank’s Website: For example, go to the official websites of HSBC Hong Kong or Bank of China Hong Kong.

- Select the Fixed Deposit Calculator: Usually found under “Personal Banking Services” or “Fixed Deposit” options.

- Input Data: Include principal (e.g., $1,000,000), annual interest rate (e.g., 4%), and deposit term (e.g., 90 days).

- View Results: The calculator will display your interest income, such as $9,589.04.

Note: Some calculators may require you to select a currency or input additional tax rates; ensure all data is accurate.

Steps and Precautions for Manual Calculations

If you prefer manual calculations, here are simple steps:

- Use the Formula: Interest = Principal × Annual Interest Rate × (Deposit Days / 365).

- Example Calculation: Suppose the principal is $1,000,000, the annual interest rate is 4%, and the deposit term is 90 days:

Interest = 1,000,000 × 0.04 × (90 / 365) Interest ≈ $9,589.04 - Verify Data: Ensure the principal, interest rate, and term data are accurate to avoid calculation errors.

Reminder: When calculating manually, pay attention to rounding, especially for decimals, to ensure precise results.

The fixed deposit interest calculation formula is straightforward: Interest = Principal × Annual Interest Rate × (Deposit Days / 365). Pay attention to the principal, interest rate, and deposit term, as these factors directly affect your returns. Choosing the right fixed deposit plan is crucial for achieving your financial goals.

Tip: Use bank interest calculators to quickly compare interest rates and benefits from different banks. This way, you can easily find the plan that best suits your needs and maximizes your returns!

FAQ

What is the annual interest rate for a fixed deposit?

The annual interest rate is the percentage of annual interest paid by the bank on your deposit. For example, with a 4% annual interest rate and a principal of $1,000,000, you would earn $40,000 in interest after one year.

Does early withdrawal affect interest income?

Yes. Most banks reduce interest rates for early withdrawals and may even impose penalties. Check the bank’s policies before depositing to avoid unnecessary losses.

How to choose the appropriate deposit term?

Choosing a deposit term depends on your financial needs. Short-term deposits are suitable for those needing flexibility, while long-term deposits are ideal for stable returns. Select the most suitable plan based on your funding strategy.

How do fixed deposit interest rates vary by currency?

Fixed deposit interest rates for different currencies vary due to market demand and exchange rate fluctuations. For example, AUD and NZD typically offer higher short-term deposit rates, while JPY rates are lower. Consider exchange rate risks when choosing a currency.

What are the benefits of using a fixed deposit calculator?

Fixed deposit calculators quickly calculate interest income, helping you compare returns from different banks and plans. These tools are user-friendly and ideal for those needing quick insights into fixed deposit returns.

Calculating fixed deposit interest is straightforward (Interest = Principal × Annual Rate × Days / 365), with short-term deposits (e.g., 90 days at 4%, yielding ~$9,589) offering flexibility and long-term deposits providing stability—but how can you pursue greater wealth growth beyond fixed returns? BiyaPay offers a digital financial platform, enabling seamless trading in U.S. and Hong Kong markets without offshore accounts, complementing fixed deposits’ stable returns with dynamic global investments.

Supporting USD, HKD, and 30+ fiat and digital currencies with real-time exchange rate tracking for transparency, plus global remittances to 190+ countries with remittance fees as low as 0.5%, it outperforms traditional banks’ costly and complex processes. A 5.48% annualized yield savings product with no lock-in period ensures balanced returns and liquidity. Sign up for BiyaPay now to combine fixed deposits’ steady income with BiyaPay’s digital asset investment solutions for efficient, low-cost wealth growth!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.