- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

The Ultimate Guide to Transferring USD to China in 2025

Image Source: pexels

What is the best way to transfer USD to China in 2025? Choosing a cheap, fast, and secure method is crucial. Bank wire transfers, while traditional, come with high fees. Online remittance services like Wise and Remitly offer lower fees and convenient operations. Cryptocurrency transfers are ideal for tech-savvy users, offering speed and no cross-border restrictions. Depending on your needs, selecting the right method can save time and money.

Key Points

- Choosing the right transfer method can save time and money. Bank wire transfers are suitable for large amounts but have high fees.

- Online remittance services like Wise and Remitly have low fees and fast delivery, ideal for small amounts or urgent transfers.

- Cryptocurrency transfers are fast and cheap, suitable for tech-savvy users, especially for urgent needs.

- When choosing a transfer method, compare fees, exchange rates, and delivery times to find the most cost-effective option.

- Preparing documents in advance and understanding transfer limits can avoid delays and issues.

Common Methods for Transferring USD to China

Bank Wire Transfer

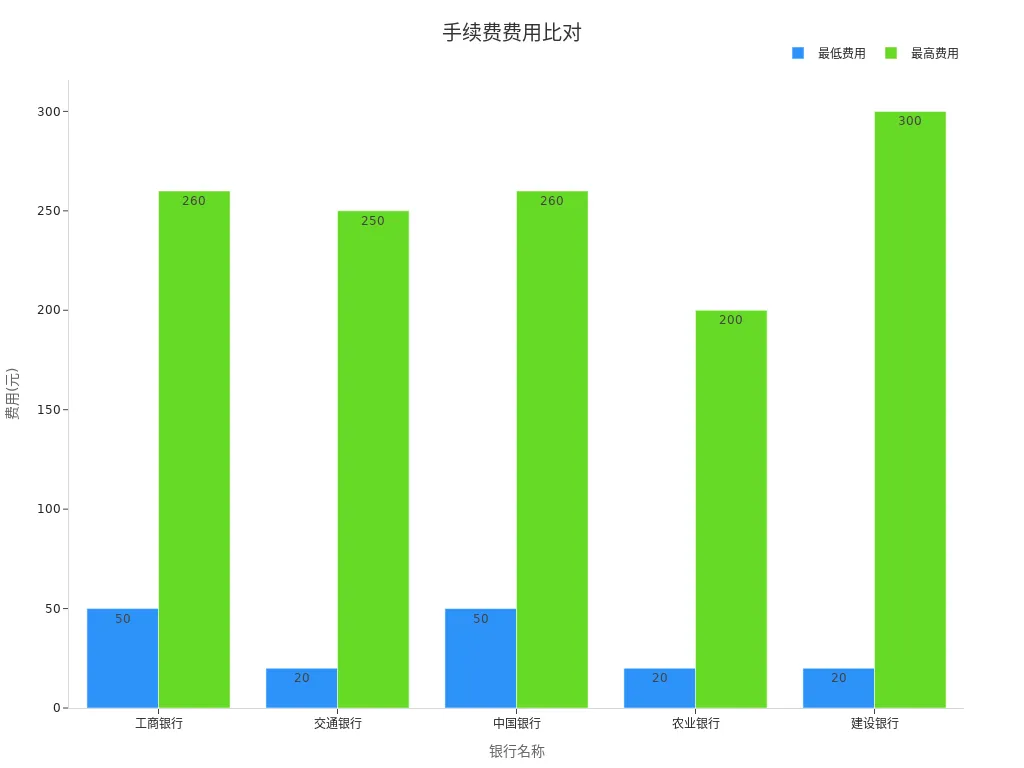

Bank wire transfer is a traditional method for transferring USD to China. You can complete the transfer through financial institutions like Hong Kong banks. Wire transfer fees typically include two parts: 1‰ of the transfer amount, with a minimum of 50 CNY and a maximum of 260 CNY; and a telegraph fee, which is 80 CNY per transaction for Hong Kong, Macau, and Taiwan, and 150 CNY per transaction for international transfers. Below is a table of specific fees:

| Fee Type | Fee Standard |

|---|---|

| Handling Fee | 1‰ of the transfer amount, minimum 50 CNY, maximum 260 CNY |

| Telegraph Fee | 80 CNY per transaction for Hong Kong, Macau, and Taiwan; 150 CNY per transaction for international transfers |

Bank wire transfers typically take 3-5 business days to arrive, suitable for users who are not in a hurry. Although fees are higher, bank wire transfers have a high success rate and are suitable for large-amount transfers.

Online Remittance Services (e.g., Wise, Remitly)

Online remittance services have gained popularity among users in recent years. You can choose platforms like Wise or Remitly, which offer lower fees and better exchange rates. Below is a comparison of the two platforms:

| Provider | Trustpilot Rating | Exchange Rate Advantage | Handling Fee |

|---|---|---|---|

| Wise | 4.3 | Optimal exchange rate 7.1895 | 36.69 USD |

| Remitly | 4.6 | Higher exchange rate | 68.2 USD |

Wise is praised for its transparent fees and real-time exchange rates, while Remitly attracts users with its higher exchange rates. Online remittance services typically deliver funds within minutes to 24 hours, making them ideal for users needing quick transfers.

Cryptocurrency Transfer

Cryptocurrency transfer is an emerging method for transferring USD to China. You can use stablecoins for cross-border payments, with low fees and fast speeds. Below are the advantages of cryptocurrency transfers:

- In Latin America, Mexico’s stablecoin remittance inflows reached USD 63.3 billion, accounting for a significant portion of total remittance inflows.

- The proportion of Brazilian companies using stablecoins for cross-border payments has risen significantly, with large transactions over USD 1 million growing by about 29%.

- In Sub-Saharan Africa, traditional remittance fees range from 8-12%, while stablecoin fees can be reduced to below 3%, with instant delivery.

- Traditional cross-border transfers take 3-5 days, while stablecoin transfers only require network fees and can settle within one block.

Cryptocurrency transfers are suitable for tech-savvy users, especially those who need fast delivery and are sensitive to fees.

Other Methods (e.g., Check Mailing, Third-Party Payment Platforms)

In addition to bank wire transfers, online remittance services, and cryptocurrency transfers, you can also choose other methods to transfer USD to China. These methods include check mailing and third-party payment platforms. While less popular than the previous options, they may be more suitable for certain needs.

Check Mailing

Check mailing is a traditional remittance method. You can complete the transfer by mailing a USD check to the recipient’s address in China. This method is suitable for users who are not in a hurry. The main features of check mailing are as follows:

- Lower Costs: The cost of mailing a check typically includes only postage fees and the bank’s check processing fees.

- Longer Delivery Time: Check mailing processing may take 2-4 weeks, depending on the mailing distance and bank processing speed.

- Lower Security: Checks may be lost or stolen during mailing, so reliable mailing services are recommended.

If you choose this method, using registered mail or courier services is recommended to enhance security.

Third-Party Payment Platforms

Third-party payment platforms are an emerging remittance method. These platforms include PayPal, Alipay International, and others. They offer convenient online payment services, suitable for small-amount transfers. Below are the features of third-party payment platforms:

- Simple Operation: You only need to register an account and link a bank card to complete the transfer.

- Fast Delivery: Transfers are typically completed within minutes to 24 hours.

- Transparent Fees: Fees are usually a fixed amount or a percentage of the transfer amount.

For example, PayPal’s fees are 2.9% of the transfer amount plus a fixed fee, while Alipay International’s fees vary based on the transfer amount and exchange rate. You can choose a suitable platform based on your needs.

Tip: When using third-party payment platforms, ensure your account information is secure and carefully verify the transfer amount and recipient details.

While check mailing and third-party payment platforms are not mainstream options, they may be better solutions in specific cases. Choosing the right method based on your transfer amount, time requirements, and security needs can make transferring USD to China more efficient.

Cost Comparison for Transferring USD to China

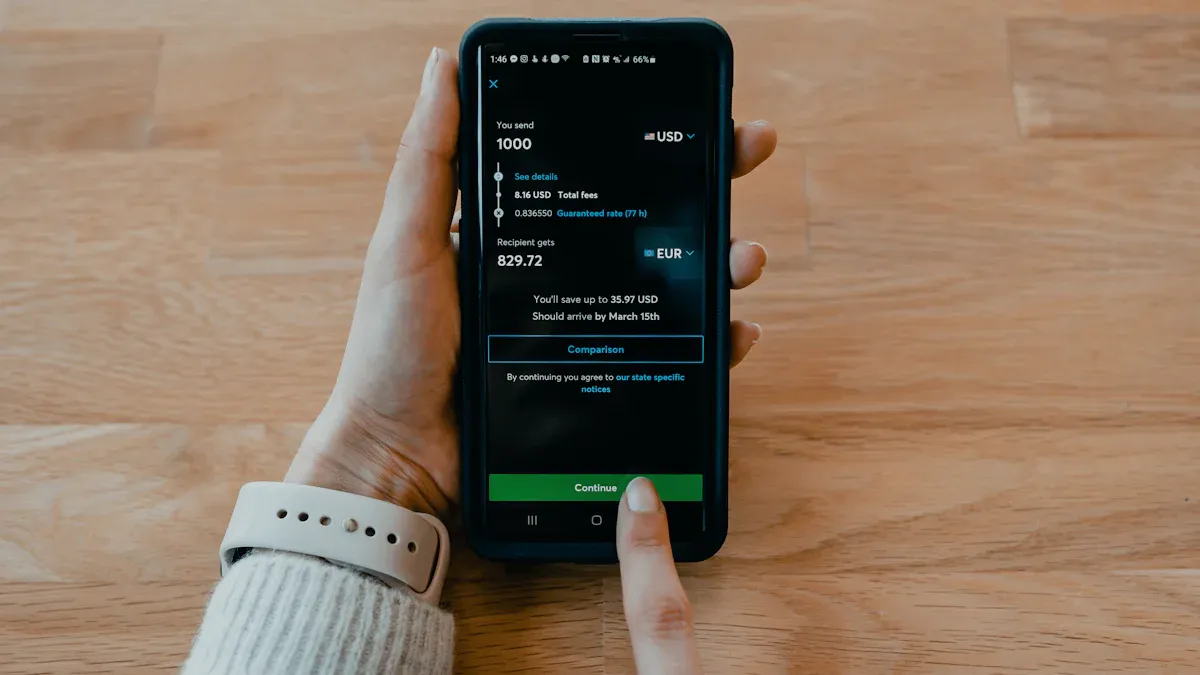

Image Source: unsplash

Fee Analysis

The fees for different transfer methods vary significantly. Bank wire transfers typically charge fees based on a percentage of the transfer amount, with minimum and maximum limits.

Generally speaking, Agricultural Bank of China has a lower maximum fee, making it suitable for large-amount transfers. China Construction Bank has a lower minimum fee, better suited for small-amount transfer needs.

Online remittance services like Wise and Remitly use fixed fees or lower percentage-based fees. For example, Wise’s fee is 36.69 USD, while Remitly’s fee is 68.2 USD. Compared to bank wire transfers, these platforms offer more transparent and lower fees.

Cryptocurrency transfer fees mainly depend on blockchain network congestion. Typically, stablecoin transfer fees are lower than traditional bank wire transfers, with no minimum or maximum limits.

Tip: When choosing a transfer method, compare fees based on the transfer amount and fee standards to select the most cost-effective option.

Exchange Rate Differences

Exchange rates are a key factor affecting the cost of transferring USD to China. Bank wire transfers often use lower exchange rates, increasing transfer costs. For example, a bank may offer an exchange rate of 6.8, while the market rate is 7.2, meaning you could lose 400 CNY for every 1000 USD transferred.

Online remittance services like Wise use real-time market exchange rates, offering better rates. For example, Wise’s exchange rate is 7.1895, much higher than bank rates. Remitly’s rates are also relatively high but may be slightly lower than Wise’s.

Cryptocurrency transfers bypass traditional exchange rate issues. You can directly convert USD to stablecoins (e.g., USDT) and then exchange them for CNY in China. This method is not only transparent but also avoids bank exchange rate spreads.

Note: When choosing a transfer method, pay attention to exchange rate differences and select platforms offering real-time rates to maximize the received amount.

Hidden Fee Analysis

Hidden fees are often overlooked by users during transfers. In addition to handling fees and exchange rate spreads, bank wire transfers may incur intermediary bank fees. These fees are typically deducted automatically during the transfer, resulting in a lower-than-expected received amount.

Online remittance services have fewer hidden fees, but you should still check if platforms charge additional service or withdrawal fees. For example, some platforms may charge extra fees during withdrawals.

Hidden fees in cryptocurrency transfers mainly come from network fees. While fees are generally low, they can increase significantly during network congestion. When using cryptocurrency transfers, choose times with lower network fees to optimize costs.

Tip: Before transferring, carefully review the fee details and confirm the actual received amount with the recipient to avoid unnecessary losses.

Speed Comparison for Transferring USD to China

Image Source: unsplash

Bank Wire Transfer Delivery Time

Bank wire transfer is a traditional method, but delivery times are longer. It typically takes 1 to 3 business days to complete the transfer. Below are the main factors affecting bank wire transfer delivery times:

- Transfer Method: Wire transfers are generally slower than other methods.

- Bank Processing Speed: Different banks have varying processing efficiencies.

- International Settlement Time: Cross-border transaction settlement times directly affect delivery speed.

- Currency Conversion: If USD-to-CNY conversion is involved, it may require an additional 2 to 5 business days.

- Holidays and Weekends: Banks do not process transfers on non-business days, which may cause delays.

- Bank Processing Peak Periods: Peak periods may increase processing times.

For example, wire transfers through Hong Kong banks typically take 3 to 5 business days to arrive. If you need fast delivery, bank wire transfers may not be the best choice.

Online Service Delivery Time

Online remittance services generally deliver faster than bank wire transfers. Below is a comparison of delivery times between online services and bank wire transfers:

| Feature | Online Services | Bank Wire Transfers |

|---|---|---|

| Delivery Time | Faster delivery | 3-5 days |

| Exchange Rate Loss Risk | Lower | Higher |

| Transaction Cost | Lower | Higher |

Online services like Wise and Remitly can typically complete transfers within minutes to 24 hours. This method is ideal for users needing fast delivery. For example, a transfer via Wise may reach the recipient’s account in China within minutes. In contrast, bank wire transfers take longer and may be affected by holidays and international settlement times.

Cryptocurrency Delivery Time

Cryptocurrency transfers are known for their fast delivery. Below are some key data points for cryptocurrency transfers:

| Metric | Value |

|---|---|

| Transaction Volume | USD 8.5 trillion |

| Number of Transactions | 1 billion |

| Transaction Value | Twice that of USD 3.9 trillion |

Cryptocurrency transfers typically complete within minutes, far faster than bank wire transfers and most online services. Additionally, stablecoin transfer fees are usually below 1 USD, regardless of the transfer amount. This method also avoids exchange rate losses and extra commissions from traditional channels. If you need a fast, secure, and low-cost transfer, cryptocurrency is a worthy option.

Tip: When using cryptocurrency transfers, choose times with lower network fees to further reduce costs.

How to Choose the Right USD Transfer Method

Choosing Based on Transfer Amount

The transfer amount is a key factor when choosing a method for transferring USD to China. For small-amount transfers, online remittance services like Wise and Remitly are ideal. These platforms have low fees and no minimum amount requirements. For example, Wise’s fee is 12.62 USD, suitable for users with smaller transfer amounts.

For large-amount transfers, bank wire transfers may be more appropriate. Bank wire transfers typically have minimum and maximum fee limits, making them suitable for larger transactions. Hong Kong banks charge a fee of 0.10% of the transfer amount, with a minimum of 50 CNY and a maximum of 260 CNY. For large transfers, this method’s fees are reasonable.

Cryptocurrency transfers are also suitable for large-amount transfers. Stablecoin transfers have no amount limits, and fees are typically below 1 USD. You can choose the most cost-effective method based on the transfer amount to minimize unnecessary costs.

Choosing Based on Delivery Time Needs

Delivery time is another critical factor when choosing a transfer method. If you need fast delivery, online remittance services and cryptocurrency transfers are the best options. Wise typically completes transfers within hours, while cryptocurrency transfers are even faster, often completing within minutes.

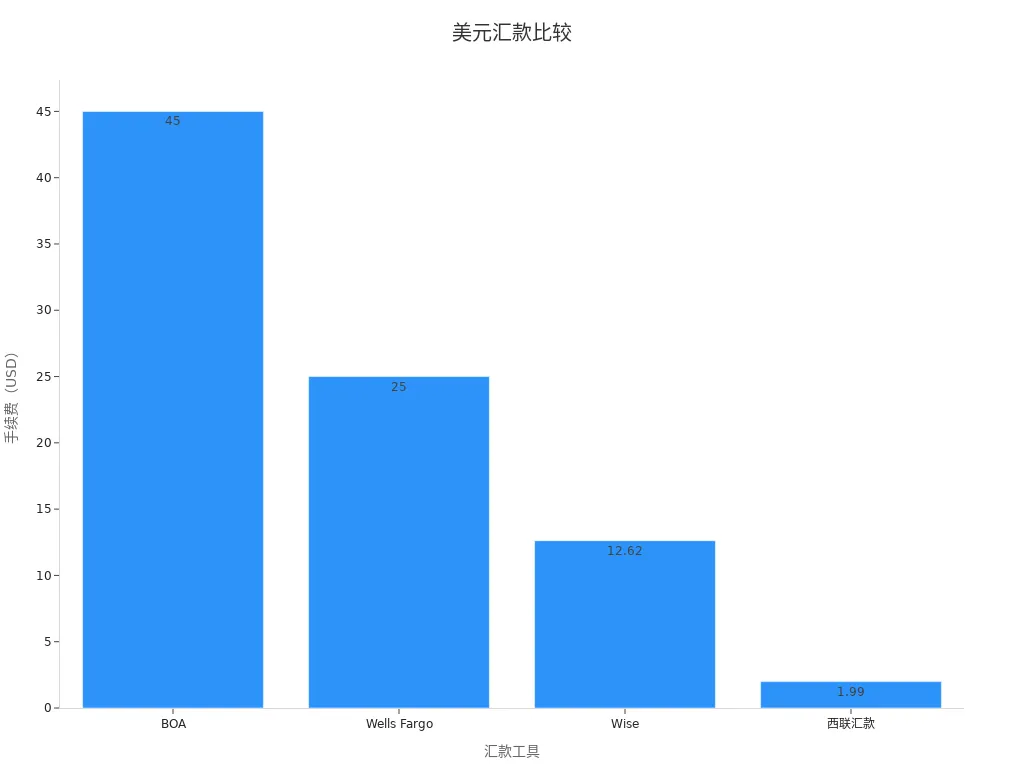

Bank wire transfers take longer, usually 1 to 5 business days. Below is a comparison of delivery times and fees for different transfer tools:

| Transfer Tool | Fee for Transferring 1000 USD | Transfer Time |

|---|---|---|

| BOA | 45 USD | 1-2 business days |

| Wells Fargo | 25 USD | 1-5 business days |

| Wise | 12.62 USD | Within hours |

| Western Union | 1.99 USD | 0-4 business days |

If your delivery time needs are flexible, bank wire transfers and Western Union are also good options. The following bar chart shows a comparison of fees for different transfer tools:

Choosing the right transfer method based on delivery time needs ensures funds arrive at the recipient’s account promptly.

Choosing Based on Fee Budget

Your fee budget directly impacts your choice. If you aim to save on fees, online remittance services are the most economical option. For example, Wise’s fee is only 12.62 USD, far lower than bank wire transfers and other traditional methods.

Bank wire transfers have higher fees but are suitable for large-amount transfer users. Hong Kong banks charge 0.10% of the transfer amount, with a minimum of 50 CNY and a maximum of 260 CNY. For small-amount transfers, this method may not be cost-effective.

Cryptocurrency transfers have the lowest fees, typically requiring only network fees. Stablecoin transfer fees are usually below 1 USD, regardless of the transfer amount. If your budget is limited, cryptocurrency transfers are a worthy option.

By comparing fees for different methods, you can choose the one that best fits your budget, reducing unnecessary expenses.

Key Factors to Consider When Transferring USD to China

Document and Identity Verification Requirements

When transferring USD to China, preparing necessary documents and completing identity verification is crucial. Bank wire transfers typically require a copy of your passport or ID, a transfer application form, and the recipient’s details, including name, bank account, and bank address. For online remittance services, you may need to upload identity documents during account registration and verify your email and phone number.

Cryptocurrency transfers have lower identity verification requirements, but some platforms still require KYC (Know Your Customer) certification. This usually involves uploading identification documents and a selfie. Ensuring all documents are clear and accurate can prevent transfer delays or failures.

Tip: Prepare all necessary documents in advance and double-check information for accuracy.

Transfer Limits and Legal Regulations

When transferring USD to China, you need to understand relevant transfer limits and legal regulations. Bank wire transfers often have limits on single transaction amounts; for example, Hong Kong banks may restrict transfers to no more than USD 50,000 per transaction. Online remittance services may also set daily or monthly transfer caps based on platform policies.

China’s foreign exchange regulations set an annual foreign exchange quota of USD 50,000 for individuals. If your transfer exceeds this quota, you may need to provide additional proof, such as income statements or property purchase contracts. While cryptocurrency transfers lack traditional transfer limits, they must still comply with China’s relevant laws and regulations.

Note: Before transferring, understand transfer limits and regulations to avoid issues caused by exceeding limits.

Tips to Avoid Hidden Fees

Hidden fees are a common issue when transferring USD to China. Bank wire transfers may incur intermediary bank fees, which are typically deducted automatically during the process. Online remittance services are more transparent, but some platforms may charge additional fees for withdrawals. Hidden fees in cryptocurrency transfers mainly come from network fees, which can increase during blockchain network congestion.

To avoid hidden fees, consider the following measures:

- Before transferring, carefully read the terms of service to understand all possible fees.

- Choose transparent fee platforms, such as Wise or Remitly.

- For cryptocurrency transfers, choose times with lower network fees for operations.

Tip: Confirm the actual received amount with the recipient to ensure no shortfall due to hidden fees.

Choosing the best USD transfer method depends on your needs. Bank wire transfers are suitable for large amounts, while online services like Wise stand out for low fees and fast delivery. Cryptocurrency transfers offer an efficient option for tech-savvy users. Below is a summary of successful cases in 2025:

| Success Case | Transfer Efficiency Improvement | Fee Reduction | Risk Management Features |

|---|---|---|---|

| Global Trade Co., Ltd. | 40% | 30% | Real-time monitoring and risk alerts |

Advance planning and comparing multiple services are crucial. By understanding fees, exchange rates, and delivery times, you can choose the most suitable method. Ensuring accurate information and avoiding hidden fees can make your transfers more efficient and secure.

FAQ

1. How to Ensure Transfer Information is Accurate?

When filling out transfer information, carefully verify the recipient’s name, bank account, and bank address. Ensure this information matches bank records exactly. Incorrect information may lead to transfer failures or delays.

2. Are Additional Taxes Required for Transfers to China?

Typically, transfers do not require additional taxes. However, for large amounts, proof of fund sources may be needed. Consult your bank or relevant institutions in advance to understand specific requirements.

3. Is Cryptocurrency Transfer Safe?

Cryptocurrency transfers are generally secure, but choosing reliable platforms is critical. Avoid unverified small exchanges. Enable two-factor authentication to protect account security.

Tip: Before transferring, check network fees and the platform’s reputation to ensure smooth transactions.

4. Do Online Remittance Services Support Real-Time Exchange Rates?

Most online remittance services, like Wise, offer real-time exchange rates. You can view the current rate before transferring to ensure the best exchange ratio. Some platforms may charge extra fees to lock in rates.

5. Will Funds Be Refunded if a Transfer Fails?

If a transfer fails, funds are typically refunded to your account. However, processing may take a few days. Contact the transfer service provider or bank to understand the specific refund process.

Note: Keep transfer receipts for easy follow-up and issue resolution.

Remitting USD to China requires balancing speed, cost, and security, and an efficient digital financial platform can enhance your cross-border fund management. BiyaPay offers a one-stop solution, enabling trading in U.S. and Hong Kong stocks without offshore accounts, helping you flexibly allocate USD and other global assets to seize market opportunities.

Supporting USD, HKD, and 30+ fiat and digital currencies with real-time exchange rate transparency, plus global remittances to 190+ countries with remittance fees as low as 0.5%, it outperforms bank wire transfers’ 1% fees and high cable costs. A 5.48% annualized yield savings product with no lock-in period ensures liquidity and returns post-remittance. Sign up for BiyaPay today to combine its low-cost, fast remittances with the article’s diverse options for an efficient, secure USD transfer experience!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.