- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

2025 HKD to CNY Exchange Rate Forecast and Expert Insights

Image Source: unsplash

In 2025, experts predict a slight decline in the HKD to CNY exchange rate throughout the year, with limited fluctuations. Sino-US trade dynamics, interest rate changes, capital flows, and policy adjustments will directly impact the exchange rate. These changes affect exchange costs, investment returns, and daily consumption. For instance, the latest exchange rate published by Hong Kong banks shows that 1 HKD is approximately 0.91 CNY, equivalent to about 0.12 USD. Investors should closely monitor market dynamics to make informed decisions.

Key Points

- The 2025 HKD to CNY exchange rate is expected to remain stable with limited fluctuations throughout the year, primarily ranging between 0.900 and 0.916, with a possible slight decline by year-end.

- The exchange rate is influenced by China’s economic performance, interest rate policies, capital flows, and international market changes, which investors need to closely monitor.

- Hong Kong’s linked exchange rate system and substantial foreign exchange reserves provide strong support for the HKD exchange rate, reducing the risk of significant fluctuations.

- Exchanging currency during the London market opening hours is more advantageous, and avoiding periods of major economic data releases can reduce the risk of exchange rate volatility.

- Investing in HKD or CNY products requires attention to exchange rate fluctuations and policy risks, with recommendations to diversify investments and use reputable financial institutions to ensure fund safety.

Current State of HKD to CNY Exchange Rate

Recent Trends

In the first half of 2025, the HKD to CNY exchange rate has remained stable. Market observations indicate that the exchange rate has generally stayed between 0.913 and 0.916. This range reflects limited short-term fluctuations in the HKD to CNY exchange rate. Daily exchange rate data published by Hong Kong banks also supports this trend. Investors and businesses can expect minimal changes in exchange costs during currency conversion. Experts note that the linked exchange rate system has played a stabilizing role, making significant fluctuations in the HKD to CNY exchange rate unlikely.

Key Data

According to the latest data from the Hong Kong Monetary Authority and the Monetary Authority of Singapore, market capital flow is as follows:

- As of June 2025, Hong Kong’s foreign exchange reserves reached USD 440 billion, with a monetary base of USD 220 billion, a reserve-to-monetary-base ratio of approximately 2:1, indicating sufficient reserves to maintain the linked exchange rate system.

- Data from the Monetary Authority of Singapore shows that foreign currency deposits in Singapore’s domestic and international banks grew to USD 9.4 billion in August, with major growth occurring in July and August.

- The Managing Director of the Monetary Authority of Singapore stated that there has been capital inflow from Hong Kong to Singapore, but the scale is small, and the flow rate is not rapid, with investors mostly in a wait-and-see and planning phase.

- Goldman Sachs estimates that approximately USD 4 billion in Hong Kong deposits were transferred to Singapore as of August.

- Overall, while there is some capital flow, its scale is limited, and there has been no large-scale capital outflow from Hong Kong deposits to Singapore.

This data indicates that, despite some capital movement, Hong Kong’s financial system remains robust. The HKD to CNY exchange rate is expected to remain stable in the short term, providing a predictable environment for investors and businesses.

2025 Exchange Rate Forecast

Image Source: unsplash

Annual Trend

In 2025, the market generally expects the HKD to CNY exchange rate to show a slight downward trend, with an annual decline of approximately 2.45%. This forecast is supported by multiple macro and micro market data. Capital inflows into Hong Kong due to safe-haven demand have increased HKD demand. The Hong Kong stock market’s continued rise has driven currency demand growth. HKD liquidity is relatively tight, with a decrease in banking system balances reflecting tighter capital supply. Hong Kong banks frequently borrow high-interest loans, indicating liquidity pressure. Increased stock settlement demand and margin financing activities have boosted HKD demand. The Hong Kong Monetary Authority uses foreign exchange fund bills and bonds as monetary policy tools to maintain the stability of the linked exchange rate.

Additionally, Hong Kong holds approximately USD 420 billion in US dollar foreign exchange reserves, supporting the monetary base by over 100%, ensuring exchange rate stability. The Hong Kong Interbank Offered Rate (HIBOR) has risen, reflecting higher market funding costs. The discount window mechanism allows banks to use foreign exchange fund bills and bonds as collateral to borrow overnight HKD liquidity, serving as a core tool for liquidity management. These factors collectively support the forecast for the HKD to CNY exchange rate trend in 2025.

Monthly Range

Based on predictions from experts and market institutions, the monthly range of the HKD to CNY exchange rate in 2025 is expected to be limited. For most of the year, the exchange rate will remain between 0.900 and 0.916. In the fourth quarter, pressure on CNY weakening intensifies, with the exchange rate range expected to fall between 0.884 and 0.910 in December. The table below summarizes the forecasted ranges for key months in 2025:

| Month | Forecast Range (HKD to CNY) | Converted to USD (Approx. 0.12 USD/HKD) |

|---|---|---|

| Jan-Mar | 0.913 - 0.916 | 0.1096 - 0.1099 |

| Apr-Jun | 0.910 - 0.915 | 0.1092 - 0.1098 |

| Jul-Sep | 0.900 - 0.912 | 0.1080 - 0.1094 |

| Oct-Dec | 0.884 - 0.910 | 0.1061 - 0.1092 |

Experts caution that, despite limited fluctuations throughout the year, pressure on CNY depreciation may intensify by year-end, and investors should closely monitor policy and international market changes.

Expert Predictions

Multiple financial experts and research institutions agree that the 2025 HKD to CNY exchange rate will be affected by expectations of CNY weakening. Slower Chinese economic growth, rising export pressures, and risks of capital outflows may put pressure on the CNY. Historical data on US 10-year Treasury yields and the US dollar index shows that when the USD strengthens, the CNY tends to depreciate. Experts use this historical data, combined with economic cycle analysis, to refine exchange rate forecasting models.

Hong Kong’s linked exchange rate system and substantial foreign exchange reserves provide strong support for the HKD. Even with CNY weakening, the decline in the HKD to CNY exchange rate is expected to be limited. Experts recommend that businesses and individuals flexibly adjust their currency exchange and investment strategies based on their funding needs and closely monitor Chinese and international economic policy developments.

Influencing Factors

Economic and Policy Factors

- China’s economic performance remains weak. Exports fell by 4.6% in 2023, and the Consumer Price Index declined for three consecutive months in December, reflecting insufficient domestic demand.

- The People’s Bank of China maintained the one-year loan prime rate unchanged on January 15, 2024, indicating limited policy space. The central bank is concerned that rate cuts could further depress the CNY exchange rate, thus opting for cautious adjustments.

- Market sentiment is pessimistic. Foreign investors continue to sell off Chinese and Hong Kong stocks, with the Hang Seng Index and Chinese concept stocks declining, reflecting low confidence in the economic outlook.

- As a financial hub connecting China to international markets, Hong Kong’s HKD to CNY exchange rate is also influenced by Greater Bay Area development policies and China-Hong Kong economic integration, with policy adjustments directly affecting exchange rate fluctuations.

Many economic indicators such as GDP, industrial production, unemployment rate, CPI, PPI, and PMI reflect economic conditions and provide statistical support for exchange rate movements.

Interest Rates and Capital Flows

Interest rate policies significantly impact exchange rates. Adjustments in interest rates by the People’s Bank of China and Hong Kong banks alter capital flows, affecting the HKD to CNY exchange rate. US policy changes, such as tax cuts, relaxed regulations, and tariff measures, drive USD strengthening and rising US Treasury yields. These changes narrow USD credit spreads, increase trade costs, and reduce investor confidence in the Chinese market. Regarding capital flows, foreign capital is exiting the Chinese and Hong Kong markets, with some funds moving to Singapore, but the scale is limited and has not significantly impacted Hong Kong’s financial system.

International Markets

-

The Hong Kong SAR Chief Executive has clearly stated that the HKD will continue to be pegged to the USD, maintaining financial stability. Hong Kong is also actively promoting its role as a global offshore CNY business hub, fostering the diversification of CNY products.

-

China’s exports remain stable, with an expanding trade surplus in goods. According to Goldman Sachs’ model, the CNY is undervalued against the USD, with stabilizing manufacturing orders supporting the CNY’s medium- to long-term appreciation.

-

The USD has recently weakened, with increased market demand for USD bearish options, reducing the USD’s safe-haven appeal, which may trigger exchange rate fluctuations and indirectly affect the HKD to CNY exchange rate.

-

The Hong Kong Monetary Authority actively buys USD to maintain the linked exchange rate system, with loose HKD liquidity and declining interest rates, indicating that the HKD exchange rate is influenced by both USD and CNY factors.

The market generally believes that the HKD’s peg to the USD provides a stable foundation for the exchange rate, while the expansion of CNY business and USD fluctuations introduce dual impacts.

Currency Exchange and Investment Advice

Exchange Timing

Choosing the right time for currency exchange can help reduce costs. Historical data shows that the Tokyo, London, and New York forex markets have varying volatility points. The London market opening hours (15:30-23:30 Beijing time) have higher volatility and trading volume, suitable for exchangers needing better liquidity. Experts recommend focusing on the Tokyo-London (approximately 15:00-16:00) and London-New York (approximately 20:00-24:00) overlapping trading sessions, as these periods offer ample liquidity and relatively stable exchange rates.

Additionally, avoid the first Friday of each month (US non-farm payroll report release) and periods of major economic data releases, such as CPI, GDP, and unemployment rates, as these times have significant exchange rate volatility and higher risks. Investors can choose low-volatility periods for HKD to CNY exchanges based on their needs to minimize unnecessary losses.

Investment Strategies

Investors can refer to various successful strategies in the market. Research shows that momentum investment strategies yield the highest cumulative excess returns with a six-month formation period and twelve-month holding period. Earnings quality also affects the performance of momentum strategies.

The book Quantitative Investing: Strategies and Techniques introduces various strategy models, including trend-following, chip-based stock selection, and sentiment-based timing, with accompanying yield and risk metrics. Arbitrage strategies such as cash-futures arbitrage, cross-period arbitrage, and pair trading are supported by empirical data. These strategies are viable in different market environments, and investors can flexibly adjust asset allocations based on their risk tolerance and market judgment.

Risk Warnings

Risks in the forex and investment markets cannot be ignored. Exchange rates are influenced by multiple factors, including economic data, policy adjustments, and international events. Although the HKD to CNY exchange rate is expected to have limited fluctuations throughout the year, sudden events may still trigger sharp short-term volatility.

Investors should closely monitor market information and avoid large-scale currency exchanges or investment operations during major economic data releases. It is recommended to diversify investments, set stop-loss points, and regularly review asset portfolios. Conducting transactions through reputable financial institutions, such as Hong Kong banks, can further ensure fund safety.

Major Currency Comparisons

Image Source: pexels

USD to CNY

The USD to CNY exchange rate remains a focal point in global financial markets. Economic policies, interest rate differentials, and trade frictions between the US and China directly impact the currency trends of both regions. Experts typically use various quantitative methods to compare exchange rate differences between major currencies and the CNY:

- Interest Rate Differential Perspective: Analyzing the yield spread between US and Chinese 10-year government bonds (approximately 2.5%-3.5%) to predict the central USD to CNY exchange rate.

- Volatility Perspective: Using three-month option-implied volatility to estimate the future range of exchange rate fluctuations.

- Effective Exchange Rate Reverse Calculation: Combining the CFETS CNY Index and the USD Index to calculate the reasonable range for CNY to USD.

- Historical Volatility Range: Estimating the possible upper and lower limits of future exchange rates based on the exchange rate volatility (±3% to ±5%) that businesses can tolerate.

Reports indicate that the CNY to USD exchange rate has relatively low volatility, with trends closely tied to the economic fundamentals of both countries. Hong Kong banks often adjust the pricing of their forex products based on the USD to CNY exchange rate, and investors need to closely monitor US interest rate policies and Chinese economic data.

EUR to CNY

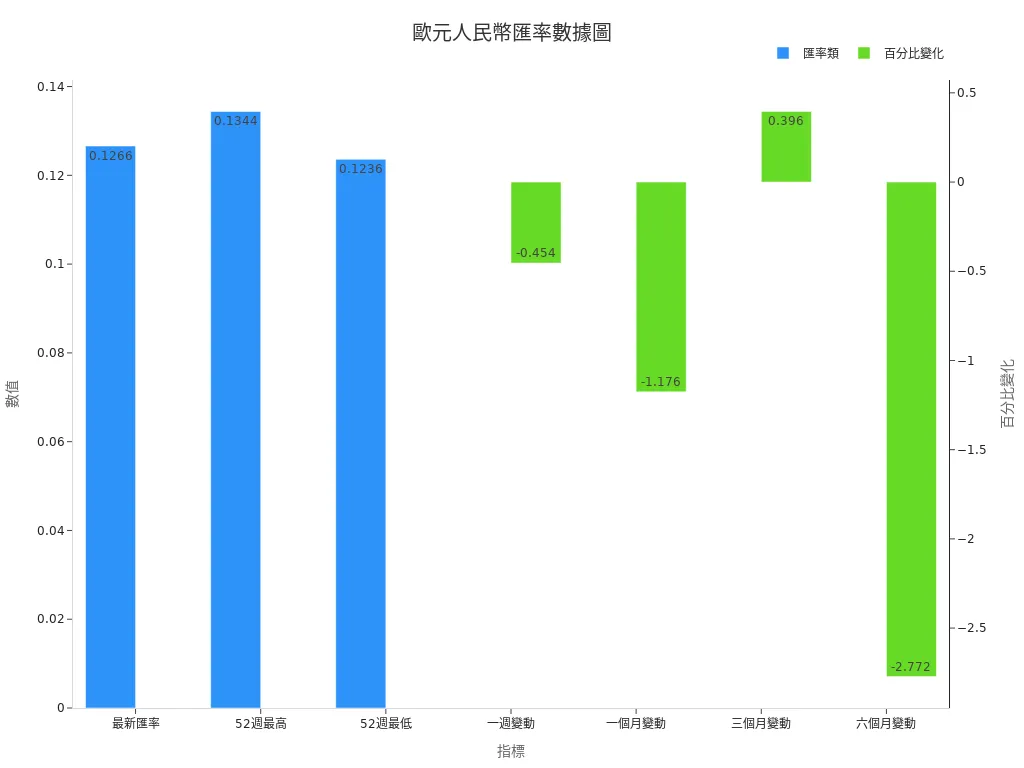

The EUR to CNY exchange rate has greater volatility, influenced by European economic data, China’s export performance, and the international trade environment. According to the latest statistics, the 2025 CNY to EUR exchange rate and volatility are as follows:

| Indicator | Value |

|---|---|

| Latest Exchange Rate | 0.1266 |

| One-Week Change | -0.454% |

| One-Month Change | -1.176% |

| Three-Month Change | 0.396% |

| Six-Month Change | -2.772% |

| 52-Week High | 0.1344 |

| 52-Week Low | 0.1236 |

The report indicates that the CNY’s volatility against the EUR is higher than against the USD, particularly during economic shocks, when the CNY is more likely to depreciate against the EUR. From 2024 to 2025, the CNY’s effective exchange rate shows a downward trend, reflecting the CNY’s weaker performance against the EUR under international trade pressures. Hong Kong banks consider these volatility factors when designing EUR-related financial products to help clients diversify risks.

HKD and Other Currencies

The HKD to CNY exchange rate, influenced by the linked exchange rate system, has limited volatility. In contrast, the CNY’s volatility against non-USD currencies like the JPY and GBP is higher. Experts find that the CNY’s exchange rate trends against these currencies are closely tied to China’s GDP, trade surplus, and other fundamental indicators. Hong Kong banks, when providing multi-currency forex services, adjust product designs and risk management strategies based on the volatility characteristics of different currencies. Investors exchanging or investing in non-USD currencies should pay special attention to the CNY’s volatility and international market dynamics to develop more robust asset allocation plans.

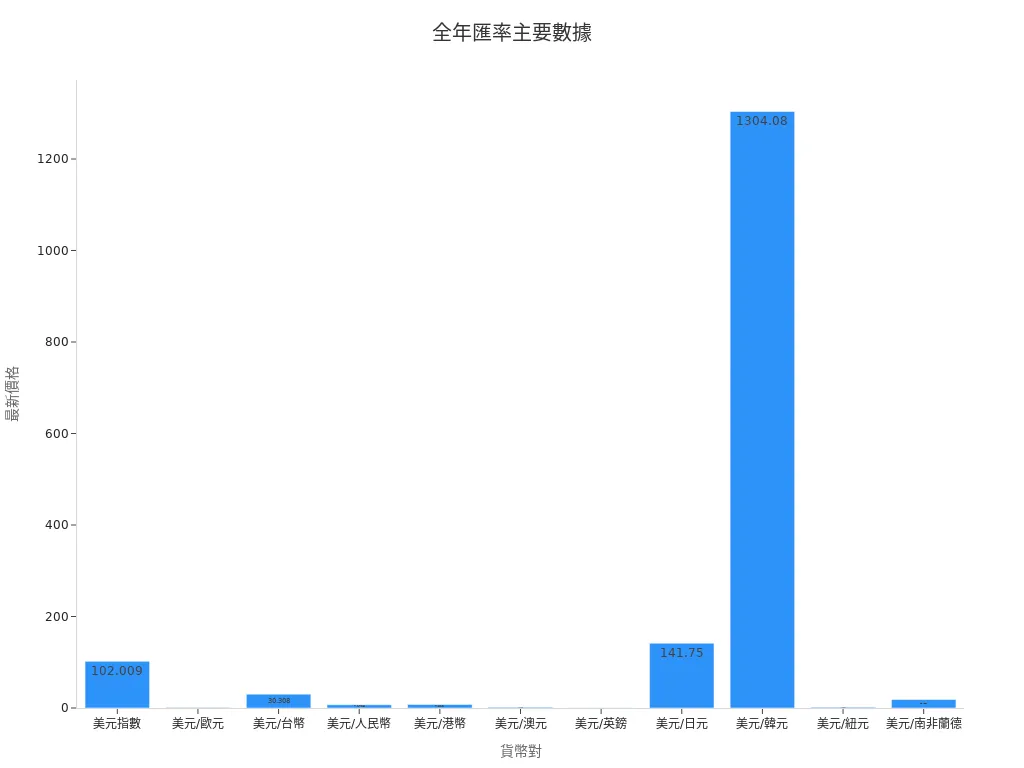

In 2025, experts predict limited volatility for the USD against major currencies throughout the year. The table below summarizes the latest prices and annual changes, helping investors quickly grasp market dynamics:

| Currency Pair | Latest Price | Six-Month Change | 52-Week High | 52-Week Low |

|---|---|---|---|---|

| USD/CNY | 7.1728 | -1.877% | 7.3425 | 6.8671 |

| USD/HKD | 7.81100 | -0.113% | 7.84970 | 7.79080 |

| USD/EUR | 0.9083 | -4.597% | 0.9556 | 0.8900 |

Investors should closely monitor central bank interest rates, international economic indicators, and major events, carefully planning currency exchanges and asset allocations to flexibly respond to market changes.

FAQ

Will the HKD to CNY exchange rate fluctuate significantly in 2025?

Experts predict limited fluctuations throughout the year. The exchange rate will mostly remain between 0.900 and 0.916. There may be a slight decline by year-end, but significant changes are unlikely.

When is the best time to exchange currency?

Investors can choose the London market opening hours (15:30-23:30 Beijing time) for currency exchange. This period has high liquidity and relatively stable exchange rates. Avoiding periods of major economic data releases can reduce risks.

What are the main factors affecting the HKD to CNY exchange rate?

- Chinese economic data

- Hong Kong interest rate policies

- International capital flows

- Sino-US trade dynamics These factors collectively influence exchange rate trends.

Will the HKD’s linked exchange rate system with the USD change?

The Hong Kong SAR government has clearly stated that it will maintain the HKD’s peg to the USD. The linked exchange rate system is unlikely to see major changes in the short term.

What are the risks of investing in HKD or CNY products?

Investors should be aware of exchange rate fluctuations, policy adjustments, and international market changes. It is recommended to diversify investments, set stop-loss points, and conduct transactions through reputable institutions like Hong Kong banks.

Navigating 2025’s HKD to CNY exchange rate fluctuations requires strategic fund management. BiyaPay offers a seamless platform for trading US and Hong Kong stocks without offshore accounts, capitalizing on market opportunities. Enjoy a 5.48% annualized yield savings product to maximize returns.

Real-time exchange rate tracking and conversions support USD, HKD, and 30+ fiat and digital currencies, with global remittances to 190+ countries at fees as low as 0.5%. Sign up for BiyaPay today to optimize funds and boost investment efficiency!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.