- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Key Considerations and Risk Management for Investing in Tencent Holdings in 2025

Image Source: pexels

In 2025, investors facing market volatility and policy changes must carefully evaluate Tencent Holdings’ potential opportunities and risks. The latest data shows that the Consumer Price Index fell to -0.1%, and the Producer Price Index for industrial products dropped by 3.3%, indicating ongoing economic pressure. Shenzhen’s reform pilot brings new opportunities, but policy details remain unclear. Tencent Holdings’ revenue grew by 7% in the first three quarters of 2024, with Chairman Ma Huateng expressing confidence in the future. Investors should closely monitor economic indicators and industry policies to make informed decisions.

Key Points

- Tencent Holdings reported strong performance in the first quarter of 2025, with revenue and profits exceeding market expectations, driven by AI technology boosting advertising and gaming businesses.

- The company continues to increase AI investments, enhancing user experience and market competitiveness of core products like WeChat and gaming.

- Regulatory policies and international political risks remain significant challenges for investing in Tencent, requiring investors to closely monitor related developments.

- Diversified investments and setting stop-loss points are key strategies for effectively managing risks, helping investors control losses and achieve steady growth.

- Continuously learning about market and technological changes and flexibly adjusting investment portfolios help seize opportunities and address uncertainties.

Core Considerations

Performance

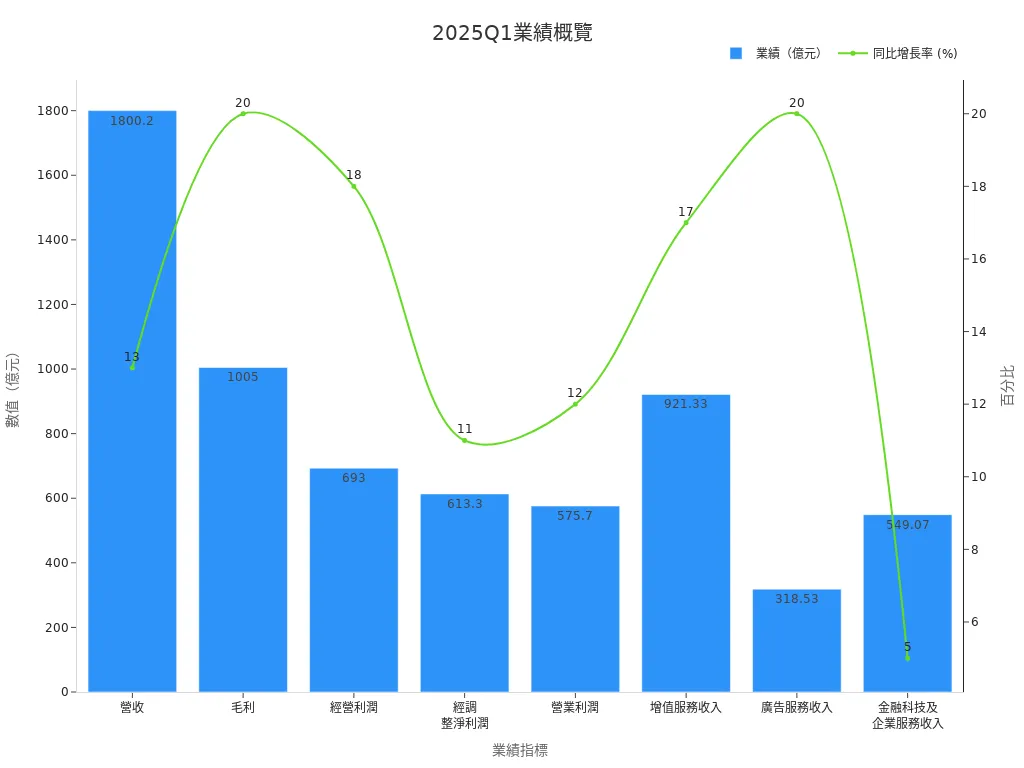

Tencent Holdings demonstrated steady growth in the first quarter of 2025. According to the latest financial report, revenue reached approximately $25.29 billion (calculated at 1 USD = 7.12 RMB), a 13% year-on-year increase, surpassing market expectations. Gross profit was about $14.12 billion, with the gross margin rising to 56%, reflecting sustained profitability growth. Operating profit (Non-IFRS) reached $9.73 billion, up 18% year-on-year. Adjusted net profit was $8.61 billion, outperforming market expectations. Value-added services revenue (including gaming and social networks) reached $12.94 billion, with domestic and international gaming revenue growing by 24% and 23%, respectively. Advertising revenue was $4.47 billion, up 20% year-on-year, primarily driven by AI technology upgrades and WeChat ecosystem optimization. Fintech and enterprise services revenue was $7.71 billion, up 5% year-on-year.

| Metric | Value (USD Billion) | Year-on-Year Growth | Remarks |

|---|---|---|---|

| Revenue | 25.29 | 13% | Exceeded market estimates |

| Gross Profit | 14.12 | 20% | Gross margin rose to 56% |

| Operating Profit (Non-IFRS) | 9.73 | 18% | AI investments created operational leverage |

| Adjusted Net Profit | 8.61 | 11% | Outperformed expectations |

| Operating Profit | 8.09 | 12% | |

| Value-Added Services Revenue | 12.94 | 17% | Growth in gaming and social network revenue |

| Advertising Revenue | 4.47 | 20% | AI upgrades and WeChat ecosystem optimization |

| Fintech and Enterprise Services Revenue | 7.71 | 5% | Growth in consumer loans, wealth management, and cloud services |

Tencent Holdings’ financial report indicates that AI technology has made substantial contributions to performance-driven advertising and evergreen gaming businesses, driving steady growth in core operations.

AI Investments

In 2025, Tencent Holdings continues to increase capital expenditure in the AI field. In 2024, total capital expenditure reached $10.78 billion, up 221% year-on-year, with significant increases in AI-related investments. The company restructured its AI team, focusing on the development of generative AI, content generation, and recommendation algorithms. Chairman Ma Huateng and President Liu Chiping emphasized that AI applications have become a core driver of the company’s future growth. In the first quarter of 2025, Tencent Holdings further increased investments in AI chips, Yuanbao applications, and AI features within WeChat. AI capabilities have significantly contributed to performance advertising, gaming, and cloud businesses.

- In the first quarter of 2025, AI technology drove WeChat to launch multiple new features, including the AI service Yuanbao, AI-powered search, and text-to-image tools for public accounts, improving user experience and content creator efficiency.

- Generative AI technology upgraded the advertising platform, enhancing image generation and video editing, improving content creation efficiency.

- Evergreen game revenue reached historic highs, WeChat Mini Shops saw rapid transaction growth, and Tencent Video and Music paid memberships maintained market leadership.

The AI strategy has become a core competitive strength for Tencent Holdings, providing sustainable growth potential for gaming, advertising, and cloud services.

Share Buybacks

Share buybacks have become an important strategy for Tencent Holdings to enhance shareholder value. In 2024, the company continued large-scale share repurchasing, stabilizing market confidence. Share buybacks help increase earnings per share, reduce market volatility, and signal the company’s confidence in future development to investors. The market generally believes that share buybacks will remain a focus of capital operations in 2025, helping maintain share price stability and enhance long-term investment appeal.

Industry Position

Tencent Holdings maintains a leading position in the Chinese and global internet industry. WeChat, as a super app, integrated DeepSeek AI search technology, further improving information retrieval efficiency. The AI search function has upgraded WeChat from a traffic platform to an intelligent operating system. This innovation has put significant pressure on competitors like Baidu, with the market reacting swiftly, causing substantial fluctuations in Baidu’s stock price. DeepSeek’s open-source nature lowers the barriers to AI application, prompting more companies to enter the market and further fragmenting market share.

| Metric | Value (USD Billion) | Year-on-Year Growth/Description |

|---|---|---|

| Q1 2025 Total Revenue | 1.03 | Up 8.7% year-on-year |

| Paying Users | 122.9 million | - |

| Subscription Revenue | 0.593 | Up 16.6% year-on-year |

| Monthly Revenue per User | 1.6 | Up from 1.5 |

| Net Profit Attributable to Equity Holders | 0.598 | Up 201.8% year-on-year |

| Cash and Equivalents | 5.29 | Robust financial position |

| Q2 Revenue Guidance | 1.12 | Up 12% |

WeChat’s AI capabilities have become a key pillar of Tencent Holdings’ competitive advantage in 2025, reinforcing its leadership in the Chinese and global internet markets.

Tencent Holdings Risks

Image Source: pexels

Regulatory Policies

Regulatory policies have always been one of the main risks facing Tencent Holdings. The Chinese government continues to strengthen regulation of the internet, gaming, and fintech industries, directly affecting corporate operations. In 2025, Tencent and Alibaba suspended some AI tool services during the college entrance examination period, reflecting the restrictive impact of regulatory policies on business flexibility. On the U.S. side, on January 7, 2025, the U.S. Department of Defense added Tencent Holdings to a blacklist of companies collaborating with the Chinese military, causing a 7% drop in the company’s share price in Hong Kong and an 8% drop in U.S. OTC trading. This action has heightened tensions in the U.S.-China tech war, negatively impacting Tencent Holdings’ international cooperation and market reputation. Fitch Ratings issued a negative outlook for Tencent Holdings in 2024, reflecting uncertainties in the policy and macroeconomic environment. Investors need to closely monitor policy developments and adjust their investment strategies promptly.

Industry Competition

Industry competition continues to intensify, and Tencent Holdings must face challenges from both local and international tech giants. The market capitalization gap between Tencent Holdings and TSMC has narrowed to approximately $109.01 billion, the smallest since the end of 2023. Tencent Holdings’ share price has risen by approximately 30% this year, outperforming most Chinese tech peers. TSMC’s share price fell by 11% in 2025, reflecting concerns about a valuation bubble in the semiconductor industry. Tencent Holdings is actively expanding its gaming business, planning to acquire South Korean game developer Nexon, valued at approximately $15 billion, demonstrating the company’s competitiveness in the global gaming market. In June 2025, Tencent Music acquired Himalaya, further expanding its audio content ecosystem and strengthening its competitive edge. These moves help solidify its industry position but also require addressing fierce competition from new entrants and existing rivals.

- The market capitalization gap between Tencent Holdings and TSMC has narrowed to approximately $109.01 billion

- Tencent Holdings’ share price has risen by approximately 30% this year

- TSMC’s share price fell by 11% in 2025

- Tencent Holdings plans to acquire Nexon, valued at approximately $15 billion

Technological Change

Technological change brings opportunities for Tencent Holdings while also posing potential risks. The company actively promotes the application of AI, cloud computing, and big data technologies, signing a strategic cooperation agreement with Xuanwu Cloud, focusing on AI-driven smart retail and cloud communication. Tencent Cloud leverages WeChat, payments, and big data capabilities to drive the intelligent transformation of the consumer goods industry, emphasizing precise marketing, channel optimization, and store verification scenarios. The company provides globally leading cloud computing, artificial intelligence, and big data technologies to support the development of the industrial internet. Cloud communication technology integrates with global edge acceleration networks to create a high-concurrency, low-latency cloud communication architecture, enhancing enterprises’ full-scenario interaction experiences. The Chinese fintech market is expected to grow from $4.86 trillion in 2025 to $10.6 trillion by 2030, with a compound annual growth rate of 15.67%. Tencent Holdings’ WeChat Pay holds a significant position in the global digital payments market. While technological innovation drives growth, failure to keep pace with new technological trends risks market elimination.

International Market

The international market environment is complex and volatile, and Tencent Holdings must address multiple challenges. In 2025, Tencent Music acquired Himalaya, expanding its audio content ecosystem and enhancing market competitiveness. The company, along with Alibaba, suspended some AI tool services during China’s college entrance examination, demonstrating the direct impact of regulatory policies on operations. The U.S. Department of Defense’s inclusion of Tencent Holdings on a blacklist caused significant share price volatility and pressured international cooperation and market reputation. The blacklist includes 134 companies, and U.S. companies have been warned to avoid collaboration with these Chinese firms, potentially leading to reputational damage and sanction risks. These factors heighten the operational uncertainty for Tencent Holdings in international markets. Investors need to closely monitor international politics, regulatory policies, and market dynamics to carefully assess related risks.

Risk Management

Image Source: pexels

Diversified Investments

When allocating assets, investors should avoid concentrating funds in a single market or industry. In 2025, BlackRock Chairman Larry Fink proposed adjusting the traditional 60/40 equity-bond allocation to 50/30/20, incorporating private assets such as real estate, infrastructure, and private credit to enhance diversification and returns. Private assets have lower correlations with equities and bonds, helping stabilize portfolios. Historical data shows that adding 10% infrastructure investments can improve overall returns. In 2024, BlackRock’s private market investments saw net inflows of $9 billion, reflecting strong market recognition of diversified investment strategies. Investors can consider combining ETFs and active investments to further diversify risks.

Stop-Loss Strategy

An effective stop-loss strategy helps investors control losses during market volatility. Investors should pre-set stop-loss points based on their risk tolerance. For example, when Tencent Holdings or other tech stocks experience significant declines, executing stop-loss orders promptly can prevent losses from expanding. Stop-loss strategies apply not only to individual stocks but also to entire portfolios. Investors should regularly review portfolio performance and flexibly adjust stop-loss levels based on market changes.

Combining Long- and Short-Term Strategies

Combining long- and short-term strategies helps balance risks and returns. In 2025, with rapid market changes, active stock selection and flexible adjustments become critical. Active ETFs combine fundamental and quantitative analysis, improving stock selection efficiency and diversifying individual stock risks. Taiwan stock market data shows that medium- to long-term holding offers higher win rates, while short-term flexible adjustments can seize volatility opportunities. Since 2020, entering the market during downturns has yielded an average gain of about 9.70% over 120 trading days and approximately 26.64% over 240 trading days. Investors can flexibly apply combined long- and short-term strategies based on their goals, actively monitor policies and market trends, and adjust portfolios accordingly.

Investment Recommendations

Risk Assessment

Investors considering Tencent Holdings should first conduct a comprehensive risk assessment. Market volatility, regulatory policies, technological changes, and international situations are all factors that cannot be ignored. Professional analysts suggest the following steps:

- Review Financial Data: Regularly check Tencent Holdings’ financial reports, including revenue, profits, and cash flow. In Q1 2025, Tencent Holdings’ cash and equivalents reached $5.29 billion, indicating a robust financial position.

- Monitor Policy Developments: Regulatory policies in China and the U.S. directly impact the company’s operations. Investors should closely track policy changes and adjust portfolios promptly.

- Evaluate Industry Competition: Analyze the dynamics of key competitors like TSMC and Alibaba to assess Tencent Holdings’ industry position.

- Set Risk Tolerance: Based on capital size and risk preference, set stop-loss points and asset allocation ratios.

Experts remind that risk assessment is not a one-time task and requires continuous adjustments based on market changes.

Continuous Learning

The technology and market environment change rapidly, and investors must maintain a learning mindset. Continuous learning helps improve judgment and reduce decision-making errors. Recommended actions for investors include:

- Regularly read authoritative financial media and industry reports to stay updated on market information.

- Participate in online or offline investment courses to learn practical knowledge about asset allocation and risk management.

- Follow announcements from Tencent Holdings and related companies to stay informed about company developments.

- Engage with professional investment advisors or peers to absorb diverse perspectives.

Continuous learning helps investors address uncertainties and improve long-term investment returns. Only by constantly updating knowledge can one remain competitive in an unpredictable market.

In 2025, the optimism index for global and Taiwanese companies has significantly declined, with the net profit optimism index dropping, reflecting a market full of uncertainties. Tencent Holdings investors should continue to cautiously assess market dynamics and actively manage risks. Industry experts point out that only by strengthening risk control and flexibly adjusting resources can resilience be maintained in a high-interest-rate and weak-demand environment. Investors need to combine data-driven decisions with their risk tolerance and flexibly adjust portfolios to seize opportunities amid changes.

FAQ

What are the main growth drivers for Tencent Holdings in 2025?

Tencent Holdings’ growth drivers in 2025 come from AI technology investments, gaming business expansion, and WeChat ecosystem innovation. The company actively promotes generative AI, enhancing advertising and cloud service performance.

What policy risks should investors watch when investing in Tencent Holdings?

Investors need to closely monitor regulatory policies in China and the U.S. Policy changes may affect the company’s business development and international cooperation, and it’s recommended to regularly review official announcements.

How do Tencent Holdings’ share buybacks impact shareholders?

- Share buybacks can increase earnings per share

- Stabilize share prices

- Boost market confidence

These factors help enhance long-term shareholder returns.

How does Tencent Holdings address industry competition?

Tencent Holdings actively acquires high-quality companies to strengthen gaming and music content. The company continues to invest in AI and cloud computing, enhancing product competitiveness and solidifying its industry leadership.

How can investors manage risks related to Tencent Holdings?

Investors can diversify assets, set stop-loss points, and regularly review portfolios. Actively monitoring market trends helps reduce losses from single-stock volatility.

Investing in Tencent Holdings demands careful navigation of market volatility and regulatory risks, but how can you streamline global wealth management? BiyaPay offers a seamless platform for trading US and Hong Kong stocks, including Tencent, without offshore accounts. Benefit from a 5.48% annualized yield savings product for steady returns.

Real-time exchange rate tracking and conversions support USD, HKD, and 30+ fiat and digital currencies, with global remittances to 190+ countries at fees as low as 0.5%. Sign up for BiyaPay today to enhance your portfolio and tackle market uncertainties!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.