- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Comparison and Selection Guide for Hang Seng Bank's Multi-Currency Fixed Deposit Offers

Image Source: pexels

Are you looking for the best fixed deposit deal? Check out Hang Seng’s fixed deposit offers now to understand the latest HKD, USD, and foreign currency fixed deposit interest rates and conditions:

| Currency | Annual Interest Rate (3 Months) | Minimum Deposit (USD) | Deposit Term Options |

|---|---|---|---|

| HKD | 1.3% | 12,800 | 3/6/12 months |

| USD | 4.05% | 12,800 | 3 months |

| RMB | 4% (NTD) | 12,800 | 3/6/12 months |

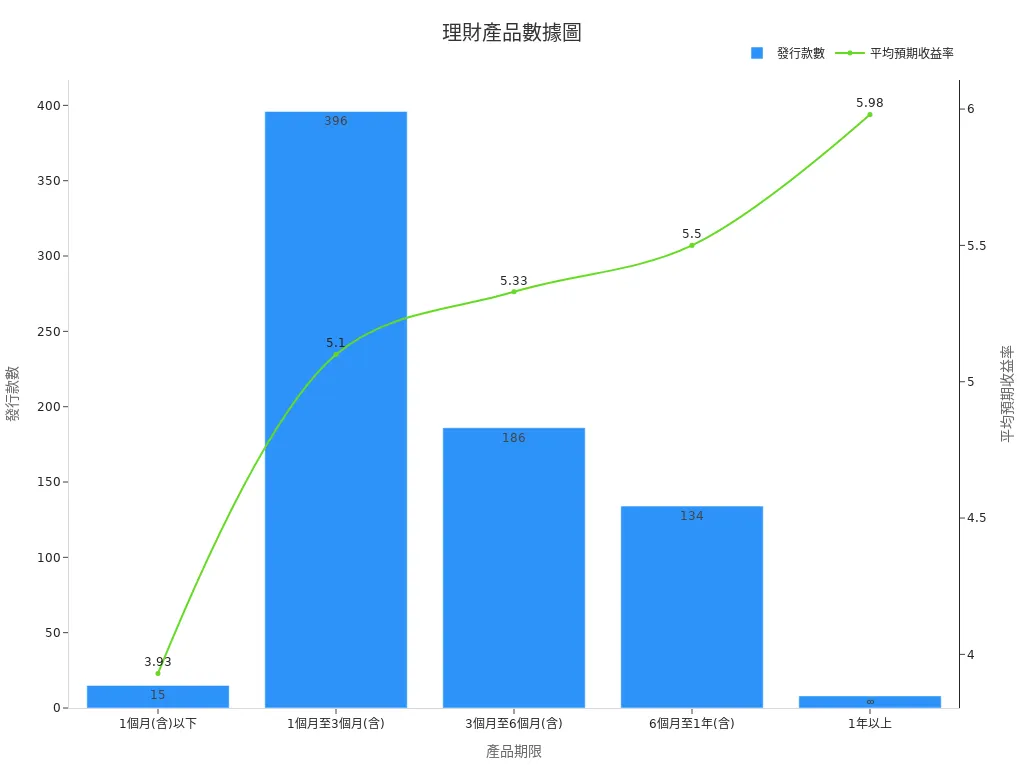

Opening an account online is convenient and fast, with some offers requiring new funds and specific amounts. You can also refer to the chart below to understand the yield distribution of different wealth management products:

Key Points

- Hang Seng Bank offers multi-currency fixed deposits, with HKD being stable without exchange rate risk, while USD and foreign currencies offer higher interest rates but require bearing exchange rate fluctuation risks.

- When choosing a fixed deposit, you should flexibly select the deposit term and currency type based on your financial goals and liquidity needs.

- Opening an account online is convenient and fast, with some offers applicable only to new funds or specific amounts, typically offering higher interest rates.

- Fixed deposits require attention to early withdrawal penalties, exchange rate fees, and interest rate changes after the promotional period to avoid loss of returns.

- Before applying, carefully read the terms, understand risks and fees, and regularly review the latest market offers to make the most suitable financial decision.

Overview of Hang Seng Fixed Deposit Offers

Image Source: pexels

Comparison of Promotional Interest Rates

When choosing a fixed deposit, your primary concern is usually the interest rate. Hang Seng’s fixed deposit offers vary based on different currencies, deposit terms, and fund sources (e.g., new funds). You can refer to the table below to quickly compare the latest promotional interest rates for HKD, USD, and major foreign currencies:

| Currency | Annual Interest Rate (3 Months) | Annual Interest Rate (6 Months) | Annual Interest Rate (12 Months) | Online Exclusive/New Funds Offer |

|---|---|---|---|---|

| HKD | 1.3% | 1.4% | 1.5% | Yes |

| USD | 4.05% | 4.10% | 4.15% | Yes |

| RMB | 4.0% | 4.1% | 4.2% | Yes |

| AUD | 3.8% | 3.9% | 4.0% | Yes |

| GBP | 3.6% | 3.7% | 3.8% | Yes |

Tip: You can check the latest and historical data on official benchmark interest rates for multiple countries, including the US, China, and Hong Kong, on Cnyes’ “Benchmark Interest Rates_Central Banks_Financial Centers” page. This information helps you understand market interest rate trends and choose the most suitable Hang Seng fixed deposit offer.

Deposit Term and Minimum Amount

When choosing a fixed deposit, in addition to interest rates, you should also pay attention to the deposit term and minimum deposit amount. Different currencies have varying deposit term options and minimum amount requirements:

- For major currencies like HKD, USD, and RMB, the minimum deposit amount is generally USD 12,800 (approximately HKD 100,000, depending on the exchange rate).

- Deposit term options are diverse, including 3 months, 6 months, and 12 months, with some currencies offering 1-month or 24-month options.

- Opening an account online usually comes with additional offers, with some offers applicable only to new funds or specific amounts.

- Promotional interest rates are higher during the promotional period but may adjust afterward.

You should choose the appropriate deposit term and amount based on your liquidity needs and financial goals. If you want flexibility in fund allocation, you can choose a shorter deposit term; if you seek higher interest rates, consider longer deposit terms and new funds offers.

HKD Fixed Deposits

Interest Rates and Conditions

When choosing an HKD fixed deposit, you should first understand the interest rates and basic conditions. Currently, Hang Seng Bank offers an annual interest rate of approximately 1.3% for a 3-month HKD fixed deposit, 1.4% for 6 months, and 1.5% for 12 months. These rates may adjust due to market changes. The minimum deposit amount required is USD 12,800, equivalent to approximately HKD 100,000, with the actual amount depending on exchange rate fluctuations. You can choose a deposit term of 3 months, 6 months, or 12 months, flexibly aligning with your financial arrangements. Some Hang Seng fixed deposit offers are only applicable to new funds or online account openings, which typically offer higher interest rates. You should pay attention to the promotional period and related conditions to ensure eligibility.

Tip: You can use online banking or mobile apps to check the latest interest rates and offers anytime, making it convenient and fast.

Advantages and Disadvantages

Choosing an HKD fixed deposit offers several benefits. First, HKD is the local primary currency, free from exchange rate risks. Depositing and withdrawing funds are both convenient. Although HKD fixed deposit interest rates are lower than USD or some foreign currencies, they are stable. You don’t need to worry about losses due to exchange rate fluctuations. For those seeking capital safety and stable returns, HKD fixed deposits are a good choice. If you want higher interest, you can consider new funds offers or longer deposit terms. However, HKD fixed deposit rates are at a medium level among Hong Kong banks. If you pursue high returns, you might consider USD or other foreign currency fixed deposits.

Note: Early withdrawal incurs penalties, so you should choose a deposit term that aligns with your liquidity needs.

USD Fixed Deposits

Interest Rates and Conditions

When choosing a USD fixed deposit, you should first understand the interest rates and conditions of different banks. Hang Seng Bank currently offers an approximately 3.80% annual interest rate for a 3-month USD fixed deposit, with a minimum deposit amount of USD 2,000. You can enjoy exclusive offers through online banking, with a simple and fast application process.

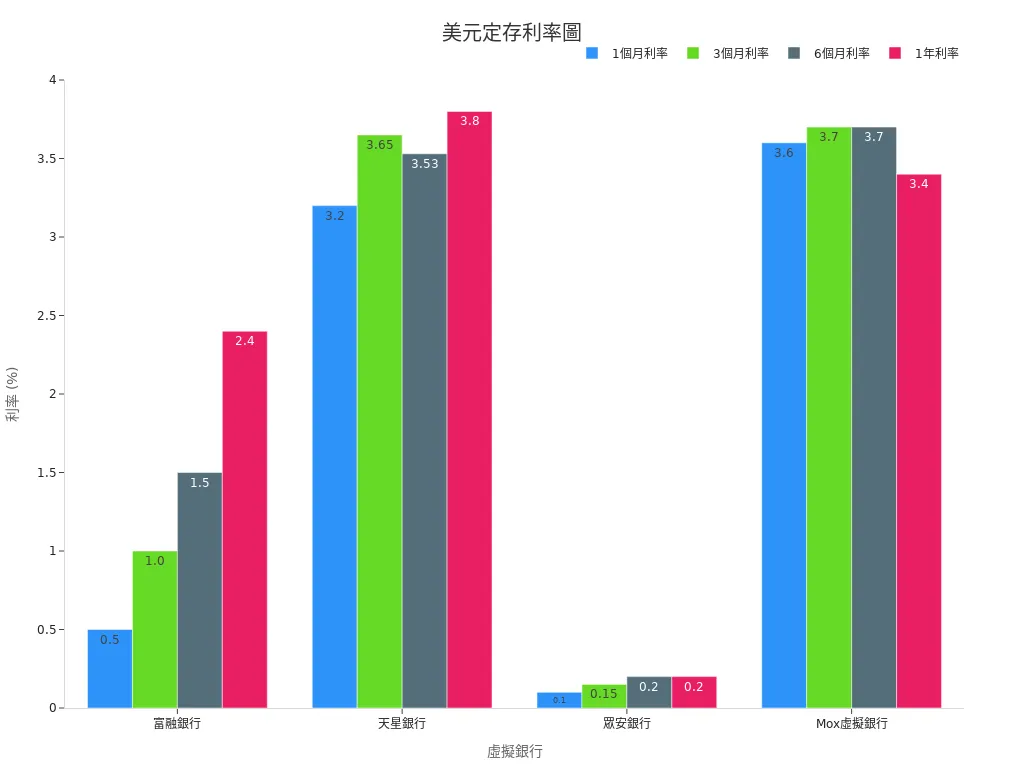

You can also compare USD fixed deposit rates from other Hong Kong banks and virtual banks:

| Bank Name | 3-Month Rate | 6-Month Rate | 1-Year Rate | Minimum Deposit |

|---|---|---|---|---|

| Hang Seng Bank | Approx. 3.80% | Approx. 3.70% | N/A | USD 2,000 |

| Standard Chartered Bank | Approx. 3.30%-3.70% | Approx. 3.30%-3.70% | Approx. 3.30%-3.70% | USD 2,000 |

| Fubon Bank | Approx. 4.30% | Approx. 4.00% | Approx. 3.90% | USD 65,000 |

| Airstar Bank (Virtual) | 3.65% | 3.53% | 3.80% | No minimum requirement |

| Mox Virtual Bank | 3.70% | 3.70% | 3.40% | USD 1 |

You can see that some virtual banks, such as Airstar Bank and Mox Virtual Bank, offer lower entry thresholds and competitive rates.

Additionally, KGI Bank recently launched a high-yield USD fixed deposit, with a maximum annual interest rate of 5.3% for 3-month and 12-month terms, valid until July 31. If you have a large amount of funds, you can also consider high-yield options like Fubon Bank.

Tip: You can check the latest USD fixed deposit rates and Hang Seng fixed deposit offers through financial information platforms or bank websites to stay updated on market trends.

Advantages and Disadvantages

USD fixed deposits offer several advantages. You can enjoy higher interest rates than HKD fixed deposits, making them suitable for those seeking capital appreciation. USD is a major international currency, ideal for individuals with overseas financial needs, such as studying abroad or traveling. Choosing online account opening is simple, and some banks have no minimum deposit requirement, offering high flexibility.

However, USD fixed deposits also carry risks. You need to bear the profit or loss from exchange rate fluctuations. If you need to convert back to HKD in the future, exchange rate changes may affect actual returns. Some high-yield offers are limited to new funds or specific deposit amounts, and rates may decrease after the promotional period.

If you prioritize flexibility, you can consider cash management products like StashAway’s Bear Gold, with an annualized return of up to 4.2%, no lock-in period, and the ability to withdraw anytime, suitable for short-term fund management.

Note: Before choosing a USD fixed deposit, assess your financial goals and risk tolerance, and pay attention to each bank’s offer terms.

Foreign Currency Fixed Deposits

Image Source: pexels

Interest Rates and Conditions

If you aim for higher interest, you can consider foreign currency fixed deposits. Hang Seng Bank currently offers fixed deposit options for popular foreign currencies, including RMB, AUD, CAD, NZD, and GBP. These foreign currency fixed deposit rates are generally higher than HKD. For example, RMB fixed deposits can reach an annual interest rate of 4.2%, AUD and CAD around 4.0%, and GBP around 3.8%. During some promotional periods or new funds programs, you may even see annual interest rates of 4.5% or higher. You only need to deposit a minimum of USD 12,800 (or equivalent in foreign currency) to enjoy these offers. Deposit term options are flexible, commonly including 3 months, 6 months, and 12 months. Applying through online banking may also offer additional interest rate rewards.

However, while foreign currency fixed deposit rates are high, you should pay attention to exchange rate fluctuations and fees. There is a spread between the bank’s buying and selling prices, and each currency exchange incurs implicit fees. When conducting telegraphic transfers, banks charge fees ranging from USD 15-30. Funds need to be locked in for a period and cannot be withdrawn at any time. When choosing Hang Seng fixed deposit offers, carefully compare the rates and conditions of different foreign currencies.

Advantages and Disadvantages

When considering foreign currency fixed deposits, you can refer to the following advantages and disadvantages:

- Interest rates are generally higher than HKD fixed deposits, suitable for those seeking high returns.

- Foreign currency fixed deposits help diversify currency risks, suitable for those with foreign currency needs or plans for overseas spending.

- Exchange rate fluctuations may bring additional returns but could also result in exchange losses.

- The spread between bank buying and selling prices creates implicit fees, and each currency exchange incurs costs.

- When transferring foreign currencies via telegraphic transfer, banks charge USD 15-30 fees.

- Funds need to be locked in for 3 months or more and cannot be accessed at any time.

- Some programs are limited to new funds or specific identities, so review terms carefully before applying.

Tip: Choose the most suitable foreign currency fixed deposit product based on your financial goals and currency needs. Regularly check Hang Seng fixed deposit offers to stay updated on the latest rates and promotional information.

Selection Guide

Financial Goals

When choosing a fixed deposit, you should first clarify your financial goals. Different goals influence your choice of currency, interest rate, and deposit term. If you seek capital safety and stable returns, HKD fixed deposits are a good choice. HKD has no exchange rate risk, suitable for daily life and short-term savings. If you aim for capital appreciation, USD or other foreign currency fixed deposits generally offer higher interest rates. For those with overseas spending, studying abroad, or investment needs, foreign currency fixed deposits are more suitable. You should choose a 3-month, 6-month, or 12-month deposit term based on your liquidity needs. Short-term fixed deposits offer flexibility, suitable for those needing access to funds at any time. Long-term fixed deposits provide higher interest rates, suitable for those looking to lock in returns.

Tip: List your financial goals, such as “short-term savings,” “capital appreciation,” or “currency risk diversification,” and choose the most suitable fixed deposit product based on these goals.

Risk Considerations

When choosing a fixed deposit, you must assess various risks. Exchange rate risk is the most common risk for foreign currency fixed deposits. When you deposit funds in USD, RMB, or other foreign currencies, converting back to HKD in the future may affect actual returns due to exchange rate fluctuations. Fund management companies hedge against exchange rate fluctuations for NTD and RMB against USD, but hedging has limited effectiveness, and exchange rate fluctuations may still cause profits or losses. You can review exchange rate and liquidity risk information in fund prospectuses or investor notices and check risk data on fund company websites or fund information platforms.

Liquidity risk is equally important. Fixed deposits lock in funds for a period, preventing immediate withdrawal. If you suddenly need funds, early withdrawal incurs penalties. You should reserve sufficient liquid funds to avoid disruptions to daily life due to locked funds. Banks establish risk management information systems to continuously monitor market risks (e.g., exchange rates, interest rates), liquidity risks, and credit risks. Market risk refers to potential asset value reductions due to changes in interest rates, exchange rates, or commodity prices. Liquidity risk refers to the inability to liquidate assets or obtain funds in time or difficulties in converting assets due to market anomalies.

You can use the following methods to assess risks:

- Review risk disclosures on bank or fund company websites.

- Observe market interest rate and exchange rate trends to assess future fluctuation possibilities.

- Choose appropriate deposit terms and currencies based on your financial needs.

- Pay attention to interest rate changes after promotional periods to avoid focusing only on short-term high rates.

Note: When choosing Hang Seng fixed deposit offers, consider interest rates, deposit terms, currency types, and your risk tolerance to make the most suitable financial decision.

Notes

Terms and Conditions

When choosing a Hang Seng Bank fixed deposit, you must carefully read all terms and conditions. Early withdrawal incurs penalties, significantly reducing the interest you actually receive. You should ensure you won’t need to access the funds during the deposit term. The auto-renewal feature automatically rolls over the principal and interest into a new fixed deposit term upon maturity. If you don’t want auto-renewal, notify the bank before maturity. You should also pay attention to hidden fees, such as account management or service fees. Some foreign currency fixed deposits involve exchange fees, with banks charging based on the daily exchange rate. Each time you exchange foreign currency, banks may charge USD 15-30 fees, affecting your actual returns.

Tip: You can review all fixed deposit product terms and conditions on Hang Seng Bank’s website to avoid losing interest due to overlooked details.

Potential Pitfalls

When applying for a fixed deposit, pay special attention to the following potential pitfalls:

- Promotional period interest rates apply only for a specific period, and rates may decrease afterward.

- New funds offers apply only to newly deposited funds, and existing funds may not enjoy the same rates.

- The application process may require additional documents or identity verification, delaying account opening.

- Foreign currency fixed deposits are subject to exchange rate fluctuations, potentially causing losses when converting back to HKD.

- Early withdrawal not only results in loss of interest but may also incur additional penalties.

You should inquire about all details with bank staff before applying and retain relevant documents. If you don’t understand any terms, immediately ask the bank to ensure you fully comprehend all risks and fees.

Note: Each time you choose a fixed deposit product, carefully compare the terms and fees of different banks to select the most suitable option.

Choosing HKD fixed deposits offers stable returns without exchange rate risk, suitable for conservative investors. USD and foreign currency fixed deposits offer higher interest rates but come with exchange costs of about 0.5% or more and exchange rate fluctuations and inflation affecting actual returns. For high returns, consider USD fixed deposits while bearing the risks. If you value flexibility, you can choose money market funds. It’s recommended to regularly review the latest market offers and read terms carefully to make the most suitable choice.

FAQ

What are new funds fixed deposit offers?

New funds fixed deposit offers apply only to funds newly deposited. You must transfer funds from another bank to enjoy higher interest rates.

What is the impact of early withdrawal?

If you withdraw early, the bank will charge penalties. You may receive only partial interest or none at all. You should plan your financial arrangements in advance.

What are the risks of foreign currency fixed deposits?

When choosing foreign currency fixed deposits, you need to bear exchange rate fluctuation risks. Converting foreign currency back to HKD may reduce actual returns.

What are the benefits of online account opening?

Opening an account through online banking is simple and fast. You can check the latest rates and offers anytime, and some products offer additional interest rate rewards.

What is the minimum deposit amount?

When opening a fixed deposit, the minimum deposit amount is generally USD 2,000 or USD 12,800, depending on the currency and product. You should check the bank’s latest requirements and exchange rates.

Hang Seng Bank’s multi-currency fixed deposits offer stable returns and flexible options to meet your financial goals, but how can you enhance fund flexibility and tap into global investment opportunities? BiyaPay provides an all-in-one financial platform, allowing you to trade US and Hong Kong stocks without offshore accounts, complementing the steady income from fixed deposits. With support for USD, HKD, and 30+ fiat and digital currencies, real-time exchange rate tracking minimizes conversion costs, while global remittances to 190+ countries feature transfer fees as low as 0.5% with swift delivery, ensuring funds are always accessible.

A 5.48% annualized yield savings product, with no lock-in period, offers greater flexibility and returns than traditional deposits. Sign up for BiyaPay today to pair Hang Seng’s reliable deposits with BiyaPay’s dynamic trading and wealth management solutions for diversified growth!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.