- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Five Tips for Steadily Investing in Bank of China Stock

Image Source: pexels

When investing in Bank of China stock, you should pay attention to the following five tips:

- Understand your risk tolerance.

- Analyze fundamentals and profitability.

- Evaluate the industry environment and policies.

- Monitor dividend policy and payouts.

- Assess valuation and changes in Zhongyin price.

Key Points

- Understand your risk tolerance, plan investment proportions reasonably, avoid blindly chasing highs or panic selling, and manage funds steadily.

- Deeply analyze Bank of China’s fundamentals, including business scope, profitability, and industry policies, to understand dividend stability and payout history, boosting investment confidence.

- Use valuation metrics to judge buying opportunities, diversify investments to reduce risk, and set stop-loss strategies to protect capital, continuously optimizing investment strategies to achieve long-term goals.

Risk Tolerance and Financial Planning

Financial Condition Assessment

Before investing in Bank of China stock, you should first review your financial condition. You can use some common financial ratios to assess your financial health. For example:

| Financial Ratio Category | Key Metrics | Significance and Use |

|---|---|---|

| Profitability | Gross Margin, Operating Margin, Net Profit Margin | Understand the company’s product value and operational efficiency |

| Solvency | Debt-to-Equity Ratio, Current Ratio, Quick Ratio | Assess short- and long-term repayment capacity |

| Growth Potential | - | Judge the company’s future development potential |

| Operational Efficiency | - | Reflect resource utilization efficiency |

You can refer to these metrics and compare them with industry peers to gain a more comprehensive understanding of your financial condition. You can also use online resources, such as the ETF Zone and digital materials, to learn how to choose investment products suitable for you.

Investment Proportion Setting

You should set appropriate investment proportions based on your risk tolerance. Market research shows that different stock allocation proportions and rebalancing strategies can effectively control risk. For example, when market volatility increases, you can reduce high-risk assets and increase low-risk assets to lower overall risk. You can refer to metrics like the Sharpe Ratio to adjust the proportion of stocks and defensive assets. It’s recommended to record each transaction and periodically review your portfolio to avoid blindly chasing highs or panic selling. This way, you can manage your funds more confidently and move forward steadily.

Fundamental Analysis

Image Source: pexels

Business Scope

When analyzing Bank of China, you should first understand its business scope. Bank of China provides both corporate and personal banking services. Corporate services include corporate loans, trade financing, and cash management. Personal services include home mortgages, consumer loans, and credit card services. These businesses reflect the bank’s revenue sources and growth potential.

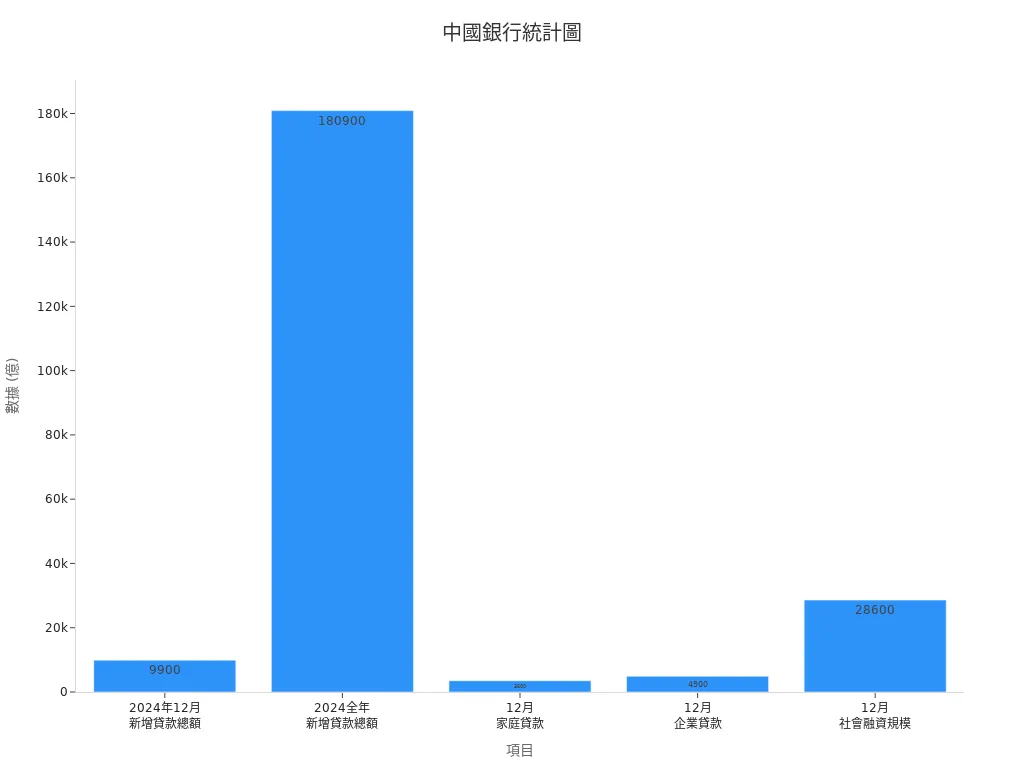

You can refer to the following table to understand key statistics for Bank of China’s main businesses in 2024 (in USD, with an exchange rate of approximately 1 USD to 7.2 RMB):

| Item | Data (USD) | Description |

|---|---|---|

| Total New Loans in December 2024 | 13.75 billion | Changes in loan demand |

| Total New Loans for 2024 | 251.25 billion | Lower demand, attention needed on growth drivers |

| Household Loans in December | 4.86 billion | Rising demand for personal loans |

| Corporate Loans in December | 6.81 billion | Rising demand for corporate loans |

| Social Financing Scale in December | 39.72 billion | Growth in funding supply |

You can see from the chart that corporate and personal loan demand saw significant recovery by year-end. This reflects Bank of China’s activity and cash flow in the market.

Profitability

To assess Bank of China’s profitability, you can start with several key financial metrics. These metrics help you evaluate the bank’s operational efficiency and risks.

| Metric Name | Reference Value | Key Interpretation |

|---|---|---|

| Gross Margin | Service Industry > 40% | A high gross margin indicates strong pricing power and cost control. |

| Net Margin | > 10% is ideal | A high net margin indicates strong final profitability; below 5% suggests operational efficiency issues. |

| Cash Flow | Consistently Positive | Positive cash flow indicates stable operations; negative cash flow signals potential risks. |

| Fixed Cost Proportion | < 50% | High fixed costs compress profits and increase operational pressure. |

You can regularly monitor these metrics to assess Bank of China’s financial health. When gross and net margins are stable and cash flow remains positive, the bank’s operational risks are lower. This gives you more confidence in making investment decisions.

Industry Environment and Policies

Macro Economy

When investing in Bank of China stock, you must pay attention to global and Chinese macroeconomic changes. These factors directly affect the banking industry’s development and Zhongyin price fluctuations. You can understand the macro economy’s impact on the banking industry through the following points:

- Global economic risks (e.g., the European debt crisis) put pressure on Chinese exports and stock markets, making market sentiment prone to fluctuations.

- Global consumer recovery is slow, sovereign debt risks are rising, and a full recovery in Chinese exports will take time.

- The market may enter a policy vacuum period in the short term, with expectations of policy tightening easing, helping to reduce the risk of sharp market declines.

- Inflationary pressures are weakening, lending pace is stable, and market liquidity is improving.

- Experts believe a policy vacuum period can alleviate market concerns, reducing short-term investment risks in the banking industry.

You should closely monitor these economic indicators and adjust your investment strategy in a timely manner. When the economic environment is stable, the Zhongyin price is generally more stable.

Regulatory Policies

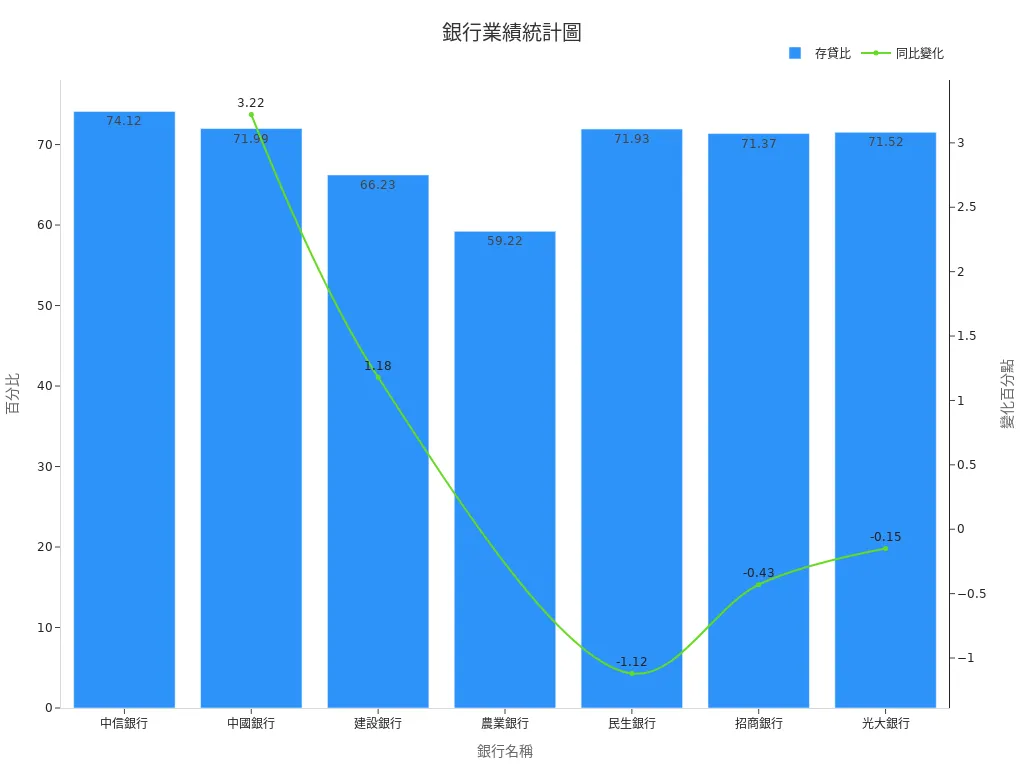

Regulatory policies directly affect banks’ asset-liability structures and lending behaviors. You can refer to the table below to understand changes in the loan-to-deposit ratio for different banks before and after regulatory policy adjustments (in USD, with an exchange rate of approximately 1 USD to 7.2 RMB):

| Bank Name | Loan-to-Deposit Ratio (%) | Year-over-Year Change (Percentage Points) | Notes |

|---|---|---|---|

| CITIC Bank | 74.12 | N/A | Close to the regulatory threshold of 75% |

| Bank of China | 71.99 | +3.22 | Fastest year-over-year increase |

| China Construction Bank | 66.23 | +1.18 | Year-over-year increase |

| Agricultural Bank | 59.22 | N/A | Lowest |

| China Minsheng Bank | 71.93 | -1.12 | Year-over-year decrease |

| China Merchants Bank | 71.37 | -0.43 | Year-over-year decrease |

| China Everbright Bank | 71.52 | -0.15 | Year-over-year decrease |

| Other Banks | Over 70% | N/A | 8 banks exceed 70% |

As of the end of April 2025, the wealth management scale of Chinese banks reached approximately USD 4.35 trillion (with 1 USD to 7.2 RMB), with a monthly increase of about USD 0.28 trillion. The average annualized return for fixed-income wealth management products rose to 3.35%, but overall performance benchmarks showed a downward trend. These changes reflect the impact of regulatory policy adjustments on bank wealth management products and returns. You should closely monitor policy developments, as policy changes affect the Zhongyin price and your investment returns.

Tip: You can regularly browse announcements from the People’s Bank of China and Hong Kong banks to stay updated on the latest policies and market dynamics, improving the accuracy of your investment decisions.

Dividends and Payouts

Image Source: pexels

Dividend Stability

When choosing Bank of China stock, you should pay special attention to dividend stability. Stable dividends can provide long-term cash flow, reducing pressure from market volatility. Bank of China has maintained stable dividends over the years, upholding payout discipline even during economic fluctuations. You can refer to the table below to understand Bank of China’s per-share cash dividends over the past three years (with 1 USD to 7.2 RMB):

| Year | Per-Share Cash Dividend (USD) | Payout Ratio (%) |

|---|---|---|

| 2022 | 0.18 | 30 |

| 2023 | 0.19 | 32 |

| 2024 | 0.20 | 33 |

Tip: You can use stable dividends as part of a long-term investment strategy to generate passive income for your portfolio.

Payout History

You should understand Bank of China’s payout history, which helps you assess future dividend potential. Since its listing, Bank of China has distributed cash dividends almost every year. This stable payout record reflects the bank’s robust operations and sufficient cash flow. You can compare Bank of China’s dividend policy with other Hong Kong banks and find that its payout ratio is above the industry average. Stable dividends help you mitigate losses during market downturns, enhancing overall returns.

Remember: Choosing bank stocks with a stable payout record can help you maintain confidence during market volatility and make it easier to achieve long-term capital appreciation.

Valuation and Zhongyin Price

Valuation Metrics

When analyzing the Zhongyin price, you should first learn to use several common valuation metrics. The Price-to-Earnings Ratio (P/E Ratio) is one of the most commonly used metrics. You can calculate the P/E ratio by dividing the company’s market capitalization by its annual net profit. A lower P/E ratio suggests the stock may be undervalued. The Price-to-Book Ratio (P/B Ratio) is calculated by dividing the market capitalization by the book value of net assets. When the P/B ratio is below 1, it indicates lower market confidence in the bank but may also present investment opportunities. You can refer to the table below to quickly compare two key valuation metrics:

| Valuation Metric | Calculation Method | Interpretation |

|---|---|---|

| P/E Ratio | Market Cap ÷ Net Profit | <8 indicates undervaluation, >15 indicates overvaluation |

| P/B Ratio | Market Cap ÷ Net Assets | <1 indicates undervaluation, >2 indicates overvaluation |

You should regularly review these metrics and compare them with other Hong Kong banks to more accurately judge the reasonable level of the Zhongyin price.

Buying Opportunities

To choose the right buying opportunity, in addition to monitoring valuation metrics, you should also pay attention to the historical volatility of the Zhongyin price and market sentiment. When both the P/E and P/B ratios are low, and the Zhongyin price is near its one-year low, it is usually a good time to enter the market. You should also pay attention to broker commissions. Market data shows that choosing low-commission brokers like Charles Schwab or Firstrade can effectively reduce investment costs and minimize hidden expenses. This is particularly important for beginner investors, as low costs can enhance asset growth efficiency. You should choose a trustworthy broker early and start accumulating investment experience to more flexibly seize Zhongyin price buying opportunities.

Tip: You can use a broker’s simulated trading function to practice identifying buying opportunities and record insights from each operation to improve your investment judgment.

Goals and Risk Management

Diversified Investment

When investing in Bank of China stock, you should first set clear investment goals. This allows you to choose appropriate asset allocations based on your risk tolerance. Diversified investment is an effective way to reduce risk. You can refer to the following points:

- The lower the number of effective stocks, the higher the market concentration and risk. In 2023, the effective number of stocks in the S&P 500 fell to 60, indicating rising market risk.

- Markowitz’s Modern Portfolio Theory suggests that including assets with low correlation in a portfolio can enhance returns under the same risk level.

- When you hold about 20 different stocks, you can eliminate approximately 95% of diversifiable risk, with additional stocks contributing less to risk reduction.

- Multi-strategy portfolios (e.g., momentum, value, trend-following) can significantly improve risk-adjusted returns.

You can apply these principles to diversify your funds across different industries and regions, reducing the impact of single-market volatility.

Stop-Loss Strategy

During the investment process, you should set stop-loss points. This allows you to limit losses and protect your capital during significant market fluctuations. You can set a maximum loss percentage for each investment based on your risk tolerance, such as no more than 10%. When the stock price falls below this stop-loss point, you should decisively sell to avoid further losses. You can also use a broker’s automated stop-loss function to reduce emotional influences. This helps you execute your investment plan with discipline, making it easier to achieve your financial goals in the long term.

After learning these five tips, you can invest in Bank of China stock with more confidence. You should regularly review your financial condition, analyze fundamentals, monitor industry policies, understand dividend payouts, and master valuation and Zhongyin price trends. Continuous learning will optimize your investment strategy.

FAQ

Is there a minimum capital requirement for investing in Bank of China stock?

You can start investing with a small amount of capital. Some brokers require a minimum deposit of only USD 100 (approximately 1 USD to 7.2 RMB).

How often does Bank of China pay dividends?

Bank of China generally pays dividends once a year. You can check the payout date and amount in the annual report.

Can I invest in multiple Hong Kong bank stocks at the same time?

You can hold stocks from multiple Hong Kong banks simultaneously. This helps diversify risk and enhance investment stability.

Investing in Bank of China stocks offers steady dividend returns and robust fundamental analysis for stable wealth growth, but how can you extend this stability to global investment opportunities? BiyaPay provides an all-in-one financial platform, enabling seamless trading of US and Hong Kong stocks, including Bank of China, without offshore accounts, empowering you to capture diverse market opportunities.

Supporting USD, HKD, and 30+ fiat and digital currencies, real-time exchange rate tracking ensures cost transparency, while global remittances to 190+ countries feature transfer fees as low as 0.5% with swift delivery, meeting the liquidity needs of bank stock investments. A 5.48% annualized yield savings product, with no lock-in period, balances market volatility risks with consistent returns. Sign up for BiyaPay today to integrate Bank of China’s reliable dividends with BiyaPay’s global financial solutions, crafting a secure, efficient investment portfolio!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.