- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Beginner’s Guide: Basics of American Depositary Receipts (ADRs) and Common Questions

Image Source: pexels

Have you ever wondered how to buy and sell stocks of well-known companies from China, Europe, or elsewhere in the U.S. market using USD? American Depositary Receipts solve this problem. You only need to use a U.S. broker to invest in shares of non-U.S. companies as easily as buying U.S. stocks. This method makes it convenient for you to participate in international markets while reducing the complexity of exchange rates and cross-border transactions.

Key Points

- American Depositary Receipts (ADRs) allow you to buy and sell non-U.S. company stocks in USD, simplifying the cross-border investment process.

- ADR trading is transparent and regulated by the U.S., with public information making it easy for you to track company financials and market trends.

- Investing in ADRs helps diversify risks and enhance returns, but you need to be aware of price volatility, exchange rate risks, and policy risks.

- Choose well-known, high-liquidity ADRs, understand the fee structure, and set stop-loss points to protect your capital.

- After opening an account with a suitable broker, you can trade ADRs during U.S. market hours, flexibly managing your investment portfolio.

Introduction to American Depositary Receipts

Image Source: pexels

Definition and Basic Operations

American Depositary Receipts are financial instruments issued by U.S. banks, representing stocks of non-U.S. companies. These securities allow you to trade in the U.S. market in USD without directly purchasing foreign company stocks. When you buy an ADR, you are essentially purchasing a certificate of ownership of foreign company stocks held by a U.S. bank.

The core of this operation lies with the issuing bank. The bank purchases the foreign company’s stocks and deposits them with a local custodian institution. Then, the bank issues a corresponding number of ADRs based on these stocks, which are traded in the U.S. market. Each ADR may represent one share, multiple shares, or even a fraction of a share of the foreign company’s stock, with the specific ratio determined at issuance.

Key Features

The features of American Depositary Receipts make them an important tool for international investing. Below are several key features:

- USD Denomination and Payment: ADRs are priced in USD, and dividends are paid in USD. This way, you don’t need to handle currency conversions, making the trading process simpler.

- Information Transparency: ADRs are listed on U.S. stock exchanges and regulated by the U.S. Securities and Exchange Commission (SEC). This ensures transparency, allowing you to easily access company financial reports and other important information.

- High Liquidity: ADRs generally have high liquidity, meaning smaller bid-ask spreads and more convenient trading.

- Low Trading Costs: Many brokers offer ADR custodial fees as low as 1 to 5 cents per share, with no minimum account requirements. Some brokers even provide commission-free trading, further reducing investment costs.

These features make American Depositary Receipts a convenient and efficient choice for international investing, especially for investors looking to participate in global markets.

Investment Advantages and Risks

Key Benefits

Choosing American Depositary Receipts as an international investment tool offers several benefits:

- Simplified Cross-Border Investment Process: You don’t need to open a foreign securities account; you can directly buy and sell stocks of well-known companies from China, Europe, and elsewhere using USD through U.S. or Hong Kong banks and brokers.

- USD Settlement Reduces Exchange Rate Risks: All transactions and dividends are denominated in USD, making it easier for you to manage funds and reducing losses due to exchange rate fluctuations.

- Transparent Information and Strict Regulation: American Depositary Receipts are listed on major U.S. exchanges and regulated by the SEC. You can easily access company financial reports and announcements, with transparent information.

- High Liquidity and Convenient Trading: You can trade ADRs in the market just like U.S. stocks, with flexible fund inflows and outflows.

- Diversified Investment Portfolio: You can easily invest in high-quality companies from different countries, diversifying risks and enhancing overall return potential.

Risk Factors

When investing in American Depositary Receipts, you should also be aware of potential risks:

- High Price Volatility: ADR prices are influenced by multiple factors, including the original stock market, exchange rates, and international news. On January 27, 2025, TSMC’s ADR plummeted 13.33% due to market concerns triggered by Chinese AI startup DeepSeek launching a new AI model. However, just a few days later, TSMC’s ADR quickly rebounded, reaching USD 208 by January 30. This example shows that ADR prices can sometimes experience significant short-term volatility due to news, but long-term value may remain intact.

- Exchange Rate Risk: Although you trade in USD, the underlying stocks of ADRs are denominated in local currencies. When the exchange rate between USD and the original stock’s currency fluctuates, ADR prices are affected.

- Policy and Regulatory Risks: Policy changes and stricter regulatory requirements in different countries may impact the operations of the original stock’s company, thereby affecting ADR performance.

- Liquidity Risk: Some less popular ADRs have lower trading volumes, which may result in larger bid-ask spreads, affecting trading efficiency.

- Delayed Company Information: Some foreign companies may disclose information more slowly, making it difficult for you to stay updated with the latest developments.

Before investing, you should assess your risk tolerance and avoid focusing solely on short-term positive news while ignoring potential risks.

Tips for Beginners

When you’re new to American Depositary Receipts, consider the following tips:

- Choose Large, Well-Known ADRs: You can prioritize highly active and transparent ADRs, such as those of Alibaba or TSMC, to reduce liquidity risks.

- Understand the Fee Structure: Be clear about the annual ADR custodial fees (typically 1 to 5 cents per share), as well as trading commissions and other miscellaneous fees charged by brokers.

- Monitor Original Stock Market Trends: Regularly track the price movements and major news of the original stock in its local market, as these directly impact ADR prices.

- Set Stop-Loss Points: You can pre-set stop-loss levels to limit losses during sudden market events and protect your capital.

- Continuously Learn International Market Knowledge: Read relevant books, news, and expert analyses to enhance your international investment perspective.

Tip: You can use simulated trading platforms to practice buying and selling ADRs, gaining familiarity with market operations before investing real money.

Trading Process and Fees

Image Source: pexels

Account Opening and Broker Selection

To invest in American Depositary Receipts, the first step is to choose a suitable broker and complete the account opening process. In recent years, more investors have chosen to invest overseas through Taiwan or Hong Kong brokers. The latest data shows that as of September this year, the trading volume of Taiwan brokers’ sub-brokerage transactions exceeded NTD 5.69 trillion, a 27% year-on-year increase, reflecting growing demand for overseas investments.

You can follow these steps to complete overseas broker account opening:

- Choose a broker, considering platform scale, legitimacy, deposit methods, product variety, and Chinese-language customer support.

- Fill in personal information.

- Upload identification and proof of address documents.

- Wait for document review, and you will receive an account opening notification upon approval.

- Deposit funds into the broker’s account, which usually incurs cross-border wire transfer fees.

- Start trading ADRs.

You can also choose Hong Kong banks or brokers, with a similar process, and some platforms support online account opening for greater convenience.

Trading Steps

After completing account opening and funding, you can start trading ADRs. The general process is as follows:

- Log into the broker’s platform and search for the stock ticker of the ADR you want to invest in.

- Enter the buy or sell quantity, choosing between a market or limit order.

- Confirm the transaction details and submit the order.

- Wait for the transaction to execute, and the system will notify you of the results instantly.

- After the transaction is completed, funds and stocks are automatically settled, similar to U.S. stock settlement, typically completed within T+2 days.

ADR trading hours align with U.S. stock market hours, typically from 09:30 to 16:00 Eastern Time, allowing you to flexibly schedule your orders.

Fees and Taxes

When trading ADRs, you need to be aware of related fees and taxes. Below is a comparison of common fees:

| Fee Item | U.S. Stocks (Overseas Brokers) | Taiwan Stocks |

|---|---|---|

| Trading Fees | 0% to 0.1% | Approx. 0.1425% plus minimum fees |

| Transaction Tax | Approx. 0.00051% | 0.3% on sales |

| Trading Activity Fee | Small fee per share | None |

You should also note that overseas brokers have lower fees and more investment options, but currency conversion and cross-border wire transfer fees range from USD 16 to 58 (calculated at 1 USD = 31 NTD). Additionally, some ADRs charge an annual custodial fee of 1 to 5 cents per share. You should carefully compare each broker’s fee structure to choose the most suitable platform.

Tip: You can use the fee calculation tools provided by brokers to estimate investment costs in advance and avoid unnecessary expenses.

Hong Kong ADRs and Market Reference

Role of Hong Kong ADRs

You can use Hong Kong ADRs to observe the international market performance of Hong Kong-listed companies. When you see the prices of Hong Kong ADRs in the U.S. market, they reflect the value of these companies in the eyes of U.S. investors. These ADRs typically fluctuate during U.S. trading hours, allowing you to gauge market sentiment before the Hong Kong stock market opens.

If you hold an account with a Hong Kong bank, you can also directly participate in ADR trading, flexibly adjusting your investment portfolio. Hong Kong ADRs also help you compare capital flows across different markets and understand international investors’ attitudes toward major Chinese companies.

Tip: You can refer to ADR price changes to predict the next day’s Hong Kong stock market opening trends, improving the accuracy of your investment decisions.

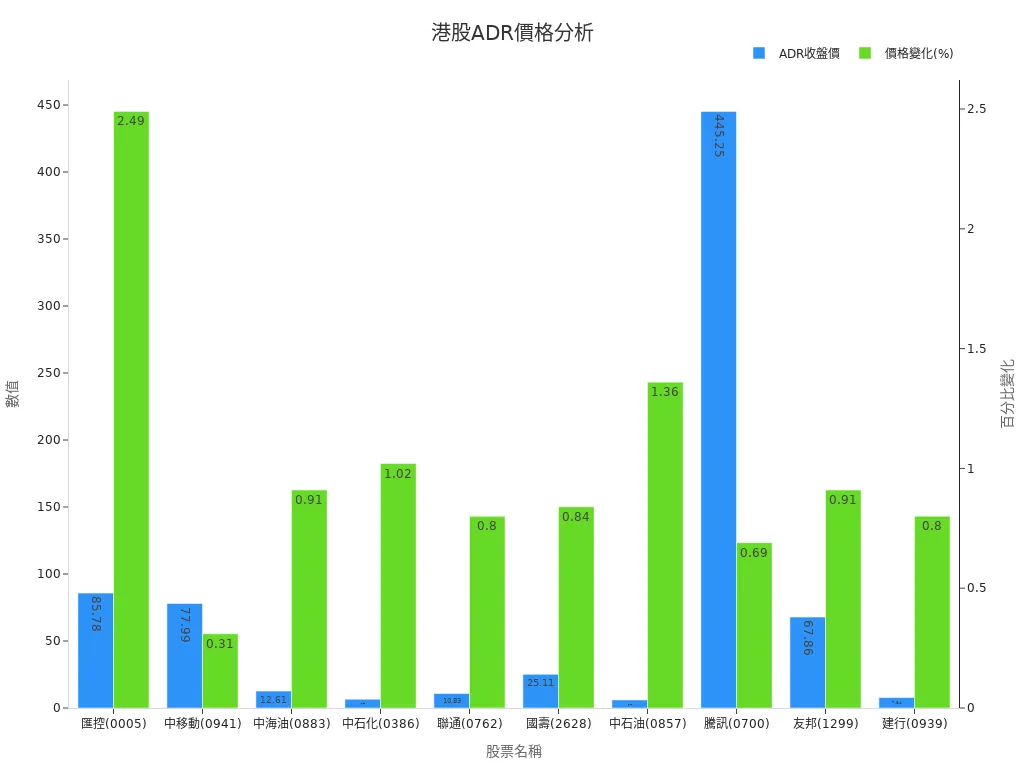

Price and Trend Reference

When analyzing Hong Kong ADRs, you can pay attention to their percentage changes compared to Hong Kong local stock prices. The table below lists the U.S. closing prices and percentage changes relative to Hong Kong stock prices for several popular Hong Kong ADRs:

| Stock Name | ADR U.S. Closing Price (USD) | Percentage Change vs. HK Stock Price (%) |

|---|---|---|

| HSBC (0005) | Approx. 85.78 | +2.49 |

| China Mobile (0941) | Approx. 77.99 | +0.31 |

| CNOOC (0883) | Approx. 12.61 | +0.91 |

| Sinopec (0386) | Approx. 6.58 | +1.02 |

| China Unicom (0762) | Approx. 10.83 | +0.80 |

| China Life (2628) | Approx. 25.11 | +0.84 |

| PetroChina (0857) | Approx. 6.01 | +1.36 |

| Tencent (0700) | Approx. 445.25 | +0.69 |

| AIA (1299) | Approx. 67.86 | +0.91 |

| CCB (0939) | Approx. 7.84 | +0.80 |

You will notice that recent Hong Kong ADR price fluctuations are mainly short-term. Market analysis suggests that investors tend to hold strong stocks for the long term, and the overall market sentiment remains healthy. You can combine ADR prices with the Hang Seng Volatility Index to assess short-term overbought or oversold conditions, enhancing your investment judgment.

Choosing American Depositary Receipts allows you to easily participate in international markets. This investment tool offers convenience but also comes with price volatility and policy risks. You should first understand your risk tolerance and conduct thorough research. Choose the investment method that suits your needs, continuously learn new knowledge, and improve your judgment.

FAQ

What are ADR custodial fees?

You need to pay an annual ADR custodial fee, typically around USD 0.01 to 0.05 per share (calculated at 1 USD = 7.8 HKD). This fee is charged by the issuing bank for managing the stocks.

How are ADR dividends distributed?

The ADR dividends you receive are paid in USD. The issuing bank deducts relevant taxes before depositing the remaining amount into your broker account.

Can I trade ADRs anytime?

You can freely trade ADRs during U.S. stock market hours (09:30 to 16:00 Eastern Time). The trading process is the same as for U.S. stocks, flexible and convenient.

Do ADR prices sync with the original stock prices?

You will find that ADR prices generally follow the original stock price movements, but due to exchange rates and market supply and demand, they may not be perfectly aligned.

Do I need to pay taxes on ADR investments?

When trading ADRs, you may need to pay U.S. capital gains tax and dividend tax. Tax agreements vary by country, so it’s recommended to consult a professional.

American Depositary Receipts (ADRs) enable seamless investment in global companies with USD, simplifying cross-border trading and boosting flexibility, but how can you further reduce costs and optimize global fund management? BiyaPay offers an all-in-one financial platform, allowing effortless trading of US and Hong Kong stock ADRs, like Tencent and Alibaba, without offshore accounts, eliminating the need for costly account setups or traditional ADR custodial fees.

Supporting USD, HKD, and 30+ fiat and digital currencies, real-time exchange rate tracking ensures transparency, while global remittances to 190+ countries feature transfer fees as low as 0.5%, significantly below conventional brokerage costs, with swift delivery to meet ADR investment liquidity needs. A 5.48% annualized yield savings product, with no lock-in period, balances exchange rate fluctuations with stable returns. Sign up for BiyaPay today to merge ADR’s global investment benefits with BiyaPay’s worldwide financial solutions, crafting a cost-effective, high-efficiency wealth-building strategy!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.