- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Analysis of Benefits and Limitations of Monthly Investment in HKEX Stocks

Image Source: pexels

Have you ever wondered why so many people choose to invest in Hong Kong stocks through monthly contributions? Monthly investment has a low entry barrier, requiring only a small amount of funds each month to diversify risk, and offers tax advantages in the long run. However, HKEX stock price volatility is significant, stock selection is limited, and platform fees can affect returns. Want to know if it’s suitable for you? Find out now!

Key Points

- Monthly investment has a low entry barrier, requiring only a small amount of funds each month to start, suitable for those with limited capital or beginner investors.

- Through dollar-cost averaging, monthly investment can diversify market volatility risks, accumulating assets more steadily over the long term.

- Choosing ETFs allows diversification across multiple companies’ stocks at once, reducing single-stock risk and enhancing investment safety.

- Monthly investment with automatic deductions helps build financial discipline, avoiding emotional influences on investment decisions.

- Investing in Hong Kong stocks is exempt from capital gains tax and dividend tax, making long-term returns more attractive, but you need to be mindful of platform fees and stock selection limitations.

Basic Operations

Monthly Investment Process

If you want to start monthly investing, the process is very simple. You only need to open an investment account with a Hong Kong bank or brokerage, select the stocks or ETFs you want to invest in monthly, and then set the monthly automatic deduction amount. For example, you can set an automatic deduction of USD 100 each month, and the system will automatically buy your selected stocks or ETFs on the designated date. This process doesn’t require you to monitor the market daily or worry about missing buying opportunities. You can flexibly adjust the monthly contribution amount or change the investment target based on your financial goals and risk tolerance.

You can choose to invest in individual stocks or ETFs. Stocks represent direct ownership of a specific company’s shares, with more concentrated returns and risks. ETFs are a basket of stocks, allowing you to diversify investments across multiple companies at once, reducing the impact of a single company’s performance. Many people choose ETFs because they can diversify risk, especially suitable for those just starting to invest.

Dollar-Cost Averaging

The most important principle of monthly investment is “dollar-cost averaging.” You invest a fixed amount each month in the same stock or ETF, regardless of whether the HKEX stock price is high or low, and the system executes automatically. This approach has several benefits:

- You don’t need to worry about market highs or lows, reducing the chance of losses due to misjudgment.

- Long-term consistent buying can diversify entry risks, avoiding the pressure of lump-sum investments.

- You reduce irrational decisions due to emotional fluctuations, fostering a long-term investment mindset.

- Studies show that if you miss the market’s low point by two months, the chance of a buy-the-dip strategy outperforming dollar-cost averaging drops significantly, proving dollar-cost averaging is more robust.

- For ETFs, from 2009 to 2024, long-term monthly investment achieved an annualized compound return of 16.4%, with asset growth exceeding tenfold.

Choosing ETFs as your monthly investment target allows you to invest in multiple companies’ stocks at once, further diversifying risk. This method is suitable for most ordinary investors who cannot time the market, enabling you to steadily accumulate capital and reduce risk.

Tip: Monthly automatic investing also reduces the number of transactions, saving on fees and avoiding losses from frequent trading.

Benefits

Image Source: pexels

Low Entry Barrier

If you want to start investing, you might worry that the entry barrier is too high. In fact, monthly investment significantly lowers this barrier. Take the Hong Kong Exchange (0388.HK) as an example: buying one lot of stock requires about USD 3,650 (based on 1 USD ≈ 7.83 HKD), but with a monthly stock investment plan, you only need USD 65 (about HKD 500) per month to start. This way, you don’t need to put up a large sum at once and can still participate in the long-term growth of HKEX stock prices.

- You can flexibly adjust the monthly contribution amount based on your financial situation.

- Many Hong Kong banks and brokerages offer monthly stock or ETF investment services with minimum contribution thresholds as low as USD 65.

- You can increase, decrease, or pause contributions at any time, making fund utilization more flexible.

Tip: In the first half of 2024, the scale of ETF holdings by individual investors exceeded USD 934 billion, showing that more people are choosing low-barrier investments.

Risk Diversification

By investing a fixed amount each month, you buy regardless of whether the HKEX stock price is high or low. This “dollar-cost averaging” method helps you diversify the risks brought by market volatility. When stock prices fall, your same contribution buys more shares; when prices rise, you buy fewer. In the long run, you don’t need to worry about short-term market fluctuations, reducing the pressure of lump-sum investments.

- You can choose ETFs, which are already diversified across multiple companies’ stocks, reducing risk further.

- You don’t need to spend time researching market timing, as the system automatically executes purchases.

- You can invest in multiple stocks or ETFs monthly to further diversify risk.

Example: Xiao Ming invests USD 65 monthly in an ETF, and after ten years, even with several market crashes, assets still grow steadily.

Financial Discipline

Monthly investment helps you build good financial habits. With monthly automatic deductions, you avoid spending impulsively. This disciplined approach is especially suitable for those just starting with financial management.

- Monthly fixed investments make budgeting easier.

- You don’t need to operate frequently, reducing wrong decisions due to emotional fluctuations.

- You can accumulate assets over the long term, achieving financial goals.

Suggestion: You can set monthly contributions to 10% of your income, and with long-term persistence, your assets will naturally grow.

Credit Card Rewards

By using a credit card for monthly investments, you can earn points or cashback. Some Hong Kong banks and brokerages accept credit card payments, allowing you to gain additional benefits while investing.

- Monthly automatic deductions make it easy to earn credit card points.

- Some credit cards offer 1% to 2% cashback, which can add up to significant extra income over time.

- You can compare different banks’ credit card offers to choose the most suitable option.

Note: You should ensure full repayment each month to avoid interest offsetting the cashback benefits.

Tax Advantages

When trading stocks and ETFs on the Hong Kong Exchange, you don’t need to pay capital gains tax or dividend tax. This is crucial for long-term investors, as you can retain more investment gains.

| Investment Vehicle | Capital Gains Tax Rate (2014-2023) | Example of Capital Gains in Dividends |

|---|---|---|

| Passive ETFs | ~10% | ~1 USD capital gains in 10 USD dividends |

| Active ETFs | 15.7% | ~1 USD capital gains in 10 USD dividends |

| Mutual Funds | 30%-60% | ~5 USD capital gains in 10 USD dividends |

When investing in ETFs or stocks in Hong Kong, you generally don’t need to worry about capital gains tax or inheritance tax. This makes your long-term returns higher than those from mutual funds. The dividends and capital gains you receive annually are almost entirely yours.

Tip: The absence of capital gains tax and inheritance tax in Hong Kong is a key reason it attracts global investors.

Limitations

Limited Stock Selection

When participating in monthly investment, you may find that the platform offers limited stock or ETF choices. Some Hong Kong banks or brokerages only provide a designated list, which may not include your preferred popular stocks or newly listed ETFs. This limitation affects your flexibility in diversifying investments and may cause you to miss high-growth opportunities.

- The book The Most Powerful Stock Selection Formula Anyone Can Learn [Growth Value Stock Selection Metrics] notes that stock selection methods, tested with 22 years of historical data, eliminating multiple biases, achieved an average annualized return of 19.5%. This data shows that freer stock selection can lead to higher long-term returns.

- Japanese Daiwa Securities analyst Takaaki Yoshino validated the same method in the Japanese stock market with similarly positive results, indicating that stock selection flexibility significantly impacts investment performance.

If you are limited to the platform’s designated stocks, you may not fully utilize your personal stock selection strategy, reducing the scope for active management.

Designated Purchase Dates

Monthly investments are typically executed automatically on a designated day each month for buying stocks or ETFs. You cannot choose the optimal market entry timing and must passively accept the HKEX stock price on that day. While this approach is simple, it may sometimes result in buying at short-term highs, increasing the average purchase cost.

Example: You set automatic purchases for the 5th of each month, but if the stock price spikes on that day, your overall investment cost increases. You cannot, like active investors, choose to buy in batches at low points.

This limitation may feel inflexible for those seeking precise operations.

Long-Term Costs

When conducting monthly investments, long-term costs are a factor you cannot ignore. Each purchase incurs transaction fees, which accumulate over time and affect total returns. You need to calculate the actual impact of these costs on asset growth.

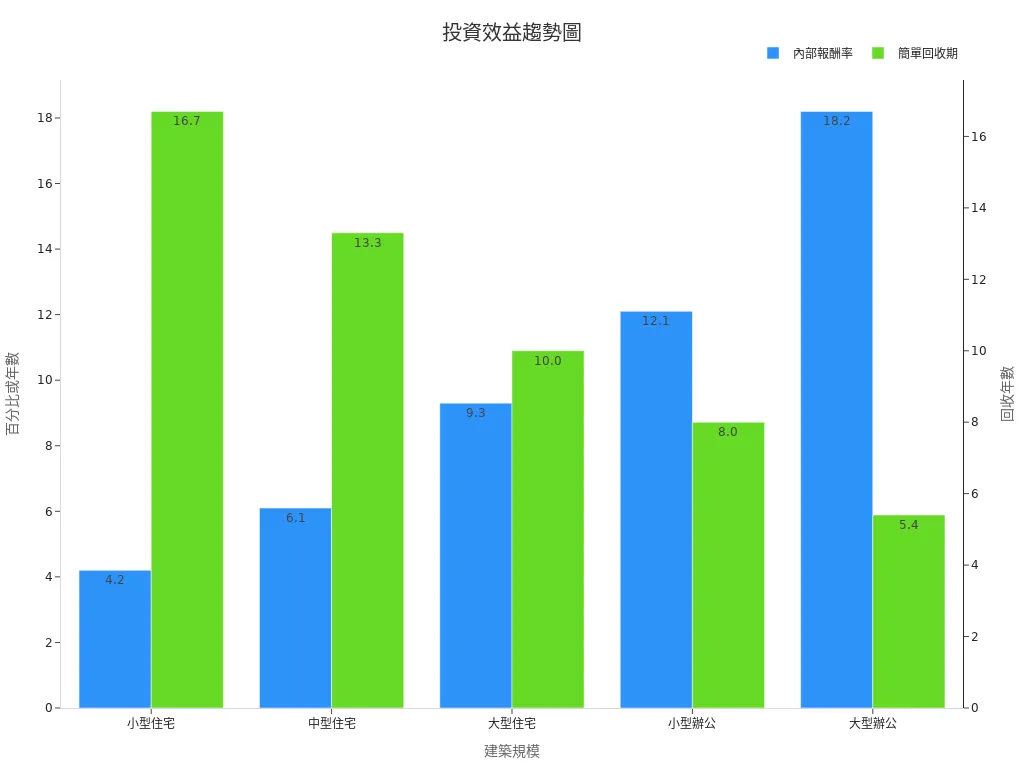

| Building Scale | Initial Additional Investment (USD) | Annual Savings (USD) | Simple Payback Period (Years) | 20-Year Net Present Value (USD) | Internal Rate of Return (%) |

|---|---|---|---|---|---|

| Small Residential (30 ping) | 19,000 | 1,140 | 16.7 | 3,800 | 4.2 |

| Medium Residential (50 ping) | 25,000 | 1,900 | 13.3 | 10,000 | 6.1 |

| Large Residential (80 ping) | 38,000 | 3,800 | 10.0 | 26,600 | 9.3 |

| Small Office (200 ping) | 127,000 | 15,900 | 8.0 | 152,000 | 12.1 |

| Large Office (1000 ping) | 476,000 | 44,400 | 5.4 | 839,000 | 18.2 |

These data show that while initial investments are high, returns increase and payback periods shorten with larger scales. When conducting monthly investments, controlling long-term costs can make asset growth more significant.

As global energy prices rise, the cost-effectiveness of long-term investments becomes more apparent. You should regularly review transaction fees and platform charges to ensure maximum long-term returns.

Platform Fees

Fee structures vary significantly across platforms. When choosing a Hong Kong bank or brokerage, you should pay attention to annual fees, transaction fees, and other hidden charges. The platform’s operating history also affects fee stability, with longer-established platforms typically having more stable fees.

| Platform Type | Platform Name | Annual Fee Range (USD) | Transaction Fee Rate | Plan Model | Free Trial Days |

|---|---|---|---|---|---|

| E-commerce Platform | Shopify | 348-3,588 | 2%-0.5% | Flat-rate | 14 days |

| E-commerce Platform | Shopline | 1,120-3,010 (plus 160 setup fee) | 1%-0.5% | Tiered | 30 days |

| E-commerce Platform | 91APP | 1,560 up to 7,120+ | 5.5% | Tiered | 30 days |

| E-commerce Platform | meepShop | 960-4,600 | 1.5%-0% | Flat-rate | 14 days |

| E-commerce Platform | WACA | 230-3,100 | No transaction fee | Tiered | 30 days |

| Marketplace Platform | Shopee | No annual fee | 5.5%-6.5% | N/A | N/A |

| Marketplace Platform | Ruten Auction | No annual fee | 2% | N/A | N/A |

| Marketplace Platform | Yahoo Super Mall | 385-1,250 annual fee, plus 480 setup fee | 3.2%-8% | N/A | N/A |

| Marketplace Platform | momo Mall | 1,280 first year, 640 subsequent years | 2.5%-5% | N/A | N/A |

You should compare the fee structures of different platforms, including fixed annual fees and variable transaction fees. Some platforms offer free trial periods, suitable for testing services before committing long-term.

Tip: Choosing platforms with transparent fees and long operating histories can reduce the risk of future fee adjustments.

Liquidity of Funds

While monthly investment is convenient, it has lower liquidity. After monthly automatic deductions, your funds are converted into stocks or ETFs, which are difficult to liquidate quickly in the short term. If you suddenly need cash, you may need to sell your holdings and wait for settlement and fund transfer.

- You cannot withdraw funds as easily as with a demand deposit.

- If the HKEX stock price experiences significant volatility, selling temporarily may result in losses.

- Some platforms may limit withdrawal frequency or charge additional fees, further reducing fund flexibility.

You should reasonably plan your monthly contribution amount based on your cash flow needs to avoid liquidity shortages affecting daily life.

HKEX Stock Price Volatility

Image Source: pexels

Impact on Monthly Investment Effectiveness

When investing in Hong Kong stocks, the most common issue is the significant volatility of HKEX stock prices. This volatility directly affects the effectiveness of your monthly investments. When you use monthly investments, the system automatically buys regardless of whether the HKEX stock price is high or low. This helps average your costs, reducing the risk of buying at a high point with lump-sum investments.

You might worry that volatility makes investments unstable. In fact, according to Bloomberg data from 2004 to 2020, whether you buy at market highs or lows monthly, the long-term investment value difference is minimal. This proves that the monthly investment strategy effectively mitigates the impact of price volatility. Especially in highly volatile markets, regular fixed-amount investments can smooth costs and enhance long-term returns.

Tip: Emerging markets like China and Russia have greater political and economic instability, leading to higher price volatility. Monthly investments can reduce the impact of short-term fluctuations on your assets.

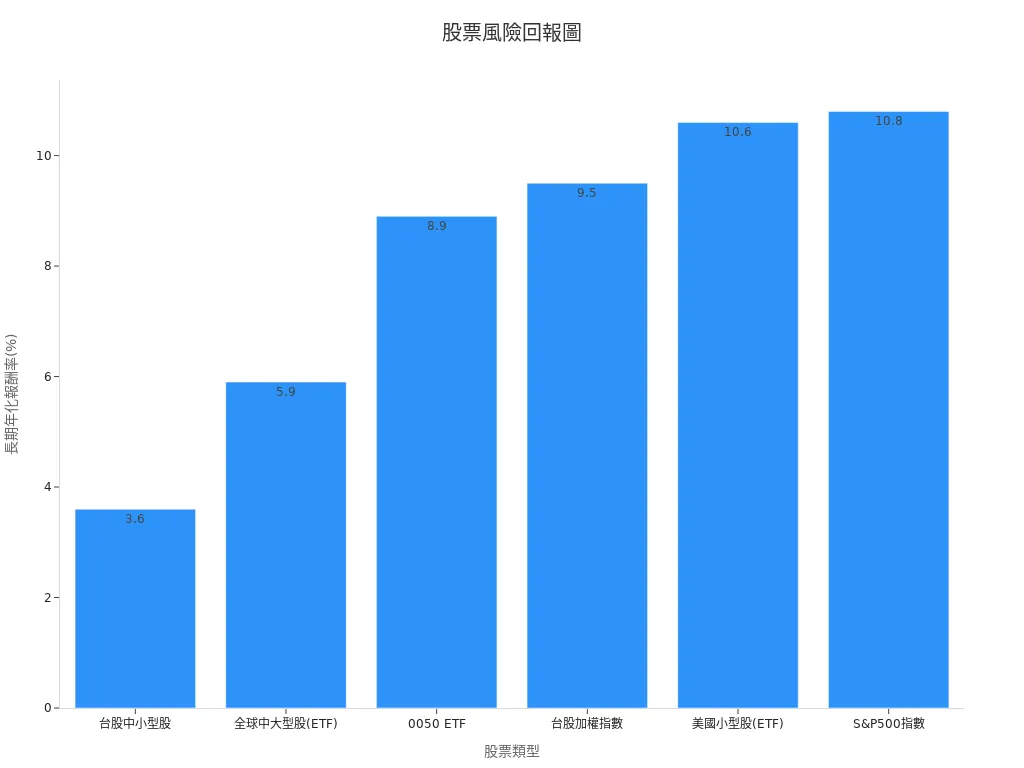

Risk and Return

The risk and return profiles differ significantly depending on the type of Hong Kong stocks or ETFs you choose. Blue-chip stocks typically have lower volatility and more stable returns; red-chip and state-owned enterprise stocks are more affected by policies and the economy, with higher volatility. ETFs diversify risk across multiple stocks, suitable for those looking to reduce single-company risk.

The table below shows the long-term annualized return rates for different stock types, making comparison easier:

| Stock Type | Long-Term Annualized Return Rate (%) |

|---|---|

| Taiwan Small-Cap Stocks | ~3.6 |

| Global Mid-to-Large-Cap Stocks (ETF) | ~5.9 |

| 0050 ETF | ~8.9 |

| Taiwan Weighted Index | ~9.5 |

| U.S. Small-Cap Stocks (ETF) | ~10.6 |

| S&P 500 Index | ~10.8 |

You should remember that higher return stocks come with greater risks. Long-term holding typically yields profits, but past performance does not guarantee future results. You should choose an investment portfolio based on your risk tolerance and financial goals.

Platform Comparison

Bank vs. Brokerage

When choosing monthly investments, you typically decide between Hong Kong banks or brokerages. Hong Kong banks offer more stable monthly stock investment plans with high brand credibility, suitable for those seeking security. However, banks have limited stock selection lists, reducing flexibility. Brokerages offer more stock and ETF choices with lower commissions and administrative fees, suitable for those aiming to reduce costs and pursue diversified investments. Brokerages’ online platforms are easy to use with faster account opening processes, but some emerging brokerages have shorter operating histories, so stability should be monitored.

Fee Differences

Fee structures vary significantly across platforms. When choosing a Hong Kong bank or brokerage, you should pay attention to commissions, administrative fees, annual fees, and hidden charges. The following list shows the main fees and features of different platforms:

- The QDM e-commerce platform’s free version charges a 5% transaction fee, while paid plans have no transaction fees.

- QDM offers diverse payment options, KOL marketing, and member tag remarketing features.

- ShopStore’s free version also charges a 5% commission, while paid plans offer more comprehensive features, including editable CSS, SEO optimization, and automated e-invoicing.

- ShopStore is suitable for beginner merchants, while QDM suits users with limited budgets seeking a minimalist style.

You can refer to the table below to understand differences in services, fee structures, and promotions across cloud platforms:

| Platform Type | Service Features | Fee Calculation Method | Discount Policy | Trial Plan |

|---|---|---|---|---|

| Google GCP | Wide infrastructure distribution, including Taiwan | Per-minute billing | 30% off for continuous use for one month | USD 300 credit for new users within one year |

| AWS | Extensive infrastructure, discounts for prepayment | Per-hour billing | 5-7% off for 1- or 3-year prepayment | Free for certain services in the first year for new accounts |

| Microsoft Azure | Many geographic regions, hybrid use discounts | Per-minute billing | 40% off with Hybrid Use Benefit | 30-day free credits for new users |

You’ll notice that platforms have monthly, commission, or buyout fee models. Some platforms like Blogger are free, but you don’t own the domain, and traffic cannot be transferred. Template website plans emphasize buyout models, where the website belongs to you after full payment, with expandable features. These differences affect your long-term costs and flexibility.

Service and Flexibility

When choosing a platform, beyond fees, you should also consider service content and flexibility. Hong Kong banks’ monthly investment services are more standardized with limited stock lists, suitable for those who don’t frequently change portfolios. Brokerages offer more self-selected stocks and ETFs, allowing you to adjust strategies based on market changes. Brokerages’ online platforms support real-time inquiries and flexible monthly contribution adjustments, making operations convenient.

If you consider overseas account opening or remittances, note the complex procedures and exchange rate risks. Some overseas platforms require more identification documents, and fund transfers take longer. You should evaluate your needs to choose the most suitable platform, ensuring a smooth investment process.

Tip: You should regularly check the platform’s fees and service terms to avoid impacts on investment returns due to policy changes. Choosing stable, transparent platforms helps you focus on long-term asset growth without overly worrying about short-term HKEX stock price fluctuations.

Suitable Audiences

Small Investors

If you have limited funds, monthly investment is particularly suitable for you. You can gradually accumulate assets with small monthly contributions. Many small investors choose aggressive funds because of the long investment horizon and higher expected returns. Before starting, you should understand your risk profile. Most fund companies require you to fill out a risk assessment form to understand your tolerance. You can also diversify investments to reduce risks from single-market volatility. Note that single remittance fees may account for 1% of the investment amount, but this decreases as the amount increases. You can use promotions or VIP plans from Hong Kong banks to reduce fees, choosing low-cost platforms to enhance long-term net returns.

- You can choose funds based on your risk profile

- Diversified investments help control risk

- Controlling fees enhances returns

Beginners

If you’re new to investing and unfamiliar with the market, monthly investment allows you to avoid timing concerns and constantly monitoring HKEX stock prices. You just need to set up automatic monthly deductions, and the system handles purchases. This simple, clear method is suitable for those with little investment experience. You can start with ETFs or large blue-chip stocks to gradually build confidence. Monthly investments also help you develop financial discipline, accumulating assets over the long term.

Busy Professionals

If you’re busy with work and lack time to research markets or trade frequently, monthly investment is a good choice. You only need to set up automatic deductions without daily market monitoring. Experts suggest that busy professionals should adopt regular fixed-amount investments to overcome time constraints and human weaknesses. You can invest consistently over the long term, allowing assets to grow steadily. Professional teams can assist in selecting investment targets, improving success rates.

Tip: You don’t need to worry about missing the best buying opportunities; disciplined long-term investing is more likely to yield stable returns.

Unsuitable Scenarios

If you fall into the following scenarios, monthly investment may not be suitable for you:

- You prefer short-term trading for quick profits

- You are extremely conservative and cannot tolerate short-term asset fluctuations

- You need high liquidity and frequently use investment funds

- You cannot handle the psychological pressure of long-term investing

Surveys show that age, income, and risk tolerance affect your choice of investment products. Younger groups prefer stable returns and low-volatility assets, while retirees prioritize income-generating products. You should choose the most suitable investment method based on your needs and goals.

By choosing monthly investment, you can enjoy benefits like low entry barriers, risk diversification, and tax exemptions. However, you should be aware of limitations such as limited stock selection, platform fees, and market volatility. You should first understand your financial goals before deciding if this method suits you. Common pitfalls include overlooking fees and over-relying on automatic investing. Understand your goals before investing and avoid blindly following trends.

FAQ

What is the minimum entry amount for monthly investment?

You can start monthly investment with about USD 65 (approximately HKD 500, 1 USD ≈ 7.83 HKD). Most Hong Kong banks and brokerages offer this low threshold.

Can you stop or change the monthly investment amount at any time?

You can adjust or pause the monthly contribution amount on the platform at any time. Most Hong Kong banks and brokerages support this flexible setting.

Does monthly investment guarantee returns?

Monthly investment does not guarantee returns. You need to bear market fluctuations, with potential profits from long-term investing but also risks of losses.

Is monthly investment suitable for those needing funds in the short term?

If you need funds in the short term, monthly investment may not be suitable. Stocks and ETFs take time to liquidate, with lower liquidity.

Can you invest in multiple stocks or ETFs monthly at the same time?

You can choose multiple stocks or ETFs for monthly investment simultaneously. This helps diversify risk and enhance portfolio stability.

Monthly stock investment in the Hong Kong Stock Exchange offers low entry barriers and dollar-cost averaging for steady wealth accumulation, with tax-free benefits boosting appeal, but how can you overcome limited stock choices and liquidity constraints to embrace global opportunities? BiyaPay provides an all-in-one financial platform, enabling seamless trading of US and Hong Kong stocks, including HKEX-listed equities and international ETFs, without offshore accounts, enhancing the flexibility of monthly investment plans.

Supporting USD, HKD, and 30+ fiat and digital currencies, real-time exchange rate tracking ensures cost transparency, while global remittances to 190+ countries feature transfer fees as low as 0.5%, with swift delivery to meet investment liquidity needs. A 5.48% annualized yield savings product, with no lock-in period, balances market volatility with stable returns. Sign up for BiyaPay today to integrate the steady strategy of monthly investments with BiyaPay’s global financial solutions, crafting a flexible, efficient wealth-building plan!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.