- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Comprehensive Guide to Dividend Collection on HKEX Stocks and Cost-Saving Methods

Image Source: pexels

When investing in HKEX dividend-paying stocks, you must closely monitor ex-dividend dates and the T+2 settlement system to ensure purchases are made at the right time. You need to be aware that different stocks may involve dividend taxes, and some brokers charge dividend collection fees, with a minimum fee of approximately USD4 (calculated at 1 USD ≈ 7.8 HKD). Choosing an appropriate securities account or Hong Kong bank account can help you effectively save costs.

Key Points

- To receive a dividend, you must purchase HKEX stocks at least two trading days before the ex-dividend date.

- Dividend collection fees and transaction costs vary significantly among brokers and banks; selecting a low-cost platform can save expenses.

- Utilizing ETFs and diversified portfolios can mitigate risks and reduce the impact of single-stock volatility on returns.

- Pay attention to dividend taxes and the risk of “gaining dividends but losing capital”; opt for long-term holdings in companies with stable dividends and strong fundamentals.

- Regularly review dividend policies and fee structures, and flexibly adjust your portfolio to enhance dividend returns and preserve capital.

Dividend Collection Essentials

Ex-Dividend Date and T+2 Settlement

To collect HKEX dividends, you must understand the ex-dividend date and T+2 settlement system. T+2 means that after purchasing a stock, the transaction is finalized two trading days later. To receive a specific dividend, you must buy the stock at least two trading days before the ex-dividend date (T-2) or earlier. Otherwise, you will miss the dividend. For example, if the ex-dividend date is Wednesday, you must buy the stock before the market closes on Monday to qualify for the dividend.

Tip: Brokers’ trading hours and settlement arrangements may vary slightly. You should check in advance to avoid missing dividend opportunities due to timing issues.

HKEX Dividend Timing

The timing and frequency of HKEX dividends vary by company. Most companies pay dividends twice a year, typically interim and final dividends. Some companies opt for quarterly dividends, and a few even pay monthly dividends. You can check specific dividend dates and ex-dividend dates in company announcements or on the HKEX website. You should regularly monitor this information to plan your buying and holding periods, improving dividend collection efficiency.

- Common dividend frequencies:

- Semi-annual dividends (most common)

- Quarterly dividends

- Monthly dividends (less common)

Dividend Tax and Stock Types

When collecting HKEX dividends, you should also note the tax arrangements for different stock types. Blue-chip stocks, red-chip stocks, and H-shares have different tax treatments. Most Hong Kong-based companies do not withhold taxes on dividends, but some Chinese H-shares or overseas companies may withhold dividend taxes. You should review company announcements to understand any withholding tax requirements.

You can refer to tax standards in other markets, such as Taiwan’s stock transactions, which involve three main tax burdens: stock transaction fees, stock transaction tax, and dividend income tax. Taiwan’s dividend income tax has two methods—combined taxation and separate taxation—with tax rates of 8.5% (with deduction) and 28%, respectively. This information can help you compare tax burdens across markets and stock types to make better dividend collection choices.

Related Fees

Image Source: pexels

Dividend Collection Fees

When collecting HKEX stock dividends, you typically need to pay dividend collection fees. These fees are charged by brokers or Hong Kong banks, mainly for processing dividend distributions. Generally, cash dividend collection fees are 0.5% of the dividend amount, with a minimum fee of approximately USD2.6 (calculated at 1 USD ≈ 7.8 HKD, HKD20 ≈ USD2.6). For stock dividends, the collection fee is calculated per lot, typically ranging from USD0.13 to USD0.64 per lot (HKD1 to HKD5), with a minimum fee of about USD3.8 (HKD30).

Fees vary significantly depending on the broker or Hong Kong bank you choose. Most securities accounts have lower dividend collection fees than Hong Kong banks. For example, Webull Securities offers commission-free HKEX stock trading, with cash dividend collection fees at only 0.2% of the dividend amount, with a minimum of USD3.8 (HKD30); stock dividend collection fees are USD0.26 per lot (HKD2), also with a minimum fee. Choosing a securities account can often reduce these fees and improve actual returns.

Tip: Before opening an account, compare dividend collection fees across brokers and Hong Kong banks. Selecting a lower-cost platform can save significant costs in the long term.

Registration and Transfer Fees

When holding HKEX stocks, you also need to pay registration and transfer fees. These fees are primarily charged by the Central Clearing and Settlement System (CCASS). The registration and transfer fee per lot of stocks is approximately USD0.19 (HKD1.5), and the transfer fee per share certificate is about USD0.32 (HKD2.5). If you operate through a Hong Kong bank or certain brokers, additional administrative fees may apply.

Below is a summary of common registration and transfer fees:

| Item | Fee (in USD) | Notes |

|---|---|---|

| Registration Fee | Approx. USD0.19/lot | Charged by CCASS |

| Transfer Fee | Approx. USD0.32/certificate | Charged by CCASS |

| Additional Administrative Fee | Varies by broker/bank | Some platforms charge extra |

You should note that these fees directly impact your dividend returns. Frequent trading or portfolio transfers can increase cumulative registration and transfer fees, raising investment costs.

Trading and Management Fees

When trading HKEX stocks, you also need to pay various trading and management fees. These include trading commissions, stamp duty, transaction levies, custody fees, and account management fees. Each fee affects your final dividend returns.

- Trading Commissions: Some brokers, like Webull Securities, offer commission-free HKEX stock trading, but most Hong Kong banks charge trading commissions, typically 0.25% to 0.5% of the transaction amount, with a minimum fee.

- Stamp Duty: 0.13% of each transaction amount, collected by the government.

- Transaction Levy: 0.00565% of each transaction amount, collected by the SFC.

- Custody Fees: Some Hong Kong banks charge monthly custody fees, while brokers rarely do.

- Account Management Fees: Some platforms charge account management fees, depending on the account type.

You can refer to the following list to compare the main fees across platforms:

- Brokers (e.g., Webull Securities)

- Trading Commission: Commission-free

- Dividend Collection Fee: 0.2% (minimum USD3.8)

- Custody Fee: Generally waived

- Hong Kong Banks

- Trading Commission: 0.25% to 0.5% (with minimum fee)

- Dividend Collection Fee: 0.5% (minimum USD2.6)

- Custody Fee: Some banks charge monthly

Note: Choosing a broker account can often reduce trading and management fees, enhancing the actual returns of dividend investments. You should regularly review fee structures and select the platform best suited to your needs.

Cost-Saving Methods

Choosing a Securities Account

When selecting a securities account, you should first compare the fee structures of different brokers and Hong Kong banks. Most Hong Kong banks charge higher trading commissions, dividend collection fees, and custody fees. For example, Hong Kong banks typically charge trading commissions of 0.25% to 0.5% of the transaction amount, with a minimum fee of about USD2.6 (calculated at 1 USD ≈ 7.8 HKD). Dividend collection fees are usually 0.5% of the dividend amount, with a minimum of USD2.6. Some banks also charge monthly custody fees.

In contrast, some online brokers like Webull Securities offer commission-free HKEX stock trading, with dividend collection fees of only 0.2%, with a minimum of USD3.8. Custody fees are generally waived. Choosing a low-fee broker account can significantly reduce investment costs and improve actual returns.

Tip: Before opening an account, thoroughly compare the fee schedules of different platforms and select the account that best suits your investment habits and scale.

ETFs and Portfolio Diversification

You can effectively save transaction costs and diversify risks by utilizing ETFs and diversified portfolio strategies. ETFs combine the diversification of funds with the trading flexibility of stocks, with management fees generally lower than actively managed funds. For example, the Yuanta Taiwan 50 (0050) ETF has a total management fee of only 0.43%, while actively managed funds typically charge over 1%. ETFs are standardized, transparent, and easy to understand, with lower transaction taxes and management fees, and flexible asset allocation.

- ETFs use a fund structure to build diversified portfolios, reducing the frequency of single-stock trades and saving transaction costs.

- Diversified portfolio strategies via ETFs allow quick sector rotation, saving time and money, and improving investment efficiency.

- ETFs, by passively tracking indices, have lower transaction costs and taxes, making them suitable for long-term dividend investors.

Market data shows that diversified investing effectively reduces risks. When one stock underperforms, gains from other holdings can offset losses, stabilizing the overall portfolio. You can use ETFs to cover different industries, regions, and asset classes, minimizing the impact of single-stock volatility on the portfolio.

- Different investment targets complement and offset each other, reducing overall risk.

- Diversified investing balances portfolio performance and reduces volatility.

- Regularly adjust the portfolio to maintain diversification benefits.

Dividend Frequency

When selecting dividend-paying stocks, you should pay attention to the company’s dividend frequency and amount. Historical data from major Asian stock markets shows that dividend-paying companies help boost total returns, especially by providing stable cash flow during economic downturns. You can include such companies in a diversified portfolio to enhance overall returns and diversify risks.

However, dividend frequency and amount are not the only considerations. You should also evaluate the company’s fundamentals and dividend policies. Some companies pay frequent dividends but may not offer higher actual returns than those with less frequent but higher-amount dividends. You should choose a dividend combination based on your cash flow needs and investment goals.

Note: Dividend yield and amounts do not guarantee future positive returns. You should regularly review portfolio performance and flexibly adjust holdings.

Dividend vs. Capital Loss Risk

When pursuing dividends, you must be mindful of the “gaining dividends but losing capital” risk. This refers to situations where you receive dividends, but the stock price drops by more than the dividend amount, resulting in an overall investment loss. For example, a stock pays a USD0.13 dividend, but the stock price falls by USD0.26 after the ex-dividend date, leading to a net loss.

You can take the following steps to mitigate this risk:

- Choose companies with strong fundamentals and stable dividend policies.

- Avoid short-term buying just before the ex-dividend date for dividends; focus on long-term holdings.

- Use ETFs and diversified portfolios to spread losses from individual stock volatility.

You should regularly review your portfolio, adjust holdings based on market changes, and ensure dividend collection while preserving capital.

Practical Tips for HKEX Dividends

Image Source: pexels

Dividend Yield Calculation

To assess a stock’s dividend attractiveness, you can first calculate the dividend yield. The calculation is simple:

Dividend Yield = Annual Dividend per Share ÷ Current Price × 100%

For example, if a company pays an annual dividend of USD0.5 and the current price is USD10, the dividend yield is 5%. You can check past dividend records on the HKEX website or company announcements. Most broker platforms also display historical dividend data, making it easy to compare the dividend performance of HKEX stocks. You should regularly check this data to ensure your chosen stocks provide stable cash flow.

Dividend Policy

Understanding a company’s dividend policy is crucial for dividend investing. Some companies commit to fixed annual dividends, while others adjust dividends based on profits. You can find relevant policies in company annual reports or HKEX announcements. A stable dividend policy indicates healthy cash flow and management’s commitment to shareholder returns. You should prioritize such companies to reduce the risk of unstable dividends affecting your income.

Tip: Compare the dividend records of different companies and choose those with consistent or increasing dividends over the years to build long-term passive income more easily.

Dividend Portfolio Planning

To build a stable dividend portfolio, you should diversify investments across multiple HKEX dividend-paying stocks. Choose companies from different industries and scales to reduce the impact of single-stock volatility on overall returns. You should also consider fees such as dividend collection fees and trading commissions, as these affect your net returns. Using ETF portfolios can further diversify risks and save costs. Regularly reviewing portfolio performance and adjusting holdings based on market changes can help you achieve stable long-term cash flow.

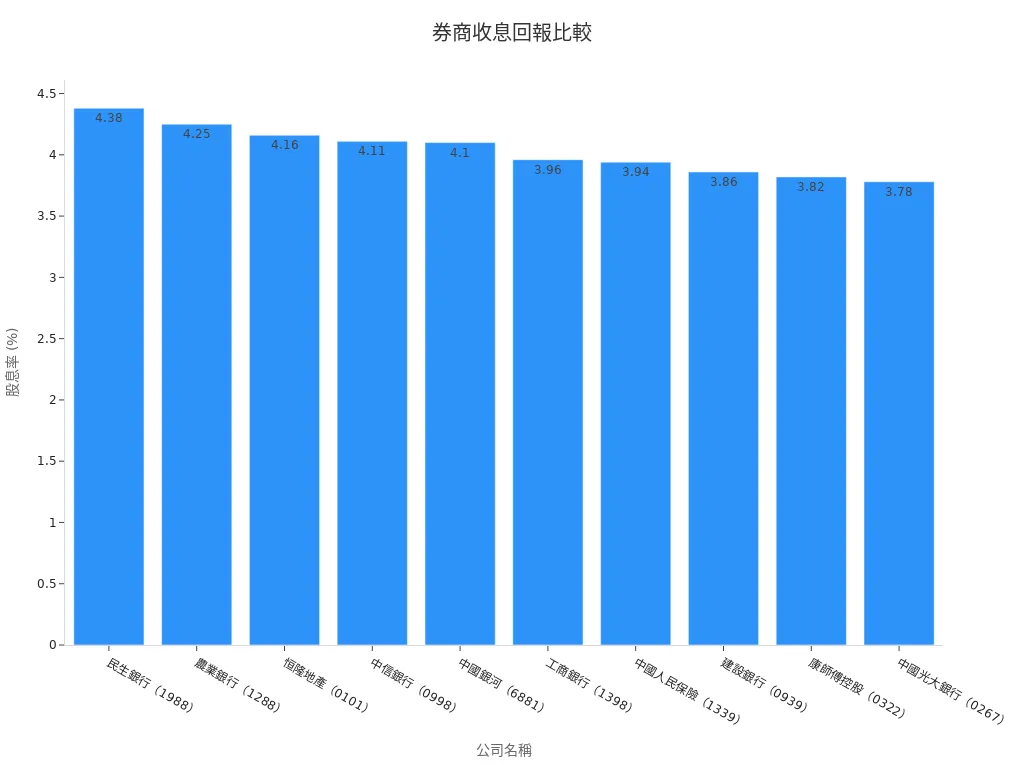

When investing in HKEX dividends, you should focus on timing, fees, and cost-saving methods. You can refer to the table below to compare dividend returns of different stocks and choose suitable brokers and accounts:

| Company Name | Dividend Yield (Return Rate) |

|---|---|

| China Minsheng Bank (1988) | 4.38% |

| Agricultural Bank of China (1288) | 4.25% |

| Hang Lung Properties (0101) | 4.16% |

| China CITIC Bank (0998) | 4.11% |

| China Galaxy Securities (6881) | 4.10% |

| Industrial and Commercial Bank of China (1398) | 3.96% |

| PICC (1339) | 3.94% |

| China Construction Bank (0939) | 3.86% |

| Tingyi (Cayman Islands) Holding (0322) | 3.82% |

| China Everbright Bank (0267) | 3.78% |

You should leverage statistical data and big data analysis to select companies with steadily growing dividends. Continuously monitor fee changes and dividend policies, flexibly adjust your dividend strategy, and enhance long-term returns.

FAQ

When should I buy stocks to receive the dividend?

You must buy the stock at least two trading days before the ex-dividend date (T-2) or earlier to qualify for the dividend.

Do HKEX stock dividends require tax payments?

Most Hong Kong-based companies do not withhold taxes on dividends. Some Chinese H-shares or overseas companies may withhold dividend taxes. You should check company announcements.

How are dividend collection fees calculated?

Brokers or Hong Kong banks typically charge 0.2% to 0.5% of the dividend amount, with a minimum of about USD2.6 to USD3.8 (calculated at 1 USD ≈ 7.8 HKD). Fees vary by platform.

What are the advantages of dividend collection with ETFs?

Using ETFs allows you to diversify risks and reduce single-stock volatility. ETFs have lower management fees and transaction costs, making them suitable for long-term dividend investing.

How do I choose a low-fee securities account?

You should compare trading commissions, dividend collection fees, and custody fees across brokers and Hong Kong banks. Choosing commission-free or low-fee platforms can enhance actual returns.

Investing in Hong Kong Stock Exchange dividend stocks, with high yields like Link REIT’s 6.6-8% and the T+2 settlement system, offers steady cash flow, but how can you minimize dividend collection fees (0.2-0.5%) and trading costs while expanding globally? BiyaPay provides an all-in-one financial platform, enabling seamless trading of US and Hong Kong stocks without offshore accounts, extending HKEX’s dividend benefits to global markets, including giants like Tencent and Alibaba.

Supporting USD, HKD, and 30+ fiat and digital currencies, real-time exchange rate tracking ensures cost transparency, while global remittances to 190+ countries feature transfer fees as low as 0.5%, with swift delivery to meet global wealth management needs. A 5.48% annualized yield savings product, with no lock-in period, balances market volatility with steady returns. Sign up for BiyaPay today to integrate HKEX’s high-yield dividend strategies with BiyaPay’s worldwide financial solutions, creating a low-cost, high-return wealth management experience!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.