- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Definition, Calculation Process, and FAQs of Hong Kong Interbank Offered Rate (HIBOR)

Image Source: pexels

The Hong Kong Interbank Offered Rate refers to the interest rate used for short-term borrowing among Hong Kong banks, directly reflecting the market’s supply and demand for funds. The Hong Kong Bankers Association calculates and publishes the latest HIBOR levels daily based on quotes from multiple banks.

In Hong Kong, over 54.5% of newly approved mortgage loans use the Hong Kong Interbank Offered Rate as a pricing reference, indicating its profound impact on mortgages and loan products. The residential mortgage loan market is approximately USD 87.7 billion (based on 1 USD = 7.8 HKD), making it the largest component of the banking loan structure.

Changes in the Hong Kong Interbank Offered Rate not only affect mortgage rates but also influence the cost of other financial products.

Key Points

- The Hong Kong Interbank Offered Rate (HIBOR) is the interest rate for short-term borrowing among Hong Kong banks, reflecting market supply and demand for funds, calculated and published daily by the Hong Kong Bankers Association based on quotes from 20 banks.

- The calculation method for HIBOR is rigorous, excluding the highest and lowest quotes and taking the average of the middle 14 quotes to ensure the rate is stable and representative.

- HIBOR directly affects Hong Kong mortgage loan rates; when HIBOR rises, borrowers face increased repayment pressure; conversely, interest burdens decrease, and banks also set cap rates to protect borrowers.

- HIBOR not only impacts mortgages but also affects the interest rates and returns of other financial products; investors should closely monitor its trends to adjust their financial strategies.

- HIBOR differs from other rates such as Prime Rate § and LIBOR; HIBOR better reflects Hong Kong’s local funding conditions, with greater rate volatility, suitable for borrowers willing to tolerate interest rate fluctuations.

What is the Hong Kong Interbank Offered Rate

Basic Definition

The Hong Kong Interbank Offered Rate refers to the interest rate used by Hong Kong banks for short-term interbank lending. This rate is determined by the Hong Kong Bankers Association. Every morning at 11 a.m., the Bankers Association collects quotes from 20 reference banks. These banks are selected based on their reputation, business scale, and credit ratings. The Bankers Association excludes the highest and lowest quotes, then selects 14 middle values and calculates their average as the day’s Hong Kong Interbank Offered Rate. This rate covers deposit terms ranging from 1 to 12 months.

The Hong Kong Interbank Offered Rate reflects the supply and demand for funds among banks. When market funds are tight, HIBOR rises; when funds are abundant, HIBOR falls.

- The Hong Kong Interbank Offered Rate (HIBOR) is the interest rate for interbank lending in Hong Kong.

- It is determined by the Hong Kong Bankers Association based on quotes from 20 reference banks, set at 11 a.m. each business day.

- The calculation method involves selecting 14 median values from the 20 bank quotes and averaging them.

- HIBOR covers Hong Kong dollar deposit terms ranging from 1 to 12 months.

Market Role

The Hong Kong Interbank Offered Rate plays a significant role in Hong Kong’s financial system. It not only reflects market liquidity but also affects funding costs. When the overnight HIBOR rose to 2.1% and the one-month HIBOR rebounded to 2.866%, short-term financing costs showed significant fluctuations. These changes directly affect fund allocation and loan rates among banks.

The People’s Bank of China issued USD 60 billion in offshore central bank bills in Hong Kong, with the market response being positive and oversubscribed by 1.16 times. Before the issuance, short-term RMB implied yields and CNH HIBOR overnight rates surged to high levels, then fell back during the issuance, indicating a close relationship between HIBOR and market sentiment and funding costs.

In the market, 20 reference banks provide different HIBOR quotes based on their funding conditions. These quotes reflect each bank’s strength and needs. The Bankers Association ensures fairness and representativeness of HIBOR by excluding extreme values. Three mainstream HIBOR rates exist in the Hong Kong market, set by HSBC, Hang Seng, and the Bankers Association, showing differences in pricing strategies among banks.

Changes in the offshore RMB Interbank Offered Rate (CNH HIBOR) are often used as an indicator of RMB exchange rate expectations and whether the People’s Bank of China is intervening. When the RMB depreciates, CNH HIBOR rates rise, reflecting increased short-selling costs, showing a close relationship between HIBOR rates and exchange rate expectations.

HIBOR Calculation

Image Source: pexels

Quotation Process

The Hong Kong Bankers Association invites 20 reference banks to provide the latest HIBOR quotes daily. The selection criteria for these reference banks include reputation, business scale in the Hong Kong dollar market, and credit ratings. Each bank submits quotes by 11 a.m. each business day based on its funding conditions and market expectations. These quotes cover multiple borrowing terms, such as 1 month, 3 months, 6 months, and 12 months. Rates for different terms vary depending on market fund demand and supply.

The quotation process for the Hong Kong Interbank Offered Rate ensures that the rate reflects the true market situation and provides a reliable pricing benchmark for financial products such as mortgages and loans.

While the Hong Kong Bankers Association discloses the number of reference banks, selection criteria, and calculation methods, it does not publish detailed statistical data on the weighting of each bank’s data or the distribution of quotes in the HIBOR calculation. This helps maintain market fairness and prevents individual banks from exerting excessive influence on the final rate.

Calculation Method

The calculation method for HIBOR is highly rigorous, aimed at excluding extreme quotes to ensure the rate is representative and stable. The calculation steps are as follows:

- Collect quotes from 20 reference banks.

- Exclude the three highest and three lowest quotes.

- Select the median values from the remaining 14 quotes.

- Calculate the average of these 14 median values as the day’s HIBOR rate.

This process is coordinated and executed by the Hong Kong Bankers Association, with the latest results published daily around 11 a.m.

For example, suppose 20 banks submit quotes of 1.80%, 1.85%, 1.90%, 1.92%, 1.95%, 1.97%, 2.00%, 2.01%, 2.03%, 2.05%, 2.07%, 2.09%, 2.10%, 2.12%, 2.15%, 2.17%, 2.20%, 2.22%, 2.25%, 2.30%. The Bankers Association would exclude the highest quotes (2.30%, 2.25%, 2.22%) and the lowest quotes (1.80%, 1.85%, 1.90%), then average the remaining 14 quotes to obtain the final HIBOR rate.

HIBOR covers multiple borrowing terms, commonly overnight, 1 month, 3 months, 6 months, and 12 months. Rates for each term vary based on market liquidity and demand. These rates serve as key reference indicators for various loan products in the Hong Kong financial market, such as mortgages and corporate loans.

Applications and Impact

Mortgage Rates

The Hong Kong Interbank Offered Rate plays a significant role in Hong Kong’s mortgage market. HIBOR-based mortgages (H mortgages) calculate rates as “HIBOR + bank spread,” for example, “H+1.3%.” Banks adjust mortgage rates based on daily HIBOR data. When HIBOR rises, H mortgage rates increase, and borrowers’ monthly repayment amounts rise. Conversely, when HIBOR falls, repayment pressure decreases. To protect borrowers, banks typically set a cap rate to limit the maximum H mortgage rate.

For example, when the U.S. cuts interest rates, HIBOR falls, leading to lower H mortgage rates, allowing borrowers to enjoy lower interest costs. The Hong Kong Bankers Association and major bank websites (such as HSBC and Hang Seng) provide the latest HIBOR and H mortgage rate data for public access.

HIBOR fluctuations directly impact mortgage loan rates. When market funds are tight, HIBOR rises, increasing borrowers’ interest costs. When funds are abundant, HIBOR falls, reducing interest expenses. These changes require borrowers to closely monitor market trends and make informed financial decisions.

Other Financial Products

The Hong Kong Interbank Offered Rate not only affects mortgage products but also influences the interest rates and returns of other financial products.

- The overnight HIBOR rate once approached zero, with the spread over the U.S. SOFR rate widening to over 350 basis points, driving changes in Hong Kong dollar liquidity.

- The widened spread triggered arbitrage trading, including USD/HKD arbitrage and forex swaps, affecting market fund flows.

- When Hong Kong dollar liquidity is abundant, the Hong Kong Monetary Authority buys USD and sells HKD, leading to record-high banking system balances, further impacting HIBOR levels.

- Interest rate changes affect financial product prices; for example, when short-term deposit rates fall, investors shift to high-yield stocks or ETFs for higher returns.

- Chinese bank stocks, due to their stable fundamentals, low valuations, and consistent dividends, attract large insurance companies and long-term funds, reflecting the close relationship between HIBOR changes and financial product investment demand.

Changes in HIBOR cause fluctuations in the interest rates and returns of various financial products. Investors and borrowers should closely monitor HIBOR trends and flexibly adjust asset allocation and borrowing strategies.

HIBOR vs. Other Rates

Image Source: pexels

Comparison with Prime Rate §

The Hong Kong banking market commonly offers two mortgage rate schemes: HIBOR-based mortgages (H mortgages) and Prime Rate-based mortgages (P mortgages). H mortgages are based on daily HIBOR rates with a fixed bank spread. P mortgages are based on the bank’s self-determined Prime Rate, which is generally more stable.

H mortgage rates are more volatile; when market funds are tight, HIBOR can surge, increasing borrowers’ interest costs. P mortgages are more influenced by bank policies and adjusted less frequently.

The main differences between the two are as follows:

| Comparison Item | H Mortgage (HIBOR-based) | P Mortgage (Prime Rate-based) |

|---|---|---|

| Pricing Basis | HIBOR + Spread | Prime Rate § - Discount |

| Rate Volatility | High, varies with market | Low, more stable |

| Adjustment Frequency | Daily | Irregular |

| Market Sensitivity | High | Low |

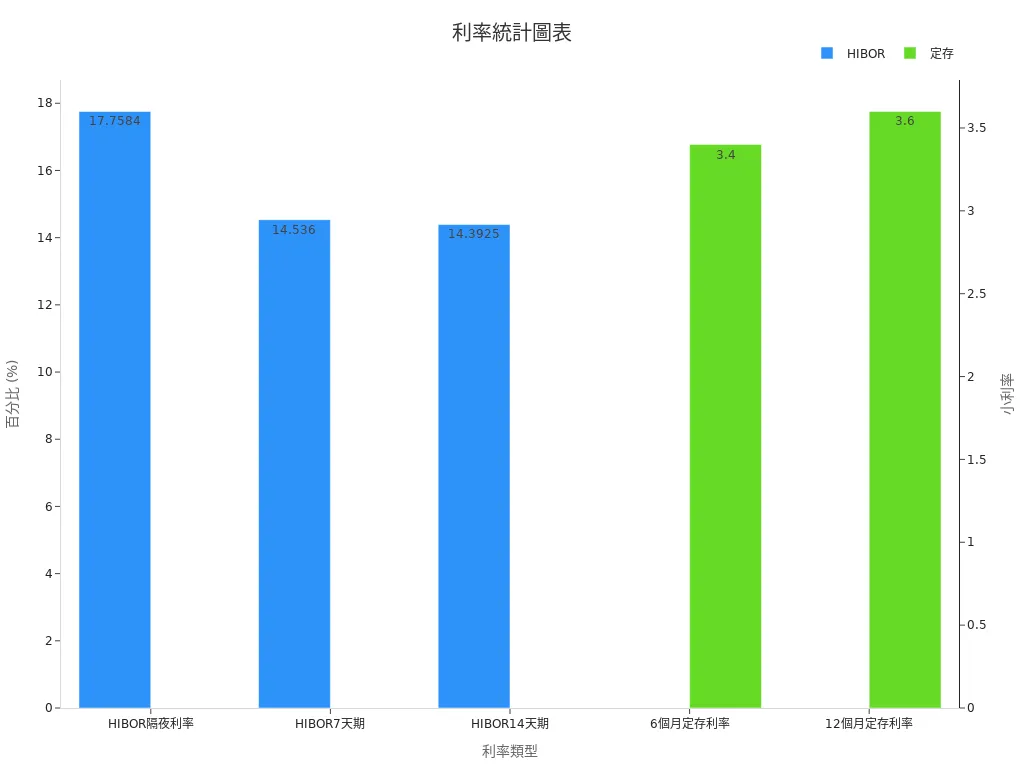

In early 2017, the overnight HIBOR rate surged to 17.7584%, with 7-day and 14-day rates reaching 14.5360% and 14.3925%, respectively, far exceeding the 6-month and 12-month deposit rates (3.4% and 3.6%, respectively). This reflects HIBOR’s high sensitivity to market liquidity changes, with volatility far exceeding that of P mortgages.

RMB deposit rates in Hong Kong range from approximately 2.5% to 3%, while HKD deposit rates are generally below 1%. Some RMB loan rates can exceed 6%, indicating that different rate products are significantly influenced by market liquidity and risk factors.

Comparison with LIBOR

HIBOR and LIBOR are both interbank lending rates, but they have clear differences. HIBOR is managed by the Hong Kong Bankers Association, calculated daily based on quotes from 20 reference banks, excluding the three highest and three lowest quotes and averaging the middle 14. LIBOR is managed by the ICE Benchmark Administration, based on quotes from multiple global major banks, with a similar calculation method but a broader range of participating banks and markets.

HIBOR primarily reflects Hong Kong’s market supply and demand, while LIBOR reflects funding costs in major global financial centers. Although both serve as short-term funding cost indicators, HIBOR is more sensitive to local market liquidity changes.

In early 2017, the overnight HIBOR rate surged significantly, showing much higher volatility than deposit rates at the time. This phenomenon is less common in the LIBOR market, as LIBOR is influenced by global fund flows and has relatively smaller fluctuations.

Although the calculation methods for HIBOR and LIBOR are similar, HIBOR more immediately reflects tight funding conditions in Hong Kong, serving as a key reference for local financial product pricing.

The Hong Kong Interbank Offered Rate directly affects the financial choices of Hong Kong residents. Understanding HIBOR helps in selecting suitable financial products and managing interest rate risks.

Market analysts often use time series models, regression models, and deep learning methods to predict interest rate trends, combining visualization tools and risk assessments to help the public grasp market trends.

Regularly checking HIBOR data enables investors and borrowers to make more informed financial decisions.

FAQ

Does HIBOR change daily?

The Hong Kong Bankers Association publishes the latest HIBOR at 11 a.m. daily. Rates fluctuate based on market fund supply and demand. Investors and borrowers should regularly check the latest data.

Is HIBOR related to U.S. dollar rates?

HIBOR primarily reflects Hong Kong’s market funding costs. Changes in U.S. dollar rates affect fund flows, indirectly impacting HIBOR. For example, when U.S. rates rise, HIBOR may also increase.

How can borrowers check the latest HIBOR?

Borrowers can visit the websites of the Hong Kong Bankers Association, HSBC, or Hang Seng Bank. These websites update HIBOR data daily for public access.

How does a rise in HIBOR affect mortgages?

When HIBOR rises, H mortgage rates increase. Borrowers’ monthly repayment amounts rise. Banks typically set a cap rate to protect borrowers’ interests.

Who is HIBOR suitable for?

HIBOR is suitable for borrowers willing to tolerate interest rate fluctuations. When market funds are abundant, HIBOR is lower, allowing borrowers to enjoy lower interest costs. However, when rates rise, repayment pressure increases.

HIBOR fluctuations impact mortgage and investment decisions, but constant monitoring and cost comparisons can overwhelm users. BiyaPay offers a streamlined solution with transfer fees as low as 0.5% and real-time exchange rate queries, enabling effortless tracking of funding costs without tedious HIBOR checks. Supporting multiple fiat and digital currency conversions with rapid registration, its 5.48% annualized yield wealth product provides flexible withdrawals for mortgage payments or investments.

Regulated internationally, it ensures secure transactions. Visit BiyaPay now to simplify your financial strategy and confidently navigate HIBOR volatility!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.