- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Comprehensive Analysis of Shanghai Composite Index Trading Rules and Hours

Image Source: pexels

Do you want to know when you can buy and sell the “Shanghai Composite Index”? You can participate in the call auction from 9:15 to 9:25 AM on trading days in the Chinese stock market, and in continuous trading from 9:30 to 11:30 AM and 1:00 to 3:00 PM. Mastering these time periods can help you plan your trading strategies more effectively and reduce the chance of missing buying or selling opportunities.

Key Points

- The Shanghai Composite Index trading is divided into three periods: call auction, continuous trading, and closing call auction. Mastering these times can help you effectively plan your buying and selling strategies.

- Trading Shanghai Composite Index constituent stocks must comply with the T+1 system and place orders in whole lots (100 shares) to avoid losses due to operational errors.

- The daily stock price fluctuation limit is generally ±10%, with some stocks at ±5%, which helps control price volatility. You need to closely monitor the limit range during investment.

- Trading involves multiple fees, including transaction commissions, stamp duty, and transfer fees. Understanding the fee rates in advance helps you accurately calculate investment costs.

- Suspensions, resumptions, and new stock listings can affect market capital flow and sentiment. Regularly reviewing company announcements can help you stay updated and adjust your investment strategy.

Shanghai Composite Index Trading Hours

Image Source: pexels

Call Auction

You can participate in the Shanghai Composite Index call auction from 9:15 to 9:25 AM daily. This period is the pre-opening matching phase. You can submit, modify, or cancel buy and sell orders during this time. After 9:20, you can only cancel orders, not place new ones or modify existing ones. At 9:25, the system matches all valid orders to determine the opening price.

The transaction price for the call auction follows clear principles:

- The transaction price is determined based on the principle of maximizing trading volume.

- Buy orders above the determined price and sell orders below the determined price must all be executed.

- At least one side of the buy or sell orders at the determined price must be fully executed.

- If multiple price levels meet the above principles, the price closest to the previous trading day’s closing price is selected.

You can view trading volume and price fluctuations during the call auction from the exchange’s published statistics. For example, the exchange discloses unexecuted buy and sell orders for the top five price levels and transaction price and volume. These data help you analyze market sentiment and price trends. In the call auction example, if a security trades 185 lots at USD 106.00, these data can help you gauge market dynamics at the opening.

Tip: Price fluctuations during the call auction period can be significant, so it’s advisable to place orders cautiously based on historical data and real-time market conditions.

Continuous Trading

Continuous trading occurs from 9:30 to 11:30 AM and 1:00 to 2:57 PM. This is the main trading period for the Shanghai Composite Index. You can submit, modify, or cancel buy and sell orders at any time during this period. The system matches transactions in real-time based on price priority and time priority principles.

During the continuous trading period, market liquidity is high, and trading volume is significant. You can flexibly adjust your trading strategy based on real-time market conditions. Note that after 2:57 PM, the system suspends continuous trading and enters the closing call auction phase.

Note: During the continuous trading period, some stocks may be temporarily suspended due to abnormal fluctuations. Please closely monitor exchange announcements.

Closing Call Auction

The closing call auction period is from 2:57 to 3:00 PM. This phase is primarily used to determine the day’s closing price. You can submit or cancel buy and sell orders between 2:57 and 3:00 PM but cannot modify existing orders. At 3:00 PM, the system matches transactions based on call auction principles to generate the closing price.

The transaction price for the closing call auction also follows the principle of maximizing trading volume. You can refer to the exchange’s published transaction price and volume and unexecuted top five price levels to analyze market sentiment during the closing period. These data are valuable for predicting the next day’s opening trends.

Tip: Large orders are common during the closing call auction period, so it’s advisable to plan your order timing based on market conditions.

Trading Days and Holidays

Regular Trading Days

You can participate in trading on the Shanghai Composite Index’s regular trading days. The Chinese stock market is generally open from Monday to Friday, except on statutory holidays. During regular trading days, market trading volume reflects overall activity. You can pay attention to the following points:

- When trading volume is high, both buyers and sellers are active, capital flow is sufficient, and stock price fluctuations are noticeable.

- When trading volume is low, the market is less active, liquidity risk increases, and trades are harder to execute.

- When the average daily trading volume (e.g., 60-day average) is too low, the stock is considered unpopular, and you should be cautious when investing.

- Rising prices with increasing volume indicate a vibrant market, attracting more buyers.

- Falling prices with shrinking volume suggest insufficient buying interest and a weakening trend.

- Price-volume divergence (e.g., rising prices with shrinking volume) may signal an impending market trend reversal.

Tip: You can combine trading volume and price trends to gauge market sentiment and adjust your trading strategy.

Holiday Arrangements

The Chinese stock market closes annually based on statutory holidays. Common holidays include New Year’s Day, Spring Festival, Qingming Festival, Labor Day, Dragon Boat Festival, Mid-Autumn Festival, and National Day. Trading volume and market sentiment fluctuate significantly before and after holidays. You can refer to the table below to understand the impact of holidays on market trading volume:

| Time Point | Total Trading Volume of Shanghai and Shenzhen Markets (USD Billion) | Comparison with Previous Trading Day (USD Billion) | Remarks |

|---|---|---|---|

| 20 Minutes After Opening | Over 10,000 | Increase of Over 2,400 | Sets record for fastest trillion-dollar trading volume |

| 42 Minutes After Opening | Over 20,000 | N/A | Trading volume continues to climb |

| After Afternoon Opening | Around 30,000 | N/A | Reaches new high |

During holidays, the Hong Kong market remains open. You will notice that on October 8, after the market reopened, the Hang Seng Index and Hang Seng Tech Index experienced significant fluctuations, reflecting the impact of holiday arrangements on different markets.

Trading Day Adjustments

Each year, the Chinese stock exchange adjusts trading days based on actual conditions. For example, during long weekends or special circumstances, the market may close earlier or later. You should regularly check exchange announcements to ensure you don’t miss important trading days. In case of unexpected events (e.g., weather disasters or policy changes), the exchange may also temporarily adjust opening or closing arrangements.

Note: When planning investments, remember to allocate sufficient time to avoid disruptions due to holidays or temporary adjustments.

Shanghai Composite Index Trading Rules

Image Source: pexels

T+1 System

When trading Shanghai Composite Index constituent stocks, you must comply with the T+1 system. This means that stocks bought today can only be sold on the next trading day (T+1 day) at the earliest. You cannot complete both buying and selling on the same day. This system helps stabilize market order and reduce excessive speculation.

You can cancel an order before it is executed. Once the order is executed, it cannot be canceled. Please carefully check the price and quantity when placing orders to avoid losses due to operational errors.

Tip: You can use the T+1 system to plan capital flow in advance, avoiding missed investment opportunities due to delayed fund availability.

Trading Units

When trading Shanghai Composite Index constituent stocks, you must place orders in “lots,” with each lot equaling 100 shares. You can only place orders in whole lots, not fractional shares. For example, if you want to buy 300 shares, you must place an order for 3 lots.

When placing an order, the system automatically checks if the quantity meets the requirements. If the quantity is not a multiple of 100, the system will prompt an error. You can check available funds and holdings in the trading software to plan your order strategy.

Note: Some securities firms or Hong Kong banks may charge different fees based on your order size, so please check the relevant fee rates in advance.

Price Fluctuation Limits

When participating in Shanghai Composite Index constituent stock trading, you must comply with price fluctuation limits. Most stocks have a daily price fluctuation limit of ±10% of the previous trading day’s closing price. Certain stocks (e.g., ST stocks) have a limit of ±5%. This system helps prevent abnormal price fluctuations and protect investors’ interests.

Price fluctuation limits impact the market and investment risks as follows:

- Stock prices may lag in reflecting market information, affecting your assessment of investment performance.

- Market liquidity decreases, making it harder to sell holdings smoothly in extreme market conditions, increasing realization risks.

- Price fluctuation limits reduce systemic risks, particularly in textile and electronics stocks.

- Trading volume and turnover rate fluctuations increase, with trading activity potentially more intense on limit days and the following day.

- The impact of price fluctuation limits on price volatility and risk varies across industries and during special periods (e.g., major events).

- The price discovery process may be disrupted, with price fluctuations potentially spilling over, further affecting market liquidity and investment risks.

When placing orders, the system automatically checks if the price exceeds the fluctuation range. If it does, the order cannot be submitted. You can flexibly adjust your buying and selling strategies based on the daily fluctuation limits.

Tip: You should closely monitor major news and market sentiment to avoid blindly chasing highs or selling lows at the fluctuation limit boundaries.

Fee Structure

When trading Shanghai Composite Index constituent stocks, you need to pay multiple fees, including:

| Fee Type | Description | Fee Standard (in USD) |

|---|---|---|

| Transaction Commission | Service fee charged by securities firms or Hong Kong banks | Generally 0.03%-0.1% of the transaction amount |

| Stamp Duty | Tax levied by the government | 0.1% of the transaction amount |

| Transfer Fee | Transfer handling fee charged by the clearing company | Approximately 0.06 USD per 1,000 shares |

| Other Fees | May include platform fees, transfer fees, etc. | Varies by securities firm or bank |

Before placing orders, you should check the latest fee rates of the securities firm or Hong Kong bank. Fee structures may vary across platforms. You can use trading software to automatically calculate estimated fees, helping you precisely control investment costs.

Note: When calculating investment returns, you must account for all fees to avoid underestimating actual costs.

Special Situations and Notes

Suspensions and Resumptions

When trading Shanghai Composite Index constituent stocks, you will often encounter suspensions and resumptions. Suspensions typically occur due to major disclosures by companies, such as asset restructuring, additional share issuance, or other significant decisions. Resumptions indicate that the company has completed the relevant disclosures, and the stock resumes trading.

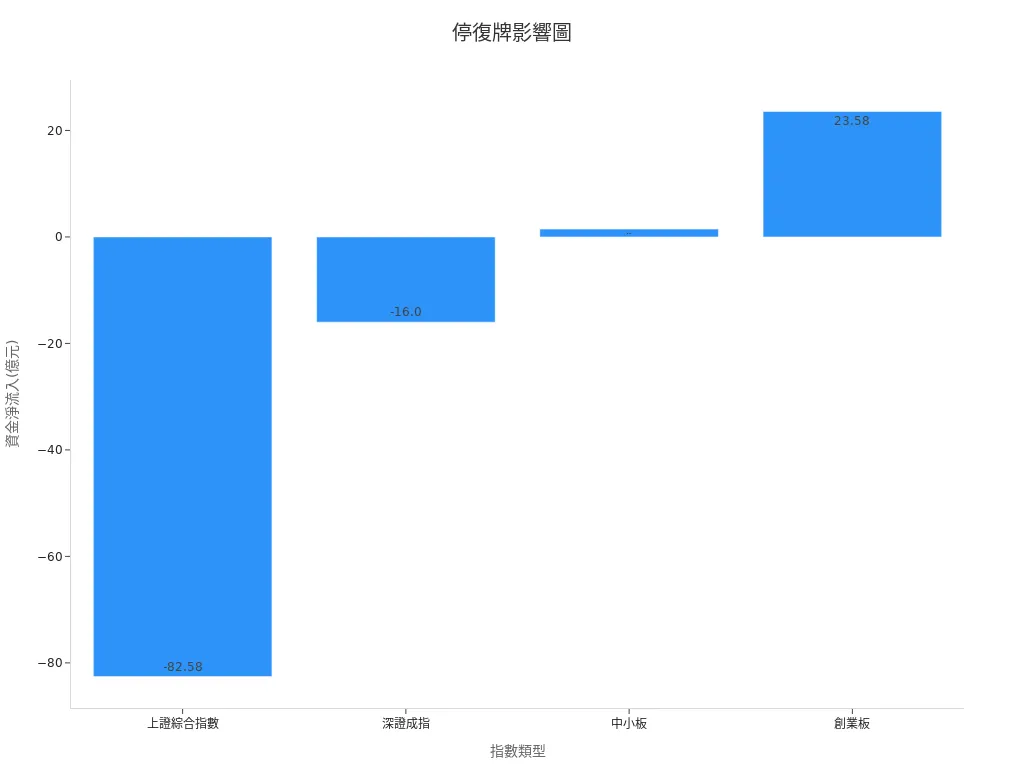

Suspensions and resumptions significantly affect market capital flow and investor sentiment. Historical data shows fluctuations in market capital flow during suspensions, with some stocks even hitting the daily limit upon resumption. You can refer to the table below to understand market capital changes during suspensions and resumptions:

| Index | Total Transaction Amount (USD Billion) | Inflow Transactions (USD Billion) | Outflow Transactions (USD Billion) | Net Capital Inflow (USD Billion) | Net Inflow Proportion |

|---|---|---|---|---|---|

| Shanghai Composite Index | 3928.83 | 1843.60 | 1926.18 | -82.58 | -2.10% |

| Shenzhen Component Index | 476.92 | 219.09 | 235.09 | -16.00 | -3.36% |

| SME Board | 713.57 | 343.05 | 341.58 | 1.47 | 0.21% |

| ChiNext | 392.04 | 198.25 | 174.66 | 23.58 | 6.02% |

You will notice that frequent suspensions and resumptions occur during heightened regulation, increasing market volatility. Several cultural and media companies, such as Huawen Media, 365 Net, and Beidou Communication, have been suspended due to major asset restructuring. When Huawen Media was suspended in 2014, it announced the acquisition target and resumption commitment, with the suspension not exceeding 3 months and no major restructuring planned within 6 months after resumption. These cases show that suspensions and resumptions directly affect your trading plans and market atmosphere.

New Stock Listings

When focusing on new stock listings, you can observe that market reactions are usually very positive. For example, Omada Health successfully went public in June 2025, with an IPO price of USD 19 per share, reaching a high of USD 23 on the first trading day and closing 21% above the IPO price. This performance indicates increased market confidence and high investor enthusiasm during new stock listings.

Due to relatively relaxed listing conditions, the Hong Kong stock market attracts many A-share companies for IPOs. In 2025, approximately 30 A-share companies are expected to list in Hong Kong. The Hang Seng Tech Index has risen 94.93% since its low in February 2024, and the Hang Seng Index has risen over 51%. These data show that new stock listings can boost overall market activity, providing you with more investment opportunities.

Announcement Review

When trading Shanghai Composite Index-related stocks, you should develop a habit of regularly reviewing company announcements. Companies disclose important information such as suspensions, resumptions, new stock listings, and major asset restructurings in announcements. You can check the latest announcements through the exchange’s official website, securities firm platforms, or Hong Kong bank investment services.

Tip: Timely access to announcement content helps you predict market trends, adjust investment strategies, and reduce risks due to delayed information.

To master the Shanghai Composite Index’s trading hours and rules, you can effectively reduce losses due to unclear regulations. You should regularly review official announcements to stay updated with the latest information. Before actual trading, familiarize yourself with every detail to enhance your judgment. Continuous learning and attention to market changes will help improve your investment success rate.

FAQ

What currency can be used to trade the Shanghai Composite Index?

You must use RMB to trade Shanghai Composite Index constituent stocks. If you trade through a Hong Kong bank, you need to convert USD to RMB at the bank’s daily exchange rate.

Under the T+1 system, when can I sell stocks bought on the same day?

Stocks bought on the same day can only be sold on the next trading day at the earliest. You cannot complete both buying and selling on the same day.

Is there a minimum trading unit for Shanghai Composite Index constituent stocks?

You must place orders in “lots,” with each lot equaling 100 shares. You cannot trade fractional shares, and the system automatically checks order quantities.

If a stock is suspended, will my funds be frozen?

When a stock you hold is suspended, your funds are temporarily locked. You cannot sell the stock until it resumes trading.

How can I check the latest trading days or holiday arrangements?

You can log into the Shanghai Stock Exchange’s official website or check the latest announcements through Hong Kong bank investment platforms to stay informed about trading days and holiday information.

Shanghai Index trading hours and T+1 rules offer a stable framework, but exchange rate fluctuations and announcement monitoring pose challenges. BiyaPay simplifies your approach, enabling US and Hong Kong stock investments without extra overseas accounts—start now at BiyaPay! With transfer fees as low as 0.5% and coverage across 190+ countries, it meets global funding needs. Real-time exchange rate queries streamline USD-RMB tracking, easing Shanghai Index quote monitoring.

Its 5.48% annualized yield wealth product offers flexible withdrawals to navigate suspensions and auction volatility. Regulated internationally, it ensures secure transactions. Visit BiyaPay today to enhance your investment strategy!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.