- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Real-World Testing and Risk Assessment of Interest Income from Large-Scale HKD Fixed Deposits

Image Source: pexels

Currently, some Hong Kong banks offer up to 4% annual interest rates for large-scale HKD fixed deposits. For example, HSBC Bank offers the following preferential rates for a 3-month fixed deposit of new funds for Premier and One Account clients:

| Currency | Term | Annual Interest Rate (Max Preferential Rate) | Minimum Deposit Amount | Maximum Deposit Limit |

|---|---|---|---|---|

| HKD | 3 months | 4% | HK$100,000 | HK$5,000,000 |

With HK$1,000,000, the actual interest income for 3 months is approximately HK$10,000. Different banks, deposit amounts, and terms affect rates and returns. The calculation method for fixed deposit interest is simple, and investors should make choices based on their financial planning.

Key Points

- Multiple Hong Kong banks offer up to 4% annual interest rates for large-scale HKD fixed deposits, with interest income varying by deposit amount and term.

- Fixed deposit interest calculation is straightforward, using the formula: principal × annual rate × deposit days ÷ 365; bank websites often provide calculators for ease of use.

- Investors should note interest rate fluctuations and liquidity restrictions; early withdrawal may result in loss of interest, so choose terms and products based on personal needs.

- Bank reputation and deposit protection schemes ensure fund safety; diversifying funds across multiple banks is recommended to reduce risk.

- When selecting fixed deposit products, compare rates, deposit thresholds, early withdrawal terms, and tax obligations to develop a suitable financial strategy.

Highest Rates and Interest

Image Source: unsplash

Latest Market Rates

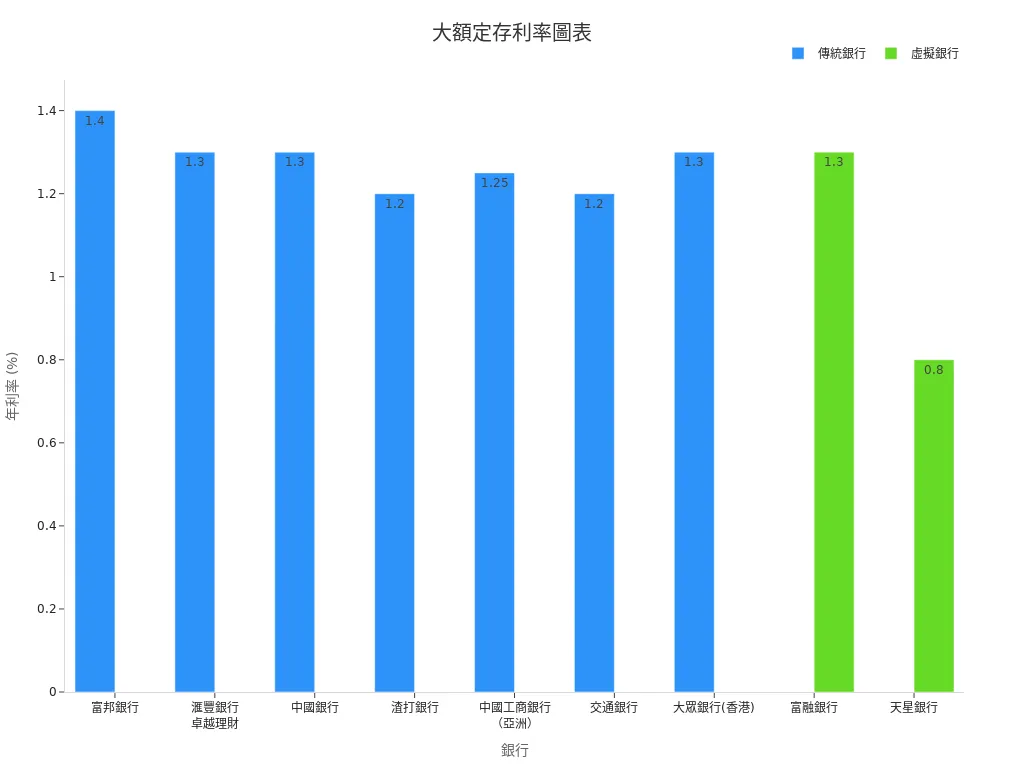

To attract large-scale funds, multiple Hong Kong banks offer various HKD fixed deposit promotions. Based on the latest market information, some banks’ annual interest rates are as follows:

- A certain Chinese commercial bank offers an annual interest rate for large-scale HKD fixed deposits as high as 3%.

- The Hong Kong branch of a major Chinese bank offers over 1.2% for one-year large-scale deposits.

- Virtual banks and some foreign banks periodically offer short-term fixed deposit promotions with rates of 3.6% or higher.

- The above data mainly comes from Hong Kong bank rate promotions and official rate tables, with some data dated May 2, 2018; actual rates should be based on the latest bank announcements.

Investors should closely monitor the latest fixed deposit promotions from banks, as rates adjust with market conditions and fund flows.

Interest Income from Large-Scale Deposits

With HK$1,000,000 as principal, investors can calculate actual interest income based on different banks and rates. Annualized return standardizes investment returns to a one-year rate, facilitating comparison across bank products. For example, if a bank offers a 3% annual rate, HK$1,000,000 yields HK$30,000 in interest after one year; at 1.2%, the annual interest is HK$12,000. For a 3-month fixed deposit at 3%, the interest is approximately HK$7,500.

| Bank Type | Annual Rate (%) | 1-Year Interest for HK$1,000,000 (HKD) | 3-Month Interest for HK$1,000,000 (HKD) |

|---|---|---|---|

| Chinese Commercial Bank | 3.0 | 30,000 | 7,500 |

| Hong Kong Branch of Major Chinese Bank | 1.2 | 12,000 | 3,000 |

| Virtual/Foreign Bank | 3.6 | 36,000 | 9,000 |

The fixed deposit interest calculation method is: principal × annual rate × (deposit days ÷ 365). Some banks also provide online fixed deposit interest calculators to help investors quickly estimate interest income for different amounts and terms.

Different banks, deposit amounts, and terms affect final interest income. Some banks offer higher rates for new funds or specific clients, and investors should choose products based on their financial planning and liquidity needs.

Rate Comparison

Bank Rate Differences

To attract large-scale funds, multiple Hong Kong banks offer varying HKD fixed deposit rates. Traditional banks like HSBC and Hang Seng typically provide stable annual rates between 2% and 3%. Virtual banks like ZA Bank and Livi Bank periodically offer short-term fixed deposit promotions with rates of 3.6% or higher. Rate differences among banks are mainly influenced by funding sources, promotional strategies, and market competition. Investors can select the most suitable bank and product based on their needs.

The table below compares large-scale fixed deposit rates, minimum deposit thresholds, and main terms across multiple banks (calculated at 1 USD ≈ 7.8 HKD):

| Bank Name | Annual Rate (%) | Minimum Deposit Amount (USD) | Main Fixed Deposit Terms |

|---|---|---|---|

| HSBC | 4.0 | 12,820 | 3 months |

| Hang Seng | 3.0 | 12,820 | 6 months |

| ZA Bank | 3.6 | 12,820 | 3 months |

| KGI Bank | 3.0 | 12,820 | 3 months |

| Chinese Commercial Bank | 3.0 | 12,820 | 12 months |

Some banks offer additional preferential rates for new funds. For example, KGI Bank’s official announcement states that a 3-month USD high-yield fixed deposit plan offers a 5% annual rate, and a 6-month plan offers 4.2%, with flexible application methods, meeting diverse client needs.

Deposit Thresholds and Terms

Banks generally have similar minimum thresholds for large-scale fixed deposits, typically around USD 12,820 (approximately HK$100,000). Deposit term options are diverse, commonly including 3 months, 6 months, and 12 months. Some banks offer higher rates or flexible terms for new funds or specific clients. Investors should choose deposit terms and amounts based on their liquidity needs. Banks also periodically adjust promotions, so it’s recommended to regularly check official announcements for the latest rates and offers.

Fixed Deposit Interest Calculation

Calculation Method

Fixed deposit interest calculation is a fundamental financial concept. Hong Kong banks generally use a simple interest formula:

Principal × Annual Rate × (Deposit Days ÷ 365).

For example, with HK$1,000,000, assuming an exchange rate of 1 USD ≈ 7.8 HKD, the principal is approximately USD 128,205. Investors can calculate fixed deposit interest income by inputting the principal, annual rate, and deposit days into the formula. This method applies to most fixed deposit products offered by Hong Kong banks.

Some bank websites provide online fixed deposit interest calculators, where users input the amount, rate, and term to instantly obtain estimated interest, facilitating product comparisons.

Interest Income Examples

Using USD 128,205 (approximately HK$1,000,000) as an example, the following table shows fixed deposit interest calculations for different annual rates and terms:

| Annual Rate (%) | Term | Interest Income (USD) |

|---|---|---|

| 3.0 | 3 months | 960 |

| 3.0 | 6 months | 1,920 |

| 3.0 | 12 months | 3,846 |

| 4.0 | 3 months | 1,282 |

| 4.0 | 6 months | 2,564 |

| 4.0 | 12 months | 5,128 |

Investors can flexibly choose deposit terms and rates based on their financial planning. Fixed deposit interest calculations help predict future cash flows and improve financial efficiency. It’s recommended to use banks’ online fixed deposit interest calculators before selecting products to ensure returns meet expectations.

Risk Assessment

Image Source: pexels

Interest Rate Fluctuations

Interest rates for large-scale HKD fixed deposits vary with market conditions, fund flows, and bank policies. When market rates rise, existing fixed deposits may become less attractive, causing investors to miss higher return opportunities. Conversely, if market rates fall, fixed deposits locked at higher rates offer an advantage.

Banks typically adjust fixed deposit rates based on the U.S. federal funds rate, Hong Kong Interbank Offered Rate (HIBOR), and funding costs. Investors should closely monitor rate trends to avoid missing opportunities to lock in returns at high rates. Short-term fixed deposits offer flexibility to respond to rate fluctuations, while long-term deposits may lock in higher rates, requiring choices based on risk tolerance.

Liquidity Restrictions

While large-scale fixed deposits offer stable returns, they have low liquidity. Early withdrawal during the deposit term typically results in interest loss or fees. Some banks offer tiered interest or flexible withdrawal products to mitigate liquidity risks.

Common liquidity management measures include:

- Multiple banks offer tiered interest services, allowing clients to withdraw principal early with interest calculated based on the actual term, reducing interest loss.

- China Minsheng Direct Bank’s “Flexible Deposit” service, with a minimum deposit of USD 1,000, has a 1-year term, allowing principal withdrawal at any time with interest maximized based on the term.

- Guangfa Bank’s “Smart Fixed and Flexible Deposit” starts at USD 10,000, offering 3, 6, and 12-month options; early partial principal withdrawal calculates interest based on the actual term.

- China Construction Bank’s “CCB Special Savings” starts at USD 5,000; deposits held for one year enjoy 1.1 times the central bank’s one-year fixed rate, with early withdrawal calculated at maximized interest rates.

- Industrial Bank’s “Xingye Bao” product has a daily redemption cap of USD 5,000, with amounts exceeding this requiring multiple days to process, indicating certain liquidity restrictions.

- Negotiable Certificates of Deposit (NCDs) are tradable, transferable bank deposit certificates with market-determined rates and low risk, serving as an alternative to large-scale fixed deposits.

Hong Kong banks also comply with regulatory requirements by establishing registration systems for large-scale cash deposits and withdrawals, recording and collecting information for transactions exceeding threshold amounts. For corporate and institutional clients, banks streamline processes to meet legitimate cash needs while enhancing scrutiny and monitoring of high-risk industries and unusual transactions. These measures enhance the safety and compliance of fund flows.

Bank Reputation and Protection

When choosing large-scale fixed deposits, a bank’s reputation and financial stability are crucial. Hong Kong banks are generally regulated by the Hong Kong Monetary Authority and participate in the Deposit Protection Scheme. Under the Hong Kong Deposit Protection Scheme, eligible deposits are protected up to HK$500,000 (approximately USD 64,000, at 1 USD ≈ 7.8 HKD). Amounts exceeding the protection limit may be at risk if a bank faces financial issues.

Large banks like HSBC, Hang Seng, and Standard Chartered have strong capital bases and high reputations. Virtual and smaller banks require extra scrutiny of their financial health and regulatory compliance. Investors should regularly review banks’ financial reports and regulatory announcements to ensure fund safety.

Tax Considerations

Interest income from large-scale fixed deposits is taxable. Under Hong Kong’s current tax regime, personal deposit interest is generally exempt from profits tax, but for businesses or specific cases, interest income may be taxable. Investors should consult professional tax advisors to understand their tax obligations and avoid legal risks from overlooking tax regulations.

Additionally, investors with accounts at banks in multiple jurisdictions should note cross-border tax reporting requirements. Some countries or regions tax global income, so investors should proactively declare relevant interest income to ensure compliance.

Professional Advice: When selecting large-scale fixed deposit products, investors should comprehensively assess interest rate fluctuations, liquidity restrictions, bank reputation, and tax obligations to develop a financial strategy aligned with their funding plans.

Selection Recommendations

Comparing Rates and Terms

When choosing HKD large-scale fixed deposits, investors should carefully compare rates, deposit thresholds, and terms across banks. Some Hong Kong banks offer additional rate promotions for new funds, significantly boosting returns for eligible clients. For example, Standard Chartered Bank’s Taiwan website once displayed that new funds reaching USD 800,000 could receive an additional 0.90% annual rate, while balances above USD 6,000,000 are calculated with tiered interest based on monthly averages, offering higher returns.

Investors are advised to consider not only annual rates but also deposit terms, early withdrawal clauses, and additional benefits like new fund promotions or mileage rewards when selecting products. These factors directly impact fixed deposit interest calculations and actual returns.

Diversifying Risk

Diversifying risk is a key principle of asset allocation. Market research shows that spreading funds across multiple banks or different deposit terms helps reduce risks from single banks or products.

- The Sharpe ratio of diversified strategy portfolios is about twice that of single strategies, effectively improving risk-adjusted returns.

- A portfolio combining five different factors can achieve a Sharpe ratio of 1.4, far higher than 0.7 for a single asset class.

- Holding about 20 different assets can eliminate 95% of diversifiable risk, with further diversification offering limited benefits.

- The optimal strategy is “broad diversification, focused concentration”, spreading funds across multiple banks and products while moderately concentrating within each bank.

Investors may consider allocating funds in batches to different banks or selecting varied deposit terms to flexibly manage liquidity while enhancing overall asset safety.

Foreign Currency Fixed Deposit Comparison

Many Hong Kong banks also offer fixed deposits in USD, EUR, RMB, and other foreign currencies. Market data shows that foreign currency fixed deposit rates are comparable to HKD deposits, with some currencies (e.g., USD) offering higher rates during specific periods. However, while there are foreign currency fixed deposit rate rankings, there is a lack of in-depth analysis on exchange rate risks for foreign currency versus HKD fixed deposits.

- When choosing foreign currency fixed deposits, investors must consider exchange rate fluctuations impacting principal and interest conversion risks.

- Foreign currency fixed deposit rate data covers 3-month, 6-month, and 1-year terms, facilitating comparison with HKD deposits.

- If USD appreciation is expected, USD fixed deposits may offer additional returns; conversely, USD depreciation could lead to conversion losses.

Investors are advised to assess exchange rate risks in addition to comparing rates across currencies when calculating fixed deposit interest, selecting products that align with their risk tolerance.

Currently, multiple Hong Kong banks offer USD fixed deposits with annual rates ranging from 3.7% to 5%, indicating that market rates remain high. When choosing fixed deposits, investors should consider the following key points:

- Rate levels and deposit terms

- Liquidity restrictions and early withdrawal clauses

- Bank safety and deposit protection

- Tax obligations

- Diversifying funds across banks or products

Experts note that investors should make choices based on their funding needs and risk tolerance to balance returns and safety.

FAQ

How is the annual interest rate for HKD large-scale fixed deposits calculated?

Banks calculate interest based on principal, annual rate, and deposit days. The formula is: principal × annual rate × (deposit days ÷ 365). For example, USD 100,000 (approximately HK$780,000) for 3 months at 3% yields about USD 750 in interest.

What deposit amount is covered by the Deposit Protection Scheme?

Hong Kong’s Deposit Protection Scheme provides up to USD 50,000 (approximately HK$390,000) protection per depositor per bank. Amounts exceeding this are not covered, so investors should diversify funds across multiple banks.

What are the impacts of early fixed deposit withdrawal?

Early withdrawal of fixed deposits typically results in partial or total interest loss, with possible fees. Some Hong Kong banks offer tiered interest to reduce losses.

Is HKD fixed deposit interest taxable?

Personal deposit interest in Hong Kong is generally exempt from profits tax. For businesses or specific cases, interest income may be taxable. Consulting a professional tax advisor is recommended for compliance.

What are the risks of foreign currency fixed deposits?

In addition to interest rate risks, foreign currency fixed deposits involve exchange rate fluctuations. If the USD-HKD exchange rate changes, converting back to HKD may result in principal and interest losses. Investors should assess their risk tolerance.

Large HKD fixed deposits offer reliable returns, but are rigid liquidity and steep transfer fees holding you back? BiyaPay unlocks a better solution! Register in minutes to access a 5.48% annualized yield savings product with flexible withdrawals, blending high returns with convenience. BiyaPay provides real-time exchange rate tracking, effortless conversions between USD, HKD, and over 30 fiat currencies with cryptocurrencies like USDT.

Its cross-border transfers reach 190+ countries with remittance fees as low as 0.5%, often settled same-day. Start now with BiyaPay to streamline your global finances securely!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.