- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What’s the Difference Between ADR and HSI Night Futures? A Comprehensive Analysis of Their Relationship

Image Source: pexels

The primary differences between ADR, HSI Night Futures, and HSI ADR lie in their trading venues, trading hours, and the way prices are reflected. ADRs are traded in the U.S. market, mainly reflecting the performance of Chinese and Hong Kong listed companies during U.S. trading hours. HSI Night Futures are futures products of the Hong Kong Stock Exchange, traded during Hong Kong’s nighttime session. The HSI ADR Index is calculated based on ADR prices and the closing prices of Hong Kong stocks, reflecting the performance of HSI constituent stocks during U.S. hours. Investors often refer to these three indicators simultaneously, as each provides a different perspective on the nighttime trends of Hong Kong stocks, offering more comprehensive market insights.

Key Points

- ADRs are traded in U.S. dollars on the U.S. market, reflecting the stock price trends of Chinese and Hong Kong listed companies during U.S. hours, facilitating participation by international investors.

- HSI Night Futures are nighttime futures products of the Hong Kong Stock Exchange, with trading hours extending from the close of the Hong Kong stock market until late at night, instantly reflecting the impact of European and U.S. market news.

- The HSI ADR Index is calculated based on ADR prices in the U.S. and the closing prices of Hong Kong stocks, comprehensively reflecting the overall performance of HSI constituent stocks during U.S. hours.

- The three have different trading hours and participants, with prices sometimes moving in sync and sometimes diverging; investors should refer to all three for comprehensive nighttime market information.

- Flexibly using information from ADRs, HSI Night Futures, and the HSI ADR Index helps predict the opening trends of Hong Kong stocks, adjust futures positions, and diversify investment risks.

What Are ADRs?

Image Source: unsplash

Definition and Characteristics

ADRs (American Depositary Receipts) are securities listed on U.S. exchanges, representing shares of Chinese or Hong Kong listed companies. Investors can buy and sell ADRs in U.S. dollars (USD) on the U.S. market without directly participating in the Hong Kong or Chinese stock markets. The main characteristics of ADRs include:

- Priced in U.S. dollars, facilitating participation by international investors.

- Trading hours cover U.S. market hours, extending the trading period for related stocks.

- Investors can receive dividend distributions with simple procedures, reducing exchange losses.

Many investors choose ADRs because they provide a convenient investment channel. According to market observations, there is a price linkage between ADRs and their parent company stocks. For example, the ADR price trends of TSMC and ASE are highly consistent with their local stocks. Academic research also indicates that the liquidity of Chinese ADRs is lower than that of local stocks, and their pricing is generally lower than that of parent company stocks, suggesting that ADRs have limited price discovery functions but are still influenced by parent company stocks and financial metrics like price-to-book ratios.

Reflecting Hong Kong Stock Nighttime Trends

ADRs can reflect the performance of Hong Kong stocks during U.S. trading hours. After the Hong Kong market closes, ADRs of related companies continue trading in the U.S. market. These price movements provide investors with a reference for the nighttime trends of Hong Kong stocks. For example, HSBC (0005)’s ADR price was $76.95, $0.25 lower than the Hong Kong stock closing price; China Life (2628)’s ADR price was $22.6, $0.1 lower than the Hong Kong stock closing price. These data show that ADR prices have direct comparative value with Hong Kong stock closing prices. Investors can use ADR price changes to predict the next day’s Hong Kong stock market opening trends, enabling more informed investment decisions.

Tip: While ADR prices can reflect the nighttime trends of Hong Kong stocks, they are influenced by U.S. market sentiment and exchange rate fluctuations. Investors should analyze from multiple perspectives and avoid relying solely on ADRs for judgments.

What Are HSI Night Futures?

Image Source: pexels

Trading Hours

HSI Night Futures are the nighttime trading sessions for Hang Seng Index futures launched by the Hong Kong Stock Exchange. This product allows investors to trade HSI futures after the Hong Kong stock market closes. According to HKEX data, HSI Night Futures’ trading hours start at 5:15 PM and originally ended at 11:45 PM. The HKEX plans to extend the closing time to 1:00 AM the next day, with potential future extensions to 3:00 AM. The nighttime trading session lasts 9 hours and 45 minutes, covering the trading hours of major U.S. markets. During this period, investors can instantly reflect the impact of European and U.S. market news on Hong Kong stocks.

Since the introduction of T+1 nighttime trading in 2013, HSI Night Futures’ trading volume has significantly increased. Initially, daily trading volume rose nearly sixfold, with last year’s average daily contract volume exceeding 37,000 contracts. This indicates an active nighttime market, effectively reflecting international market dynamics.

Tip: The nighttime trading session overlaps with European and U.S. markets, allowing investors to capture fluctuations driven by international news in real time.

Price Influencing Factors

The prices of HSI Night Futures are influenced by multiple factors, mainly including:

- U.S. and European stock market trends: The nighttime trading session overlaps with U.S. and European stock markets, and their fluctuations directly impact HSI Night Futures prices.

- Major international economic data or policy news: Events like U.S. Federal Reserve interest rate decisions or economic data releases can trigger price changes in HSI Night Futures.

- Hong Kong stock market closing prices: At the start of the nighttime session, the day’s Hong Kong stock market closing price serves as a key reference point, with investors adjusting their nighttime positions based on the closing situation.

- Exchange rate fluctuations: Changes in exchange rates, such as USD to HKD or RMB, also affect investor sentiment and nighttime futures prices.

Investors should closely monitor these factors and flexibly adjust their trading strategies. While nighttime futures prices can instantly reflect international news, they may sometimes experience larger volatility due to lower liquidity compared to daytime sessions. Investors are advised to analyze from multiple perspectives to reduce risks from single-market news.

HSI ADR Index

Calculation Method

The HSI ADR Index is an index calculated based on ADR prices traded in the U.S. market and the closing prices of Hong Kong stocks. This index mainly reflects the performance of HSI constituent stocks in the U.S. market during U.S. hours. The calculation method generally involves converting the ADR price of each HSI constituent stock into HKD based on its exchange ratio with the Hong Kong stock and the exchange rate (e.g., USD to HKD), then comparing it with the Hong Kong stock closing price. Finally, the weighted average of all constituent stocks’ changes is calculated to derive the HSI ADR Index.

For example: If the ADR of an HSI constituent stock rises at the U.S. market close, after exchange rate conversion, its weight in the HSI ADR Index also increases. This way, the HSI ADR Index reflects the overall performance of HSI constituent stocks during U.S. hours.

Comparison with HSI Night Futures

Both the HSI ADR Index and HSI Night Futures reflect the nighttime trends of Hong Kong stocks, but they have clear differences. The HSI ADR Index is primarily calculated based on ADR prices in the U.S. market, reflecting U.S. investors’ views on HSI constituent stocks. HSI Night Futures, on the other hand, are futures traded during Hong Kong’s nighttime session, with participants mainly being Asian and local investors.

The table below provides a simple comparison:

| Indicator | Trading Venue | Reference Price Source | Main Participants |

|---|---|---|---|

| HSI ADR Index | U.S. | ADR Prices | U.S. Investors |

| HSI Night Futures | Hong Kong | Futures Contract Prices | Asian and Local Investors |

The HSI ADR Index is more influenced by U.S. market sentiment and USD to HKD exchange rates. HSI Night Futures are more aligned with Asian timezone news and liquidity. The two may sometimes rise or fall in sync, but they can also diverge due to different market news and participant sentiments. Investors can refer to both the HSI ADR Index and HSI Night Futures for more comprehensive insights into Hong Kong stock nighttime trends.

Main Differences and Relationships

Trading Hour Differences

ADRs, HSI Night Futures, and the HSI ADR Index have different trading hours. ADRs are traded on U.S. exchanges, with trading hours typically from 9:30 AM to 4:00 PM Eastern Time. HSI Night Futures are traded during Hong Kong’s nighttime session, from 5:15 PM to 11:45 PM Hong Kong time, with potential extensions to midnight or later. The HSI ADR Index is calculated based on U.S. ADR closing prices and Hong Kong stock closing prices, reflecting the performance of HSI constituent stocks during U.S. hours.

| Indicator | Trading Venue | Main Trading Hours (Local Time) | Reference Value |

|---|---|---|---|

| ADR | U.S. | 09:30-16:00 (U.S.) | Reflects U.S. session performance |

| HSI Night Futures | Hong Kong | 17:15-23:45 (Hong Kong) | Reflects nighttime futures trends |

| HSI ADR Index | U.S. | Based on ADR closing | Comprehensive nighttime performance |

These different trading hours allow investors to continue monitoring market changes after the Hong Kong stock market closes. Each indicator provides a reference for Hong Kong stock trends during different time periods.

Price Linkage and Divergence

The prices of ADRs, HSI Night Futures, and the HSI ADR Index sometimes move in sync and sometimes diverge. This phenomenon mainly stems from different market participants and news sources.

- Price Linkage: When global market news is clear, such as major U.S. economic data releases or large corporate earnings, ADR prices, HSI Night Futures, and the HSI ADR Index often move in the same direction. At such times, all three reflect the market’s expectations for Hong Kong stocks.

- Price Divergence: Sometimes, U.S. and Asian markets interpret the same news differently. For example, U.S. investors may react strongly to Chinese policy news, causing ADR prices to fall, while Asian investors may see limited impact, so HSI Night Futures may not follow the decline. In such cases, the HSI ADR Index may diverge from HSI Night Futures.

Tip: Investors should monitor all three indicators simultaneously, especially noting when their trends are inconsistent, as this may reflect different market sentiments or news influences.

Investment Applications

Investors can use information from ADRs, HSI Night Futures, and the HSI ADR Index to formulate more comprehensive investment strategies.

- Predicting Hong Kong Stock Market Opening Trends: Investors can use ADRs and the HSI ADR Index to predict the direction of the Hong Kong stock market’s opening the next day. These indicators reflect U.S. session market sentiment, helping capture the impact of nighttime news on Hong Kong stocks.

- Real-Time Futures Position Adjustments: HSI Night Futures provide nighttime trading opportunities, allowing investors to flexibly adjust futures positions based on European and U.S. market news.

- Multi-Perspective Risk Management: The three indicators each have their strengths. ADRs and the HSI ADR Index are more influenced by U.S. market sentiment and USD to HKD exchange rates, while HSI Night Futures are more aligned with Asian timezone news. Investors can use different indicators to diversify risks and avoid losses from single-market fluctuations.

Tip: The HSI ADR Index comprehensively reflects the performance of HSI constituent stocks during U.S. hours, but investors should not rely solely on one indicator for decisions. It’s recommended to refer to both HSI Night Futures and ADRs to improve judgment accuracy.

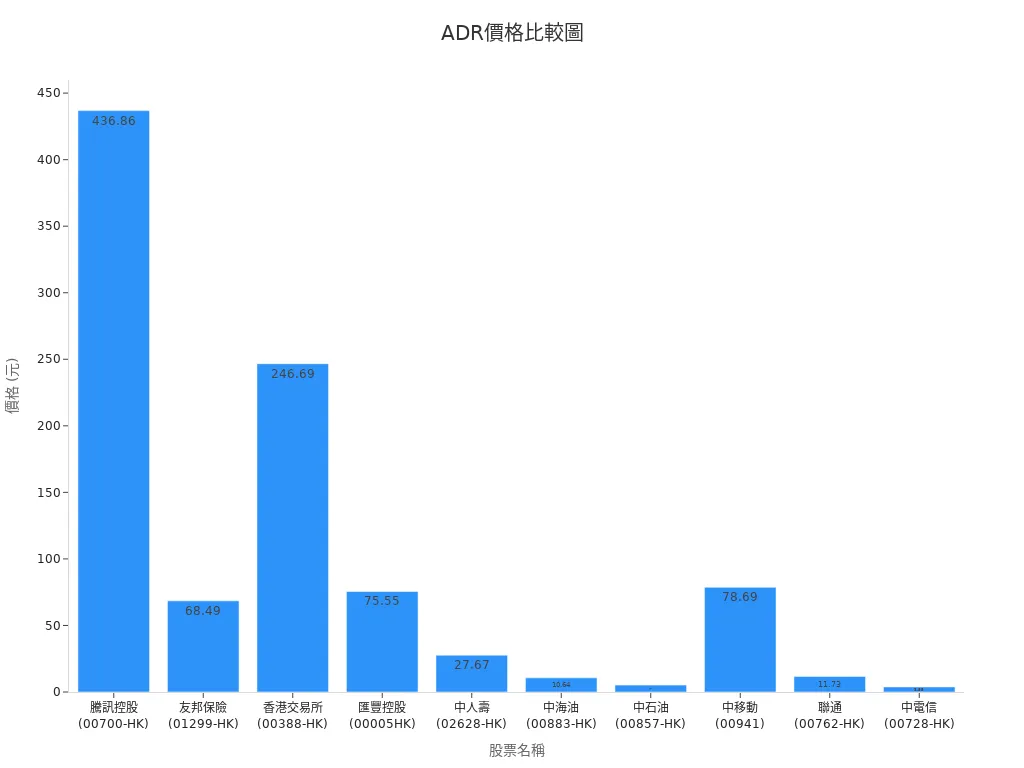

ADRs, HSI Night Futures, and the HSI ADR Index each have unique reference value. ADR prices differ from Hong Kong stocks, HSI Night Futures instantly reflect international news, and the HSI ADR Index comprehensively reflects the performance of HSI constituent stocks during U.S. hours. The table below shows the price differences between multiple Hong Kong stock ADRs and their Hong Kong closing prices:

| Stock Name | ADR Price | ADR vs. Hong Kong Stock Difference |

|---|---|---|

| Tencent Holdings | HKD 436.86 | HKD 6.86 higher than Hong Kong stock |

| AIA | HKD 68.49 | HKD 0.39 higher than Hong Kong stock |

| Hong Kong Exchanges | HKD 246.69 | HKD 1.89 higher than Hong Kong stock |

Investors should flexibly use the information from all three to improve judgment accuracy.

FAQ

Why Do ADR Prices Differ from Hong Kong Stock Prices?

ADR prices are influenced by U.S. market sentiment, USD to HKD exchange rates, and trading hours. Hong Kong stock prices are determined by the Hong Kong market. The two reflect the perspectives of different market participants.

Who Are HSI Night Futures Suitable For?

HSI Night Futures are suitable for investors looking to capture international news at night and flexibly adjust futures positions. They typically focus on European and U.S. market dynamics.

How Is the HSI ADR Index Calculated?

The HSI ADR Index is calculated based on U.S. ADR closing prices, converted using the exchange ratio and USD to HKD exchange rate, then compared with Hong Kong stock closing prices to compute a weighted average change.

How Should Investors Refer to All Three Indicators Simultaneously?

Investors can first use ADRs and the HSI ADR Index to predict the next day’s Hong Kong stock market opening, then use HSI Night Futures to adjust futures positions in real time and diversify risks.

What Are the Risks of ADR Investment?

ADR investments involve risks from USD to HKD exchange rate fluctuations, U.S. market regulations, and liquidity risks. Investors should analyze from multiple perspectives and carefully assess risks.

ADR and Hang Seng Index night futures offer valuable market insights, but are exchange rate risks and trading barriers limiting your flexibility? BiyaPay delivers a seamless solution! Trade US and Hong Kong stocks directly without offshore accounts, capitalizing on global opportunities effortlessly. Enjoy a 5.48% annualized yield savings product with flexible withdrawals for optimal liquidity.

Real-time exchange rate tracking supports conversions between USD, HKD, and over 30 fiat currencies with USDT, while remittances to 190+ countries start at just 0.5% in fees, arriving swiftly. Join BiyaPay today to enhance your global investment strategy!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.