- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Introduction to Hang Seng Bank Stock: Understanding Its Value and Risks

Image Source: pexels

You may wonder, what is Hang Seng Bank stock? In fact, Hang Seng Bank stock represents partial ownership in one of Hong Kong’s major banks. Hang Seng Bank is listed on the Hong Kong Stock Exchange and is a constituent of the Hang Seng Index, reflecting its significant position in the market. By observing Hang Seng Bank’s stock price, you can gauge market confidence in the banking sector. Investing in such stocks offers the potential for stable dividends, but you should also be mindful of risks brought by market volatility and policy changes.

Key Points

- Hang Seng Bank stock represents ownership in one of Hong Kong’s major banks, with the stock code 00011.HK, making it easy to check and trade on trading platforms.

- Investing in Hang Seng Bank stock offers stable dividends and brand advantages, but you need to be aware of risks from market volatility, economic conditions, and policy changes.

- As a constituent of the Hang Seng Index, Hang Seng Bank stock has high liquidity and attracts attention from large funds, enhancing its stability and transparency.

- Before investing, learn basic financial evaluation methods, regularly review financial reports and market trends, and develop an investment strategy based on your risk tolerance.

- Long-term holding and diversified investments can help reduce risks, while a monthly stock purchase plan can average costs, suitable for investors seeking stable returns.

Basic Information

Company Overview

You can view Hang Seng Bank as one of Hong Kong’s most iconic banks. Since its establishment in 1933, Hang Seng Bank has focused on providing diversified financial services to individual and corporate clients. You will notice that Hang Seng Bank has an extensive branch network in Hong Kong and is actively developing digital banking services. The bank is known for its prudent management and innovation, frequently launching new products to meet market demands. For example, you can use Hang Seng Bank for foreign exchange, investment and wealth management, insurance, and loans, among other financial services. Headquartered in Central, Hong Kong, the bank collaborates with multiple international financial institutions, enhancing its global competitiveness.

Stock Code

If you want to trade Hang Seng Bank stock on the Hong Kong Stock Exchange, you need to know its stock code, 00011.HK. This code helps you quickly locate the stock on trading platforms. You can enter this code to check real-time stock prices, trading volume, and historical trends. Hang Seng Bank stock is priced in Hong Kong dollars, but you should pay attention to the USD/HKD exchange rate, as it affects your actual investment returns. For example, 1 USD is approximately 7.8 HKD (subject to real-time exchange rates), and you can calculate your investment costs based on this rate.

Hang Seng Index Constituent

Hang Seng Bank is one of the constituents of the Hang Seng Index. You can understand that the Hang Seng Index reflects the overall performance of the Hong Kong stock market, and as a constituent, Hang Seng Bank holds a significant position in Hong Kong’s economy. When you invest in Hang Seng Bank stock, you are indirectly participating in the development of Hong Kong’s major economic entities. Hang Seng Index constituents typically have high liquidity and significant market attention. You can leverage these characteristics to flexibly adjust your investment portfolio and diversify risks.

Tip: As a Hang Seng Index constituent, Hang Seng Bank is often a target for large funds and ETFs, which helps enhance the stock’s stability and transparency.

Hang Seng Bank Stock Price

Image Source: pexels

Price Volatility

You may notice that Hang Seng Bank’s stock price has experienced significant fluctuations in recent years. When Hong Kong’s economy grows, the stock price typically rises. Conversely, when uncertainties arise, such as global economic slowdowns or policy adjustments, the stock price may decline. For instance, during the 2020 pandemic, Hang Seng Bank’s stock price dropped significantly but gradually recovered as the economy stabilized. You can use historical charts to observe these fluctuations and understand how market sentiment affects Hang Seng Bank’s stock price.

Tip: You can consider participating in a monthly stock purchase plan. This approach allows you to invest a fixed amount monthly, averaging costs regardless of price fluctuations, reducing risks from short-term volatility.

Influencing Factors

Hang Seng Bank’s stock price is influenced by multiple factors. You should pay attention to the following:

- Economic Environment: When Hong Kong or the global economy performs well, Hang Seng Bank’s stock price tends to benefit. During economic downturns, the stock price may face pressure.

- Interest Rate Policy: When the U.S. Federal Reserve adjusts interest rates, Hong Kong’s banking sector is affected. Rising rates may increase banks’ interest income, boosting Hang Seng Bank’s stock price.

- Regulatory Policies: Changes in policies by the Hong Kong Monetary Authority or mainland China can impact the banking industry’s operating environment, affecting Hang Seng Bank’s stock price.

- Market Sentiment: Shifts in investor confidence can cause short-term fluctuations in Hang Seng Bank’s stock price.

You can regularly monitor these factors to help predict the stock price’s trends. Remember, stock price fluctuations are normal, and long-term investors should focus on fundamental analysis.

Investment Value

Financial Performance

You can see Hang Seng Bank’s stable performance in its financial reports. The bank publishes annual revenue, profits, and balance sheets. You will find that its revenue primarily comes from interest income, fees, and other financial services. When Hong Kong’s economy grows steadily, the bank’s profitability typically improves. By reviewing data from the past five years, you can see that Hang Seng Bank maintains stable capital adequacy and liquidity even during economic fluctuations, reflecting strong risk management. If you are concerned about Hang Seng Bank’s stock price, financial performance is a key reference.

Tip: Regularly review Hang Seng Bank’s interim and annual financial reports to stay updated on its financial health, aiding in smarter investment decisions.

Dividend Policy

If you value stable cash flow, Hang Seng Bank’s dividend policy is worth noting. The bank is known for consistent dividend payouts. By holding its stock, you have the opportunity to receive cash dividends annually. Historical records show that Hang Seng Bank maintained dividends even during economic downturns, making it attractive for those seeking long-term returns. By comparing dividend yields of Hong Kong banks, you will find Hang Seng Bank’s payout level is relatively high. If you opt for a monthly stock purchase plan, you can reinvest dividends to further enhance long-term returns.

Note: Dividends are not guaranteed. Hang Seng Bank adjusts its dividend policy based on profits and economic conditions. Stay updated with company announcements.

Long-Term Potential

If you focus on long-term growth, Hang Seng Bank’s innovation and brand strength are noteworthy. The bank actively develops digital banking services to enhance customer experience. You can manage accounts, investments, and wealth management via its mobile app. The bank also introduces new products, such as global investment services, foreign currency wealth management, and insurance solutions, to meet diverse client needs. You can also explore related investment products, such as equity-linked notes (ELI) or exchange-traded funds (ETFs), to diversify risks and allocate assets flexibly.

If you are concerned about the long-term trend of Hang Seng Bank’s stock price, note its strong market position in Hong Kong’s banking sector. As a Hang Seng Index constituent, it is frequently targeted by large funds and ETFs, enhancing liquidity and stability. You can leverage these advantages to build a diversified portfolio and boost overall return potential.

Tip: Periodically review your portfolio and adjust holdings based on market changes to optimize asset allocation using Hang Seng Bank and related products.

Risk Factors

Image Source: pexels

When investing in Hang Seng Bank stock, you must acknowledge various potential risks. Stock prices may fluctuate significantly due to multiple factors and could even become worthless. You should not rely solely on online information for investment decisions; instead, carefully assess all risks and seek professional advice.

Market Volatility

You will notice that Hang Seng Bank’s stock price often fluctuates with market sentiment and economic conditions. During global economic instability or geopolitical tensions, Hong Kong’s stock market is easily affected, and bank stock prices may decline. During the 2020 pandemic, Hang Seng Bank’s stock price dropped sharply, reflecting the pressure market volatility places on investors. If you choose long-term investment, be prepared for short-term price fluctuations. You can consider diversifying investments to reduce risks from a single stock.

Note: All stock investments carry risks. Carefully review risk disclosure statements to understand potential worst-case losses.

Industry Competition

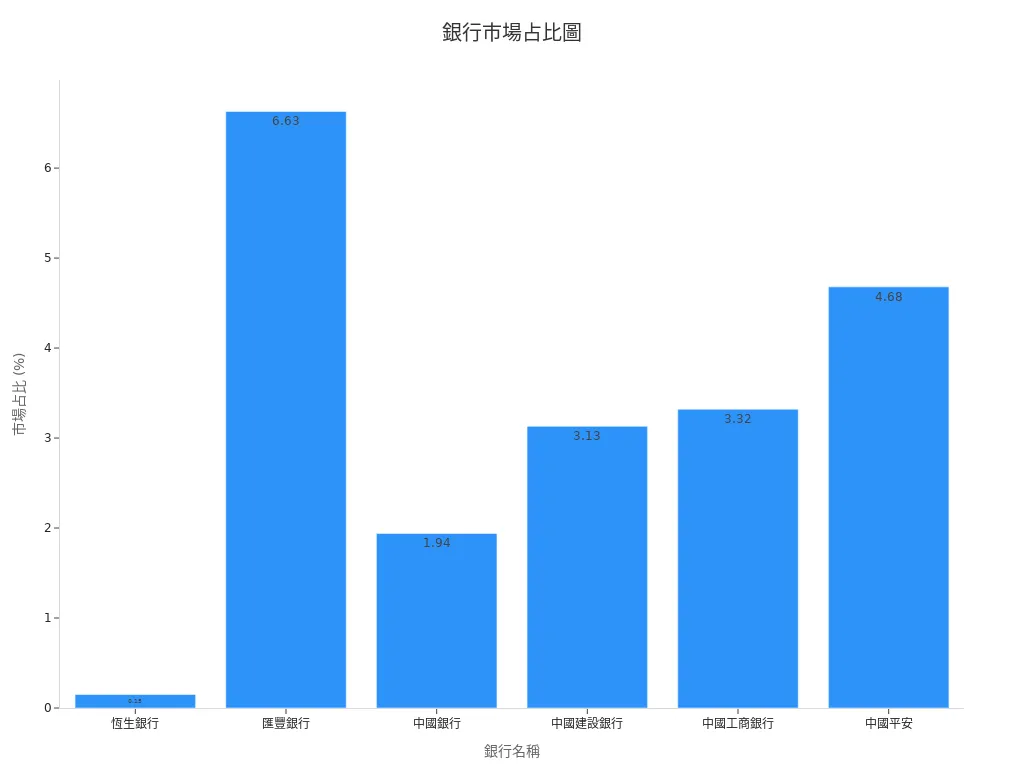

Hong Kong’s banking sector is highly competitive. You will see that, besides Hang Seng Bank, several large banks compete for clients. According to the latest statistics, Hang Seng Bank’s asset size is approximately HKD 1,651.144 billion (about USD 211.8 billion, based on 1 USD = 7.8 HKD), with a market share of only 0.15%. In comparison, HSBC, Bank of China, and China Construction Bank hold larger market shares. You can refer to the table below for major banks’ market shares:

| Bank Name | Asset Size (HKD Billion) | Market Share (%) |

|---|---|---|

| Hang Seng Bank | 16511.44 | 0.15 |

| HSBC | N/A | 6.63 |

| Bank of China | N/A | 1.94 |

| China Construction Bank | N/A | 3.13 |

| Industrial and Commercial Bank of China | N/A | 3.32 |

| Ping An Insurance | N/A | 4.68 |

From the data above, you can see that Hang Seng Bank’s market share in Hong Kong’s banking sector is relatively small. You should note that industry competition may impact the bank’s profitability and future growth. You can refer to the following data sources for more industry information:

- Financial Supervisory Commission (FSC) annual reports and statistics, providing data on banking market shares.

- Annual reports and financial data from major financial holding companies (e.g., Cathay Financial, Fubon Financial, CTBC Financial).

- Global market research institutions like Statista and Allied Market Research, analyzing global financial market trends.

- Annual reports from major global financial institutions (e.g., JPMorgan Chase, HSBC, ICBC), providing market share and trend data.

You should regularly monitor these sources to stay informed about industry changes and make wiser investment decisions.

Economic and Policy Factors

You also need to pay attention to how economic conditions and policy changes affect Hang Seng Bank. During economic downturns in Hong Kong or globally, banking business volume decreases, bad debt risks rise, and the stock price faces pressure. U.S. Federal Reserve interest rate adjustments directly impact Hong Kong banks’ interest income. Regulatory changes from the Hong Kong or Chinese governments, such as capital requirements or anti-money laundering rules, also affect operating costs and profitability.

Tip: Regularly follow policy announcements from the Hong Kong Monetary Authority and the U.S. Federal Reserve to stay ahead of market trends.

If you rely solely on online information, you may overlook the latest policy or economic data. You should consult official reports and professional analyses and make investment decisions based on your risk tolerance.

Getting Started Tips

Evaluation Methods

Before investing in Hang Seng Bank stock, you should learn basic evaluation methods. You can start with the following:

- Observe Hang Seng Bank’s revenue data and growth potential to assess whether the company is developing sustainably.

- Analyze financial statements, including balance sheets, income statements, and cash flow statements, to evaluate the company’s financial health.

- Pay attention to metrics like Earnings Per Share (EPS), return on assets, return on equity, gross margin, and debt-to-equity ratio to gauge operational efficiency.

- Monitor market trends and trading activity to understand the stock’s market popularity.

- Track buying and selling behavior of major investors and institutions to understand capital flows.

Tip: Use online financial platforms to access Hang Seng Bank’s latest financial data and market analyses to improve your judgment.

Suitable Investors

Hang Seng Bank stock may suit you if you fall into the following categories:

- You seek stable cash flow and value dividend income.

- You are willing to hold long-term and can tolerate short-term fluctuations.

- You aim to diversify investment risks and avoid focusing on a single industry or company.

- You have basic financial knowledge and can read simple financial reports and market information.

Note: If you pursue short-term speculation or cannot tolerate price fluctuations, Hang Seng Bank stock may not be suitable.

Investment Steps

You can follow these steps to start investing in Hang Seng Bank stock:

- Open a securities account and choose a suitable online broker.

- Gather Hang Seng Bank’s basic information and financial reports for individual stock analysis.

- Monitor institutional trends and capital flows to understand market trends.

- Determine your investment amount based on your risk tolerance (calculate in USD, referencing real-time exchange rates).

- Place buy orders and regularly review your holdings’ performance.

- Stay updated with company announcements and market news, adjusting your strategy as needed.

Tip: Consider a monthly stock purchase plan to spread entry points, average costs, and reduce risks.

You can see that Hang Seng Bank stock offers stable dividends and brand advantages but faces risks like market volatility and industry competition. If you seek long-term stable returns, consider diversifying investments and regularly reviewing financial data. Assess your risk tolerance before investing and avoid blindly following trends.

FAQ

What is the minimum investment amount for Hang Seng Bank stock?

You can purchase based on the Hong Kong Stock Exchange’s minimum trading unit. At current prices, approximately 100 shares are required, totaling about USD 1,500 (based on 1 USD = 7.8 HKD).

Does Hang Seng Bank stock carry currency risks?

When investing in USD, the HKD/USD exchange rate affects your actual returns. While HKD is pegged to USD, minor fluctuations may still occur.

How are Hang Seng Bank stock dividends received?

When holding the stock, dividends are automatically deposited into your securities account. You can reinvest dividends or withdraw them as cash.

What are the benefits of a monthly stock purchase plan?

Investing a fixed amount monthly averages costs, reducing risks from short-term price fluctuations, suitable for long-term investors.

Is Hang Seng Bank stock suitable for short-term trading?

If you seek short-term high returns, Hang Seng Bank stock may not be ideal. It has lower volatility, better suited for stable, long-term investors.

Hang Seng Bank stock offers steady dividends, but do market volatility and exchange rate risks concern you? BiyaPay provides a seamless financial solution! Trade US and Hong Kong stocks directly without offshore accounts, capitalizing on global opportunities effortlessly. Benefit from a 5.48% annualized yield savings product with flexible withdrawals for optimal liquidity.

Real-time exchange rate tracking supports conversions between USD, HKD, and over 30 fiat currencies with USDT, while remittances to 190+ countries start at just 0.5% in fees, arriving swiftly. Join BiyaPay today to streamline investments and manage global funds with ease!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.