- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

HSBC Stock Stable Dividend and Growth Strategy

Image Source: pexels

When deploying HSBC stock in 2025, investors should focus on a stable dividend and growth strategy. HSBC management targets a tangible book value return rate of 14% to 16% and plans to implement up to $3 billion in share buybacks. The dividend payout ratio remains at 50%, with ample interim dividends and cash flow, attracting long-term dividend investors. Experts generally believe that strong growth momentum in the Asian market and diversified wealth management businesses provide HSBC with a stable profit foundation. However, market volatility and changes in credit costs also require careful attention.

Key Points

- HSBC maintains a stable dividend policy, with a projected dividend yield exceeding 8% in 2025, suitable for long-term dividend investors.

- Strong economic growth in the Asian market allows HSBC to seize growth opportunities through diversified businesses and wealth management.

- Investors should diversify their bank stock allocations to reduce risk and enhance portfolio stability.

- HSBC’s strong capital adequacy ratio and risk management capabilities support sustained dividends and share buyback plans.

- Investors need to monitor global economic and interest rate changes, flexibly adjusting their holding strategies to address market volatility.

Investment Outlook

Economic Environment

In 2025, the global and local economic environment poses multiple challenges and opportunities for HSBC’s business.

- Although global inflationary pressure has eased, tariffs in the coming months may push up some prices, making inflation trends harder to predict, and the Federal Reserve may resume rate cuts in the second half of the year.

- High policy uncertainty, particularly changes in trade policies, suppresses economic activity and consumer confidence, directly affecting bank business growth.

- Escalating U.S.-China trade tensions weaken China’s export revenue, with domestic demand becoming the main economic driver, and RMB depreciation may be used as a government adjustment tool.

- The U.S. economy is affected by government layoffs, fiscal austerity, and trade tariff policies, leading to declining consumer confidence, rising inflation expectations, and deepening market concerns.

- Global and local economic data indicate that HSBC must face interest rate adjustment pressures and operational challenges from trade wars, with financial markets expected to remain volatile, requiring banks to flexibly adjust strategies.

Experts suggest that investors should closely monitor interest rate trends and policy changes in major economies, cautiously assessing the risks and returns of bank stocks.

Performance Trends

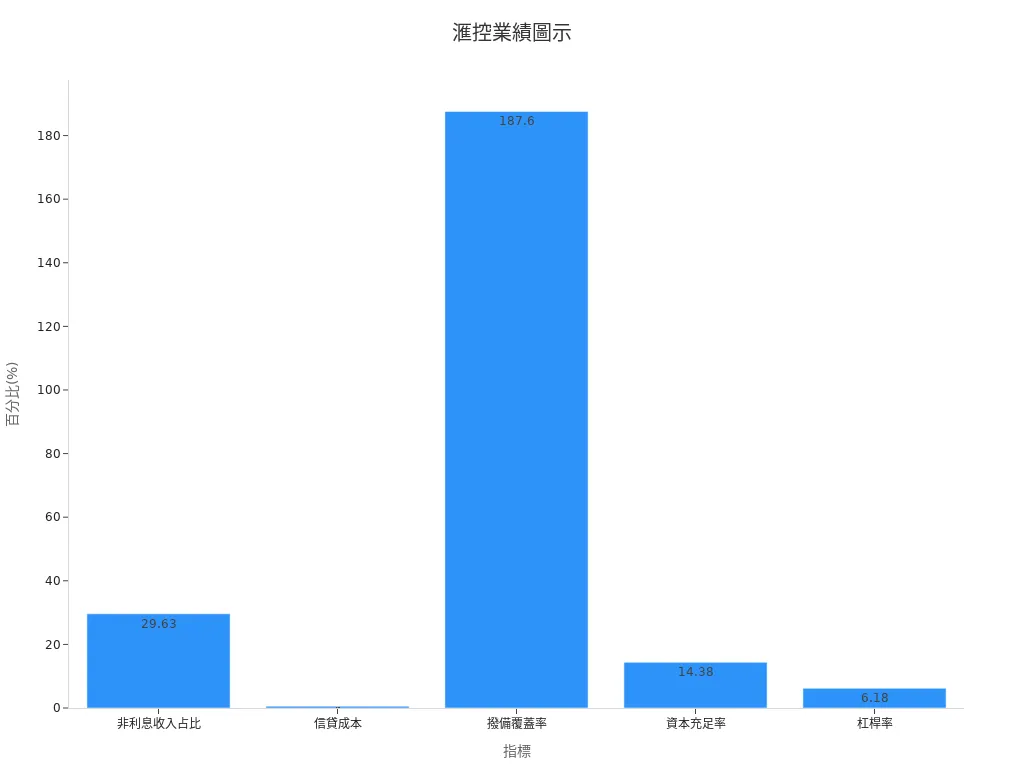

HSBC’s 2025 performance showcases several highlights, with competitive revenue structure and cost control.

| Metric | HSBC Data | Market Average Comparison |

|---|---|---|

| Non-interest Income Proportion | 29.63% | Indicates optimized revenue structure, presumed above average |

| Credit Costs | 0.58% (Q4) | Up 81% year-on-year, requiring attention to cost control pressure |

| Provision Coverage Ratio | 187.60% | Down from year-end but remains high, with strong risk buffering capacity |

| Capital Adequacy Ratio | 14.38% | Improved year-on-year, solid capital base |

| Leverage Ratio | 6.18% | Improved capital utilization efficiency |

HSBC’s non-interest income accounts for nearly 30%, indicating diversified revenue sources capable of withstanding interest rate fluctuations. Although credit costs have risen, the provision coverage ratio and capital adequacy ratio remain high, reflecting strong risk management capabilities. Improved capital utilization efficiency supports future buybacks and dividend plans. Overall, HSBC outperforms many peers in revenue structure and cost control, providing investors with a stable foundation.

HSBC Dividend

Image Source: pexels

Dividend Policy

HSBC has consistently attracted long-term investors with its stable dividend policy. In 2025, management reaffirmed a dividend payout ratio target of 50%, reflecting the company’s commitment to stable returns. According to the latest financial report, HSBC’s tangible book value return guidance has increased from the market’s expected 12.5% to about 15%, indicating sustained profitability growth. The bank’s 2024 fiscal year net interest income is projected to reach $43 billion, in line with market expectations, further solidifying its cash flow foundation.

Additionally, HSBC launched a new share buyback program, exceeding market and UBS expectations, demonstrating ample cash flow. The 2025 tangible book value return guidance remains in the 14% to 16% range, reflecting stable mid-term financial performance. The common equity Tier 1 capital ratio is maintained at 14% to 14.5%, ensuring capital adequacy and providing strong support for the dividend policy.

- HSBC 2025 dividend payout ratio target: 50%

- Dividend yield expected to remain above 8%, more attractive than most Hong Kong banks

- Tangible book value return guidance: 14% to 16%

- Net interest income projection: $43 billion (approximately HK$335.4 billion at 1 USD = 7.8 HKD)

- Capital adequacy ratio: 14% to 14.5%

- Share buyback program continues to progress

Experts note that HSBC’s stable cash flow and high dividend yield provide long-term security for dividend-focused investors.

Dividend Deployment

Dividend-focused investors should consider the following strategies when deploying HSBC stock:

- Long-term Holding

HSBC’s stable dividend record and cash flow make it suitable for long-term dividend investors. Long-term holding can benefit from compound interest effects, reducing the impact of short-term volatility. - Diversified Bank Stock Allocation

Investors can allocate funds across multiple Hong Kong banks, such as Hang Seng Bank and Bank of China Hong Kong, to reduce single-bank risk and enhance overall portfolio stability. - Comparing Fixed Deposits and Dividend Returns

HSBC’s dividend yield is expected to exceed 8%, far surpassing typical Hong Kong dollar fixed deposit rates. Based on 2025 projections, HSBC’s annual dividend returns significantly outperform fixed deposits, suitable for investors seeking stable cash flow. - Monitoring Dividend Timing and Reinvestment

Investors can flexibly manage cash flow based on HSBC’s dividend schedule. Some investors choose to reinvest dividends to further enhance long-term returns.

| Investment Method | Annual Return Rate (Projected) | Liquidity | Risk Level |

|---|---|---|---|

| HSBC Stock Dividend | Above 8% | Medium | Medium |

| Hong Kong Bank Fixed Deposit | Below 2% | High | Low |

| Diversified Bank Stock Portfolio | 5% - 7% | Medium | Low to Medium |

Tip: Dividend-focused investors should periodically review their holding proportions and adjust deployment based on market conditions to ensure a robust portfolio.

Growth Strategy

Image Source: pexels

Business Momentum

HSBC’s 2025 growth momentum is primarily driven by the Asian market, wealth management business, cost reduction, and expert network advantages. Asia’s economic recovery outpaces the global market, bringing significant growth potential. According to International Monetary Fund (IMF), Asia (excluding Japan) contributed to global GDP growth from 20% in 2000 to 37%, and is expected to surpass other regions by 2040. This reflects Asia’s robust economic vitality, providing banks with broad opportunities.

- New economy sectors in Asia (e.g., information technology, healthcare, consumer goods) account for over 50% of the MSCI Asia (excluding Japan) stock index, indicating rapid development in new industries.

- Asian stocks have up to a 56% discount on price-to-book ratio (PB) compared to U.S. stocks, offering clear value.

- HSBC Asset Management has managed Asian equity funds since 1973, with managers averaging 18 years of industry experience, covering high-dividend, small-cap, and blue-chip stocks, integrating ESG into the investment process, and earning an A+ rating from the UN Principles for Responsible Investment.

- Emerging Asian markets (e.g., India, ASEAN) are driven by global supply chain shifts, investment growth, and young demographic dividends, with strong structural growth momentum.

- HSBC’s Asian equity funds have outperformed the average of similar funds over the past three years, focusing on cyclical and growth stocks benefiting from economic recovery.

The wealth management business has also become a growth engine for HSBC. Rapid private wealth growth in Asia and strong middle-class consumption drive demand for wealth management products. HSBC actively expands its wealth management services, leveraging its expert network to provide diversified asset allocation solutions for high-net-worth and emerging affluent clients. Artificial intelligence and digital technology innovations also drive growth in high-end manufacturing and technology sectors, creating new business opportunities for the bank.

In cost reduction, HSBC continues to optimize operations and improve capital efficiency. Through digital transformation and automation, the bank reduces redundant processes, lowers operating costs, and enhances profitability. The expert network helps the bank seize opportunities in high-growth regional industries, boosting overall competitiveness.

Experts note that Asia’s stable economic growth benefits from supply chain reorganization, rapid private wealth accumulation, and AI-driven technological advancements, enabling HSBC to expand market share through diversified strategies.

Growth Deployment

Growth-oriented investors deploying HSBC stock should seize low-buy opportunities and flexibly adjust holding proportions. In 2025, Asia (excluding Japan) GDP is projected to grow by 4.5%, with Taiwan and South Korea’s semiconductor industries driven by AI and digital tech investments, becoming regional highlights. HSBC actively allocates resources to markets like Japan, South Korea, India, and Indonesia, focusing on consumer services, high-end manufacturing, and quality state-owned enterprises, injecting structural growth potential into portfolios.

Investors can refer to the following deployment suggestions:

- Low-Buy Opportunities

When HSBC’s stock price corrects or market sentiment weakens, growth-oriented investors can buy in batches to lower average holding costs. Asian stocks currently offer high price-to-book discounts, making them attractive for value investing. - Setting Target Prices

Based on broker and analyst forecasts, HSBC’s 2025 target price ranges from USD 9.2 to USD 9.5 (approximately HK$72 to HK$74 at 1 USD = 7.8 HKD). Investors can set staged profit-taking and stop-loss targets based on personal risk tolerance. - Adjusting Holding Proportions

As Asia’s structural growth momentum strengthens, investors can moderately increase holdings in HSBC and related Asian bank stocks, diversifying across high-growth industries and regions to enhance return potential. - Monitoring Industry Trends

Artificial intelligence, digital technology, and green transformation are future growth themes. Investors should closely track related industry developments, flexibly adjusting portfolios to seize new economy opportunities.

| Deployment Strategy | Main Content | Risk Warning |

|---|---|---|

| Low-Buy Opportunities | Buy in batches to lower average costs | Market volatility risk |

| Setting Target Prices | Refer to broker forecasts, staged profit-taking/stop-loss | Forecasts may not be accurate |

| Adjusting Holding Proportions | Increase allocation to Asia and new economy sectors | Industry concentration risk |

| Monitoring Industry Trends | Focus on AI, digital tech, green transformation | Rapid industry changes |

Tip: Growth-oriented investors should periodically review market conditions and industry trends, flexibly adjust holding proportions, and combine diversification principles to enhance portfolio resilience.

Expert Views

Market Forecasts

Multiple international brokers and analysts hold a cautiously optimistic view of HSBC stock in 2025. According to the latest reports, mainstream brokers set HSBC’s target price at USD 9.2 to USD 9.5 (approximately HK$72 to HK$74 at 1 USD = 7.8 HKD), reflecting confidence in its profitability and capital returns. Analysts generally believe that strong growth momentum in Asia, effective wealth management, and digital transformation will boost overall valuation. Some experts also caution that short-term market volatility persists, particularly influenced by interest rate policies, geopolitical issues, and trade dynamics, requiring investor vigilance.

Experts suggest that investors closely monitor global economic data and major central bank policy developments, flexibly adjusting holding strategies to avoid over-concentration in a single market.

Investment Recommendations

Experts emphasize that investing in HSBC should balance short-term volatility risks with mid-to-long-term holding strategies. Statistical data shows that short-term trading, while increasing transaction frequency and statistical reliability, also raises trading costs. With a win rate of about 50%, it indicates that even if not every trade is profitable, there is still overall profit potential. Average gains per profitable trade are higher, with smaller losses during unprofitable trades. However, short-term strategies face overnight gap risks, which are relatively high.

- Mid-to-long-term holding strategies typically require higher capital and do not recommend leverage.

- Long-term performance curves show an annual return rate of about 6-8% (excluding leverage), with stable upward trends.

- Investors need to assess their risk tolerance, particularly for unpredictable factors like overnight gaps.

Experts recommend that long-term investors consider buying in batches and periodically review holding proportions. Mid-to-long-term holding helps smooth short-term volatility, enhancing portfolio stability. Short-term investors must strictly implement stop-loss and profit-taking strategies to control risks.

Tip: Investors should select appropriate investment cycles based on their capital size and risk preferences, combining diversification principles to enhance overall return potential.

HSBC Risks

Key Risks

In 2025, HSBC will face multiple external risks.

- The U.S. Federal Reserve maintained policy rates at 4.25-4.5% in May 2025, with limited chances of rate cuts in the short term. If the economy does not slow as expected, only two rate cuts are projected for the year. This sustains pressure on bank net interest margins, affecting profitability.

- Since September 2024, China has eased monetary policy, including a 0.5% reserve requirement cut, a 0.1% rate cut, and increased support for the property market and businesses. While this helps stabilize markets, China’s Caixin Services PMI fell to 50.7 in April, and manufacturing PMI also declined, reflecting pressure from trade policies and tariffs on business confidence.

- Although U.S.-China trade talks have progressed, global trade dynamics remain uncertain. If tariff policies tighten again, they will impact cross-border business and capital flows.

- U.S. corporate earnings estimates for 2025 have been revised downward, reflecting external economic challenges to bank operations.

Investors should closely monitor interest rate policies, regulatory developments, and trade dynamics in major economies, adjusting asset allocations early.

Investment Opportunities

HSBC’s diversified business and capital strategies enable it to seize potential growth opportunities in Asia.

- The bank actively expands in Asia, benefiting from regional economic recovery and rising wealth management demand. Emerging Asian markets like India and ASEAN countries, driven by global supply chain shifts and young demographic dividends, show significant growth potential.

- China’s continued policy easing and supportive measures help mitigate tariff and economic downturn risks, bolstering stock market and business confidence.

- HSBC’s capital adequacy ratio remains at 14% to 14.5% (at 1 USD = 7.8 HKD), ensuring support for dividend and buyback plans.

- The Bank of Japan maintains a policy rate of 0.5%, supporting stability in Japan and regional economies, providing a favorable environment for HSBC’s cross-regional operations.

| Risk Factor | Impact Direction | Potential Upside |

|---|---|---|

| Interest Rate Policy | Profitability pressure | Asian market growth |

| Regulatory Changes | Rising costs | China’s policy easing |

| Trade Dynamics | Cross-border business volatility | Diversified business layout |

Experts believe that HSBC’s diversified business and robust capital strategies can effectively mitigate external risks while seizing long-term growth opportunities in Asia.

Investors in 2025 should adopt diversified strategies, balancing dividends and growth. Asia has many high-dividend companies with high payout ratios, with dividends accounting for over 60% of total stock returns. A bottom-up stock selection approach helps capture gains at different stages, balancing stability and growth. Dividend-paying stocks have lower volatility, outperforming non-dividend stocks over the long term. Federal Reserve rate cut expectations lower corporate borrowing costs, enhancing profitability and dividend potential. Experts recommend that investors periodically review holding proportions based on their goals, flexibly adjusting deployment.

FAQ

What is the projected dividend yield for HSBC stock in 2025?

HSBC management expects the dividend yield to remain above 8% in 2025. This level is higher than most Hong Kong banks. Investors can calculate actual returns using the exchange rate of 1 USD = 7.8 HKD.

What is the difference between investing in HSBC and fixed deposits?

HSBC stock offers higher dividend potential, with an annual return rate projected above 8%. Hong Kong bank fixed deposits generally offer below 2%. Stocks carry price volatility risk, while fixed deposits are more stable.

What are the main risks facing HSBC?

HSBC must address interest rate policy changes, increased regulatory requirements, and global trade uncertainties. These factors affect profitability and capital returns.

How should growth-oriented investors deploy HSBC?

Growth-oriented investors can buy HSBC in batches, set target prices (e.g., USD 9.2 to USD 9.5), and adjust holding proportions based on market conditions, focusing on Asian market opportunities.

What are the characteristics of HSBC’s dividend policy?

HSBC maintains a 50% dividend payout ratio target with robust cash flow. The company also implements share buyback programs, providing stable returns for long-term dividend investors.

HSBC stock’s high dividends and Asian market growth appeal to investors, but do market volatility and currency risks complicate your strategy? BiyaPay offers a seamless solution! Trade US and Hong Kong stocks directly without offshore accounts, capitalizing on global opportunities effortlessly. Enjoy a 5.48% annualized yield savings product with flexible withdrawals for optimal liquidity.

Real-time exchange rate tracking supports conversions between USD, HKD, and over 30 fiat currencies with USDT, while remittances to 190+ countries start at just 0.5% in fees, arriving swiftly. Sign up with BiyaPay today to enhance your global investment portfolio!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.