- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

2025 Analysis of Differences in Standard Chartered and Other Banks' Foreign Currency ATM Services

Image Source: unsplash

You may notice that Standard Chartered’s foreign currency ATMs only allow you to withdraw CNY, not other currencies like USD or JPY directly. In contrast, other Hong Kong banks such as Hang Seng and HSBC allow you to choose from multiple foreign currencies. There are significant differences in withdrawal limits, supported currency types, service functions, and distribution locations. These differences directly impact your withdrawal experience.

Key Points

- Standard Chartered’s foreign currency ATMs only support CNY withdrawals; other currencies require exchanging via mobile app and collection at a branch, making the process more complex.

- Other banks like Hang Seng, HSBC, Bank of China, and Citibank support multiple mainstream currencies, with higher withdrawal limits and faster, more convenient operations.

- Standard Chartered’s foreign currency ATMs are sparsely distributed, mainly in urban areas, while other banks’ ATMs are more widespread, convenient for users in various regions.

- When choosing a foreign currency withdrawal service, consider your commonly used currencies, withdrawal locations, and limits to select the most suitable bank.

- Using a mobile app to exchange foreign currencies can enhance flexibility, but for multiple currency cash needs, opt for banks with multi-currency ATM support.

Comparison of Standard Chartered Foreign Currency ATMs

Image Source: pexels

Supported Currencies

When using Standard Chartered’s foreign currency ATMs, you can only withdraw CNY. This is significantly different from other Hong Kong banks’ foreign currency ATMs. You cannot directly withdraw mainstream currencies like USD, JPY, or EUR at Standard Chartered’s foreign currency ATMs. If you need other currencies, you must first exchange them via the SC Mobile app and then make an appointment to collect cash at a branch. This process is much more complex than withdrawing foreign currency directly at an ATM.

Tip: If you frequently need CNY cash, Standard Chartered’s foreign currency ATMs offer convenience. However, if you need multiple currencies, consider other Hong Kong banks’ foreign currency ATMs.

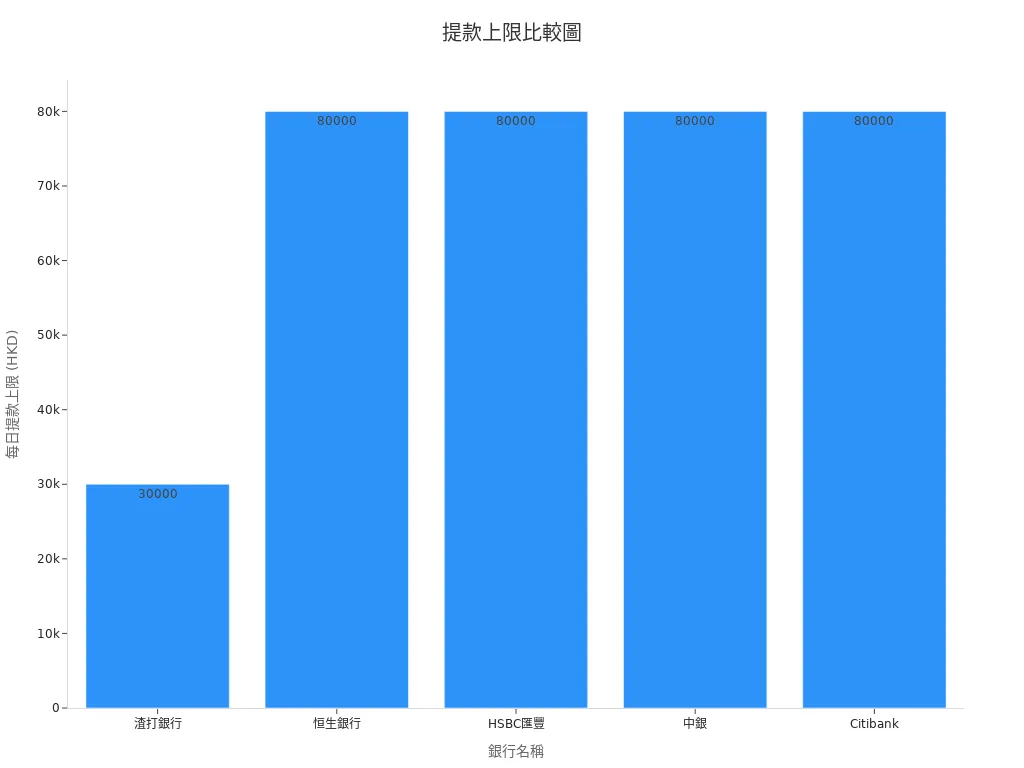

Withdrawal Limits

You can withdraw CNY cash equivalent to a maximum of USD 3,800 (approximately HKD 30,000) daily at Standard Chartered’s foreign currency ATMs. This limit meets most daily needs. You can use different withdrawal cards, including Standard Chartered’s debit and credit cards. Different card types may have varying withdrawal limits, so check the relevant details in advance.

| Card Type | Daily Withdrawal Limit (USD) |

|---|---|

| Standard Chartered Debit Card | 3,800 |

| Standard Chartered Credit Card | 3,800 |

Service Functions

The primary function of Standard Chartered’s foreign currency ATMs is to allow you to quickly withdraw CNY cash. You cannot directly exchange or withdraw other currencies at these ATMs. If you need USD, JPY, or other currencies, you must first exchange them via the SC Mobile app and then make an appointment to collect cash at a branch. This process requires additional time and steps. When using Standard Chartered’s foreign currency ATMs, you don’t need to make an appointment; you can operate with an eligible withdrawal card.

Note: Standard Chartered’s foreign currency ATMs are limited in distribution, mainly located at select major branches. If you live in a remote area, you may need to travel to the city to use them.

Other Banks’ Foreign Currency ATMs

Hang Seng

You can withdraw up to 12 foreign currencies at Hang Seng Bank’s foreign currency ATMs. These currencies include USD, CNY, JPY, EUR, GBP, AUD, CAD, SGD, CHF, THB, NZD, and KRW. You only need a Hang Seng debit card to access these ATMs at major branches and some shopping malls. The daily withdrawal limit is generally USD 10,000 (calculated at the daily exchange rate), sufficient for most travel or business needs. During withdrawal, the system instantly calculates the exchange rate, letting you know the exact amount. Some ATMs are also available to non-Hang Seng customers but may incur additional fees.

HSBC

HSBC’s foreign currency ATMs are widely distributed across Hong Kong, Kowloon, and the New Territories. You can withdraw four mainstream currencies, including CNY, JPY, USD, and EUR, at 39 foreign currency ATMs. The daily withdrawal limit is USD 10,250 (approximately HKD 80,000, based on the daily exchange rate). You simply insert an HSBC debit card, select the currency and amount, and the withdrawal process is quick and straightforward. HSBC’s foreign currency ATMs are mainly located at branches and transport hubs, making it convenient to exchange cash anytime. Non-HSBC customers may incur a fee when withdrawing.

Tip: HSBC’s foreign currency ATMs support fewer currencies but have many locations, ideal for those needing quick access to mainstream currencies.

Bank of China

At Bank of China (Hong Kong)’s foreign currency ATMs, you can withdraw multiple mainstream currencies. Commonly supported currencies include USD, CNY, JPY, EUR, AUD, and GBP. These ATMs are located at major branches and some large shopping malls. The daily withdrawal limit is generally USD 10,000. You only need a Bank of China debit card to instantly exchange and withdraw cash. Some ATMs also support non-Bank of China customers but charge a fee. Bank of China’s foreign currency ATMs are highly convenient for those who frequently travel abroad or need multiple currencies.

Citibank

You can withdraw USD, CNY, JPY, EUR, GBP, AUD, and other currencies at Citibank’s foreign currency ATMs. These ATMs are mainly located in core commercial areas like Central and Causeway Bay. The daily withdrawal limit is approximately USD 10,000. You simply insert a Citibank debit card, select the desired currency and amount, and complete the transaction. Citibank’s foreign currency ATMs are a flexible choice for those who frequently need multiple currencies.

Note: If you travel or go on business trips often, choosing banks with multi-currency support and widespread ATM locations makes cash withdrawals more convenient and faster.

Service Convenience

Image Source: unsplash

Distribution Locations

When looking for Standard Chartered’s foreign currency ATMs in Hong Kong, you’ll find limited options. Standard Chartered’s foreign currency ATMs are mainly concentrated in core commercial areas like Central and Causeway Bay, with only a few branches offering them. If you live in the New Territories or remote areas, you may need to travel to the city to use them. In contrast, Hang Seng, HSBC, Bank of China, and Citibank have more widely distributed foreign currency ATMs. You can find these ATMs at major branches, shopping malls, transport hubs, and even some residential areas. These banks’ coverage significantly enhances the convenience of withdrawing foreign currencies.

| Bank | Number of Foreign Currency ATM Locations | Main Coverage Areas |

|---|---|---|

| Standard Chartered | Few (approx. 10) | Major urban branches |

| Hang Seng | Approx. 30 | Hong Kong, Kowloon, New Territories key locations |

| HSBC | Approx. 39 | Hong Kong, Kowloon, New Territories, transport hubs |

| Bank of China | Approx. 25 | Branches, shopping malls |

| Citibank | Approx. 10 | Core commercial districts |

Tip: If you frequently need foreign currency cash, choosing a bank with more ATM locations will be more convenient.

Operational Process

When withdrawing CNY at Standard Chartered’s foreign currency ATMs, the process is simple. You insert a Standard Chartered debit or credit card, select the CNY amount, and confirm to withdraw cash. You don’t need to make an appointment or go through extra steps. If you need USD, JPY, or other currencies, you must first exchange them via the SC Mobile app and then make an appointment to collect cash at a branch, which is more complex.

Other banks like Hang Seng, HSBC, Bank of China, and Citibank’s foreign currency ATMs support multiple currencies. You insert a bank debit card, select the currency type and amount, and the system instantly calculates the exchange rate (based on the daily rate); you confirm and withdraw cash. Some banks’ ATMs support non-customers but charge additional fees. You don’t need to make appointments, and the process is quick.

Note: If you’re not a customer of the bank, check for fees and daily withdrawal limits (e.g., USD 10,000, based on the daily exchange rate) when withdrawing.

Pros and Cons of Standard Chartered Foreign Currency ATMs

Advantages

When using Standard Chartered’s foreign currency ATMs, you can quickly withdraw CNY cash. This is very convenient for those frequently traveling to mainland China. You don’t need to make an appointment or go through complex processes. Simply insert an eligible withdrawal card, select the amount, and the machine dispenses CNY instantly. This immediacy saves you significant time.

You can also use the SC Mobile app to exchange foreign currencies. This feature allows you to check exchange rates and perform exchanges on your phone, then make an appointment to collect cash at a branch. This digital service enhances your flexibility. You don’t need to visit a branch to inquire or queue, making mobile operations faster.

Tip: If you mainly need CNY cash, Standard Chartered’s foreign currency ATMs offer the most convenience.

Disadvantages

At Standard Chartered’s foreign currency ATMs, you can only withdraw CNY. You cannot directly withdraw USD, JPY, EUR, or other currencies. If you need these currencies, you must first exchange them via the SC Mobile app and then make an appointment to collect cash at a branch. This process is much more complex than other Hong Kong banks’ foreign currency ATMs.

Standard Chartered’s foreign currency ATMs have limited distribution. You can mostly find them only at branches in Central, Causeway Bay, and other urban areas. If you live in the New Territories or remote areas, using them is inconvenient. The daily withdrawal limit is USD 3,800 (approximately HKD 30,000), which, while sufficient for daily use, is slightly lower than other banks’ limits.

Note: If you frequently need multiple currency cash or want to withdraw easily in various locations, Standard Chartered’s foreign currency ATMs may not suit you.

User Suggestions

You should choose a bank service based on your actual needs. If you frequently travel to mainland China and mainly need CNY cash, Standard Chartered’s foreign currency ATMs offer an efficient experience. You can withdraw CNY at urban branches anytime without appointments, and the process is simple.

If you travel or go on business trips often and need multiple currency cash, consider foreign currency ATMs from Hang Seng, HSBC, Bank of China, or Citibank. These banks support multiple mainstream currencies, have more locations, higher withdrawal limits, and more straightforward processes.

If you value digital services, you can use the SC Mobile app to exchange currencies and make branch appointments for cash collection. This method suits those who don’t need immediate cash withdrawals and prefer mobile banking.

Note: When choosing a bank, consider your commonly used currencies, withdrawal locations, and convenience to select the most suitable foreign currency withdrawal service.

When choosing a foreign currency withdrawal service, first understand the key differences among banks. The table below clearly shows the differences between Standard Chartered’s foreign currency ATMs and other Hong Kong banks in supported currencies, daily withdrawal limits, and service functions:

| Bank Name | Supported Currencies | Daily Withdrawal Limit (USD) | Other Service Functions |

|---|---|---|---|

| Standard Chartered | CNY only | 3,800 | Cash and check deposits, remittances, account integration |

| Hang Seng | 12 types | 10,250 | Balance inquiries, password changes, transfers |

| HSBC | 4 types | 10,250 | 24-hour foreign currency cash withdrawals |

| Bank of China | 5 types | 10,250 | Forex treasury withdrawals, balance inquiries, password changes |

| Citibank | 4 types | 10,250 | Check deposits, balance inquiries, bill payments |

You can choose the most suitable service based on the following suggestions:

- If you frequently need CNY, Standard Chartered’s foreign currency ATMs are simple and suitable for you.

- If you need multiple currencies or higher withdrawal limits, Hang Seng, HSBC, Bank of China, or Citibank are more flexible.

- You can use financial data analysis methods (such as ratio analysis, trend analysis, comparative analysis) to choose the bank that best meets your needs based on commonly used currencies and withdrawal amounts.

FAQ

Which currencies can be withdrawn at Standard Chartered’s foreign currency ATMs?

You can only withdraw CNY at Standard Chartered’s foreign currency ATMs. For USD, JPY, or other currencies, you must exchange via the SC Mobile app and make an appointment to collect at a branch.

What currency options are available at other Hong Kong banks’ foreign currency ATMs?

You can withdraw USD, JPY, EUR, GBP, and other currencies at Hang Seng, HSBC, Bank of China, and Citibank ATMs. Supported currencies vary by bank.

Are there fees for withdrawals?

Using your own bank’s debit card typically incurs no fees. When using another bank’s card, fees may apply. Check the relevant charges in advance.

What are the daily withdrawal limits?

You can withdraw up to USD 3,800 in CNY daily at Standard Chartered. Other banks like Hang Seng, HSBC, Bank of China, and Citibank have limits of about USD 10,000, based on the daily exchange rate.

Can non-customers use foreign currency ATMs?

Some banks’ foreign currency ATMs support non-customers. If you’re not a customer, the bank may charge additional fees. Check the ATM’s instructions.

Standard Chartered’s foreign currency ATMs offer limited currency options and sparse locations, with cumbersome exchange processes, while restricted flexible investment and savings options independently hinder fund efficiency. BiyaPay, as an all-in-one financial platform, enables real-time US and HK stock investments without complex procedures, facilitating global asset allocation. Platform remittance fees are as low as 0.5%, covering 190+ countries with same-day transfers. Its flexible savings product offers a 5.48% annualized return, with daily interest credited automatically and withdrawals anytime, supporting 30+ fiat and 200+ cryptocurrencies, secured by KYC.

Try BiyaPay now to start your global investment journey! Join BiyaPay for efficient fund management!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.