- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Calculate Interest for Large Fixed Deposits? Use a Term Deposit Interest Calculator to Find Out

Image Source: pexels

What is a large fixed deposit? Many people hope to earn stable interest income with a sum of money, but interest rates and thresholds for large fixed deposits vary greatly among banks. According to 2025 data from major banks, USD fixed deposits for 6 months have interest rates ranging from about 2.5% to 3.4%, with thresholds ranging from USD 300,000 to USD 1,000,000. TWD fixed deposits for 1 year have interest rates of about 1.7% to 1.8%. Some Hong Kong banks, such as HSBC, require an average monthly asset balance of USD 1,500,000 for high-interest USD fixed deposits. Investors can use a term deposit interest calculator to quickly compare the actual returns of different schemes.

| Currency | Term | Interest Rate Range | Remarks |

|---|---|---|---|

| TWD | 1 Year | Approx. 1.7% to 1.8% | Large fixed deposit rates are generally lower, with thresholds around USD 300,000 to USD 1,000,000 |

| USD | 6 Months | Approx. 2.5% to 3.4% | Rates are generally higher than TWD, requiring new funds and high thresholds |

Key Points

- Large fixed deposits typically require a minimum deposit of USD 1,000,000, with banks offering higher interest rates and exclusive wealth management services, suitable for investors with substantial funds.

- Interest calculation is divided into simple and compound interest; compound interest allows interest to be reinvested into the principal, yielding higher returns for long-term deposits, and investors should choose the appropriate method based on their needs.

- Using a term deposit interest calculator can quickly calculate interest income, avoid calculation errors, and improve financial planning efficiency; ensure accurate input of principal, interest rate, and term.

- Thresholds and interest rates for large fixed deposits vary significantly among banks; investors should compare multiple options, note penalties for early withdrawal and interest rate types, and choose the most suitable scheme.

- Regularly monitor market and bank promotions, and flexibly adjust deposit strategies to maximize fund efficiency, making financial planning more stable and effective.

What Are Large Fixed Deposits?

Definition and Characteristics

A large fixed deposit refers to a deposit amount that meets a bank’s high threshold, such as USD 1,000,000 or more. Many Hong Kong banks set USD 1,000,000 as the starting point for large fixed deposits. These products are mainly targeted at clients with substantial funds, with the following characteristics:

- High deposit amount: Typically requires USD 1,000,000 or more, with some banks requiring even higher amounts.

- Flexible deposit terms: Clients can choose fixed deposit terms of 1 month, 3 months, 6 months, or over 1 year.

- Exclusive products: Banks design exclusive products for large fixed deposits and provide dedicated wealth management services.

Note: The definition and threshold for large fixed deposits vary among banks, and clients should check the relevant details first.

Interest Rate Promotions

To attract large funds, banks offer higher interest rates and various promotions for large fixed deposits. In Hong Kong, for example, when clients deposit USD 1,000,000 or more, banks typically provide higher annual interest rates than standard fixed deposits. Common promotions include:

- New Funds Promotion: As long as clients deposit new funds, banks offer additional interest rate rewards.

- Exclusive Rates for New Clients: First-time account holders or clients making large fixed deposits for the first time receive higher interest rates.

- Flexible Batch Deposits: Some banks allow clients to deposit in batches, enabling flexible fund allocation and reducing idle fund risks.

Banks also adjust promotions based on market interest rates and funding needs, so clients are advised to regularly compare the latest large fixed deposit schemes from different banks to select the most suitable product.

Interest Calculation Methods

Image Source: pexels

Calculation Formulas

When calculating term deposit interest, banks use either simple or compound interest depending on the product. The most common calculation formulas are as follows:

- Simple Interest Calculation Formula

Interest = Principal × Annual Interest Rate × Deposit Term (Years)

For example, depositing USD 10,000 at a 3% annual interest rate for 1 year yields interest of USD 10,000 × 3% × 1 = USD 300. - Compound Interest Calculation Formula

Interest = Principal × (1 + Annual Interest Rate)^Deposit Term (Years) − Principal

For example, depositing USD 10,000 at a 3% annual interest rate for 1 year yields interest of USD 10,000 × (1 + 3%)^1 − USD 10,000 ≈ USD 300. For 3 years, interest is USD 10,000 × (1 + 3%)^3 − USD 10,000 ≈ USD 927.27. - Term Deposit Interest Calculator

Investors can use a term deposit interest calculator, inputting principal, annual interest rate, and deposit term to instantly calculate interest income, facilitating comparison of actual returns across banks and products.

Tip: Some banks calculate interest based on days, using the formula “Interest = Principal × Annual Interest Rate × Number of Days ÷ 365”, which is especially common for non-integer-year terms.

Simple vs. Compound Interest

Simple and compound interest calculation methods and applicable scenarios differ significantly. The table below summarizes their main differences:

| Item | Simple Interest Method | Compound Interest Method |

|---|---|---|

| Interest Calculation | Interest is calculated solely on the principal, not reinvested | Interest is added to the principal, and subsequent interest is calculated on the principal plus interest |

| Interest Payout | Monthly interest is directly credited to a savings account | Interest is reinvested into the principal, creating a compounding effect |

| Example | USD 100,000, 1.07% annual rate, 1-year interest ≈ USD 1,070 | USD 100,000, 1.07% annual rate, 1-year interest ≈ USD 1,075 |

| Effect Difference | Minimal difference for short-term or small amounts | Significantly higher returns than simple interest for long-term or large deposits |

| Applicable Scenarios | Short-term fixed deposits, interest withdrawal | Lump-sum fixed deposits, long-term investments |

| Advantages | Interest can be withdrawn monthly, offering flexible fund use | Interest reinvested into principal maximizes returns through compounding |

- Simple interest is suitable for short-term fixed deposits or clients needing regular interest withdrawals, such as 3-month or 6-month deposits.

- Compound interest is suitable for long-term or large funds, especially for investors seeking interest-on-interest, such as lump-sum fixed deposits over 1 year.

Note: Under compound interest, the longer the term and the larger the amount, the more significant the interest income difference.

Fixed vs. Floating Interest Rates

Hong Kong banks offer fixed and floating interest rate fixed deposit products. Fixed interest rates remain unchanged during the deposit term, suitable when expecting rates to fall. Floating interest rates adjust with market or central bank rates, suitable when rates are low and expected to rise. Investors should choose the appropriate rate type based on their liquidity needs and expectations for interest rate trends.

Banks often hold promotional interest rate events, especially for foreign currency deposits, which typically offer higher rates than local currencies. Investors should note the duration of promotions, post-promotion rates, and remittance costs. When selecting fixed deposit products, it’s recommended to use a term deposit interest calculator to quickly compare actual returns and improve financial planning efficiency.

Calculation Steps

Preparing Data

Before calculating large fixed deposit interest, investors should prepare the following data:

- Principal: The lump-sum deposit amount, e.g., USD 1,000,000.

- Annual Interest Rate: Based on the bank’s announced rate, e.g., 3%.

- Deposit Term: Calculated in months or years, common terms include 6 months or 1 year.

- Interest Calculation Method: Confirm whether the bank uses lump-sum, installment, or interest-withdrawal methods.

- Interest Rate Type: Divided into fixed or floating rates.

Common three fixed deposit interest calculation methods in Hong Kong banks are:

- Lump-Sum Deposit: A one-time deposit with compound interest, suitable for most people. Formula: Principal × (1 + Monthly Interest Rate)^Term, where Monthly Interest Rate = Annual Interest Rate ÷ 12.

- Installment Deposit: Fixed monthly deposits with compound interest, suitable for those wanting to enforce savings.

- Interest Withdrawal: A one-time deposit with simple interest, suitable for those needing regular cash flow.

Investors should choose the appropriate calculation method based on their needs and convert annual rates to monthly rates (dividing by 12) for consistent comparison across bank products.

Practical Example

For a USD 1,000,000 principal, 3% annual interest rate, and 1-year term, assuming a lump-sum deposit (compound interest) method:

- Calculate monthly interest rate: 3% ÷ 12 = 0.25%

- Term: 12 months

- Interest calculation:

Interest = USD 1,000,000 × (1 + 0.0025)^12 − USD 1,000,000

≈ USD 1,000,000 × 1.0304 − USD 1,000,000 = USD 30,400

For an interest-withdrawal (simple interest) method:

- Interest = USD 1,000,000 × 3% = USD 30,00

Note: Some investors overlook interest rate types or calculation methods, leading to calculation errors. It’s recommended to use a term deposit interest calculator, verify results after inputting accurate data, and avoid financial planning errors due to incorrect inputs.

Common errors include:

- Ignoring whether the rate is annual or monthly.

- Entering incorrect term units.

- Failing to confirm whether the bank uses simple or compound interest.

Investors should carefully review bank terms and compare multiple fixed deposit products to ensure accurate interest calculations.

Term Deposit Interest Calculator

How to Use

A term deposit interest calculator helps investors quickly calculate interest income for different principals, rates, and terms. Most Hong Kong banks and financial websites offer such tools. Investors can follow these steps:

- Select Calculation Method

Choose simple or compound interest. Large fixed deposits mostly use compound interest, while short-term deposits often use simple interest. - Input Principal

Enter the deposit amount in the calculator, e.g., USD 1,000,000. - Enter Annual Interest Rate

Input the bank’s announced annual interest rate, e.g., 3.2%. - Set Deposit Term

Enter the deposit term (in months or years), e.g., 12 months or 1 year. - Select Interest Rate Type

If supported, choose fixed or floating interest rates to simulate different scenarios. - Click Calculate

Press the “Calculate” or “Start” button, and the system instantly displays total interest and maturity principal plus interest.

Expert Tip: Some term deposit interest calculators show detailed calculation processes, making it easier for investors to verify data.

Input Precautions

When using a term deposit interest calculator, investors should note the following to ensure accurate results:

- Interest Rate Unit

Confirm that the input is the annual interest rate. Some banks list monthly rates, which should be converted to annual rates before input. - Term Unit

The deposit term should match the interest rate unit. For example, if the rate is annual, the term should be in years; if monthly, divide the annual rate by 12. - Calculation Method Selection

Choose simple or compound interest based on the bank’s product description. Selecting the wrong method leads to significant errors. - Principal Input

Enter the amount in USD and verify accuracy. Some calculators support multiple currencies, so select the correct one. - Floating Rate Simulation

For floating rates, input different rate scenarios to assess potential return fluctuations.

Common input errors and solutions:

| Error Type | Example | Solution |

|---|---|---|

| Incorrect Rate Unit | Entering 3% monthly rate as annual rate | Convert monthly rate to annual by multiplying by 12 |

| Mismatched Term Unit | Annual rate with 12-month term | Convert 12 months to 1 year |

| Wrong Calculation Method | Selecting simple interest for a compound interest product | Check bank product details and select correctly |

| Currency Input Error | Entering principal in HKD instead of USD | Confirm currency and re-enter |

Note: If the calculated result significantly differs from the bank’s expected return, recheck all input data or consult a bank representative for assistance.

A term deposit interest calculator significantly improves financial planning efficiency, helping investors instantly compare actual interest income across banks and products. By inputting accurate data, most calculation errors can be avoided, making fund utilization more precise.

Interest Income Comparison

Image Source: pexels

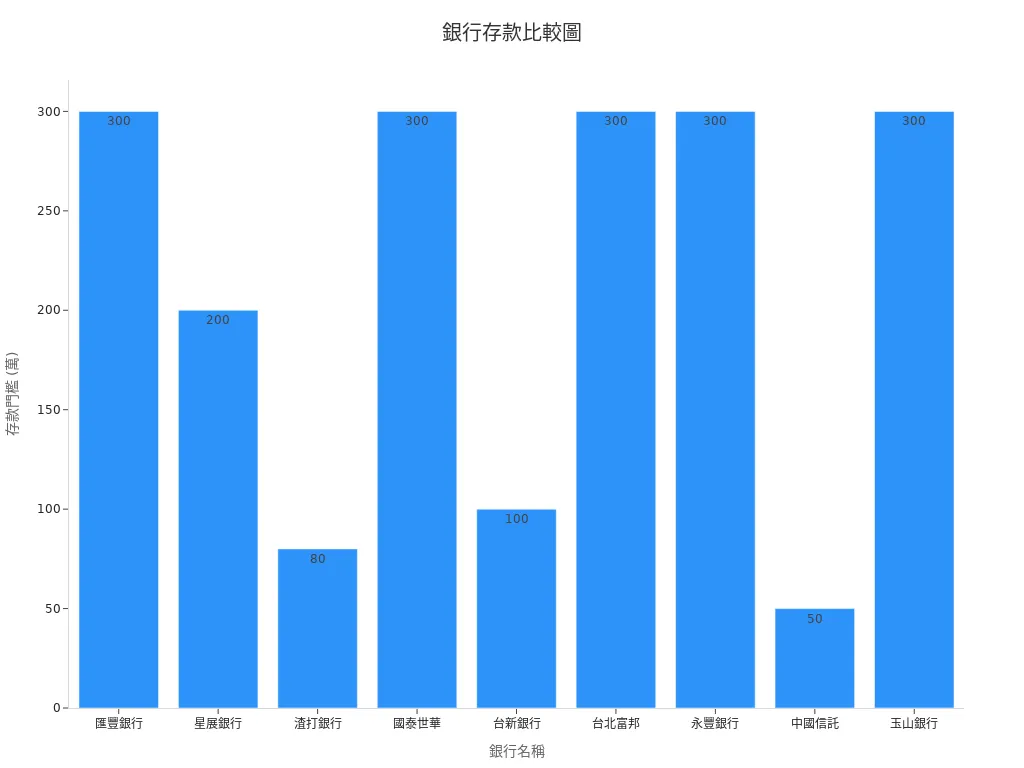

Bank and Product Comparison

When choosing large fixed deposits, investors should compare deposit thresholds, wealth management tiers, and interest rate promotions across banks. Major banks have varying minimum deposit thresholds, and some offer tiered exclusive services based on client asset levels. The table below summarizes minimum deposit thresholds and wealth management tiers for major banks:

| Bank Name | Minimum Deposit Threshold (USD) | Wealth Management Tier Examples |

|---|---|---|

| HSBC | Approx. USD 100,000 | Premier: USD 100,000, Jade: USD 500,000 |

| DBS | Approx. USD 66,000 | Treasures: USD 66,000 |

| Standard Chartered | Approx. USD 26,000 | Priority: USD 26,000, Premium: USD 100,000, Private: USD 1,000,000 |

| Cathay United | Approx. USD 100,000 | Gold VIP: USD 100,000, Platinum VIP: USD 333,000, Diamond VIP: USD 1,000,000 |

| Taishin Bank | Approx. USD 33,000 | Wealth Member: USD 33,000, Prestige Member: USD 100,000, Million Member: USD 333,000, Gold Diamond Member: USD 1,000,000, Emerald Member: USD 1,666,000 |

| Taipei Fubon | Approx. USD 100,000 | Stable Wealth Member: USD 100,000, Smart Wealth Member: USD 333,000, Constant Wealth Member: USD 1,000,000 |

| SinoPac Bank | Approx. USD 100,000 | Yongju Member: USD 100,000, Yongfu Member: USD 333,000, Yongchuan Member: USD 1,000,000 |

| CTBC Bank | Approx. USD 16,600 | Chuangfu Family: USD 16,600, Shoufu Family: USD 100,000, Dingfu Family: USD 500,000, Chuanfu Family: USD 1,000,000, Zhenfu Family: USD 50,000,000 |

| E.Sun Bank | Approx. USD 100,000 | New Wealth Member: USD 100,000, Elite Member: USD 333,000, Pinnacle Member: USD 1,000,000, Ultimate Member: USD 33,333,000 |

Investors can choose the appropriate bank and wealth management tier based on their fund size. Some banks include loan balances in threshold calculations, offering more flexibility. Interest rate promotions require checking the latest information on bank websites or financial platforms, as rates and conditions frequently adjust due to market fluctuations.

Other Influencing Factors

In addition to interest rates and thresholds, several factors directly affect final interest income:

- Early Withdrawal Penalties: If investors withdraw funds before maturity, banks typically impose penalties or cancel promotional rates, significantly reducing returns.

- Floating Rate Risks: For floating rate products, returns may be higher or lower than expected due to market-driven rate changes, requiring assessment of risk tolerance.

- Batch Deposit Flexibility: Some banks allow batch deposits, aiding flexible fund allocation, but this may affect applicable rates and promotional conditions.

- Product Detail Variations: Banks differ in compound/simple interest, payout methods, and other details; investors should review terms to avoid losses due to oversight.

Expert Advice: Investors should comprehensively compare bank thresholds, rates, promotions, and product details based on liquidity needs, risk tolerance, and financial goals to select the most suitable large fixed deposit scheme and effectively enhance fund efficiency.

Interest calculation and product comparison for large fixed deposits are crucial for fund management. Investors should leverage term deposit interest calculators to quickly grasp actual returns across banks. Each Hong Kong bank offers different rates, thresholds, and promotions. During financial planning, investors must choose based on their liquidity needs. Experts suggest continuously monitoring market changes and flexibly adjusting deposit strategies to maximize fund efficiency.

FAQ

Is there a minimum amount requirement for large fixed deposits?

Most Hong Kong banks require a minimum deposit of USD 100,000 or more. Some premium wealth management schemes have thresholds up to USD 1,000,000. Investors should check official bank information.

Are there penalties for early withdrawal?

Banks generally impose penalties or cancel promotional rates for early withdrawals. Investors should review product terms to avoid interest losses.

Are interest rates fixed or floating?

Hong Kong banks offer both fixed and floating interest rate options. Fixed rates remain unchanged during the term, while floating rates adjust with the market. Investors can choose based on their needs.

Is term deposit interest income taxable?

Hong Kong currently does not levy profits tax on bank deposit interest income. Investors subject to taxation in other regions should seek professional advice.

Can large fixed deposits be deposited in batches?

Some Hong Kong banks allow batch deposits, but rates and promotional conditions may vary. Investors should inquire about details with the bank beforehand.

High thresholds and cumbersome processes for large fixed deposits, along with costly cross-border fund management, restrict efficiency, while limited flexible savings options independently hinder fund utilization. BiyaPay, as an all-in-one financial platform, enables real-time US and HK stock investments without complex procedures, facilitating global asset allocation. Platform remittance fees are as low as 0.5%, covering 190+ countries with same-day transfers. Its flexible savings product offers a 5.48% annualized return, with daily interest credited automatically and withdrawals anytime, supporting 30+ fiat and 200+ cryptocurrencies, secured by KYC.

Try BiyaPay now to start your global investment journey! Join BiyaPay for efficient fund management!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.